Best states for auto insurance – Finding affordable auto insurance is a top priority for most drivers. While insurance rates vary significantly across the US, some states consistently offer more favorable premiums than others. This article delves into the factors that influence auto insurance costs, explores the methodology used to identify the best states for affordable coverage, and highlights the top states with the lowest average premiums. We’ll also discuss the reasons behind higher insurance costs in certain states and provide valuable tips for saving on your auto insurance premiums.

Understanding the factors that contribute to insurance rates, such as driving history, vehicle type, age, and location, is crucial for making informed decisions about your coverage. By comparing premiums across different states and exploring various strategies for reducing costs, you can find the most affordable and comprehensive auto insurance plan that meets your individual needs.

Factors Influencing Auto Insurance Rates

Auto insurance premiums are calculated based on various factors that insurers use to assess the risk of insuring a particular driver. These factors can significantly influence the cost of insurance, and understanding them can help you make informed decisions to potentially lower your premiums.

Driving History

Your driving history plays a crucial role in determining your auto insurance rates. Insurers analyze your driving record to assess your risk of accidents.

- A clean driving record with no accidents or violations generally results in lower premiums.

- Having a history of accidents, speeding tickets, or DUI convictions will significantly increase your rates.

- The severity of the violation or accident also impacts your premiums; a more serious incident will likely lead to higher increases.

For example, a driver with a clean record in California might pay an average of $1,500 per year for car insurance, while a driver with a DUI conviction could face premiums exceeding $3,000.

Vehicle Type

The type of vehicle you drive is another key factor in determining your insurance rates. Insurers consider the vehicle’s make, model, year, and safety features to assess its risk of being involved in an accident.

- Luxury cars or sports cars often have higher insurance rates due to their higher repair costs and potential for higher speeds.

- Vehicles with advanced safety features, such as anti-lock brakes and airbags, may qualify for discounts.

- Older vehicles, especially those with lower safety ratings, may also have higher premiums due to their increased risk of accidents.

For instance, a driver in Texas insuring a high-performance sports car might pay over $2,000 per year, while a driver with a fuel-efficient sedan could pay around $1,000.

Age

Your age is a significant factor in auto insurance rates, as younger and older drivers are considered higher risk.

- Teenagers often have higher premiums due to their lack of driving experience and higher risk-taking behavior.

- Drivers over the age of 65 may also have higher premiums due to potential health issues that could affect their driving abilities.

- Drivers in their 20s and 30s typically have lower premiums as they have more experience and are statistically less likely to be involved in accidents.

A teenager in Florida might pay over $3,000 per year for insurance, while a driver in their 30s with a clean record could pay around $1,200.

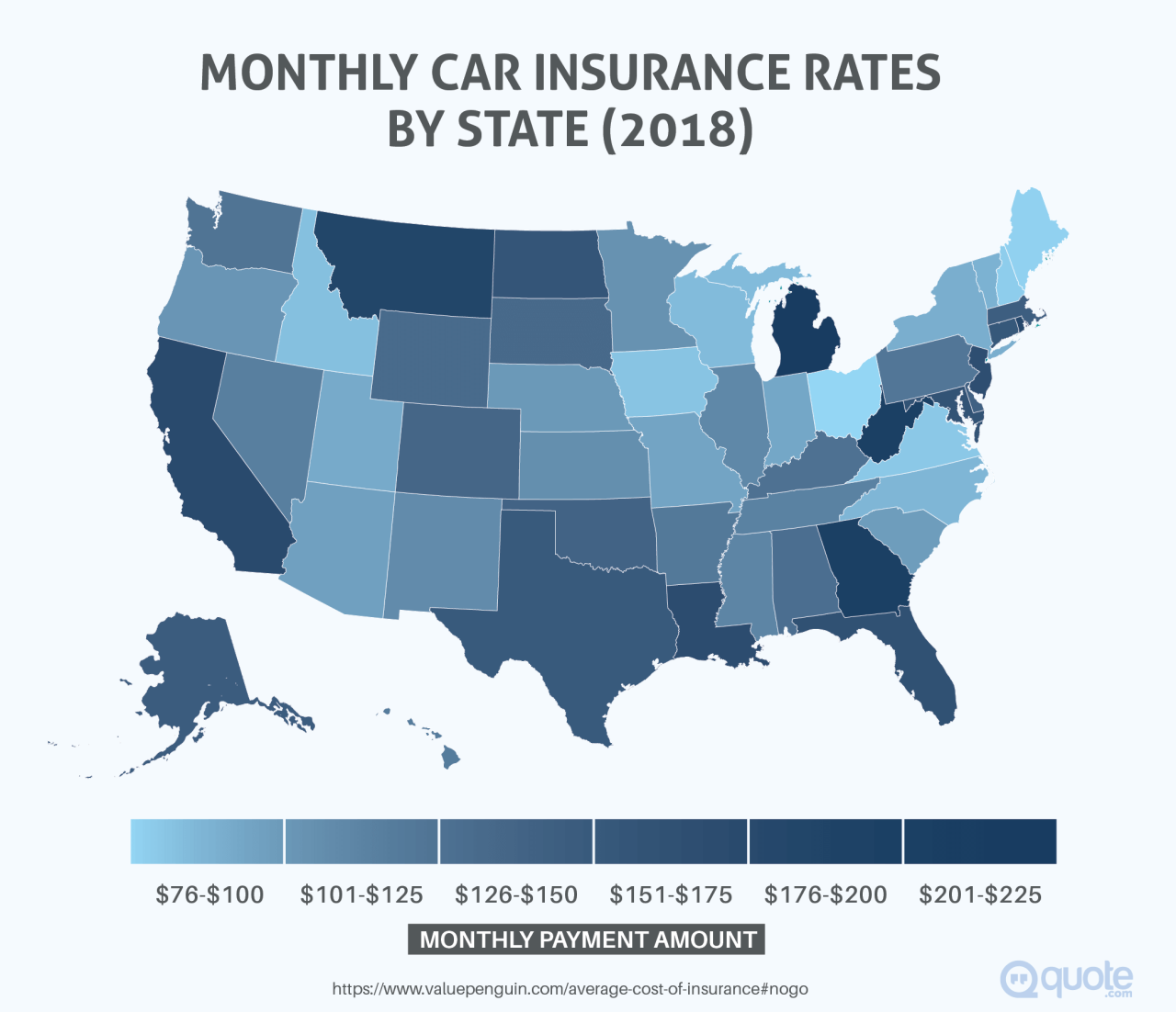

Location

Your location, including your state and zip code, significantly influences your auto insurance rates.

- States with higher population density and traffic congestion tend to have higher insurance rates due to a greater likelihood of accidents.

- Areas with higher crime rates or a history of natural disasters may also have higher premiums.

- Your zip code can impact rates as insurers consider factors like local accident statistics and the cost of repairs in your area.

For example, a driver in New York City might pay significantly more for insurance than a driver in a rural area of Wyoming, even with identical driving records and vehicles.

Methodology for Identifying Best States

This section delves into the methodology employed to rank states based on their average auto insurance premiums, providing insights into the data sources, criteria, and limitations of this analysis.

Data Sources and Criteria, Best states for auto insurance

The ranking of states is based on data collected from various sources, including:

* Insurance Information Institute (III): This organization provides comprehensive data on auto insurance premiums across the United States, offering a reliable source for analyzing average costs.

* National Association of Insurance Commissioners (NAIC): The NAIC gathers data on insurance markets, including auto insurance premiums, from state insurance departments, contributing to a comprehensive understanding of national trends.

* State Insurance Departments: Individual state insurance departments maintain data on auto insurance premiums within their jurisdictions, providing valuable insights into local market conditions.

The criteria used to determine the best states for auto insurance are primarily focused on:

* Average Auto Insurance Premiums: The average annual premium for a standard auto insurance policy is a key indicator of affordability, allowing for direct comparisons between states.

* State-Specific Factors: Factors such as population density, traffic volume, and accident rates are considered, as these can influence insurance premiums within specific states.

Limitations and Potential Biases

It’s crucial to acknowledge the limitations and potential biases inherent in this methodology:

* Data Availability and Consistency: Data availability and consistency across states can vary, potentially influencing the accuracy of comparisons.

* Policy Variations: Auto insurance policies differ in coverage and features across states, making direct comparisons challenging.

* Individual Risk Factors: This methodology focuses on average premiums, neglecting individual risk factors that significantly influence insurance costs, such as driving history, age, and vehicle type.

Illustrative Example

To illustrate the methodology, consider the example of comparing auto insurance premiums in California and Florida. Data from the III reveals that California has a higher average annual premium than Florida. However, this comparison should be interpreted cautiously, considering factors such as:

* Higher Population Density in California: California’s higher population density and traffic volume contribute to increased accident risk, potentially driving up premiums.

* State-Specific Regulations: California has stricter insurance regulations than Florida, which can influence pricing.

It’s essential to acknowledge that these are just two factors influencing the comparison, and a comprehensive analysis would require considering numerous other variables.

Top States for Affordable Auto Insurance: Best States For Auto Insurance

Finding affordable auto insurance is a top priority for most drivers. Fortunately, some states consistently offer lower average premiums than others. Understanding the factors that contribute to these differences can help you find the best rates for your needs.

States with the Lowest Average Premiums

This section will highlight the top 5 states with the lowest average auto insurance premiums. For each state, we’ll provide the average premium, minimum coverage requirements, and top insurance providers.

- Idaho: Idaho has the lowest average annual premium of $725. The minimum coverage requirements include $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $15,000 property damage liability, and $25,000 uninsured motorist coverage. Top insurance providers in Idaho include Geico, State Farm, and Progressive.

- Maine: Maine has the second-lowest average annual premium of $762. The minimum coverage requirements include $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $10,000 property damage liability, and $25,000 uninsured motorist coverage. Top insurance providers in Maine include Geico, State Farm, and Progressive.

- North Dakota: North Dakota has the third-lowest average annual premium of $784. The minimum coverage requirements include $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $25,000 property damage liability, and $25,000 uninsured motorist coverage. Top insurance providers in North Dakota include Geico, State Farm, and Progressive.

- Vermont: Vermont has the fourth-lowest average annual premium of $805. The minimum coverage requirements include $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $10,000 property damage liability, and $25,000 uninsured motorist coverage. Top insurance providers in Vermont include Geico, State Farm, and Progressive.

- Wyoming: Wyoming has the fifth-lowest average annual premium of $812. The minimum coverage requirements include $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $25,000 property damage liability, and $25,000 uninsured motorist coverage. Top insurance providers in Wyoming include Geico, State Farm, and Progressive.

Reasons for Affordable Auto Insurance

Several factors contribute to the lower average auto insurance premiums in these states.

- Lower Risk Profiles: States with lower accident rates and fewer claims generally have lower premiums. This is often due to factors like lower population density, safer driving conditions, and stricter traffic laws.

- Competitive Insurance Market: When multiple insurance companies compete for customers, they tend to offer more competitive rates. This can drive down average premiums for consumers.

- Lower Cost of Living: States with lower overall costs of living, including housing, healthcare, and transportation, may have lower insurance premiums. This is because insurers consider these factors when calculating their rates.

- State Regulations: Some states have regulations that limit the factors insurers can consider when setting rates. This can help keep premiums more affordable for consumers.

States with Higher Auto Insurance Premiums

While some states offer affordable auto insurance rates, others present a more expensive landscape for drivers. Several factors contribute to higher premiums in certain states, making it crucial to understand these dynamics when comparing insurance options.

Factors Contributing to Higher Premiums

The cost of auto insurance is influenced by a combination of factors, including:

- Accident Rates: States with higher accident rates typically have higher insurance premiums. This is because insurance companies have to pay out more claims in these areas, leading to increased costs that are reflected in premiums.

- Cost of Car Repairs: Regions with high costs of living, particularly for auto repairs, tend to have higher insurance premiums. This is because insurance companies have to pay more to fix damaged vehicles in these areas.

- Traffic Density: States with heavy traffic congestion often have higher accident rates, contributing to increased insurance premiums.

- Insurance Regulations: States with stricter regulations, such as mandatory coverage requirements or limits on insurance company profits, may have higher premiums.

- Cost of Living: Higher costs of living in general, including healthcare and legal expenses, can also contribute to higher insurance premiums.

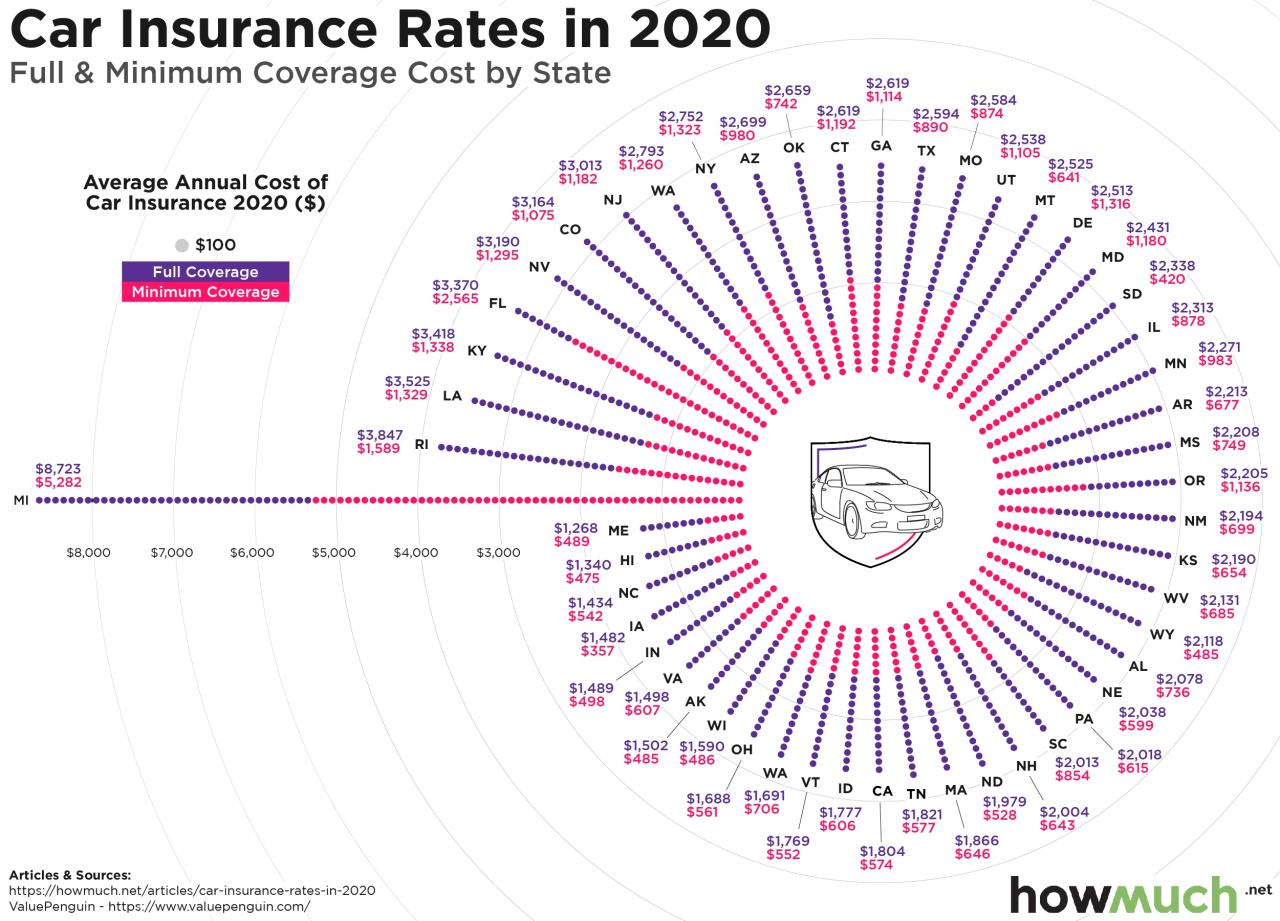

States with the Highest Average Premiums

Based on data from the National Association of Insurance Commissioners (NAIC), the five states with the highest average auto insurance premiums in 2023 are:

- Michigan: Michigan has the highest average auto insurance premium in the US, primarily due to its no-fault insurance system and high medical costs. The average annual premium in Michigan is estimated to be around $2,600.

- Louisiana: Louisiana has the second-highest average premium, primarily attributed to its high accident rates and expensive car repairs. The average annual premium in Louisiana is estimated to be around $2,400.

- Florida: Florida has the third-highest average premium, primarily due to its high population density, frequent hurricanes, and high litigation costs. The average annual premium in Florida is estimated to be around $2,300.

- New Jersey: New Jersey has the fourth-highest average premium, primarily due to its high population density, strict insurance regulations, and expensive car repairs. The average annual premium in New Jersey is estimated to be around $2,200.

- Pennsylvania: Pennsylvania has the fifth-highest average premium, primarily due to its high population density, high accident rates, and expensive car repairs. The average annual premium in Pennsylvania is estimated to be around $2,100.

Minimum Coverage Requirements in High-Premium States

It’s essential to understand the minimum coverage requirements in each state, as they can significantly impact insurance costs. Here are the minimum coverage requirements in the five states with the highest average premiums:

| State | Bodily Injury Liability per Person | Bodily Injury Liability per Accident | Property Damage Liability | Uninsured Motorist Coverage |

|---|---|---|---|---|

| Michigan | $250,000 | $500,000 | $50,000 | $250,000/$500,000 |

| Louisiana | $15,000 | $30,000 | $10,000 | $15,000/$30,000 |

| Florida | $10,000 | $20,000 | $10,000 | $10,000/$20,000 |

| New Jersey | $15,000 | $30,000 | $5,000 | $15,000/$30,000 |

| Pennsylvania | $15,000 | $30,000 | $5,000 | $15,000/$30,000 |

Note: These minimum coverage requirements are subject to change, so it’s always advisable to consult with your state’s Department of Insurance for the most up-to-date information.

State-Specific Considerations for Auto Insurance

Choosing the right auto insurance policy is crucial, and it’s important to remember that insurance regulations and requirements vary significantly from state to state. These differences can have a major impact on your coverage options, premiums, and even the types of accidents you’re protected against.

No-Fault Laws

No-fault laws determine how car accident claims are handled. In no-fault states, drivers file claims with their own insurance company, regardless of who caused the accident. This simplifies the claims process but may limit your ability to sue the other driver.

For example, in Michigan, a no-fault state, drivers are required to carry personal injury protection (PIP) coverage, which covers medical expenses, lost wages, and other related costs.

In contrast, in states with traditional fault systems, you can sue the other driver if they are at fault. This allows you to potentially recover more significant damages but can also lead to lengthy legal battles.

Minimum Coverage Requirements

Each state has its own minimum coverage requirements, also known as “liability limits.” These limits determine the minimum amount of coverage you must have for bodily injury, property damage, and uninsured/underinsured motorist coverage.

- Bodily injury liability covers injuries to others in an accident.

- Property damage liability covers damage to other people’s vehicles or property.

- Uninsured/underinsured motorist coverage protects you if you’re hit by a driver without insurance or with insufficient coverage.

For example, in California, the minimum liability limits are $15,000 per person, $30,000 per accident for bodily injury, and $5,000 for property damage. In contrast, in Texas, the minimum liability limits are much lower, at $30,000 per person, $60,000 per accident for bodily injury, and $25,000 for property damage.

Driver’s Education Programs

Some states offer driver’s education programs that can help reduce insurance premiums. These programs teach safe driving practices and can help young drivers develop better driving skills.

For example, in Florida, drivers under the age of 25 can receive a discount on their insurance premiums if they complete a state-approved driver’s education course.

These state-specific regulations and programs can significantly impact your auto insurance costs and coverage options. It’s essential to research the requirements and laws in your state to ensure you have adequate coverage and avoid any unexpected financial burdens.

Tips for Saving on Auto Insurance

Auto insurance is a necessary expense for most drivers, but it doesn’t have to break the bank. With some planning and effort, you can significantly reduce your premiums and keep more money in your pocket. Here are some practical tips to help you save on your auto insurance.

Improving Driving History

A clean driving record is crucial for lowering your insurance rates. Insurance companies consider your driving history a significant factor in determining your risk. A history of accidents, traffic violations, or DUI convictions will likely lead to higher premiums.

- Drive Safely and Avoid Violations: The most effective way to improve your driving history is to drive safely and avoid traffic violations. This includes obeying traffic laws, driving defensively, and avoiding distractions while driving.

- Take Defensive Driving Courses: Taking a defensive driving course can demonstrate your commitment to safe driving practices. Many insurance companies offer discounts for completing these courses.

- Maintain a Clean Record: Once you have a clean driving record, it’s essential to maintain it. Avoid speeding, running red lights, or engaging in any other risky driving behaviors.

Choosing a Safe Vehicle

The type of vehicle you drive also plays a role in your insurance rates. Insurance companies consider factors like the vehicle’s safety features, repair costs, and theft risk.

- Select Vehicles with Safety Features: Choose vehicles with advanced safety features like anti-lock brakes, electronic stability control, and airbags. These features can reduce the severity of accidents and, therefore, lower your insurance costs.

- Consider Repair Costs: Vehicles with higher repair costs, especially luxury cars or sports cars, often have higher insurance premiums.

- Research Theft Rates: Some vehicles are more prone to theft than others. Research theft rates for different models before making a purchase, as higher theft rates can lead to higher insurance premiums.

Bundling Insurance Policies

Bundling your auto insurance with other insurance policies, such as homeowners or renters insurance, can often lead to significant discounts.

- Explore Bundling Options: Contact your current insurance provider or shop around for quotes from different companies to see if they offer bundling discounts.

- Benefits of Bundling: Bundling policies often results in lower premiums than purchasing them separately.

Shopping Around for Quotes

It’s crucial to shop around for quotes from different insurance companies to compare prices and coverage options.

- Use Online Comparison Tools: Several online comparison tools allow you to enter your information and receive quotes from multiple insurance companies.

- Contact Insurance Companies Directly: Don’t rely solely on online tools. Contact insurance companies directly to discuss your needs and get personalized quotes.

- Negotiate Your Premium: Once you have received quotes from multiple companies, you can use them to negotiate a lower premium with your current provider.

Credit Score Impact

In many states, your credit score can affect your auto insurance rates. Insurance companies believe that individuals with good credit are more likely to be responsible drivers and less likely to file claims.

- Maintain a Good Credit Score: To avoid higher premiums, strive to maintain a good credit score.

- Check Your Credit Report: Review your credit report regularly to ensure it is accurate and identify any errors that may be affecting your score.

Driving Habits

Your driving habits, such as mileage and driving location, can also impact your insurance rates.

- Lower Mileage: If you drive fewer miles annually, you may qualify for a lower premium.

- Safe Driving Location: Insurance companies consider the risk associated with your driving location. Driving in areas with high crime rates or heavy traffic may result in higher premiums.

Resources for Finding Affordable Auto Insurance

Finding the best auto insurance rates can be a time-consuming and confusing process. Fortunately, there are numerous resources available to help consumers compare quotes and find affordable coverage.

Online Insurance Comparison Tools

Online insurance comparison tools are a convenient and efficient way to gather quotes from multiple insurance providers. These tools allow you to enter your information once and receive personalized quotes from various companies. This saves you time and effort compared to contacting each insurer individually.

- Benefits of Online Comparison Tools:

- Convenience: You can compare quotes from the comfort of your home, at any time.

- Speed: Online tools provide instant quotes, allowing you to quickly see different options.

- Transparency: You can see the coverage details and pricing of each quote side-by-side.

- Objectivity: Online tools are not biased towards any particular insurance company.

Independent Insurance Agents

Independent insurance agents work with multiple insurance companies, allowing them to offer a wide range of coverage options. They can help you compare quotes, understand your coverage needs, and find the best policy for your situation.

- Benefits of Working with Independent Agents:

- Expertise: Independent agents have a deep understanding of the insurance market and can provide personalized advice.

- Personalized Service: They take the time to understand your individual needs and recommend the right coverage.

- Advocacy: Independent agents can act as your advocate with the insurance company if you have a claim.

Understanding Insurance Policies and Coverage Options

Before making a decision, it’s crucial to understand the different types of coverage offered by insurance companies. This includes liability coverage, collision and comprehensive coverage, and uninsured/underinsured motorist coverage.

- Key Coverage Options:

- Liability Coverage: This covers damage or injuries you cause to others in an accident.

- Collision Coverage: This covers damage to your vehicle in an accident, regardless of who is at fault.

- Comprehensive Coverage: This covers damage to your vehicle from events like theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects you if you are involved in an accident with a driver who has no insurance or insufficient coverage.

“It’s essential to read your policy carefully and understand the coverage you are purchasing. This will help you make informed decisions about your insurance needs.”

Conclusive Thoughts

In conclusion, navigating the complex world of auto insurance requires careful consideration of state-specific factors, individual driving habits, and available coverage options. By understanding the key influences on insurance rates, utilizing online comparison tools, and implementing cost-saving strategies, drivers can secure affordable and reliable coverage that protects them on the road. Remember, choosing the right insurance policy is a crucial step in ensuring financial security and peace of mind.

FAQ Resource

What are the biggest factors that influence auto insurance rates?

Several factors contribute to auto insurance rates, including driving history, vehicle type, age, location, credit score, and coverage options.

How often should I shop around for auto insurance quotes?

It’s generally recommended to compare quotes at least annually, as rates can fluctuate based on various factors.

What are some common discounts offered by insurance companies?

Common discounts include safe driver discounts, good student discounts, multi-car discounts, and bundling discounts.

What should I do if I have a speeding ticket or an accident?

Report any traffic violations or accidents to your insurance company promptly. They can help you understand how these events might impact your premiums.