Auto insurance quotes by state can vary significantly, influenced by a complex interplay of factors. From state-specific regulations and driving laws to individual risk profiles, understanding these differences is crucial for securing the best possible rates. This article explores the key factors that determine auto insurance costs across states, providing valuable insights for informed decision-making.

The cost of auto insurance is a significant expense for most drivers, and understanding how it’s calculated is essential. State regulations, driving history, vehicle type, and even the weather patterns can all influence the final price. By comparing quotes from different insurers and understanding the factors that impact costs, drivers can make informed decisions and potentially save money on their insurance premiums.

Understanding Auto Insurance Quotes by State

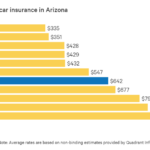

Auto insurance rates can vary significantly from state to state, and understanding the factors that contribute to these differences is crucial for finding the best coverage at the most affordable price. Several factors influence auto insurance quotes, including state regulations, driving laws, and local risk factors.

State Regulations and Their Impact on Insurance Costs

State regulations play a significant role in shaping auto insurance costs. These regulations dictate various aspects of insurance, including minimum coverage requirements, rate setting, and the availability of certain coverage options. Here’s a closer look at how state regulations impact insurance premiums:

- Minimum Coverage Requirements: States have different minimum coverage requirements for auto insurance. These requirements, often referred to as “financial responsibility laws,” specify the minimum amounts of coverage drivers must carry for bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage. States with higher minimum coverage requirements generally have higher average insurance premiums because drivers are required to carry more coverage. For example, in states with higher minimum coverage requirements for bodily injury liability, insurance companies must offer policies with higher limits, leading to higher premiums.

- Rate Setting: States have different approaches to rate setting. Some states allow insurance companies to set rates based on factors such as age, driving history, and credit score, while others have stricter regulations that limit the use of these factors. States with more restrictive rate-setting regulations often have lower average insurance premiums because insurance companies have less flexibility in pricing policies. For example, states that prohibit the use of credit scores in rate setting may have lower premiums compared to states that allow it.

- Availability of Coverage Options: States also vary in the types of coverage they require or allow. For instance, some states require or allow coverage for uninsured/underinsured motorist (UM/UIM) coverage, while others do not. States with mandatory UM/UIM coverage often have higher average premiums due to the added coverage requirement. Additionally, some states allow insurance companies to offer specific types of coverage, such as “ride-sharing coverage” or “electric vehicle coverage,” which can affect premiums in those areas.

Key Factors Affecting Auto Insurance Quotes

Getting the best possible auto insurance rate requires understanding the factors that influence your premium. These factors vary from state to state, but some key elements remain consistent across the country.

Vehicle Type

The type of vehicle you drive significantly impacts your insurance premium. Insurance companies assess vehicles based on several factors:

- Safety Features: Cars with advanced safety features, such as anti-lock brakes, airbags, and stability control, generally receive lower premiums. These features reduce the risk of accidents and injuries, leading to lower insurance costs for the insurer.

- Repair Costs: Vehicles with expensive parts or complex repair procedures often have higher insurance premiums. For example, luxury cars or high-performance vehicles are often more expensive to repair, resulting in higher insurance costs.

- Theft Risk: Vehicles with a higher risk of theft tend to have higher insurance premiums. For example, popular models or vehicles with desirable features are more likely to be targeted by thieves, leading to increased insurance costs.

- Value: The value of your vehicle also plays a role in determining your premium. More expensive vehicles generally have higher premiums due to the higher cost of replacement or repair in case of an accident.

Driving History

Your driving history is one of the most significant factors affecting your auto insurance rates. Insurance companies consider your past driving record to assess your risk as a driver.

- Accidents: A history of accidents, especially at-fault accidents, significantly increases your insurance premium. Insurance companies view drivers with a history of accidents as higher risk and charge accordingly.

- Traffic Violations: Traffic violations, such as speeding tickets or reckless driving citations, also impact your premium. These violations indicate a higher risk of future accidents, leading to increased insurance costs.

- DUI/DWI Convictions: Driving under the influence (DUI) or driving while intoxicated (DWI) convictions have the most significant impact on your insurance premium. These convictions indicate a serious disregard for safety and significantly increase your risk profile, resulting in substantially higher insurance rates.

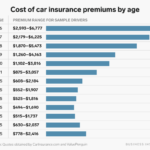

Age

Age is a factor in determining auto insurance premiums, with younger and older drivers typically paying higher rates.

- Young Drivers: Younger drivers, particularly those under 25, generally have higher insurance premiums due to their lack of experience and higher risk of accidents. Insurance companies consider young drivers to be statistically more likely to be involved in accidents.

- Older Drivers: While older drivers have more experience, they may face higher premiums due to factors such as age-related health conditions or decreased reaction time. Insurance companies consider older drivers to be at a higher risk of accidents due to these factors.

Coverage Levels

The level of coverage you choose significantly impacts your insurance premium. Higher coverage levels, such as comprehensive and collision coverage, provide more protection but also result in higher premiums.

- Liability Coverage: This coverage protects you financially if you cause an accident and injure someone or damage their property. Higher liability limits provide more protection but also increase your premium.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if you are involved in an accident, regardless of fault. Collision coverage is optional but highly recommended for most drivers. Higher deductibles (the amount you pay out-of-pocket before your insurance kicks in) can lower your premium.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by non-collision events, such as theft, vandalism, or natural disasters. Comprehensive coverage is optional but recommended for vehicles with a higher value or financed vehicles. Similar to collision coverage, higher deductibles can reduce your premium.

Optional Add-ons

Optional add-ons, such as roadside assistance, rental car reimbursement, or gap insurance, can increase your insurance premium. While these add-ons offer additional protection, they come at an extra cost. It’s essential to weigh the benefits of these add-ons against the potential increase in your premium.

State-Specific Insurance Regulations: Auto Insurance Quotes By State

Each state in the US has its own unique set of laws governing auto insurance. These regulations play a crucial role in shaping the insurance market, influencing the types of coverage available, and ultimately impacting the cost of auto insurance for consumers. Understanding these state-specific regulations is essential for making informed decisions about your insurance needs.

Mandatory Coverage Requirements

State laws mandate certain types of auto insurance coverage to ensure financial protection for drivers and their victims in the event of an accident. These mandatory coverage requirements vary significantly across states.

- Liability Coverage: This is the most common mandatory coverage, requiring drivers to carry insurance that covers damages to others and their property in case of an accident. The minimum liability limits, which specify the maximum amount of coverage, vary widely from state to state. For example, in Texas, the minimum liability limit is $30,000 per person and $60,000 per accident, while in New York, the minimum limit is $25,000 per person and $50,000 per accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you in case you are involved in an accident with a driver who is uninsured or underinsured. It helps cover your medical expenses, lost wages, and property damage. Some states require this coverage, while others allow drivers to opt out.

- Personal Injury Protection (PIP): PIP coverage, also known as no-fault insurance, covers medical expenses and lost wages for you and your passengers, regardless of who is at fault in an accident. This coverage is mandatory in some states, such as Florida and New York, while it is optional in others.

- Property Damage Liability: This coverage pays for damages to other people’s property, such as their vehicles or buildings, in case you are at fault in an accident. This coverage is usually mandatory in most states.

Impact of State-Specific Insurance Laws on Consumer Costs, Auto insurance quotes by state

State-specific insurance regulations have a significant impact on the cost of auto insurance for consumers.

- Mandatory Coverage Requirements: States with higher mandatory coverage requirements generally have higher average auto insurance premiums. This is because drivers are required to carry more insurance, which increases the overall cost.

- Tort Laws: Some states have “no-fault” laws, which limit the ability of drivers to sue for pain and suffering after an accident. These laws can lead to lower insurance premiums as insurers face fewer lawsuits.

- Rate Regulation: Some states regulate insurance rates to prevent insurers from charging excessive premiums. These regulations can help to keep costs down for consumers.

- Insurance Fraud: States with strict laws against insurance fraud can help to reduce costs by preventing insurers from paying out fraudulent claims.

State-Specific Insurance Laws and Their Impact on Coverage Options

State laws can also affect the availability of certain coverage options, such as:

- Gap Insurance: This coverage helps to pay the difference between the actual cash value of your vehicle and the amount you owe on your auto loan if your vehicle is totaled. Some states may have regulations that limit the availability or terms of gap insurance.

- Rental Reimbursement: This coverage helps to pay for a rental car if your vehicle is damaged in an accident and is being repaired. Some states may have regulations that limit the amount of rental reimbursement coverage that insurers can offer.

- Ride-Sharing Coverage: As ride-sharing services have become more popular, some states have implemented regulations to ensure that drivers and passengers are adequately protected. These regulations can affect the availability and cost of insurance for ride-sharing drivers.

Finding the Best Auto Insurance Rates

Securing the most affordable auto insurance rates requires a proactive approach and a strategic comparison of different providers and their offerings. By carefully navigating the process, you can optimize your coverage while minimizing your premiums.

Comparing Auto Insurance Quotes

To find the best auto insurance rates, it’s crucial to compare quotes from multiple providers. This involves gathering information from various insurance companies and evaluating their coverage options, pricing, and customer service. Here’s a step-by-step guide to help you navigate this process:

- Gather Your Information: Before contacting insurance companies, compile all the necessary information, including your driving history, vehicle details, and desired coverage levels. This will streamline the quoting process and ensure accuracy.

- Utilize Online Comparison Tools: Many websites offer online comparison tools that allow you to input your information and receive quotes from multiple insurers simultaneously. These tools can save you time and effort by automating the process.

- Contact Insurance Companies Directly: After using online comparison tools, consider contacting insurance companies directly to discuss your specific needs and obtain personalized quotes. This allows for a more in-depth conversation about your coverage options and potential discounts.

- Compare Quotes Carefully: Once you have collected quotes from various insurers, carefully review each one, paying attention to coverage details, premiums, and any additional fees or charges. Ensure that the quotes you are comparing are for the same coverage levels and deductibles.

- Consider Customer Service and Reputation: In addition to price, consider the insurer’s reputation for customer service, claims handling, and financial stability. Look for companies with positive reviews and strong financial ratings.

Popular Auto Insurance Providers and Coverage Options

Here is a table comparing some popular auto insurance providers and their coverage options:

| Provider | Liability Coverage | Collision Coverage | Comprehensive Coverage | Other Coverage Options |

|---|---|---|---|---|

| Progressive | Yes | Yes | Yes | Roadside assistance, rental car reimbursement |

| State Farm | Yes | Yes | Yes | Accident forgiveness, drive safe and save discounts |

| Geico | Yes | Yes | Yes | Medical payments coverage, uninsured motorist coverage |

| Allstate | Yes | Yes | Yes | Accident forgiveness, drive safe and save discounts |

| Liberty Mutual | Yes | Yes | Yes | Accident forgiveness, new car replacement coverage |

Negotiating Insurance Premiums and Securing Discounts

Once you have identified potential insurance providers, explore ways to negotiate your premiums and secure discounts:

- Shop Around: Continue comparing quotes from different insurers even after you have found a few that you like. This competition can help you negotiate a lower premium.

- Bundle Policies: Consider bundling your auto insurance with other policies, such as homeowners or renters insurance, to potentially receive a discount.

- Improve Your Driving Record: Maintain a clean driving record by avoiding traffic violations and accidents. This can significantly impact your insurance premiums.

- Ask About Discounts: Inquire about available discounts, such as good student discounts, safe driver discounts, and multi-car discounts. Some insurers offer discounts for installing anti-theft devices or taking defensive driving courses.

- Review Your Coverage Regularly: Periodically review your coverage needs and adjust them as necessary. If you have made significant changes to your driving habits or vehicle ownership, you may be able to reduce your premiums.

Understanding State-Specific Risks

Every state has its own unique driving environment and risk factors that impact auto insurance premiums. Understanding these factors can help you make informed decisions about your coverage and potentially save money on your insurance.

Accident Rates and Claims Frequency

The frequency of accidents and claims varies significantly across states. States with higher population density, heavy traffic, and more urban areas tend to have higher accident rates.

- States with higher accident rates generally have higher insurance premiums, as insurers have to pay out more claims.

- States with lower accident rates often have lower insurance premiums, as insurers experience fewer claims and have lower payouts.

Impact of Natural Disasters and Weather Patterns

States prone to natural disasters, such as hurricanes, earthquakes, tornadoes, and floods, typically have higher insurance premiums. Insurers consider the likelihood and severity of these events when setting rates.

- Coastal states, particularly those in hurricane-prone areas, may have higher insurance premiums due to the risk of wind damage and flooding.

- States with high seismic activity, such as California, may have higher premiums due to the risk of earthquakes.

- States with severe weather patterns, such as hailstorms or tornadoes, may have higher premiums due to the risk of damage to vehicles.

Traffic Laws and Enforcement

States with stricter traffic laws and stricter enforcement of those laws often have lower accident rates. This can result in lower insurance premiums, as insurers face fewer claims.

- States with stricter DUI laws may have lower accident rates and, therefore, lower insurance premiums.

- States with more comprehensive driver education programs may have lower accident rates and lower insurance premiums.

Ultimate Conclusion

Navigating the complexities of auto insurance quotes by state can be challenging, but armed with the right information, you can make informed decisions to secure the best rates. By understanding the factors that influence premiums, comparing quotes from different providers, and taking advantage of available discounts, drivers can optimize their insurance coverage and save money. Remember, knowledge is power when it comes to auto insurance, so take the time to research and compare options to find the best fit for your individual needs.

FAQ Summary

How often should I compare auto insurance quotes?

It’s recommended to compare auto insurance quotes at least once a year, or even more frequently if your circumstances change, such as a new car purchase, a change in your driving record, or a move to a different state.

What are some common discounts available on auto insurance?

Common discounts include good driver discounts, safe driver discounts, multi-car discounts, multi-policy discounts, and discounts for safety features like anti-theft devices or airbags.

How can I improve my driving record to get lower insurance rates?

Avoid traffic violations, maintain a clean driving record, and consider defensive driving courses to demonstrate responsible driving habits and potentially qualify for lower premiums.