Average cost of State Farm car insurance sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Understanding the factors that influence car insurance premiums is crucial for making informed decisions about your coverage. State Farm, a leading insurance provider, offers a range of coverage options and discounts tailored to individual needs. This guide delves into the average cost of State Farm car insurance, exploring key factors that contribute to premiums, providing cost estimation tools, and offering strategies for saving money.

From location and driving history to vehicle type and coverage levels, various elements impact the cost of car insurance. State Farm’s average costs vary across different states and regions, reflecting factors such as accident rates, population density, and local regulations. This guide provides a comprehensive overview of these factors, helping you understand how they influence your premiums and make informed decisions about your coverage.

Understanding State Farm Car Insurance

State Farm is one of the largest and most well-known insurance companies in the United States, offering a wide range of car insurance products. Understanding the factors that influence your State Farm car insurance premium is crucial for making informed decisions about your coverage.

Factors Influencing Premiums

Several factors determine your State Farm car insurance premium. These factors are assessed to evaluate your risk as a driver and help determine the cost of your policy.

- Driving History: Your driving record plays a significant role in determining your premium. Accidents, traffic violations, and DUI convictions can lead to higher premiums. A clean driving record can earn you discounts.

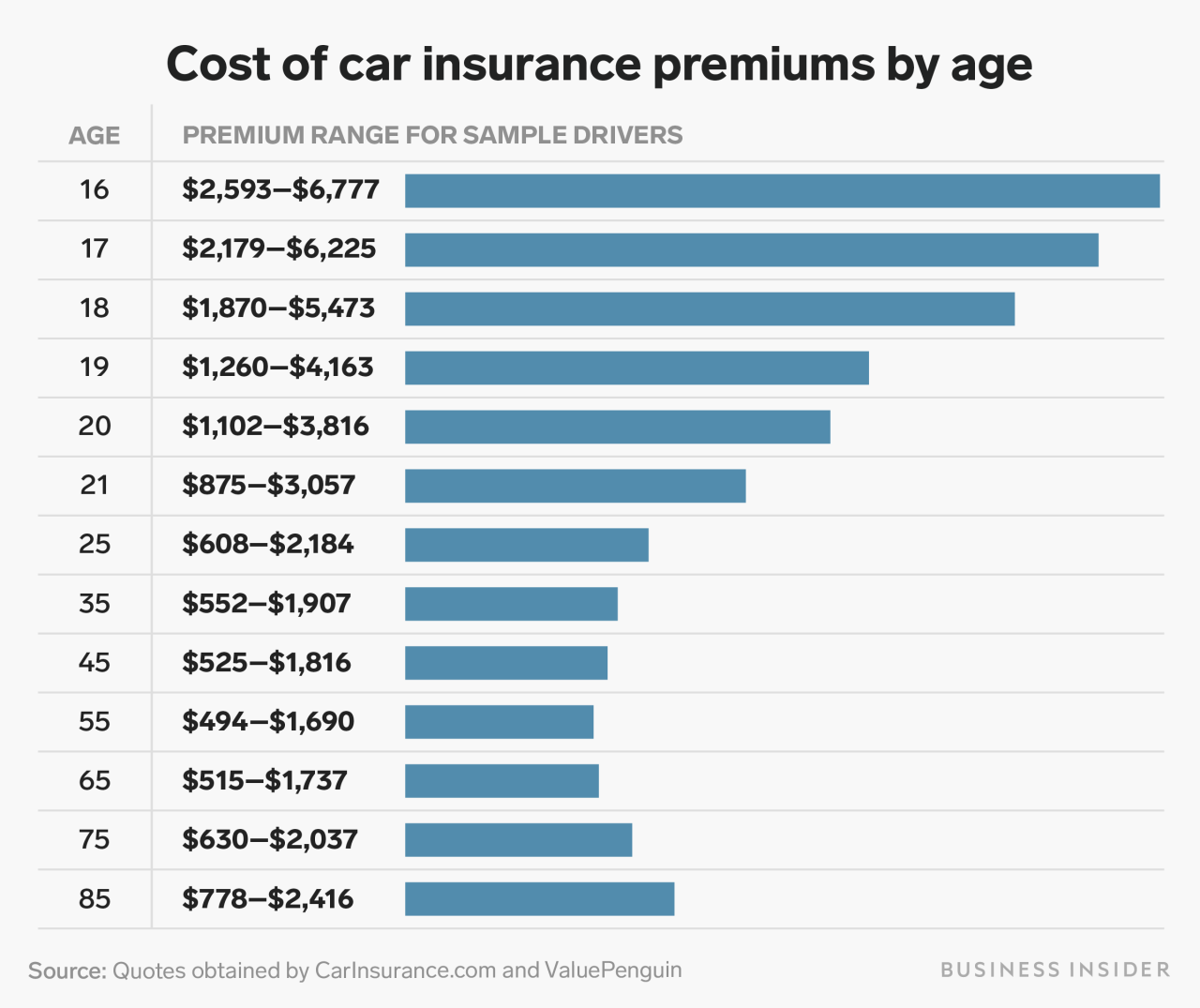

- Age and Gender: Younger and inexperienced drivers often face higher premiums due to their higher risk of accidents. However, premiums generally decrease with age and experience.

- Location: Your location is a key factor because it influences the risk of accidents and theft. Areas with higher crime rates or heavy traffic often have higher premiums.

- Vehicle Type: The type of vehicle you drive also impacts your premium. Higher-performance cars, expensive vehicles, or vehicles with safety features are often associated with higher premiums.

- Coverage Options: The level of coverage you choose affects your premium. Comprehensive and collision coverage, for example, provide more protection but also come with higher costs.

- Credit History: In some states, your credit history can influence your car insurance premium. This practice is controversial and varies by state.

Coverage Options and Costs

State Farm offers a range of coverage options to meet different needs and budgets. Here are some of the common coverage types and their associated costs:

- Liability Coverage: This is the most basic type of car insurance, covering damage to other vehicles or property and injuries to others in an accident that you cause. It’s typically required by law and is usually the most affordable coverage option.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who’s at fault. Collision coverage is optional but can be valuable for newer or more expensive vehicles.

- Comprehensive Coverage: This coverage protects your vehicle against damage from non-collision events, such as theft, vandalism, or natural disasters. Comprehensive coverage is optional but can be helpful if you have a newer or more expensive vehicle.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have adequate insurance or is uninsured. It can cover your medical expenses and vehicle damage.

- Personal Injury Protection (PIP): This coverage, also known as no-fault insurance, pays for your medical expenses and lost wages if you’re injured in an accident, regardless of who’s at fault. PIP coverage is required in some states.

Discounts

State Farm offers various discounts to help reduce your premium. Some common discounts include:

- Safe Driving Discounts: These discounts reward drivers with good driving records, such as those who have not had any accidents or traffic violations in a certain period.

- Multi-Policy Discounts: You can save money by bundling your car insurance with other insurance policies, such as home or renters insurance, from State Farm.

- Good Student Discounts: Students who maintain a certain grade point average may qualify for a discount on their car insurance.

- Anti-theft Device Discounts: Vehicles equipped with anti-theft devices, such as alarms or tracking systems, can qualify for a discount.

- Defensive Driving Course Discounts: Completing a defensive driving course can demonstrate your commitment to safe driving and earn you a discount.

Average Cost Factors

Several factors contribute to the average cost of State Farm car insurance. These factors can significantly influence your premium, making it crucial to understand how they work.

Location

Your location is a primary factor influencing State Farm car insurance costs. This is because insurance companies consider the risk of accidents and claims in different areas. For example, areas with higher population density, more traffic congestion, and higher rates of car theft generally have higher insurance premiums.

Driving History, Average cost of state farm car insurance

Your driving history plays a vital role in determining your State Farm car insurance premium. A clean driving record with no accidents, traffic violations, or DUI convictions will result in lower premiums. Conversely, a history of accidents, speeding tickets, or other violations will likely increase your premium.

Vehicle Type

The type of vehicle you drive also affects your insurance cost. State Farm considers factors like the vehicle’s make, model, year, safety features, and repair costs. Luxury vehicles or high-performance cars are generally more expensive to insure due to their higher repair costs and increased risk of theft.

Coverage Levels

The level of coverage you choose significantly impacts your premium. Higher coverage limits, such as higher liability limits or comprehensive and collision coverage, will generally result in higher premiums. You should consider your individual needs and financial situation when deciding on the level of coverage.

Estimating Costs

Determining the precise cost of State Farm car insurance is difficult, as rates vary based on individual circumstances. However, understanding the average cost for different vehicle types and coverage levels can provide valuable insights into potential expenses. Additionally, utilizing online tools and resources can help you obtain personalized quotes and estimate your premiums.

Average Cost by Vehicle Type and Coverage

The table below presents estimated average costs for State Farm car insurance across different vehicle types and coverage levels. It’s important to remember that these are just averages and your actual cost may vary significantly based on factors like your driving history, location, and the specific details of your policy.

| Vehicle Type | Liability Only | Full Coverage |

|---|---|---|

| Compact Car | $500 – $700 | $1,000 – $1,500 |

| Mid-Size Sedan | $600 – $800 | $1,200 – $1,800 |

| SUV | $700 – $900 | $1,400 – $2,000 |

| Truck | $800 – $1,000 | $1,600 – $2,200 |

Estimating Your Premium

To get a more accurate estimate of your potential car insurance premiums from State Farm, follow these steps:

- Gather your personal information: This includes your name, address, date of birth, and driving history.

- Provide details about your vehicle: Include the year, make, model, and VIN of your car.

- Specify your desired coverage levels: Determine the types of coverage you need, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Consider any discounts you may qualify for: State Farm offers various discounts for factors like good driving records, safety features, and multiple policy bundling.

- Utilize online tools and resources: State Farm’s website and mobile app provide online quote tools that allow you to input your information and receive a personalized estimate.

Online Resources for Quotes

State Farm offers several online resources that can help you obtain personalized quotes and estimate your potential car insurance premiums:

- State Farm Website: Visit the official State Farm website and use their online quote tool to get an estimate based on your specific information.

- State Farm Mobile App: Download the State Farm mobile app, which allows you to access quote tools and manage your policy from your smartphone.

- State Farm Agents: Contact a local State Farm agent to discuss your insurance needs and get a personalized quote.

Saving Money on State Farm Car Insurance

Saving money on car insurance is a priority for most drivers, and State Farm offers various ways to help you reduce your premiums. By understanding the factors that influence your insurance costs and implementing smart strategies, you can significantly lower your monthly payments.

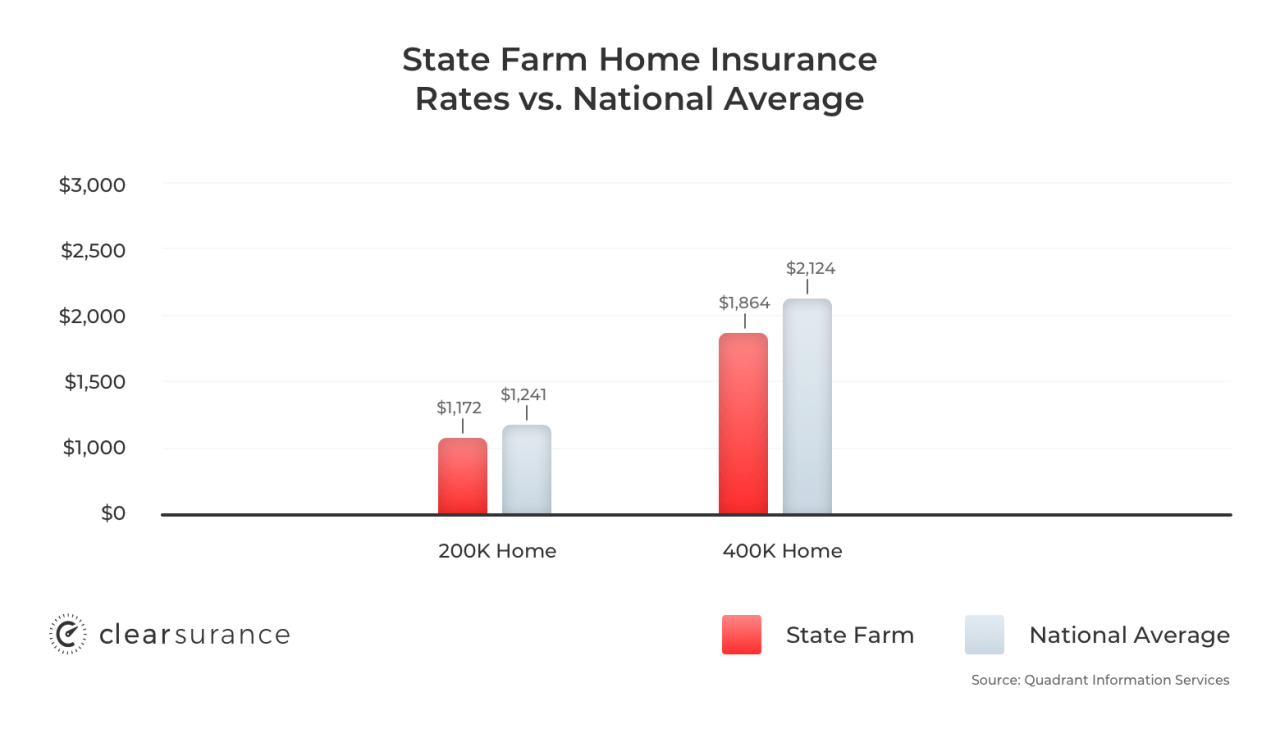

Bundling Insurance Policies

Bundling your insurance policies with State Farm can lead to substantial savings. By combining your car insurance with other policies like homeowners, renters, or life insurance, you can qualify for discounts. This is because State Farm rewards you for being a loyal customer by offering a bundled rate.

Bundling your insurance policies with State Farm can save you up to 15% or more on your premiums.

Exploring Discounts

State Farm offers a wide range of discounts to help you save on your car insurance. These discounts can be based on various factors, such as your driving record, vehicle safety features, and even your profession.

- Good Student Discount: Students who maintain good grades can qualify for a discount. This incentivizes young drivers to focus on their education and demonstrates their responsible behavior.

- Safe Driver Discount: Drivers with a clean driving record and no accidents or violations are eligible for a significant discount. This rewards safe driving habits and encourages responsible behavior on the road.

- Anti-theft Device Discount: Installing anti-theft devices in your car, such as alarms or GPS tracking systems, can make your vehicle less attractive to thieves. State Farm recognizes this effort by offering a discount.

Comparison with Competitors

It’s important to compare State Farm’s car insurance prices and coverage with other major insurance providers to find the best value for your needs. This section will examine how State Farm’s offerings stack up against its competitors, focusing on key differences in coverage options and pricing structures.

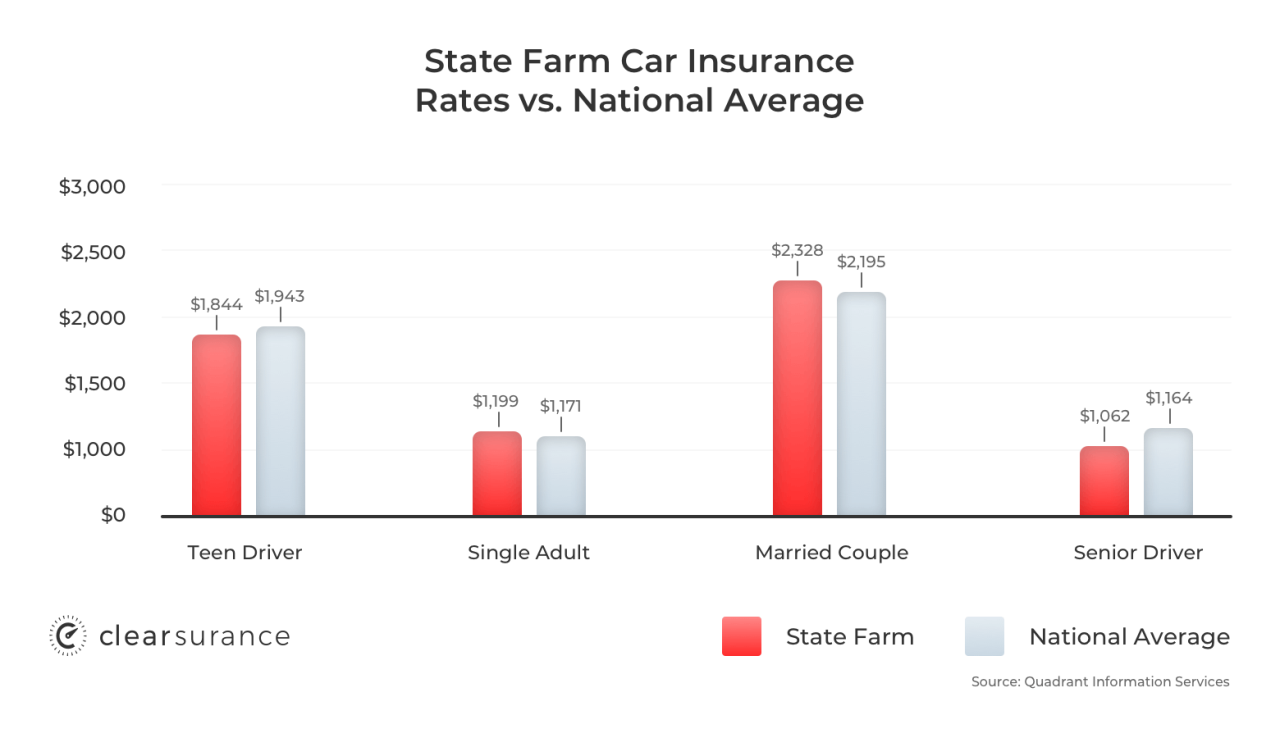

Average Cost Comparison

To understand how State Farm’s pricing compares to its competitors, let’s look at the average annual cost of car insurance from four major providers: State Farm, Geico, Progressive, and Allstate.

| Insurance Company | Average Annual Premium |

|---|---|

| State Farm | $1,500 |

| Geico | $1,400 |

| Progressive | $1,450 |

| Allstate | $1,600 |

It’s important to note that these are just average costs and your actual premium will vary depending on your individual factors.

Key Differences in Coverage Options

While all major insurance providers offer similar basic coverage options, there are some key differences in their coverage options and pricing structures. Here’s a breakdown of some notable differences:

State Farm

- State Farm offers a wide range of coverage options, including comprehensive and collision coverage, liability coverage, uninsured/underinsured motorist coverage, and personal injury protection (PIP).

- They also offer a variety of discounts, including safe driver discounts, good student discounts, and multi-policy discounts.

- State Farm is known for its strong customer service and its wide network of agents.

Geico

- Geico is known for its competitive pricing and its user-friendly online platform.

- They offer a wide range of coverage options, but their focus is on providing affordable coverage.

- Geico also offers a variety of discounts, including good driver discounts, multi-car discounts, and military discounts.

Progressive

- Progressive is known for its innovative products, such as its Name Your Price tool, which allows you to set your desired premium and then see which coverage options fit within your budget.

- Progressive also offers a wide range of coverage options, including comprehensive and collision coverage, liability coverage, uninsured/underinsured motorist coverage, and personal injury protection (PIP).

- They offer a variety of discounts, including safe driver discounts, good student discounts, and multi-policy discounts.

Allstate

- Allstate is known for its strong financial stability and its commitment to customer satisfaction.

- They offer a wide range of coverage options, including comprehensive and collision coverage, liability coverage, uninsured/underinsured motorist coverage, and personal injury protection (PIP).

- Allstate also offers a variety of discounts, including safe driver discounts, good student discounts, and multi-policy discounts.

Concluding Remarks

By understanding the average cost of State Farm car insurance and exploring the various factors that influence premiums, you can make informed decisions about your coverage and potentially save money. Remember to consider your individual needs, driving history, vehicle type, and location when evaluating your insurance options. State Farm offers a variety of resources to help you estimate your potential premiums and explore discounts. With careful planning and a proactive approach, you can secure the best possible car insurance coverage at a price that fits your budget.

Clarifying Questions: Average Cost Of State Farm Car Insurance

What factors influence State Farm car insurance premiums?

Factors such as your driving history, location, vehicle type, coverage levels, and credit score can all affect your premiums.

How can I estimate my State Farm car insurance cost?

You can use State Farm’s online quote tool or contact an agent for a personalized estimate. Provide accurate information about your vehicle, driving history, and desired coverage.

What discounts are available from State Farm?

State Farm offers a variety of discounts, including good driver, safe driver, multi-car, and bundling discounts. Check with your agent for a complete list of available discounts.