Auto insurance quote washington state is a crucial step for any Washington resident seeking affordable and comprehensive coverage. Navigating the complex world of auto insurance can be daunting, but understanding the key factors and available options can empower you to make informed decisions.

This guide provides a comprehensive overview of auto insurance in Washington State, covering everything from mandatory coverage requirements to factors influencing premium costs. We’ll delve into the various types of coverage available, explore the process of obtaining quotes, and discuss strategies for maximizing savings.

Understanding Auto Insurance in Washington State

Driving a car in Washington State comes with certain responsibilities, including having adequate auto insurance coverage. Understanding the mandatory requirements and various types of coverage available can help you make informed decisions about your insurance needs.

Mandatory Auto Insurance Coverage in Washington State

Washington State law requires all drivers to carry a minimum amount of auto insurance coverage. This coverage protects you and others in case of an accident. The minimum requirements are as follows:

- Liability Coverage: This coverage protects you financially if you are at fault in an accident. It covers the other driver’s medical expenses, property damage, and lost wages. The minimum liability coverage required in Washington State is:

- $25,000 per person for bodily injury.

- $50,000 per accident for bodily injury.

- $10,000 per accident for property damage.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with an uninsured or underinsured driver. It covers your medical expenses, property damage, and lost wages. The minimum UM/UIM coverage required in Washington State is the same as the minimum liability coverage:

- $25,000 per person for bodily injury.

- $50,000 per accident for bodily injury.

- $10,000 per accident for property damage.

Types of Auto Insurance Coverage in Washington State

In addition to the mandatory coverage, you can choose to purchase other types of auto insurance coverage to further protect yourself and your vehicle. Some common types of coverage include:

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than an accident, such as theft, vandalism, fire, or natural disasters.

- Medical Payments Coverage (Med Pay): This coverage pays for your medical expenses, regardless of who is at fault in an accident.

- Personal Injury Protection (PIP): This coverage provides benefits for medical expenses, lost wages, and other expenses related to injuries sustained in an accident, regardless of who is at fault.

- Rental Reimbursement: This coverage pays for a rental car while your vehicle is being repaired after an accident.

- Roadside Assistance: This coverage provides assistance with services such as towing, jump starts, and tire changes.

Factors Influencing Auto Insurance Premiums in Washington State

Several factors can affect your auto insurance premiums in Washington State, including:

- Driving History: Your driving record, including accidents, traffic violations, and DUI convictions, can significantly impact your premium.

- Age and Gender: Younger drivers and male drivers generally pay higher premiums than older drivers and female drivers.

- Vehicle Type: The make, model, and year of your vehicle can affect your premium. For example, luxury vehicles or high-performance cars typically have higher premiums.

- Location: Your location can affect your premium due to factors such as traffic density, crime rates, and weather conditions.

- Credit Score: Your credit score can be used to assess your risk as an insurance customer. Individuals with higher credit scores may qualify for lower premiums.

- Coverage Levels: The amount of coverage you choose can affect your premium. Higher coverage limits generally result in higher premiums.

- Deductible: Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible generally results in lower premiums.

- Discounts: Many insurance companies offer discounts for things like safe driving, good student records, multiple vehicles insured, and safety features on your vehicle.

Obtaining an Auto Insurance Quote

Getting an auto insurance quote in Washington State is a straightforward process that involves gathering some basic information about yourself and your vehicle. This information helps insurance companies assess your risk and provide you with a personalized quote.

Methods for Obtaining Auto Insurance Quotes

Several methods can be used to obtain auto insurance quotes. Each method has its advantages and disadvantages, making it important to choose the best option based on your needs and preferences.

Table Comparing Quote Methods

| Method | Advantages | Disadvantages |

|---|---|---|

| Online Quote | Convenience, speed, ability to compare multiple quotes simultaneously | May not be as personalized as a phone quote, potential for inaccuracies if information is entered incorrectly |

| Phone Quote | Personalized service, ability to ask questions and get clarification | May take longer than an online quote, limited ability to compare quotes from multiple insurers simultaneously |

| In-Person Quote | Most personalized service, opportunity to build a relationship with an insurance agent | Least convenient, may require scheduling an appointment |

Importance of Comparing Quotes

Comparing quotes from multiple insurance providers is crucial to ensure you get the best possible rate. Different insurers use various factors to calculate premiums, resulting in varying rates for the same coverage.

“By comparing quotes, you can potentially save hundreds of dollars on your annual insurance premiums.”

Comparing quotes also allows you to understand the different coverage options available and choose the best plan for your needs.

Factors Affecting Auto Insurance Quotes

In Washington State, various factors influence your auto insurance premiums. Understanding these factors can help you make informed decisions about your coverage and potentially lower your costs.

Driving History

Your driving history plays a significant role in determining your auto insurance premiums. Insurance companies use your driving record to assess your risk of accidents.

- Accidents: A history of accidents, especially those deemed your fault, will generally increase your premiums. The severity of the accident and the number of accidents you’ve had will also be considered.

- Traffic Violations: Traffic violations, such as speeding tickets, reckless driving, or DUI convictions, can significantly impact your premiums. The more serious the violation, the higher the impact on your rates.

- Driving Experience: Newer drivers with less experience on the road are often considered higher risk, resulting in higher premiums. As you gain experience and build a clean driving record, your rates may decrease.

Vehicle Type and Value

The type and value of your vehicle also influence your auto insurance premiums.

- Vehicle Type: Sports cars, luxury vehicles, and vehicles with powerful engines are often considered higher risk due to their potential for higher speeds and more severe accidents. These vehicles may attract higher premiums.

- Vehicle Value: The value of your vehicle directly impacts your insurance costs. Higher-value vehicles require more expensive repairs or replacements in case of an accident, leading to higher premiums.

- Safety Features: Vehicles equipped with safety features like anti-lock brakes, airbags, and stability control are often considered safer and may qualify for lower premiums.

Age, Gender, and Credit Score

These factors also play a role in determining your auto insurance premiums, although their impact can vary by insurance company and state.

- Age: Younger drivers, especially those under 25, are generally considered higher risk due to inexperience and statistical trends. Older drivers, over 65, may also see higher premiums due to potential health concerns. However, this can vary depending on the individual’s driving history and risk profile.

- Gender: Historically, males have been statistically associated with higher accident rates, leading to higher premiums. However, this trend is becoming less pronounced, and many states are moving towards gender-neutral pricing.

- Credit Score: In some states, including Washington, insurance companies can use your credit score to assess your risk. A good credit score can potentially lead to lower premiums, while a poor credit score may result in higher premiums. This practice is controversial, as it links financial responsibility to driving behavior.

Discounts and Savings Opportunities

Saving money on your auto insurance is a smart move. Fortunately, many discounts are available in Washington State, potentially lowering your premiums significantly. Understanding these discounts and employing effective strategies can lead to substantial savings.

Discounts Offered in Washington State

Auto insurance companies in Washington State offer a variety of discounts to policyholders. These discounts are designed to reward safe driving practices, responsible vehicle ownership, and other positive attributes. Here are some common discounts:

- Good Driver Discount: This discount is awarded to drivers with a clean driving record, typically with no accidents or traffic violations for a specified period.

- Safe Driver Discount: Similar to the good driver discount, this discount rewards drivers who have not been involved in accidents or received traffic violations.

- Multi-Car Discount: Insuring multiple vehicles with the same insurance company often earns a discount. This discount recognizes the increased loyalty and business the insurer receives from insuring multiple vehicles.

- Multi-Policy Discount: Bundling multiple insurance policies, such as auto, home, and renter’s insurance, with the same company can result in a discount. This discount reflects the benefits of a consolidated customer relationship and the insurer’s ability to provide comprehensive coverage.

- Defensive Driving Course Discount: Completing a defensive driving course can lead to a discount. This discount recognizes the driver’s commitment to improving their driving skills and knowledge, potentially reducing their risk on the road.

- Anti-theft Device Discount: Installing anti-theft devices on your vehicle, such as alarms or tracking systems, can make your car less attractive to thieves. This reduction in risk for the insurance company can result in a discount.

- Good Student Discount: Students with good academic performance, typically with a high GPA, may qualify for a discount. This discount recognizes the positive attributes of responsible and academically successful individuals, often correlating with safe driving practices.

- Loyalty Discount: Long-term customers who have maintained their auto insurance with the same company for an extended period may receive a loyalty discount. This discount acknowledges the value of customer loyalty and the insurer’s desire to retain existing clients.

- Low Mileage Discount: Drivers who have a low annual mileage, typically driving less than a certain threshold, may be eligible for a discount. This discount recognizes the reduced risk of accidents associated with less frequent driving.

Maximizing Savings on Auto Insurance

Here are some strategies to maximize savings on your auto insurance premiums:

- Shop Around: Comparing quotes from multiple insurance companies is crucial. Different insurers may offer varying rates and discounts. Online comparison tools can streamline this process.

- Maintain a Good Driving Record: Avoiding accidents and traffic violations is the most effective way to lower your premiums. A clean driving record significantly impacts your insurance rates.

- Consider Increasing Your Deductible: A higher deductible, the amount you pay out-of-pocket before your insurance kicks in, can lead to lower premiums. Carefully assess your risk tolerance and financial capacity before making this decision.

- Bundle Your Policies: As mentioned earlier, bundling your auto insurance with other policies, such as home or renter’s insurance, can result in significant savings.

- Take Advantage of Discounts: Be aware of the discounts available to you and actively pursue those that apply. For example, if you’re a good student or have completed a defensive driving course, make sure to inform your insurer.

- Review Your Coverage Regularly: Your insurance needs may change over time. Periodically review your coverage to ensure it still aligns with your current situation and consider adjusting your policy as needed.

Table of Discounts and Eligibility Criteria

| Discount | Eligibility Criteria |

|---|---|

| Good Driver Discount | Clean driving record, no accidents or traffic violations for a specified period. |

| Safe Driver Discount | Similar to Good Driver Discount, rewards drivers with no accidents or traffic violations. |

| Multi-Car Discount | Insuring multiple vehicles with the same insurance company. |

| Multi-Policy Discount | Bundling multiple insurance policies (auto, home, renter’s) with the same company. |

| Defensive Driving Course Discount | Completing a defensive driving course. |

| Anti-theft Device Discount | Installing anti-theft devices on your vehicle (alarms, tracking systems). |

| Good Student Discount | Students with good academic performance (high GPA). |

| Loyalty Discount | Long-term customers who have maintained their auto insurance with the same company. |

| Low Mileage Discount | Drivers with low annual mileage (typically less than a certain threshold). |

Choosing the Right Insurance Provider: Auto Insurance Quote Washington State

Finding the right auto insurance provider in Washington State is crucial for ensuring you have adequate coverage at a competitive price. With so many companies available, it can be overwhelming to choose the best fit for your needs. This section will guide you through the process of evaluating different providers, comparing their strengths and weaknesses, and understanding the importance of customer service and claims handling.

Evaluating Insurance Providers

It’s essential to carefully evaluate different auto insurance providers to find one that aligns with your specific needs and budget. Here’s a checklist to help you in this process:

- Coverage Options: Compare the types of coverage offered by each provider, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Ensure the coverage options meet your individual requirements and legal obligations in Washington State.

- Pricing and Discounts: Obtain quotes from multiple providers to compare premiums and identify potential discounts. Factors like safe driving history, vehicle safety features, and bundling insurance policies can significantly impact your rates.

- Financial Stability: Research the financial strength and stability of each provider using resources like AM Best or Standard & Poor’s. A financially sound company is more likely to be able to pay claims in the event of an accident.

- Customer Service and Claims Handling: Investigate the provider’s reputation for customer service and claims handling. Look for reviews, ratings, and testimonials from other customers to gauge their experience.

- Digital Experience: Evaluate the provider’s online platform and mobile app. A user-friendly digital experience can simplify policy management, claims reporting, and communication with the insurer.

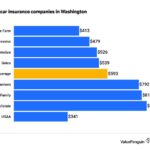

Comparing Major Insurance Companies

Several major insurance companies operate in Washington State, each with its own strengths and weaknesses. It’s essential to compare their offerings and consider your individual needs to make an informed decision.

| Insurance Company | Strengths | Weaknesses |

|---|---|---|

| State Farm | Wide network of agents, strong financial stability, competitive pricing | Limited online features, customer service can vary |

| Geico | Affordable premiums, user-friendly website and app, fast claims processing | Limited agent network, less personalized service |

| Progressive | Wide range of discounts, innovative features like Name Your Price tool, strong online presence | Customer service can be inconsistent, higher premiums for some drivers |

| Allstate | Excellent customer service, comprehensive coverage options, strong financial stability | Higher premiums compared to some competitors, limited online features |

| Farmers | Wide network of agents, strong customer service, specialized coverage options for certain vehicles | Higher premiums compared to some competitors, limited online features |

Importance of Customer Service and Claims Handling

Customer service and claims handling are crucial aspects to consider when choosing an auto insurance provider. Excellent customer service ensures a smooth and positive experience, while efficient claims handling can make a significant difference during a stressful time.

- Responsive Customer Support: Look for a provider that offers readily available and responsive customer support through multiple channels, such as phone, email, and online chat. Quick response times and helpful assistance are essential when you have questions or need help with your policy.

- Efficient Claims Process: A streamlined claims process can make a stressful situation less overwhelming. Choose a provider with a reputation for fair and efficient claims handling, including prompt assessments, timely payments, and clear communication throughout the process.

- Positive Customer Reviews: Reading reviews from other customers can provide valuable insights into a provider’s customer service and claims handling practices. Look for feedback on their responsiveness, helpfulness, and overall satisfaction with the experience.

Understanding Your Policy

Once you’ve secured an auto insurance policy, it’s crucial to understand its terms and conditions to ensure you’re adequately covered. Your policy Artikels the details of your insurance agreement, including the coverage you’re entitled to, the limits and deductibles, and the responsibilities of both you and your insurance provider.

Key Terms and Conditions, Auto insurance quote washington state

Understanding the key terms and conditions of your auto insurance policy is essential for making informed decisions about your coverage and ensuring you’re protected in the event of an accident or other covered event. Here are some common terms you’ll encounter:

- Coverage: The types of protection your policy provides, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Limits: The maximum amount your insurance company will pay for covered losses, such as bodily injury or property damage.

- Deductible: The amount you’re responsible for paying out of pocket before your insurance coverage kicks in.

- Premium: The amount you pay to your insurance company for your policy.

- Exclusions: Specific events or situations that are not covered by your policy.

Filing a Claim

If you need to file a claim, it’s important to understand the process and the steps involved:

- Report the incident: Contact your insurance company as soon as possible after an accident or other covered event.

- Provide information: Be prepared to provide details about the incident, including the date, time, location, and any other relevant information.

- Complete a claim form: Your insurance company will provide you with a claim form to fill out.

- Submit supporting documentation: Gather any relevant documentation, such as police reports, medical bills, or repair estimates.

- Follow up: Keep in touch with your insurance company to track the status of your claim.

Resolving Disputes

If you have a dispute with your insurance company, it’s important to know your rights and options:

- Review your policy: Carefully read your policy to understand the terms and conditions.

- Contact your insurance company: Attempt to resolve the dispute directly with your insurance company.

- File a complaint: If you’re unable to resolve the dispute with your insurance company, you can file a complaint with the Washington State Office of the Insurance Commissioner.

- Consider mediation or arbitration: These options can help you reach a mutually agreeable solution.

Understanding Coverage Limits and Deductibles

Coverage limits and deductibles are crucial aspects of your auto insurance policy that directly impact how much you pay in premiums and how much you’re responsible for in the event of a claim:

- Coverage Limits: These limits represent the maximum amount your insurance company will pay for covered losses. For example, your liability coverage might have a limit of $100,000 per person and $300,000 per accident.

- Deductibles: Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. For example, if you have a $500 deductible for collision coverage and you’re in an accident, you’ll pay the first $500 in repair costs.

Outcome Summary

By understanding the nuances of auto insurance in Washington State, you can confidently secure the right coverage for your needs and budget. Remember to compare quotes from multiple providers, leverage available discounts, and carefully review your policy terms to ensure you’re adequately protected on the road.

Essential FAQs

How often should I review my auto insurance policy?

It’s recommended to review your auto insurance policy at least annually, or whenever you experience a significant life change, such as a new car, change in driving habits, or a change in your financial situation.

What happens if I don’t have car insurance in Washington State?

Driving without the required minimum auto insurance coverage in Washington State can result in fines, license suspension, and even vehicle impoundment. It’s crucial to maintain valid insurance to avoid legal consequences.