Auto insurance minimum limits by state are crucial for understanding your legal obligations as a driver. These limits, set by each state, determine the minimum amount of coverage you must carry to protect yourself and others in the event of an accident. Driving without the required minimum coverage can result in serious consequences, including fines, license suspension, and even jail time.

The minimum limits vary significantly from state to state, reflecting factors such as population density, traffic volume, and the cost of living. Understanding these limits is essential for ensuring you have adequate financial protection in the event of an accident. This guide will provide a comprehensive overview of auto insurance minimum limits by state, exploring the different types of coverage, factors affecting premiums, and the importance of reviewing your insurance needs.

Understanding Minimum Auto Insurance Requirements

Every state in the United States has minimum auto insurance requirements that drivers must meet to legally operate a vehicle. These requirements are designed to protect drivers and their passengers from the financial burden of accidents.

Purpose of Minimum Auto Insurance Limits

Minimum auto insurance limits are set by each state to ensure that drivers have adequate financial protection in case of an accident. This coverage helps pay for damages to other vehicles, injuries to other people, and other expenses related to an accident.

Potential Consequences of Driving Without Minimum Coverage

Driving without minimum auto insurance coverage can have serious consequences, including:

- Fines and Penalties: You could face fines, license suspension, or even jail time for driving without insurance.

- Financial Ruin: If you cause an accident without insurance, you could be held personally liable for all damages and injuries, potentially leading to significant financial hardship.

- Difficulty Obtaining Insurance: Driving without insurance can make it difficult to obtain insurance in the future, as insurers may view you as a higher risk.

Factors Influencing Minimum Insurance Limits in Different States, Auto insurance minimum limits by state

Several factors influence the minimum auto insurance limits set by different states:

- Cost of Living: States with higher costs of living often have higher minimum insurance limits to reflect the higher costs of medical care and vehicle repairs.

- Traffic Density: States with higher traffic density may have higher minimum insurance limits to address the increased risk of accidents.

- State Laws and Regulations: Each state has its own specific laws and regulations regarding auto insurance, which can influence minimum limits.

- Economic Conditions: Economic factors, such as inflation and unemployment, can also influence minimum insurance limits.

State-Specific Minimum Coverage Requirements

It’s crucial to understand the specific minimum auto insurance requirements in your state. These requirements vary widely from state to state, and failing to meet them can lead to significant financial consequences in the event of an accident.

Minimum Coverage Requirements by State

This table summarizes the minimum coverage requirements for each state, providing a quick reference point.

| State | Liability Coverage | Property Damage Coverage | Uninsured/Underinsured Motorist Coverage |

|---|---|---|---|

| Alabama | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Alaska | $50,000 per person/$100,000 per accident | $25,000 | $50,000 per person/$100,000 per accident |

| Arizona | $25,000 per person/$50,000 per accident | $15,000 | $25,000 per person/$50,000 per accident |

| Arkansas | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| California | $15,000 per person/$30,000 per accident | $5,000 | $15,000 per person/$30,000 per accident |

| Colorado | $25,000 per person/$50,000 per accident | $15,000 | $25,000 per person/$50,000 per accident |

| Connecticut | $20,000 per person/$40,000 per accident | $10,000 | $20,000 per person/$40,000 per accident |

| Delaware | $30,000 per person/$60,000 per accident | $10,000 | $30,000 per person/$60,000 per accident |

| Florida | $10,000 per person/$20,000 per accident | $10,000 | $10,000 per person/$20,000 per accident |

| Georgia | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Hawaii | $20,000 per person/$40,000 per accident | $10,000 | $20,000 per person/$40,000 per accident |

| Idaho | $25,000 per person/$50,000 per accident | $15,000 | $25,000 per person/$50,000 per accident |

| Illinois | $20,000 per person/$40,000 per accident | $15,000 | $20,000 per person/$40,000 per accident |

| Indiana | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Iowa | $20,000 per person/$40,000 per accident | $10,000 | $20,000 per person/$40,000 per accident |

| Kansas | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Kentucky | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Louisiana | $15,000 per person/$30,000 per accident | $10,000 | $15,000 per person/$30,000 per accident |

| Maine | $50,000 per person/$100,000 per accident | $25,000 | $50,000 per person/$100,000 per accident |

| Maryland | $30,000 per person/$60,000 per accident | $15,000 | $30,000 per person/$60,000 per accident |

| Massachusetts | $20,000 per person/$40,000 per accident | $5,000 | $20,000 per person/$40,000 per accident |

| Michigan | $20,000 per person/$40,000 per accident | $10,000 | $20,000 per person/$40,000 per accident |

| Minnesota | $30,000 per person/$60,000 per accident | $10,000 | $30,000 per person/$60,000 per accident |

| Mississippi | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Missouri | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Montana | $25,000 per person/$50,000 per accident | $20,000 | $25,000 per person/$50,000 per accident |

| Nebraska | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Nevada | $15,000 per person/$30,000 per accident | $10,000 | $15,000 per person/$30,000 per accident |

| New Hampshire | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| New Jersey | $15,000 per person/$30,000 per accident | $5,000 | $15,000 per person/$30,000 per accident |

| New Mexico | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| New York | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| North Carolina | $30,000 per person/$60,000 per accident | $25,000 | $30,000 per person/$60,000 per accident |

| North Dakota | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Ohio | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Oklahoma | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Oregon | $25,000 per person/$50,000 per accident | $20,000 | $25,000 per person/$50,000 per accident |

| Pennsylvania | $15,000 per person/$30,000 per accident | $5,000 | $15,000 per person/$30,000 per accident |

| Rhode Island | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| South Carolina | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| South Dakota | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Tennessee | $25,000 per person/$50,000 per accident | $15,000 | $25,000 per person/$50,000 per accident |

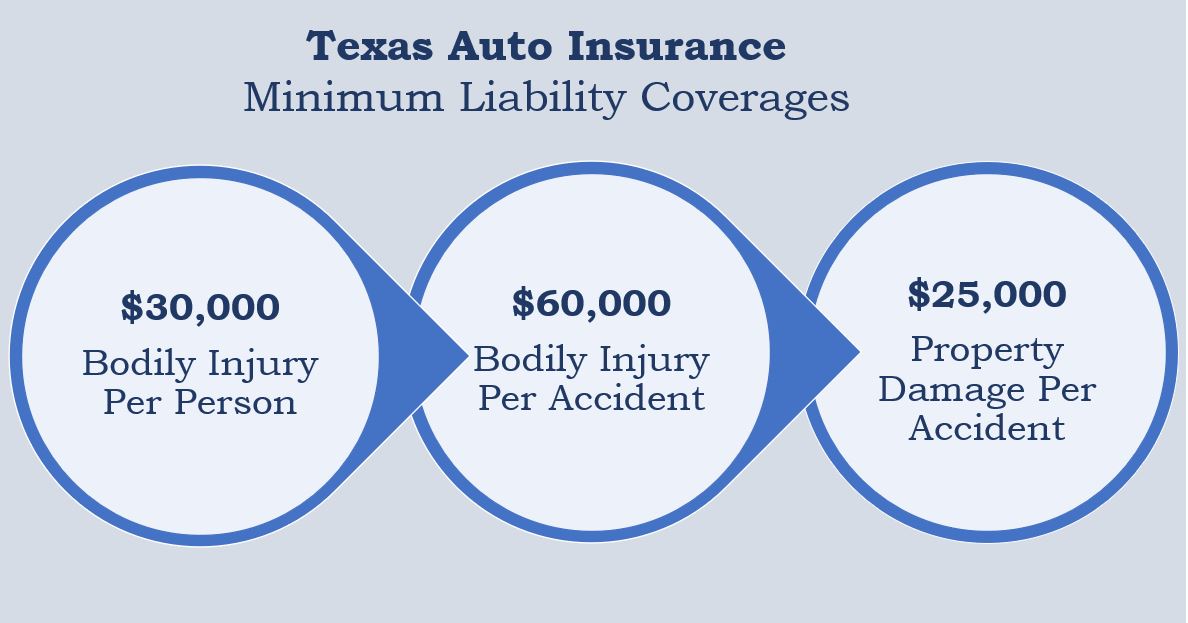

| Texas | $30,000 per person/$60,000 per accident | $25,000 | $30,000 per person/$60,000 per accident |

| Utah | $25,000 per person/$65,000 per accident | $15,000 | $25,000 per person/$65,000 per accident |

| Vermont | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Virginia | $25,000 per person/$50,000 per accident | $20,000 | $25,000 per person/$50,000 per accident |

| Washington | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| West Virginia | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Wisconsin | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Wyoming | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

It’s important to note that these are minimum requirements, and you may choose to purchase higher coverage limits to better protect yourself financially.

Remember to consult the official state website for the most up-to-date information and to verify the accuracy of the data provided here.

Liability Coverage: Auto Insurance Minimum Limits By State

Liability coverage is a crucial part of auto insurance that protects you financially if you cause an accident that results in injuries or property damage to others. It essentially acts as a safety net, covering the costs associated with the accident, up to the limits specified in your policy.

Liability coverage is designed to shield you from potential financial ruin in the event of an accident caused by your negligence. It covers the expenses incurred by the other party, such as medical bills, lost wages, and property repair or replacement costs.

How Liability Coverage Protects Drivers

Liability coverage is activated when you are at fault in an accident. It provides financial protection to the other driver(s) and their passengers involved in the accident, covering their expenses up to the limits of your policy.

Here’s how liability coverage works:

* Bodily Injury Liability: This part of your liability coverage covers the medical expenses of the other driver(s) and their passengers, including treatment, rehabilitation, and lost wages.

* Property Damage Liability: This portion of your liability coverage covers the cost of repairing or replacing the other driver’s vehicle or any other property damaged in the accident, such as fences or buildings.

Examples of Liability Coverage in Action

Liability coverage can be a lifesaver in various scenarios. Here are some examples:

* Scenario 1: You accidentally back your car into another vehicle in a parking lot, causing damage to their car and injuring the driver. Your liability coverage will pay for the repairs to the other vehicle and the injured driver’s medical expenses.

* Scenario 2: You are driving on a busy highway and make a sudden lane change, hitting another vehicle. Your liability coverage will pay for the other driver’s injuries, medical bills, and property damage.

Liability coverage is essential for every driver, regardless of driving experience. It protects you from financial hardship and ensures you can meet your legal obligations in the event of an accident.

Property Damage Coverage

Property damage coverage is a vital component of auto insurance, protecting you financially if you cause damage to another person’s property in an accident. This coverage helps pay for repairs or replacement of the other driver’s vehicle, as well as any other damaged property, like fences, buildings, or street signs.

How Property Damage Coverage Protects Drivers

Property damage coverage works by covering the costs of repairing or replacing the other driver’s property if you are at fault in an accident. It also covers any legal fees associated with the claim.

Examples of Property Damage Coverage Use

Here are some scenarios where property damage coverage would be used:

* Rear-ending another vehicle: If you rear-end another car, causing damage to their bumper or other parts, your property damage coverage would help pay for the repairs.

* Hitting a parked car: If you accidentally hit a parked car while driving, your property damage coverage would cover the cost of repairing the damaged vehicle.

* Damaging a fence or building: If you lose control of your car and hit a fence or building, your property damage coverage would help pay for the repairs.

* Causing damage to a street sign or traffic light: If you damage a street sign or traffic light in an accident, your property damage coverage would cover the cost of replacing it.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage (UM/UIM) is a type of auto insurance that protects you and your passengers if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages. This coverage helps pay for medical bills, lost wages, and property damage.

UM/UIM coverage is essential for protecting drivers and passengers from financial hardship in the event of an accident with an uninsured or underinsured driver. It helps to ensure that you can receive compensation for your injuries and losses, even if the other driver is at fault and lacks sufficient insurance.

Situations Where Uninsured/Underinsured Motorist Coverage Would Be Used

Here are some examples of situations where UM/UIM coverage would be used:

- You are stopped at a red light and a driver runs a red light, hitting your vehicle. The other driver is uninsured.

- You are involved in a multi-car accident. The driver who caused the accident has liability coverage, but it’s not enough to cover all the damages.

- You are hit by a hit-and-run driver, and the driver is never identified.

Additional Coverage Options

While minimum auto insurance requirements are essential, they may not fully protect you in every situation. Many drivers opt for additional coverage options to enhance their protection and peace of mind. These optional coverages provide broader financial protection in case of accidents or unforeseen events.

Collision Coverage

Collision coverage protects you financially if your vehicle is damaged in an accident, regardless of who is at fault. It covers repairs or replacement costs, minus your deductible.

- Benefit: It provides financial security to cover repairs or replacement costs after an accident, regardless of fault.

- Drawback: It increases your premium and may not be necessary if your vehicle is older or has low value.

- Example: If you hit a parked car and damage your vehicle, collision coverage will help cover the repair costs, even if you were at fault.

Comprehensive Coverage

Comprehensive coverage protects you from financial losses due to damages to your vehicle caused by events other than collisions, such as theft, vandalism, natural disasters, or animal collisions. It also covers repairs or replacement costs, minus your deductible.

- Benefit: It provides financial protection for damages caused by events beyond your control.

- Drawback: It increases your premium and may not be necessary if your vehicle is older or has low value.

- Example: If your car is damaged by a hailstorm, comprehensive coverage will help cover the repair costs.

Personal Injury Protection (PIP)

Personal Injury Protection (PIP) coverage, also known as no-fault insurance, covers your medical expenses, lost wages, and other related costs if you are injured in an accident, regardless of who is at fault.

- Benefit: It provides financial protection for medical expenses, lost wages, and other related costs after an accident, regardless of fault.

- Drawback: It increases your premium and may be less necessary if you have excellent health insurance.

- Example: If you are injured in an accident and require medical treatment, PIP coverage will help cover the costs.

Factors Affecting Insurance Premiums

Auto insurance premiums are calculated based on various factors that insurers use to assess your risk of being involved in an accident. These factors can influence the cost of your insurance significantly, and understanding them can help you make informed decisions about your coverage and potentially reduce your premiums.

Driving History

Your driving history plays a significant role in determining your insurance premiums. A clean driving record with no accidents or traffic violations will generally result in lower premiums. Conversely, having a history of accidents, speeding tickets, or other traffic offenses can increase your premiums. Insurance companies view drivers with a history of accidents as higher risk and therefore charge them higher premiums. For instance, if you have had two accidents in the past three years, your premiums might be significantly higher than someone with a clean driving record.

Vehicle Type

The type of vehicle you drive is another important factor that affects your insurance premiums. Insurers consider factors like the vehicle’s make, model, year, safety features, and value when determining your premium. Vehicles with a history of high repair costs, high theft rates, or poor safety ratings are generally considered riskier and therefore have higher premiums. For example, a high-performance sports car will typically have a higher insurance premium than a compact sedan due to its higher repair costs and potential for higher speeds.

Location

The location where you live and drive also plays a significant role in your insurance premiums. Areas with high traffic density, higher crime rates, or more severe weather conditions tend to have higher accident rates. As a result, insurance companies charge higher premiums in these areas. For instance, if you live in a city with a high population density, you might pay more for insurance than someone living in a rural area with lower traffic volume.

Age and Gender

Your age and gender can also influence your insurance premiums. Younger drivers, particularly those under the age of 25, are statistically more likely to be involved in accidents. Insurance companies typically charge higher premiums to younger drivers, recognizing this increased risk. Similarly, gender can also play a role, with some studies suggesting that men tend to be involved in more accidents than women. However, it’s important to note that this is a generalization, and individual driving habits and experiences play a significant role.

Credit Score

In many states, insurance companies use your credit score as a factor in determining your insurance premiums. This practice is based on the idea that individuals with good credit are more financially responsible and therefore less likely to make claims. While this practice is controversial, it’s a reality in many states, and improving your credit score can potentially lead to lower premiums.

Coverage Levels

The amount of coverage you choose will directly affect your insurance premiums. Higher coverage limits, such as higher liability limits or comprehensive and collision coverage, will result in higher premiums. However, these higher coverage limits can provide greater financial protection in the event of an accident. It’s important to weigh the cost of higher coverage against the potential benefits and choose the coverage levels that best meet your individual needs and financial situation.

Driving Habits

Your driving habits, such as the number of miles you drive annually and the purpose of your driving, can also impact your insurance premiums. Drivers who commute long distances or drive frequently for work may have higher premiums than those who drive less. Similarly, drivers who use their vehicles for commercial purposes or for transporting hazardous materials may also have higher premiums.

Discounts

Many insurance companies offer discounts that can help reduce your premiums. These discounts can be based on various factors, such as good driving history, safe driving courses, vehicle safety features, multiple policies, and bundling your insurance with other products like home or renters insurance. It’s worth exploring the discounts available from your insurer and taking advantage of any that apply to you.

Importance of Reviewing Insurance Coverage

It’s crucial to regularly review your auto insurance coverage to ensure it adequately protects you and your financial well-being. Your insurance needs can change over time due to various factors, and failing to update your coverage could leave you vulnerable in case of an accident.

Factors Affecting Insurance Needs

Changes in your life can significantly impact your auto insurance needs. Consider these factors:

- Changes in driving habits: If you start driving more frequently, commute longer distances, or drive in high-risk areas, your insurance needs may change. For example, if you transition from a short commute to a longer one, you might need higher liability limits to cover potential damages in a more extensive accident.

- Adding a new driver: Adding a new driver to your policy, especially a young or inexperienced driver, can increase your premiums. Consider adjusting coverage levels to reflect the additional risk.

- Purchasing a new vehicle: Buying a new car, especially a more expensive or high-performance model, will likely require higher coverage limits to protect your investment adequately.

- Changes in financial circumstances: If your financial situation changes, you may need to reassess your insurance coverage. For instance, if you experience a significant increase in assets, you might want to consider increasing your liability limits to protect your assets in case of a lawsuit.

Adjusting Insurance Coverage

When your circumstances change, contact your insurance agent to discuss adjusting your coverage. Here’s a general process:

- Review your current policy: Start by understanding your existing coverage levels and deductibles. Analyze your policy and identify any areas that might need adjustment.

- Assess your needs: Consider the factors mentioned earlier, such as changes in driving habits, new drivers, or vehicle purchases. Determine how these factors impact your insurance requirements.

- Contact your agent: Discuss your needs and desired changes with your insurance agent. They can help you understand the available coverage options and provide recommendations tailored to your specific situation.

- Obtain quotes: Get quotes from different insurance companies to compare rates and coverage options. This allows you to find the best value for your needs.

- Make necessary adjustments: Based on the quotes and your needs, adjust your coverage levels and deductibles. Remember that increasing coverage levels may increase your premiums, while increasing deductibles may lower your premiums but increase your out-of-pocket expenses in case of an accident.

Concluding Remarks

Knowing your state’s auto insurance minimum limits is a vital step in responsible driving. By understanding the required coverage and its implications, you can make informed decisions about your insurance needs and ensure you have adequate protection. Remember, your insurance is a safety net, providing financial security in the face of unexpected events. Regularly reviewing your coverage, considering additional options, and seeking professional advice can help you navigate the complexities of auto insurance and drive with peace of mind.

Question Bank

What happens if I get into an accident and don’t have the required minimum auto insurance?

If you are involved in an accident and do not have the required minimum auto insurance, you could face serious consequences. You may be held personally liable for the damages caused, potentially facing lawsuits and financial ruin. Your license could also be suspended, and you may be required to pay fines and penalties.

How often should I review my auto insurance coverage?

It is recommended to review your auto insurance coverage at least once a year, or more frequently if you experience any significant life changes such as a new vehicle purchase, a change in driving habits, or a change in your financial situation. Reviewing your coverage ensures that you have adequate protection and that your premiums are still competitive.