Auto insurance out of state is a crucial topic for anyone planning to drive beyond their home state. Whether you’re on a road trip, relocating, or simply visiting family, understanding the legal requirements and coverage options is essential. Failing to have proper insurance can result in hefty fines, legal complications, and even financial ruin in case of an accident.

This guide will explore the ins and outs of auto insurance out of state, covering everything from obtaining coverage to managing your policy effectively. We’ll also discuss the factors that affect insurance rates, the different coverage options available, and the specific needs of temporary residents, students, and military personnel.

Understanding Out-of-State Auto Insurance

Driving in a state other than your home state requires understanding the specific legal requirements and insurance coverage options available. It’s important to be aware of the potential risks associated with driving without proper insurance coverage.

Legal Requirements for Driving in Another State

Each state has its own set of rules and regulations regarding auto insurance. When driving in another state, you must comply with the minimum insurance requirements of that state. This typically includes liability coverage, which protects you from financial responsibility if you cause an accident that results in injury or property damage to others.

Potential Risks of Driving Without Proper Insurance Coverage

Driving without proper insurance coverage in another state can result in severe consequences, including:

- Financial Ruin: If you cause an accident and don’t have adequate insurance coverage, you could be held personally liable for all damages, including medical expenses, property repairs, and lost wages. This could lead to significant financial hardship.

- Legal Penalties: Driving without insurance is illegal in all states. You could face fines, license suspension, and even jail time.

- Vehicle Impoundment: Your vehicle may be impounded until you provide proof of insurance.

Coverage Options for Out-of-State Drivers

There are several options available to ensure you have adequate insurance coverage when driving in another state:

- Out-of-State Coverage: Your existing auto insurance policy may automatically extend some coverage to other states. However, it’s crucial to review your policy carefully to determine the specific coverage limits and exclusions that apply outside your home state.

- Non-Resident Coverage: Many insurance companies offer non-resident coverage, which provides specific insurance for drivers who reside in one state but frequently drive in another. This coverage is tailored to the specific needs of out-of-state drivers.

- Temporary Insurance: If you’re only driving in another state for a short period, you may be able to purchase temporary insurance coverage. This option is typically available for trips lasting a few days or weeks.

Obtaining Out-of-State Auto Insurance

Securing out-of-state auto insurance can seem complicated, but it’s a straightforward process if you understand the requirements and steps involved. You’ll need to choose a reputable insurance company that operates in the state where you’ll be driving and follow the application procedures.

Documents Required for Application

When applying for out-of-state auto insurance, you’ll typically need to provide several documents to verify your identity, vehicle ownership, and driving history.

Here are the most common documents required:

- Driver’s License: A valid driver’s license from your current state of residence is essential.

- Vehicle Registration: You’ll need to provide the registration certificate for the vehicle you’re insuring.

- Proof of Insurance: If you have an existing insurance policy, provide the policy details, including the policy number and coverage information.

- Social Security Number: This is necessary for identification and processing your application.

- Vehicle Identification Number (VIN): The VIN is a unique identifier for your vehicle, essential for the insurance company to accurately assess your risk.

- Driving History: You might be asked to provide your driving record, which includes information about accidents, violations, and driving history.

Finding the Best Insurance Rates

Getting the best possible insurance rates for out-of-state coverage requires some research and comparison.

Here are some tips to help you find the most competitive rates:

- Compare Quotes: Obtain quotes from multiple insurance companies. You can use online comparison websites or contact insurance agents directly.

- Bundle Policies: If you have other insurance policies, like homeowners or renters insurance, inquire about discounts for bundling your policies with the same company.

- Ask About Discounts: Insurance companies often offer discounts for good driving records, safety features in your vehicle, and other factors. Don’t hesitate to ask about available discounts.

- Consider Coverage Options: Carefully evaluate the different coverage options available and choose the levels of coverage that best suit your needs and budget.

- Read the Fine Print: Before committing to a policy, thoroughly review the policy documents, including the terms and conditions, to ensure you understand the coverage details and any exclusions.

Factors Affecting Out-of-State Insurance Rates

When you’re driving outside your home state, your auto insurance rates can change significantly. Several factors determine how much you’ll pay for coverage.

Understanding these factors is crucial for planning your trips and ensuring you have adequate coverage.

Driving History, Auto insurance out of state

Your driving history is a significant factor in determining your insurance rates, both in your home state and when you’re driving out of state. A clean driving record with no accidents or traffic violations will generally result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions can significantly increase your rates.

Vehicle Type

The type of vehicle you drive also influences your insurance rates. Sports cars, luxury vehicles, and high-performance vehicles are generally more expensive to insure due to their higher repair costs and greater risk of accidents. On the other hand, smaller, fuel-efficient vehicles typically have lower insurance premiums.

Coverage Levels

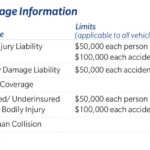

The amount of coverage you choose will also impact your rates. Higher coverage limits, such as liability coverage, comprehensive coverage, and collision coverage, will generally result in higher premiums. However, it’s essential to choose coverage levels that meet your needs and financial situation.

State Insurance Laws

Each state has its own unique set of insurance laws, which can significantly affect your rates. Some states have mandatory coverage requirements, such as minimum liability limits, while others have more flexible regulations. States with higher accident rates or more expensive medical costs often have higher insurance premiums.

Comparison of Insurance Costs in Different States

Here’s a comparison of average annual auto insurance premiums for a single driver with a clean driving record, driving a 2020 Toyota Camry, with minimum coverage requirements in different states:

| State | Average Annual Premium |

|---|---|

| California | $1,850 |

| Florida | $1,600 |

| Texas | $1,400 |

| New York | $2,100 |

| Pennsylvania | $1,550 |

These are just average premiums and actual rates may vary depending on individual factors. It’s essential to compare quotes from multiple insurers to find the best rates for your specific situation.

Coverage Options for Out-of-State Drivers

Navigating the world of auto insurance can be confusing, especially when you’re driving in a state different from your home state. Understanding the different coverage options available is crucial for ensuring you have the right protection in case of an accident.

Types of Auto Insurance Coverage

Here’s a breakdown of common auto insurance coverage types:

- Liability Coverage: This is the most basic type of insurance and is required in most states. It covers damages to other people’s property and injuries caused by you in an accident. This coverage typically has two parts:

- Bodily Injury Liability: Pays for medical expenses, lost wages, and pain and suffering for the other driver and passengers involved in an accident you caused.

- Property Damage Liability: Covers repairs or replacement costs for the other driver’s vehicle and any other property damaged in an accident you caused.

- Collision Coverage: Pays for repairs or replacement costs for your vehicle if it’s damaged in an accident, regardless of who is at fault. This coverage is optional but can be essential if you have a loan on your vehicle.

- Comprehensive Coverage: Covers damage to your vehicle from non-accident events like theft, vandalism, fire, or natural disasters. Like collision coverage, it’s optional but can be valuable for protecting your investment in your vehicle.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient insurance. It helps pay for your medical expenses and vehicle repairs.

- Personal Injury Protection (PIP): This coverage, also known as “no-fault” insurance, pays for your medical expenses and lost wages, regardless of who caused the accident. It’s often required in certain states, but it’s not always available in others.

- Medical Payments Coverage (Med Pay): This coverage pays for your medical expenses, regardless of who caused the accident, up to a certain limit. It’s optional and can be a good addition to your policy if you have a high deductible on your health insurance.

Comparing Coverage Options

Here’s a table summarizing the benefits and limitations of each coverage option:

| Coverage Type | Benefits | Limitations |

|---|---|---|

| Liability Coverage | Protects you financially from claims by other drivers and passengers in case you cause an accident. | Doesn’t cover your own vehicle’s damages. |

| Collision Coverage | Pays for repairs or replacement costs for your vehicle after an accident, regardless of fault. | May have a deductible you need to pay before the insurance kicks in. |

| Comprehensive Coverage | Covers damage to your vehicle from non-accident events like theft, vandalism, or natural disasters. | May have a deductible you need to pay before the insurance kicks in. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you’re involved in an accident with an uninsured or underinsured driver. | May have limits on the amount of coverage provided. |

| Personal Injury Protection (PIP) | Covers your medical expenses and lost wages after an accident, regardless of fault. | May have limits on the amount of coverage provided. |

| Medical Payments Coverage (Med Pay) | Pays for your medical expenses after an accident, regardless of fault. | May have limits on the amount of coverage provided. |

Examples of Coverage Use

Here are some examples of situations where specific coverage types are essential:

- Liability Coverage: If you cause an accident that results in injuries to the other driver and damage to their vehicle, liability coverage will help pay for their medical expenses, lost wages, and vehicle repairs.

- Collision Coverage: If you’re involved in an accident and your vehicle is damaged, collision coverage will help pay for repairs or replacement costs, even if you were at fault.

- Comprehensive Coverage: If your vehicle is stolen or damaged by a natural disaster, comprehensive coverage will help pay for repairs or replacement costs.

- Uninsured/Underinsured Motorist Coverage: If you’re involved in an accident with a driver who doesn’t have insurance or has insufficient insurance, uninsured/underinsured motorist coverage will help pay for your medical expenses and vehicle repairs.

- Personal Injury Protection (PIP): If you’re injured in an accident, PIP coverage will help pay for your medical expenses and lost wages, even if you were at fault.

- Medical Payments Coverage (Med Pay): If you’re injured in an accident and your health insurance has a high deductible, Med Pay coverage can help pay for your medical expenses.

Out-of-State Insurance for Temporary Residents: Auto Insurance Out Of State

Moving to a new state for a short period can be an exciting adventure, but it’s essential to understand the insurance requirements for temporary residents. If you’re planning to relocate temporarily, it’s crucial to ensure your vehicle is properly insured in the new state.

Temporary residents, also known as out-of-state residents, are individuals who live in a state for a specific period but maintain their permanent residency in another state. Temporary residents often face different insurance requirements than those who reside in a state permanently.

Duration of Residency

The duration of your stay is a critical factor in determining the insurance requirements for temporary residents. States typically classify temporary residency into two categories: short-term and long-term.

Short-term residency refers to stays that are typically less than six months. Long-term residency, on the other hand, refers to stays that are longer than six months.

It’s essential to understand the specific requirements for short-term and long-term residents in the state you’re visiting. For instance, in some states, if you’re staying for more than six months, you might be required to register your vehicle in the new state and obtain insurance from a licensed insurer.

Tips for Obtaining Temporary Out-of-State Insurance Coverage

Here are some tips for obtaining temporary out-of-state insurance coverage:

- Contact your current insurer. Many insurance companies offer temporary out-of-state coverage for their policyholders. You can inquire about the coverage options and costs.

- Obtain a non-resident insurance policy. Some insurance companies offer non-resident policies specifically designed for individuals who are temporarily living in another state.

- Consider using your existing policy. In some cases, your existing insurance policy may provide sufficient coverage for your temporary stay. However, it’s crucial to confirm with your insurer that your policy covers you in the new state.

- Compare rates from different insurers. Before making a decision, it’s essential to compare rates from multiple insurance companies to ensure you’re getting the best deal.

- Review the policy documents carefully. Ensure you understand the terms and conditions of your policy, including the coverage limits and exclusions.

Out-of-State Insurance for Students

Heading off to college in another state? You’ll need to make sure your car insurance is up to par. Whether you’re driving your own car or borrowing a family vehicle, understanding the ins and outs of out-of-state insurance is crucial.

Coverage Options for Student Drivers

Student drivers often have unique insurance needs. Here are some key coverage options to consider:

- Liability Coverage: This is the most basic type of car insurance, and it’s required in most states. It covers damages to other people’s property and injuries to other people if you’re at fault in an accident.

- Collision Coverage: This coverage pays for repairs to your vehicle if you’re in an accident, regardless of who is at fault. This can be particularly helpful if you’re driving an older car, as it could help you replace or repair it if it’s totaled.

- Comprehensive Coverage: This coverage protects you from damage to your vehicle caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): This coverage helps pay for medical expenses, lost wages, and other expenses if you’re injured in an accident, regardless of who is at fault.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

Out-of-State Insurance for Military Personnel

Military personnel often face unique challenges when it comes to auto insurance due to frequent relocations and deployments. Understanding the specific requirements and coverage options available to service members is crucial to ensuring adequate protection while stationed out of state.

Coverage Options Available Through Military Insurance Programs

Military insurance programs offer specific coverage options designed to meet the needs of service members. These programs often provide comprehensive coverage at competitive rates, taking into account the unique circumstances of military life.

- Servicemembers’ Group Life Insurance (SGLI): SGLI is a life insurance program that provides a death benefit to the beneficiary of a service member who dies while on active duty. It is a valuable benefit for families who rely on the service member’s income.

- Military Family Life Insurance (MFLI): MFLI is a temporary life insurance program available to service members and their families. It provides coverage for a specific period, such as during a deployment or a period of high risk.

- Federal Employees’ Group Life Insurance (FEGLI): FEGLI is a life insurance program available to federal employees, including military personnel. It offers a variety of coverage options, including term life insurance, whole life insurance, and accidental death and dismemberment insurance.

Tips for Navigating Insurance Requirements for Military Relocations

Relocating for military service can be a complex process, and navigating insurance requirements can be challenging. Here are some tips to help you manage your insurance needs during a military move:

- Contact your current insurance provider: Inform your current insurance provider about your upcoming relocation and inquire about coverage options in your new state. They may be able to offer a seamless transition of your policy.

- Research state-specific insurance requirements: Each state has its own set of auto insurance requirements. Be sure to familiarize yourself with the regulations in your new state of residence.

- Explore military-specific insurance programs: Many insurance companies offer discounts and special programs for military personnel. Research these options to find the best fit for your needs.

- Obtain proof of insurance: Always carry proof of insurance in your vehicle, especially during a move. This will ensure you have the necessary documentation if you are stopped by law enforcement.

Tips for Managing Out-of-State Insurance

Navigating out-of-state auto insurance can seem complicated, but with a bit of planning and organization, it can be a smooth process. Here are some tips to help you manage your out-of-state insurance effectively.

Keeping Insurance Documents Up-to-Date

It’s crucial to keep your insurance documents organized and up-to-date. This includes your insurance policy, proof of insurance, and any other relevant documentation. Having these documents readily available can save you time and hassle in case of an accident or any other unforeseen situation.

- Digital Storage: Consider storing your insurance documents digitally. This allows you to access them anytime, anywhere, and also makes it easier to share them with others if needed. Many insurance companies offer online portals where you can view and download your policy documents.

- Physical Copies: Always keep a physical copy of your insurance card in your vehicle. This is a quick and easy way to provide proof of insurance if you’re stopped by law enforcement or need to show it at a repair shop.

- Updating Contact Information: Make sure your insurance company has your current contact information, including your address, phone number, and email address. This ensures you receive important notifications and updates regarding your policy.

Finding the Best Insurance Deals and Managing Costs

Finding the best insurance deal and managing costs can be a challenge, but with some research and planning, you can find a policy that meets your needs without breaking the bank.

- Compare Quotes: Don’t settle for the first quote you get. Shop around and compare quotes from multiple insurance companies. Online comparison websites can make this process easier and faster.

- Consider Bundling: If you have multiple insurance policies, such as home, renters, or health insurance, see if your current insurance company offers discounts for bundling them together. Bundling policies can often lead to significant savings.

- Explore Discounts: Many insurance companies offer discounts for various factors, such as good driving records, safety features in your car, and membership in certain organizations. Ask your insurance company about the discounts they offer and see if you qualify.

- Review Your Policy Regularly: It’s a good idea to review your insurance policy at least once a year to make sure it still meets your needs. Your insurance needs may change over time, so it’s important to adjust your coverage accordingly.

Conclusion

Navigating the world of out-of-state auto insurance can seem daunting, but with careful planning and understanding, you can ensure you’re adequately protected while on the road. Remember to review your insurance needs, compare quotes from different providers, and keep your documents updated. By taking these steps, you can confidently explore new destinations without worrying about insurance-related headaches.

Detailed FAQs

What happens if I get into an accident in another state with only my home state insurance?

Your home state insurance will likely cover you, but there might be limitations or exclusions. You should contact your insurance company immediately to report the accident and confirm your coverage.

Do I need to get a new insurance policy every time I drive in another state?

Not necessarily. Some insurance companies offer nationwide coverage, meaning your existing policy will be valid in all states. However, you may need to inform your insurer about your out-of-state travel plans.

How can I find the best out-of-state insurance rates?

Start by comparing quotes from multiple insurance providers. Consider factors like your driving history, vehicle type, and desired coverage levels. You can also use online comparison tools to simplify the process.