Average car insurance cost washington state – Average car insurance cost in Washington State is influenced by a variety of factors, including your driving history, vehicle type, and coverage options. Understanding these factors can help you make informed decisions about your car insurance and potentially save money.

The average cost of car insurance in Washington can vary significantly depending on your individual circumstances. For example, a young driver with a poor driving record will likely pay more than an older driver with a clean driving record. Similarly, the type of vehicle you drive can also affect your insurance costs. Sports cars and luxury vehicles tend to be more expensive to insure than standard sedans.

Understanding Car Insurance Costs in Washington State

Car insurance costs in Washington State, like anywhere else, are influenced by a variety of factors. These factors determine your individual risk profile, which in turn affects the premium you pay. Understanding these factors can help you make informed decisions to potentially lower your insurance costs.

Factors Influencing Car Insurance Costs

Several factors play a role in determining car insurance costs in Washington State. These include:

- Driving History: Your driving record, including accidents, violations, and DUI convictions, is a significant factor. A clean record typically translates to lower premiums, while a history of accidents or violations will likely lead to higher rates.

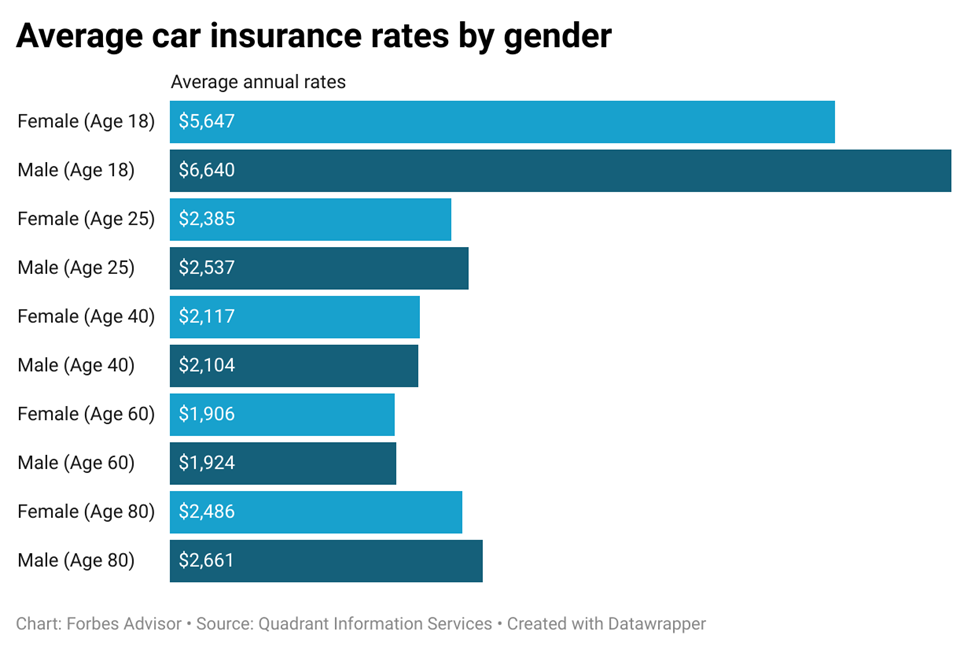

- Age and Gender: Younger and inexperienced drivers are statistically more likely to be involved in accidents, leading to higher premiums. Similarly, insurance companies often consider gender as a factor, though this practice is becoming less common due to regulatory changes.

- Vehicle Type: The type of vehicle you drive is a major factor. Sports cars, luxury vehicles, and high-performance cars are often considered riskier and therefore attract higher premiums.

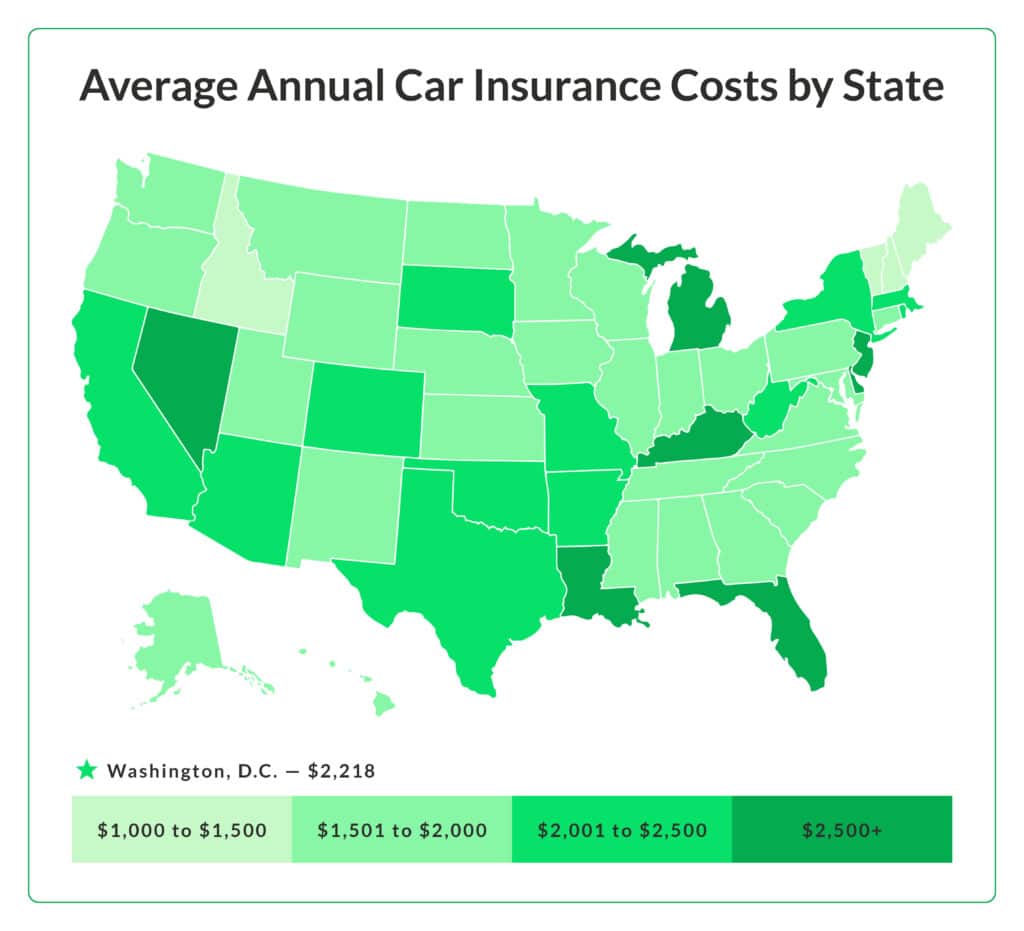

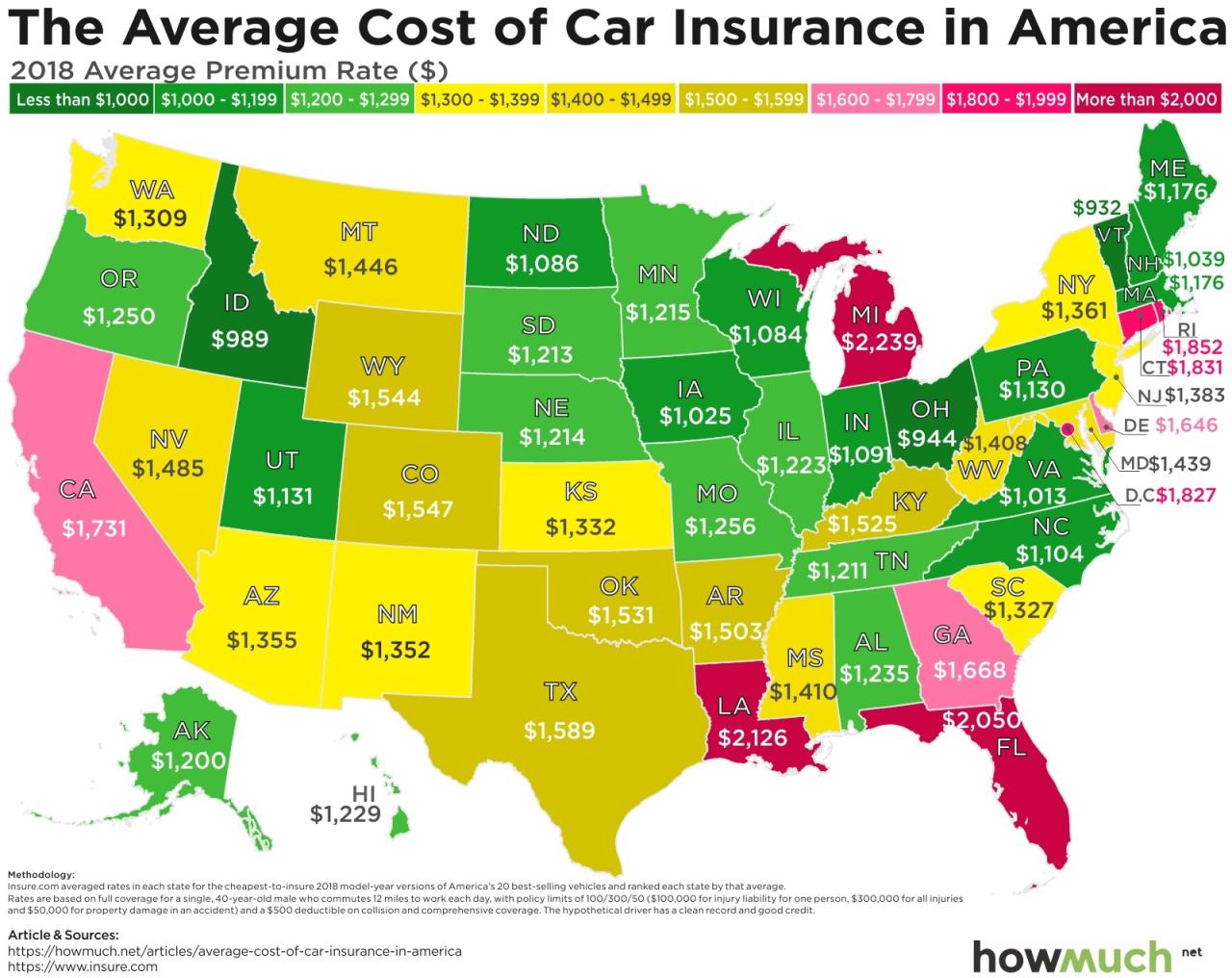

- Location: Where you live can impact your insurance costs. Areas with higher crime rates or more traffic congestion may have higher insurance premiums due to the increased risk of accidents.

- Credit Score: In some states, including Washington, insurance companies may consider your credit score as a factor in determining your rates. This is based on the assumption that people with good credit are more financially responsible and less likely to file claims.

- Coverage Options: The type and amount of coverage you choose will also affect your premium. Comprehensive and collision coverage, which protect against damage to your vehicle, typically come with higher premiums compared to liability coverage, which only covers damages to other vehicles or individuals.

- Discounts: Several discounts can help reduce your insurance premiums. These include discounts for good driving records, safe driving courses, anti-theft devices, and bundling multiple insurance policies with the same company.

Major Components of Car Insurance Costs

The overall cost of car insurance is comprised of several key components:

- Administrative Costs: These include expenses related to running the insurance company, such as salaries, marketing, and technology.

- Claims Costs: This is the largest component of insurance costs and represents the money paid out for claims filed by policyholders.

- Profit Margin: Insurance companies aim to make a profit, and this is reflected in the premiums they charge.

- Reinsurance Costs: Insurance companies may purchase reinsurance to protect themselves against catastrophic events. The cost of reinsurance is passed on to policyholders in the form of higher premiums.

- State Taxes and Fees: State governments impose taxes and fees on insurance premiums, which contribute to the overall cost.

Role of State Regulations and Laws

State regulations and laws play a crucial role in shaping insurance rates. Washington State has specific laws and regulations that govern the insurance industry, including:

- Minimum Coverage Requirements: The state mandates minimum liability coverage requirements for all drivers, ensuring that all drivers have adequate financial protection in case of an accident.

- Rate Regulation: Washington State has a regulated insurance market, meaning that insurance rates are subject to review and approval by the state insurance commissioner. This helps ensure that rates are fair and reasonable.

- Consumer Protection Laws: The state has laws in place to protect consumers from unfair or deceptive insurance practices. These laws provide recourse for policyholders who feel they have been treated unfairly.

Average Car Insurance Premiums in Washington

Understanding the average car insurance premiums in Washington can help you estimate your potential costs and make informed decisions about your coverage. This information is essential for budgeting and comparing different insurance providers.

Average Premiums by Vehicle Type

The average annual car insurance premium in Washington varies depending on the type of vehicle you drive. Here’s a breakdown of average premiums for common vehicle types:

| Vehicle Type | Average Annual Premium |

|---|---|

| Sedan | $1,500 – $2,000 |

| SUV | $1,800 – $2,500 |

| Truck | $2,000 – $3,000 |

Average Premiums by Driver Profile

Your personal characteristics also influence your car insurance premiums. Here’s how different driver profiles can impact your costs:

Age

Younger drivers generally pay higher premiums due to their higher risk of accidents. As you age and gain more driving experience, your premiums tend to decrease.

Driving History

Drivers with a clean driving record and no accidents or violations typically pay lower premiums. Conversely, drivers with a history of accidents, speeding tickets, or DUI convictions can expect higher premiums.

Credit Score

Your credit score can surprisingly affect your car insurance premiums. Insurers use credit scores as a proxy for risk assessment, with individuals with good credit scores often receiving lower premiums.

Factors Affecting Individual Car Insurance Rates

Your driving history, the type of car you drive, and the coverage you choose all play a significant role in determining your car insurance premiums. Understanding these factors can help you make informed decisions to potentially lower your costs.

Driving History

Your driving record is a primary factor in calculating your insurance premiums. Insurance companies view drivers with a clean record as less risky and, therefore, offer them lower rates. Here’s how past driving incidents can affect your premiums:

- Accidents: Even a single accident can significantly increase your insurance premiums. The severity of the accident and your level of fault will determine the impact on your rates.

- Traffic Tickets: Speeding tickets, reckless driving citations, and other traffic violations can also lead to higher premiums. The more violations you have, the higher your risk profile and the more expensive your insurance will be.

- DUI/DWI: A DUI or DWI conviction can result in extremely high insurance premiums or even denial of coverage. These offenses demonstrate a significant risk to insurance companies.

Vehicle Safety Features and Age

The safety features and age of your car can also influence your insurance premiums. Insurance companies generally offer lower rates for vehicles with advanced safety features and newer models:

- Safety Features: Cars equipped with features like anti-lock brakes (ABS), electronic stability control (ESC), and airbags are considered safer and therefore attract lower insurance premiums.

- Vehicle Age: Newer cars tend to have more safety features and are less likely to be involved in accidents. As a result, they often have lower insurance premiums than older vehicles.

Coverage Options

The types of coverage you choose will directly affect your insurance premiums. Here’s a breakdown of common coverage options and their impact on your costs:

- Liability Coverage: This coverage protects you financially if you are responsible for an accident that injures someone or damages their property. Higher liability limits will generally lead to higher premiums, but they provide greater financial protection in case of a serious accident.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault. Choosing a higher deductible can lower your premium, but you’ll be responsible for paying more out of pocket in case of an accident.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, or natural disasters. Similar to collision coverage, a higher deductible can lower your premium.

Strategies to Lower Car Insurance Costs

In Washington State, car insurance premiums can vary significantly. Understanding the factors that influence your rates can help you implement strategies to lower your costs. There are various ways to reduce your car insurance premiums, from choosing the right coverage to maintaining a good driving record.

Lowering Car Insurance Premiums

Here are some practical tips for reducing your car insurance premiums:

- Shop Around for Quotes: Compare quotes from multiple insurance companies to find the best rates for your needs. Online comparison tools can make this process easier.

- Increase Your Deductible: A higher deductible means you pay more out-of-pocket in the event of an accident, but it can lead to lower premiums. Consider your financial situation and risk tolerance when deciding on your deductible.

- Choose a Safer Car: Cars with better safety features and lower repair costs generally have lower insurance premiums. Research car safety ratings before making a purchase.

- Maintain a Good Driving Record: Avoid traffic violations and accidents, as these can significantly increase your premiums.

- Take Defensive Driving Courses: Completing a defensive driving course can demonstrate your commitment to safe driving and may qualify you for discounts.

- Bundle Your Policies: Combining your auto insurance with other policies, such as homeowners or renters insurance, can often lead to discounts.

- Pay Your Premiums on Time: Late payments can negatively impact your credit score and potentially increase your insurance rates.

- Consider Discounts: Many insurance companies offer discounts for various factors, such as good student status, being a member of certain organizations, or having anti-theft devices installed in your car.

Benefits of Bundling Insurance Policies

Bundling your auto insurance with other policies, such as homeowners or renters insurance, can offer significant financial benefits:

- Discounts: Insurance companies often provide discounts for bundling multiple policies. This can save you a considerable amount of money on your premiums.

- Convenience: Having all your insurance policies with one company simplifies your insurance management. You only have one point of contact for claims and billing.

- Potential for Better Rates: Bundling can sometimes lead to lower overall premiums compared to purchasing individual policies.

Maintaining a Good Driving Record and Credit Score

A good driving record and credit score are crucial for obtaining lower car insurance premiums:

- Driving Record: Avoid traffic violations and accidents, as these can significantly increase your premiums. A clean driving record demonstrates responsible driving habits, which insurance companies value.

- Credit Score: Your credit score is often considered by insurance companies when determining your premiums. A good credit score indicates financial responsibility, which can lead to lower rates.

Resources for Obtaining Car Insurance Quotes: Average Car Insurance Cost Washington State

Getting car insurance quotes is an essential step in finding the best coverage at the most affordable price. You can easily compare quotes from different insurance providers and choose the policy that best suits your needs and budget.

Reputable Car Insurance Providers in Washington State

Several reputable car insurance providers operate in Washington State, offering a variety of coverage options and pricing structures. It’s important to research and compare quotes from multiple providers to find the best deal.

- State Farm: State Farm is one of the largest insurance providers in the US, offering comprehensive car insurance coverage in Washington. They have a strong reputation for customer service and competitive pricing.

- Geico: Known for its popular commercials, Geico is another major car insurance provider in Washington. They offer competitive rates and a user-friendly online quoting system.

- Progressive: Progressive is known for its personalized insurance options and its “Name Your Price” tool, which allows customers to set their desired price and find policies that fit their budget.

- Liberty Mutual: Liberty Mutual offers a wide range of insurance products, including car insurance. They are known for their strong financial stability and customer service.

- USAA: USAA is a military-focused insurance provider, offering competitive rates and excellent customer service to active military personnel, veterans, and their families.

Tips for Comparing Insurance Quotes

When comparing car insurance quotes, it’s crucial to consider various factors to ensure you’re getting the best deal.

- Compare Coverage Options: Each insurance provider offers different coverage options, so it’s essential to compare them side-by-side. Make sure you understand the different types of coverage, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Consider Deductibles: Deductibles are the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles usually result in lower premiums, but you’ll have to pay more in case of an accident.

- Check for Discounts: Many insurance providers offer discounts for good driving records, safety features, multiple policy bundling, and other factors. Ask about available discounts to potentially reduce your premiums.

- Read Reviews: Before choosing an insurance provider, it’s a good idea to read reviews from other customers to get an idea of their experiences. Look for reviews on websites like Yelp, Trustpilot, and Consumer Reports.

- Get Multiple Quotes: Don’t settle for the first quote you receive. Get quotes from several insurance providers to ensure you’re getting the best price.

Insurance Provider Contact Information, Average car insurance cost washington state

| Insurance Provider | Contact Information | Website Address |

|---|---|---|

| State Farm | 1-800-STATE-FARM (1-800-782-8332) | https://www.statefarm.com/ |

| Geico | 1-800-432-5426 | https://www.geico.com/ |

| Progressive | 1-800-PROGRESSIVE (1-800-776-4737) | https://www.progressive.com/ |

| Liberty Mutual | 1-800-225-2467 | https://www.libertymutual.com/ |

| USAA | 1-800-531-USAA (1-800-531-8722) | https://www.usaa.com/ |

Last Point

Ultimately, the best way to find affordable car insurance in Washington is to shop around and compare quotes from multiple insurers. By taking the time to understand the factors that influence car insurance costs, you can make informed decisions about your coverage and save money in the process.

Frequently Asked Questions

How often should I review my car insurance rates?

It’s generally a good idea to review your car insurance rates at least once a year, or even more frequently if you experience any major life changes, such as getting married, having a child, or moving to a new state.

What are some common discounts offered by car insurance companies?

Common discounts include safe driver discounts, good student discounts, multi-car discounts, and bundling discounts for combining home and auto insurance.

Can I get car insurance without a credit check?

While some insurers may not require a credit check, many do use credit history as a factor in determining your insurance rates.