Auto insurance minimums by state are essential to understanding your legal obligations as a driver. While the purpose of auto insurance is to protect you financially in case of an accident, driving without adequate coverage can lead to serious consequences, including hefty fines, license suspension, and even imprisonment.

Each state in the U.S. has its own minimum requirements for auto insurance, ensuring that drivers have a baseline level of financial responsibility. These minimums typically cover bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage. The amounts required for each coverage type can vary significantly depending on the state, reflecting factors such as population density, traffic patterns, and accident rates.

Introduction to Auto Insurance Minimums

Understanding auto insurance minimums is crucial for every driver. It’s like having a safety net in case of an accident, protecting you financially and legally. Auto insurance is designed to cover potential costs associated with accidents, including property damage, medical expenses, and legal fees.

Consequences of Driving Without Adequate Coverage

Driving without the minimum required auto insurance can have serious consequences. Here are some key points to consider:

- Financial Ruin: If you cause an accident without adequate coverage, you could be personally responsible for all costs, including medical bills, repairs, and legal fees. This can lead to significant financial hardship and even bankruptcy.

- License Suspension: Most states require proof of insurance to drive legally. If you are caught driving without insurance, your license could be suspended, making it impossible to drive legally.

- Legal Action: If you are involved in an accident without insurance, the other party can sue you for damages, potentially resulting in a hefty judgment against you.

- Jail Time: In some states, driving without insurance can even lead to jail time, especially if you cause an accident or have multiple offenses.

State-Specific Minimum Requirements

Every state has its own set of minimum auto insurance requirements. These minimums are designed to protect you and other drivers on the road in case of an accident. Understanding these requirements is crucial for ensuring you have adequate coverage and avoiding legal penalties.

State-Specific Minimum Requirements

The minimum auto insurance requirements vary significantly from state to state. The table below provides a comprehensive overview of the minimum coverage requirements for each state, categorized into liability coverage, property damage coverage, and uninsured/underinsured motorist coverage.

| State | Liability Coverage | Property Damage Coverage | Uninsured/Underinsured Motorist Coverage |

|---|---|---|---|

| Alabama | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Alaska | $50,000 per person/$100,000 per accident | $25,000 | $50,000 per person/$100,000 per accident |

| Arizona | $25,000 per person/$50,000 per accident | $15,000 | $25,000 per person/$50,000 per accident |

| Arkansas | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| California | $15,000 per person/$30,000 per accident | $5,000 | $15,000 per person/$30,000 per accident |

| Colorado | $25,000 per person/$50,000 per accident | $15,000 | $25,000 per person/$50,000 per accident |

| Connecticut | $20,000 per person/$40,000 per accident | $10,000 | $20,000 per person/$40,000 per accident |

| Delaware | $30,000 per person/$60,000 per accident | $10,000 | $30,000 per person/$60,000 per accident |

| Florida | $10,000 per person/$20,000 per accident | $10,000 | $10,000 per person/$20,000 per accident |

| Georgia | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Hawaii | $20,000 per person/$40,000 per accident | $10,000 | $20,000 per person/$40,000 per accident |

| Idaho | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Illinois | $20,000 per person/$40,000 per accident | $15,000 | $20,000 per person/$40,000 per accident |

| Indiana | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Iowa | $20,000 per person/$40,000 per accident | $10,000 | $20,000 per person/$40,000 per accident |

| Kansas | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Kentucky | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Louisiana | $15,000 per person/$30,000 per accident | $10,000 | $15,000 per person/$30,000 per accident |

| Maine | $50,000 per person/$100,000 per accident | $25,000 | $50,000 per person/$100,000 per accident |

| Maryland | $30,000 per person/$60,000 per accident | $15,000 | $30,000 per person/$60,000 per accident |

| Massachusetts | $20,000 per person/$40,000 per accident | $5,000 | $20,000 per person/$40,000 per accident |

| Michigan | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Minnesota | $30,000 per person/$60,000 per accident | $10,000 | $30,000 per person/$60,000 per accident |

| Mississippi | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Missouri | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Montana | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Nebraska | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Nevada | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| New Hampshire | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| New Jersey | $15,000 per person/$30,000 per accident | $5,000 | $15,000 per person/$30,000 per accident |

| New Mexico | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| New York | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| North Carolina | $30,000 per person/$60,000 per accident | $25,000 | $30,000 per person/$60,000 per accident |

| North Dakota | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Ohio | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Oklahoma | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Oregon | $25,000 per person/$50,000 per accident | $20,000 | $25,000 per person/$50,000 per accident |

| Pennsylvania | $15,000 per person/$30,000 per accident | $5,000 | $15,000 per person/$30,000 per accident |

| Rhode Island | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| South Carolina | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| South Dakota | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Tennessee | $25,000 per person/$50,000 per accident | $15,000 | $25,000 per person/$50,000 per accident |

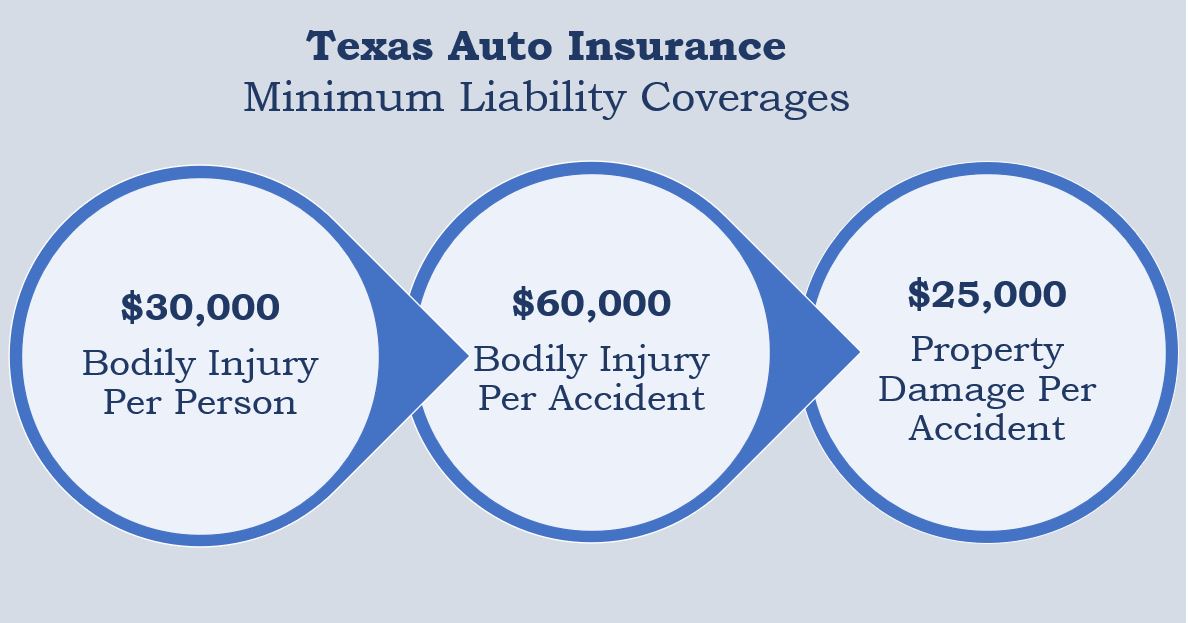

| Texas | $30,000 per person/$60,000 per accident | $25,000 | $30,000 per person/$60,000 per accident |

| Utah | $25,000 per person/$65,000 per accident | $15,000 | $25,000 per person/$65,000 per accident |

| Vermont | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Virginia | $25,000 per person/$50,000 per accident | $20,000 | $25,000 per person/$50,000 per accident |

| Washington | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| West Virginia | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Wisconsin | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Wyoming | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

It’s important to note that these are just the minimum requirements. You may want to consider purchasing higher limits of coverage to protect yourself and your assets in the event of a serious accident.

You can find more information on auto insurance regulations in your state by visiting the official website of your state’s Department of Insurance.

Factors Influencing Minimums: Auto Insurance Minimums By State

State minimum auto insurance requirements are not uniform across the country. Several factors contribute to these variations, ensuring that coverage levels are appropriate for the specific needs of each state’s driving population.

Population Density and Traffic Patterns, Auto insurance minimums by state

Population density and traffic patterns significantly influence state minimums. States with high population density and heavy traffic often have higher minimum requirements. This is because the risk of accidents is higher in such areas, leading to potentially higher costs for injuries and property damage.

States with high population density and heavy traffic often have higher minimum requirements to ensure sufficient coverage for potential accidents.

Accident Rates

States with higher accident rates tend to have higher minimum insurance requirements. This is because the frequency of accidents in these states results in greater costs for insurance companies, which they pass on to policyholders through higher premiums.

States with higher accident rates often have higher minimum insurance requirements to compensate for the increased risk of accidents.

Examples of States with High Minimums

- New York: New York has some of the highest minimum insurance requirements in the country, reflecting its high population density and heavy traffic.

- Pennsylvania: Pennsylvania’s minimum insurance requirements are also among the highest in the nation, reflecting its dense population and high accident rates.

- New Jersey: New Jersey has high minimum insurance requirements due to its dense population and high volume of traffic.

Understanding Coverage Types

Understanding the different types of auto insurance coverage is crucial for making informed decisions about your policy. These coverages protect you financially in the event of an accident, and they are essential for ensuring your safety and well-being on the road.

Liability Coverage

Liability coverage is the most basic type of auto insurance, and it is required by law in all states. This coverage protects you financially if you cause an accident that results in injuries or damage to another person or their property.

- Bodily injury liability coverage: This coverage pays for medical expenses, lost wages, and other damages related to injuries caused to others in an accident.

- Property damage liability coverage: This coverage pays for repairs or replacement of property damaged in an accident that you caused, such as another vehicle, a building, or a fence.

The amount of liability coverage you need will depend on several factors, including your state’s minimum requirements, your assets, and your risk tolerance.

Property Damage Coverage

Property damage coverage, often referred to as collision coverage, is designed to protect you in case of an accident that damages your own vehicle. This coverage pays for repairs or replacement of your vehicle, regardless of who is at fault. It covers damages caused by collisions with other vehicles, objects, or even accidents involving rollovers.

- Collision coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in a collision with another vehicle or object, even if you are at fault.

- Comprehensive coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged by something other than a collision, such as theft, vandalism, fire, or natural disasters.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage is a vital protection against drivers who are uninsured or have insufficient insurance to cover your losses in an accident.

- Uninsured motorist coverage: This coverage protects you if you are injured in an accident caused by an uninsured driver. It pays for your medical expenses, lost wages, and other damages.

- Underinsured motorist coverage: This coverage protects you if you are injured in an accident caused by a driver who has insurance, but the coverage is insufficient to cover your losses.

UM/UIM coverage is crucial for safeguarding yourself financially in the event of an accident involving a driver who is uninsured or underinsured.

Additional Considerations

While adhering to state minimum auto insurance requirements is crucial, understanding the limitations of such coverage and exploring additional options is equally important. Carrying coverage beyond the minimums can provide greater financial security and peace of mind in the event of an accident.

Scenarios Where Minimum Coverage May Not Be Sufficient

Minimum coverage may not be adequate in various situations, potentially leaving you financially vulnerable. It’s essential to consider your individual circumstances and needs when deciding on the appropriate level of insurance.

- High-Value Vehicles: If you own a luxury or high-performance vehicle, minimum coverage may not fully compensate for the cost of repairs or replacement in case of an accident.

- Multiple Drivers: If multiple individuals drive your vehicle, minimum coverage might not be sufficient to cover all potential liabilities arising from accidents involving different drivers.

- High-Risk Areas: Living in areas with high traffic density or a history of accidents may warrant higher coverage limits to ensure adequate protection against potential claims.

- Significant Assets: If you have significant assets, such as a home or investments, minimum coverage may not provide sufficient protection against liability claims that could jeopardize these assets.

Optional Coverage Options That Enhance Protection

Beyond the minimum requirements, several optional coverage options can enhance your protection and provide greater financial security.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. It’s essential for newer or high-value vehicles.

- Comprehensive Coverage: This coverage protects your vehicle against damages caused by events other than accidents, such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage provides protection if you’re involved in an accident with a driver who is uninsured or underinsured. It helps cover your medical expenses and property damage.

- Rental Reimbursement: This coverage helps pay for a rental car while your vehicle is being repaired after an accident.

- Medical Payments Coverage: This coverage helps pay for your medical expenses, regardless of fault, if you’re injured in an accident.

Finding the Right Coverage

While meeting state minimums is crucial, it might not provide enough protection for your specific needs. You should carefully consider your individual circumstances and driving habits to ensure you have adequate coverage.

Comparing Quotes

Shopping around for auto insurance quotes is essential to finding the best rates and coverage. Here are some tips for comparing quotes:

- Use online comparison tools: These tools allow you to quickly compare quotes from multiple insurers without having to contact each one individually.

- Get quotes from a variety of insurers: Don’t just stick with the first few insurers you find. Get quotes from a wide range of companies, including both large and small insurers.

- Ask about discounts: Many insurers offer discounts for things like good driving records, safe driving courses, and bundling insurance policies. Be sure to ask about all the discounts you may qualify for.

- Review the policy carefully: Before you choose a policy, make sure you understand the coverage it provides. Pay close attention to the deductibles, limits, and exclusions.

Considering Personal Needs and Driving Habits

Your personal needs and driving habits can significantly impact the type and amount of coverage you require. Here are some factors to consider:

- The value of your vehicle: If you have a newer or more expensive vehicle, you’ll need higher liability limits to protect yourself in case of an accident.

- Your driving history: If you have a history of accidents or traffic violations, you may need to pay higher premiums or have limited coverage options.

- Your driving habits: If you drive a lot, drive in high-traffic areas, or frequently drive at night, you may need more coverage than someone who drives less frequently or in safer areas.

- Your financial situation: Your ability to pay for repairs or medical expenses in the event of an accident should also influence your coverage choices.

Seeking Advice from an Insurance Agent

An insurance agent can provide valuable advice and guidance on selecting the right auto insurance coverage for your specific needs. They can:

- Help you understand the different types of coverage available.

- Evaluate your individual risk factors and recommend appropriate coverage levels.

- Compare quotes from multiple insurers and find the best options for you.

- Answer any questions you have about auto insurance.

Final Review

Understanding auto insurance minimums by state is crucial for all drivers. While adhering to the minimum requirements is essential, it’s important to remember that these minimums may not be sufficient to cover all potential expenses in the event of an accident. Therefore, it’s wise to consider carrying coverage beyond the minimums, especially if you have a family, own a newer vehicle, or drive frequently in high-traffic areas. By carefully evaluating your needs and seeking advice from an insurance agent, you can ensure you have the appropriate coverage to protect yourself and your loved ones on the road.

Question Bank

What happens if I get into an accident and only have minimum coverage?

If you are at fault in an accident and your coverage is only the minimum, you could be held personally liable for any damages exceeding your coverage limits. This could result in significant financial hardship.

How can I find out what the minimum auto insurance requirements are in my state?

You can find this information on your state’s Department of Motor Vehicles (DMV) website or by contacting your insurance agent.

Is it worth it to get more coverage than the minimum requirements?

While minimum coverage may satisfy the legal requirements, it may not be enough to cover all potential expenses in the event of an accident. Additional coverage options, such as collision, comprehensive, and higher liability limits, can provide greater financial protection.

How do I know if I need uninsured/underinsured motorist coverage?

Uninsured/underinsured motorist coverage is crucial because it protects you in case you are hit by a driver who is uninsured or has insufficient coverage. It’s a good idea to have this coverage even if you have a clean driving record, as you can never be certain about the insurance status of other drivers on the road.