Best car insurance rates washington state – Best car insurance rates in Washington State are a hot topic for drivers, and for good reason. With so many factors influencing your premiums, finding the most affordable coverage can feel like a daunting task. But fear not! This guide will break down everything you need to know about car insurance in Washington, from understanding the different types of coverage to finding the best deals.

We’ll explore the key factors that impact your rates, such as your driving history, vehicle type, and location. We’ll also delve into the various discounts available to help you save money. By the end, you’ll be equipped with the knowledge to make informed decisions about your car insurance and secure the best possible rates.

Understanding Car Insurance in Washington State: Best Car Insurance Rates Washington State

Car insurance is a crucial aspect of responsible vehicle ownership in Washington State, ensuring financial protection in case of accidents or other incidents. It is mandatory to have car insurance in Washington State, and the state has specific requirements for the minimum coverage levels. Understanding the different types of coverage, factors influencing rates, and available discounts can help you make informed decisions and find the best car insurance policy for your needs.

Required Car Insurance Coverage

Washington State requires all drivers to have a minimum level of car insurance coverage, known as the “Financial Responsibility Law.” This law mandates that drivers carry liability insurance to protect themselves and others in case of an accident. The required minimum coverage levels are:

- Liability Coverage: This coverage protects you financially if you are at fault in an accident. It covers the other driver’s medical expenses, property damage, and lost wages. The minimum required liability coverage in Washington State is $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $10,000 for property damage.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with an uninsured or underinsured driver. It covers your medical expenses, lost wages, and property damage. The minimum required uninsured/underinsured motorist coverage in Washington State is $25,000 per person and $50,000 per accident.

Factors Influencing Car Insurance Rates

Several factors can influence your car insurance rates in Washington State, including:

- Driving Record: Your driving history is a major factor in determining your insurance rates. A clean driving record with no accidents or traffic violations will typically result in lower premiums. However, having accidents, speeding tickets, or DUI convictions can significantly increase your rates.

- Vehicle Type: The type of vehicle you drive can also impact your insurance rates. High-performance cars or expensive vehicles are generally more expensive to insure due to their higher repair costs and potential for greater damage in accidents.

- Age and Gender: Insurance companies often consider age and gender when calculating rates. Young drivers, especially those under 25, typically pay higher premiums due to their higher risk of accidents. In some cases, women may receive lower rates than men, as they statistically have lower accident rates.

- Location: Your location can also affect your insurance rates. Areas with high traffic congestion, crime rates, or a higher frequency of accidents generally have higher insurance premiums.

- Credit History: Some insurance companies may consider your credit history when setting your rates. A good credit history can indicate financial responsibility, which may lead to lower premiums. However, this practice is not universal and may vary depending on the insurance company.

- Coverage Levels: The amount of coverage you choose can also influence your rates. Higher coverage limits, such as for liability or comprehensive coverage, will generally result in higher premiums. However, it’s important to consider the level of protection you need and balance it with your budget.

Common Car Insurance Discounts

Several discounts are available to help you save money on your car insurance premiums in Washington State. These discounts can vary depending on the insurance company, so it’s always a good idea to inquire about the specific discounts offered by your chosen provider. Here are some common discounts:

- Good Student Discount: This discount is available to students with good grades. It recognizes that students with high academic achievement tend to be more responsible drivers.

- Safe Driver Discount: This discount is offered to drivers with a clean driving record and no accidents or traffic violations. It rewards safe driving behavior.

- Multi-Car Discount: If you insure multiple vehicles with the same insurance company, you may be eligible for a multi-car discount. This discount reflects the reduced risk associated with insuring multiple vehicles from the same household.

- Anti-theft Device Discount: Installing anti-theft devices in your vehicle, such as an alarm system or GPS tracking, can reduce your insurance rates. These devices deter theft and help recover stolen vehicles.

- Loyalty Discount: Some insurance companies offer loyalty discounts to customers who have been with them for a certain period of time. This discount rewards customer loyalty and long-term relationships.

- Bundling Discount: You may receive a discount if you bundle your car insurance with other types of insurance, such as homeowners or renters insurance. This discount reflects the convenience and reduced administrative costs for the insurance company.

Finding the Best Car Insurance Rates

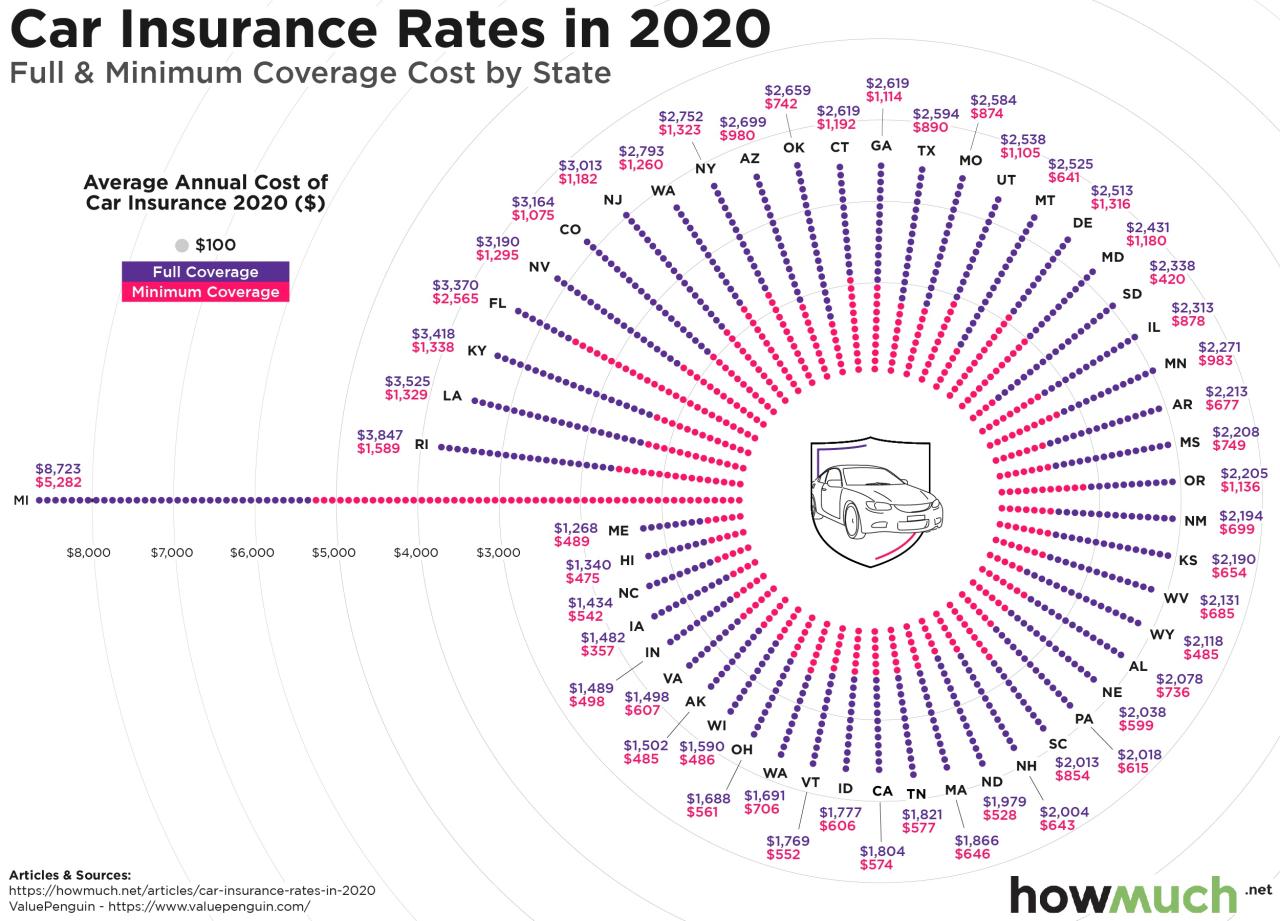

Finding the best car insurance rates in Washington State involves careful research and comparison of different providers. Several factors influence your insurance premium, including your driving history, vehicle type, and coverage options. This section explores some of the major car insurance providers in Washington State, highlighting their key features and benefits, and Artikels different methods for obtaining car insurance quotes.

Major Car Insurance Providers in Washington State

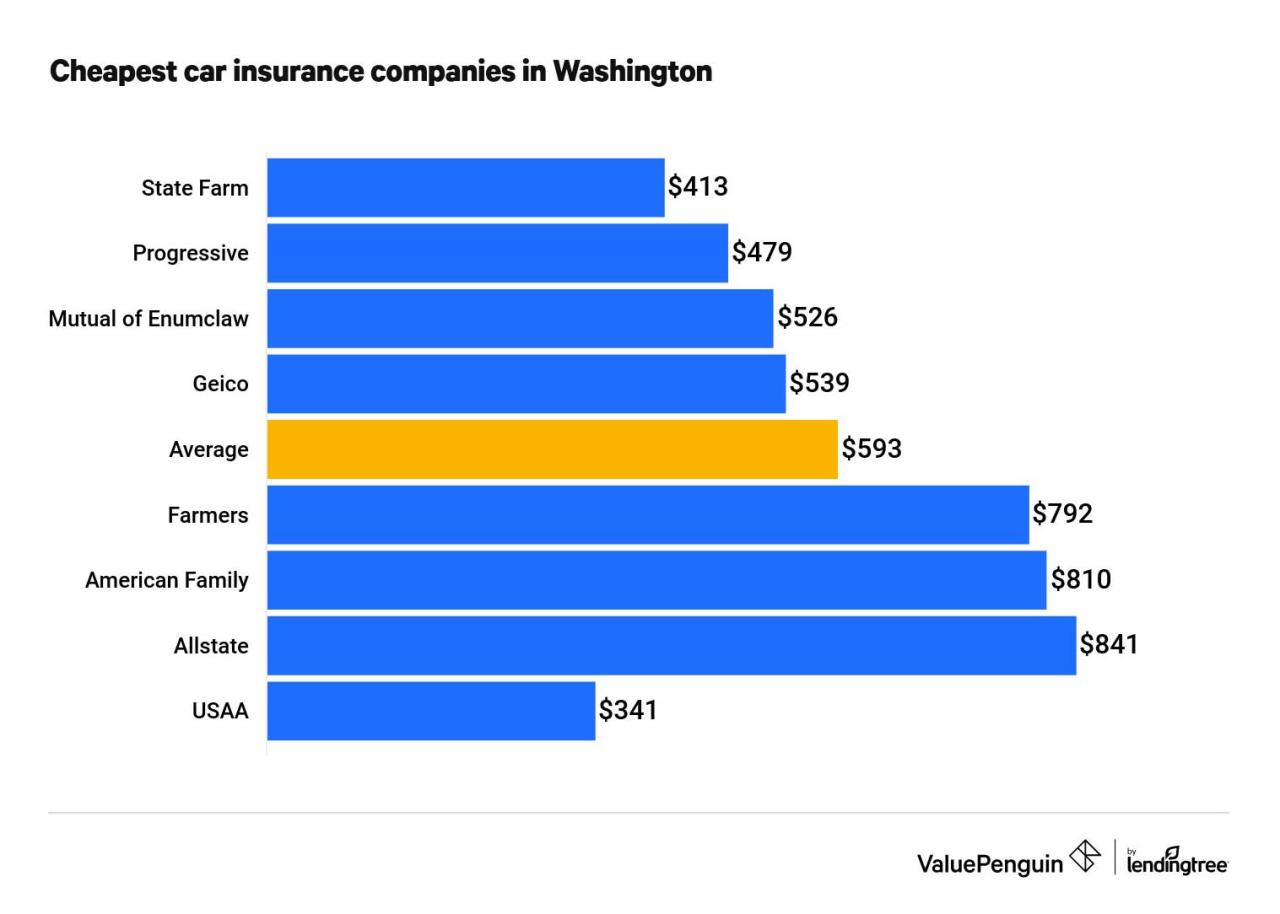

Comparing different insurance providers is crucial to finding the best rates. Each provider offers unique features and benefits that cater to different needs. Here are some of the major car insurance providers in Washington State:

- State Farm: Known for its wide range of coverage options, competitive rates, and excellent customer service. State Farm offers discounts for safe driving, bundling insurance policies, and being a good student. They also have a strong financial rating and a wide network of agents across the state.

- Geico: Renowned for its affordable rates and convenient online tools. Geico offers various discounts, including those for good drivers, multiple car insurance, and military service. Their online platform allows for easy policy management and quote requests.

- Progressive: Offers a wide range of coverage options and discounts, including those for good drivers, safe driving courses, and multiple car insurance. Progressive is also known for its innovative tools, such as its Name Your Price tool, which allows you to set your desired premium and find policies that match.

- Liberty Mutual: Offers a comprehensive suite of insurance products, including car insurance. They are known for their strong financial rating and commitment to customer satisfaction. Liberty Mutual offers various discounts, including those for good drivers, bundling policies, and being a good student.

- USAA: Exclusively available to military personnel, veterans, and their families, USAA offers competitive rates and excellent customer service. They provide various discounts, including those for good drivers, multiple car insurance, and military service.

Obtaining Car Insurance Quotes

To compare rates and find the best car insurance deal, you can utilize various methods for obtaining quotes.

- Online Quote Tools: Most insurance providers offer online quote tools that allow you to enter your information and receive instant quotes. This is a convenient and quick way to compare rates from multiple providers.

- Insurance Comparison Websites: Several websites specialize in comparing insurance quotes from different providers. These websites allow you to enter your information once and receive quotes from multiple companies, streamlining the comparison process.

- Contacting Insurance Agents: You can also contact insurance agents directly to obtain quotes. This allows you to discuss your specific needs and receive personalized recommendations.

Tips for Saving on Car Insurance

Lowering your car insurance premiums in Washington state can significantly impact your budget. By implementing strategic measures, you can optimize your insurance costs and secure the best possible rates. This section will guide you through practical tips for achieving this goal.

Improving Your Driving Record

A clean driving record is crucial for obtaining lower car insurance rates. By maintaining a safe driving history, you can demonstrate your responsible driving behavior to insurance companies, resulting in favorable premiums.

- Avoid Traffic Violations: Speeding tickets, reckless driving, and other traffic violations can significantly increase your insurance premiums. Practice defensive driving techniques and adhere to traffic laws to minimize the risk of violations.

- Complete a Defensive Driving Course: Enrolling in a defensive driving course can demonstrate your commitment to safe driving practices. Many insurance companies offer discounts for completing such courses, further reducing your premiums.

- Maintain a Clean Driving Record: Avoid any incidents that could lead to accidents or traffic violations. Practice safe driving habits, including staying alert, following traffic laws, and avoiding distractions.

Reducing Your Risk of Accidents

Proactively reducing your risk of accidents is a crucial strategy for securing lower insurance rates. By implementing preventative measures, you can minimize the likelihood of accidents and demonstrate your commitment to safe driving to insurance companies.

- Regular Vehicle Maintenance: Ensure your vehicle is in good working order by performing regular maintenance, including oil changes, tire rotations, and brake inspections. A well-maintained vehicle is less likely to experience mechanical failures that could lead to accidents.

- Safe Driving Practices: Avoid distractions while driving, such as using your phone or texting. Stay alert and focused on the road, and adjust your driving speed based on weather conditions and road hazards.

- Driving in Safe Conditions: Avoid driving during severe weather conditions, such as heavy rain, snow, or fog. These conditions can significantly increase the risk of accidents.

Negotiating with Insurance Companies

Negotiating with insurance companies is an effective way to secure lower rates. By understanding your options and utilizing strategic tactics, you can leverage your bargaining power to obtain favorable premiums.

- Shop Around for Quotes: Compare quotes from multiple insurance companies to identify the most competitive rates. Online comparison tools can streamline this process, allowing you to obtain quotes from various insurers simultaneously.

- Bundle Your Policies: Bundling your car insurance with other policies, such as homeowners or renters insurance, can often result in significant discounts. Explore this option with your current insurer or other companies to determine if it’s advantageous.

- Increase Your Deductible: Consider increasing your deductible, the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible generally translates to lower premiums, as you are taking on more financial responsibility.

- Ask About Discounts: Inquire about available discounts, such as good driver discounts, safe driver discounts, and discounts for safety features in your vehicle.

- Negotiate After a Renewal: Contact your insurance company near your renewal date and negotiate for lower rates. They may be more willing to offer discounts to retain your business.

Understanding Your Policy

Knowing the ins and outs of your car insurance policy is crucial for navigating potential claims and making informed decisions about your coverage. Understanding the different sections of your policy and common exclusions and limitations will help you make the most of your insurance.

Policy Sections

Your car insurance policy is divided into different sections, each outlining specific aspects of your coverage.

- Declarations Page: This page contains your personal information, vehicle details, policy effective dates, and coverage limits.

- Coverages: This section details the types of coverage you have chosen, such as liability, collision, comprehensive, and uninsured/underinsured motorist.

- Exclusions and Limitations: This section specifies situations where coverage may not apply, such as driving under the influence or using your vehicle for commercial purposes.

- Conditions: This section Artikels your responsibilities as a policyholder, including reporting accidents, cooperating with investigations, and paying premiums on time.

- Definitions: This section defines key terms used in the policy, ensuring clear understanding of the language used.

Common Policy Exclusions and Limitations

It’s important to understand the limitations and exclusions in your policy. Here are some common examples:

- Driving Without a Valid License: Coverage may be denied if you’re driving without a valid license or with a suspended license.

- Driving Under the Influence: Coverage may be denied if you’re driving under the influence of alcohol or drugs.

- Using Your Vehicle for Business Purposes: If you use your vehicle for commercial purposes, your personal insurance policy may not cover you.

- Wear and Tear: Normal wear and tear on your vehicle is typically not covered by comprehensive or collision coverage.

- Acts of War or Terrorism: Coverage may be excluded for damages resulting from acts of war or terrorism.

Filing a Claim

If you need to file a claim, follow these steps:

- Contact Your Insurance Company: Immediately report the accident or incident to your insurance company. They will guide you through the claim process.

- Gather Information: Collect as much information as possible, including the date, time, and location of the accident, the names and contact information of all parties involved, and details of any witnesses.

- File a Claim Form: Your insurance company will provide you with a claim form. Fill it out accurately and completely.

- Provide Supporting Documentation: Provide any relevant documentation, such as police reports, medical bills, and repair estimates.

- Cooperate with the Investigation: Be prepared to answer questions from your insurance company and cooperate with their investigation.

Resources for Car Insurance Information

Navigating the world of car insurance can be overwhelming, especially in a state like Washington with its unique regulations and coverage options. Fortunately, numerous resources are available to help you make informed decisions about your car insurance.

Reputable Websites and Organizations

These websites and organizations offer valuable information and tools to help you understand car insurance in Washington.

- Washington State Department of Insurance (WSDOI): The WSDOI is the primary regulatory body for the insurance industry in Washington. Their website provides comprehensive information on car insurance laws, consumer rights, and complaint procedures. They also offer a variety of resources, including publications, FAQs, and online tools.

- Insurance Information Institute (III): The III is a non-profit organization that provides information and resources on insurance topics, including car insurance. Their website offers articles, reports, and statistics on various aspects of car insurance, including coverage options, pricing trends, and safety tips.

- National Association of Insurance Commissioners (NAIC): The NAIC is an association of insurance commissioners from all 50 states, the District of Columbia, and five U.S. territories. Their website provides information on insurance regulations, consumer protection, and industry trends.

- Consumer Reports: Consumer Reports is a non-profit organization that provides independent reviews and ratings of consumer products and services, including car insurance. Their website offers detailed information on car insurance companies, coverage options, and pricing comparisons.

Contacting the Washington State Department of Insurance, Best car insurance rates washington state

The WSDOI provides various ways to reach out for assistance:

- Website: www.insurance.wa.gov

- Phone: (800) 562-6900

- Email: insurance@insurance.wa.gov

- Mailing Address:

PO Box 4010

Olympia, WA 98504-4010

Online Tools for Comparing Car Insurance Quotes

Several websites offer online tools for comparing car insurance quotes from multiple companies. These tools can help you save time and money by providing a quick and easy way to compare rates and coverage options.

- Insurify: Insurify is a popular online platform that allows you to compare car insurance quotes from over 20 insurance companies. It uses an advanced algorithm to find the best rates based on your individual needs and preferences.

- Policygenius: Policygenius is another website that offers car insurance quote comparison tools. They also provide helpful information on insurance topics and can help you find the best coverage for your needs.

- The Zebra: The Zebra is a website that compares car insurance quotes from over 100 insurance companies. They offer a variety of features, including personalized recommendations, coverage explanations, and discount analysis.

Final Wrap-Up

Navigating the world of car insurance can feel overwhelming, but armed with the right information, you can confidently secure the best coverage at a price that fits your budget. Remember to compare quotes, leverage discounts, and consider your individual needs. With a little effort, you can find the perfect car insurance policy that provides peace of mind while safeguarding your wallet.

FAQ Section

What are the minimum car insurance requirements in Washington State?

Washington State requires drivers to carry liability insurance, which covers damages to other people and property in case of an accident. The minimum limits are $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $10,000 for property damage.

What are some common car insurance discounts in Washington State?

Many insurers offer discounts for good driving records, safe driving courses, multiple vehicle policies, and bundling with other insurance types. You may also be eligible for discounts based on your age, occupation, or membership in certain organizations.

How often should I review my car insurance policy?

It’s a good idea to review your policy at least annually to ensure you’re still getting the best coverage and rates. Your needs and driving situation may change over time, and your current policy might no longer be the most suitable.