Auto insurance out of state coverage is a crucial consideration for anyone venturing beyond their home state, whether for a brief vacation, a permanent relocation, or frequent cross-state travel. Understanding the nuances of out-of-state insurance is essential to ensure you have adequate protection in case of an accident or other unforeseen events.

This guide will explore the differences between in-state and out-of-state auto insurance coverage, the various types of coverage available, the process of obtaining out-of-state insurance, and the key factors to consider when choosing a policy. We’ll also discuss the costs associated with out-of-state coverage and provide valuable tips for minimizing expenses and navigating the claims process smoothly.

Understanding Out-of-State Auto Insurance Coverage

Driving outside your home state is common, whether for a vacation, a move, or a work trip. It’s important to understand how your auto insurance coverage changes when you drive in another state.

Differences Between In-State and Out-of-State Coverage

Your in-state auto insurance policy generally provides coverage for accidents and other incidents that occur within your home state. However, when you drive out of state, the coverage provided by your policy might differ in several ways. Here’s a breakdown of key differences:

- Minimum Coverage Requirements: Each state has its own minimum auto insurance requirements, which can vary significantly. For instance, some states require higher liability limits than others. Your in-state policy might not meet the minimum requirements of the state you’re driving in, leaving you underinsured and potentially liable for significant financial losses in case of an accident.

- Coverage Exclusions: Your policy might exclude certain types of coverage when you drive out of state. For example, some policies might exclude coverage for certain types of accidents or specific types of vehicles.

- Claims Processing: The process of filing a claim and receiving compensation might differ depending on the state where the accident occurs. Your insurance company might have different procedures for handling claims in different states.

Factors Determining the Need for Out-of-State Coverage

Several factors determine whether you need additional coverage when driving out of state. Here are some key considerations:

- Temporary Travel: If you’re only traveling out of state for a short period, your existing policy might be sufficient. However, if you’re driving in a state with higher minimum coverage requirements, you might need to consider purchasing additional coverage.

- Relocation: If you’re moving to a new state, you’ll need to obtain an auto insurance policy that complies with that state’s requirements. Your current policy might not be valid in your new state, and you’ll need to switch to a new policy that meets the local regulations.

- Frequent Cross-State Driving: If you frequently drive across state lines for work or other reasons, you might need to consider a policy that provides coverage in multiple states. This can help ensure you’re adequately covered in all the states you drive in.

Legal Requirements for Auto Insurance in Different States

Each state has its own set of laws governing auto insurance requirements. Here’s a summary of key aspects:

- Minimum Coverage Requirements: States have different minimum coverage requirements for liability insurance, which covers damages you cause to others in an accident. These requirements typically include:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages for injuries you cause to others in an accident.

- Property Damage Liability: This coverage pays for repairs or replacement of property you damage in an accident.

- Other Coverage Requirements: Some states also require additional coverage, such as:

- Personal Injury Protection (PIP): This coverage pays for your medical expenses, lost wages, and other damages, regardless of who is at fault in an accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage.

- Exceptions and Variations: States might have exceptions or variations to their auto insurance requirements. For instance, some states might exempt certain types of vehicles or drivers from certain coverage requirements.

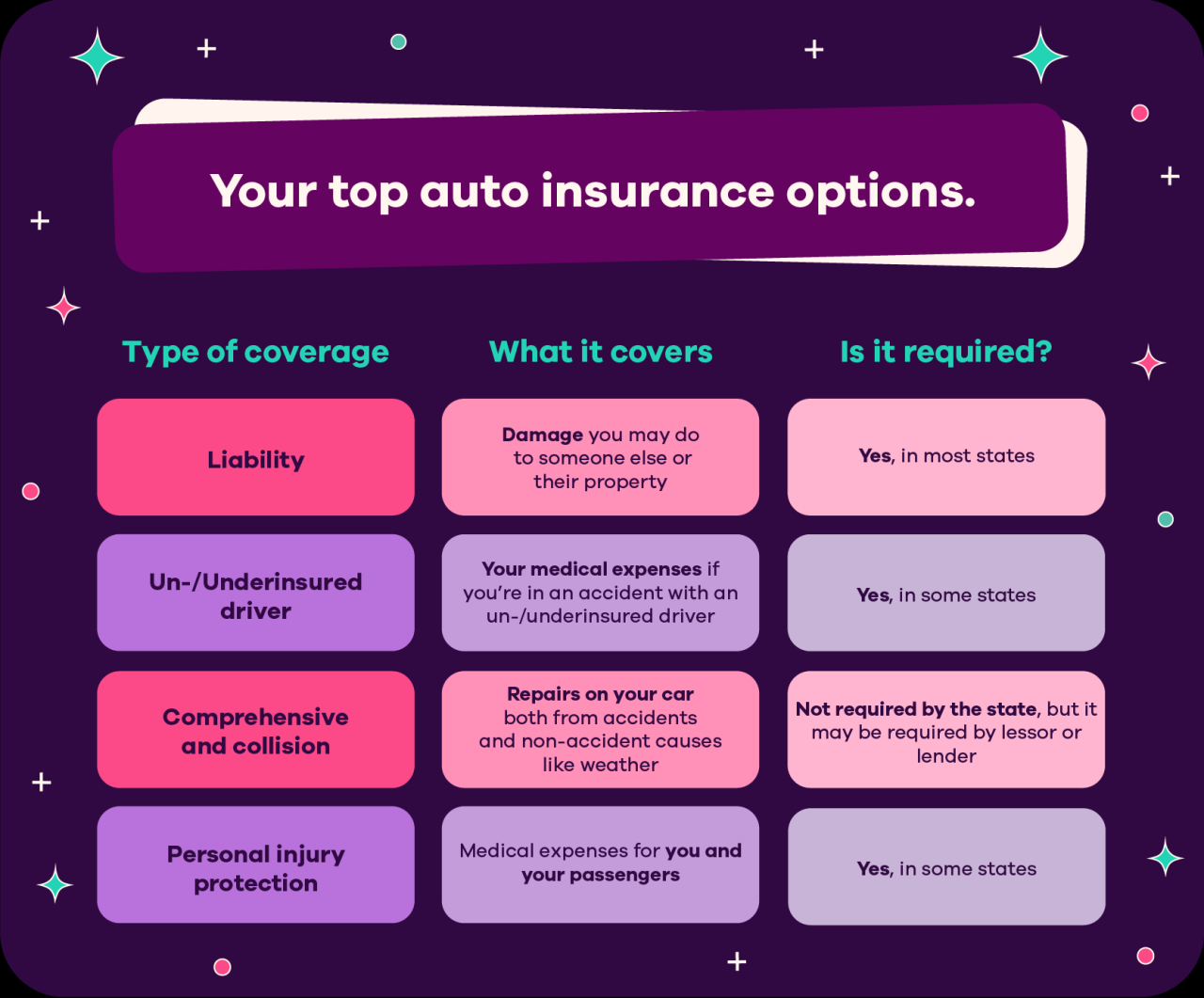

Types of Out-of-State Coverage

When you’re driving out of state, it’s essential to understand the different types of auto insurance coverage that can protect you in case of an accident or other incident. While your standard insurance policy may provide some coverage, certain situations might require additional protection. This section will delve into the various types of out-of-state auto insurance coverage, explaining their purpose and benefits, and highlighting their relevance to out-of-state travel.

Liability Coverage

Liability coverage is a fundamental component of auto insurance, protecting you financially if you cause an accident that results in damage to another person’s property or injuries. It covers the costs associated with the other party’s medical expenses, property repairs, lost wages, and legal fees. In out-of-state situations, liability coverage is particularly crucial as the laws and regulations governing liability insurance can vary significantly from state to state. For instance, some states have higher minimum liability coverage requirements than others, and some states may require additional coverage, such as uninsured motorist coverage.

Collision Coverage

Collision coverage pays for repairs to your vehicle if it’s damaged in an accident, regardless of who is at fault. This coverage is optional but highly recommended, especially when driving in unfamiliar areas or during adverse weather conditions. It provides financial protection for your vehicle, ensuring you can get it repaired or replaced after an accident. For example, if you’re driving through a mountainous region and your vehicle is damaged in a collision with another vehicle or a roadside object, collision coverage would help cover the repair costs.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damages caused by events other than accidents, such as theft, vandalism, fire, natural disasters, and hailstorms. While it’s not mandatory, comprehensive coverage can be essential for out-of-state travel, especially when venturing into areas prone to natural disasters or high crime rates. For instance, if you’re driving through a hurricane-prone region and your vehicle is damaged by a storm, comprehensive coverage would help pay for repairs or replacement.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you in the event of an accident caused by a driver who either lacks insurance or has insufficient insurance to cover your losses. It’s crucial when driving in states with a high number of uninsured drivers or where minimum liability coverage limits are low. If you’re involved in an accident with an uninsured driver, UM coverage can help cover your medical expenses, lost wages, and property damage.

Obtaining Out-of-State Auto Insurance: Auto Insurance Out Of State Coverage

Securing out-of-state auto insurance can be a necessary step when you’re relocating, traveling for an extended period, or even just visiting another state for a while. It’s crucial to understand the process, available options, and potential challenges involved.

This section Artikels the steps involved in obtaining out-of-state auto insurance, highlighting the different types of coverage available and factors to consider when making your choice.

Contacting Insurance Companies

When you need out-of-state auto insurance, contacting insurance companies is the first step. This involves reaching out to companies that operate in the state where you’ll be driving. You can do this through their websites, phone calls, or by visiting their offices.

It’s important to be prepared with the necessary information, such as:

- Your driver’s license information

- Vehicle registration details

- Driving history

- Information about your current insurance policy

By providing this information, insurance companies can quickly assess your needs and provide you with personalized quotes.

Providing Necessary Documentation

To secure out-of-state auto insurance, you’ll need to provide the insurance company with the required documentation. This typically includes:

- Proof of identity, such as your driver’s license or passport

- Vehicle registration documents

- Proof of residency in the state where you’re seeking coverage

- Details about your driving history, such as your driving record

- Information about any prior insurance policies

The specific documents required may vary depending on the insurance company and the state you’re in.

Understanding Policy Terms

Before you commit to an out-of-state auto insurance policy, it’s crucial to carefully review the policy terms and conditions. This includes understanding the following aspects:

- Coverage Limits: This refers to the maximum amount the insurance company will pay for covered losses. It’s important to ensure that the coverage limits are sufficient to protect you in case of an accident.

- Deductibles: This is the amount you’ll have to pay out-of-pocket before your insurance coverage kicks in. A higher deductible usually means lower premiums, while a lower deductible means higher premiums.

- Exclusions: These are specific situations or events that are not covered by your insurance policy. Make sure you understand what’s excluded from your coverage to avoid surprises.

- Premiums: This is the amount you’ll pay for your insurance policy. Premiums can vary based on factors such as your driving history, vehicle type, and the state you’re in.

Types of Out-of-State Coverage

There are various options available when it comes to securing out-of-state auto insurance:

- Temporary Policies: These policies provide short-term coverage for a specific period, often used for travel or temporary relocation. They’re typically more affordable than permanent policies but offer limited coverage.

- Extended Coverage: This option allows you to extend your existing auto insurance policy to cover driving in another state. It’s a convenient option if you’re traveling frequently or relocating temporarily.

- Permanent Changes to Existing Policies: If you’re moving permanently to another state, you may need to change your existing auto insurance policy to reflect your new residency. This involves contacting your insurance company and updating your policy to reflect the new state’s requirements.

Challenges and Considerations

Securing out-of-state auto insurance may come with some challenges:

- Higher Premiums: Out-of-state insurance policies may have higher premiums than your current policy, especially if the state you’re driving in has higher insurance costs.

- Specific State Requirements: Each state has its own unique insurance requirements, such as minimum coverage limits or specific types of coverage. It’s crucial to understand these requirements to ensure you’re fully compliant.

- Limited Coverage Options: Some insurance companies may not offer coverage in all states, limiting your choices and potentially impacting the available coverage options.

Coverage Limits and Exclusions

Understanding the limits and exclusions in your out-of-state auto insurance policy is crucial to ensure you’re adequately protected in case of an accident or incident. These provisions determine the maximum amount your insurer will pay for covered losses and specify situations where coverage may not apply.

Coverage Limits

Coverage limits in your auto insurance policy define the maximum amount your insurer will pay for a particular type of claim. These limits are usually expressed in dollar amounts, and they can vary depending on the type of coverage and the state you’re driving in.

For example, if your policy has a bodily injury liability limit of $100,000 per person, your insurer will pay up to $100,000 for injuries sustained by one person in an accident you caused. If the total cost of injuries to multiple people exceeds your policy’s limit, you might be personally responsible for the difference.

Coverage limits can also apply to property damage liability, comprehensive coverage, collision coverage, and uninsured/underinsured motorist coverage. Understanding these limits is essential to ensure you have adequate coverage to meet your needs and protect yourself financially in the event of an accident.

Common Exclusions

Out-of-state auto insurance policies often have exclusions, which are situations or circumstances where coverage may not apply. Some common exclusions include:

- Driving a vehicle not listed on your policy: If you’re driving a vehicle that’s not listed on your policy, you may not be covered in case of an accident.

- Driving under the influence of alcohol or drugs: Most policies exclude coverage if you’re driving while intoxicated.

- Using your vehicle for commercial purposes: If you’re using your vehicle for business purposes, your personal auto insurance policy may not cover you.

- Driving in certain areas: Some policies may exclude coverage in certain areas, such as war zones or areas with high crime rates.

- Certain types of accidents: Some policies may exclude coverage for accidents caused by specific events, such as natural disasters or acts of war.

It’s important to carefully review your policy to understand its exclusions and avoid situations where your coverage may not apply.

Scenarios

Here are some scenarios where coverage limits or exclusions might apply:

- Scenario 1: You’re driving in another state and get into an accident that causes $50,000 in damages to the other vehicle. Your property damage liability limit is $25,000. You’ll be responsible for the remaining $25,000 in damages.

- Scenario 2: You’re driving your friend’s car, which isn’t listed on your policy, and get into an accident. Your policy may not cover the damages because you were driving a vehicle not listed on your policy.

- Scenario 3: You’re using your vehicle to deliver food for a food delivery service. Your policy may not cover you in case of an accident because you were using your vehicle for commercial purposes.

Filing a Claim with Out-of-State Coverage

Filing a claim with out-of-state auto insurance involves similar steps as filing a claim with in-state coverage. However, there may be some differences in procedures, timelines, and documentation requirements. Understanding these differences can help you navigate the claims process effectively.

Reporting the Incident

After an accident, it is crucial to report the incident to your insurance company as soon as possible. This initial report will trigger the claims process and provide your insurer with the necessary information to start investigating the claim.

- Contact your insurer’s claims department. You can usually find the contact information on your insurance card or policy documents.

- Provide the necessary details. This includes the date, time, and location of the accident, as well as the names and contact information of all parties involved.

- If possible, take photos of the damage to your vehicle and the accident scene. This documentation can be helpful in supporting your claim.

Providing Documentation

To process your claim, your insurer will likely request additional documentation. This may include:

- A copy of the police report. If the accident involved a police investigation, you will need to obtain a copy of the report.

- Medical records. If you sustained injuries in the accident, you will need to provide your insurer with your medical records.

- Repair estimates. You will need to obtain repair estimates from qualified repair shops to support your claim for vehicle damage.

Navigating the Claims Process

The claims process can vary depending on the specific circumstances of your accident and the insurer’s procedures.

- Be prepared for communication delays. Communicating with an out-of-state insurer may take longer due to time zone differences or other logistical factors.

- Keep detailed records of all communication. This includes dates, times, and the names of individuals you spoke with. This documentation can be helpful in case of any disputes or discrepancies.

- Be patient and persistent. The claims process can be lengthy and frustrating. However, it is important to stay patient and persistent in following up with your insurer.

Differences in Claim Handling Procedures, Auto insurance out of state coverage

There may be differences in claim handling procedures between in-state and out-of-state insurance providers.

- Different state laws. Each state has its own laws governing auto insurance, which can impact claim handling procedures. For example, some states have mandatory no-fault insurance laws, while others do not.

- Different insurer networks. Out-of-state insurers may have different networks of repair shops and medical providers. This can impact your choices for repairs or medical treatment.

- Different communication channels. Some out-of-state insurers may have limited communication channels, such as phone or email, while others may offer online portals or mobile apps.

Tips for Effective Claims Processing

Here are some tips for navigating the claims process effectively:

- Understand your policy coverage. Review your policy carefully to understand your coverage limits, deductibles, and exclusions.

- Be proactive in gathering documentation. This will help speed up the claims process and avoid delays.

- Be honest and accurate in your communications. Providing false or misleading information can jeopardize your claim.

- Follow up regularly. Check in with your insurer to track the progress of your claim and address any questions or concerns.

Costs and Considerations

Getting auto insurance coverage out-of-state can be more expensive than your in-state policy. This is because factors like state regulations, driving history, and the type of vehicle you drive can influence your premium.

Out-of-State Auto Insurance Costs

The cost of out-of-state auto insurance can vary significantly depending on the state you’re driving in. Several factors can influence the premium, including:

- State Regulations: Each state has its own set of regulations for auto insurance, including minimum coverage requirements and rates. Some states have higher minimum coverage requirements than others, which can lead to higher premiums.

- Driving History: Your driving record is a major factor in determining your auto insurance premium. If you have a history of accidents, tickets, or DUI convictions, you can expect to pay higher premiums. This is especially true if you are driving in a state with stricter regulations regarding driving offenses.

- Vehicle Type: The type of vehicle you drive also plays a role in the cost of your auto insurance. For example, sports cars and luxury vehicles are generally more expensive to insure than standard sedans or hatchbacks. This is because these vehicles are more expensive to repair or replace in case of an accident.

Strategies for Minimizing Out-of-State Insurance Costs

Here are some strategies to help you minimize the cost of out-of-state auto insurance:

- Bundle Your Policies: If you have other insurance policies, such as homeowners or renters insurance, consider bundling them with your auto insurance. Many insurers offer discounts for bundling multiple policies.

- Maintain a Good Driving Record: One of the best ways to reduce your auto insurance premium is to maintain a good driving record. Avoid accidents, tickets, and other driving offenses.

- Explore Discounts: Many insurers offer discounts for various factors, such as being a good student, having a good credit score, or having safety features in your vehicle. Ask your insurer about available discounts.

- Compare Quotes: Before you choose an insurer, get quotes from multiple companies. This will help you find the best rates and coverage for your needs.

Additional Resources and Tips

Navigating the world of out-of-state auto insurance can be a bit of a maze. Luckily, there are a number of resources available to help you find the right coverage and make informed decisions. This section provides information on where to find additional resources and tips to make your journey smoother.

Government Websites

Government websites are valuable resources for information on out-of-state auto insurance requirements. They often provide details on minimum coverage limits, insurance laws, and consumer protection measures. For example, the website of the Department of Motor Vehicles (DMV) in the state where you’ll be driving can provide information on required coverage and registration procedures. The National Association of Insurance Commissioners (NAIC) website also offers a wealth of information on insurance regulations across the country.

Last Point

Navigating the complexities of out-of-state auto insurance can be daunting, but with careful planning and a thorough understanding of your coverage options, you can ensure you have the protection you need while traveling or living beyond your home state. By researching state requirements, comparing policies, and understanding the terms and conditions of your insurance, you can confidently navigate the road ahead, knowing you’re covered in case of unexpected events.

Clarifying Questions

What happens if I get into an accident in another state and don’t have out-of-state coverage?

If you’re involved in an accident in another state and don’t have out-of-state coverage, you could face serious financial consequences. You may be held liable for damages, medical expenses, and other costs associated with the accident. It’s crucial to have adequate insurance coverage to protect yourself from such liabilities.

How long does temporary out-of-state coverage last?

The duration of temporary out-of-state coverage varies depending on the insurance company and the specific policy. Some companies offer coverage for a few days, while others may provide coverage for a few weeks or even months. It’s important to review the policy terms to understand the coverage period.

Is out-of-state insurance always more expensive than in-state coverage?

Out-of-state insurance premiums can vary depending on several factors, including the state you’re driving in, your driving history, the type of vehicle you drive, and the coverage you choose. In some cases, out-of-state coverage may be more expensive, while in others, it may be comparable to in-state rates. It’s essential to get quotes from multiple insurance companies to compare rates and find the best value for your needs.

What are the penalties for driving without insurance in another state?

Penalties for driving without insurance in another state can vary depending on the state’s laws. You could face fines, license suspension, or even jail time. It’s crucial to comply with the insurance requirements of each state you drive in to avoid legal consequences.