Best car insurance companies in washington state – Finding the best car insurance in Washington State can be a daunting task, especially with so many companies vying for your business. Understanding the state’s unique insurance landscape, comparing quotes, and carefully considering coverage options are crucial steps to securing the best possible protection for yourself and your vehicle.

Washington State has its own set of regulations and requirements for car insurance, which can impact the types of coverage available and the cost of premiums. It’s important to research and understand these regulations before making a decision.

Understanding Washington State’s Insurance Landscape

Washington State’s car insurance market is a complex and dynamic environment influenced by a variety of factors, including state regulations, market competition, and consumer demand. Understanding the unique aspects of this market can help drivers make informed decisions about their car insurance needs.

Mandatory Coverage Requirements in Washington State

Washington State requires all drivers to carry a minimum level of car insurance coverage to protect themselves and others on the road. This mandatory coverage, known as financial responsibility, ensures that drivers have the financial resources to cover the costs of accidents they may cause.

The mandatory coverage requirements in Washington State include:

- Liability Coverage: This coverage protects you financially if you cause an accident that results in injuries or property damage to others. Washington State requires a minimum of $25,000 per person/$50,000 per accident for bodily injury liability and $10,000 for property damage liability.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. Washington State requires a minimum of $25,000 per person/$50,000 per accident for UM/UIM coverage.

- Damage to Your Own Vehicle: Washington State does not require drivers to carry collision or comprehensive coverage, which protect your own vehicle from damage caused by accidents or other events. However, many lenders require borrowers to have these coverages to protect their investment.

Washington State’s Regulatory Environment for Car Insurance

The Washington State Office of the Insurance Commissioner (OIC) is responsible for regulating the car insurance market in the state. The OIC’s mission is to protect consumers by ensuring that insurance companies operate fairly and responsibly.

The OIC sets rules and regulations that govern car insurance companies in Washington State. These regulations cover a wide range of topics, including:

- Pricing: The OIC sets guidelines for how insurance companies can price their policies, ensuring that rates are fair and competitive.

- Coverage: The OIC regulates the types of coverage that insurance companies must offer and the minimum levels of coverage that drivers must carry.

- Consumer Protection: The OIC enforces laws that protect consumers from unfair or deceptive practices by insurance companies.

Key Factors to Consider When Choosing Car Insurance

Finding the right car insurance policy in Washington State is crucial for protecting yourself financially in case of an accident. But with so many options available, it can be overwhelming to know where to start. This section Artikels some key factors to consider when choosing your car insurance.

Comparing Quotes From Multiple Insurers

It is essential to compare quotes from multiple insurers to ensure you get the best possible rate. You can use online comparison tools or contact insurers directly to obtain quotes. When comparing quotes, be sure to consider the coverage offered, the deductible, and the premium.

Coverage Limits and Deductibles

Coverage limits and deductibles are two important factors that affect your car insurance premium.

Coverage limits refer to the maximum amount that your insurer will pay for a covered loss.

Deductibles are the amount you pay out of pocket before your insurance coverage kicks in.

A higher deductible usually means a lower premium, while a lower deductible means a higher premium.

It’s important to choose coverage limits and deductibles that are right for your individual needs and financial situation.

Factors That Impact Premiums

Several factors can influence your car insurance premiums, including:

- Driving history: Your driving record, including accidents, tickets, and other violations, can significantly impact your premiums. Drivers with clean records generally receive lower rates.

- Vehicle type: The type of vehicle you drive can also affect your premiums. High-performance cars, luxury vehicles, and SUVs often have higher insurance premiums than smaller, less expensive cars.

- Location: Your location can also impact your premiums. Insurance rates tend to be higher in areas with higher rates of accidents or theft.

- Credit score: In some states, insurance companies may use your credit score to determine your premiums. This is because studies have shown a correlation between credit score and driving risk.

- Age: Younger drivers typically pay higher premiums than older drivers, as they are considered to be at higher risk.

- Gender: Historically, women have paid lower premiums than men, but this trend is changing in some states.

- Marital status: Married drivers often pay lower premiums than single drivers, as they are statistically considered to be at lower risk.

- Driving experience: Drivers with more experience typically pay lower premiums than those with less experience.

- Safety features: Vehicles with safety features, such as anti-lock brakes, airbags, and stability control, can qualify for discounts.

Top Car Insurance Companies in Washington State

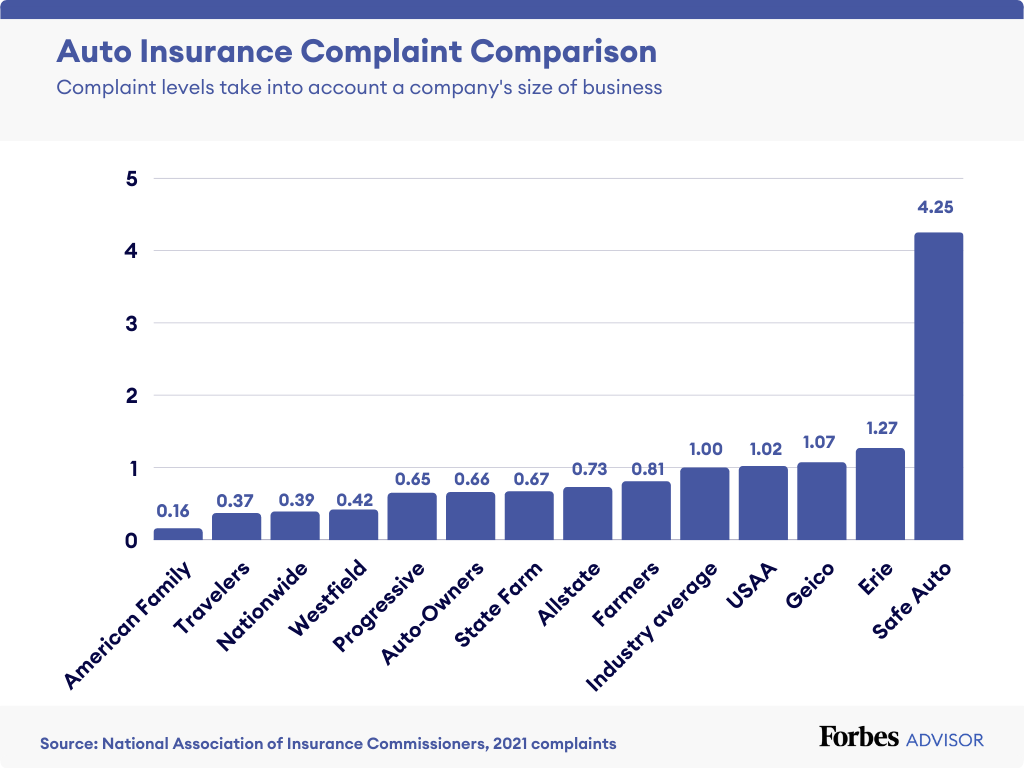

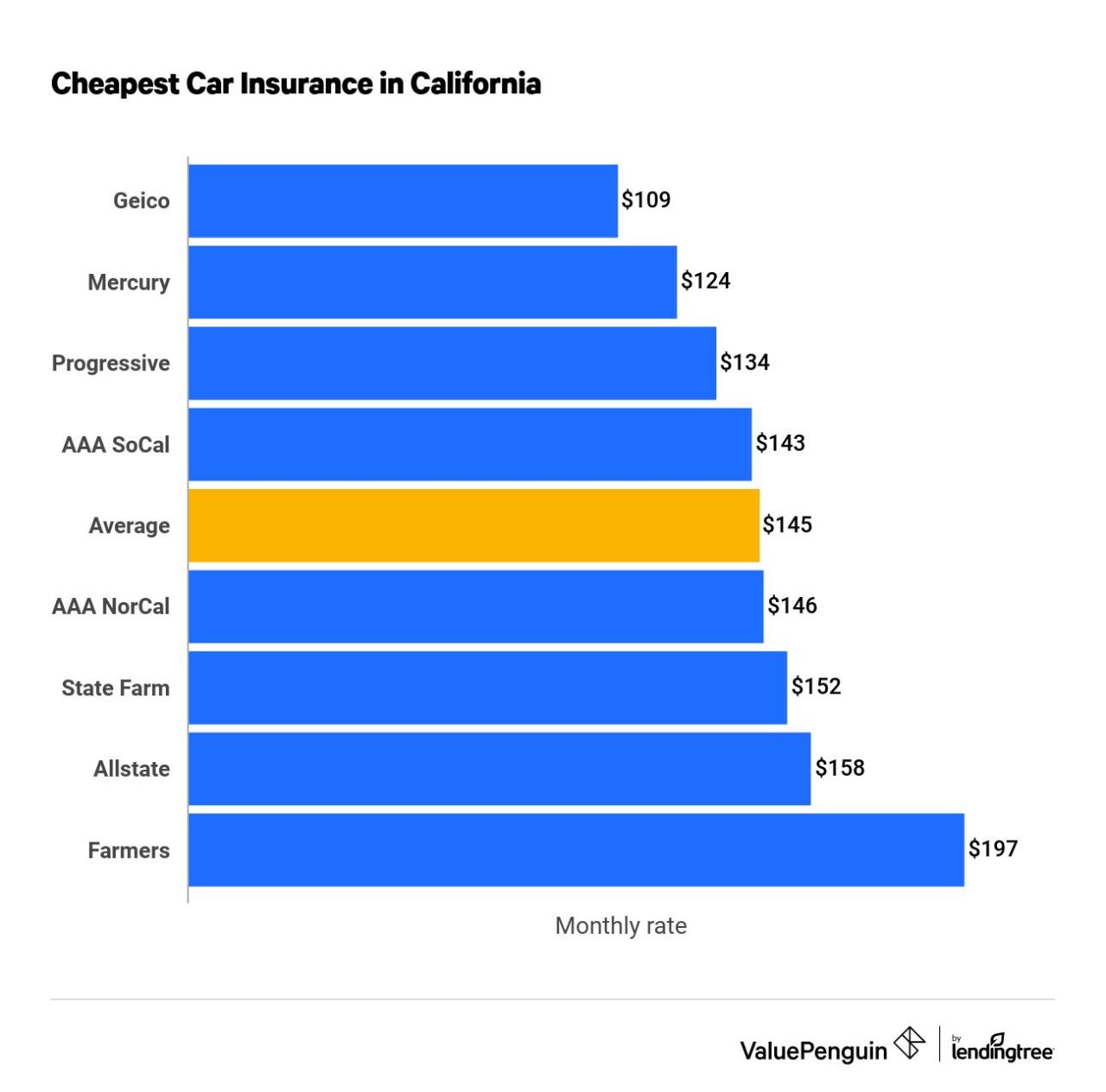

Choosing the right car insurance company is crucial for protecting yourself financially in case of an accident or other unforeseen events. Washington State offers a diverse range of insurance providers, each with its unique strengths and offerings. To help you make an informed decision, we’ve compiled a list of the top 5 car insurance companies in the state, considering factors like average premium rates, customer satisfaction ratings, claims handling efficiency, and coverage options.

Top Car Insurance Companies in Washington State

| Company | Average Premium Rates | Customer Satisfaction Ratings | Claims Handling Efficiency | Coverage Options |

|---|---|---|---|---|

| Geico | $1,200 – $1,500 per year | 4.5 out of 5 stars | Excellent | Comprehensive, collision, liability, uninsured/underinsured motorist, personal injury protection |

| State Farm | $1,300 – $1,600 per year | 4.0 out of 5 stars | Good | Comprehensive, collision, liability, uninsured/underinsured motorist, personal injury protection, rental car reimbursement |

| Progressive | $1,400 – $1,700 per year | 4.2 out of 5 stars | Good | Comprehensive, collision, liability, uninsured/underinsured motorist, personal injury protection, roadside assistance |

| USAA | $1,100 – $1,400 per year | 4.8 out of 5 stars | Excellent | Comprehensive, collision, liability, uninsured/underinsured motorist, personal injury protection, military discounts |

| Farmers Insurance | $1,250 – $1,550 per year | 3.8 out of 5 stars | Good | Comprehensive, collision, liability, uninsured/underinsured motorist, personal injury protection, accident forgiveness |

Specialized Coverage Options

Beyond the basic requirements, Washington state offers several specialized coverage options that can provide additional protection and peace of mind. These options are designed to address specific situations and needs, offering tailored coverage for your unique circumstances.

Collision and Comprehensive Coverage

These coverages protect you from financial losses resulting from damage to your vehicle, regardless of who is at fault.

- Collision Coverage: Pays for repairs or replacement of your vehicle if it’s damaged in an accident, even if you’re at fault. This coverage is usually required if you have a loan or lease on your vehicle.

- Comprehensive Coverage: Protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, fire, natural disasters, or falling objects.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

- Uninsured Motorist Coverage: Covers your medical expenses, lost wages, and property damage if you’re hit by a driver without insurance.

- Underinsured Motorist Coverage: Covers the difference between the other driver’s insurance coverage and your actual losses if you’re hit by a driver with insufficient insurance.

Rental Car Reimbursement

This coverage provides financial assistance if you need to rent a car while your vehicle is being repaired after an accident.

Rental car reimbursement covers the cost of renting a similar vehicle while your car is being repaired, up to a certain limit and duration.

Roadside Assistance

This coverage offers on-the-spot assistance for various roadside emergencies, providing peace of mind in case of unexpected situations.

- Towing: Covers the cost of towing your vehicle to a repair shop or safe location in case of a breakdown or accident.

- Battery Jump-Start: Provides assistance in jump-starting your vehicle if the battery is dead.

- Flat Tire Change: Covers the cost of changing a flat tire.

- Lockout Service: Provides assistance if you’re locked out of your vehicle.

Tips for Saving on Car Insurance

Car insurance is a necessity for all drivers in Washington State. While it’s essential to have adequate coverage, you don’t have to break the bank to get it. There are several ways to reduce your premiums and save money on your car insurance.

Maintain a Good Driving Record

A clean driving record is one of the most significant factors in determining your car insurance rates. Maintaining a good driving record can significantly reduce your premiums. Here are some tips for keeping your driving record clean:

- Obey all traffic laws: This includes following speed limits, stopping at red lights and stop signs, and using your turn signals.

- Avoid distractions: Distracted driving is a major cause of accidents. Put away your phone, avoid eating while driving, and focus on the road.

- Take a defensive driving course: These courses can teach you how to be a safer driver and may even qualify you for a discount on your insurance.

Bundle Insurance Policies

Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can often result in significant discounts. This is because insurance companies offer incentives to customers who bundle their policies with them. Ask your insurance company about bundling options to see if you can save money.

Take Advantage of Discounts

Most insurance companies offer a variety of discounts to their policyholders. These discounts can be based on factors such as your driving record, your vehicle’s safety features, your age, and your occupation.

- Good student discount: This discount is available to students who maintain a certain GPA.

- Safe driver discount: This discount is available to drivers who have a clean driving record for a specific period.

- Anti-theft device discount: This discount is available to drivers who have anti-theft devices installed in their vehicles.

- Multi-car discount: This discount is available to drivers who insure multiple vehicles with the same company.

“Shopping around for car insurance is essential. Different insurance companies offer different rates, so it’s important to compare quotes from multiple companies before you choose a policy.”

Understanding Claims and Disputes

Navigating the claims process after an accident is a crucial part of having car insurance. It’s essential to understand your rights and responsibilities, as well as how to effectively interact with your insurer. This section will guide you through the claims process and provide tips for resolving any potential disputes.

The Claims Process and the Insurer’s Role

When you’re involved in an accident, your insurer plays a vital role in helping you navigate the aftermath. Here’s a general overview of the claims process:

- Report the Accident: Contact your insurer as soon as possible after the accident. Provide them with the necessary details, such as the date, time, location, and any injuries sustained.

- File a Claim: Your insurer will guide you through the process of filing a claim. This usually involves completing forms and providing documentation.

- Investigation: The insurer will investigate the accident to determine liability and assess the damages. This may involve reviewing police reports, witness statements, and medical records.

- Negotiation: Once the investigation is complete, the insurer will negotiate a settlement with you. This involves determining the amount of compensation you’ll receive for your losses, including vehicle repairs, medical expenses, and lost wages.

- Payment: If you agree to the settlement, the insurer will issue payment to you. This can be in the form of a check, direct deposit, or other payment methods.

Your insurer is obligated to act in good faith and provide you with fair and reasonable compensation for your losses. They are also required to handle claims promptly and efficiently.

Documenting Accidents and Injuries

Thorough documentation is crucial in any accident claim. It strengthens your case and helps ensure you receive the appropriate compensation. Here’s what you should do:

- Take Photographs: Capture images of the accident scene, including damage to your vehicle, any injuries sustained, and any relevant road conditions.

- Gather Witness Information: Collect contact information from any witnesses who saw the accident. Their accounts can be valuable in supporting your claim.

- Obtain Police Report: If the police were called to the scene, request a copy of the accident report. This official document provides an objective account of the incident.

- Seek Medical Attention: If you’re injured, seek immediate medical attention. Keep all medical records and documentation related to your injuries.

- Keep a Detailed Journal: Maintain a journal or diary documenting your experience after the accident. This includes any physical limitations, emotional distress, or financial losses you’ve incurred.

Resolving Disputes with Insurance Companies, Best car insurance companies in washington state

Disputes with insurance companies can arise for various reasons, such as disagreements over liability, the extent of damages, or the amount of compensation offered. Here are some tips for resolving disputes:

- Understand Your Policy: Carefully review your insurance policy to understand your coverage and rights.

- Communicate Clearly: Express your concerns and expectations clearly and respectfully to your insurer. Maintain a written record of all communication.

- Seek Mediation: If you can’t reach a resolution through direct communication, consider seeking mediation. A neutral third party can help facilitate a compromise.

- Consult an Attorney: If mediation fails or you believe your insurer is acting in bad faith, consult with an attorney specializing in insurance law.

Closure

Ultimately, the best car insurance company for you depends on your individual needs and circumstances. By understanding the factors that influence premiums, comparing quotes from multiple insurers, and carefully considering your coverage options, you can find a policy that provides adequate protection at a reasonable price. Remember to review your policy regularly and make adjustments as needed to ensure you have the coverage you need.

Popular Questions: Best Car Insurance Companies In Washington State

What are the mandatory car insurance coverages in Washington State?

Washington State requires drivers to have liability insurance, which covers damages to other people and property in case of an accident. This includes bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage.

How can I lower my car insurance premiums?

There are several ways to lower your car insurance premiums, such as maintaining a good driving record, bundling insurance policies, taking advantage of discounts, and choosing a higher deductible.

What are the best ways to compare car insurance quotes?

You can use online comparison websites, contact insurance agents directly, or use a broker to compare quotes from multiple insurers.

What should I do if I have a car insurance claim?

Contact your insurance company as soon as possible after an accident. Provide them with all necessary information and follow their instructions for filing a claim.