Auto insurance price comparison by state is crucial for finding the best deal on your car insurance. Every state has its own unique regulations, driving habits, and demographics that influence insurance costs. Understanding these factors can help you save money on your premiums.

From state-specific regulations to individual driving habits, a multitude of factors contribute to the price of auto insurance. This guide explores the key elements that determine your insurance costs, providing insights into how to navigate the complexities of finding the most affordable coverage.

Auto Insurance Price Comparison by State

Navigating the world of auto insurance can feel like a maze, especially when you’re trying to find the best rates. Comparing prices across different insurance companies is crucial to ensure you’re getting the most competitive deal. However, the process can be time-consuming and overwhelming, especially if you’re unsure where to start.

Several factors influence auto insurance costs, making it even more challenging to determine the best deal. Understanding these factors can empower you to make informed decisions and potentially save money on your premiums.

Factors Influencing Auto Insurance Costs

The cost of auto insurance varies based on a variety of factors. These factors can be grouped into categories, including:

- Vehicle-Related Factors:

- Vehicle Make and Model: Some car models are more expensive to repair or replace than others. This can significantly impact your insurance premium.

- Vehicle Year: Newer vehicles often have more advanced safety features and are more expensive to repair, leading to higher insurance costs. Older vehicles, on the other hand, may have depreciated in value, resulting in lower premiums.

- Vehicle Usage: If you drive your vehicle frequently for work or long commutes, your insurance premium will likely be higher than someone who drives less often.

- Driver-Related Factors:

- Driving History: Your driving record, including accidents and traffic violations, plays a significant role in determining your insurance premium. A clean driving record generally leads to lower premiums.

- Age and Gender: Younger drivers, especially males, tend to have higher insurance rates due to higher risk factors. As drivers age, their premiums typically decrease.

- Credit History: In some states, insurance companies use credit scores to assess risk. A good credit score can often lead to lower premiums.

- Location-Related Factors:

- State of Residence: Auto insurance regulations and the prevalence of accidents and theft vary significantly by state. These factors can impact your premium.

- Zip Code: Insurance rates can even differ within the same city, depending on the crime rate, traffic density, and other factors in your specific area.

- Coverage Options:

- Liability Coverage: This coverage protects you financially if you are responsible for an accident that injures another person or damages their property. Higher liability limits generally lead to higher premiums.

- Collision and Comprehensive Coverage: These coverages protect you in case of an accident involving your own vehicle or damage caused by non-collision events like theft or vandalism. Choosing higher deductibles can lower your premium.

- Optional Coverages: Additional coverages, such as uninsured/underinsured motorist coverage, rental car reimbursement, and roadside assistance, can add to your premium.

Factors Influencing Auto Insurance Prices by State

Auto insurance premiums can vary significantly from state to state, and several factors contribute to these price differences. Understanding these factors can help you make informed decisions about your insurance coverage and potentially save money.

State Regulations

State governments play a crucial role in setting the framework for auto insurance rates. Each state has its own set of regulations that determine how insurance companies can calculate premiums. These regulations can impact various aspects of insurance, including:

- Minimum Coverage Requirements: Some states mandate higher minimum coverage levels than others, leading to higher premiums in those states.

- No-Fault Laws: States with no-fault insurance laws typically have higher premiums as they require drivers to cover their own medical expenses after an accident, regardless of fault.

- Rate Regulation: Some states have strict rate regulation, limiting the amount insurance companies can charge for premiums. This can result in lower premiums in those states.

- Insurance Fraud Laws: States with stricter insurance fraud laws can deter fraudulent claims, leading to lower premiums overall.

Demographics, Driving Habits, and Vehicle Types

Besides state regulations, factors related to demographics, driving habits, and vehicle types also influence auto insurance premiums.

- Population Density: States with higher population densities often have higher insurance premiums due to increased traffic congestion and a higher likelihood of accidents.

- Driving Habits: Drivers with a history of accidents, speeding tickets, or DUI convictions will generally face higher premiums. This is because they are considered higher risk by insurance companies.

- Vehicle Type: The type of vehicle you drive also plays a significant role in determining your premium. Luxury cars, sports cars, and vehicles with high repair costs typically have higher insurance premiums.

- Age and Gender: Younger drivers and males tend to have higher premiums due to their higher risk of accidents. However, this can vary based on individual driving history and other factors.

Average Auto Insurance Premiums Across States

The average auto insurance premiums across different states can vary considerably. For example, states with higher population densities, stricter regulations, and higher rates of accidents often have higher premiums. Here is a comparison of average auto insurance premiums in different states:

| State | Average Annual Premium |

|---|---|

| Michigan | $2,839 |

| Louisiana | $2,531 |

| Florida | $2,474 |

| New Jersey | $2,284 |

| Pennsylvania | $1,892 |

| Ohio | $1,853 |

| Texas | $1,688 |

| California | $1,662 |

| Utah | $1,454 |

| Idaho | $1,352 |

It is important to note that these are just averages, and individual premiums can vary based on the factors mentioned above.

Methods for Comparing Auto Insurance Prices

Finding the best auto insurance rates involves comparing prices from different providers. This process can be time-consuming and overwhelming, but it’s essential to ensure you’re getting the best possible coverage at the most affordable price.

Obtaining Quotes from Insurance Providers

Requesting quotes from various insurance providers is a crucial step in comparing auto insurance prices. This involves contacting each provider individually, providing them with your personal information and vehicle details, and receiving a personalized quote.

- Contacting Insurance Providers Directly: You can obtain quotes by calling insurance companies directly, visiting their websites, or going to their physical offices. This method allows you to ask specific questions and receive personalized advice from agents.

- Using Online Comparison Tools: Many websites and apps offer online comparison tools that allow you to compare quotes from multiple insurance providers simultaneously. These tools streamline the process by gathering your information once and sending it to multiple companies, saving you time and effort.

- Working with Insurance Brokers: Insurance brokers act as intermediaries between you and insurance companies. They can compare quotes from multiple providers and help you find the best policy based on your needs and budget.

Using Online Comparison Tools

Online comparison tools are a popular and efficient way to compare auto insurance prices. These tools simplify the process by gathering your information once and sending it to multiple insurance providers.

- Enter Your Information: You’ll typically need to provide basic information such as your name, address, date of birth, driving history, and vehicle details.

- Select Your Coverage Options: You can customize your coverage options, such as liability limits, comprehensive and collision coverage, and deductibles.

- Compare Quotes: The tool will generate quotes from multiple insurance providers, allowing you to compare prices, coverage options, and discounts.

- Request a Policy: Once you’ve chosen a provider, you can request a policy directly through the comparison tool.

Working with Insurance Brokers

Insurance brokers are licensed professionals who represent you in the insurance market. They can help you compare quotes from multiple providers and find the best policy based on your needs and budget.

- Personalized Advice: Brokers can provide personalized advice and recommendations based on your specific circumstances and risk profile.

- Negotiation: They can negotiate better rates and coverage options on your behalf.

- Time Savings: Brokers can save you time and effort by handling the quote comparison process for you.

Tips for Saving on Auto Insurance

Auto insurance is a necessity for most drivers, but it can be a significant expense. Fortunately, there are several ways to reduce your premiums and save money. By understanding these strategies and taking advantage of available discounts, you can significantly lower your insurance costs.

Increasing Your Deductible, Auto insurance price comparison by state

Increasing your deductible is a straightforward way to lower your premiums. Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible means you’ll pay more if you have an accident, but it also means you’ll pay less in premiums. Consider the trade-off between your risk tolerance and potential savings. For example, if you’re comfortable paying a higher deductible in case of an accident, you can save a substantial amount on your premiums.

Maintaining a Good Driving Record

A clean driving record is crucial for keeping your insurance premiums low. Avoiding accidents, traffic violations, and DUI convictions demonstrates responsible driving behavior, which insurers reward with lower premiums. Safe driving habits and adherence to traffic laws are essential for both your safety and your wallet.

Bundling Policies

Bundling your auto insurance with other policies, such as homeowners or renters insurance, can lead to significant savings. Insurance companies often offer discounts for bundling multiple policies together. By combining your policies, you benefit from streamlined management, potentially lower premiums, and the convenience of having all your insurance needs met under one roof.

Discounts Available to Drivers

Insurance companies offer a range of discounts to drivers who meet certain criteria. These discounts can significantly reduce your premiums, so it’s worth exploring the options available to you.

Safe Driver Discounts

Safe driver discounts are awarded to drivers with a clean driving record and no accidents or violations. These discounts can vary depending on the insurance company and the specific criteria for eligibility.

Good Student Discounts

Good student discounts are often offered to students who maintain a certain GPA. This discount acknowledges the responsible behavior and academic achievements of students, rewarding them with lower insurance premiums.

Multi-Car Discounts

Multi-car discounts are available to drivers who insure multiple vehicles with the same insurance company. This discount incentivizes policyholders to bundle their vehicles and ensures loyalty to the insurer.

Understanding Your Auto Insurance Policy

Your auto insurance policy is a contract between you and your insurance company that Artikels the coverage you have in case of an accident or other covered event. Understanding the different types of coverage and how they work is crucial to ensure you have the right protection for your needs.

Liability Coverage

Liability coverage is essential and protects you financially if you are at fault in an accident. It covers the other driver’s medical expenses, property damage, and legal fees.

- Bodily Injury Liability: Covers medical expenses, lost wages, and pain and suffering for the other driver and passengers injured in an accident caused by you.

- Property Damage Liability: Covers damages to the other driver’s vehicle or property.

State minimum liability coverage requirements vary, but it’s generally advisable to carry higher limits than the minimum to protect yourself from significant financial liability.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This coverage is optional, but it’s essential if you have a loan or lease on your car.

If you have a loan or lease on your vehicle, your lender will likely require collision coverage.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damages from non-collision events, such as theft, vandalism, fire, hail, or natural disasters. This coverage is optional, but it’s beneficial if your vehicle is relatively new or has a high value.

You can choose to waive comprehensive coverage if your vehicle is older and has a lower value.

Finding the Right Insurance Provider

Choosing the right auto insurance provider is a crucial decision that can significantly impact your financial well-being and peace of mind. This section will guide you through key considerations to help you find the best insurance provider for your needs.

Factors to Consider

- Financial Stability: A financially sound insurance provider is essential to ensure they can fulfill their obligations when you need to file a claim. Look for companies with high ratings from independent financial institutions like A.M. Best or Standard & Poor’s.

- Customer Service: Excellent customer service is crucial for a positive insurance experience. Research companies known for their responsiveness, helpfulness, and resolution of customer issues. Consider reading online reviews and testimonials from other customers.

- Claims Handling: A smooth and efficient claims process is vital when you need to file a claim. Look for companies with a reputation for prompt claim payments and minimal hassle. Consider asking about their claims handling process and average claim settlement time.

- Policy Coverage: Ensure the policy you choose offers adequate coverage for your needs. This includes liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Compare coverage options and limits offered by different providers.

- Discounts: Many insurance companies offer discounts for various factors, such as safe driving records, good credit scores, multiple vehicle insurance, and anti-theft devices. Ask about available discounts and make sure you qualify for them.

- Price: While price is a significant factor, it shouldn’t be the only consideration. Compare quotes from multiple providers and ensure you understand the coverage you’re getting for the price.

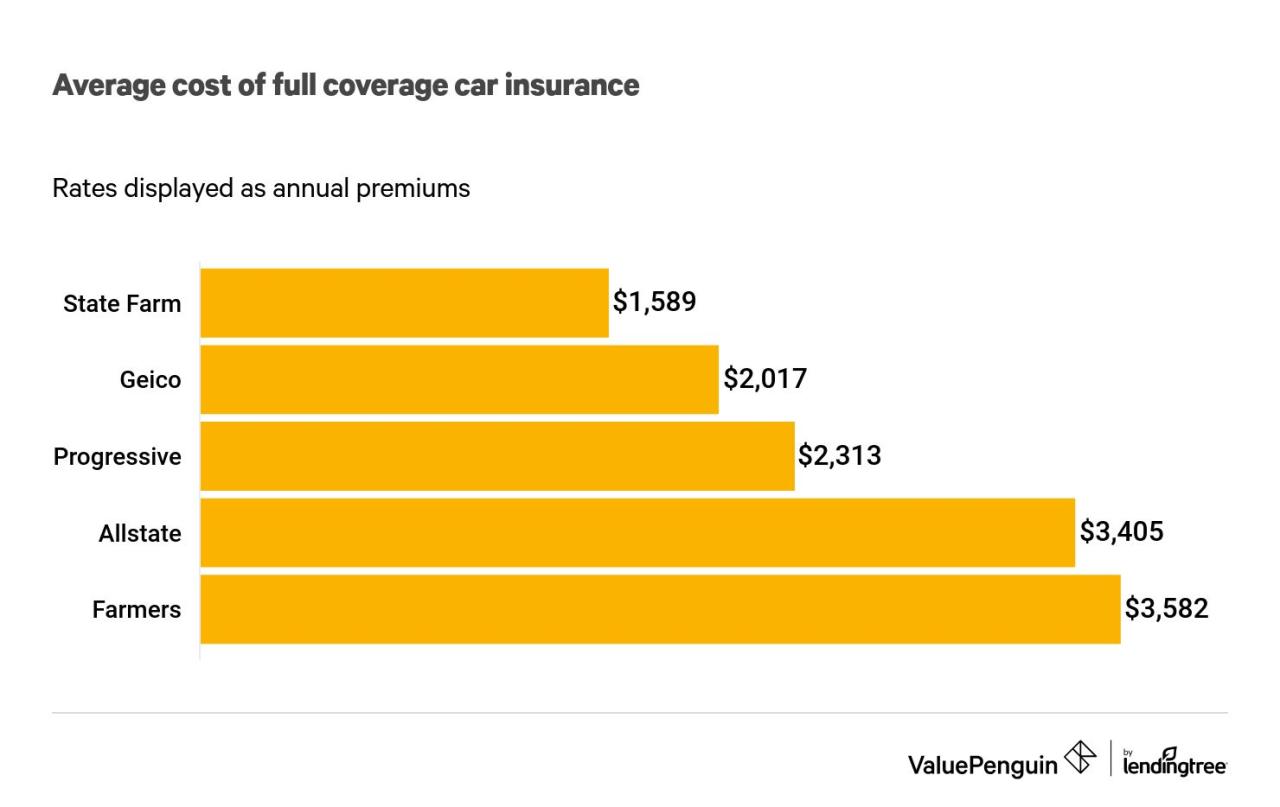

Comparing Top Auto Insurance Companies

| State | Top-Rated Companies | Key Features |

|---|---|---|

| California | Geico, State Farm, USAA | Competitive pricing, strong financial stability, excellent customer service. |

| Texas | State Farm, USAA, Farmers | Wide range of coverage options, comprehensive discounts, robust claims handling. |

| Florida | Progressive, State Farm, Geico | Innovative technology, personalized coverage options, strong customer support. |

| New York | Geico, State Farm, Liberty Mutual | Competitive pricing, comprehensive coverage options, reputable claims handling. |

| Illinois | State Farm, Allstate, USAA | Wide agent network, extensive coverage options, strong financial stability. |

Ultimate Conclusion

In conclusion, comparing auto insurance prices by state is essential for securing the most competitive rates. By understanding the factors that influence costs, utilizing online comparison tools, and exploring available discounts, you can significantly reduce your premiums. Remember to carefully consider your individual needs and choose a reputable insurance provider that offers comprehensive coverage and excellent customer service.

Answers to Common Questions

How often should I compare auto insurance prices?

It’s recommended to compare auto insurance prices at least annually, or even more frequently if you experience major life changes, such as a new car purchase, a change in your driving record, or a move to a different state.

What information do I need to get an accurate auto insurance quote?

To get an accurate quote, you’ll typically need to provide your driving history, vehicle information, address, and desired coverage levels. Some insurance providers may also ask about your age, gender, and credit score.

Can I bundle my auto and home insurance policies for a discount?

Yes, many insurance providers offer discounts for bundling your auto and home insurance policies. This can result in significant savings on your premiums.

What is a deductible, and how does it affect my auto insurance premium?

A deductible is the amount you pay out-of-pocket for repairs or replacement before your insurance coverage kicks in. A higher deductible typically results in lower premiums, while a lower deductible leads to higher premiums.