Business Insurance Washington State: Protecting Your Business is a vital step for any entrepreneur or business owner in the Evergreen State. Navigating the complex world of insurance can feel daunting, but understanding the legal requirements and available options can help you make informed decisions to safeguard your business from unexpected risks.

From general liability to workers’ compensation and property insurance, there are various types of coverage designed to protect your business from financial loss. This guide will delve into the key aspects of business insurance in Washington, exploring the types of coverage available, factors influencing costs, and how to choose the right provider for your specific needs.

Understanding Business Insurance in Washington State

Operating a business in Washington State requires navigating a complex landscape of legal requirements, including insurance. Ensuring you have the right coverage protects your assets, employees, and customers while complying with state regulations. This guide will provide a comprehensive overview of business insurance in Washington State, covering legal requirements, common types of insurance, and resources for further information.

Legal Requirements for Business Insurance in Washington State

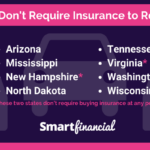

Washington State doesn’t mandate specific types of business insurance for all businesses. However, certain industries and situations require specific coverage. For example, businesses handling hazardous materials or operating in specific sectors might need additional insurance. It’s crucial to consult with an insurance professional to determine the specific legal requirements for your industry and business structure.

Common Types of Business Insurance in Washington State

Various business insurance policies can protect your business from financial losses due to unexpected events. Here are some common types of business insurance needed in Washington State:

- General Liability Insurance: Provides coverage for bodily injury, property damage, and personal injury claims arising from your business operations. This is crucial for protecting your business from lawsuits and financial burdens.

- Workers’ Compensation Insurance: Required for employers with employees in Washington State. It covers medical expenses, lost wages, and other benefits for employees injured or sick due to work-related causes. Failure to provide workers’ compensation insurance can result in severe penalties.

- Commercial Property Insurance: Protects your business property, including buildings, equipment, and inventory, against losses from fire, theft, vandalism, and natural disasters. This policy safeguards your assets and ensures business continuity in the event of a covered incident.

- Business Interruption Insurance: Provides financial compensation for lost income and ongoing expenses when your business is temporarily shut down due to a covered event, such as a fire or natural disaster. This policy helps your business stay afloat during challenging times.

- Professional Liability Insurance (Errors & Omissions): This insurance is crucial for businesses offering professional services, such as consulting, accounting, or legal advice. It protects you from claims arising from errors, omissions, or negligence in your professional services.

- Product Liability Insurance: This insurance protects your business from claims arising from injuries or damages caused by your products. It’s crucial for businesses selling products directly to consumers.

- Cyber Liability Insurance: This insurance covers your business from losses due to cyberattacks, data breaches, and other cyber threats. It helps protect your sensitive data, reputation, and financial stability in the digital age.

Washington State Department of Insurance Website

The Washington State Department of Insurance (DOI) website is a valuable resource for business owners seeking information about insurance requirements, regulations, and consumer protection. The website offers various resources, including:

- Insurance Licensing and Regulation: The DOI regulates the insurance industry in Washington State, ensuring that insurance companies operate fairly and responsibly. The website provides information on insurance licenses, regulations, and compliance requirements.

- Consumer Protection Resources: The DOI is committed to protecting consumers’ rights and interests in the insurance market. The website offers resources on insurance fraud, complaints, and dispute resolution processes.

- Insurance Market Information: The DOI collects and publishes data on the insurance market in Washington State, providing insights into insurance rates, coverage, and industry trends. This information can help businesses make informed decisions about their insurance needs.

- Publications and Guides: The DOI publishes various guides and publications on insurance topics, including business insurance, workers’ compensation, and health insurance. These resources provide valuable information and insights for businesses.

Key Types of Business Insurance in Washington

Every business in Washington State faces unique risks, and protecting your company from these risks is crucial for its long-term success. Understanding the key types of business insurance available can help you make informed decisions about your coverage and mitigate potential financial losses.

General Liability Insurance

General liability insurance is a fundamental component of any comprehensive business insurance plan in Washington. It provides financial protection against third-party claims alleging bodily injury, property damage, or personal injury resulting from your business operations.

- Examples of covered incidents: A customer slips and falls on your premises, a client suffers property damage due to your negligence, or a third party is injured by your product.

- Importance in Washington: Washington State has a relatively high cost of living, and medical expenses and legal fees can be substantial. General liability insurance can help cover these costs, preventing financial ruin for your business.

- Benefits: General liability insurance not only protects your assets but also enhances your business reputation. By demonstrating a commitment to safety and responsibility, you build trust with customers, suppliers, and the community.

Workers’ Compensation Insurance

Workers’ compensation insurance is a legally mandated coverage in Washington State, designed to protect employees who suffer work-related injuries or illnesses. It provides medical benefits, lost wages, and rehabilitation services.

- Key Differences from Other Insurance: Unlike other business insurance types, workers’ compensation is mandatory for most employers in Washington. It is not optional and is governed by state law. Additionally, it provides benefits directly to employees, not the business itself.

- Importance in Washington: Washington has a robust workers’ compensation system, offering comprehensive benefits to injured workers. This system is designed to ensure that employees receive the necessary care and support while minimizing financial hardship.

- Benefits: Workers’ compensation insurance protects your business from costly lawsuits, reduces employee absenteeism, and promotes a safe and healthy work environment. By providing a safety net for employees, it fosters a sense of security and loyalty.

Property Insurance, Business insurance washington state

Property insurance safeguards your business assets from various perils, such as fire, theft, vandalism, and natural disasters.

- Types of Coverage: Property insurance can cover your building, equipment, inventory, and other physical assets. It can also provide business interruption coverage, compensating for lost income during downtime.

- Importance in Washington: Washington State experiences a variety of natural disasters, including earthquakes, wildfires, and floods. Property insurance can help you recover from these events and resume business operations.

- Benefits: Property insurance provides financial security, protecting your investment in your business and ensuring its continuity. It also helps you avoid the devastating financial consequences of a major loss.

Factors Affecting Business Insurance Costs in Washington: Business Insurance Washington State

The cost of business insurance in Washington, like elsewhere, is influenced by a variety of factors. Understanding these factors can help businesses in Washington make informed decisions about their insurance coverage and minimize their premiums.

Industry Type

The type of industry a business operates in significantly impacts its insurance costs. Some industries, like construction or manufacturing, are inherently riskier than others, such as retail or services. Higher risk industries generally face higher insurance premiums due to the increased likelihood of accidents, injuries, or property damage.

- Construction: Construction businesses face higher risks due to the nature of their work, which often involves hazardous materials, heavy machinery, and working at heights. This increased risk translates to higher premiums for general liability, workers’ compensation, and property insurance.

- Manufacturing: Manufacturing businesses also carry a higher risk profile due to the use of machinery, potential for product liability claims, and the presence of hazardous materials. This often leads to higher premiums for product liability insurance, general liability, and workers’ compensation.

- Retail: Retail businesses generally face lower risk compared to construction or manufacturing. They typically have lower risks of accidents, injuries, and property damage. This translates to lower premiums for general liability and property insurance.

- Services: Service businesses, such as consulting or accounting firms, often have the lowest risk profile. They typically don’t involve hazardous materials, heavy machinery, or physical products, resulting in lower premiums for general liability and professional liability insurance.

Choosing the Right Business Insurance Provider

Finding the right business insurance provider in Washington can feel like a daunting task, but it’s crucial for securing the right coverage at a competitive price. The right provider will understand your specific needs and offer policies tailored to your business.

Tips for Finding a Reputable Business Insurance Provider

Here are some tips for finding a reputable business insurance provider in Washington:

- Start with Recommendations: Ask other business owners in your industry for recommendations. They can provide valuable insights based on their experiences.

- Check Online Reviews: Explore online review platforms like Yelp, Google Reviews, and the Better Business Bureau to gauge the reputation of potential providers.

- Look for Licensed and Certified Providers: Ensure the provider is licensed to operate in Washington State and has the necessary certifications to offer the type of insurance you need.

- Consider Financial Stability: Check the provider’s financial strength ratings from organizations like AM Best or Standard & Poor’s. This indicates their ability to pay claims in the future.

- Seek Local Providers: Local providers may offer personalized service and a deeper understanding of the Washington business landscape.

Comparing Business Insurance Providers

Once you’ve identified a few potential providers, it’s time to compare their offerings. Here’s a sample comparison chart to help you organize your research:

| Provider | Policy Options | Coverage Limits | Deductibles | Premiums | Customer Service | Financial Strength |

|---|---|---|---|---|---|---|

| Provider A | [List policy options] | [List coverage limits] | [List deductibles] | [List premiums] | [Describe customer service] | [Indicate financial strength rating] |

| Provider B | [List policy options] | [List coverage limits] | [List deductibles] | [List premiums] | [Describe customer service] | [Indicate financial strength rating] |

| Provider C | [List policy options] | [List coverage limits] | [List deductibles] | [List premiums] | [Describe customer service] | [Indicate financial strength rating] |

Evaluating Insurance Quotes

When you receive insurance quotes from different providers, carefully evaluate them based on the following factors:

- Coverage: Ensure the quote covers all the risks your business faces, including property, liability, and other potential losses.

- Deductibles: Understand the deductible amount you’ll be responsible for in the event of a claim. Higher deductibles usually result in lower premiums, but you’ll need to pay more out of pocket.

- Premiums: Compare the total annual premium costs and look for any discounts or incentives offered.

- Customer Service: Consider the provider’s reputation for responsiveness and customer satisfaction.

- Financial Strength: As mentioned earlier, check the provider’s financial strength rating to assess their ability to pay claims in the future.

Understanding Business Insurance Claims in Washington

Navigating the process of filing a business insurance claim can feel overwhelming, especially during a stressful time. Understanding the steps involved and the common reasons for claims can make the process smoother.

Filing a Business Insurance Claim in Washington

Filing a business insurance claim in Washington involves several steps. The process can vary slightly depending on the specific insurance policy and the nature of the claim. Here’s a general Artikel:

- Report the Claim: Contact your insurance agent or the insurance company directly as soon as possible after the incident occurs. This ensures timely action and prevents potential complications.

- Gather Documentation: Prepare a detailed account of the incident, including dates, times, and any witnesses. Collect relevant documentation, such as police reports, medical records, repair estimates, and photographs of the damage.

- Submit the Claim: Complete the necessary claim forms provided by your insurance company. Be accurate and thorough in your descriptions and ensure you include all required documentation.

- Review and Investigation: The insurance company will review your claim and may conduct an investigation to verify the details and assess the extent of the loss.

- Negotiate and Settlement: Once the investigation is complete, the insurance company will present a settlement offer. You have the right to negotiate this offer and may need to provide additional information or documentation.

- Payment: If you accept the settlement offer, the insurance company will process payment according to the terms of your policy.

Common Reasons for Business Insurance Claims in Washington

Business insurance claims are triggered by a wide range of events, with some being more common than others. Here are some frequent reasons for claims in Washington:

- Property Damage: This includes damage to your business property caused by fire, theft, vandalism, natural disasters (such as earthquakes or floods), or other unforeseen events.

- Liability Claims: These arise when your business is accused of causing harm or injury to another person or their property. Examples include slip-and-fall accidents, product liability, or professional negligence.

- Business Interruption: This covers losses incurred when your business is unable to operate due to an insured event. It helps compensate for lost income and expenses.

- Employee Injuries: Worker’s compensation insurance covers medical expenses and lost wages for employees injured on the job.

Concluding Remarks

In the end, understanding business insurance in Washington is essential for any business owner who wants to protect their investment and ensure a secure future. By navigating the legal requirements, choosing the right coverage, and working with a reputable provider, you can create a solid foundation for your business’s success and peace of mind. Remember, the right insurance can be a crucial safety net, providing financial protection and allowing you to focus on growing your business with confidence.

Frequently Asked Questions

What are the penalties for not having required business insurance in Washington State?

The specific penalties vary depending on the type of insurance and the nature of the violation. However, businesses that fail to comply with insurance requirements could face fines, license suspension, or even legal action in case of an incident.

How can I find a reputable business insurance provider in Washington?

Start by seeking recommendations from other businesses in your industry or professional organizations. You can also check online reviews and ratings, and consider contacting the Washington State Department of Insurance for a list of licensed providers.

What are some common reasons for business insurance claims in Washington?

Common reasons for claims include accidents on business premises, property damage, employee injuries, product liability, and lawsuits from customers or vendors.