Finding the best auto insurance rates in Washington State can feel like navigating a maze, but it doesn’t have to be overwhelming. Washington’s unique auto insurance market, influenced by factors like driving history, vehicle type, and even your credit score, presents a complex landscape for finding the best deals. This guide will equip you with the knowledge and strategies to secure the most affordable rates while ensuring you have the right coverage to protect yourself and your vehicle.

We’ll delve into the key factors that determine your rates, explore the top insurance providers in Washington, and uncover effective strategies to save money on your premiums. Whether you’re a seasoned driver or a new car owner, understanding the ins and outs of Washington’s auto insurance market will empower you to make informed decisions and secure the best possible coverage at a price that works for you.

Understanding Washington State’s Auto Insurance Landscape

Navigating the world of auto insurance in Washington State can seem complex, but understanding the key factors influencing rates and the unique characteristics of the market can help you find the best coverage at the most competitive price.

Factors Influencing Auto Insurance Rates in Washington State

Several factors contribute to the cost of auto insurance in Washington State. These factors are used by insurance companies to assess the risk associated with insuring a particular driver and vehicle.

- Driving History: Your driving record is a major factor in determining your insurance rates. Accidents, traffic violations, and DUI convictions can significantly increase your premiums.

- Age and Gender: Younger drivers, particularly males, are statistically more likely to be involved in accidents, leading to higher premiums.

- Vehicle Type: The make, model, and year of your vehicle influence your insurance rates. Expensive, high-performance cars tend to have higher insurance costs due to their potential for greater damage and repair expenses.

- Location: The location where you live and drive impacts your insurance rates. Areas with higher crime rates, traffic congestion, and accident frequency often have higher premiums.

- Credit Score: While controversial, some insurance companies use your credit score as a proxy for risk assessment. Individuals with lower credit scores may face higher insurance premiums.

- Coverage Levels: The amount and types of coverage you choose, such as liability limits, comprehensive and collision coverage, and uninsured/underinsured motorist coverage, directly influence your premium.

Unique Characteristics of the Washington State Auto Insurance Market

Washington State’s auto insurance market has several unique characteristics that influence the availability and cost of coverage.

- State-Mandated Coverage: Washington State law requires drivers to carry specific minimum auto insurance coverage, including liability, personal injury protection (PIP), and uninsured/underinsured motorist coverage.

- No-Fault System: Washington State operates under a no-fault insurance system, meaning that drivers can seek compensation for injuries and damages from their own insurance company, regardless of fault.

- Limited Choice of Insurance Companies: The Washington State auto insurance market is dominated by a relatively small number of large insurance companies, which can limit consumer choices and price competition.

Types of Coverage Mandated by Washington State Law

Washington State law mandates that all drivers carry specific minimum levels of auto insurance coverage. These coverages are designed to protect drivers and passengers in case of an accident.

- Liability Coverage: This coverage protects you financially if you cause an accident that results in injuries or property damage to others. It covers the other party’s medical expenses, lost wages, and property damage up to the policy limits.

- Personal Injury Protection (PIP): This coverage covers your own medical expenses, lost wages, and other expenses related to injuries you sustain in an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are injured in an accident caused by an uninsured or underinsured driver. It covers your medical expenses, lost wages, and other expenses up to the policy limits.

Factors Determining Auto Insurance Rates

Auto insurance premiums in Washington state, like in most places, are calculated based on a variety of factors. These factors are designed to assess the risk an insurer takes when covering you. Understanding these factors can help you make informed decisions to potentially lower your premiums.

Driving History

Your driving history is a significant factor in determining your auto insurance rates. Insurance companies look at your past driving record to gauge your likelihood of getting into an accident. A clean driving record will generally result in lower premiums, while a history of accidents, traffic violations, or DUI convictions will likely increase your rates.

- Accidents: Each accident on your record, regardless of fault, will likely increase your premium. The severity of the accident and the number of accidents you’ve had will influence the increase. For example, a minor fender bender might have a smaller impact than a serious accident involving injuries or property damage.

- Traffic Violations: Traffic violations, such as speeding tickets, running red lights, or parking violations, also impact your rates. The severity of the violation and the number of violations you’ve received will affect the increase in your premiums.

- DUI Convictions: A DUI conviction is one of the most significant factors that can increase your auto insurance rates. Insurance companies view DUI convictions as a serious risk and will often charge significantly higher premiums for drivers with this on their record.

Vehicle Type

The type of vehicle you drive plays a significant role in determining your auto insurance rates. Insurance companies consider factors like the vehicle’s safety features, repair costs, and likelihood of theft when setting premiums.

- Safety Features: Vehicles with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, are generally considered safer and may qualify for lower insurance rates. Insurance companies often offer discounts for vehicles with these features.

- Repair Costs: Vehicles that are more expensive to repair or replace will typically have higher insurance premiums. This is because the insurer’s financial risk is higher if the vehicle is damaged in an accident.

- Likelihood of Theft: Vehicles that are more prone to theft will also generally have higher insurance premiums. This is because the insurer has a higher risk of having to pay for a stolen vehicle.

Age

Your age is another factor that insurance companies use to determine your rates. Younger drivers are statistically more likely to be involved in accidents, so they often pay higher premiums. As drivers gain experience and age, their rates typically decrease.

- Young Drivers: Drivers under the age of 25, especially those with less driving experience, are often considered higher risk. They may be required to pay higher premiums or have additional restrictions on their policies, such as having a parent or guardian listed as a co-insured.

- Mature Drivers: Drivers over the age of 65 may also face higher premiums, as they may be more susceptible to health issues that could affect their driving ability. However, some insurance companies offer discounts for senior drivers who complete defensive driving courses or have a clean driving record.

Location

Where you live can also influence your auto insurance rates. Insurance companies consider factors like the density of traffic, the frequency of accidents, and the cost of living in your area when setting premiums.

- Urban Areas: Urban areas with high traffic volume and congestion tend to have higher accident rates, which can lead to higher insurance premiums. The higher cost of living in these areas may also contribute to higher repair costs, further impacting premiums.

- Rural Areas: Rural areas with lower population density and less traffic may have lower accident rates, resulting in lower insurance premiums. However, long distances between towns and limited access to emergency services can increase the cost of claims, which could offset the lower accident rates.

Credit Score

While not directly related to driving, your credit score can impact your auto insurance rates in some states, including Washington. Insurance companies argue that people with good credit are more likely to be financially responsible and less likely to file frivolous claims.

- Impact on Rates: A good credit score can lead to lower insurance premiums, while a poor credit score can result in higher premiums. The extent of the impact varies by insurance company and state, but it’s generally a factor considered when setting rates.

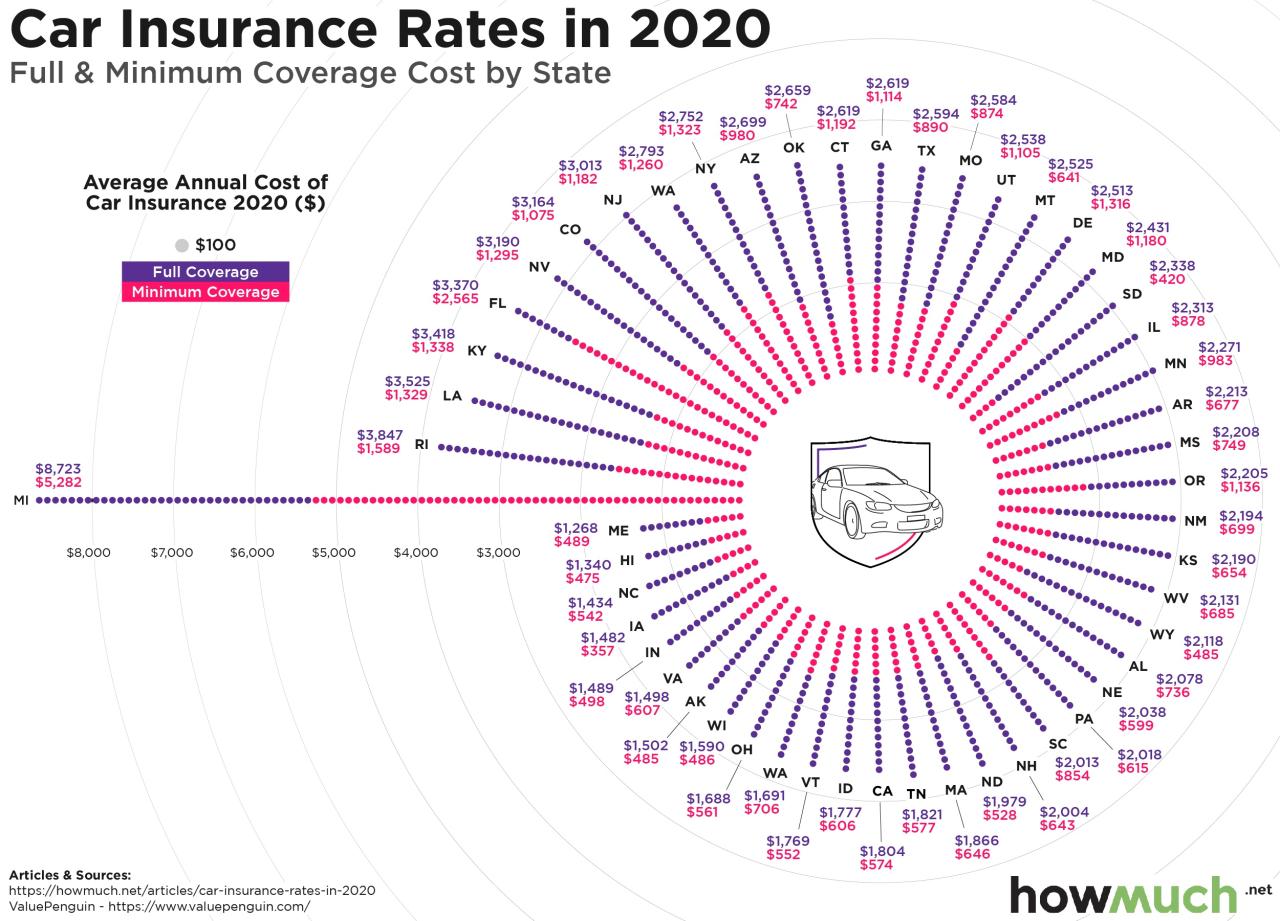

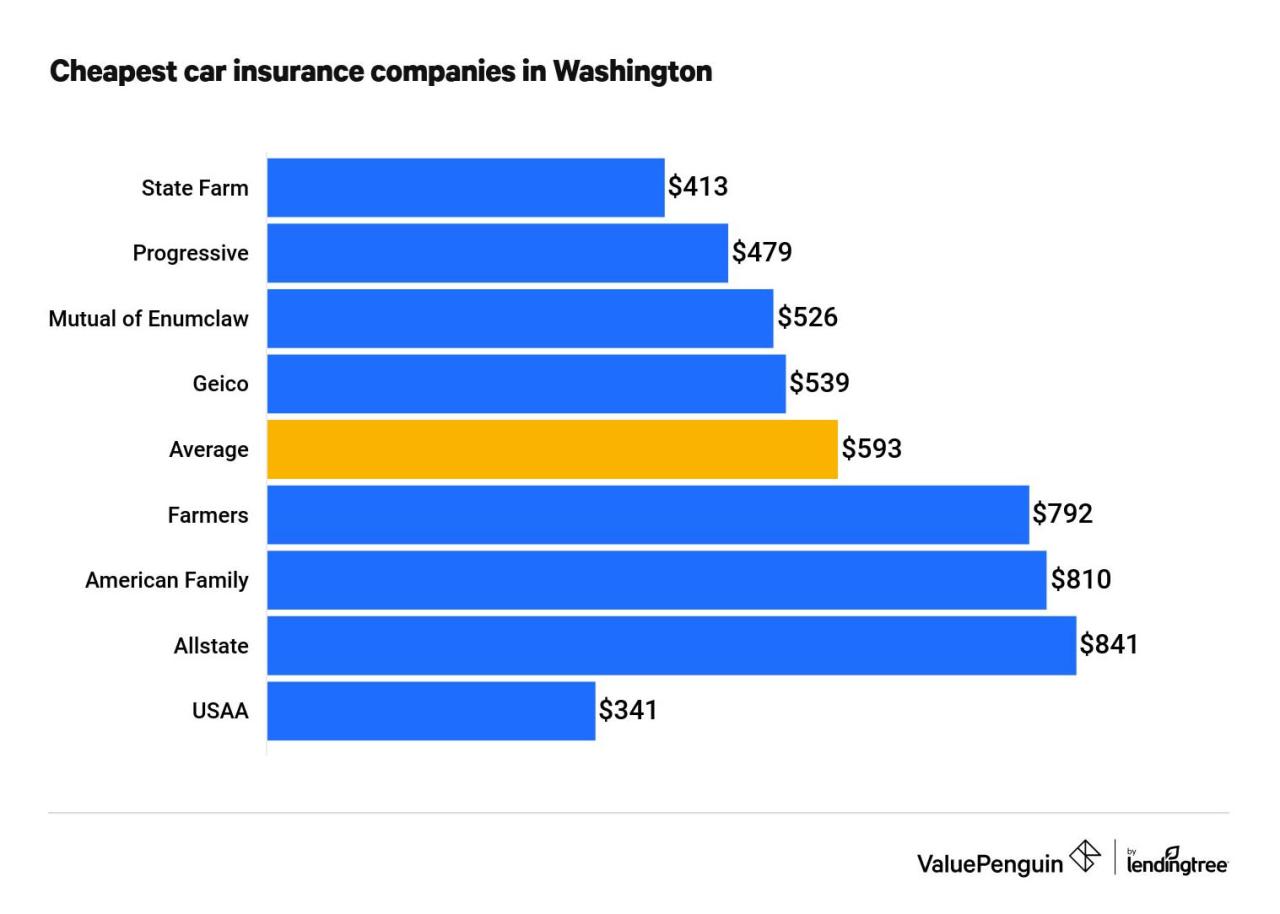

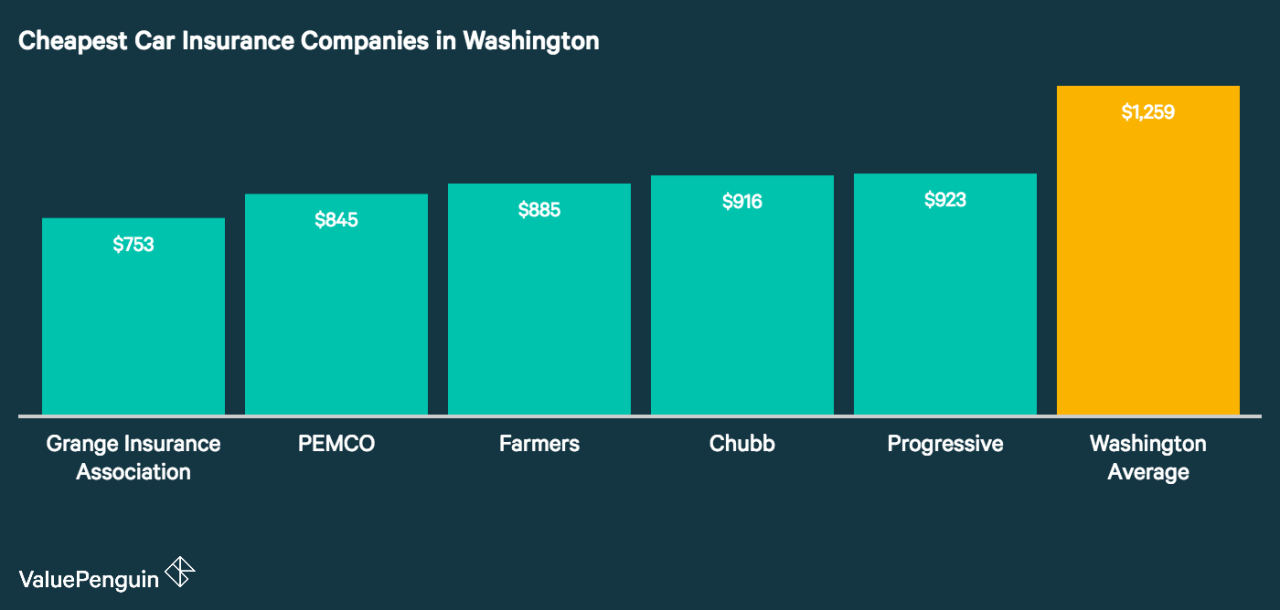

Top Insurance Providers in Washington State

Finding the right auto insurance provider can be a daunting task, especially in a state like Washington with its unique insurance landscape. With so many options available, it’s essential to compare different providers based on factors like customer satisfaction, claims handling, and pricing.

Top Auto Insurance Providers in Washington State

To help you navigate this process, we’ve compiled a table comparing the top five auto insurance providers in Washington State based on key performance indicators.

| Provider | Customer Satisfaction | Claims Handling | Pricing |

|---|---|---|---|

| State Farm | High | Excellent | Competitive |

| Geico | High | Good | Very Competitive |

| Progressive | Moderate | Good | Competitive |

| USAA | Very High | Excellent | Competitive |

| Liberty Mutual | Moderate | Good | Competitive |

It’s important to note that these rankings are based on a combination of factors, and individual experiences may vary. We recommend researching each provider further to find the best fit for your specific needs.

Pros and Cons of Top Auto Insurance Providers

Here’s a breakdown of the pros and cons of each provider, based on customer reviews and industry reports:

State Farm

- Pros: Strong customer service, extensive network of agents, wide range of coverage options, strong financial stability.

- Cons: Can be expensive for some drivers, claims processing can be slow at times.

Geico

- Pros: Highly competitive pricing, convenient online and mobile services, quick and efficient claims handling.

- Cons: Limited customer service options, may not offer as many coverage options as other providers.

Progressive

- Pros: Offers a variety of discounts, innovative features like Snapshot telematics program, strong online presence.

- Cons: Customer service can be inconsistent, claims processing can be slow at times.

USAA

- Pros: Excellent customer service, highly rated for claims handling, competitive pricing for military members and their families.

- Cons: Only available to military members and their families.

Liberty Mutual

- Pros: Strong financial stability, offers a variety of discounts, good customer service.

- Cons: Pricing can be higher than other providers, may not be as widely available as other providers.

Saving Money on Auto Insurance in Washington

Finding affordable auto insurance in Washington is crucial, as the state has a relatively high average premium. Luckily, several strategies can help you lower your insurance costs.

Strategies for Lowering Auto Insurance Premiums

Lowering your auto insurance premiums in Washington involves a combination of proactive measures and careful choices. Here are some effective strategies:

- Improve Your Driving Record: A clean driving record is a significant factor in determining your insurance rate. Avoid traffic violations, accidents, and DUI offenses. Even a minor infraction can increase your premium.

- Maintain a Good Credit Score: Your credit score, surprisingly, plays a role in your auto insurance premiums. Insurers use credit history to assess risk, and a good credit score often translates to lower rates.

- Choose a Safe Vehicle: The type of car you drive impacts your insurance costs. Vehicles with advanced safety features, good safety ratings, and lower theft risk generally receive lower premiums.

- Increase Your Deductible: Raising your deductible, the amount you pay out-of-pocket before insurance kicks in, can significantly reduce your premium. However, ensure you can afford the deductible if you need to file a claim.

- Bundle Your Policies: Combining your auto insurance with other policies like homeowners or renters insurance from the same provider can lead to significant discounts.

- Shop Around for Quotes: Comparing quotes from multiple insurers is essential to finding the best rate. Use online comparison tools or contact insurance agents directly.

Negotiating Rates and Exploring Discounts

Negotiating your auto insurance rates and exploring available discounts can further lower your premiums.

- Ask for a Review: Contact your insurer periodically to request a review of your policy and rates. They may adjust your premium based on changes in your driving record, vehicle, or other factors.

- Negotiate Discounts: Inquire about available discounts, such as:

- Good Student Discount: For students with good grades.

- Safe Driver Discount: For drivers with a clean driving record.

- Multi-Car Discount: For insuring multiple vehicles under the same policy.

- Anti-theft Device Discount: For vehicles equipped with anti-theft devices.

- Pay-in-Full Discount: For paying your premium in full upfront.

- Consider Usage-Based Insurance: Some insurers offer usage-based insurance programs that track your driving habits and reward safe driving with lower premiums.

Comparing Quotes from Multiple Insurers

Comparing quotes from different insurance providers is crucial to finding the best rate for your needs.

- Use Online Comparison Tools: Several websites and apps allow you to compare quotes from multiple insurers simultaneously. This can save you time and effort.

- Contact Insurance Agents Directly: Reach out to insurance agents in your area and request quotes. They can provide personalized recommendations and explain different policy options.

- Review Policy Details Carefully: When comparing quotes, pay close attention to the coverage details, deductibles, and any exclusions or limitations.

Understanding Coverage Options

Navigating the world of auto insurance can feel overwhelming, especially when faced with a myriad of coverage options. Understanding the different types of coverage available in Washington State is crucial for making informed decisions that protect you financially in the event of an accident. This section will guide you through the key coverage types, helping you determine the right level of protection for your needs and budget.

Liability Coverage, Best auto insurance rates in washington state

Liability coverage is the most fundamental type of auto insurance, and it’s required by law in Washington State. This coverage protects you financially if you cause an accident that results in injuries or property damage to others. Liability coverage is divided into two parts:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages incurred by the other driver(s) and passengers in the other vehicle(s) involved in an accident that you caused.

- Property Damage Liability: This coverage pays for repairs or replacement costs of the other driver’s vehicle and any other property damaged in an accident that you caused.

The minimum liability coverage required in Washington State is:

$25,000 for bodily injury liability per person

$50,000 for bodily injury liability per accident

$10,000 for property damage liability per accident

However, it’s crucial to remember that these minimum limits might not be sufficient to cover all potential costs in a serious accident. Consider increasing your liability limits, especially if you have assets that could be at risk in the event of a lawsuit.

Collision Coverage

Collision coverage protects your vehicle from damage caused by a collision with another vehicle or object, regardless of who is at fault. This coverage pays for repairs or replacement of your vehicle, minus your deductible. Collision coverage is optional, but it’s essential if you want to protect yourself from significant financial losses in the event of an accident.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. This coverage also pays for repairs or replacement of your vehicle, minus your deductible. Comprehensive coverage is optional, but it’s a good idea to consider it if you want to protect your vehicle from a wide range of risks.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist (UM/UIM) coverage protects you and your passengers if you are involved in an accident with a driver who is uninsured or has insufficient insurance. UM coverage pays for your medical expenses and other damages if the other driver is uninsured, while UIM coverage covers the difference between your damages and the other driver’s liability limits if they are underinsured. UM/UIM coverage is optional, but it’s highly recommended to have it, as it provides critical financial protection in situations where the other driver’s insurance is inadequate.

Personal Injury Protection (PIP)

Personal Injury Protection (PIP) coverage, also known as “no-fault” insurance, covers your medical expenses and lost wages regardless of who is at fault in an accident. PIP coverage is mandatory in Washington State, with a minimum coverage limit of $10,000. It’s important to note that PIP coverage only applies to you and your passengers, not the other driver(s) involved in the accident.

Medical Payments Coverage

Medical Payments coverage is optional and provides additional coverage for your medical expenses, regardless of who is at fault in an accident. This coverage is similar to PIP, but it doesn’t cover lost wages. Medical Payments coverage can be a valuable addition to your policy if you want to ensure that your medical expenses are fully covered in the event of an accident.

Rental Reimbursement Coverage

Rental Reimbursement coverage pays for a rental car while your vehicle is being repaired after an accident. This coverage can be especially helpful if you rely on your vehicle for work or other essential activities. Rental Reimbursement coverage is optional, but it can be a valuable addition to your policy if you want to avoid the inconvenience of being without a vehicle during repairs.

Towing and Labor Coverage

Towing and Labor coverage pays for the cost of towing your vehicle to a repair shop if it breaks down or is involved in an accident. This coverage can also cover the cost of labor for basic repairs performed at the roadside. Towing and Labor coverage is optional, but it can be a worthwhile investment if you want to avoid the expense of towing your vehicle yourself.

Conclusion

Armed with the information and strategies Artikeld in this guide, you can confidently navigate the Washington auto insurance market and find the best rates for your needs. Remember to compare quotes from multiple insurers, take advantage of available discounts, and consider your coverage options carefully. By taking a proactive approach and understanding the nuances of Washington’s auto insurance landscape, you can secure affordable and comprehensive coverage that provides peace of mind on the road.

Detailed FAQs: Best Auto Insurance Rates In Washington State

What are the minimum insurance requirements in Washington State?

Washington State requires all drivers to carry liability coverage, which includes bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage.

How often should I review my auto insurance policy?

It’s recommended to review your policy at least annually, or even more frequently if you experience major life changes like a new car purchase, marriage, or a change in your driving record.

Can I get a discount on my auto insurance if I have a good driving record?

Yes, most insurance companies offer discounts for drivers with clean driving records. This can include discounts for accident-free driving, safe driving courses, and good student discounts.