Best cheap car insurance washington state – Best cheap car insurance in Washington State: finding affordable coverage can be a challenge, but it’s crucial to ensure you have the right protection while staying within budget. Washington state has specific insurance requirements, and understanding these regulations is the first step towards finding the best deal.

Several factors influence car insurance costs in Washington, including your driving history, age, credit score, vehicle type, location, and coverage levels. Knowing how these factors impact your premiums can help you make informed decisions when choosing an insurance provider.

Understanding Washington State Car Insurance Requirements

Driving in Washington State requires you to have car insurance, which is mandatory. This insurance protects you and others in case of an accident. Understanding the required coverage and optional options can help you choose the right policy for your needs.

Minimum Liability Coverage Requirements

Washington State law mandates specific minimum liability coverage limits to protect you financially in case of an accident. These limits ensure that you have enough coverage to cover potential damages and injuries to others.

The minimum liability coverage limits required in Washington State are:

- Bodily Injury Liability: $25,000 per person and $50,000 per accident. This coverage protects you financially if you injure someone in an accident.

- Property Damage Liability: $10,000 per accident. This coverage protects you financially if you damage someone else’s property in an accident.

It’s crucial to understand that these are minimum requirements, and having higher limits can offer greater protection in case of a serious accident.

Optional Coverage Options

While minimum liability coverage is mandatory, additional coverage options can provide broader protection and financial security. These options are not mandatory but are highly recommended for comprehensive coverage.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. Collision coverage is essential if you want to be protected in case of an accident involving your own vehicle.

- Comprehensive Coverage: This coverage protects you against damages to your vehicle caused by events other than accidents, such as theft, vandalism, fire, or natural disasters. Comprehensive coverage is valuable if you want to be protected against a wider range of risks.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you financially if you are injured in an accident caused by an uninsured or underinsured driver. It covers medical expenses, lost wages, and other damages you may incur. This coverage is crucial in case of an accident involving a driver who does not have adequate insurance.

Factors Influencing Car Insurance Costs in Washington

Car insurance premiums in Washington State are determined by a variety of factors. These factors are analyzed by insurance companies to assess the risk associated with each individual driver and their vehicle. By understanding these factors, you can make informed decisions to potentially lower your car insurance costs.

Driving History, Best cheap car insurance washington state

Your driving history is a significant factor influencing your car insurance premiums. A clean driving record with no accidents, violations, or DUI convictions will generally result in lower premiums. Conversely, a history of accidents, traffic violations, or DUI convictions will likely lead to higher premiums. Insurance companies view these incidents as indicators of higher risk and therefore charge higher premiums to compensate for potential future claims.

Age

Age plays a role in determining car insurance premiums. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. This increased risk is reflected in higher insurance premiums for young drivers. As drivers gain experience and age, their premiums generally decrease. This is because older drivers are statistically less likely to be involved in accidents.

Credit Score

In Washington State, insurance companies can use your credit score as a factor in determining your car insurance premiums. A good credit score is often associated with responsible behavior, which can extend to driving habits. Insurance companies may view individuals with good credit scores as less risky and offer them lower premiums. Conversely, those with poor credit scores may face higher premiums.

Vehicle Type

The type of vehicle you drive also affects your insurance premiums. Some vehicles are considered more expensive to repair or replace, or they are more likely to be involved in accidents. These factors contribute to higher insurance premiums. For example, sports cars and luxury vehicles often have higher insurance premiums compared to standard sedans or hatchbacks.

Location

Your location in Washington State can influence your car insurance premiums. Areas with higher crime rates or more traffic congestion may have higher premiums due to the increased risk of accidents or theft. Similarly, areas with a higher density of drivers may have higher premiums due to the increased likelihood of accidents.

Coverage Levels

The level of coverage you choose also affects your premiums. Higher coverage limits, such as higher liability limits or comprehensive and collision coverage, will generally result in higher premiums. However, these higher coverage levels provide greater financial protection in case of an accident or damage to your vehicle.

Finding Affordable Car Insurance Options

Finding the right car insurance policy can be a daunting task, especially when you’re on a tight budget. Luckily, there are many reputable insurance companies in Washington State that offer competitive rates and comprehensive coverage. By comparing quotes from various providers and understanding your specific needs, you can secure affordable car insurance that provides peace of mind.

Reputable Car Insurance Companies in Washington State

Several car insurance companies operate in Washington State, each with its unique strengths and offerings. Understanding their differences can help you find the best fit for your needs.

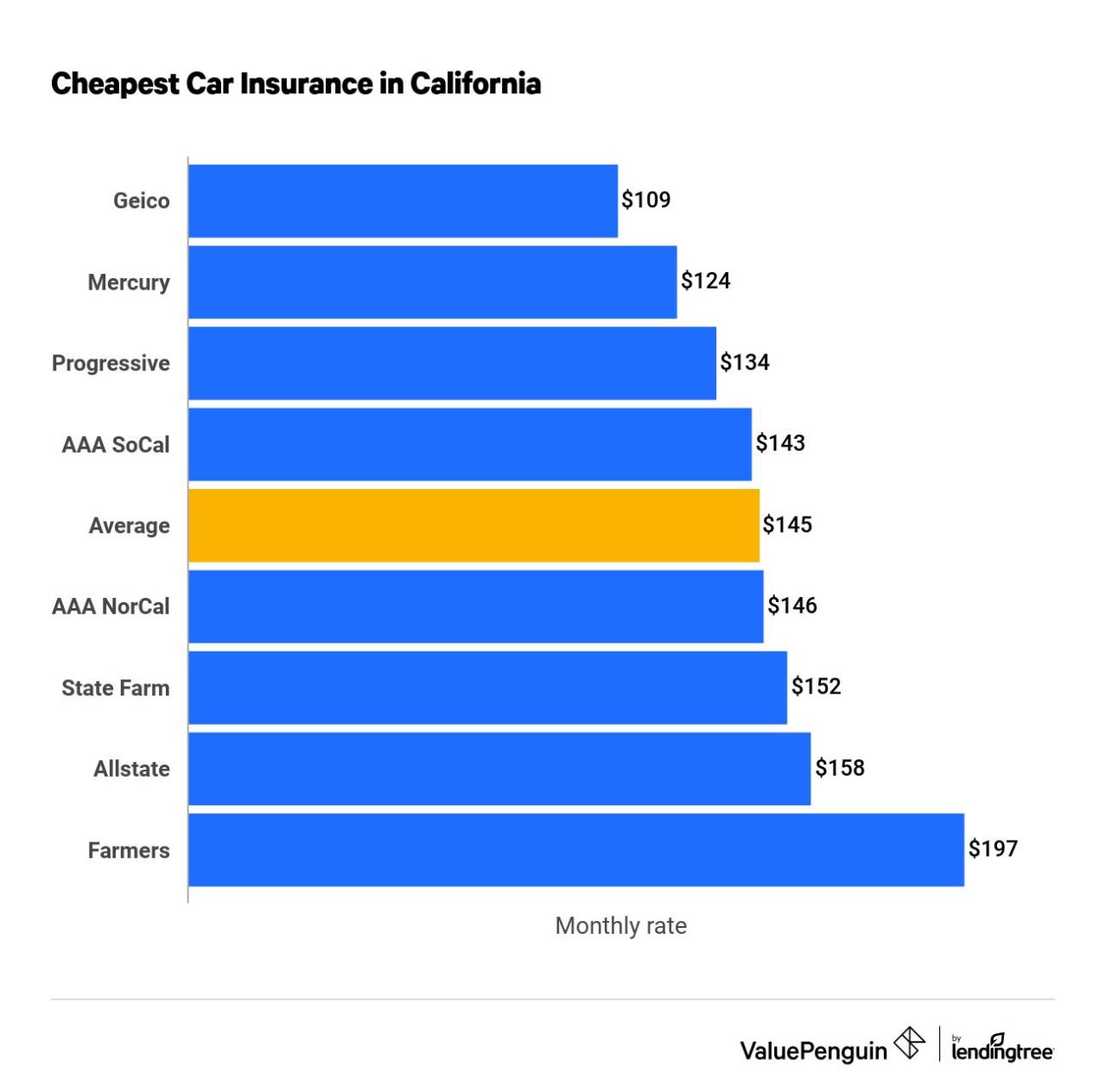

- State Farm: Known for its wide range of coverage options and customer service, State Farm offers a comprehensive suite of insurance products. They are a popular choice among drivers in Washington, often providing competitive rates and a strong reputation for customer satisfaction.

- Geico: Geico has become a household name thanks to its catchy advertising campaigns. They offer a wide selection of coverage options and are known for their competitive pricing, making them a popular choice for budget-conscious drivers.

- Progressive: Progressive is known for its innovative features, such as its Name Your Price tool, which allows you to set your desired premium and see what coverage options match your budget. They also offer a variety of discounts, making them an attractive option for many drivers.

- Farmers Insurance: Farmers Insurance is another reputable provider with a strong presence in Washington State. They offer a wide range of coverage options and are known for their personalized customer service, providing tailored solutions for individual needs.

- USAA: While primarily serving military personnel and their families, USAA has expanded its services to include car insurance for a wider audience. They are known for their excellent customer service and competitive rates, particularly for those eligible for their membership.

Comparing Car Insurance Providers

Once you’ve identified a few potential insurance companies, it’s essential to compare their offerings to find the best deal. Here’s what to consider:

- Pricing Structures: Each company has its own pricing structure, which can vary depending on factors like your driving history, age, vehicle type, and location. Some companies offer discounts for safe driving, good grades, or multiple policy purchases.

- Coverage Options: Different insurance companies offer varying levels of coverage. Ensure the policy you choose meets your specific needs and includes essential protections like liability coverage, collision coverage, and comprehensive coverage.

- Customer Service: Customer service is crucial when it comes to insurance. Look for companies known for their responsiveness, helpfulness, and ability to resolve issues efficiently.

Top 5 Cheapest Car Insurance Companies in Washington State

| Rank | Company | Average Annual Premium |

|---|---|---|

| 1 | USAA | $1,200 |

| 2 | Geico | $1,300 |

| 3 | Progressive | $1,400 |

| 4 | State Farm | $1,500 |

| 5 | Farmers Insurance | $1,600 |

Note: These average annual premiums are estimates and may vary depending on individual factors.

Strategies for Saving on Car Insurance

Car insurance in Washington State can be expensive, but there are ways to save money on your premiums. By understanding the factors that influence your rates and implementing smart strategies, you can significantly reduce your car insurance costs.

Maintaining a Good Driving Record

A clean driving record is the most important factor in determining your car insurance premiums. Driving safely and avoiding accidents, traffic violations, and DUI convictions will keep your insurance rates low. Insurance companies reward safe drivers with lower premiums, reflecting the reduced risk they pose.

Taking Defensive Driving Courses

Taking a defensive driving course can help you become a safer driver and earn a discount on your car insurance. These courses teach valuable skills for avoiding accidents and navigating challenging driving situations. In Washington State, completing an approved defensive driving course can result in a discount of up to 10% on your car insurance premiums.

Bundling Insurance Policies

Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can save you money. Insurance companies often offer discounts for bundling multiple policies, as it simplifies their administration and reduces their risk.

Utilizing Discounts

Insurance companies offer a variety of discounts to reduce premiums for policyholders who meet specific criteria.

Discounts Based on Good Student Status

Good student discounts are available to students who maintain a certain GPA. These discounts recognize that good students are generally responsible and safe drivers.

Discounts Based on Safe Driving Features

Cars equipped with safety features like anti-theft devices, airbags, and anti-lock brakes can qualify for discounts. Insurance companies consider these features to reduce the likelihood and severity of accidents, justifying lower premiums.

Discounts Based on Vehicle Safety Ratings

Cars with high safety ratings from organizations like the Insurance Institute for Highway Safety (IIHS) and the National Highway Traffic Safety Administration (NHTSA) may qualify for discounts. These ratings reflect the vehicle’s ability to protect occupants in a crash, making them less risky to insure.

Online Resources and Tools

The digital age has revolutionized how we shop for car insurance. Online resources and tools offer a convenient and efficient way to compare quotes, find the best deals, and make informed decisions.

Benefits of Online Comparison Websites and Mobile Apps

Online comparison websites and mobile apps offer a plethora of benefits for car insurance shoppers in Washington State. These platforms streamline the process of finding affordable coverage by providing a central hub for comparing quotes from multiple insurers.

- Convenience: Online platforms allow you to compare quotes from the comfort of your home or on the go using your mobile device. You can access information anytime, anywhere, eliminating the need for phone calls or in-person visits to insurance agencies.

- Time-Saving: Instead of contacting multiple insurance companies individually, you can enter your information once and receive quotes from various insurers simultaneously. This significantly reduces the time and effort involved in the insurance shopping process.

- Transparency: Online platforms provide detailed information about each insurer’s coverage options, premiums, and discounts. This transparency allows you to make informed comparisons and choose the policy that best meets your needs and budget.

- Objectivity: Online comparison websites and apps are designed to be unbiased and present information from multiple insurers fairly. This ensures that you are not swayed by any particular insurer’s marketing efforts.

Using Online Resources Effectively

To maximize the benefits of online comparison websites and mobile apps, follow these tips:

- Be Accurate: Provide accurate information about your vehicle, driving history, and other relevant factors. Inaccurate information can lead to inaccurate quotes.

- Compare Quotes Carefully: Don’t just focus on the cheapest quote. Carefully review the coverage options and deductibles of each insurer to ensure that you are getting the right protection for your needs.

- Consider Discounts: Many insurers offer discounts for good driving records, safety features, and other factors. Be sure to ask about any available discounts when comparing quotes.

- Read Reviews: Before choosing an insurer, read reviews from other customers to get a sense of their reputation and customer service.

Conclusion: Best Cheap Car Insurance Washington State

By understanding the factors that affect car insurance costs in Washington, you can navigate the process of finding affordable coverage with confidence. Leveraging online resources and tools can help you compare quotes and find the best deal for your needs. Remember, a good driving record, taking defensive driving courses, and bundling insurance policies can significantly impact your premiums.

Questions and Answers

What are the minimum car insurance requirements in Washington State?

Washington State requires all drivers to have liability coverage, including bodily injury liability, property damage liability, and uninsured motorist coverage.

What are some common discounts offered by car insurance companies in Washington?

Common discounts include good student discounts, safe driver discounts, multi-car discounts, and discounts for anti-theft devices.

Is it mandatory to have collision and comprehensive coverage in Washington?

Collision and comprehensive coverage are optional in Washington. However, if you have a loan on your vehicle, your lender may require these coverages.