Finding the best insurance company in Washington State is crucial for securing peace of mind and protecting your assets. With unique requirements and regulations specific to the state, navigating the insurance landscape can be challenging. This guide delves into the key factors to consider when choosing an insurance provider, from coverage options and pricing to customer service and financial stability.

Washington State’s diverse geography and climate also influence insurance needs. From the bustling cities to the scenic mountains and coastal areas, understanding the specific risks associated with your location is essential. We’ll explore the different types of insurance commonly purchased in Washington State, including auto, homeowners, health, life, and renters insurance, providing a comprehensive overview of their benefits and coverage options.

Understanding Insurance Needs in Washington State

Washington State presents a unique landscape for insurance needs, shaped by its diverse geography, climate, and regulations. Understanding these factors is crucial for individuals and families seeking the right insurance coverage.

Insurance Requirements and Regulations

Washington State has specific regulations governing various types of insurance, including auto, health, and homeowners insurance. For instance, the state mandates that all drivers carry liability insurance, with minimum coverage limits for bodily injury and property damage. Additionally, Washington State requires homeowners to carry insurance against natural disasters like earthquakes, which are common in certain regions. Understanding these regulations is essential to ensure compliance and avoid potential penalties.

Common Insurance Needs

Individuals and families in Washington State face various insurance needs based on their specific circumstances. Common needs include:

- Auto Insurance: Washington’s diverse terrain, ranging from urban areas to mountainous regions, influences the risk of accidents and the need for comprehensive coverage.

- Homeowners Insurance: The state’s susceptibility to earthquakes, wildfires, and other natural disasters necessitates adequate homeowners insurance coverage.

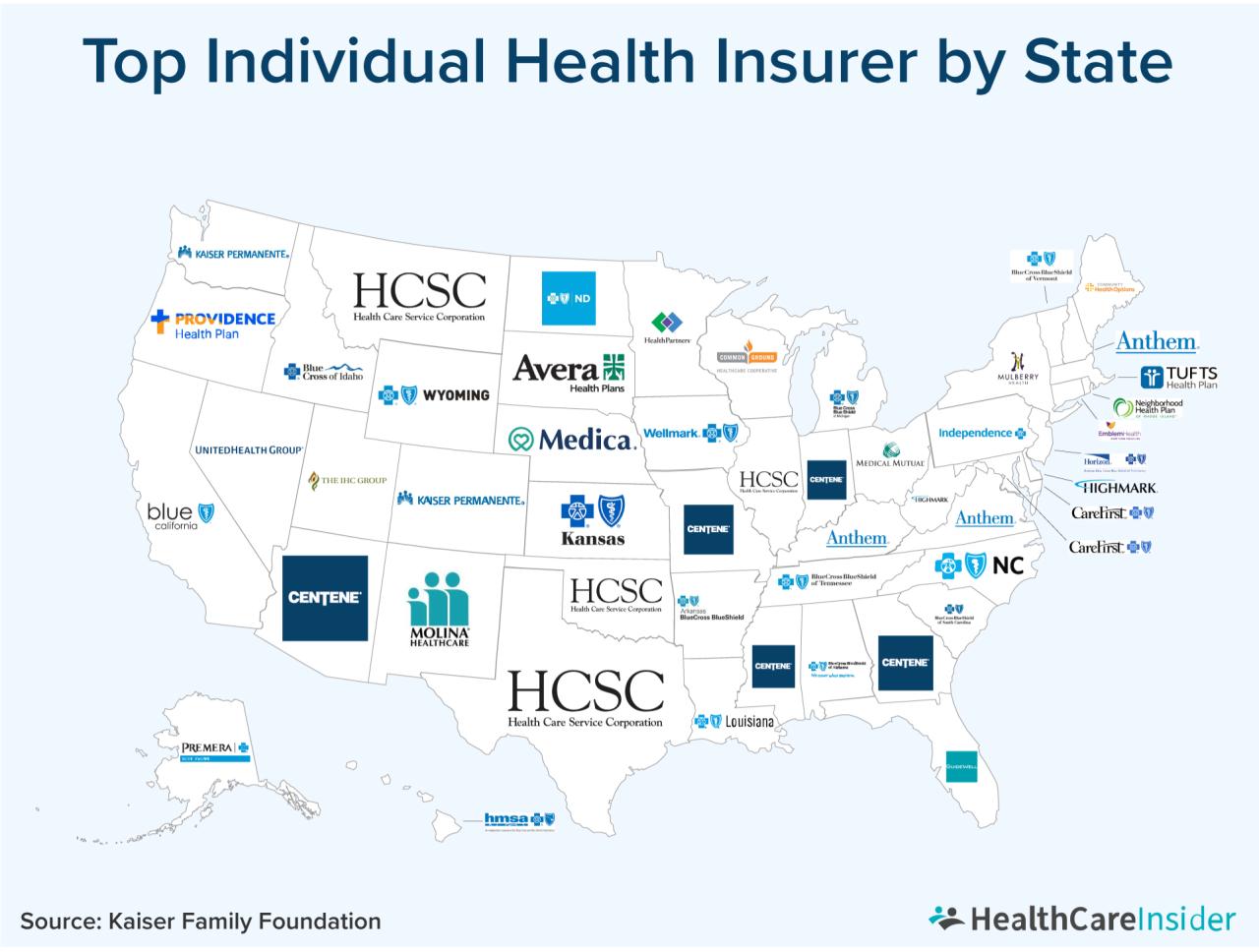

- Health Insurance: Washington State offers various health insurance options, including individual plans, employer-sponsored plans, and government-funded programs like Medicaid.

- Life Insurance: Life insurance provides financial protection for loved ones in the event of the policyholder’s death. It is especially important for individuals with dependents or significant debt obligations.

Impact of Geography and Climate

Washington State’s diverse geography and climate significantly impact insurance needs. The state’s mountainous terrain and coastal regions increase the risk of natural disasters, including earthquakes, landslides, wildfires, and floods. For instance, residents in areas prone to earthquakes may require earthquake insurance coverage, while those living near the coast may need flood insurance. The state’s rainy climate also contributes to the risk of water damage, making comprehensive homeowners insurance essential.

Evaluating Insurance Companies

Choosing the right insurance company is a crucial decision, as it directly impacts your financial well-being and peace of mind. In Washington State, you have a diverse range of insurance companies to choose from, each with its own strengths and weaknesses. To make an informed decision, you need to evaluate these companies based on several key factors.

Comparing Insurance Companies

It’s essential to compare different insurance companies to find the best fit for your needs and budget. This involves considering factors like coverage options, pricing, customer service, financial stability, and online tools and resources. Here’s a table comparing some popular insurance companies in Washington State based on these factors:

| Insurance Company | Coverage Options | Pricing | Customer Service | Financial Stability | Online Tools and Resources |

|---|---|---|---|---|---|

| Safeco Insurance | Wide range of coverage options, including home, auto, renters, and business insurance | Competitive pricing, with discounts available for bundling policies | Excellent customer service, with a high customer satisfaction rating | Financially stable, with a strong track record of paying claims | User-friendly website and mobile app, with online quote tools and claims filing options |

| State Farm | Comprehensive coverage options, including home, auto, life, and health insurance | Known for its affordable rates and discounts | Large network of agents, providing personalized service | Highly financially stable, with a strong reputation for reliability | Online tools for managing policies, paying premiums, and filing claims |

| Farmers Insurance | Offers a variety of insurance products, including home, auto, life, and business insurance | Competitive pricing and discounts for bundling policies | Strong customer service, with a focus on personalized attention | Financially sound, with a history of paying claims promptly | Online resources for managing policies, getting quotes, and filing claims |

| Liberty Mutual | Offers a wide range of coverage options, including home, auto, renters, and business insurance | Competitive pricing, with discounts available for safe driving and good credit | Excellent customer service, with a high level of satisfaction | Financially stable, with a strong track record of paying claims | User-friendly website and mobile app, with online quote tools and claims filing options |

| Allstate | Comprehensive coverage options, including home, auto, life, and business insurance | Known for its competitive pricing and discounts | Large network of agents, providing personalized service | Highly financially stable, with a strong reputation for reliability | Online tools for managing policies, paying premiums, and filing claims |

Coverage Options

Insurance companies offer various coverage options, each with its own benefits and limitations. It’s crucial to choose a company that provides the coverage you need at a price you can afford. For instance, if you own a home, you’ll need homeowner’s insurance, which covers damages to your property and liability for accidents. Similarly, if you own a car, you’ll need auto insurance, which covers damages to your vehicle and liability for accidents.

Pricing

Insurance premiums can vary significantly between companies, so it’s essential to compare quotes from multiple providers. Factors that influence pricing include your driving record, credit score, age, and location. You can use online quote tools or contact insurance agents directly to get personalized quotes.

Customer Service

Customer service is an important factor to consider, as you may need to contact your insurance company for questions, claims, or policy changes. Look for companies with a reputation for excellent customer service, responsive agents, and efficient claim processing.

Financial Stability

It’s crucial to choose a financially stable insurance company that can pay your claims in the event of an accident or disaster. You can check a company’s financial stability by looking at its ratings from independent agencies like A.M. Best and Standard & Poor’s.

Online Tools and Resources

Many insurance companies offer online tools and resources that make managing your policies easier. These can include online quote tools, policy management portals, claims filing options, and mobile apps. Look for companies that provide user-friendly online tools and resources that meet your needs.

Key Insurance Types in Washington State

Washington State residents face various risks, and insurance plays a crucial role in protecting individuals and families from financial hardship. This section will delve into the essential insurance types commonly purchased in Washington State, providing a comprehensive overview of their benefits and coverage options.

Auto Insurance

Auto insurance is mandatory in Washington State, and it protects drivers and vehicle owners from financial losses arising from accidents, theft, and other incidents involving their vehicles. The state mandates minimum coverage limits for liability, which covers injuries and property damage to others. Drivers can choose additional coverage options to enhance their protection.

- Liability Coverage: This coverage protects you financially if you cause an accident that injures another person or damages their property. It covers medical expenses, lost wages, and property repairs. Washington State mandates minimum liability limits of $25,000 per person, $50,000 per accident, and $10,000 for property damage.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. Collision coverage is optional, but it’s typically required if you have a car loan.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, fire, or natural disasters. Comprehensive coverage is optional, but it’s often a good idea if you have a newer or more expensive vehicle.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. It can help cover your medical expenses, lost wages, and property damage.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses, lost wages, and other related expenses if you’re injured in an accident, regardless of fault. PIP is required in Washington State.

Homeowners Insurance, Best insurance company in washington state

Homeowners insurance provides financial protection for your home and its contents against various perils, including fire, theft, vandalism, and natural disasters. It also covers liability for injuries or property damage that occur on your property.

- Dwelling Coverage: This coverage pays for repairs or replacement of your home’s structure in case of damage or destruction. It covers the building itself, including the roof, walls, foundation, and plumbing.

- Personal Property Coverage: This coverage protects your belongings inside your home, such as furniture, appliances, clothing, and electronics, from damage or loss. It also covers belongings outside your home, such as a shed or patio furniture.

- Liability Coverage: This coverage protects you financially if someone is injured on your property or if you cause property damage to someone else’s property. It covers medical expenses, lost wages, and legal defense costs.

- Additional Living Expenses: This coverage helps pay for temporary housing, food, and other living expenses if your home is damaged or destroyed and you can’t live in it.

Health Insurance

Health insurance provides financial protection against the high costs of medical care, including doctor visits, hospital stays, prescription drugs, and preventive services. Washington State has implemented the Affordable Care Act (ACA), which provides various options for obtaining health insurance.

- Individual Health Insurance: This type of insurance is purchased by individuals or families directly from an insurance company. It offers flexibility in choosing plans and providers, but premiums can be higher than employer-sponsored plans.

- Employer-Sponsored Health Insurance: This type of insurance is offered by employers to their employees. It’s often more affordable than individual plans, but it’s tied to your employment.

- Government-Sponsored Health Insurance: Washington State offers various government-sponsored health insurance programs, such as Medicaid and Medicare. These programs provide coverage to low-income individuals and families, seniors, and people with disabilities.

Life Insurance

Life insurance provides a financial safety net for your loved ones in the event of your death. It pays a death benefit to your beneficiaries, which can be used to cover expenses such as funeral costs, mortgage payments, and living expenses.

- Term Life Insurance: This type of insurance provides coverage for a specific period, such as 10, 20, or 30 years. It’s typically more affordable than permanent life insurance, but it doesn’t build cash value.

- Permanent Life Insurance: This type of insurance provides lifelong coverage. It’s more expensive than term life insurance, but it builds cash value that you can borrow against or withdraw.

- Whole Life Insurance: This type of permanent life insurance has a fixed premium and a guaranteed death benefit. It also builds cash value that grows at a fixed rate.

- Universal Life Insurance: This type of permanent life insurance has a flexible premium and death benefit. It also builds cash value that grows at a variable rate.

Renters Insurance

Renters insurance provides financial protection for your personal belongings and liability coverage if someone is injured in your rental unit. It’s essential for renters, as it helps cover the costs of replacing or repairing your belongings in case of theft, fire, or other perils.

- Personal Property Coverage: This coverage protects your belongings inside your rental unit, such as furniture, appliances, clothing, and electronics, from damage or loss.

- Liability Coverage: This coverage protects you financially if someone is injured on your property or if you cause property damage to someone else’s property.

- Additional Living Expenses: This coverage helps pay for temporary housing, food, and other living expenses if your rental unit is damaged or destroyed and you can’t live in it.

Finding the Best Insurance Company

Finding the best insurance company in Washington State requires a comprehensive approach. It’s not just about getting the lowest price; it’s about finding a company that offers reliable coverage, excellent customer service, and a strong financial standing.

Comparing Quotes and Negotiating Rates

Comparing quotes from different insurance companies is crucial to finding the best deal. It’s also a good idea to be prepared to negotiate rates.

- Get quotes from multiple companies. Use online comparison websites, contact insurance brokers, or reach out to individual insurance companies directly.

- Provide accurate information. Ensure your information is correct when requesting quotes, as inaccuracies can lead to higher premiums.

- Consider different coverage options. Explore various coverage options and deductibles to find the right balance between cost and protection.

- Negotiate rates. Don’t be afraid to negotiate with insurance companies. Highlight factors like your good driving record, safety features in your car, or multiple policies you may have with them.

- Ask about discounts. Inquire about available discounts such as safe driver discounts, good student discounts, or bundling discounts for multiple insurance policies.

Reading Insurance Policies Carefully

It’s essential to understand the terms and conditions of your insurance policy. This includes carefully reviewing the policy document and asking clarifying questions.

- Read the policy carefully. Pay close attention to coverage limits, deductibles, exclusions, and any specific conditions.

- Ask questions. Don’t hesitate to ask your insurance agent or company representative about anything you don’t understand.

- Consider a policy review. Periodically review your policy to ensure it still meets your needs and that you are not paying for unnecessary coverage.

Insurance Industry Trends in Washington State

The insurance industry in Washington State is undergoing significant transformations, driven by technological advancements, evolving customer expectations, and a growing focus on sustainability. These trends are reshaping the way insurance is offered, purchased, and experienced.

The Impact of Technology on Insurance Offerings

Technology is playing a pivotal role in revolutionizing insurance offerings in Washington State. Insurance companies are leveraging digital platforms, artificial intelligence (AI), and data analytics to create more efficient, personalized, and convenient insurance experiences.

- Online Platforms and Mobile Apps: Insurance companies are increasingly offering online platforms and mobile apps that allow customers to purchase insurance policies, manage their accounts, and file claims easily. These digital channels provide 24/7 access to insurance services, eliminating the need for physical visits to insurance agents.

- Artificial Intelligence (AI) and Machine Learning: AI and machine learning are being used to automate various insurance processes, such as risk assessment, pricing, and fraud detection. AI-powered chatbots and virtual assistants are also being implemented to provide customers with instant support and answer their queries.

- Data Analytics: Insurance companies are using data analytics to gain insights into customer behavior, market trends, and risk factors. This data helps them develop more accurate risk assessments, personalize insurance offerings, and identify potential fraud.

The Increasing Importance of Personalized Insurance Solutions

Consumers are increasingly demanding personalized insurance solutions that cater to their specific needs and circumstances. Insurance companies in Washington State are responding to this demand by offering tailored insurance packages and flexible payment options.

- Customized Coverage: Insurance companies are offering a wider range of coverage options to meet the unique needs of different customer segments. For example, some companies offer specialized insurance policies for homeowners with solar panels or electric vehicles.

- Flexible Payment Plans: Insurance companies are providing more flexible payment options, such as monthly installments or pay-as-you-go plans, to make insurance more affordable and accessible to a wider range of customers.

- Data-Driven Risk Assessment: Insurance companies are using data analytics to personalize risk assessments and pricing based on individual customer profiles. This allows them to offer more competitive rates to customers with lower risk profiles.

The Role of Sustainability in Insurance Practices

Sustainability is becoming increasingly important in the insurance industry, with companies taking steps to reduce their environmental impact and promote sustainable practices.

- Green Insurance Products: Some insurance companies are offering green insurance products that incentivize sustainable practices, such as discounts for homeowners who install solar panels or electric vehicle charging stations.

- Environmental Risk Management: Insurance companies are increasingly considering environmental risks, such as climate change, in their underwriting and risk assessment processes. This helps them better understand and manage the potential impact of these risks on their insured clients.

- Sustainable Investments: Insurance companies are also investing in sustainable businesses and projects that promote environmental protection and social responsibility. This aligns their investment portfolios with their commitment to sustainability.

Outcome Summary: Best Insurance Company In Washington State

By following our step-by-step guide, you can confidently compare quotes, negotiate rates, and ultimately find the insurance company that best suits your individual needs and budget. Stay informed about emerging trends in the insurance industry, such as the impact of technology and personalized solutions, to ensure you’re getting the most comprehensive and cost-effective coverage possible.

Essential Questionnaire

What are the main factors to consider when choosing an insurance company in Washington State?

When choosing an insurance company in Washington State, consider factors such as coverage options, pricing, customer service, financial stability, and online tools and resources. It’s essential to compare quotes from multiple companies and thoroughly review their policies to ensure they meet your specific needs.

What are the common insurance needs for individuals and families in Washington State?

Common insurance needs in Washington State include auto insurance, homeowners or renters insurance, health insurance, and life insurance. The specific needs will vary depending on factors such as age, income, family size, and lifestyle.

How can I find the best insurance company for my specific needs?

Start by identifying your insurance needs, then research different companies and compare quotes. Consider factors such as coverage options, pricing, customer service, and financial stability. It’s also helpful to read reviews and seek recommendations from trusted sources.