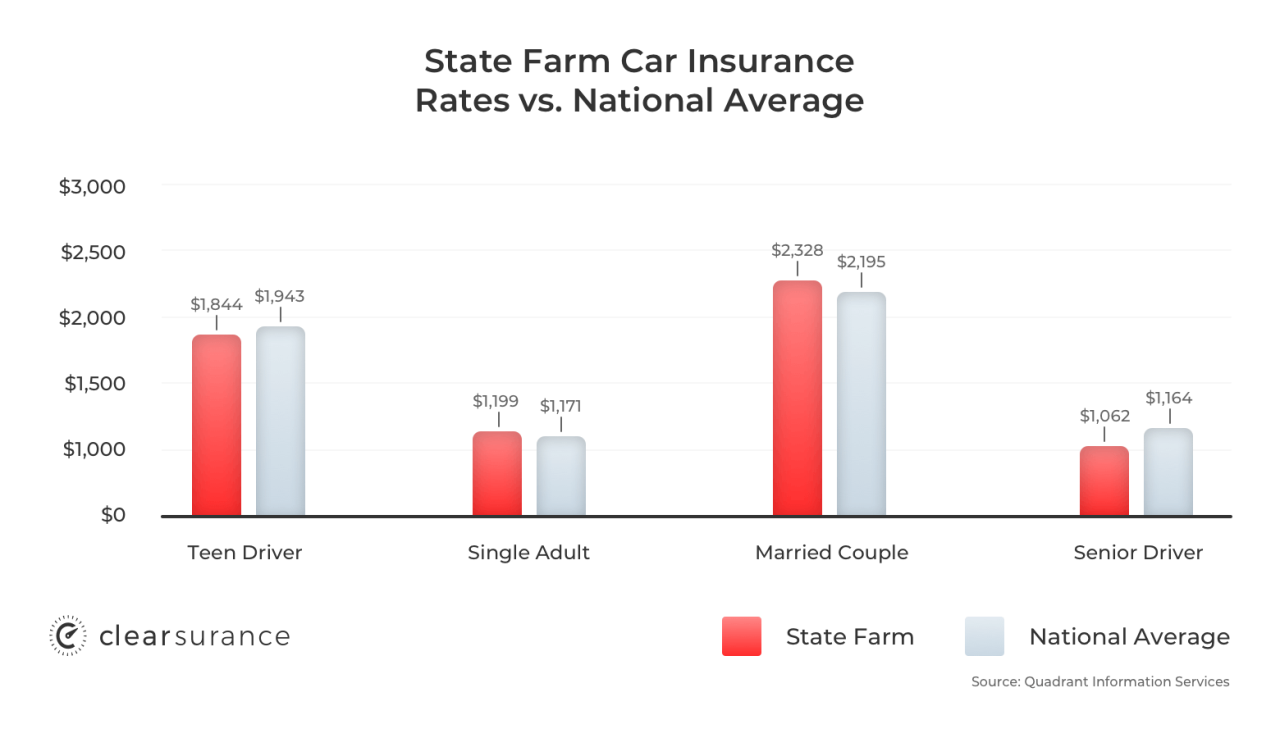

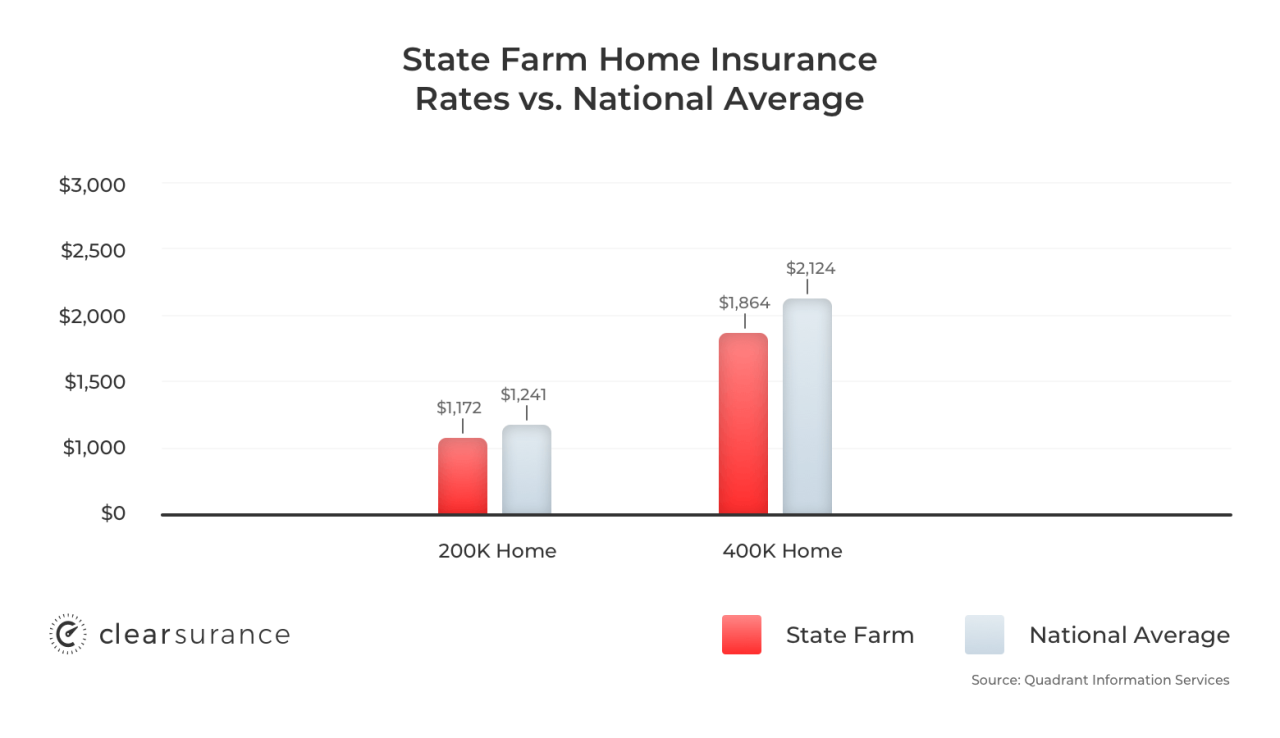

Average State Farm auto insurance cost is a key consideration for drivers seeking affordable coverage. Factors like your driving record, vehicle type, location, and coverage choices significantly influence your premiums. Understanding these factors can help you make informed decisions about your insurance needs and potentially save money.

This guide explores the average State Farm auto insurance rates across different states, examines various coverage options, and highlights discounts and savings opportunities. We’ll also delve into customer reviews and experiences, providing insights into State Farm’s service quality and claim handling. By the end, you’ll have a comprehensive understanding of State Farm auto insurance and be equipped to make informed decisions about your coverage.

Factors Influencing State Farm Auto Insurance Costs

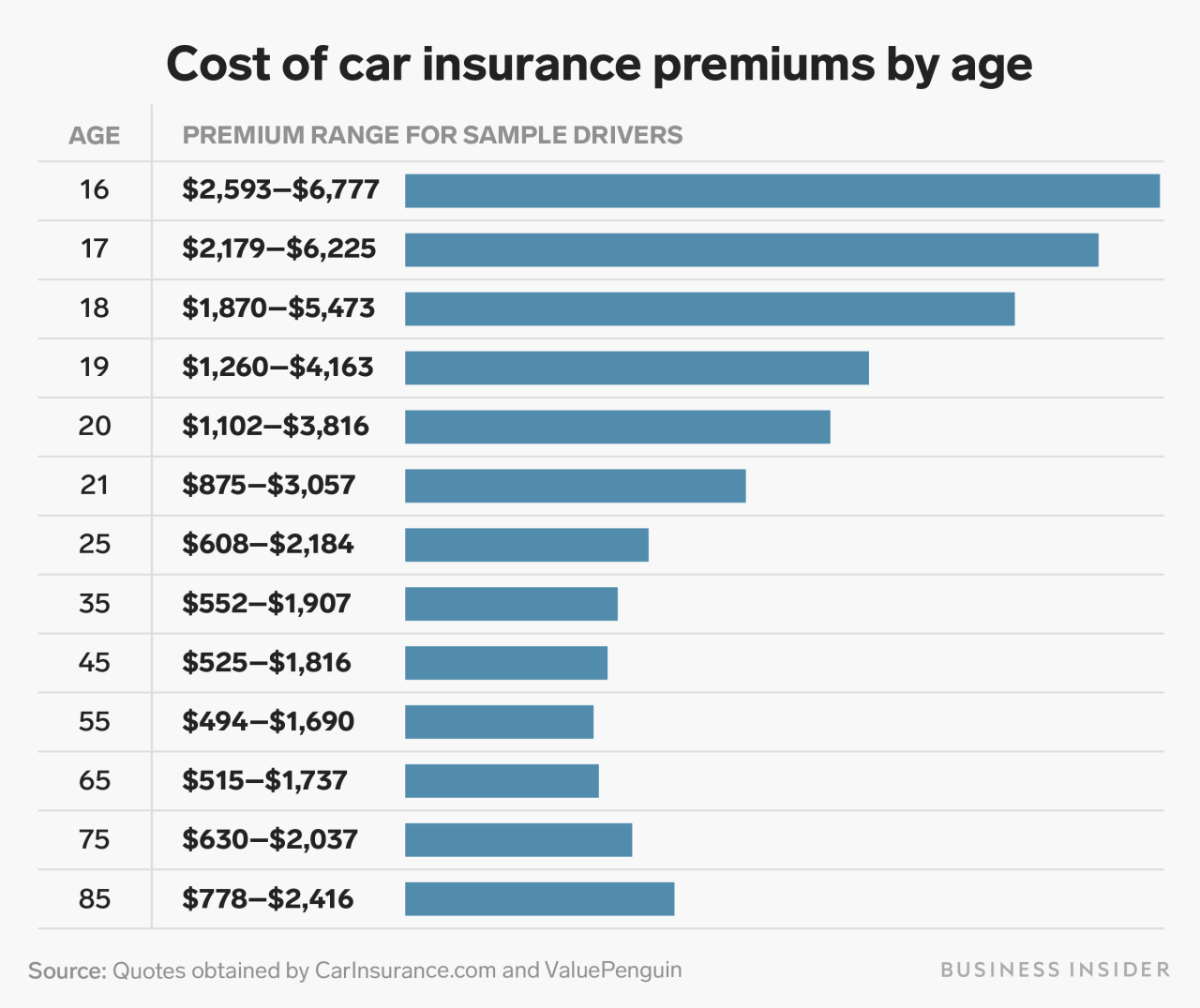

State Farm, like other insurance providers, considers various factors when determining your auto insurance premiums. Understanding these factors can help you make informed decisions to potentially lower your costs.

Driving History

Your driving record plays a crucial role in determining your insurance rates. A clean driving record with no accidents or violations typically translates to lower premiums. Conversely, having a history of accidents, traffic violations, or even DUI convictions can significantly increase your insurance costs. For instance, a driver with a recent speeding ticket might face a premium increase of 15-25% compared to a driver with a clean record.

Average State Farm Auto Insurance Rates by State

State Farm, a leading insurance provider, offers auto insurance policies across the United States. The average cost of State Farm auto insurance can vary significantly from state to state, influenced by a multitude of factors such as traffic density, accident rates, and the cost of vehicle repairs.

Average State Farm Auto Insurance Rates by State

State Farm auto insurance rates can vary significantly across the United States. The following table presents average annual premiums for State Farm auto insurance in different states:

| State | Average Annual Premium |

|---|---|

| Alabama | $1,400 |

| Alaska | $2,100 |

| Arizona | $1,600 |

| Arkansas | $1,300 |

| California | $2,000 |

| Colorado | $1,700 |

| Connecticut | $1,900 |

| Delaware | $1,500 |

| Florida | $2,200 |

| Georgia | $1,500 |

| Hawaii | $2,300 |

| Idaho | $1,400 |

| Illinois | $1,800 |

| Indiana | $1,500 |

| Iowa | $1,300 |

| Kansas | $1,200 |

| Kentucky | $1,400 |

| Louisiana | $2,000 |

| Maine | $1,600 |

| Maryland | $1,800 |

| Massachusetts | $2,100 |

| Michigan | $2,000 |

| Minnesota | $1,600 |

| Mississippi | $1,300 |

| Missouri | $1,400 |

| Montana | $1,500 |

| Nebraska | $1,200 |

| Nevada | $1,800 |

| New Hampshire | $1,700 |

| New Jersey | $2,200 |

| New Mexico | $1,600 |

| New York | $2,300 |

| North Carolina | $1,500 |

| North Dakota | $1,200 |

| Ohio | $1,600 |

| Oklahoma | $1,400 |

| Oregon | $1,700 |

| Pennsylvania | $1,900 |

| Rhode Island | $2,000 |

| South Carolina | $1,600 |

| South Dakota | $1,300 |

| Tennessee | $1,500 |

| Texas | $1,800 |

| Utah | $1,500 |

| Vermont | $1,800 |

| Virginia | $1,700 |

| Washington | $1,900 |

| West Virginia | $1,400 |

| Wisconsin | $1,700 |

| Wyoming | $1,400 |

It is important to note that these are just average rates and your actual premium may vary based on your individual circumstances.

Reasons for Rate Differences, Average state farm auto insurance cost

The wide range of average premiums across states can be attributed to several factors:

* Traffic Density and Accident Rates: States with higher traffic density and accident rates generally have higher insurance premiums. This is because insurers have to pay out more claims in these areas.

* Cost of Vehicle Repairs: The cost of vehicle repairs can vary significantly from state to state. States with higher costs of living and labor tend to have higher insurance premiums.

* State Regulations: Each state has its own set of regulations governing auto insurance. These regulations can impact the cost of insurance by setting minimum coverage requirements or mandating certain benefits.

* Local Risk Factors: Local risk factors, such as the prevalence of theft or vandalism, can also influence insurance rates.

It is important to note that these are just a few of the many factors that can affect State Farm auto insurance rates. The specific factors that apply to you will depend on your individual circumstances.

State Farm Auto Insurance Coverage Options

State Farm offers a wide range of auto insurance coverage options to meet the diverse needs of its policyholders. These options provide financial protection in case of accidents, theft, or other incidents involving your vehicle. Understanding the different coverage options and their implications is crucial for making informed decisions about your insurance policy.

State Farm Auto Insurance Coverage Options

State Farm provides several coverage options, each designed to protect you and your vehicle in different scenarios. The most common coverage types include:

Liability Coverage

Liability coverage protects you financially if you cause an accident that results in injuries or damage to another person or their property. It typically includes two components:

* Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages related to injuries caused to other people in an accident.

* Property Damage Liability: This coverage pays for repairs or replacement of damaged property, such as another vehicle or a building, that you are responsible for.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it is damaged in an accident with another vehicle or object, regardless of who is at fault. This coverage is optional, and you may choose to decline it if your vehicle is older or has a low value.

Comprehensive Coverage

Comprehensive coverage pays for repairs or replacement of your vehicle if it is damaged by events other than collisions, such as theft, vandalism, fire, or natural disasters. This coverage is also optional and may be declined for older vehicles.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage to cover your losses. This coverage can pay for medical expenses, lost wages, and other damages related to injuries you sustain in an accident caused by an uninsured or underinsured driver.

Other Coverage Options

State Farm offers additional coverage options, such as:

* Medical Payments Coverage: This coverage pays for medical expenses for you and your passengers, regardless of who is at fault in an accident.

* Rental Reimbursement Coverage: This coverage pays for rental car expenses if your vehicle is being repaired after an accident.

* Roadside Assistance Coverage: This coverage provides assistance for situations like flat tires, jump starts, and towing.

Comparison of State Farm Auto Insurance Coverage Options

| Coverage Type | Key Features | Benefits | Cost |

|---|---|---|---|

| Liability Coverage | Protects you financially if you cause an accident resulting in injuries or damage to others. | Provides financial protection against legal and medical expenses in case of an accident. | Typically required by law, and the cost varies based on the limits you choose. |

| Collision Coverage | Pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault. | Provides financial protection for your vehicle in case of an accident. | Optional, and the cost varies based on the value of your vehicle and your driving record. |

| Comprehensive Coverage | Pays for repairs or replacement of your vehicle if it is damaged by events other than collisions. | Provides financial protection for your vehicle against theft, vandalism, fire, and natural disasters. | Optional, and the cost varies based on the value of your vehicle and your location. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage. | Provides financial protection against losses caused by uninsured or underinsured drivers. | Optional, but highly recommended, and the cost varies based on your state’s requirements and your coverage limits. |

Understanding Coverage Levels and Premiums

The amount of coverage you choose directly impacts your insurance premiums. Higher coverage limits generally result in higher premiums. It is important to carefully consider your individual needs and financial situation when selecting your coverage levels. If you are unsure about the right coverage for you, consult with a State Farm agent to discuss your options and find a policy that meets your specific requirements.

Discounts and Savings Offered by State Farm

State Farm offers a variety of discounts that can help you save money on your auto insurance. These discounts can vary depending on your location, driving history, and the type of car you drive. By taking advantage of these discounts, you can significantly reduce your overall insurance costs.

Discounts Offered by State Farm

State Farm offers a wide range of discounts that can help you save money on your auto insurance. These discounts can be categorized into several key areas, each designed to reward responsible driving, safe vehicle ownership, and customer loyalty.

- Good Driver Discounts: These discounts reward drivers with a clean driving record. They are typically offered to drivers who have not been involved in accidents or received traffic violations for a certain period of time. For instance, State Farm may offer a discount for drivers who have not had an accident in the past three to five years.

- Safe Vehicle Discounts: These discounts are offered for vehicles equipped with safety features that reduce the risk of accidents or injuries. These features can include anti-theft devices, airbags, anti-lock brakes, and other safety technologies. State Farm may offer a discount for vehicles with advanced safety features like lane departure warning, blind spot monitoring, or automatic emergency braking.

- Multi-Policy Discounts: These discounts are offered to customers who bundle multiple insurance policies with State Farm, such as auto, home, and life insurance. Bundling your policies can save you a significant amount of money on your premiums. For example, State Farm may offer a discount of 10% or more for bundling your auto and homeowners insurance policies.

- Other Discounts: State Farm also offers a variety of other discounts, including discounts for:

- Good Student Discount: For students who maintain a certain GPA.

- Defensive Driving Course Discount: For drivers who complete a defensive driving course.

- Paid-in-Full Discount: For customers who pay their premiums in full.

- Loyalty Discount: For customers who have been with State Farm for a certain period of time.

- Military Discount: For active military personnel and veterans.

Maximizing Savings with State Farm Discounts

To maximize your savings, it is important to be aware of all the discounts available from State Farm and ensure you are eligible for them. Here are some tips:

- Review your driving record: Make sure your driving record is clean and free of any accidents or violations.

- Consider safety features: If you are planning to purchase a new vehicle, consider those with advanced safety features.

- Bundle your insurance policies: Combine your auto, home, and life insurance policies with State Farm to take advantage of multi-policy discounts.

- Ask about other discounts: Inquire about other discounts that may be available, such as good student, defensive driving, or loyalty discounts.

- Contact State Farm: Speak with a State Farm agent to discuss your specific needs and learn about the discounts you qualify for.

Customer Reviews and Experiences with State Farm

Customer reviews and experiences offer valuable insights into the overall performance and customer satisfaction levels of State Farm auto insurance. These reviews can help potential customers make informed decisions about choosing an insurance provider.

Customer Satisfaction Levels

Customer satisfaction levels with State Farm auto insurance vary depending on factors such as individual experiences, claims processing, and customer service interactions. State Farm consistently ranks among the top insurance providers in terms of customer satisfaction.

- J.D. Power: State Farm has consistently received high ratings in J.D. Power’s annual Auto Insurance Satisfaction Study. In 2022, State Farm ranked among the top providers in customer satisfaction.

- Consumer Reports: Consumer Reports has also given State Farm high marks for customer satisfaction, highlighting its strong claims handling and customer service.

Claim Processing Experiences

Claim processing is a crucial aspect of customer satisfaction with any insurance provider. Customers often share their experiences with claim processing, highlighting both positive and negative aspects.

- Positive Experiences: Many customers praise State Farm for its efficient and straightforward claim processing. They often mention the ease of filing claims, prompt communication, and fair settlements.

- Challenges: Some customers have reported challenges with claim processing, including delays in communication, difficulties in reaching customer service representatives, and disputes over claim settlements.

Overall Service Quality

Overall service quality is another key aspect of customer satisfaction with State Farm auto insurance. Customers often comment on their experiences with customer service representatives, communication, and overall responsiveness.

- Positive Feedback: Many customers commend State Farm for its friendly and helpful customer service representatives. They often mention the ease of reaching customer service and the promptness of responses.

- Areas for Improvement: Some customers have indicated areas for improvement, such as longer wait times for customer service, difficulties in reaching specific departments, and inconsistent communication.

Comparison to Other Providers

Comparing State Farm to other major auto insurance providers based on customer feedback reveals both strengths and areas for improvement.

- Strengths: State Farm consistently ranks high in customer satisfaction surveys, particularly for its claim processing and customer service.

- Areas for Improvement: While State Farm performs well overall, some customers have reported challenges with claim processing and customer service, particularly in terms of communication and responsiveness.

Getting a Quote and Comparing Rates: Average State Farm Auto Insurance Cost

Getting an accurate estimate of your State Farm auto insurance costs is crucial for making informed decisions. State Farm provides a straightforward process for obtaining a quote, but it’s also essential to compare rates from multiple insurers to ensure you’re getting the best value for your coverage.

Obtaining a Quote from State Farm

To get a quote from State Farm, you can either visit their website, call their customer service line, or speak with a local agent. State Farm’s website offers a convenient online quoting tool that allows you to quickly enter your information and receive an estimated rate.

When requesting a quote, State Farm will require some basic information about you and your vehicle, including:

- Your name, address, and contact information

- Your driving history, including any accidents or violations

- Your vehicle’s make, model, year, and mileage

- Your desired coverage levels and deductibles

Comparing Quotes from Multiple Insurers

While State Farm offers competitive rates, it’s always advisable to compare quotes from several other insurance companies. This helps you ensure that you’re getting the best possible price for the coverage you need.

- Online comparison tools: Websites like Policygenius and Insurify allow you to enter your information once and receive quotes from multiple insurers simultaneously. This streamlines the comparison process and saves you time.

- Direct quotes: Contact several insurance companies directly to request quotes. This gives you the opportunity to ask questions and clarify details about their policies.

Tips for Negotiating Insurance Premiums

While negotiating auto insurance premiums can be challenging, there are several strategies you can employ to potentially lower your costs:

- Bundle your insurance: Combining your auto insurance with other policies, such as homeowners or renters insurance, can often result in significant discounts.

- Improve your driving record: Maintaining a clean driving record with no accidents or violations is one of the most effective ways to lower your premiums.

- Increase your deductible: Choosing a higher deductible can lead to lower premiums, as you agree to pay more out-of-pocket in the event of a claim.

- Shop around regularly: Insurance rates can fluctuate, so it’s a good idea to compare quotes from different insurers every year or two to ensure you’re still getting the best deal.

Conclusive Thoughts

Navigating the world of auto insurance can feel overwhelming, but understanding the factors that influence your premiums and exploring different coverage options can empower you to make informed choices. By comparing quotes from multiple insurers, leveraging discounts, and understanding your coverage needs, you can secure affordable and comprehensive auto insurance that fits your budget and driving habits. Remember, it’s essential to choose an insurer that prioritizes customer satisfaction and offers reliable service when you need it most.

Question & Answer Hub

How do I get a quote from State Farm?

You can get a quote online, over the phone, or by visiting a local State Farm agent. You’ll need to provide basic information about yourself, your vehicle, and your driving history.

What are some common discounts offered by State Farm?

State Farm offers a variety of discounts, including good driver, safe vehicle, multi-policy, and defensive driving discounts. You can find a complete list of discounts on their website or by contacting a local agent.

What if I have a claim with State Farm?

State Farm has a reputation for prompt and efficient claim processing. You can report a claim online, over the phone, or by visiting a local agent. They will guide you through the process and help you resolve your claim.