Best states for car insurance – Finding affordable car insurance can feel like a daunting task, especially when you consider the wide range of factors that influence premiums. From state-specific regulations to individual driving habits, navigating the world of car insurance can be complex. This guide explores the best states for affordable car insurance, providing insights into the key factors that contribute to lower rates. We’ll delve into the relationship between average income, population density, and traffic accidents, and examine how state-mandated coverage requirements and weather conditions impact premiums. You’ll discover the top states with the lowest average car insurance costs, along with a breakdown of average annual premiums for different types of coverage. We’ll also provide practical tips for comparing quotes, negotiating lower rates, and maintaining a good driving record to reduce your insurance costs.

Ultimately, understanding the factors that influence car insurance rates empowers you to make informed decisions and find the best coverage for your needs at a price that fits your budget. Let’s explore the world of car insurance together and uncover the secrets to saving money on your premiums.

Factors Influencing Car Insurance Rates

A multitude of factors contribute to the cost of car insurance, making it a complex and sometimes confusing landscape for consumers. Understanding these factors is crucial for making informed decisions about your coverage and finding the best rates.

Average Income Levels

The average income level in a state plays a significant role in determining car insurance premiums. States with higher average incomes generally have higher car insurance rates. This is because individuals with higher incomes tend to own more expensive vehicles, which are more costly to repair or replace in the event of an accident. Additionally, higher income levels often translate to higher property values, which could lead to higher liability claims in the event of an accident.

Population Density

Population density also influences car insurance costs. States with higher population densities tend to have higher car insurance rates due to increased traffic congestion and a higher likelihood of accidents. In densely populated areas, the frequency of accidents can increase, leading to more claims and higher premiums.

Prevalence of Traffic Accidents, Best states for car insurance

The prevalence of traffic accidents in a state is directly related to car insurance rates. States with higher accident rates tend to have higher premiums. This is because insurance companies need to account for the increased risk of accidents and potential claims in these areas.

State-Mandated Insurance Coverage Requirements

State-mandated insurance coverage requirements can have a significant impact on car insurance premiums. States with more stringent coverage requirements, such as higher minimum liability limits, often have higher premiums. These requirements ensure that drivers have adequate coverage in the event of an accident, but they can also increase the cost of insurance.

Weather Conditions

Weather conditions, particularly extreme weather events, can influence car insurance costs. States prone to hurricanes, tornadoes, or severe snowstorms often have higher premiums. These events can lead to widespread damage to vehicles, increasing the likelihood of claims and driving up insurance costs.

Top States for Affordable Car Insurance

Finding affordable car insurance is a top priority for many drivers. While rates vary based on factors like driving history, vehicle type, and coverage levels, some states consistently offer lower premiums than others. This section will delve into the top five states with the most affordable car insurance rates, providing a comprehensive overview of average annual premiums and a breakdown of costs for different coverage types.

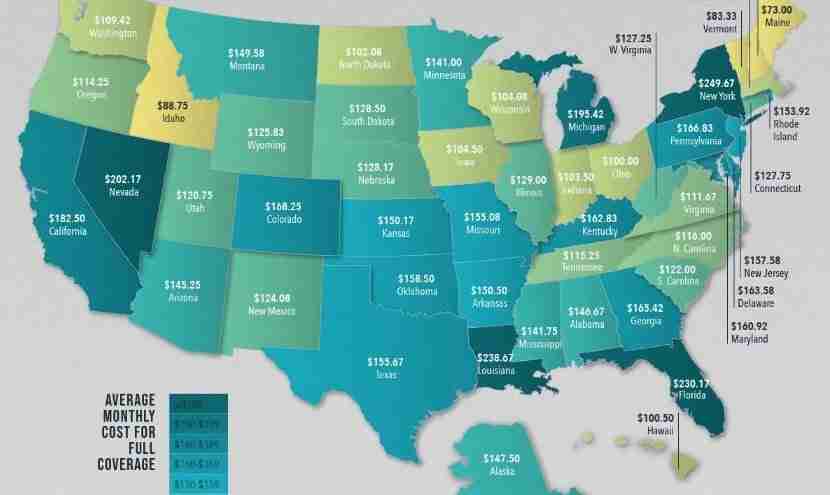

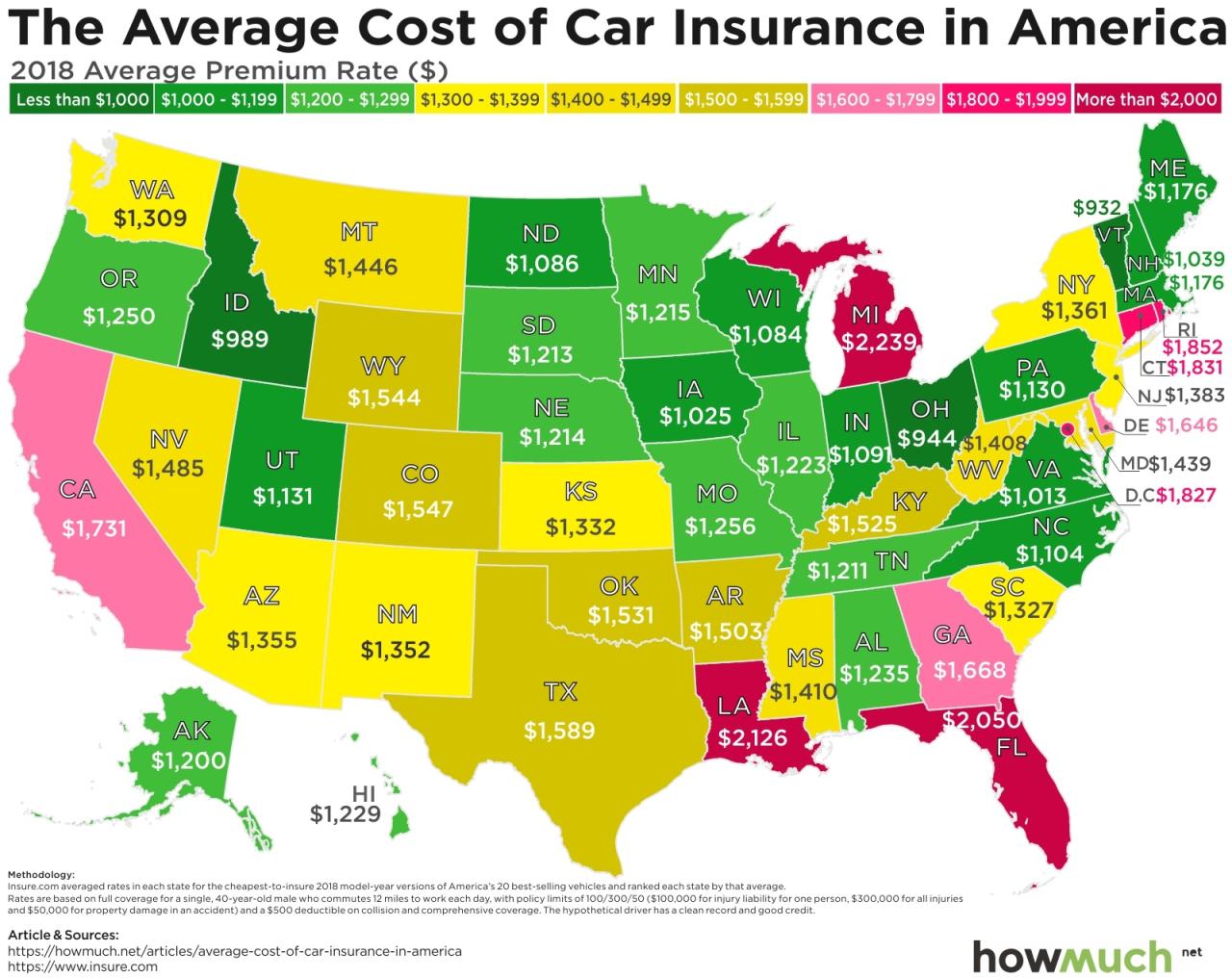

Average Car Insurance Premiums by State

The following table showcases the top five states with the lowest average annual car insurance premiums, based on data from the National Association of Insurance Commissioners (NAIC). The data represents the average premium for a standard driver profile with minimum liability coverage, collision, and comprehensive coverage.

| State | Average Annual Premium |

|—|—|

| Maine | $1,058 |

| Idaho | $1,102 |

| North Dakota | $1,114 |

| Vermont | $1,121 |

| South Dakota | $1,138 |

Breakdown of Coverage Costs

While the overall average premiums provide a general understanding of affordability, it’s crucial to examine the cost of individual coverage types. Here’s a breakdown of average premiums for liability, collision, and comprehensive coverage in the top five states:

| State | Liability | Collision | Comprehensive |

|—|—|—|—|

| Maine | $450 | $325 | $283 |

| Idaho | $480 | $350 | $272 |

| North Dakota | $490 | $360 | $264 |

| Vermont | $500 | $370 | $251 |

| South Dakota | $510 | $380 | $248 |

Factors Influencing Coverage Costs

The cost of car insurance coverage varies based on a range of factors, including:

* Driving History: Drivers with a clean driving record, no accidents, and no traffic violations typically enjoy lower premiums.

* Vehicle Type: Higher-value vehicles, luxury cars, and vehicles with a history of theft or accidents often have higher premiums.

* Location: Urban areas with higher traffic density and crime rates generally have higher insurance premiums.

* Age and Gender: Younger drivers and males tend to have higher premiums due to increased risk.

* Credit Score: In many states, insurance companies use credit score as a factor in determining premiums, with higher scores often leading to lower rates.

Factors Affecting Individual Car Insurance Rates: Best States For Car Insurance

Beyond the general factors that influence state-level insurance rates, several individual characteristics and circumstances play a significant role in determining your car insurance premiums. These factors are analyzed by insurance companies to assess your risk profile and calculate your insurance cost.

Age

Age is a crucial factor in car insurance pricing. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents due to their lack of experience and risk-taking behavior. As drivers age and gain more experience, their risk profile decreases, leading to lower premiums.

- Young Drivers: Typically face higher premiums due to their higher risk of accidents.

- Mature Drivers: Often enjoy lower premiums as they have more experience and a better driving record.

- Senior Drivers: May see slightly higher premiums due to potential health concerns or reduced reaction times.

Driving History

Your driving history is a key indicator of your risk as a driver. A clean driving record with no accidents, tickets, or violations generally leads to lower insurance rates. Conversely, a history of accidents, speeding tickets, or other violations will increase your premiums.

- Accident History: Accidents, even minor ones, significantly impact your insurance rates, as they demonstrate a higher risk of future accidents.

- Traffic Violations: Speeding tickets, reckless driving, and other traffic violations increase your risk profile, leading to higher premiums.

- DUI/DWI Convictions: These offenses are considered extremely serious and result in significantly higher premiums, often for several years.

Credit Score

Surprisingly, your credit score can also affect your car insurance rates. Insurance companies use credit scores as a proxy for financial responsibility, assuming that those with good credit are more likely to be responsible drivers. While this practice is controversial, several states allow insurance companies to consider credit scores when determining premiums.

- Good Credit: Usually leads to lower insurance rates as it suggests financial responsibility.

- Poor Credit: Can result in higher premiums as it might indicate a higher risk of claims.

- Credit Score Impact Varies: The extent to which credit score affects insurance rates varies by state and insurance company.

Vehicle Make, Model, and Year

The type of vehicle you drive significantly influences your insurance rates. Insurance companies assess the safety features, repair costs, and theft risk associated with different vehicles. Vehicles with advanced safety features, lower repair costs, and lower theft rates tend to have lower insurance premiums.

- Safety Features: Cars with anti-theft systems, airbags, and other safety features are generally considered safer and result in lower premiums.

- Repair Costs: Vehicles with expensive parts and complex repairs tend to have higher insurance premiums.

- Theft Risk: Vehicles with high theft rates are considered riskier and may attract higher premiums.

Driving Habits

Your driving habits, including mileage and commuting distance, can also influence your car insurance premiums. Insurance companies understand that drivers who commute long distances or drive frequently are more likely to be involved in accidents.

- Mileage: Higher annual mileage generally leads to higher premiums as you spend more time on the road.

- Commuting Distance: Long commutes increase the risk of accidents, resulting in potentially higher premiums.

- Driving Habits: Aggressive driving habits, such as speeding or tailgating, can increase your risk of accidents and higher premiums.

Insurance Discounts

Many insurance companies offer discounts to reduce premiums for policyholders who demonstrate responsible driving habits or meet specific criteria. These discounts can significantly lower your insurance costs.

- Safe Driving Discount: Awarded to drivers with clean driving records and no accidents or violations.

- Good Student Discount: Available to students with good academic standing, often with a GPA requirement.

- Multi-Car Discount: Offered for insuring multiple vehicles with the same insurance company.

- Multi-Policy Discount: Awarded for bundling car insurance with other insurance policies, such as homeowners or renters insurance.

- Safety Feature Discount: Available for vehicles equipped with advanced safety features like anti-theft systems or airbags.

- Defensive Driving Course Discount: Offered to drivers who complete a certified defensive driving course.

Tips for Finding Affordable Car Insurance

Finding affordable car insurance requires careful research and comparison. You can significantly reduce your premiums by implementing smart strategies and understanding the factors that influence your rates.

Comparing Car Insurance Quotes

Comparing quotes from multiple insurers is crucial to finding the best deal. Here’s a step-by-step guide:

- Gather your information: Before starting, collect essential details like your driving history, vehicle information, and desired coverage levels.

- Use online comparison tools: Several websites, like Policygenius and NerdWallet, allow you to enter your information once and receive quotes from various insurers. These tools can save you time and effort.

- Contact insurers directly: Reach out to insurers you’re interested in and request a personalized quote. This gives you an opportunity to ask questions and discuss specific needs.

- Compare coverage details: Don’t just focus on the price; carefully examine the coverage details, deductibles, and policy terms of each quote. Ensure you’re comparing apples to apples.

- Consider discounts: Ask about available discounts, such as good driver, multi-car, or bundling discounts. Many insurers offer discounts for safety features in your car or for completing a defensive driving course.

Negotiating Lower Car Insurance Premiums

Once you’ve gathered quotes, you can negotiate for a better price. Here are some tips:

- Shop around regularly: Don’t assume your current insurer offers the best rate. Compare quotes annually to ensure you’re getting the most competitive price.

- Bundle your insurance: Combining your car insurance with other policies, like homeowners or renters insurance, can often lead to significant discounts.

- Increase your deductible: A higher deductible means you pay more out of pocket in case of an accident but can lower your premium.

- Ask about discounts: Inquire about any discounts you may be eligible for, such as good driver, safe driver, or multi-car discounts.

- Consider a usage-based insurance program: Some insurers offer programs that track your driving habits and reward safe drivers with lower premiums.

Maintaining a Good Driving Record and Credit Score

Your driving record and credit score are crucial factors in determining your car insurance rates. Here’s how to improve them:

- Avoid traffic violations: Driving safely and obeying traffic laws can prevent accidents and keep your driving record clean, leading to lower premiums.

- Complete a defensive driving course: These courses teach safe driving techniques and can earn you discounts on your insurance.

- Monitor your credit score: Regularly check your credit report and take steps to improve your score by paying bills on time and reducing debt.

- Dispute errors on your credit report: If you find inaccuracies, contact the credit reporting agency and request a correction.

Benefits of Bundling Car Insurance

Bundling your car insurance with other policies, like homeowners or renters insurance, can lead to significant savings. Here are some benefits:

- Reduced premiums: Insurers often offer discounts for bundling multiple policies with them. This can save you money on both your car and home insurance.

- Convenience: Having all your insurance policies with one provider simplifies managing your coverage and billing.

- Improved customer service: Dealing with a single insurer can make it easier to resolve claims and access customer support.

State-Specific Insurance Regulations

Each state in the US has its own unique set of car insurance laws and regulations that can significantly impact the cost and coverage of your policy. Understanding these regulations is crucial for making informed decisions about your car insurance.

Coverage Requirements and Limits

State-specific insurance regulations establish minimum coverage requirements that all drivers must carry. These requirements vary from state to state and often include liability coverage, personal injury protection (PIP), and uninsured/underinsured motorist (UM/UIM) coverage. The limits of these coverages, which define the maximum amount the insurance company will pay for a covered event, also differ significantly.

- Liability Coverage: This coverage protects you financially if you cause an accident that results in injuries or property damage to others. It typically covers bodily injury liability and property damage liability. The minimum limits for liability coverage can vary widely between states. For example, in Texas, the minimum liability coverage is $30,000 per person and $60,000 per accident for bodily injury, and $25,000 for property damage. In contrast, in New York, the minimum liability coverage is $25,000 per person and $50,000 per accident for bodily injury, and $10,000 for property damage.

- Personal Injury Protection (PIP): PIP coverage, also known as no-fault insurance, covers medical expenses and lost wages for you and your passengers, regardless of who caused the accident. This coverage is mandatory in some states, like Florida and New York, while it’s optional in others. The amount of coverage and benefits provided under PIP can vary widely.

- Uninsured/Underinsured Motorist (UM/UIM) Coverage: UM/UIM coverage protects you financially if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient insurance. It covers medical expenses, lost wages, and property damage caused by the other driver. The availability and limits of UM/UIM coverage vary between states.

Impact on Consumer Choice and Costs

State-specific insurance regulations directly influence consumer choice and insurance costs. Higher minimum coverage requirements and limits can lead to higher insurance premiums but also provide greater financial protection in case of an accident. Conversely, lower minimum requirements may result in lower premiums but offer less protection.

- Choice of Coverage: States with higher minimum coverage requirements often have more stringent regulations regarding coverage options, which may limit consumer choice. For example, some states require specific types of coverage, such as PIP, while others allow drivers to choose optional coverages.

- Premium Costs: State regulations significantly impact insurance premiums. States with higher minimum coverage requirements and more stringent regulations generally have higher average premiums. For example, states like New Jersey and Pennsylvania, with higher minimum coverage requirements and stricter regulations, tend to have higher average insurance premiums compared to states like Wyoming and South Dakota, with lower minimum requirements and more relaxed regulations.

Final Review

Finding the best state for affordable car insurance is a multi-faceted process. By understanding the key factors that influence premiums, comparing quotes from different providers, and taking advantage of available discounts, you can significantly reduce your insurance costs. Remember, your driving record and credit score play a crucial role in determining your rates, so maintaining a clean driving history and improving your credit score can lead to significant savings. By following the tips and insights Artikeld in this guide, you can navigate the complex world of car insurance and secure the most affordable coverage for your needs.

FAQs

What are some common car insurance discounts?

Common car insurance discounts include safe driving discounts, good student discounts, multi-car discounts, and bundling discounts (combining car insurance with other types of insurance).

How often should I review my car insurance policy?

It’s recommended to review your car insurance policy at least annually, or whenever you experience a significant life change, such as a new car purchase, marriage, or change in driving habits.

What factors affect my car insurance premium besides my driving record?

Besides your driving record, factors like your age, credit score, vehicle type, and location can influence your car insurance premium.