Best car insurance in washington state – Navigating the world of car insurance in Washington State can feel overwhelming, but it doesn’t have to be. Finding the best car insurance policy for your needs requires careful consideration of various factors, from coverage options to premium costs. This guide will equip you with the knowledge and tools to make informed decisions and secure the most suitable insurance plan for your situation.

Whether you’re a seasoned driver or just getting behind the wheel, understanding Washington State’s car insurance requirements is crucial. This guide will cover everything from mandatory coverage to factors that influence premiums, empowering you to make confident choices when selecting your car insurance.

Understanding Washington State Car Insurance Requirements

Driving a car in Washington State comes with the responsibility of having car insurance. This is not just a suggestion; it’s a legal requirement. To ensure you’re driving safely and legally, it’s crucial to understand the specific car insurance requirements in the state.

Washington State’s Mandatory Car Insurance Coverage

It’s essential to have the minimum required car insurance coverage in Washington State. These coverages are designed to protect you and others in case of an accident.

- Liability Coverage: This coverage is mandatory and protects you financially if you cause an accident that results in injuries or damage to another person’s property. It includes two parts:

- Bodily Injury Liability: This covers medical expenses, lost wages, and pain and suffering for the other driver and passengers involved in the accident.

- Property Damage Liability: This covers repairs or replacement costs for the other driver’s vehicle or any damaged property.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with an uninsured or underinsured driver. It covers your medical expenses, lost wages, and property damage.

Penalties for Driving Without Car Insurance

Driving without the required car insurance in Washington State is a serious offense with significant consequences.

- Fines: You could face hefty fines, ranging from hundreds to thousands of dollars, depending on the severity of the offense.

- License Suspension: Your driver’s license can be suspended for a period of time, preventing you from driving legally.

- Vehicle Impoundment: Your vehicle may be impounded until you obtain the required insurance coverage.

- Increased Insurance Premiums: Even if you obtain insurance after being caught driving without it, you may face higher premiums in the future.

Washington State Department of Licensing’s Role in Car Insurance Regulations

The Washington State Department of Licensing (DOL) plays a vital role in regulating car insurance in the state.

- Enforcing Insurance Requirements: The DOL enforces the state’s car insurance laws, ensuring that all drivers have the necessary coverage.

- Issuing Driver’s Licenses: The DOL issues driver’s licenses only to individuals who provide proof of car insurance.

- Maintaining a Database: The DOL maintains a database of all licensed drivers and their insurance information.

- Investigating Insurance Fraud: The DOL investigates cases of insurance fraud, protecting consumers from dishonest insurance practices.

Key Factors to Consider When Choosing Car Insurance

Finding the best car insurance in Washington State requires careful consideration of various factors to ensure you have the right coverage at the best price.

Comparing Quotes from Multiple Insurers

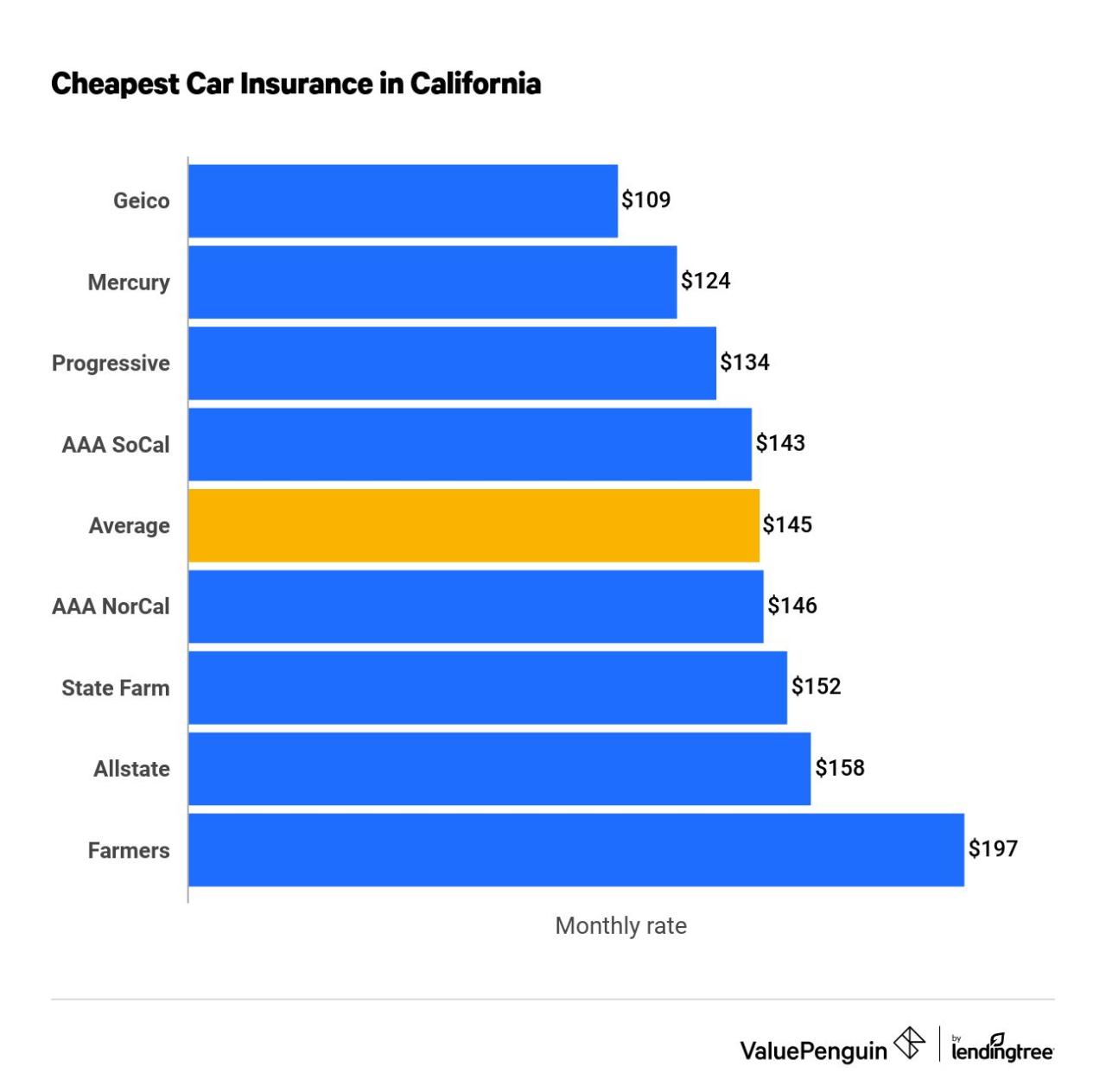

It is crucial to compare quotes from multiple insurers before settling on a policy. Each insurer has its own pricing structure and coverage options, so getting quotes from several companies allows you to find the best deal that fits your specific needs and budget. Online comparison tools can help you streamline this process by providing quotes from multiple insurers simultaneously.

Popular Car Insurance Companies in Washington State

Finding the right car insurance company can be a daunting task, especially with so many options available. Washington State is home to a diverse range of insurance providers, each with its unique offerings and pricing structures. To make your search easier, we’ve compiled a list of some of the most popular car insurance companies in the state, along with their key features and customer satisfaction ratings.

Popular Car Insurance Companies in Washington State

This table provides an overview of some of the top-rated car insurance companies in Washington State, based on factors like average premiums, customer satisfaction, and coverage options. Remember, these are just a few examples, and it’s essential to compare quotes from multiple companies to find the best deal for your specific needs.

| Company Name | Average Premiums | Customer Satisfaction Rating | Key Coverage Options |

|---|---|---|---|

| State Farm | $1,200-$1,800 per year | 4.5/5 stars | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist, Personal Injury Protection |

| Geico | $1,100-$1,700 per year | 4.2/5 stars | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist, Personal Injury Protection, Rental Car Reimbursement |

| Progressive | $1,000-$1,600 per year | 4.0/5 stars | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist, Personal Injury Protection, Accident Forgiveness |

| USAA | $1,000-$1,500 per year | 4.8/5 stars | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist, Personal Injury Protection, Emergency Roadside Assistance |

Types of Car Insurance Coverage

In Washington state, you are legally required to carry certain types of car insurance to protect yourself and others on the road. Understanding the different types of coverage and their benefits is essential to make informed decisions about your car insurance policy. This section will Artikel the most common types of car insurance coverage and their relevance in real-life scenarios.

Liability Coverage, Best car insurance in washington state

Liability coverage is the most basic type of car insurance and is required in Washington state. It protects you financially if you cause an accident that injures someone or damages their property. Liability coverage includes:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages to the other driver and passengers if you are at fault in an accident. It is usually expressed as a limit per person and a limit per accident, such as 25/50/10, which means up to $25,000 per person and up to $50,000 per accident for bodily injury liability.

- Property Damage Liability: This coverage pays for repairs or replacement of the other driver’s vehicle or property if you are at fault in an accident. It is usually expressed as a single limit, such as $10,000, meaning up to $10,000 for property damage liability.

For example, if you rear-end another car, causing $5,000 in damages to their vehicle and $10,000 in medical bills for the driver, your property damage liability coverage would pay for the $5,000 in vehicle damage, and your bodily injury liability coverage would pay for the $10,000 in medical bills, up to the limits of your policy.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. This coverage is optional but highly recommended, especially if you have a newer or financed vehicle. For example, if you hit a tree while driving, your collision coverage would pay for the repairs to your car, even if you were not at fault.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, fire, hail, or natural disasters. Like collision coverage, comprehensive coverage is optional but can be very beneficial, especially if you have a newer or financed vehicle. For example, if your car is damaged by a hailstorm, your comprehensive coverage would pay for the repairs.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage (UM/UIM) protects you and your passengers if you are injured in an accident caused by a driver who does not have insurance or has insufficient insurance. This coverage is optional but highly recommended as it can help you recover damages that the at-fault driver’s insurance may not cover. For example, if you are hit by a driver who does not have insurance, your UM/UIM coverage would pay for your medical expenses and other damages, up to the limits of your policy.

Tips for Saving on Car Insurance Premiums

Finding the best car insurance in Washington state is important, but so is saving money on your premiums. By taking a few steps, you can significantly reduce your costs without sacrificing coverage.

Maintain a Good Driving Record

A clean driving record is one of the most significant factors influencing your insurance rates. Every traffic violation, accident, or DUI conviction increases your risk profile, leading to higher premiums.

- Avoid speeding tickets, reckless driving citations, and any other moving violations.

- Be cautious and defensive while driving to minimize the chances of accidents.

- If you have a minor violation, consider attending traffic school to potentially avoid points on your license.

Take Defensive Driving Courses

Taking a defensive driving course can demonstrate to insurance companies that you’re committed to safe driving practices. These courses often teach you valuable skills for avoiding accidents and handling challenging driving situations.

- Most insurance companies offer discounts for completing defensive driving courses.

- The course can refresh your driving knowledge and enhance your awareness on the road.

- These courses are usually inexpensive and can be completed online or in person.

Bundle Your Insurance Policies

Many insurance companies offer discounts when you bundle multiple policies, such as car insurance, homeowners insurance, or renters insurance. Combining your policies with the same insurer can save you money in the long run.

- Bundling your policies simplifies your insurance management and reduces administrative costs for the insurance company.

- The discounts offered for bundling can vary depending on the insurance company and the types of policies you bundle.

- Check with your current insurer to see if they offer bundling discounts or compare quotes from other insurers to find the best deals.

Choose Car Safety Features

Modern cars come equipped with a wide range of safety features that can significantly reduce the risk of accidents and injuries. These features can also lead to lower insurance premiums.

- Anti-lock brakes (ABS) and electronic stability control (ESC) can prevent skidding and improve vehicle control in challenging conditions.

- Airbags and seatbelts provide crucial protection in case of an accident.

- Advanced driver-assistance systems (ADAS), such as lane departure warning, blind spot monitoring, and adaptive cruise control, can alert drivers to potential hazards and reduce the likelihood of accidents.

Explore Discounts Offered by Insurance Companies

Insurance companies offer various discounts to their policyholders, and taking advantage of these discounts can significantly reduce your premiums.

- Good Student Discount: This discount is typically available to students with good grades.

- Safe Driver Discount: This discount is awarded to drivers with a clean driving record.

- Multi-Car Discount: This discount applies if you insure multiple vehicles with the same insurance company.

- Anti-theft Device Discount: Installing anti-theft devices, such as alarms or tracking systems, can make your car less attractive to thieves and qualify you for a discount.

- Pay-in-Full Discount: Paying your premium in full upfront can often result in a discount.

- Loyalty Discount: Long-term customers with a good driving record may be eligible for a loyalty discount.

Common Car Insurance Claims in Washington State

Understanding the most common car insurance claims in Washington State can help you make informed decisions about your coverage needs and potentially save money on your premiums. By being aware of the types of claims that are most frequently filed, you can prioritize the coverage that best aligns with your individual risk profile.

Types of Car Insurance Claims

The most common types of car insurance claims filed in Washington State typically fall into these categories:

- Collision Claims: These claims arise when your vehicle collides with another vehicle, an object, or even a stationary object like a tree. These claims are covered by collision coverage, which is optional in Washington State.

- Comprehensive Claims: These claims cover damage to your vehicle caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. Comprehensive coverage is also optional in Washington State.

- Liability Claims: These claims are filed when you are at fault for causing an accident that results in damage to another person’s vehicle or injuries to another person. Liability coverage is mandatory in Washington State.

- Uninsured/Underinsured Motorist Claims: These claims are filed when you are involved in an accident with a driver who is either uninsured or underinsured. Uninsured/underinsured motorist coverage is mandatory in Washington State.

- Personal Injury Protection (PIP) Claims: These claims cover medical expenses, lost wages, and other related costs for you and your passengers, regardless of who is at fault in an accident. PIP coverage is mandatory in Washington State.

The Claims Process

The claims process typically involves the following steps:

- Report the Accident: Immediately contact your insurance company to report the accident and provide them with the necessary details, such as the date, time, location, and the other parties involved.

- File a Claim: Your insurance company will provide you with a claim form to complete and submit.

- Provide Documentation: You will need to provide your insurance company with supporting documentation, such as a police report, medical bills, and repair estimates.

- Insurance Company Investigation: Your insurance company will investigate the claim to determine the extent of the damage and the liability involved.

- Negotiate a Settlement: Once the investigation is complete, your insurance company will negotiate a settlement with you.

- Receive Payment: If you accept the settlement, your insurance company will issue payment for your claim.

Tips for Navigating the Claims Process

Here are some tips to help you navigate the claims process effectively:

- Be Prepared: Before filing a claim, gather all the necessary documentation, such as your insurance policy, driver’s license, registration, and contact information for the other parties involved.

- Document Everything: Take photos or videos of the accident scene, any injuries, and the damage to your vehicle.

- Be Honest and Accurate: Provide your insurance company with accurate and truthful information.

- Be Patient: The claims process can take some time, so be patient and stay in communication with your insurance company.

- Seek Legal Advice: If you are having trouble with your insurance company, you may want to seek legal advice from an attorney.

Resources for Washington State Car Insurance Consumers: Best Car Insurance In Washington State

Navigating the world of car insurance in Washington State can be challenging, but numerous resources are available to help consumers make informed decisions and protect their rights. These resources offer valuable information, assistance, and advocacy for consumers facing car insurance-related issues.

Official Websites for Washington State Agencies

The Washington State Department of Licensing (DOL) and the Washington State Insurance Commissioner (OIC) are essential resources for car insurance consumers. The DOL oversees driver licensing, vehicle registration, and title services, while the OIC regulates the insurance industry and protects consumer rights.

- Washington State Department of Licensing (DOL): [https://www.dol.wa.gov/](https://www.dol.wa.gov/) – Provides information on driver licensing, vehicle registration, and insurance requirements.

- Washington State Insurance Commissioner (OIC): [https://www.insurance.wa.gov/](https://www.insurance.wa.gov/) – Offers consumer resources, complaint filing, and information on insurance regulations and consumer rights.

Consumer Protection Agencies and Advocacy Groups

Several consumer protection agencies and advocacy groups provide valuable support and resources to Washington State car insurance consumers. These organizations can assist with insurance-related complaints, provide information, and advocate for consumer rights.

- Washington State Office of the Attorney General: [https://www.atg.wa.gov/](https://www.atg.wa.gov/) – Handles consumer complaints, enforces consumer protection laws, and provides legal assistance.

- Consumer Protection Division of the Washington State Department of Commerce: [https://www.commerce.wa.gov/](https://www.commerce.wa.gov/) – Addresses consumer complaints, investigates unfair business practices, and provides information on consumer rights.

- Washington State Insurance Commissioner: [https://www.insurance.wa.gov/](https://www.insurance.wa.gov/) – Provides information on insurance regulations, consumer rights, and handles consumer complaints.

Reputable Insurance Comparison Websites

Insurance comparison websites can help consumers compare quotes from multiple insurance providers and find the best coverage at the most competitive price.

- Policygenius: [https://www.policygenius.com/](https://www.policygenius.com/) – Provides personalized quotes from various insurance companies and offers helpful resources for understanding insurance policies.

- The Zebra: [https://www.thezebra.com/](https://www.thezebra.com/) – Allows consumers to compare quotes from multiple insurers and offers detailed information on coverage options.

- Insurify: [https://www.insurify.com/](https://www.insurify.com/) – Offers a comprehensive comparison of insurance quotes from various companies and provides insights into coverage options.

Final Conclusion

By taking the time to research, compare quotes, and understand your insurance options, you can find the best car insurance in Washington State that fits your budget and provides the protection you need. Remember, your car insurance is a safety net, and choosing the right policy can make a significant difference in your peace of mind and financial well-being.

Expert Answers

What are the minimum car insurance requirements in Washington State?

Washington State requires all drivers to carry liability insurance, which covers damages to other people and their property in an accident. The minimum liability coverage requirements are $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $10,000 for property damage.

What are some common car insurance discounts available in Washington State?

Many insurance companies offer discounts for various factors, including good driving records, safety features in your car, multiple policies bundled together, and completing defensive driving courses.

What should I do if I get into an accident?

If you’re involved in an accident, prioritize safety and ensure everyone is okay. Then, exchange information with the other driver(s) involved, take photos of the damage, and report the accident to your insurance company as soon as possible.