Can I get car insurance out of state? This is a common question for those who move, travel frequently, or simply want to explore their options. The answer, like most things in the world of insurance, is “it depends.” Car insurance laws vary widely from state to state, and your eligibility for out-of-state coverage depends on factors like residency, driving history, and the specific insurance provider.

This guide will delve into the complexities of obtaining car insurance in a different state, exploring the factors that influence your options and providing practical tips for navigating the process. Whether you’re planning a temporary relocation or a permanent move, understanding the intricacies of out-of-state insurance can help you make informed decisions and ensure you have the right coverage.

Understanding State Insurance Laws: Can I Get Car Insurance Out Of State

Each state in the United States has its own set of laws regarding car insurance requirements. These laws are designed to protect drivers, passengers, and other road users in the event of an accident.

Understanding the differences in state insurance laws is crucial for anyone driving in a state other than their own. Not only can failing to meet a state’s minimum insurance requirements result in hefty fines and penalties, but it can also leave you financially vulnerable in the event of an accident.

Insurance Coverage Requirements

State insurance laws specify the minimum levels of coverage that drivers must carry. These requirements typically include liability coverage, which protects others in the event of an accident caused by the insured driver. Some states also require other types of coverage, such as personal injury protection (PIP) or uninsured/underinsured motorist (UM/UIM) coverage.

Here are some examples of how insurance coverage requirements can vary across states:

- Liability Coverage: The minimum liability coverage requirements for bodily injury and property damage can differ significantly between states. For instance, some states may require a minimum of $25,000 per person and $50,000 per accident for bodily injury, while others may require $100,000 per person and $300,000 per accident.

- Personal Injury Protection (PIP): Some states mandate PIP coverage, which covers medical expenses and lost wages for the insured driver and passengers, regardless of fault. Other states do not require PIP coverage.

- Uninsured/Underinsured Motorist (UM/UIM) Coverage: This type of coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. Some states require UM/UIM coverage, while others do not.

Consequences of Driving with Out-of-State Insurance

Driving with out-of-state insurance that does not meet the minimum requirements of the state you are driving in can have serious consequences. These consequences can include:

- Fines and Penalties: You could face hefty fines and penalties if you are caught driving without the required insurance coverage.

- License Suspension: In some cases, your driver’s license could be suspended if you fail to meet the state’s insurance requirements.

- Financial Responsibility: If you are involved in an accident and do not have adequate insurance coverage, you could be held personally responsible for all damages and injuries.

Understanding Your Insurance Policy

It is essential to understand your insurance policy and ensure that it meets the requirements of the state you are driving in. If you are planning to drive in another state, contact your insurance agent to discuss your coverage and any necessary adjustments.

It is also a good idea to keep a copy of your insurance card readily available in your vehicle, as law enforcement officers may request it during a traffic stop.

Out-of-State Residency and Insurance

Determining residency for insurance purposes can be complex, as it often goes beyond just having a physical address. Insurance companies use a variety of factors to assess your residency, including your primary residence, the length of your stay, and your intent to stay.

Temporary Stays and Frequent Travel, Can i get car insurance out of state

Insurance companies consider the duration and purpose of your stay when evaluating your residency status. A temporary stay, such as a vacation or business trip, typically won’t change your residency for insurance purposes. However, if you frequently travel or spend significant time in another state, your insurance company might question your residency.

For example, if you frequently travel for work and spend several months a year in another state, your insurance company might require you to obtain insurance in that state.

Out-of-State Insurance for Temporary Residents

If you are a temporary resident in another state, you may be able to maintain your existing out-of-state insurance under certain circumstances.

- Short-Term Stays: For short-term stays, such as vacations or business trips, your existing insurance policy may provide coverage in the other state. Check your policy documents for details on coverage limitations or exclusions.

- Military Deployment: Military personnel deployed to another state often maintain their residency in their home state and may be eligible to continue their existing insurance. The Servicemembers Civil Relief Act (SCRA) protects the rights of service members and their families during military service.

- Student Insurance: If you are a student attending college in another state, your existing insurance may cover you, especially if you maintain your home state residency. However, you should check with your insurance provider to ensure coverage extends to your new location.

Obtaining Out-of-State Insurance

Securing car insurance in a state different from your primary residence can be necessary if you’re relocating, spending a significant amount of time there, or simply need temporary coverage. The process might involve some additional steps and considerations compared to getting insurance in your home state.

Requirements for Obtaining Out-of-State Insurance

Insurance providers typically require specific documentation and information to process your application for out-of-state coverage. These documents help them assess your risk profile and determine appropriate premiums.

- Proof of Residency: This is crucial for demonstrating your connection to the state where you’re seeking insurance. Common forms of proof include a driver’s license, voter registration card, utility bills, bank statements, or lease agreements with your name and the address in the new state.

- Vehicle Information: You’ll need to provide details about your car, such as the year, make, model, VIN (Vehicle Identification Number), and any modifications.

- Driving History: Insurance companies will require your driving record, which includes details about any accidents, traffic violations, or suspensions. You can obtain this from your state’s Department of Motor Vehicles (DMV).

- Previous Insurance Information: They may ask for details about your previous insurance policies, including coverage details and claim history. This helps them understand your risk profile and potential claims experience.

- Personal Information: You’ll need to provide your name, date of birth, social security number, contact information, and other personal details for the application process.

Challenges and Limitations

While obtaining out-of-state insurance is possible, it’s essential to be aware of potential challenges or limitations:

- Higher Premiums: Out-of-state insurance may be more expensive compared to coverage in your home state. This is because insurance companies might perceive you as a higher risk due to unfamiliarity with your driving habits and the local environment.

- Limited Coverage Options: Not all insurance companies offer coverage in every state. You might find a smaller selection of providers and coverage options when applying for out-of-state insurance.

- State-Specific Requirements: Each state has its own unique insurance regulations, including minimum coverage requirements and specific exclusions. You need to ensure you meet the legal requirements of the state where you’re getting insurance.

- Potential for Non-Renewal: If you’re only seeking temporary out-of-state coverage, your policy might not be renewed once it expires. You’ll need to reapply for coverage or switch to a different provider if you plan to continue driving in that state.

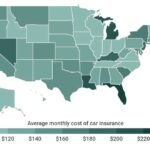

Factors Affecting Out-of-State Insurance Costs

When you’re moving to a new state, understanding how insurance costs might change is essential. Your driving history, the type of vehicle you drive, and the level of coverage you choose all play a significant role in determining your premium. It’s also crucial to consider the potential costs of obtaining insurance in your new state versus keeping your existing policy. This section will help you navigate these factors and make informed decisions about your insurance.

Driving History

Your driving history is a major factor in determining your insurance premiums. A clean driving record with no accidents or violations will typically result in lower rates, while a history of accidents, traffic violations, or DUI convictions will likely lead to higher premiums. Insurance companies use a complex system of points to assess your driving record, and each state may have different point systems and penalties.

For example, a speeding ticket in one state might carry a higher point value than in another, impacting your insurance rates differently. When you move to a new state, your insurance company will need to access your driving record from your previous state to accurately assess your risk. This is why it’s essential to provide your new insurer with all necessary information, including any accidents or violations, even if they occurred in a different state.

Vehicle Type

The type of vehicle you drive is another significant factor in determining your insurance costs. Some vehicles are considered more risky than others, due to factors like their value, safety features, and the likelihood of theft or accidents. For example, high-performance sports cars, luxury vehicles, and vehicles with a history of high repair costs are typically associated with higher insurance premiums.

On the other hand, smaller, fuel-efficient vehicles with good safety ratings often have lower premiums. When you move to a new state, it’s essential to research how insurance companies in that state classify your vehicle and what factors they consider when determining premiums. You may find that the cost of insuring your vehicle varies from state to state, even if it’s the same make and model.

Coverage Levels

The level of coverage you choose also plays a significant role in your insurance premiums. Higher levels of coverage, such as comprehensive and collision coverage, offer more protection but come at a higher cost. Basic liability coverage, which is required in most states, is the most affordable option but provides the least protection.

When you move to a new state, you may find that the minimum liability coverage requirements differ from your previous state. It’s important to research these requirements and ensure you have adequate coverage to meet the legal standards and protect yourself financially in case of an accident. You can also consider factors like your personal financial situation and the value of your vehicle when determining the appropriate level of coverage for you.

Comparing Costs: In-State vs. Out-of-State

When you’re moving, you have two options: you can maintain your existing insurance policy in your original state or obtain a new policy in your new state. Both options have pros and cons, and the best choice for you will depend on your individual circumstances.

Maintaining your existing policy might seem like the easiest option, but it could be more expensive in the long run. Your current insurer may charge higher premiums if you’re no longer living in your original state, or they may not even offer coverage in your new state. Additionally, if you’re involved in an accident in your new state, your insurer might not be familiar with the local laws and regulations, potentially leading to complications and delays in claims processing.

Potential Discounts and Cost-Saving Options

There are several discounts and cost-saving options available to help you reduce your out-of-state insurance premiums. Here are some of the most common:

- Good Student Discount: If you’re a student with good grades, you may be eligible for a discount. This discount is usually available for students under a certain age who maintain a certain GPA.

- Safe Driver Discount: If you have a clean driving record with no accidents or violations, you may qualify for a safe driver discount. This discount is usually offered to drivers who have not been involved in an accident or received a traffic ticket for a certain period of time.

- Multi-Car Discount: If you insure multiple vehicles with the same insurer, you may be eligible for a multi-car discount. This discount is usually offered for each additional vehicle insured with the same company.

- Anti-theft Device Discount: If your vehicle has anti-theft devices installed, such as an alarm system or GPS tracking, you may qualify for a discount. This discount is usually offered to drivers who take steps to reduce the risk of theft.

- Loyalty Discount: Some insurers offer loyalty discounts to customers who have been with them for a certain period of time. This discount is usually offered to reward long-term customers for their business.

- Bundling Discount: If you bundle your insurance policies, such as home, auto, and renters insurance, with the same insurer, you may qualify for a bundling discount. This discount is usually offered to encourage customers to purchase multiple policies from the same company.

It’s important to contact different insurance companies and get quotes to compare rates and see which offers the best discounts and coverage options for you. You can also consider using an online insurance comparison tool to quickly and easily compare rates from multiple insurers. By taking the time to shop around and explore your options, you can find the best insurance coverage at a price that fits your budget.

Tips for Managing Out-of-State Insurance

Navigating out-of-state car insurance can be a bit tricky, but with a little planning and research, you can ensure you’re properly covered. This guide will help you understand the process, find the right insurance, and manage your policy effectively.

Understanding Your Insurance Needs

Before you start looking for insurance in a new state, it’s essential to understand your specific needs. Consider factors like your driving history, the type of car you drive, and your coverage requirements. Knowing what you need will help you narrow down your search and find the best policy for your situation.

Getting Quotes and Comparing Options

Once you know what you need, you can start getting quotes from different insurance companies. There are several ways to do this:

- Online Comparison Websites: Websites like NerdWallet, PolicyGenius, and Insurance.com allow you to compare quotes from multiple insurers simultaneously.

- Directly Contact Insurance Companies: You can call or visit the websites of insurance companies in your new state to get personalized quotes.

- Use a Local Insurance Broker: An insurance broker can help you compare quotes from various insurers and find the best policy for your needs.

When comparing quotes, make sure to consider the following factors:

- Coverage Limits: Ensure the coverage limits are sufficient for your needs.

- Deductibles: A higher deductible typically means a lower premium, but you’ll pay more out of pocket if you need to file a claim.

- Discounts: Many insurers offer discounts for things like good driving records, safety features in your car, and bundling multiple insurance policies.

- Customer Service: Read online reviews and check the insurer’s ratings with organizations like the Better Business Bureau to get an idea of their customer service reputation.

Switching Your Insurance Policy

Once you’ve chosen an insurance company, you’ll need to switch your policy. Here’s what you can expect:

- Contact Your Current Insurer: Notify your current insurer that you’re moving and canceling your policy.

- Provide Proof of Residency: Your new insurer will likely require proof of residency, such as a driver’s license, utility bill, or lease agreement.

- Get a New Insurance Card: Your new insurer will provide you with an insurance card, which you should keep in your car.

- Cancel Your Old Policy: Once your new policy is in effect, make sure to cancel your old policy to avoid paying for duplicate coverage.

Maintaining Your Out-of-State Insurance

Once you have out-of-state insurance, it’s important to keep your policy up-to-date and manage it effectively. This includes:

- Paying Your Premiums on Time: Make sure to pay your premiums on time to avoid late fees and potential policy cancellation.

- Notifying Your Insurer of Changes: Inform your insurer of any changes to your situation, such as a change in address, vehicle, or driving record.

- Reviewing Your Policy Regularly: It’s a good idea to review your policy at least once a year to ensure it still meets your needs.

- Filing Claims Promptly: If you need to file a claim, do so as soon as possible after an accident or incident.

Important Considerations

Here are some additional tips for managing out-of-state insurance:

- Check Your State’s Minimum Coverage Requirements: Ensure your policy meets the minimum coverage requirements in your new state.

- Understand Your Policy’s Coverage Areas: Some insurance policies may have limited coverage areas. Make sure your policy covers the areas you plan to drive in.

- Keep Copies of Your Insurance Documents: Always keep copies of your insurance card, policy documents, and any other relevant paperwork.

- Be Prepared for Potential Rate Increases: Out-of-state insurance rates may be higher than your previous rates. Be prepared for potential rate increases.

Ultimate Conclusion

Ultimately, securing car insurance in a different state requires careful planning and research. By understanding the relevant laws, residency requirements, and insurance provider policies, you can navigate the process efficiently and obtain the coverage you need. Remember to consult with an insurance agent or broker for personalized advice and to explore all available options to find the best policy for your individual needs.

Query Resolution

What happens if I drive with out-of-state insurance in another state?

Driving with out-of-state insurance in a different state can have consequences. While some states might not have strict enforcement, others could issue fines or even suspend your driving privileges if your insurance doesn’t meet their minimum requirements. It’s best to check with the state’s Department of Motor Vehicles to ensure compliance.

Can I get out-of-state insurance if I’m just visiting for a short period?

You might be able to obtain temporary out-of-state insurance for a short visit. However, insurance providers typically have specific requirements for temporary residents, and the coverage might be limited. It’s best to contact the insurance provider directly to inquire about their policies for temporary residents.

What documents do I need to provide when applying for out-of-state insurance?

Insurance providers will typically require documents like your driver’s license, proof of residency, vehicle registration, and details about your driving history. They may also ask for information about your vehicle, such as the make, model, and year.