Best car insurance Washington state Reddit is a treasure trove of insights and experiences from fellow Washingtonians navigating the world of auto insurance. Whether you’re a new driver, a seasoned veteran, or simply looking for the best deal, the collective wisdom of Reddit users can help you find the right coverage for your needs and budget.

This article delves into the key factors that influence car insurance rates in Washington, explores the different types of coverage available, and highlights popular car insurance providers mentioned on Reddit. We’ll also examine the importance of comparing quotes from multiple insurers, discuss practical tips for saving on premiums, and provide insights on navigating the claims process.

Understanding Car Insurance in Washington State: Best Car Insurance Washington State Reddit

Navigating the world of car insurance in Washington state can feel overwhelming, but understanding the key factors and available options will help you make informed decisions. This guide will provide an overview of car insurance in Washington, covering important aspects like rate determination, coverage types, and mandatory requirements.

Factors Influencing Car Insurance Rates

Several factors contribute to the calculation of your car insurance premium in Washington state. These factors are used by insurance companies to assess your risk profile and determine the cost of insuring your vehicle.

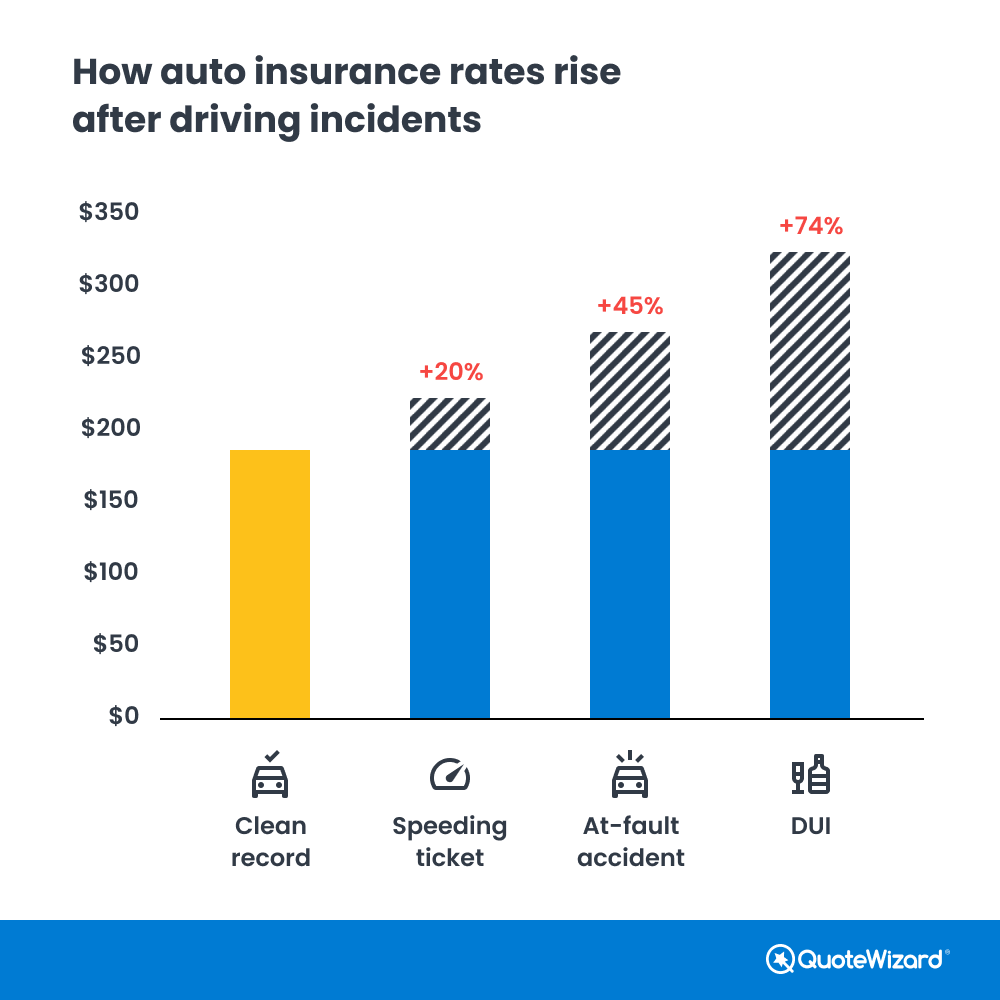

- Driving History: Your driving record plays a significant role in determining your insurance rates. A clean driving record with no accidents or violations will generally result in lower premiums. However, accidents, traffic violations, and DUI convictions can lead to higher premiums.

- Vehicle Type: The type of car you drive influences your insurance rate. Luxury vehicles, sports cars, and vehicles with high performance capabilities are generally more expensive to insure due to their higher repair costs and potential for greater damage in accidents.

- Age and Gender: Age and gender are factors considered by insurance companies, as they are correlated with driving experience and risk. Younger drivers, especially those under 25, typically pay higher premiums due to their lack of experience.

- Location: Your location within Washington state can affect your insurance rates. Areas with higher crime rates or higher traffic congestion may have higher premiums.

- Credit History: In Washington state, insurance companies can use your credit history as a factor in determining your insurance rates. Individuals with good credit history may receive lower premiums.

- Coverage Levels: The amount of coverage you choose, such as the limits for liability, comprehensive, and collision coverage, will impact your premium. Higher coverage limits generally result in higher premiums.

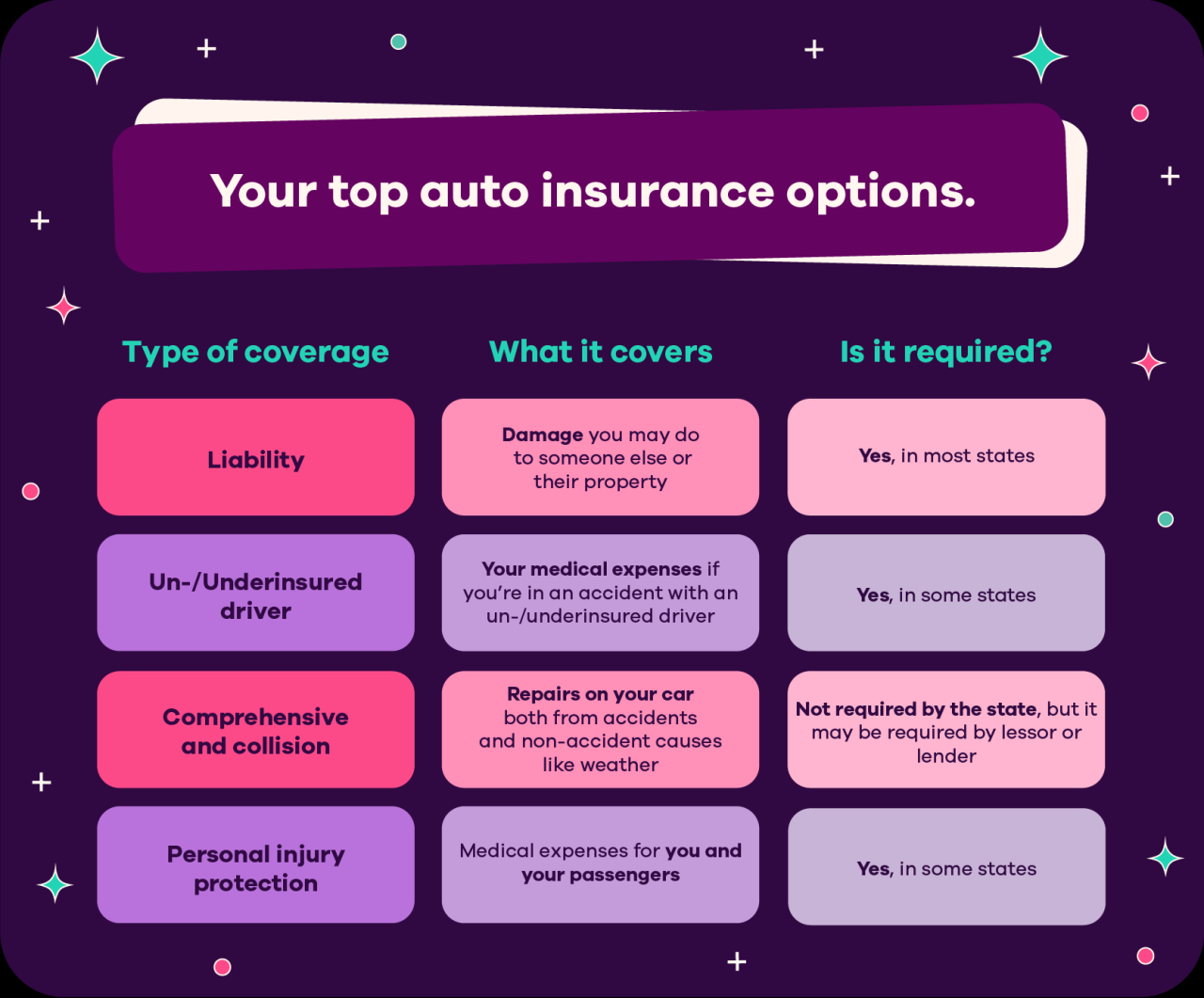

Types of Car Insurance Coverage, Best car insurance washington state reddit

Car insurance policies in Washington state typically offer a variety of coverage options, each designed to protect you and your vehicle in different situations.

- Liability Coverage: This is the most basic type of car insurance and is required in Washington state. It covers damages to other people’s property and injuries to other people in the event of an accident that you cause. Liability coverage is typically expressed as a per-person and per-accident limit, such as 25/50/10, which means $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $10,000 for property damage.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. You can choose to waive this coverage if your vehicle is older or has a low value.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged due to non-collision events, such as theft, vandalism, fire, or natural disasters. Like collision coverage, you can choose to waive this coverage for older or low-value vehicles.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient insurance to cover your damages.

- Personal Injury Protection (PIP): This coverage, also known as “no-fault” insurance, covers medical expenses, lost wages, and other related expenses for you and your passengers, regardless of who is at fault in an accident.

Mandatory Insurance Requirements

Washington state requires all drivers to have a minimum amount of liability insurance to operate a vehicle legally. This minimum coverage is known as the “financial responsibility law” and includes:

- $25,000 per person for bodily injury liability

- $50,000 per accident for bodily injury liability

- $10,000 per accident for property damage liability

Reddit as a Source for Car Insurance Recommendations

Reddit is a valuable platform for gathering insights and recommendations on various topics, including car insurance. Users often share their experiences, seek advice, and discuss different insurance providers, making Reddit a valuable resource for those looking for car insurance in Washington state.

Common Themes and Sentiments

Reddit discussions on car insurance in Washington state often revolve around finding affordable coverage, understanding different policy options, and navigating the complexities of insurance claims. Users frequently express concerns about rising premiums, the need for comprehensive coverage, and the importance of finding a reliable insurer with excellent customer service.

Popular Car Insurance Providers

- Geico: Geico is a popular choice for many Reddit users due to its competitive rates and user-friendly online platform. However, some users have reported challenges with customer service and claims processing.

- Progressive: Progressive is known for its customizable insurance options and its popular “Name Your Price” tool. However, some users have experienced difficulty with their claims process and found their rates to be higher than expected.

- State Farm: State Farm is a well-established insurer with a strong reputation for customer service. However, some users have found their rates to be higher compared to other providers.

- USAA: USAA is a highly-rated insurer that specializes in serving military members and their families. However, eligibility is restricted to those with a military connection.

User Experiences and Reviews

“I switched to Geico a few months ago and have been happy with the rates so far. Their online platform is easy to use, but I haven’t had to deal with their customer service yet, so I can’t comment on that.”

“I’ve been with Progressive for years and have always had good experiences with their customer service. However, my rates have been creeping up lately, so I’m considering other options.”

“State Farm has been my insurer for over a decade, and I’ve always been satisfied with their coverage and customer service. Their rates are a bit higher, but I value their reliability.”

Factors to Consider When Choosing Car Insurance

Choosing the right car insurance in Washington State is crucial for protecting yourself financially in case of an accident or other unforeseen events. Navigating the options can be overwhelming, but understanding the key factors involved can make the process easier.

Comparing Quotes from Multiple Insurers

It is essential to obtain quotes from several different insurance providers before making a decision. This allows you to compare prices, coverage options, and customer service experiences. Websites like Policygenius and insurance comparison websites can streamline this process.

Factors to Consider When Choosing Car Insurance

Several factors can influence your car insurance premium and overall coverage. Here are some key points to consider:

- Budget: Determine how much you can afford to pay for car insurance each month. Consider your financial situation, including other expenses and income.

- Coverage Needs: Evaluate your specific needs based on factors like the value of your car, your driving history, and your personal risk tolerance.

- Driving History: Your driving record plays a significant role in determining your insurance premium. A clean driving history with no accidents or violations will generally result in lower premiums.

- Car Model and Year: The make, model, and year of your vehicle can impact your insurance cost. Newer, more expensive cars tend to have higher premiums due to their repair costs.

- Location: Your location in Washington State can influence your car insurance rates. Areas with higher crime rates or more traffic congestion may have higher premiums.

- Deductible: Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible generally leads to lower premiums.

- Customer Service: Consider the reputation of the insurance provider for customer service, claims handling, and responsiveness. Read reviews and compare customer satisfaction ratings.

Tips for Saving on Car Insurance in Washington

Car insurance is a necessity in Washington state, but it can be expensive. Fortunately, there are several ways to save on your premiums. By implementing some smart strategies, you can potentially lower your monthly costs and keep more money in your pocket.

Safe Driving Practices

Safe driving habits play a significant role in determining your insurance rates. Insurance companies reward drivers with clean records by offering lower premiums. Here are some key strategies:

- Maintain a Clean Driving Record: Avoid traffic violations, accidents, and DUI offenses. These incidents can significantly increase your insurance premiums.

- Defensive Driving Courses: Completing a defensive driving course can demonstrate your commitment to safe driving practices. Some insurance companies offer discounts for course completion.

- Avoid Distracted Driving: Distracted driving, including texting, talking on the phone, or eating, increases the risk of accidents. Stay focused on the road at all times.

Bundling Policies

Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can lead to substantial savings. Insurance companies often offer discounts for combining multiple policies.

Discounts

Insurance companies offer a wide range of discounts to their policyholders. Some common discounts include:

- Good Student Discount: Students with high GPAs may qualify for a discount.

- Safe Driver Discount: Drivers with clean driving records and no accidents or violations can often receive a discount.

- Multi-Car Discount: Insuring multiple vehicles with the same company can lead to a discount.

- Anti-theft Device Discount: Installing anti-theft devices in your car, such as alarms or GPS tracking systems, can make your vehicle less attractive to thieves and earn you a discount.

- Loyalty Discount: Staying with the same insurance company for an extended period can earn you a loyalty discount.

Vehicle Type

The type of vehicle you drive significantly influences your insurance premiums. Generally, luxury cars, sports cars, and vehicles with high performance engines are more expensive to insure.

- Safety Features: Cars equipped with advanced safety features, such as anti-lock brakes, airbags, and stability control, tend to have lower insurance rates.

- Vehicle Age: Older cars are generally cheaper to insure due to their lower value and reduced risk of theft.

Driving History

Your driving history is a critical factor in determining your insurance premiums. Drivers with a history of accidents or violations face higher premiums.

Credit Score

In Washington state, insurance companies are permitted to use your credit score as a factor in determining your insurance rates. A good credit score can lead to lower premiums.

Claims Process

Navigating the claims process is essential for a smooth insurance experience. Here are some tips:

- Document Everything: Take photos or videos of the accident scene, any damage to your vehicle, and any injuries sustained.

- Report the Claim Promptly: Contact your insurance company as soon as possible after an accident.

- Be Honest and Accurate: Provide truthful and detailed information about the accident to your insurance company.

Conclusive Thoughts

By leveraging the collective knowledge of Reddit users and understanding the intricacies of Washington state’s insurance landscape, you can make informed decisions about your car insurance. Remember, choosing the right coverage isn’t just about finding the lowest price, it’s about ensuring you have adequate protection in case of an accident or other unforeseen events.

Helpful Answers

What are the mandatory car insurance requirements in Washington state?

Washington state requires all drivers to carry liability insurance, which covers damages to others in case of an accident. This includes bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage.

How do I find the best car insurance rates in Washington state?

The best way to find the best car insurance rates is to compare quotes from multiple insurers. Online comparison tools can make this process quick and easy. Consider factors like your driving history, vehicle type, and coverage needs when comparing quotes.

What are some tips for saving money on car insurance in Washington state?

You can save money on car insurance by maintaining a good driving record, bundling your insurance policies, exploring discounts for safe driving courses or anti-theft devices, and choosing a higher deductible.