Auto insurance state regulations are crucial for understanding the financial responsibility you hold as a driver. From minimum coverage requirements to fault vs. no-fault systems, these regulations shape the landscape of auto insurance across the country. The specific rules and regulations of your state play a significant role in determining the types of coverage you need, the premiums you pay, and the financial implications of accidents.

This comprehensive guide delves into the intricacies of auto insurance state regulations, exploring key factors that influence your premiums, and providing valuable insights into finding the best coverage for your needs. We’ll break down different types of auto insurance coverage, highlight state-specific programs, and offer practical tips for navigating the complex world of auto insurance.

Auto Insurance State Regulations

State governments play a crucial role in regulating the auto insurance industry. This ensures that consumers are protected and that the industry operates fairly and responsibly. These regulations cover various aspects of auto insurance, including minimum coverage requirements, financial responsibility laws, and dispute resolution processes.

Minimum Coverage Requirements

States have different minimum coverage requirements for auto insurance. This is the amount of coverage that drivers must have to legally operate a vehicle. These requirements typically include:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages to other people if you are at fault in an accident.

- Property Damage Liability: This coverage pays for damage to other people’s property if you are at fault in an accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured.

Fault vs. No-Fault Systems

States also differ in their approach to fault determination in auto accidents.

- Fault Systems: In fault systems, the driver who is at fault for the accident is responsible for paying for the damages. These states typically have a tort system, which allows accident victims to sue the at-fault driver for damages.

- No-Fault Systems: In no-fault systems, each driver’s insurance company pays for their own damages, regardless of who was at fault. These states typically have a “personal injury protection” (PIP) system, which provides coverage for medical expenses and lost wages.

Financial Responsibility Laws

Financial responsibility laws require drivers to prove they can pay for damages they cause in an accident. States typically have several ways to meet this requirement, such as:

- Auto Insurance: Purchasing auto insurance with the required minimum coverage is the most common way to meet financial responsibility requirements.

- Surety Bond: Drivers can post a surety bond with the state to demonstrate their ability to pay for damages.

- Cash Deposit: Some states allow drivers to deposit a certain amount of cash with the state to meet financial responsibility requirements.

Factors Influencing Auto Insurance Premiums

Auto insurance premiums are determined by a complex interplay of factors, and understanding these factors can help you make informed decisions to potentially lower your costs.

Driving History

Your driving history is a significant factor in determining your auto insurance premium. Insurance companies assess your driving record to gauge your risk of accidents.

- Accidents and Violations: A history of accidents, particularly at-fault accidents, can significantly increase your premium. Similarly, traffic violations like speeding tickets or DUI convictions will also raise your rates.

- Years of Driving Experience: Newer drivers, especially those with less than five years of experience, are generally considered higher risk due to their lack of experience. This often translates into higher premiums for younger drivers.

- Claims History: The number of claims you’ve filed in the past, even if you weren’t at fault, can impact your premium. Insurance companies may view a history of claims as an indicator of potentially riskier driving habits.

Vehicle Type

The type of vehicle you drive plays a crucial role in determining your auto insurance premium. Insurance companies consider factors like the vehicle’s make, model, year, and safety features.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, are generally considered safer and may qualify for lower premiums.

- Vehicle Value: Higher-value vehicles are more expensive to repair or replace in the event of an accident, leading to higher premiums. Sports cars and luxury vehicles often fall into this category.

- Vehicle Theft Risk: Certain vehicle models are more prone to theft, and insurance companies factor this risk into their premium calculations.

Demographics

Demographic factors, such as your age, gender, and location, can also influence your auto insurance premium.

- Age: Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents, resulting in higher premiums. However, premiums often decrease with age as drivers gain experience and become more responsible.

- Gender: Historically, men have been statistically more likely to be involved in accidents than women, leading to slightly higher premiums for men in some states. However, this trend is changing, and some states have moved towards gender-neutral pricing.

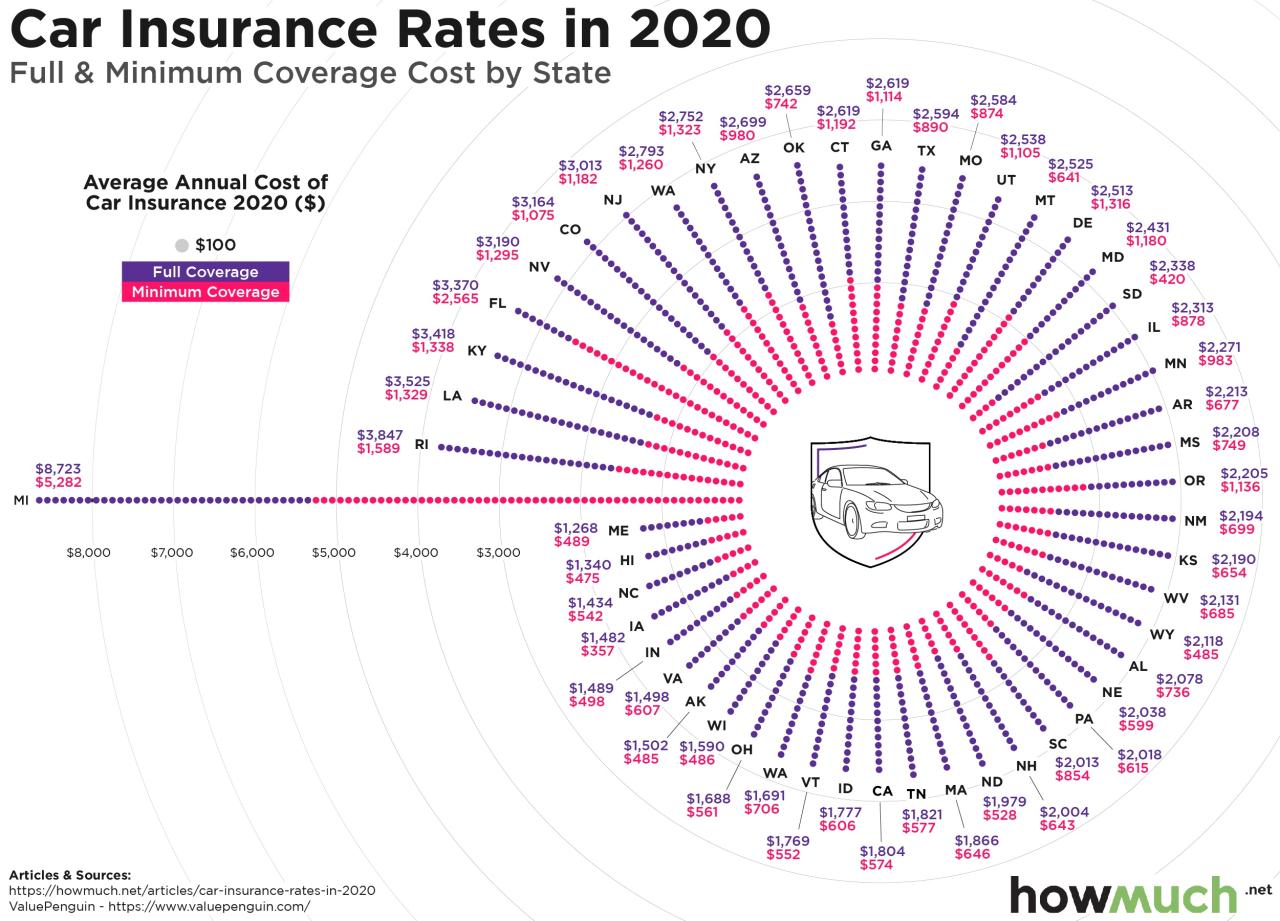

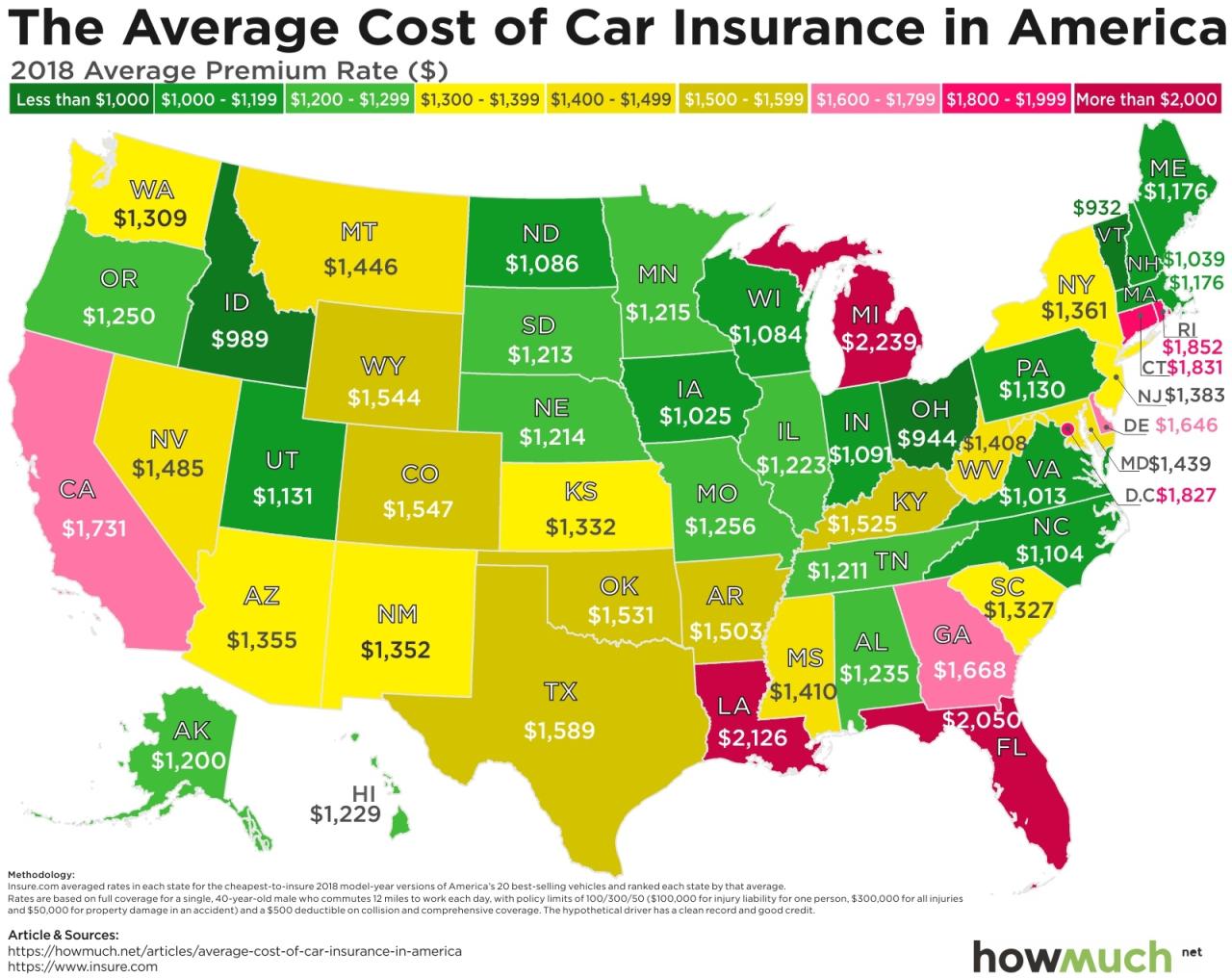

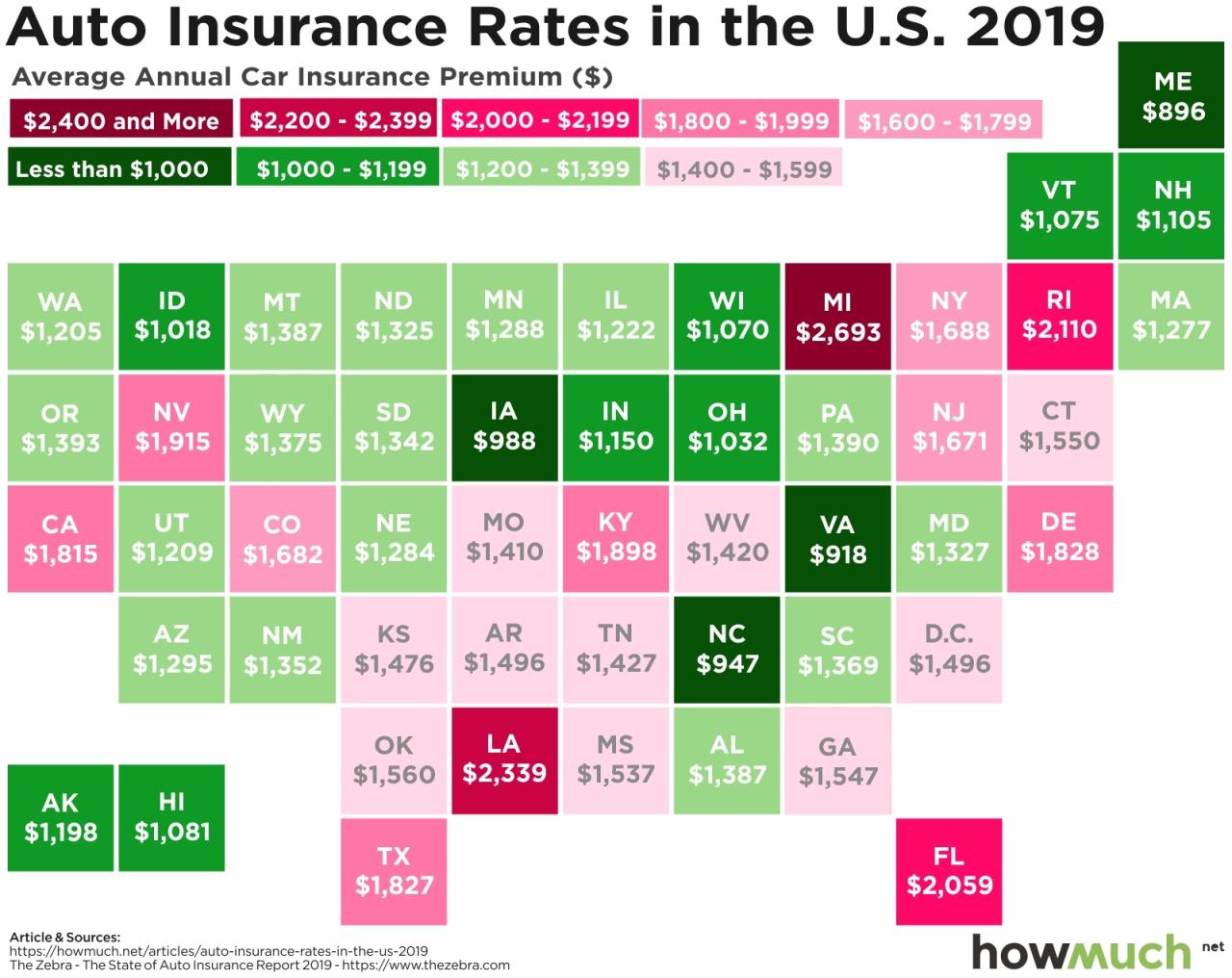

- Location: Your geographic location, including your city, state, and zip code, can significantly impact your premium. Areas with higher crime rates, traffic congestion, and accident frequencies generally have higher insurance rates.

State-Specific Risk Factors

State-specific risk factors, such as weather conditions and traffic density, can also play a role in determining auto insurance premiums.

- Weather Conditions: States with severe weather conditions, such as hurricanes, tornadoes, or heavy snowfall, may have higher insurance rates due to the increased risk of accidents and damage.

- Traffic Density: Areas with high traffic density, such as major cities, often have higher insurance rates due to the increased risk of accidents.

Types of Auto Insurance Coverage

Auto insurance policies offer a range of coverage options designed to protect you financially in the event of an accident or other covered incident. Understanding the different types of coverage and their benefits is crucial for making informed decisions about your insurance needs.

Liability Coverage

Liability coverage is the most fundamental type of auto insurance and is typically required by law in most states. It protects you financially if you cause an accident that results in injuries or property damage to others. This coverage can pay for:

- Bodily injury liability: Covers medical expenses, lost wages, and pain and suffering for injuries caused to others in an accident you caused.

- Property damage liability: Covers the cost of repairs or replacement of property damaged in an accident you caused, such as another vehicle, a building, or a fence.

Liability coverage is typically expressed as a limit, such as 25/50/25. This means the policy will cover up to $25,000 per person for bodily injury, up to $50,000 per accident for bodily injury, and up to $25,000 per accident for property damage.

It is important to note that liability coverage protects you from financial responsibility for damages you cause to others, but it does not cover your own vehicle or injuries.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it is damaged in an accident with another vehicle or object, regardless of who is at fault. This coverage is optional, but it is often recommended if you have a loan or lease on your vehicle, as the lender may require it.

- For example, if you hit a parked car and damage your own vehicle, collision coverage would pay for the repairs or replacement of your vehicle.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than collisions, such as:

- Theft

- Vandalism

- Fire

- Hail

- Flooding

- Windstorms

This coverage is also optional, but it can be valuable for protecting your investment in your vehicle.

For example, if your car is stolen or damaged by a hailstorm, comprehensive coverage would pay for the repairs or replacement of your vehicle.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you are injured in an accident caused by a driver who is uninsured or has insufficient insurance. This coverage can pay for:

- Medical expenses

- Lost wages

- Pain and suffering

UM/UIM coverage is typically optional, but it is strongly recommended as it can provide crucial financial protection in the event of an accident with an uninsured or underinsured driver.

For example, if you are hit by a driver who has no insurance and you suffer injuries, UM coverage would help pay for your medical expenses and other related costs.

Personal Injury Protection (PIP)

Personal injury protection (PIP) coverage, also known as no-fault insurance, pays for your medical expenses and lost wages, regardless of who is at fault in an accident. This coverage is mandatory in some states and optional in others.

- PIP coverage is typically limited to a certain amount, such as $10,000 or $25,000.

Medical Payments Coverage, Auto insurance state

Medical payments coverage (MedPay) pays for your medical expenses, regardless of who is at fault in an accident. This coverage is optional and typically has a lower limit than PIP coverage.

- MedPay coverage is often used to supplement health insurance or to cover medical expenses that are not covered by health insurance.

Rental Reimbursement Coverage

Rental reimbursement coverage pays for the cost of renting a vehicle while your vehicle is being repaired after an accident. This coverage is optional and can be very helpful if you rely on your vehicle for transportation.

- The coverage typically has a daily limit and a maximum amount that it will pay.

Towing and Labor Coverage

Towing and labor coverage pays for the cost of towing your vehicle to a repair shop after an accident or breakdown. This coverage is optional and can be helpful in avoiding unexpected expenses.

- The coverage typically has a limit on the amount it will pay for towing and labor.

Finding the Best Auto Insurance in a State

Finding the best auto insurance policy for your needs can be a daunting task, but it’s crucial to ensure you have adequate coverage at a reasonable price. With a little research and careful comparison, you can find a policy that fits your budget and provides the protection you need.

Steps to Find the Best Auto Insurance

Finding the best auto insurance policy involves a systematic approach. Here’s a step-by-step guide to help you navigate the process:

- Assess Your Needs: Before you start comparing quotes, take some time to evaluate your individual needs and circumstances. Consider factors like your driving history, the type of vehicle you own, the amount of coverage you require, and your budget. This will help you narrow down your search and identify policies that align with your specific requirements.

- Gather Quotes: Once you have a clear understanding of your needs, it’s time to start gathering quotes from different insurance companies. You can do this online, by phone, or by visiting an insurance agent in person. Make sure to provide accurate information to all insurers so you receive accurate quotes.

- Compare Quotes: After gathering quotes, carefully compare the different policies and their coverage options. Pay attention to the premiums, deductibles, and limits for each policy. You can use a comparison website or spreadsheet to organize the information and make side-by-side comparisons.

- Read Policy Details: Don’t just focus on the price; take the time to read the policy documents carefully. Pay attention to the coverage details, exclusions, and any limitations. This will help you understand what you are covered for and what you are not.

- Check Company Reputation: Before making a decision, research the financial stability and customer service reputation of the insurance companies you are considering. You can check online reviews, ratings from independent organizations like J.D. Power, and the company’s financial health ratings from agencies like A.M. Best.

- Consider Discounts: Many insurance companies offer discounts for various factors, such as good driving records, safety features in your vehicle, and bundling multiple insurance policies. Ask about available discounts and make sure you are taking advantage of all that apply to you.

- Negotiate: Don’t be afraid to negotiate the price of your policy. If you have a good driving record and are willing to increase your deductible, you may be able to lower your premium. You can also try to negotiate a better rate if you are bundling multiple policies with the same insurer.

Tips for Comparing Quotes

Comparing quotes effectively is crucial to finding the best auto insurance policy. Here are some helpful tips to guide your comparison process:

- Use Comparison Websites: Comparison websites can streamline the quote gathering process. They allow you to enter your information once and receive quotes from multiple insurers.

- Be Consistent: When comparing quotes, make sure you are using the same information for each insurer. This includes your driving history, vehicle details, coverage options, and deductibles.

- Look Beyond Price: While price is an important factor, don’t solely focus on the cheapest option. Consider the overall value of the policy, including coverage, customer service, and the insurer’s financial stability.

Negotiating Rates

Negotiating your auto insurance rate can help you save money. Here are some strategies to consider:

- Shop Around: Don’t settle for the first quote you receive. Get quotes from multiple insurers and compare their rates.

- Bundle Policies: Bundling your auto insurance with other policies, such as homeowners or renters insurance, can often result in discounts.

- Increase Your Deductible: Raising your deductible can lower your premium. However, make sure you can afford to pay the deductible in case of an accident.

- Improve Your Driving Record: Maintaining a clean driving record can lead to lower premiums. Avoid traffic violations and accidents.

- Ask About Discounts: Inquire about available discounts, such as those for good students, safe drivers, or vehicle safety features.

- Be Prepared to Switch: If you are not satisfied with your current insurer’s rate, be prepared to switch to another company.

Factors to Consider Beyond Price

While price is a significant factor, it’s essential to consider other factors beyond the cost of your auto insurance policy.

- Customer Service: Choose an insurer known for providing excellent customer service. You want a company that is responsive to your needs and will assist you efficiently when you need to file a claim.

- Claims Handling: Research the insurer’s claims handling process. Look for companies that have a reputation for handling claims fairly and promptly.

- Financial Stability: Consider the insurer’s financial stability. You want to make sure the company can pay out claims if you need to file one. Check the insurer’s financial ratings from organizations like A.M. Best.

State-Specific Auto Insurance Programs

Many states have implemented programs and initiatives to address specific needs within their auto insurance markets. These programs aim to provide affordable coverage options, promote safe driving practices, and ensure equitable access to insurance for all residents.

Low-Cost Auto Insurance Options

Several states offer low-cost auto insurance programs to assist drivers with limited financial resources. These programs typically provide subsidized premiums or discounts to eligible individuals.

- Eligibility Criteria: Eligibility for these programs often depends on factors such as income level, household size, and driving history. Drivers may need to meet specific requirements, such as having a clean driving record or completing a defensive driving course.

- Benefits: These programs can significantly reduce insurance premiums, making coverage more affordable for low-income drivers. This can help individuals maintain financial stability and ensure they have adequate insurance protection.

Driver Education Programs

States recognize the importance of driver education in promoting safe driving habits. Many offer programs designed to educate new drivers and enhance the skills of experienced drivers.

- Eligibility Criteria: Driver education programs are often open to all residents, with specific programs targeting young drivers, seniors, or individuals with specific driving needs.

- Benefits: These programs can help drivers develop essential skills, such as defensive driving techniques, hazard awareness, and safe vehicle operation. By promoting responsible driving practices, these programs can contribute to a reduction in accidents and insurance claims.

Examples of Successful State-Level Programs

Several states have implemented successful programs that have positively impacted their auto insurance markets. For instance, the “Good Driver Discount Program” in California offers discounts to drivers with clean driving records, encouraging safe driving habits and rewarding responsible behavior. This program has contributed to a decrease in accidents and a reduction in insurance premiums for eligible drivers.

Final Wrap-Up

By understanding the complexities of auto insurance state regulations and the factors that influence your premiums, you can make informed decisions to secure the best coverage for your needs. Remember, comparing quotes, considering customer service, and understanding your state’s specific programs are essential steps towards finding the right auto insurance policy. Take the time to research and evaluate your options, and drive with peace of mind knowing you have the appropriate protection.

Questions and Answers: Auto Insurance State

What are the minimum coverage requirements in my state?

Minimum coverage requirements vary by state. It’s essential to check your state’s Department of Motor Vehicles website for specific requirements.

How can I lower my auto insurance premiums?

You can potentially lower your premiums by maintaining a good driving record, choosing a safe vehicle, increasing your deductible, bundling insurance policies, and exploring discounts offered by your insurer.

What does uninsured/underinsured motorist coverage protect me from?

This coverage protects you if you’re involved in an accident with a driver who is uninsured or underinsured. It covers your medical expenses, lost wages, and property damage.