Can i have out of state car insurance – Can I get out-of-state car insurance? This question often arises when individuals move, travel frequently, or spend extended periods in another state. Understanding the nuances of out-of-state car insurance is crucial, as it can significantly impact your financial well-being in the event of an accident.

Navigating the world of insurance can be confusing, especially when you’re dealing with interstate matters. Factors like residency, driving history, and state-specific regulations play a role in determining your eligibility and coverage options.

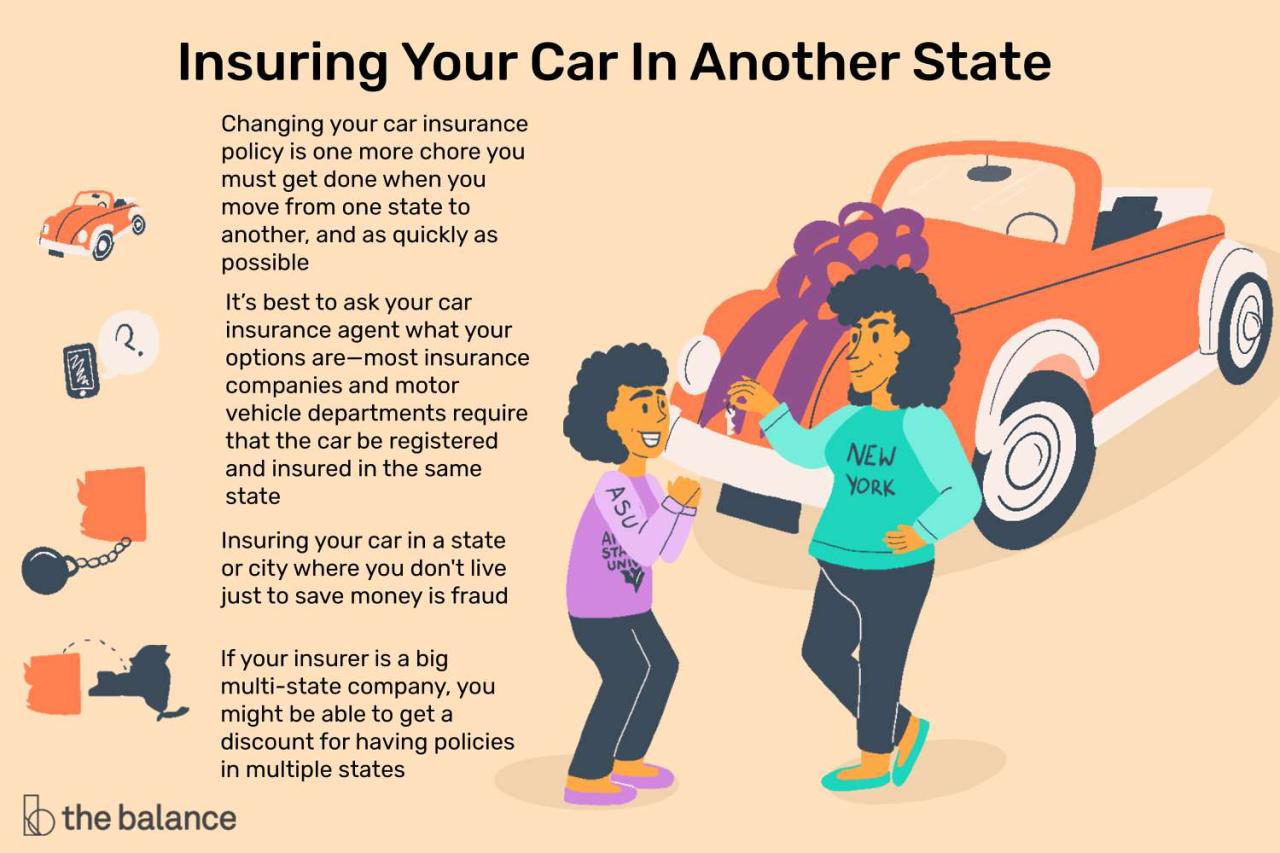

Understanding Out-of-State Car Insurance

Out-of-state car insurance is a crucial aspect of responsible driving when you’re traveling beyond your home state. It ensures you have the necessary financial protection in case of an accident or other incidents on the road.

Differences Between In-State and Out-of-State Car Insurance

In-state car insurance typically covers you within the boundaries of your state of residence. It adheres to the specific regulations and requirements of your home state. Out-of-state car insurance, on the other hand, provides coverage when you drive in a state other than your own. It might need to comply with the laws of the state you’re visiting, potentially requiring additional coverage or adjustments to your policy.

Factors Influencing the Need for Out-of-State Car Insurance

Several factors can influence the need for out-of-state car insurance.

- Duration of Travel: If you’re only driving through a state briefly, your in-state insurance might suffice. However, for extended trips or relocations, out-of-state coverage becomes essential.

- State Laws: Each state has its own insurance requirements. Some states might have higher minimum liability limits than others. You could face penalties or legal consequences if your in-state insurance doesn’t meet the requirements of the state you’re driving in.

- Specific Coverage Needs: Certain situations, such as driving a rental car or transporting valuable goods, might necessitate additional coverage beyond your standard in-state policy.

Potential Consequences of Driving Without Proper Insurance in Another State, Can i have out of state car insurance

Driving without adequate car insurance in another state can have serious consequences.

- Financial Liability: In case of an accident, you could be held personally liable for damages, medical expenses, and other costs. This could result in significant financial burdens, even if the accident wasn’t your fault.

- Legal Penalties: Many states have strict penalties for driving without insurance, including fines, license suspension, and even jail time.

- Vehicle Impoundment: Your vehicle could be impounded until you provide proof of insurance. This can cause inconvenience and additional costs.

Eligibility for Out-of-State Car Insurance

Getting car insurance in a state other than your primary residence might seem complicated, but it’s not impossible. Insurance companies have specific criteria for determining eligibility, and understanding these requirements is key to securing coverage.

Residency and Driving History

Your residency is a significant factor in determining eligibility for out-of-state car insurance. Insurance companies typically require you to be a resident of the state where you’re applying for coverage.

“Residency” generally means your permanent address, where you live most of the time.

This doesn’t necessarily mean you need to be a registered voter or have a driver’s license in that state. However, you’ll need to provide proof of residency, which can include:

- Utility bills

- Bank statements

- Lease agreement

- Paycheck stubs

Your driving history is another crucial aspect of eligibility. Insurance companies review your driving record to assess your risk as a driver.

“Driving history” encompasses your past driving incidents, including accidents, traffic violations, and driving convictions.

A clean driving record with no accidents or violations will generally lead to lower insurance premiums. Conversely, a history of accidents or violations could result in higher premiums or even denial of coverage.

Benefits of Out-of-State Car Insurance

Out-of-state car insurance can offer several advantages, particularly if you’re relocating or spending a significant amount of time in another state. These benefits can include cost savings, access to specific coverage features, and greater flexibility.

Coverage Options and Their Benefits

Different states have varying insurance requirements and coverage options. This means that you might find more favorable coverage options in one state compared to another. For instance, some states offer more comprehensive coverage or lower premiums for certain types of vehicles.

Cost Savings

One of the primary benefits of out-of-state car insurance is the potential for cost savings. Insurance premiums are influenced by factors like the cost of living, accident rates, and competition in the insurance market. If you’re moving to a state with lower insurance costs, you could potentially save money on your premiums.

Specific Coverage Features

Out-of-state car insurance can also offer specific coverage features that might not be available in your current state. For example, some states offer unique coverage options for specific types of vehicles, such as classic cars or motorcycles.

Flexibility

Out-of-state car insurance can provide greater flexibility, especially if you frequently travel between states or have multiple residences. You can maintain coverage in your home state while also having coverage in the state where you’re temporarily residing.

Obtaining Out-of-State Car Insurance: Can I Have Out Of State Car Insurance

Securing out-of-state car insurance involves a straightforward process, but it’s crucial to understand the necessary steps to ensure a smooth transition. This section will guide you through the process of acquiring out-of-state car insurance, from contacting insurance companies to completing the required paperwork.

Contacting Insurance Companies and Comparing Quotes

Once you’ve decided to obtain out-of-state car insurance, the first step is to contact insurance companies in your new state. You can find insurance companies through online searches, recommendations from friends or family, or by checking the state’s Department of Insurance website.

Here are some tips for contacting insurance companies and comparing quotes:

- Gather your information: Before you start contacting insurance companies, gather your driver’s license, vehicle registration, and any relevant insurance information from your previous insurer. This will help you provide accurate information and get more precise quotes.

- Get multiple quotes: Don’t settle for the first quote you receive. Get quotes from several different insurance companies to compare prices and coverage options. This will ensure you’re getting the best possible deal.

- Ask questions: Don’t hesitate to ask questions about coverage options, deductibles, and any other factors that might affect your policy. Understanding the details of your insurance policy will help you make an informed decision.

- Compare apples to apples: When comparing quotes, make sure you’re comparing similar coverage options. For example, if one quote includes comprehensive coverage and another doesn’t, it’s difficult to make a fair comparison.

Completing Necessary Paperwork and Documentation

After choosing an insurance company, you’ll need to complete the necessary paperwork and documentation. This process may vary depending on the insurance company, but generally includes the following steps:

- Complete an application: You’ll need to fill out an application form with your personal information, vehicle details, and coverage preferences.

- Provide proof of insurance: If you have existing car insurance, you’ll need to provide proof of insurance from your previous insurer. This can be in the form of an insurance card or a copy of your insurance policy.

- Provide proof of residency: You’ll need to provide proof of residency in your new state. This can be a utility bill, bank statement, or lease agreement.

- Pay your premium: Once you’ve completed the application and provided all the necessary documentation, you’ll need to pay your premium. You can usually pay your premium online, by phone, or by mail.

Considerations for Out-of-State Car Insurance

While out-of-state car insurance can offer potential benefits, it’s crucial to carefully weigh the risks and potential drawbacks before making a decision. Understanding the specific coverage limitations and potential challenges is essential for making an informed choice.

Potential Risks of Out-of-State Car Insurance

It’s important to understand the potential risks associated with obtaining out-of-state car insurance. These risks can impact your coverage, financial stability, and overall driving experience.

- Limited Coverage in Your Home State: Out-of-state insurance may not provide adequate coverage in your home state, particularly if you’re involved in an accident there. This could leave you financially vulnerable in the event of a claim.

- Higher Premiums: Some states have higher insurance premiums than others, and you might end up paying more for out-of-state coverage than you would for insurance in your home state.

- Difficulty Filing Claims: Filing a claim with an out-of-state insurer can be more complex and time-consuming, especially if you’re involved in an accident in a different state.

- Lack of Local Representation: You may have limited access to local representatives or agents if you choose out-of-state insurance, making it challenging to resolve issues or get assistance in person.

Understanding Coverage Limitations

It’s essential to thoroughly understand the specific coverage limitations of any out-of-state insurance policy. This includes:

- State-Specific Requirements: Different states have varying insurance requirements, and an out-of-state policy may not meet the minimum coverage standards in your home state.

- Exclusions and Limitations: Out-of-state policies may have exclusions or limitations that are not present in policies offered in your home state. This could impact your coverage in certain situations.

- Coverage for Out-of-State Accidents: Ensure your out-of-state policy provides adequate coverage for accidents that occur outside of your home state.

Potential Challenges and Complications

Obtaining and maintaining out-of-state car insurance can present challenges and complications.

- State Regulations: Some states have regulations that restrict or prohibit the issuance of out-of-state insurance policies.

- Verification and Documentation: You may need to provide additional documentation or verification to prove your residency and eligibility for out-of-state insurance.

- Communication and Language Barriers: Communicating with an out-of-state insurer can be challenging, especially if you’re unfamiliar with their language or policies.

Alternative Options for Out-of-State Coverage

If you’re only driving out of state temporarily, you may not need a full out-of-state car insurance policy. Several alternative options offer coverage for short-term trips, each with its own set of advantages and disadvantages.

Here’s a breakdown of the most common alternatives:

Temporary Insurance Policies

Temporary insurance policies, also known as short-term or non-owner car insurance, are designed for drivers who need coverage for a limited time. These policies can provide liability, collision, and comprehensive coverage for periods ranging from a few days to a few months.

- Pros:

- Cost-effective: Temporary policies are typically less expensive than a full out-of-state policy, especially for short trips.

- Flexibility: You can choose the coverage period and the level of coverage that suits your needs.

- Convenience: Many providers offer online applications and quick policy issuance.

- Cons:

- Limited coverage: Temporary policies may not offer the same level of coverage as a full policy, especially for comprehensive and collision coverage.

- Higher premiums: Compared to standard policies, temporary insurance policies often come with higher daily or weekly premiums.

- Availability: Not all insurance companies offer temporary policies, and availability may vary by state.

Rental Car Insurance

Rental car companies often offer insurance options for drivers who rent their vehicles. These policies can provide coverage for damage to the rental car and liability for accidents.

- Pros:

- Convenience: Rental car insurance is typically offered at the time of rental, making it easy to obtain.

- Comprehensive coverage: Rental car insurance often includes coverage for damage to the rental car, as well as liability for accidents.

- Peace of mind: It provides protection against potential financial losses in case of an accident or damage to the rental car.

- Cons:

- Cost: Rental car insurance can be expensive, and it may not always be necessary if you already have comprehensive and collision coverage on your personal vehicle.

- Limited coverage: Rental car insurance may not cover all types of accidents or damages, and it may have specific exclusions.

- Redundancy: If your existing car insurance policy includes coverage for rental cars, purchasing additional insurance from the rental company may be redundant.

Comparison of Coverage Options

| Coverage Option | Coverage | Pros | Cons |

|—|—|—|—|

| Out-of-State Car Insurance | Full coverage, including liability, collision, comprehensive, and other optional coverage | Comprehensive coverage, peace of mind, may offer lower premiums than temporary policies | May be more expensive than temporary policies, requires a full policy |

| Temporary Insurance Policies | Liability, collision, and comprehensive coverage for a limited time | Cost-effective for short trips, flexible coverage options, convenient online application | Limited coverage compared to full policies, higher premiums than standard policies, limited availability |

| Rental Car Insurance | Damage to the rental car, liability for accidents | Convenient, comprehensive coverage for the rental car, peace of mind | Expensive, may not be necessary if you have existing coverage, may have specific exclusions |

Concluding Remarks

While securing out-of-state car insurance can be a complex process, it’s essential to ensure you have adequate coverage regardless of where you’re driving. By carefully considering your needs, researching options, and understanding the potential risks, you can make informed decisions to protect yourself financially and legally on the road.

Questions Often Asked

What if I’m only driving in another state for a short period?

You may be able to use your current in-state insurance for a short trip. However, it’s crucial to check your policy for coverage limitations and consider purchasing temporary insurance if needed.

Can I get out-of-state insurance even if I don’t live there?

In most cases, you’ll need to establish residency in the state to obtain permanent out-of-state insurance. However, some states offer temporary insurance options for non-residents.

How do I find out what insurance is required in a specific state?

You can visit the website of the Department of Motor Vehicles (DMV) or insurance regulatory agency in the state you’re driving in.

What are the penalties for driving without proper insurance in another state?

Penalties can vary by state and may include fines, license suspension, or even jail time. It’s essential to comply with the insurance requirements of each state you drive in.