Beaver state insurance in salem oregon – Beaver State Insurance in Salem, Oregon, stands as a trusted name in the community, providing comprehensive insurance solutions for individuals and businesses alike. With a rich history and unwavering commitment to customer satisfaction, Beaver State Insurance has become a cornerstone of the Salem landscape, offering a wide range of insurance products tailored to meet the diverse needs of its clientele.

From auto and home insurance to life and business coverage, Beaver State Insurance offers a comprehensive suite of options designed to protect what matters most. The company’s dedicated team of insurance professionals is committed to providing personalized guidance and support, ensuring that each customer receives the best possible coverage at competitive rates.

Beaver State Insurance Overview

Beaver State Insurance is a well-established insurance provider in Oregon, serving individuals and businesses with a wide range of insurance solutions. The company has a rich history, deeply rooted in the community, and is dedicated to providing reliable and personalized insurance services.

Company History and Mission

Beaver State Insurance was founded in 1947, with a mission to provide exceptional insurance services to the residents of Oregon. Over the years, the company has grown significantly, expanding its services to meet the evolving needs of its customers. The company’s commitment to customer satisfaction and community involvement has been a driving force behind its success.

Values

Beaver State Insurance is guided by core values that shape its business practices and interactions with customers. These values include:

* Integrity: Honesty and ethical conduct are paramount in all aspects of the company’s operations.

* Customer Focus: The company prioritizes understanding the needs of its customers and providing tailored solutions.

* Community Involvement: Beaver State Insurance actively supports local organizations and initiatives, demonstrating its commitment to the well-being of the community.

Services Offered in Salem, Oregon

Beaver State Insurance offers a comprehensive range of insurance products and services to residents of Salem, Oregon. The company’s expertise and experience allow it to provide customized insurance solutions to meet individual and business needs.

Types of Insurance Policies

Beaver State Insurance offers a diverse selection of insurance policies to protect its clients from various risks. The following table provides an overview of the different types of policies available:

| Policy Type | Coverage | Description |

|---|---|---|

| Auto Insurance | Liability, collision, comprehensive | Protects against financial losses resulting from accidents involving your vehicle. |

| Home Insurance | Dwelling, personal property, liability | Provides coverage for your home and belongings against damage or loss due to various perils. |

| Life Insurance | Term life, whole life, universal life | Offers financial protection to your loved ones in the event of your death. |

| Business Insurance | Property, liability, workers’ compensation | Protects your business from financial risks associated with property damage, legal claims, and employee injuries. |

Beaver State Insurance in Salem, Oregon

Beaver State Insurance is a prominent insurance provider in Salem, Oregon, offering a wide range of insurance solutions to meet the diverse needs of individuals and businesses in the community. With a strong commitment to customer service and community involvement, Beaver State Insurance has established itself as a trusted and reliable partner for Salem residents.

Services Offered, Beaver state insurance in salem oregon

Beaver State Insurance in Salem provides a comprehensive suite of insurance products and services, including:

- Auto Insurance: Protecting your vehicle and financial well-being in the event of an accident or damage.

- Home Insurance: Ensuring your home and belongings are insured against various risks, such as fire, theft, and natural disasters.

- Business Insurance: Offering tailored coverage for businesses of all sizes, protecting against liability, property damage, and other risks.

- Life Insurance: Providing financial security for your loved ones in the event of your passing.

- Health Insurance: Helping individuals and families access affordable and comprehensive health coverage.

- Renters Insurance: Protecting your personal belongings and liability while renting.

- Motorcycle Insurance: Offering specific coverage for motorcycles and their riders.

- Boat Insurance: Protecting your boat and its contents from various risks.

Community Presence

Beaver State Insurance actively engages with the Salem community through various initiatives and partnerships. The company demonstrates its commitment to the community by:

- Supporting Local Organizations: Sponsoring local events, charities, and non-profit organizations, contributing to the well-being of the community.

- Employing Local Residents: Providing job opportunities for Salem residents, contributing to the local economy.

- Volunteering: Encouraging employees to volunteer their time and skills to local organizations, fostering a sense of community responsibility.

- Community Outreach Programs: Participating in community events, such as health fairs and safety awareness campaigns, to educate and engage with residents.

Partnerships and Sponsorships

Beaver State Insurance in Salem has forged strategic partnerships and sponsorships with local organizations, demonstrating its commitment to supporting the community. Some notable examples include:

- Salem Chamber of Commerce: Beaver State Insurance is an active member of the Salem Chamber of Commerce, participating in networking events and advocating for business interests in the community.

- Salem-Keizer School District: The company has sponsored educational programs and initiatives within the Salem-Keizer School District, supporting the development of future generations.

- Salem Art Association: Beaver State Insurance has sponsored art exhibitions and events, promoting the arts and cultural scene in Salem.

- Salem-Keizer Volcanoes: The company has partnered with the Salem-Keizer Volcanoes minor league baseball team, providing sponsorship and supporting local sports.

Comparison to Other Insurance Providers

| Insurance Provider | Strengths | Weaknesses |

|—|—|—|

| Beaver State Insurance | Strong community presence, personalized service, competitive rates | Limited product offerings compared to national providers |

| State Farm | Extensive product offerings, nationwide network, strong brand recognition | Higher premiums compared to some local providers |

| Farmers Insurance | Wide range of insurance products, local agents, competitive rates | Limited digital capabilities |

| Allstate | Strong digital platform, 24/7 customer service, comprehensive insurance options | Higher premiums compared to some local providers |

| Liberty Mutual | Innovative insurance products, strong customer service, competitive rates | Limited presence in some areas |

Customer Experience with Beaver State Insurance

Beaver State Insurance is known for its commitment to providing excellent customer service and a positive experience for its policyholders. The company’s focus on customer satisfaction is evident in its numerous positive reviews and testimonials.

Customer Testimonials and Reviews

Many customers have shared their positive experiences with Beaver State Insurance in Salem. They often praise the company’s friendly and helpful staff, efficient claims processing, and competitive rates. Online review platforms like Google and Yelp showcase numerous five-star ratings and glowing reviews. For example, one customer wrote, “I have been with Beaver State Insurance for several years and have always been happy with their service. They are always quick to respond to my questions and have helped me find the best insurance coverage for my needs.”

Customer Service Practices and Policies

Beaver State Insurance prioritizes customer service and has implemented various practices to ensure a positive experience. These include:

- Dedicated customer service representatives: Beaver State Insurance employs a team of dedicated customer service representatives who are available to answer questions, address concerns, and provide assistance. They are trained to handle a wide range of inquiries and are equipped to provide solutions tailored to individual needs.

- Multiple communication channels: Customers can reach Beaver State Insurance through various channels, including phone, email, and online chat. This allows customers to choose the most convenient method of communication.

- 24/7 online access: Beaver State Insurance offers a user-friendly online portal that allows customers to access their policy information, make payments, and file claims anytime, anywhere.

Ease of Filing Claims

Beaver State Insurance makes the claims filing process as straightforward as possible. Customers can file claims online, over the phone, or in person. The company aims to process claims promptly and efficiently, ensuring a smooth and stress-free experience.

- Online claims portal: Customers can file claims online through the Beaver State Insurance website. The portal is designed to be user-friendly and guides customers through the necessary steps. This allows for quick and convenient claim submission.

- 24/7 claims reporting: Beaver State Insurance provides 24/7 claims reporting options, allowing customers to report claims at any time, regardless of the day or hour. This ensures that customers can receive immediate assistance and support in case of an emergency.

- Dedicated claims adjusters: Beaver State Insurance assigns dedicated claims adjusters to each claim. These adjusters are responsible for investigating the claim, assessing the damage, and determining the appropriate compensation. They work closely with customers to ensure a fair and timely resolution.

Customer Portal Features

Beaver State Insurance’s customer portal offers a range of features designed to enhance the customer experience.

| Feature | Description |

|---|---|

| Policy Information | Access to policy details, including coverage limits, deductibles, and payment history. |

| Payment Management | Make payments, view payment history, and set up automatic payments. |

| Claims Filing | File claims online, track claim status, and communicate with claims adjusters. |

| Document Upload | Upload relevant documents, such as accident reports or medical records. |

| Contact Information | Update contact information and preferences. |

Insurance Needs in Salem, Oregon

Salem, Oregon, like any other city, faces unique insurance needs driven by its local environment, demographics, and economic activities. Understanding these specific needs is crucial for residents and businesses to secure adequate coverage and navigate potential risks effectively.

Common Insurance Needs in Salem

Salem residents and businesses require a range of insurance policies to protect against various risks. Here are some common insurance needs:

- Homeowners Insurance: Salem’s housing market is diverse, encompassing single-family homes, townhouses, and apartments. Homeowners insurance protects against perils like fire, theft, and natural disasters, ensuring financial security in case of damage or loss.

- Auto Insurance: Salem experiences moderate traffic volume, but road conditions can be challenging during inclement weather. Auto insurance provides coverage for liability, collision, and comprehensive risks, safeguarding individuals and their vehicles.

- Renters Insurance: With a significant student population and a growing rental market, renters insurance is essential for protecting personal belongings and providing liability coverage.

- Business Insurance: Salem’s economy encompasses various industries, including manufacturing, healthcare, and technology. Business insurance policies like general liability, workers’ compensation, and property insurance are crucial for mitigating risks and ensuring business continuity.

- Health Insurance: Salem has a growing healthcare industry, but healthcare costs can be significant. Health insurance provides coverage for medical expenses, promoting access to quality healthcare services.

- Life Insurance: Life insurance offers financial protection for loved ones in the event of the policyholder’s death, providing financial security and peace of mind.

Insurance Challenges in Salem

While Salem offers a range of insurance options, residents and businesses face specific challenges:

- Natural Disasters: Salem is susceptible to earthquakes, wildfires, and floods, which can significantly impact property and infrastructure. Securing adequate coverage for these risks is essential for mitigating financial losses.

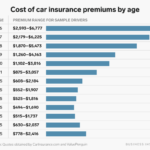

- Rising Insurance Premiums: Like many areas, Salem has experienced rising insurance premiums due to factors like inflation, increased claims, and changing risk profiles. This trend can make securing affordable insurance challenging.

- Limited Insurance Options: While Salem has a range of insurance providers, competition can be limited in certain areas, potentially leading to higher premiums or fewer coverage options.

- Understanding Insurance Policies: Navigating the complexities of insurance policies can be overwhelming for individuals and businesses. Understanding coverage details, exclusions, and policy terms is crucial for making informed decisions.

Impact of Local Factors on Insurance Needs

Salem’s local factors influence insurance needs in various ways:

- Climate: Salem’s temperate climate with occasional heavy rains and wildfire risks necessitates insurance policies that address these specific perils.

- Demographics: Salem’s growing population, including a significant student population and a diverse mix of residents, influences the demand for different insurance types.

- Economy: Salem’s economy, driven by manufacturing, healthcare, and technology, shapes the insurance needs of businesses and individuals.

Average Insurance Premiums in Salem

The table below presents average insurance premiums for different types of policies in Salem, based on industry data and estimates:

| Policy Type | Average Annual Premium |

|---|---|

| Homeowners Insurance | $1,200 – $2,000 |

| Auto Insurance | $1,000 – $1,800 |

| Renters Insurance | $150 – $300 |

| Business Liability Insurance | $500 – $2,500 |

| Health Insurance (Individual) | $400 – $800 (per month) |

| Life Insurance (Term) | $50 – $200 (per month) |

Note: These premiums are estimates and can vary based on factors like coverage level, deductibles, and individual risk profiles.

Insurance Industry Trends in Salem, Oregon: Beaver State Insurance In Salem Oregon

The insurance industry in Salem, Oregon, is undergoing significant transformations driven by technological advancements, evolving customer expectations, and shifting demographics. Understanding these trends is crucial for insurance providers to remain competitive and effectively meet the evolving needs of their clients.

Insurance Technology Landscape

The insurance industry in Salem is witnessing a rapid adoption of technology, impacting various aspects of operations, customer interactions, and product offerings.

- Insurtech Solutions: The rise of insurtech companies is introducing innovative solutions for policy management, claims processing, and customer engagement. These companies are leveraging data analytics, artificial intelligence, and mobile applications to enhance efficiency and customer experience.

- Digital Transformation: Insurance providers in Salem are increasingly adopting digital platforms and tools to streamline their operations, improve customer service, and offer personalized insurance solutions. This includes online quoting, policy management, and claims reporting.

- Data Analytics and Predictive Modeling: The use of data analytics and predictive modeling is gaining traction in Salem, enabling insurers to better assess risk, personalize pricing, and optimize their product offerings. This helps them to understand customer behavior and identify potential risks.

Impact of Changing Demographics

Salem’s demographics are evolving, influencing the demand for specific insurance products and services.

- Aging Population: As the population ages, the demand for health insurance, long-term care insurance, and life insurance is likely to increase. This trend presents an opportunity for insurance providers to cater to the needs of an aging population.

- Growing Diversity: Salem’s diverse population requires insurance providers to offer culturally sensitive products and services that meet the unique needs of different communities. This includes language support, culturally appropriate marketing, and product customization.

- Shifting Lifestyle Preferences: Changing lifestyle preferences, such as the rise of remote work and the growing popularity of ride-sharing services, are impacting the demand for certain types of insurance, such as auto insurance and homeowners insurance.

Key Factors Influencing the Insurance Industry

The insurance industry in Salem is influenced by a complex interplay of factors.

| Factor | Impact |

|---|---|

| Regulatory Environment | Regulations governing insurance practices, pricing, and consumer protection significantly influence the operating environment for insurance providers. |

| Economic Conditions | Economic fluctuations, such as interest rate changes, inflation, and unemployment, can impact insurance premiums, investment returns, and customer purchasing power. |

| Natural Disasters | Salem’s location in a seismically active region makes it vulnerable to earthquakes, wildfires, and other natural disasters. These events can lead to significant claims payouts and increased insurance premiums. |

| Competition | The insurance industry in Salem is competitive, with numerous national and regional providers vying for market share. This competition drives innovation and pricing pressure. |

Ending Remarks

Whether you’re a Salem resident seeking peace of mind with reliable home and auto insurance or a business owner looking for comprehensive liability coverage, Beaver State Insurance is a valuable resource. Their commitment to customer service, coupled with their deep understanding of the local market, makes them a trusted partner in safeguarding your future.

FAQ Section

What are the hours of operation for Beaver State Insurance in Salem?

The hours of operation for Beaver State Insurance in Salem may vary depending on the specific location. You can find the hours for each branch on their website or by contacting them directly.

Does Beaver State Insurance offer discounts?

Yes, Beaver State Insurance offers a variety of discounts, such as multi-policy discounts, safe driver discounts, and good student discounts. You can learn more about available discounts by contacting them directly.

How do I file a claim with Beaver State Insurance?

You can file a claim with Beaver State Insurance online, by phone, or in person at a local branch. The specific steps for filing a claim will depend on the type of insurance policy you have.

What are the payment options for Beaver State Insurance?

Beaver State Insurance typically accepts a variety of payment methods, including credit cards, debit cards, and checks. You can find more information about payment options on their website or by contacting them directly.