Average car insurance washington state – Average car insurance in Washington State can vary greatly depending on several factors, including your driving history, age, vehicle type, and location. Understanding the intricacies of Washington’s car insurance market is crucial for finding the best coverage at a price that fits your budget. This guide provides a comprehensive overview of everything you need to know about car insurance in Washington, from mandatory coverage requirements to tips for finding affordable options.

From navigating the complexities of different coverage types to understanding the impact of location and demographics on premiums, this guide aims to empower you with the knowledge you need to make informed decisions about your car insurance.

Understanding Washington State Car Insurance

Driving in Washington State requires you to have car insurance, ensuring you’re protected financially in case of an accident. It’s crucial to understand the mandatory coverage requirements and the various types of car insurance available to make informed decisions about your policy.

Mandatory Car Insurance Coverage in Washington

Washington State mandates specific types of car insurance to protect drivers and their property. These requirements aim to ensure financial responsibility for accidents and safeguard the public.

- Liability Coverage: This coverage protects you financially if you cause an accident that results in injury or damage to another person or their property. It covers medical expenses, property damage, and legal fees. Washington State requires minimum liability coverage limits:

- Bodily Injury Liability: $25,000 per person and $50,000 per accident.

- Property Damage Liability: $10,000 per accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. It covers your medical expenses and property damage. Washington State requires minimum coverage limits that match the liability limits.

- Financial Responsibility: This requirement ensures you can demonstrate financial responsibility for any accidents you cause. You can meet this requirement by providing proof of insurance or by posting a surety bond.

Types of Car Insurance in Washington

Washington State offers a variety of car insurance options to suit different needs and budgets. Understanding these options can help you choose the best coverage for your situation.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged by something other than an accident, such as theft, vandalism, or natural disasters.

- Medical Payments Coverage (Med Pay): This coverage pays for medical expenses for you and your passengers, regardless of fault, in case of an accident.

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other expenses related to injuries sustained in an accident, regardless of fault.

- Rental Reimbursement Coverage: This coverage pays for a rental car while your vehicle is being repaired after an accident.

- Roadside Assistance Coverage: This coverage provides assistance with services like towing, flat tire changes, and jump starts.

Factors Influencing Car Insurance Premiums in Washington

Several factors influence the cost of your car insurance premiums in Washington. Understanding these factors can help you find ways to potentially lower your premiums.

- Driving History: Your driving record plays a significant role in determining your premium. Accidents, speeding tickets, and DUI convictions can increase your premiums.

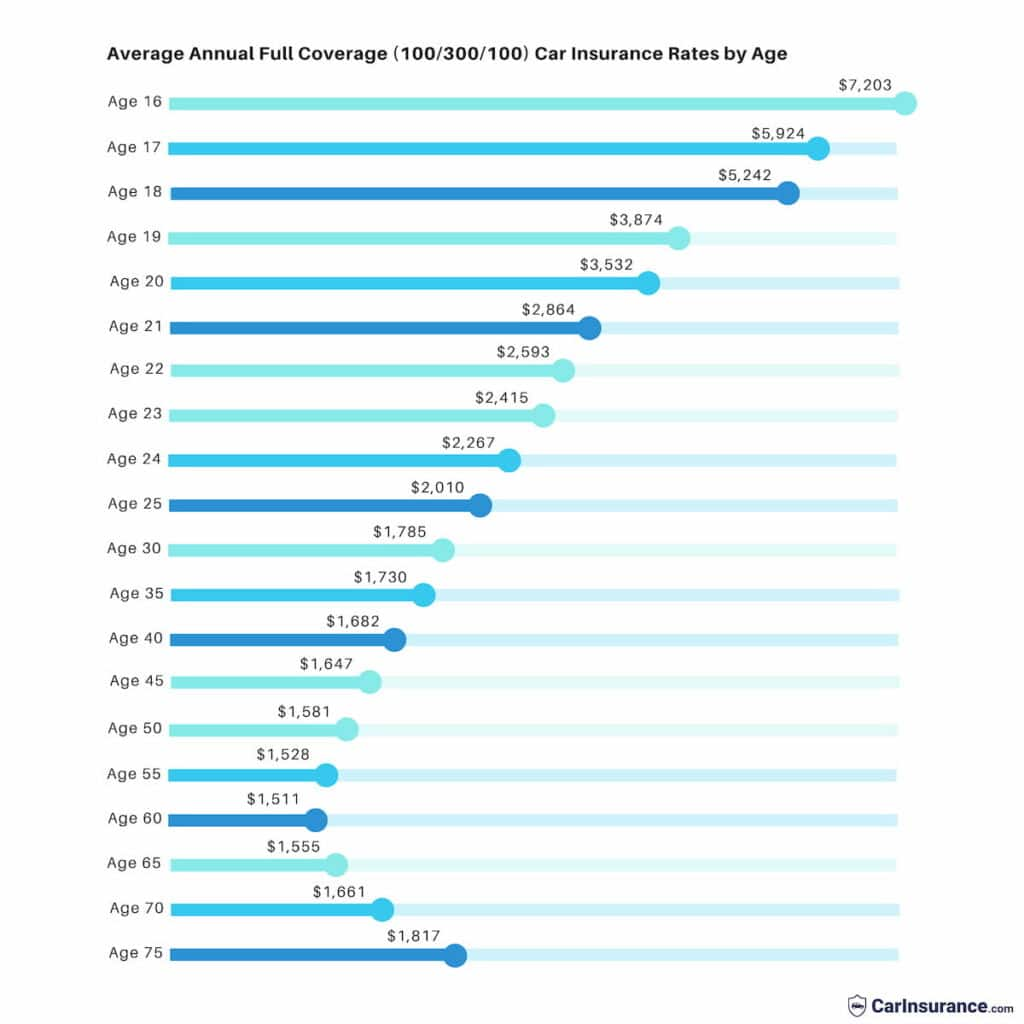

- Age: Younger drivers are generally considered higher risk and may pay higher premiums. As you gain experience and age, your premiums may decrease.

- Vehicle Type: The type of vehicle you drive can influence your premium. Sports cars and luxury vehicles are often associated with higher risks and may have higher premiums.

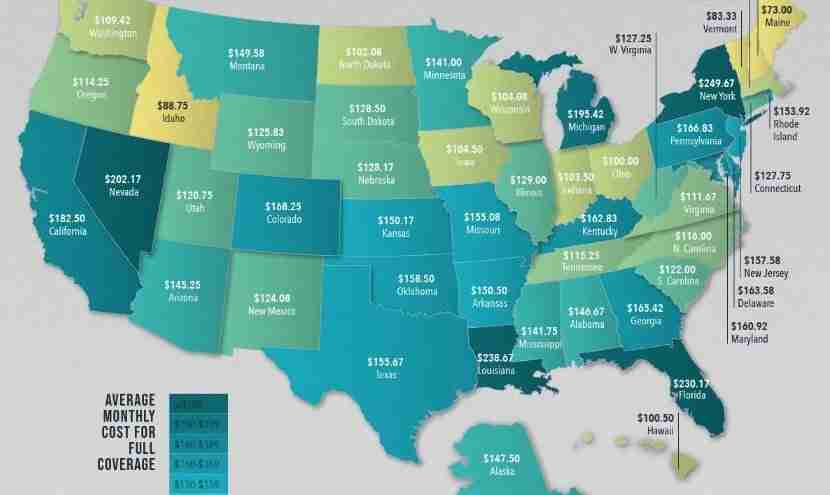

- Location: Where you live can affect your premium. Areas with higher rates of accidents or theft may have higher premiums.

- Credit Score: In some states, including Washington, insurance companies may use your credit score as a factor in determining your premium. This practice is controversial, but it’s important to be aware of it.

Factors Affecting Average Car Insurance Costs: Average Car Insurance Washington State

Several factors influence the average car insurance costs in Washington State. These factors are considered by insurance companies when calculating premiums, and they can significantly impact how much you pay for coverage. This section explores the key factors, including demographics, vehicle type, and location, to help you understand the dynamics of car insurance pricing.

Demographics

Demographic factors play a crucial role in determining car insurance rates. Insurance companies analyze historical data to identify trends associated with age, gender, and marital status. These trends help them assess the risk associated with different demographic groups and adjust premiums accordingly.

- Age: Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. This higher risk translates to higher premiums. As drivers gain experience and age, their risk profile generally decreases, leading to lower premiums.

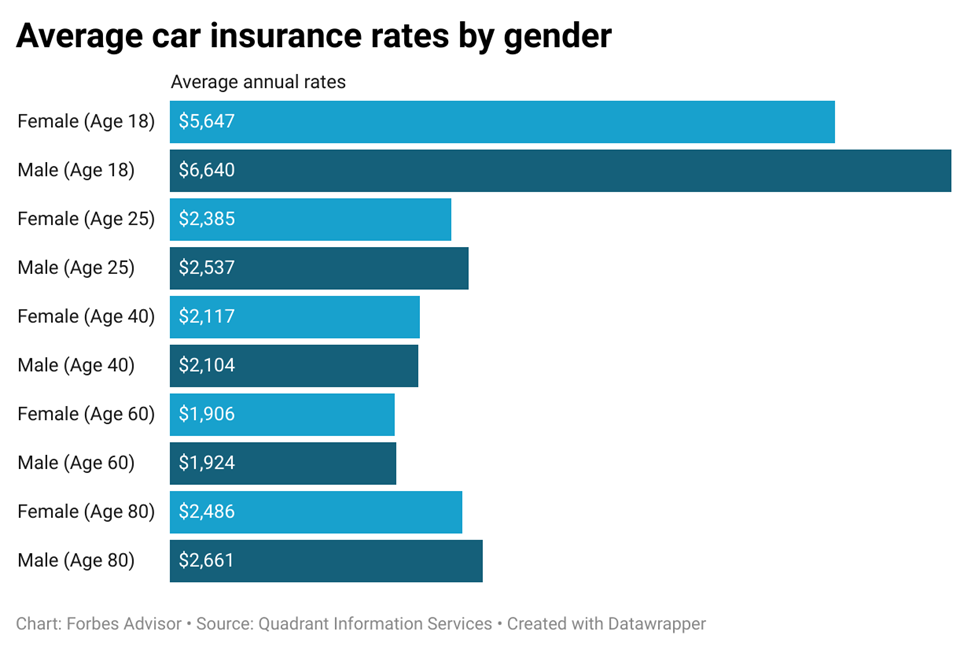

- Gender: Historically, statistics have shown that men tend to have higher accident rates than women. However, this gap has narrowed in recent years. Insurance companies continue to consider gender as a factor in their pricing models, but the impact is less significant than in the past.

- Marital Status: Studies have indicated that married individuals tend to have lower accident rates than single individuals. This correlation could be attributed to factors such as increased responsibility and a more stable lifestyle. As a result, married individuals often enjoy lower insurance premiums.

Vehicle Type

The type of vehicle you drive is another major factor influencing your car insurance costs. Insurance companies consider the vehicle’s safety features, repair costs, and likelihood of theft when determining premiums. Here’s a comparison of average car insurance premiums for different vehicle types in Washington:

| Vehicle Type | Average Premium |

|---|---|

| Sedans | $1,200 – $1,500 |

| SUVs | $1,500 – $1,800 |

| Trucks | $1,800 – $2,200 |

As you can see, SUVs and trucks generally have higher premiums than sedans. This is due to factors like their size, weight, and higher repair costs. Trucks, in particular, are often associated with higher accident rates and are considered riskier vehicles.

Location

Where you live significantly impacts your car insurance rates. Insurance companies analyze factors such as traffic density, crime rates, and weather conditions to assess the risk associated with different areas. Here’s how location can affect your premiums:

- Traffic Density: Areas with heavy traffic congestion are more prone to accidents. Insurance companies charge higher premiums in such locations to account for the increased risk.

- Crime Rates: Regions with high crime rates, particularly car theft, have higher insurance premiums. This is because insurance companies have to factor in the cost of covering stolen vehicles.

- Weather Conditions: Areas prone to extreme weather events, such as snowstorms, hurricanes, or hail, can have higher insurance premiums. These events increase the risk of accidents and vehicle damage.

Finding Affordable Car Insurance in Washington

Securing affordable car insurance in Washington can be a significant challenge, given the state’s diverse driving conditions and potential for high insurance costs. However, with the right strategies and understanding of available options, you can find a policy that meets your needs without breaking the bank.

Comparison Shopping

Comparison shopping is essential when seeking affordable car insurance. By obtaining quotes from multiple insurance companies, you can compare prices, coverage options, and discounts. Online comparison tools and insurance brokers can streamline this process.

- Use online comparison websites: Many websites allow you to enter your information once and receive quotes from multiple insurance companies. This saves time and effort.

- Contact insurance brokers: Insurance brokers work with multiple companies and can help you find the best policy based on your specific needs.

- Request quotes directly from insurers: Contacting insurance companies directly allows you to ask questions and get personalized quotes.

Negotiating Premiums

Once you’ve gathered quotes, you can negotiate with insurance companies to potentially lower your premiums.

- Discuss your driving record: A clean driving record is a significant factor in determining your premium. If you have a good driving history, emphasize this to the insurer.

- Explore payment options: Paying your premium annually or semi-annually can often result in lower overall costs compared to monthly payments.

- Bundle your policies: Combining your car insurance with other insurance policies, such as homeowners or renters insurance, can lead to discounts.

Discounts

Insurance companies offer various discounts to reduce premiums. Taking advantage of these discounts can significantly impact your overall costs.

- Safe driving discounts: Many insurers offer discounts for drivers with clean driving records, demonstrating safe driving habits.

- Good student discounts: If you are a student with good grades, you may qualify for a discount on your car insurance.

- Multi-car discounts: Insuring multiple vehicles with the same company often results in a discount.

- Anti-theft device discounts: Installing anti-theft devices in your car can lower your premium.

- Loyalty discounts: Staying with the same insurer for a long period can lead to discounts for continued loyalty.

Average Car Insurance Rates in Washington

Here’s a table comparing average car insurance rates for different major insurance companies in Washington State, based on a hypothetical driver profile:

| Insurance Company | Average Annual Premium | Key Features | Coverage Options |

|---|---|---|---|

| Geico | $1,200 | Wide range of discounts, strong customer service | Comprehensive, collision, liability, uninsured/underinsured motorist |

| State Farm | $1,300 | Strong financial stability, extensive agent network | Comprehensive, collision, liability, uninsured/underinsured motorist |

| Progressive | $1,150 | Innovative features, online tools for managing policies | Comprehensive, collision, liability, uninsured/underinsured motorist |

| USAA | $1,050 | Exclusive to military members and families, competitive rates | Comprehensive, collision, liability, uninsured/underinsured motorist |

| Liberty Mutual | $1,250 | Strong financial stability, comprehensive coverage options | Comprehensive, collision, liability, uninsured/underinsured motorist |

Key Considerations for Choosing Car Insurance

Choosing the right car insurance in Washington State involves careful consideration of various factors to ensure you have adequate coverage at a reasonable price. This section will guide you through the essential elements of car insurance selection, helping you make an informed decision.

Factors to Consider When Choosing Car Insurance, Average car insurance washington state

It’s crucial to assess your individual needs and circumstances when selecting car insurance. This checklist will help you navigate the process:

- Coverage Limits: Determine the appropriate liability limits, which cover damages to others’ property or injuries in an accident. Higher limits provide greater protection but come at a higher cost. Consider factors like your assets and driving history.

- Deductibles: A deductible is the amount you pay out of pocket before your insurance kicks in. Lower deductibles mean lower premiums but higher out-of-pocket costs in case of an accident. Evaluate your risk tolerance and financial situation.

- Customer Service: Choose a company with a strong reputation for prompt and helpful customer service. Consider factors like response times, claim handling procedures, and customer satisfaction ratings.

- Discounts: Many insurers offer discounts for safe driving records, good credit scores, multiple car insurance policies, and safety features in your vehicle. Explore these discounts to potentially lower your premium.

- Policy Exclusions: Understand what your policy does not cover. Some common exclusions include damage caused by wear and tear, acts of God, and driving without a valid license.

- Policy Reviews: Regularly review your policy to ensure it still meets your needs. Your insurance needs may change over time, such as when you acquire a new car or your family grows.

Types of Car Insurance Policies

Different types of car insurance policies offer varying levels of coverage. Understanding the benefits and drawbacks of each policy is essential for making an informed decision:

- Liability Insurance: This is the most basic type of car insurance, covering damages to others’ property or injuries caused by your negligence. It’s mandatory in Washington State. However, it doesn’t cover your own vehicle.

- Collision Coverage: This covers damage to your vehicle in an accident, regardless of who’s at fault. It’s optional but highly recommended. This coverage can help you repair or replace your vehicle after an accident.

- Comprehensive Coverage: This covers damage to your vehicle caused by non-collision events, such as theft, vandalism, or natural disasters. It’s optional and can help you protect your vehicle against unexpected events.

- Uninsured/Underinsured Motorist Coverage: This covers your medical expenses and property damage if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. It’s essential to protect yourself from financial losses in such situations.

Understanding Your Car Insurance Policy

Reading and understanding the terms and conditions of your car insurance policy is crucial. The policy Artikels your rights and responsibilities, coverage limits, deductibles, and exclusions.

Pay close attention to the fine print, as it can contain important information about your coverage and potential limitations.

It’s essential to clarify any ambiguities or uncertainties with your insurance agent or company representative to avoid misunderstandings or disputes later.

Resources and Additional Information

Navigating the world of car insurance in Washington State can be overwhelming, but with the right resources, you can make informed decisions and ensure you have the coverage you need. This section provides valuable links, contact information, and answers to common questions to guide you through the process.

Online Resources for Quotes, Comparisons, and Claims

The internet offers a wealth of resources for obtaining car insurance quotes, comparing rates, and filing claims. Here are some reputable websites you can utilize:

- Washington State Office of the Insurance Commissioner (OIC): The OIC website provides a comprehensive guide to car insurance in Washington, including information on consumer rights, filing complaints, and finding licensed insurance agents. [link to OIC website]

- Insurance Comparison Websites: Websites like [website name 1], [website name 2], and [website name 3] allow you to compare quotes from multiple insurance providers, saving you time and effort.

- Individual Insurance Provider Websites: Many insurance companies have user-friendly websites where you can obtain quotes, manage your policy, and file claims online.

Contact Information for the Washington State Office of the Insurance Commissioner

The Washington State Office of the Insurance Commissioner (OIC) plays a crucial role in protecting consumer rights and resolving insurance disputes. They are your advocate when dealing with insurance companies. You can reach them at:

- Website: [link to OIC website]

- Phone: [OIC phone number]

- Email: [OIC email address]

- Mailing Address: [OIC mailing address]

Commonly Asked Questions about Car Insurance in Washington State

- What is the minimum car insurance coverage required in Washington State? Washington State requires drivers to carry liability insurance with minimum coverage limits of $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $10,000 for property damage. However, it’s highly recommended to consider higher coverage limits to protect yourself financially in the event of an accident.

- What factors affect my car insurance rates in Washington State? Several factors influence your car insurance rates, including your driving history, age, gender, vehicle type, location, and credit score. Understanding these factors can help you make choices that may lower your premiums.

- How can I find affordable car insurance in Washington State? There are various ways to find affordable car insurance, including comparing quotes from multiple providers, exploring discounts, maintaining a good driving record, and considering higher deductibles.

- What are the different types of car insurance coverage available in Washington State? Car insurance policies offer various types of coverage, including liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection. Choosing the right coverage depends on your individual needs and risk tolerance.

- What should I do if I need to file a car insurance claim in Washington State? If you need to file a claim, contact your insurance company immediately. Provide them with all the necessary information, including details of the accident, any injuries, and damage to your vehicle. They will guide you through the claims process.

Closure

By understanding the factors that influence car insurance premiums in Washington State, you can proactively take steps to lower your costs and secure the right coverage for your needs. Remember, comparing quotes from multiple insurers, exploring available discounts, and staying informed about your policy are essential steps to ensure you have the protection you need at a price you can afford.

Key Questions Answered

What is the minimum car insurance coverage required in Washington State?

Washington State requires drivers to carry liability coverage, including bodily injury liability, property damage liability, and uninsured motorist coverage.

How often should I review my car insurance policy?

It’s recommended to review your car insurance policy at least annually, or whenever there are significant life changes, such as a new car purchase, a change in your driving record, or a move to a new location.

What are some common car insurance discounts available in Washington?

Common discounts include safe driver discounts, good student discounts, multi-car discounts, and anti-theft device discounts.

What is the role of the Washington State Office of the Insurance Commissioner?

The Washington State Office of the Insurance Commissioner protects consumer rights, regulates insurance companies, and resolves insurance disputes.