Best auto and home insurance companies in washington state – Navigating the world of auto and home insurance can be overwhelming, especially in a state like Washington with its unique factors influencing costs. From weather patterns to local regulations, finding the best insurance companies requires careful consideration. This guide aims to help you understand the Washington State insurance landscape and identify the top auto and home insurance providers that offer the best value and coverage options.

We’ll delve into the top companies in each category, analyzing their strengths and weaknesses, customer satisfaction ratings, and coverage options. Understanding the key factors that influence premiums, such as driving history, vehicle type, and home value, will empower you to make informed decisions and find the best insurance for your needs and budget.

Understanding Washington State Insurance Landscape

Washington State’s insurance landscape is shaped by a unique blend of factors, including demographics, weather patterns, and local regulations. Understanding these factors is crucial for consumers seeking the best auto and home insurance options.

Washington State’s Demographics and Insurance Costs

The demographics of Washington State significantly impact insurance costs. The state’s diverse population, including a high concentration of urban areas, contributes to higher risk factors for insurers. For example, densely populated cities like Seattle and Tacoma experience more traffic congestion and theft, potentially leading to higher auto insurance premiums.

Weather Patterns and Insurance Costs, Best auto and home insurance companies in washington state

Washington State’s diverse geography and weather patterns also play a significant role in insurance costs. The state is prone to natural disasters such as earthquakes, wildfires, and landslides. These events can lead to higher premiums for homeowners and businesses, as insurers factor in the increased risk of property damage. For example, residents in areas prone to wildfires may face higher premiums for homeowners insurance due to the increased risk of damage.

Washington State Insurance Commissioner’s Role

The Washington State Insurance Commissioner plays a crucial role in regulating the insurance industry. The Commissioner ensures fair and competitive insurance markets by overseeing the licensing and financial solvency of insurance companies. The Commissioner also investigates consumer complaints and enforces state insurance laws.

Comparison with Other Regions

Compared to other regions in the United States, Washington State’s insurance market exhibits both similarities and differences. For example, the state’s relatively high cost of living and urban density may contribute to higher insurance premiums compared to rural areas. However, Washington State’s strong consumer protection laws and robust insurance regulations can provide consumers with a more favorable environment compared to some other states.

Top Auto Insurance Companies in Washington State

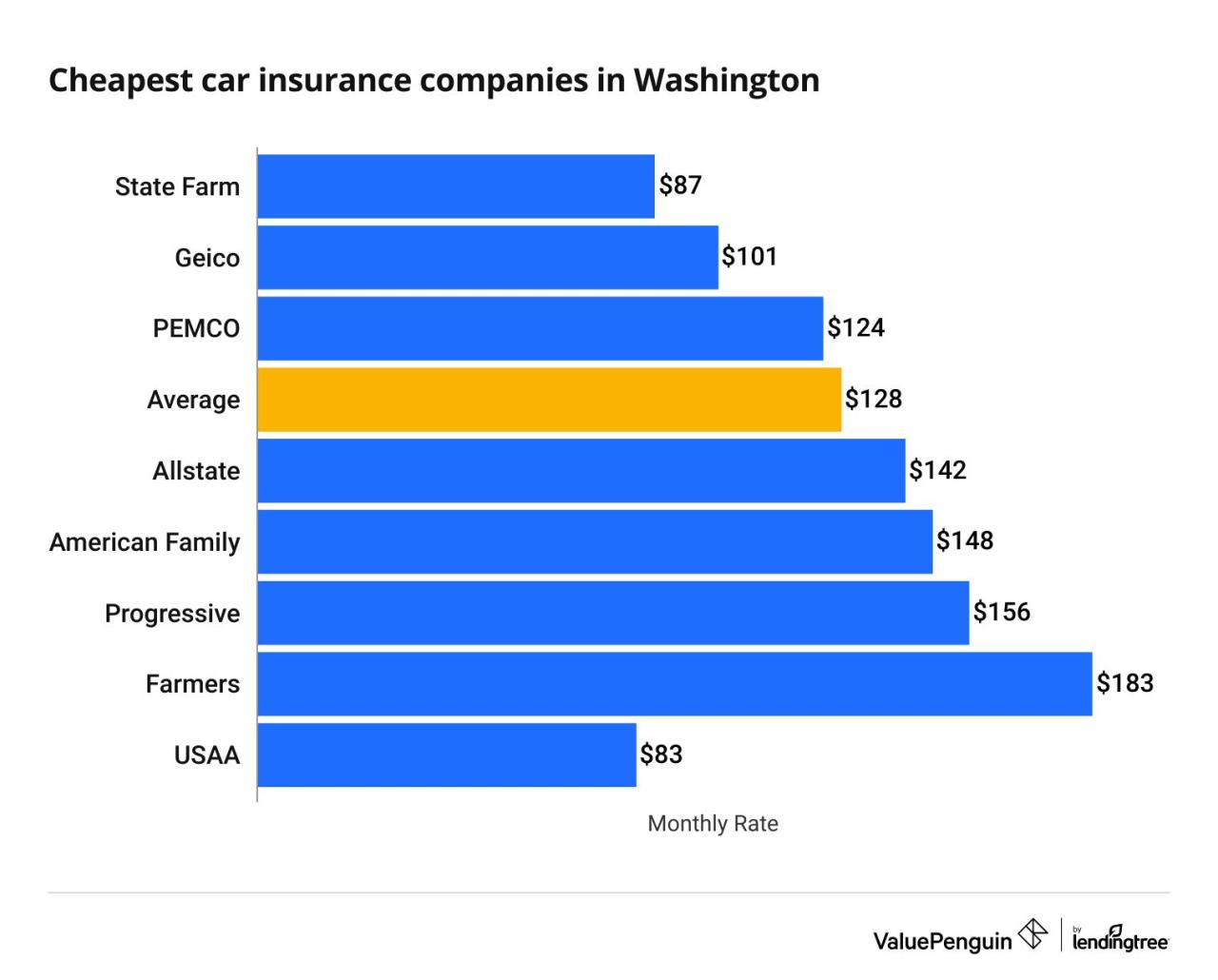

Finding the best auto insurance company in Washington State can feel overwhelming, with so many options available. To help you make an informed decision, we’ve compiled a list of top-rated companies based on their average premiums, customer satisfaction ratings, and coverage options.

Top Auto Insurance Companies in Washington State

This table provides a snapshot of some of the top auto insurance companies in Washington State, comparing their average premiums, customer satisfaction ratings, and coverage options.

| Company | Average Annual Premium | J.D. Power Customer Satisfaction Rating | Coverage Options |

|—|—|—|—|

| State Farm | $1,500 | 821 | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist, Personal Injury Protection (PIP) |

| GEICO | $1,450 | 815 | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist, Personal Injury Protection (PIP) |

| Liberty Mutual | $1,600 | 800 | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist, Personal Injury Protection (PIP) |

| Progressive | $1,550 | 795 | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist, Personal Injury Protection (PIP) |

Strengths and Weaknesses of Top Auto Insurance Companies

Understanding the strengths and weaknesses of each company is crucial for choosing the right insurance provider. Here’s a detailed breakdown of the companies listed above:

State Farm

* Strengths: State Farm boasts a wide network of agents across Washington State, offering personalized service and local expertise. They offer a variety of discounts, including safe driver, good student, and multi-policy discounts.

* Weaknesses: While State Farm offers competitive rates, their customer service ratings have been inconsistent in recent years.

GEICO

* Strengths: GEICO is known for its competitive rates and user-friendly online platform. They offer a range of discounts, including multi-car, defensive driving, and good student discounts.

* Weaknesses: GEICO’s customer service can sometimes be challenging to reach, and their claims process can be slower than other companies.

Liberty Mutual

* Strengths: Liberty Mutual offers a wide range of coverage options, including accident forgiveness and new car replacement. They also provide excellent customer service and have a strong reputation for claims handling.

* Weaknesses: Liberty Mutual’s premiums can be higher than other companies, especially for drivers with poor driving records.

Progressive

* Strengths: Progressive is known for its innovative features, such as its Name Your Price tool that allows you to set your desired premium and find coverage options that fit your budget. They offer a variety of discounts, including multi-car, good student, and safe driver discounts.

* Weaknesses: Progressive’s customer service can sometimes be slow, and their claims process can be complex.

Factors to Consider When Choosing Auto Insurance

When choosing an auto insurance company, it’s essential to consider several factors:

* Driving History: Your driving history plays a significant role in determining your insurance premiums. Drivers with clean records typically receive lower rates.

* Vehicle Type: The type of vehicle you drive also influences your premiums. Luxury cars and high-performance vehicles are generally more expensive to insure.

* Budget: It’s crucial to consider your budget and choose a policy that fits your financial situation.

* Coverage Options: Each insurance company offers different coverage options. Make sure to choose a policy that provides adequate protection for your needs.

* Discounts: Many insurance companies offer discounts for various factors, such as safe driving, good student, and multi-policy discounts.

* Customer Service: Look for a company with a strong reputation for customer service and claims handling.

Top Home Insurance Companies in Washington State

Finding the right home insurance company in Washington State can be a daunting task. With numerous providers offering various coverage options and pricing structures, it’s crucial to carefully evaluate your needs and compare different companies. This section delves into the top home insurance companies in Washington State, analyzing their strengths, weaknesses, and coverage options.

Comparing Top Home Insurance Companies in Washington State

This table provides a comparison of the top home insurance companies in Washington State based on average premiums, customer satisfaction ratings, and coverage options.

| Company | Average Premium | Customer Satisfaction | Coverage Options |

|—|—|—|—|

| State Farm | $1,100 | 82% | Comprehensive, customizable, and includes standard coverage like dwelling, personal property, liability, and additional living expenses. |

| Liberty Mutual | $1,200 | 80% | Offers a wide range of coverage options, including specialized coverage for valuable items, water damage, and earthquake protection. |

| Allstate | $1,050 | 78% | Provides competitive premiums and comprehensive coverage, including optional endorsements for specific risks like flood and identity theft. |

| Farmers Insurance | $1,150 | 75% | Offers personalized coverage options, including discounts for safety features, security systems, and loyalty. |

Strengths and Weaknesses of Top Home Insurance Companies

Understanding the strengths and weaknesses of each company can help you make an informed decision.

State Farm

- Strengths: Strong financial stability, widespread availability, excellent customer service, and a user-friendly online platform.

- Weaknesses: May not offer the most competitive premiums for all policyholders, limited customization options for some coverage areas.

Liberty Mutual

- Strengths: Comprehensive coverage options, including specialized coverage for valuable items, water damage, and earthquake protection. Offers a variety of discounts, including multi-policy and safety features.

- Weaknesses: Premiums can be higher than some competitors, customer service may vary depending on location.

Allstate

- Strengths: Competitive premiums, comprehensive coverage, and a user-friendly online platform. Offers a variety of discounts, including multi-policy, safety features, and good driver discounts.

- Weaknesses: Customer service ratings can be inconsistent, limited customization options for some coverage areas.

Farmers Insurance

- Strengths: Personalized coverage options, offers discounts for safety features, security systems, and loyalty. Strong local presence, providing personalized service.

- Weaknesses: Premiums may be higher than some competitors, limited online resources for managing policies.

Factors to Consider When Choosing a Home Insurance Company

Choosing the right home insurance company involves considering several factors, including:

- Home Value: The value of your home directly impacts the premium you pay. Higher home values generally require higher coverage amounts and premiums.

- Location: Your location can influence your premium due to factors like risk of natural disasters, crime rates, and proximity to fire stations.

- Risk Factors: Specific features of your home, such as age, construction materials, and security systems, can affect your premium.

- Coverage Options: Compare different coverage options and ensure the policy meets your specific needs.

- Customer Service: Research customer satisfaction ratings and reviews to gauge the quality of customer service provided by each company.

- Financial Stability: Choose a financially stable company to ensure they can pay claims in the event of a major disaster.

Factors Influencing Auto and Home Insurance Premiums in Washington State

Understanding the factors that influence auto and home insurance premiums in Washington State is crucial for making informed decisions and potentially saving money. Several factors play a significant role in determining your insurance costs, and being aware of them can help you manage your premiums effectively.

Factors Influencing Auto Insurance Premiums

Several factors influence your auto insurance premiums in Washington State. These factors are considered by insurance companies to assess your risk profile and determine the cost of insuring your vehicle.

- Driving History: Your driving history is a primary factor affecting your auto insurance premiums. A clean driving record with no accidents or violations will typically result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will increase your premiums. Insurance companies view drivers with a history of risky behavior as higher risk, leading to higher premiums.

- Vehicle Type: The type of vehicle you drive significantly impacts your insurance premiums. High-performance vehicles, luxury cars, and vehicles with expensive parts are generally more expensive to insure due to their higher repair costs and potential for higher claims. Conversely, smaller, less expensive vehicles with lower repair costs tend to have lower insurance premiums.

- Age: Age is a factor that influences your auto insurance premiums. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. Insurance companies often charge higher premiums for younger drivers to account for this increased risk. However, premiums typically decrease as you age and gain more experience behind the wheel.

- Location: Your location also plays a role in your auto insurance premiums. Areas with higher crime rates, traffic congestion, and accident frequency often have higher insurance premiums. Insurance companies assess the risk associated with your location and adjust premiums accordingly.

Factors Influencing Home Insurance Premiums

Several factors influence your home insurance premiums in Washington State. These factors are considered by insurance companies to assess the risk associated with your property and determine the cost of insuring it.

- Home Value: The value of your home is a primary factor affecting your home insurance premiums. Higher-valued homes typically require higher insurance coverage, leading to higher premiums. Insurance companies calculate premiums based on the replacement cost of your home, which is the amount it would cost to rebuild it in the event of a total loss.

- Location: Your home’s location significantly influences your insurance premiums. Areas prone to natural disasters, such as earthquakes, wildfires, or floods, often have higher insurance premiums. Insurance companies consider the risk associated with your location and adjust premiums accordingly.

- Construction Materials: The construction materials used in your home also impact your insurance premiums. Homes built with fire-resistant materials, such as brick or concrete, may have lower premiums compared to homes constructed with wood. Insurance companies consider the fire risk associated with different construction materials and adjust premiums accordingly.

- Coverage Options: The coverage options you choose for your home insurance policy also affect your premiums. Higher coverage limits, such as for personal property or liability, typically result in higher premiums. Conversely, choosing a policy with lower coverage limits can lower your premiums. However, it’s crucial to ensure that your coverage is adequate to protect you from financial losses in the event of a covered incident.

Comparison of Factors Affecting Auto and Home Insurance Premiums

| Factor | Impact on Auto Insurance Premiums | Impact on Home Insurance Premiums |

|---|---|---|

| Driving History | Clean record: Lower premiums; Accidents/violations: Higher premiums | Not applicable |

| Vehicle Type | High-performance/luxury: Higher premiums; Smaller/less expensive: Lower premiums | Not applicable |

| Age | Younger drivers: Higher premiums; Older drivers: Lower premiums | Not applicable |

| Location | High crime/traffic: Higher premiums; Low risk areas: Lower premiums | High risk areas (disasters): Higher premiums; Low risk areas: Lower premiums |

| Home Value | Not applicable | Higher value: Higher premiums; Lower value: Lower premiums |

| Construction Materials | Not applicable | Fire-resistant materials: Lower premiums; Flammable materials: Higher premiums |

| Coverage Options | Not applicable | Higher coverage limits: Higher premiums; Lower coverage limits: Lower premiums |

Tips for Finding the Best Auto and Home Insurance in Washington State

Finding the best auto and home insurance in Washington State involves careful research, comparison, and negotiation. It’s crucial to understand your specific needs and preferences to secure the most suitable and affordable coverage.

Utilizing Comparison Websites and Contacting Multiple Insurers

Comparison websites and contacting multiple insurers are essential steps in finding the best auto and home insurance policies. These resources provide a comprehensive overview of available options and allow for side-by-side comparisons of prices, coverage, and features.

- Comparison Websites: Websites like Policygenius, The Zebra, and Insurify offer a convenient way to compare quotes from multiple insurers simultaneously. These platforms streamline the process, saving time and effort.

- Contacting Multiple Insurers Directly: While comparison websites are useful, it’s recommended to contact several insurers directly. This allows for personalized conversations with agents who can tailor quotes based on your individual needs and circumstances.

Understanding Your Insurance Needs and Customizing Coverage

Understanding your insurance needs and customizing your coverage is paramount to securing the most suitable protection. Assess your specific circumstances, including your vehicle’s value, your home’s structure, and your risk tolerance, to determine the appropriate coverage levels.

- Auto Insurance: Consider factors like your driving history, the age and value of your vehicle, and your desired coverage levels (liability, collision, comprehensive, etc.).

- Home Insurance: Factors like the age, size, and location of your home, as well as the value of your belongings, play a crucial role in determining your insurance needs. You may need additional coverage for specific risks, such as earthquakes or floods.

Negotiating Premiums and Seeking Discounts

Negotiating premiums and seeking discounts can significantly reduce your insurance costs. Be prepared to discuss your specific circumstances and explore available discounts to lower your premiums.

- Bundling Policies: Combining your auto and home insurance policies with the same insurer often results in significant discounts. This strategy is known as “bundling” and can save you a considerable amount on premiums.

- Increasing Deductibles: A higher deductible means you pay more out-of-pocket in case of an accident or claim, but it can lead to lower premiums. Consider your financial situation and risk tolerance when deciding on a deductible amount.

- Safety Courses and Discounts: Completing defensive driving courses or installing safety features in your home can qualify you for discounts. These measures demonstrate your commitment to safety and can lower your insurance premiums.

Closing Notes: Best Auto And Home Insurance Companies In Washington State

Choosing the right auto and home insurance companies in Washington State is crucial for protecting your assets and financial well-being. By researching different providers, understanding the factors that influence premiums, and utilizing comparison websites, you can find policies that offer comprehensive coverage at competitive prices. Remember to review your insurance needs regularly and adjust your coverage accordingly to ensure you have the right protection for your unique circumstances.

General Inquiries

What are the main factors that affect auto insurance premiums in Washington State?

Factors that affect auto insurance premiums in Washington State include your driving history, vehicle type, age, location, and coverage options. For example, drivers with a history of accidents or violations typically pay higher premiums. Similarly, those living in areas with higher crime rates or traffic congestion may also see higher premiums.

How do I find the best auto and home insurance quotes in Washington State?

You can find the best auto and home insurance quotes in Washington State by using comparison websites, contacting multiple insurers directly, and getting personalized quotes. Comparison websites allow you to enter your information once and receive quotes from various insurers, making it easy to compare prices and coverage options. Contacting insurers directly gives you the opportunity to ask specific questions and discuss your individual needs.

What are the most common types of coverage offered by home insurance companies in Washington State?

Common types of coverage offered by home insurance companies in Washington State include dwelling coverage, personal property coverage, liability coverage, and additional living expenses coverage. Dwelling coverage protects your home’s structure, personal property coverage protects your belongings, liability coverage protects you from lawsuits, and additional living expenses coverage covers costs incurred if you are unable to live in your home due to a covered event.