Can I get auto insurance from another state? This question arises when individuals move, travel, or even work across state lines. While the answer isn’t always a simple yes or no, understanding the nuances of state residency and insurance regulations is crucial. This guide explores the complexities of obtaining auto insurance across state borders, examining the factors that influence eligibility, the potential benefits and drawbacks, and the steps involved in the process.

State residency plays a pivotal role in determining your eligibility for auto insurance. Factors such as your driver’s license, voter registration, and primary residence all contribute to establishing residency. Misrepresenting your residency to obtain insurance can lead to serious consequences, including policy cancellation and potential legal ramifications.

Understanding State Residency and Insurance: Can I Get Auto Insurance From Another State

When it comes to auto insurance, your state of residency plays a crucial role in determining your coverage options and premiums. It’s essential to understand the legal definition of residency and how it impacts your insurance eligibility.

Residency Requirements for Auto Insurance

The legal definition of residency can vary slightly from state to state, but it generally refers to the place where you have established a permanent home and intend to remain for an indefinite period. This means more than just having a physical address; it involves demonstrating a genuine connection to the state.

Several factors contribute to determining residency, including:

- Driver’s License: Holding a driver’s license issued by the state where you claim residency is a strong indicator of your intent to live there.

- Voter Registration: Being registered to vote in a particular state signifies your intent to participate in the political process of that state, further supporting your claim of residency.

- Primary Residence: The location of your primary residence, where you spend the majority of your time and keep your belongings, is a key factor in establishing residency. This can be evidenced by utility bills, property tax records, or lease agreements.

- Employment: If you are employed in a particular state, it strengthens your residency claim, as it indicates your economic ties to that location.

- Bank Accounts and Financial Records: Maintaining bank accounts and other financial records in a specific state reinforces your residency claim, demonstrating your financial connection to that location.

Implications of Misrepresenting Residency

It is illegal to misrepresent your residency to obtain insurance at a lower rate or to avoid paying higher premiums in your actual state of residence. Insurance companies have sophisticated systems to verify residency claims, and they may investigate any inconsistencies.

If you are caught misrepresenting your residency, you could face severe consequences, including:

- Policy Cancellation: Your insurance policy could be canceled, leaving you without coverage.

- Denial of Claims: If you file a claim while misrepresenting your residency, the insurance company may deny your claim, leaving you financially responsible for any damages or injuries.

- Fines and Penalties: Depending on the state, you could face fines and penalties for insurance fraud.

- Criminal Charges: In some cases, misrepresenting your residency for insurance purposes could result in criminal charges, including fraud and perjury.

Restrictions on Out-of-State Insurance

While the principle of interstate commerce often allows drivers to utilize insurance policies from other states, certain states impose restrictions on out-of-state auto insurance. These restrictions aim to ensure adequate coverage and financial responsibility within their jurisdictions.

Reasons for Restrictions

States may impose restrictions on out-of-state insurance for several reasons:

- Ensuring Adequate Coverage: States strive to ensure that drivers within their borders have sufficient insurance coverage to protect other drivers and pedestrians in case of accidents. Out-of-state policies may not meet the minimum coverage requirements of the state where the driver is operating the vehicle.

- Financial Responsibility: Restrictions on out-of-state insurance help ensure that drivers are financially responsible for any accidents they may cause. By requiring drivers to obtain insurance from within the state, states can monitor the financial stability of insurance companies and ensure that they have the resources to cover claims.

- Preventing Fraud and Abuse: States may restrict out-of-state insurance to prevent fraudulent activities, such as individuals obtaining insurance from states with lower premiums and then driving in states with higher premiums.

- State Revenue: Some states may impose restrictions to protect their revenue streams. By requiring drivers to obtain insurance from within the state, states can collect premium taxes and fees.

Consequences of Driving with Out-of-State Insurance in a Restricted State

Driving with out-of-state insurance in a state where it’s prohibited can have significant consequences:

- Fines and Penalties: Drivers may face fines and penalties for violating state insurance regulations. These penalties can range from warnings to hefty fines and even license suspension.

- Denial of Coverage: If an accident occurs, the driver’s out-of-state insurance policy may not cover the damages or injuries, leaving the driver financially responsible for the costs.

- Legal Issues: Driving with prohibited insurance can lead to legal complications, such as difficulty in defending oneself in court or facing additional legal claims.

- Difficulty in Registering Vehicles: Some states may require proof of in-state insurance before allowing drivers to register their vehicles.

Circumstances Allowing Out-of-State Insurance

There are specific circumstances where you may be permitted to maintain insurance coverage from your home state while living or working in another state. These situations typically involve temporary or short-term stays, with specific requirements and regulations depending on the state you are visiting or relocating to.

While most states require you to have insurance from that state if you are a resident, exceptions are made for individuals who are temporarily in a state for specific purposes.

Temporary Visits, Can i get auto insurance from another state

You may be able to maintain your home state’s insurance coverage for a temporary visit, such as a vacation or a short-term work assignment. In most cases, your insurance policy will cover you for a limited period in another state. However, it is crucial to check with your insurance provider to determine the specific coverage duration and limitations.

For instance, a typical vacation may be covered under your home state’s policy for 30 to 90 days.

- Duration of Coverage: Your insurance provider will typically have a policy limit for temporary coverage, usually between 30 to 90 days. You need to confirm the coverage period with your insurance company.

- Documentation: If you are stopped by law enforcement, you will need to provide proof of your residency and temporary stay. This may include your driver’s license, proof of address, and a travel itinerary.

- Specific Coverage: While your home state’s policy will cover you for accidents during a temporary visit, it is essential to confirm the coverage details and limits with your insurance provider. This may include coverage for liability, property damage, and medical expenses.

Military Deployments

Military personnel often have unique insurance needs due to frequent relocations and deployments. Many states have specific regulations regarding insurance coverage for military members stationed in their state.

- State Regulations: States often have reciprocal agreements with other states to recognize military members’ home state insurance coverage. This ensures that military personnel stationed in a state other than their home state are still covered under their existing insurance policy.

- Coverage: Your insurance provider will typically cover you under your home state’s policy during a military deployment, even if you are stationed in another state. It is essential to inform your insurance company about your deployment to ensure continuous coverage.

- Documentation: You may need to provide proof of your military status and deployment orders to your insurance company and law enforcement, if required. This documentation will help validate your home state residency and coverage.

Work Assignments

You may be able to maintain your home state’s insurance coverage for a work assignment in another state, depending on the duration of the assignment and your employer’s policies.

- Duration of Assignment: Your insurance company may have a policy limit for temporary coverage related to work assignments. The length of the assignment will be a crucial factor in determining whether your home state’s insurance is valid.

- Employer Policies: Your employer may have policies regarding insurance coverage for employees working in other states. They may require you to obtain insurance from the state where you are working or provide supplementary coverage. Confirm your employer’s insurance policies before starting your work assignment.

- Documentation: If you are stopped by law enforcement, you will need to provide proof of your work assignment and your home state residency. This may include your employment contract, proof of address, and driver’s license.

Comparing Coverage and Rates

Understanding how auto insurance rates vary across states is crucial when considering obtaining coverage from another state. This section explores the differences in average rates, coverage options, and the potential benefits and drawbacks of choosing out-of-state insurance.

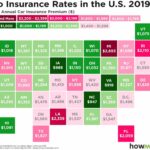

Average Auto Insurance Rates by State

Auto insurance rates are influenced by various factors, including vehicle type, driving history, and coverage levels. The following table provides a general comparison of average annual premiums for different states, based on a hypothetical driver with a clean driving record and a mid-range vehicle:

| State | Average Annual Premium |

|---|---|

| California | $2,100 |

| Florida | $2,300 |

| New York | $1,900 |

| Texas | $1,700 |

It’s important to note that these rates are just averages and can vary significantly depending on individual circumstances. It’s recommended to obtain quotes from multiple insurers to compare rates and coverage options.

Potential Benefits and Drawbacks of Out-of-State Insurance

Obtaining auto insurance from another state can offer potential benefits, such as lower premiums, but it’s essential to weigh these against potential drawbacks.

Benefits

- Lower Premiums: In some cases, insurers in other states may offer lower premiums due to different risk profiles or regulatory environments.

- More Coverage Options: Some states offer more comprehensive coverage options or optional add-ons that may not be available in your current state.

Drawbacks

- Coverage Limitations: Out-of-state insurance may not fully cover accidents or incidents that occur in your state of residence.

- Claims Processing Difficulties: Filing claims with an out-of-state insurer can be more complex and time-consuming.

- Legal Challenges: Potential legal issues may arise if your insurance policy does not comply with the laws of your state of residence.

Coverage Options Comparison

Coverage options vary across states, impacting the level of protection offered by your insurance policy. Here’s a comparison of key coverage areas:

Liability Limits

Liability coverage protects you financially if you cause an accident that injures someone or damages their property. States have minimum liability limits, which determine the maximum amount your insurer will pay for damages.

| State | Minimum Liability Limits (per person/per accident) |

|---|---|

| California | $15,000/$30,000 |

| Florida | $10,000/$20,000 |

| New York | $25,000/$50,000 |

| Texas | $30,000/$60,000 |

Collision and Comprehensive Coverage

Collision coverage protects your vehicle from damage caused by an accident, while comprehensive coverage covers damage from other events, such as theft, vandalism, or natural disasters.

- Collision Coverage: Some states require collision coverage for certain types of vehicles or situations, while others leave it optional.

- Comprehensive Coverage: Comprehensive coverage is typically optional in most states, but it’s recommended to have it if your vehicle is new or has a high value.

Optional Add-ons

States may offer different optional add-ons to enhance your auto insurance coverage. These can include:

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with a driver who doesn’t have adequate insurance.

- Roadside Assistance: Provides services like towing, flat tire changes, and jump-starts.

- Rental Car Reimbursement: Covers the cost of a rental car if your vehicle is damaged or stolen.

Navigating the Insurance Application Process

Applying for auto insurance in a new state can seem daunting, but it’s a straightforward process if you follow the right steps. This section will guide you through the process of applying for auto insurance in your new state.

Gathering Necessary Information

Before starting your application, gather all the necessary information. This includes personal details, vehicle information, and your driving history.

- Personal Details:

- Full Name

- Date of Birth

- Social Security Number

- Contact Information (Phone Number, Email Address, and Current Address)

- Employment Information (Employer Name, Occupation, and Length of Employment)

- Marital Status

- Vehicle Identification Number (VIN)

- Make, Model, and Year

- Vehicle Usage (Daily Commute, Pleasure Driving, etc.)

- Vehicle Value (This is important for determining the amount of coverage you need)

- Your Driving Record (Number of Accidents, Traffic Violations, and Driving Experience)

- Your Previous Insurance History (Insurance Carrier, Coverage Details, and Policy Number)

Factors Influencing Insurance Eligibility

Obtaining auto insurance from another state might seem convenient, but it’s not always a straightforward process. Various factors influence your eligibility, and understanding these factors is crucial to ensuring you get the coverage you need.

Impact of Personal Factors

Several personal factors play a significant role in determining your eligibility for auto insurance in a different state. These factors include:

- Age: Insurance companies typically offer lower premiums to older drivers, considering them statistically less likely to be involved in accidents. Younger drivers, especially those under 25, often face higher premiums due to their higher risk profile.

- Driving Record: Your driving history significantly influences your insurance eligibility. A clean driving record with no accidents or violations will generally lead to lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions can result in higher premiums or even denial of coverage.

- Credit Score: While not universally applicable, some states allow insurance companies to consider your credit score when determining your rates. A good credit score often indicates financial responsibility, which can lead to lower premiums.

- Vehicle Type: The type of vehicle you drive also influences your insurance premiums. Sports cars and high-performance vehicles are generally considered riskier and attract higher premiums than standard sedans or hatchbacks.

Impact of Prior Claims and Driving Violations

Your insurance history, including prior claims and driving violations, has a significant impact on your eligibility and premiums.

- Prior Claims: Filing claims for accidents or damage to your vehicle can increase your premiums. The number and severity of your claims will determine the impact on your rates. For example, a minor fender bender might have a smaller impact than a major accident involving injuries.

- Driving Violations: Traffic violations, such as speeding tickets or reckless driving, can significantly increase your premiums. The severity of the violation and the frequency of such violations influence the impact on your rates.

Situations Where Eligibility May Be Denied or Restricted

In some cases, insurance companies may deny or restrict coverage based on specific state regulations or company policies. Here are some examples:

- High-Risk Drivers: Individuals with a history of multiple accidents, serious violations, or DUI convictions may be considered high-risk drivers and denied coverage by some insurance companies.

- Non-Standard Vehicles: Certain types of vehicles, such as modified cars or vehicles used for commercial purposes, may not be covered by standard insurance policies. You might need to seek specialized coverage from a niche insurer.

- State Residency Requirements: Some states require you to be a resident for a certain period before you can obtain insurance. This requirement ensures that insurance companies can accurately assess your risk profile and adjust premiums accordingly.

Seeking Professional Guidance

Navigating the complexities of out-of-state insurance can be challenging, even with a thorough understanding of the rules and regulations. Consulting with an insurance agent or broker can provide invaluable personalized advice and guidance to ensure you obtain the right coverage at the best possible price.

Insurance professionals are well-versed in state-specific regulations, coverage requirements, and market trends. They can help you understand the nuances of out-of-state insurance, assess your individual needs, and recommend the most suitable insurance options.

Finding Reputable Insurance Professionals

Locating trustworthy insurance agents or brokers in different states is crucial. Here are some tips for finding reputable professionals:

- Seek referrals: Ask friends, family, or colleagues for recommendations.

- Check online directories: Websites like the National Association of Insurance Commissioners (NAIC) and the Independent Insurance Agents & Brokers of America (IIABA) offer directories of licensed insurance professionals.

- Verify licenses and credentials: Ensure the agent or broker is licensed in the state where you need insurance.

- Read reviews and testimonials: Online platforms like Yelp and Google Reviews provide insights into the experiences of previous clients.

- Schedule consultations: Contact several insurance professionals to discuss your needs and compare their services.

Closing Summary

Navigating the world of out-of-state auto insurance can be complex, but with proper research and guidance, it’s possible to find the right coverage for your needs. Remember to consult with an insurance agent or broker who specializes in interstate insurance matters to ensure you meet all state requirements and obtain the most suitable coverage for your specific situation.

FAQ

What if I’m only visiting a state for a short period?

Most states allow you to obtain temporary insurance coverage for short-term visits. You’ll typically need to provide proof of residency in your home state and your vehicle’s registration.

Can I use my out-of-state insurance if I move to a new state?

Generally, you’ll need to obtain insurance from the state you move to. However, some states may allow you to continue using your out-of-state insurance for a limited time, especially if you’re in the process of relocating.

What are the consequences of driving without proper insurance?

Driving without valid insurance can result in hefty fines, suspension of your driver’s license, and even the impoundment of your vehicle. In some cases, you may also face legal action.