Auto insurance state minimum limits are the minimum amounts of coverage required by law in each state. These limits are designed to protect drivers and their passengers in case of an accident, ensuring that there is financial coverage for damages and injuries. While these minimum limits are a starting point, it’s crucial to understand their limitations and consider whether they provide adequate protection in the event of a serious accident.

This guide delves into the intricacies of auto insurance state minimum limits, exploring their purpose, types of coverage, variations across states, and the potential consequences of driving with insufficient coverage. We will also discuss the importance of exceeding state minimum limits to ensure comprehensive financial protection.

Understanding State Minimum Limits

Every state in the U.S. requires drivers to carry a minimum amount of auto insurance. These minimum limits are set by the state government and are designed to ensure that drivers have enough coverage to pay for damages or injuries they might cause to others in an accident.

Purpose of State Minimum Limits

State minimum auto insurance limits serve a crucial purpose by providing a basic level of financial protection for drivers and their victims. They ensure that individuals have adequate coverage to address potential liabilities arising from accidents.

Rationale for Setting Minimum Limits

The rationale behind setting minimum limits is rooted in promoting fairness and protecting innocent parties involved in accidents. By mandating minimum coverage, states aim to:

- Ensure that all drivers have at least a basic level of financial responsibility.

- Prevent individuals from being financially devastated by accidents caused by uninsured or underinsured drivers.

- Reduce the number of uninsured drivers on the road, thereby improving overall road safety.

Consequences of Driving Without Minimum Coverage

Driving without the required minimum auto insurance coverage can have serious consequences. These include:

- Financial Ruin: In case of an accident, you will be personally liable for all damages and injuries, potentially leading to financial ruin.

- License Suspension: Most states will suspend your driver’s license if you are caught driving without insurance. This can significantly disrupt your daily life.

- Fines and Penalties: You may face hefty fines and penalties for violating the law. These penalties can vary depending on the state and the number of offenses.

- Jail Time: In some cases, driving without insurance can even result in jail time, especially if you have a history of offenses.

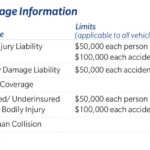

Types of Coverage

State minimum limits usually include a few essential types of coverage, which are designed to protect you financially in case of an accident. These coverages are the bare minimum required by law, and they may not be enough to fully protect you in all situations.

It is important to understand the limitations of each type of coverage and to consider whether additional coverage is necessary for your specific needs. You should always consult with an insurance agent to discuss your individual needs and obtain a comprehensive quote for your auto insurance.

Liability Coverage

Liability coverage protects you from financial responsibility if you cause an accident that injures another person or damages their property. This coverage is usually divided into two parts:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages related to injuries sustained by the other driver or passengers in the other vehicle.

- Property Damage Liability: This coverage pays for repairs or replacement of the other driver’s vehicle or other property damaged in the accident.

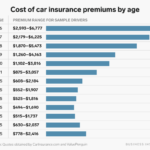

State minimum limits for liability coverage vary widely from state to state. For example, in some states, the minimum limit for bodily injury liability may be $25,000 per person and $50,000 per accident, while in other states, it may be $100,000 per person and $300,000 per accident.

The limitations of minimum liability coverage are that it may not be enough to cover all the damages in a serious accident. If you are found at fault in an accident that results in significant injuries or property damage, the minimum limits may not be sufficient to cover the costs. Additionally, if you are involved in an accident in a state with higher minimum limits, you may be held liable for the difference between the minimum limits in your state and the minimum limits in the state where the accident occurred.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. This coverage is optional in most states, but it is highly recommended if you have a loan or lease on your vehicle.

The limitations of collision coverage are that it has a deductible, which is the amount you must pay out of pocket before your insurance company will cover the remaining costs. Additionally, collision coverage typically does not cover damages caused by events other than collisions, such as hail or vandalism.

Comprehensive Coverage

Comprehensive coverage pays for repairs or replacement of your vehicle if it is damaged by events other than collisions, such as theft, fire, hail, or vandalism. This coverage is also optional in most states, but it is highly recommended if you have a loan or lease on your vehicle.

The limitations of comprehensive coverage are that it has a deductible, which is the amount you must pay out of pocket before your insurance company will cover the remaining costs. Additionally, comprehensive coverage typically does not cover damages caused by collisions or wear and tear.

Variations Across States

State minimum auto insurance limits can vary significantly, and understanding these differences is crucial for drivers to ensure they have adequate coverage.

Minimum limits are established by individual states to ensure basic financial protection for drivers involved in accidents. However, these minimums might not be sufficient to cover all potential expenses, such as medical bills, lost wages, or property damage.

Minimum Limits by State

Here’s a table showcasing minimum liability limits for bodily injury (BI), property damage (PD), and uninsured motorist (UM) coverage in selected states:

| State | Bodily Injury per Person | Bodily Injury per Accident | Property Damage | Uninsured Motorist |

|---|---|---|---|---|

| California | $15,000 | $30,000 | $5,000 | $15,000/$30,000 |

| Florida | $10,000 | $20,000 | $10,000 | $10,000/$20,000 |

| New York | $25,000 | $50,000 | $10,000 | $25,000/$50,000 |

| Texas | $30,000 | $60,000 | $25,000 | $30,000/$60,000 |

This table provides a snapshot of minimum limits in different states, but it’s essential to consult your state’s Department of Motor Vehicles (DMV) for the most up-to-date information.

Factors Influencing Minimum Limits

Several factors influence state-specific minimum auto insurance limits, including:

- Traffic density and accident rates: States with higher traffic volumes and accident rates tend to have higher minimum limits to address potential higher costs associated with accidents.

- Cost of living: States with a higher cost of living, particularly for medical care, may have higher minimum limits to ensure adequate coverage for medical expenses.

- Political climate and legislative priorities: State legislatures can prioritize different aspects of auto insurance, such as affordability versus coverage levels, which can impact minimum limits.

- Lobbying efforts by insurance companies and consumer groups: Insurance companies and consumer advocacy groups can influence legislative decisions regarding minimum limits, advocating for their respective interests.

Financial Responsibility Laws

Financial responsibility laws are state regulations designed to ensure that drivers have the financial means to cover damages caused by accidents they are involved in. These laws are directly tied to state minimum limits for auto insurance, as they mandate that drivers carry at least the minimum coverage to meet financial responsibility requirements.

Penalties for Violating Financial Responsibility Laws

Violating financial responsibility laws can result in serious consequences. These laws aim to protect the public from drivers who lack the financial capacity to compensate for damages they may cause.

- License Suspension: The most common penalty is the suspension of the driver’s license. This prevents the driver from legally operating a vehicle until they comply with financial responsibility requirements.

- Vehicle Registration Suspension: The state may also suspend the vehicle’s registration, preventing it from being driven on public roads.

- Fines and Court Costs: Drivers may face substantial fines and court costs for violating these laws. These penalties vary by state but can be significant.

- Jail Time: In some cases, especially for repeat offenders or serious violations, drivers could face jail time.

Situations Where Minimum Limits Might Be Insufficient

While state minimum limits are designed to provide a basic level of financial protection, they are often insufficient to cover the full extent of damages in serious accidents. Here are some scenarios where minimum limits might not be enough:

- Multiple Injuries: In accidents involving multiple injured individuals, the minimum limits for bodily injury liability may not be enough to cover the medical expenses and lost wages of all victims.

- Significant Property Damage: Accidents involving expensive vehicles or significant property damage, such as damage to a building, can easily exceed the minimum limits for property damage liability.

- Fatalities: In cases of fatalities, the minimum limits for wrongful death coverage may not be sufficient to compensate the surviving family members for their loss.

- High-Value Vehicles: Accidents involving high-value vehicles, such as luxury cars or classic automobiles, can result in significant repair costs that exceed the minimum limits for property damage liability.

Consequences of Insufficient Coverage

Driving without adequate auto insurance can have severe consequences, both financially and legally. In the event of an accident, insufficient coverage can leave you responsible for substantial costs that could financially cripple you. Additionally, failing to meet minimum insurance requirements can lead to legal repercussions, including fines, license suspension, and even jail time.

Financial Implications of Insufficient Coverage

In the event of an accident, drivers with inadequate coverage may face significant financial burdens. This can include:

- Medical Expenses: If you are injured in an accident, your health insurance may not cover all your medical expenses. Without sufficient liability coverage, you could be responsible for the medical bills of the other driver and passengers, which can easily reach tens of thousands of dollars.

- Property Damage: If you are at fault for an accident and cause damage to the other driver’s vehicle, your coverage may not be enough to cover the repairs. You could be left responsible for paying the entire cost of repairs, which can be substantial, especially for newer vehicles.

- Lost Wages: If you are injured and unable to work, you will lose income. Without sufficient coverage, you may not have the financial resources to cover your living expenses.

- Legal Fees: If you are sued by the other driver, you will need to hire an attorney to defend yourself. Legal fees can be substantial, adding to your financial burden.

Legal Ramifications of Driving Without Sufficient Insurance, Auto insurance state minimum limits

Driving without sufficient insurance can have serious legal consequences. These can include:

- Fines: You could face substantial fines for driving without the required insurance. The amount of the fine varies by state, but it can be thousands of dollars.

- License Suspension: Your driver’s license could be suspended until you provide proof of sufficient insurance. This can make it difficult to get to work, school, or other essential activities.

- Jail Time: In some states, driving without insurance is a criminal offense. You could be arrested and sentenced to jail time, even for a first offense.

Importance of Adequate Coverage

While state minimum limits may seem sufficient, exceeding these limits is crucial for comprehensive financial protection in the event of an accident. These minimums often cover only the bare essentials, leaving you vulnerable to significant financial burdens in many scenarios.

Understanding the Risks of Minimum Limits

Minimum limits may not be enough to cover the full cost of damages in a serious accident, leaving you personally liable for the difference. Here are a few scenarios where minimum limits could be inadequate:

- High Medical Expenses: If you or another driver sustains severe injuries requiring extensive medical treatment, minimum limits might not cover the entire cost, leaving you responsible for the remaining expenses.

- Multiple Vehicle Damage: In accidents involving multiple vehicles, the cost of repairs or replacement could easily exceed minimum limits, leaving you responsible for the difference.

- Loss of Income: If you’re unable to work due to injuries, minimum limits might not cover lost wages, putting you in a precarious financial situation.

- Legal Fees: If a lawsuit arises from an accident, legal fees can be substantial, and minimum limits may not cover these costs.

Determining Appropriate Coverage Levels

To determine the appropriate level of insurance coverage, consider the following factors:

- Value of Your Vehicle: Ensure your coverage is sufficient to replace your vehicle if it’s totaled in an accident. Consider factors like depreciation and market value.

- Financial Situation: Assess your ability to cover out-of-pocket expenses in the event of an accident. Higher coverage limits provide greater financial security.

- Driving Habits: If you frequently drive in high-traffic areas or have a history of accidents, consider higher coverage limits to mitigate potential risks.

- Family Circumstances: If you have dependents or a family to support, higher coverage limits are essential to protect them financially in the event of an accident.

Closing Notes: Auto Insurance State Minimum Limits

Understanding auto insurance state minimum limits is essential for all drivers. By being aware of these limits and their implications, you can make informed decisions about your insurance coverage, ensuring adequate protection for yourself and others. Remember, while state minimum limits are a starting point, exceeding them can provide greater peace of mind and financial security in the event of an accident.

FAQ Corner

What happens if I get into an accident and don’t have enough insurance coverage?

You could be held personally liable for the damages and injuries caused. This means you could face significant financial losses, legal action, and even the loss of your driver’s license.

How do I know if my current insurance coverage meets the state minimum limits?

Check your insurance policy documents or contact your insurance agent. They can provide you with the details of your coverage and explain if it meets the state minimum requirements.

Can I choose to have more coverage than the state minimum limits?

Absolutely! You can choose to purchase higher coverage limits to provide greater financial protection in case of an accident. This is generally recommended, especially if you have a new car, a high-value vehicle, or a family to protect.

What factors should I consider when determining my insurance coverage?

Consider your financial situation, the value of your vehicle, your driving history, and your personal risk tolerance. It’s also a good idea to consult with an insurance agent to discuss your specific needs and options.