Auto insurance in Washington state is a crucial aspect of responsible driving, ensuring financial protection in case of accidents or unforeseen events. Understanding the state’s requirements, factors affecting premiums, and available coverage options is essential for every driver. This guide provides a comprehensive overview of auto insurance in Washington, helping you navigate the complexities and make informed decisions.

From mandatory coverage and minimum liability limits to the impact of driving history, vehicle type, and credit score on premiums, this guide covers a wide range of topics. We’ll also delve into the different types of auto insurance coverage available, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Additionally, we’ll offer valuable tips on choosing the right policy, filing claims, and accessing helpful resources.

Understanding Washington State Auto Insurance Requirements: Auto Insurance In Washington State

Driving in Washington State requires you to have auto insurance. This is a legal requirement that ensures you are financially protected in case of an accident. The state has specific requirements for auto insurance coverage, which we will discuss in detail.

Minimum Liability Limits

Washington State requires all drivers to have a minimum amount of liability insurance. This coverage protects you from financial losses if you cause an accident that injures someone or damages their property.

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages if you injure someone in an accident. The minimum requirement is $25,000 per person and $50,000 per accident.

- Property Damage Liability: This coverage pays for repairs or replacement of damaged property if you cause an accident. The minimum requirement is $10,000 per accident.

Financial Responsibility Law

Washington State’s Financial Responsibility Law ensures that drivers are financially responsible for accidents they cause. This law requires drivers to have proof of insurance or other financial responsibility, such as a surety bond or self-insurance.

The Financial Responsibility Law is designed to protect the public from uninsured drivers.

Penalties for Driving Without Insurance

Driving without the required auto insurance in Washington State can lead to significant penalties. These penalties can include:

- Fines: You could face a fine of up to $1,000 for driving without insurance.

- License Suspension: Your driver’s license can be suspended for up to 90 days for driving without insurance.

- Vehicle Impoundment: Your vehicle can be impounded until you provide proof of insurance.

- Increased Insurance Rates: If you are caught driving without insurance, your insurance rates will likely increase significantly.

Factors Affecting Auto Insurance Premiums in Washington

Several factors influence the cost of your auto insurance premiums in Washington. Understanding these factors can help you make informed decisions to potentially lower your insurance costs.

Driving History

Your driving history is a significant factor in determining your auto insurance premiums. Insurance companies assess your risk based on your past driving behavior.

- A clean driving record with no accidents or violations typically results in lower premiums.

- Accidents, traffic violations, and DUI convictions can significantly increase your premiums.

- The severity of the violations also matters; a speeding ticket may result in a smaller premium increase than a DUI.

Vehicle Type

The type of vehicle you drive plays a crucial role in your auto insurance premiums.

- High-performance vehicles, luxury cars, and vehicles with expensive repair costs are generally more expensive to insure.

- This is because they are more likely to be involved in accidents and the repair costs are higher.

- Conversely, older, less expensive vehicles often have lower insurance premiums.

Age

Your age is another factor that insurance companies consider.

- Young drivers, especially those under 25, are statistically more likely to be involved in accidents, leading to higher premiums.

- As you age, your premiums typically decrease because you gain experience and are considered less risky drivers.

Location

Where you live can significantly impact your auto insurance premiums.

- Insurance companies consider the frequency of accidents, theft rates, and other risks in different areas.

- Areas with higher crime rates and more traffic congestion may have higher insurance premiums.

Credit Score

In Washington, insurance companies are allowed to use your credit score to determine your auto insurance premiums.

- A good credit score can lead to lower premiums, while a poor credit score can result in higher premiums.

- This is because a good credit score is often associated with responsible financial behavior, which can be an indicator of responsible driving behavior.

Coverage Options

The types of coverage you choose can significantly impact your premiums.

- Comprehensive coverage protects you against damage to your vehicle from events like theft, vandalism, and natural disasters.

- Collision coverage protects you against damage to your vehicle in an accident, regardless of who is at fault.

- Higher coverage limits typically mean higher premiums, but also offer greater financial protection.

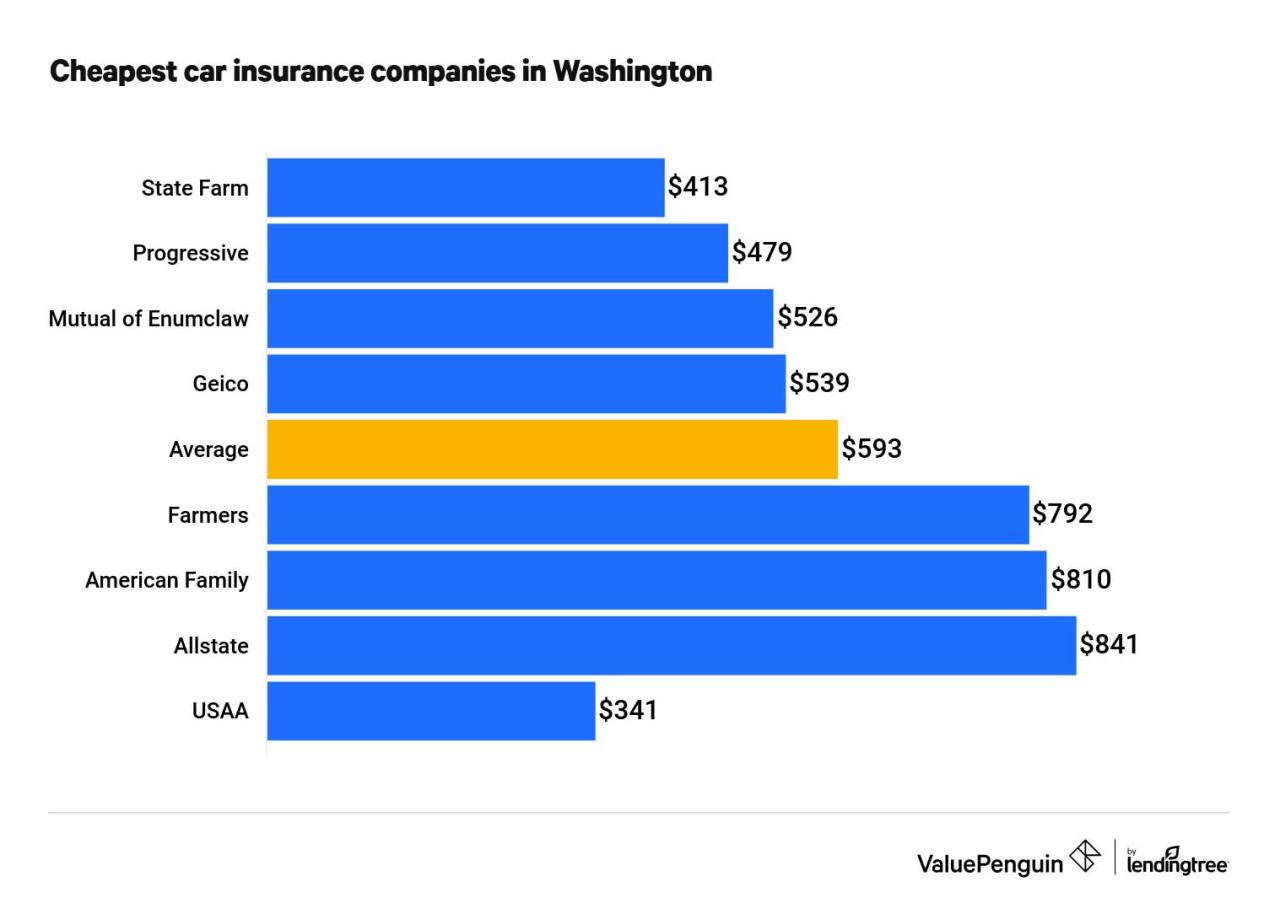

Average Premiums

According to the Insurance Information Institute, the average annual auto insurance premium in Washington in 2023 was $1,800.

- This is slightly higher than the national average of $1,700.

- However, individual premiums can vary widely depending on the factors discussed above.

Types of Auto Insurance Coverage in Washington

Washington State requires drivers to have specific auto insurance coverage to protect themselves and others in case of an accident. Understanding the different types of coverage available is crucial for choosing the right policy that meets your needs and budget. This section will explore the various types of auto insurance coverage in Washington, their benefits, limitations, and examples of when they would apply.

Liability Coverage

Liability coverage is the most basic and essential type of auto insurance in Washington. It protects you financially if you are at fault in an accident and cause damage to another person’s property or injuries to another person. Liability coverage is typically expressed in two limits:

* Bodily Injury Liability: This covers medical expenses, lost wages, and pain and suffering for injuries you cause to others in an accident.

* Property Damage Liability: This covers repairs or replacement costs for damage you cause to another person’s vehicle or property.

Liability coverage is required by law in Washington. The minimum limits are:

* $25,000 per person for bodily injury

* $50,000 per accident for bodily injury

* $10,000 per accident for property damage

However, it’s highly recommended to have higher liability limits than the minimum. This is because the minimum limits may not be sufficient to cover the costs of a serious accident, and you could be personally liable for any expenses exceeding the policy limits.

Here are some examples of situations where liability coverage would apply:

* You rear-end another car while driving, causing damage to their vehicle and injuring the driver. Your liability coverage would pay for the other driver’s medical expenses and vehicle repairs.

* You run a red light and hit another car, causing damage to both vehicles and injuring passengers in the other car. Your liability coverage would pay for the other driver’s medical expenses, vehicle repairs, and any injuries to the passengers.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. It covers damage caused by collisions with other vehicles, objects, or even hitting a pothole.

Collision coverage is optional in Washington, but it is recommended if you have a loan or lease on your vehicle. If you have collision coverage, your insurance company will pay for repairs or replacement of your vehicle, minus your deductible. The deductible is the amount you pay out of pocket before your insurance kicks in.

Here are some examples of situations where collision coverage would apply:

* You are involved in an accident with another vehicle, and your car is damaged. Collision coverage would pay for repairs or replacement of your vehicle, minus your deductible.

* You hit a pothole and damage your tire and rim. Collision coverage would pay for repairs or replacement of your tire and rim, minus your deductible.

* You lose control of your car and hit a tree, causing significant damage to your vehicle. Collision coverage would pay for repairs or replacement of your vehicle, minus your deductible.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than collisions. This includes damage from:

* Theft

* Vandalism

* Fire

* Hail

* Flooding

* Falling objects

* Animal collisions

Like collision coverage, comprehensive coverage is optional in Washington. It is typically recommended for newer vehicles or vehicles with a high value.

Here are some examples of situations where comprehensive coverage would apply:

* Your car is stolen and never recovered. Comprehensive coverage would pay for the replacement value of your vehicle, minus your deductible.

* A tree falls on your car during a storm, causing significant damage. Comprehensive coverage would pay for repairs or replacement of your vehicle, minus your deductible.

* Your car is damaged by hail. Comprehensive coverage would pay for repairs or replacement of your vehicle, minus your deductible.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you are injured in an accident caused by a driver who has no insurance or insufficient insurance to cover your losses. This coverage can help pay for your medical expenses, lost wages, and pain and suffering.

UM/UIM coverage is optional in Washington, but it is strongly recommended. It is especially important if you drive in areas with a high number of uninsured drivers.

Here are some examples of situations where UM/UIM coverage would apply:

* You are hit by a driver who has no insurance. Your UM/UIM coverage would pay for your medical expenses and other losses.

* You are hit by a driver who has insurance but their limits are too low to cover your losses. Your UIM coverage would pay for the difference between your losses and the other driver’s insurance limits.

Comparison of Coverage Types

| Coverage Type | What It Covers | Cost | Benefits |

|---|---|---|---|

| Liability | Damage or injuries you cause to others | Lower cost | Required by law, protects you from financial ruin |

| Collision | Damage to your vehicle in an accident, regardless of fault | Higher cost | Protects your investment in your vehicle |

| Comprehensive | Damage to your vehicle from events other than collisions | Higher cost | Protects your vehicle from unexpected damage |

| Uninsured/Underinsured Motorist | Injuries caused by a driver without or with insufficient insurance | Higher cost | Protects you from financial losses if the other driver is uninsured or underinsured |

Choosing the Right Auto Insurance Policy in Washington

Selecting the right auto insurance policy is crucial to ensure you have adequate coverage while managing your budget effectively. It involves considering various factors, comparing different options, and understanding the available discounts and savings.

Factors to Consider

Choosing the right auto insurance policy requires a thorough assessment of your individual needs, driving habits, and financial situation. These factors play a significant role in determining the type of coverage, policy limits, and overall cost of your insurance.

- Driving History: Your driving record, including any accidents, violations, or suspensions, significantly impacts your insurance premiums. A clean driving record typically results in lower premiums.

- Vehicle Type and Value: The make, model, year, and value of your vehicle directly influence your insurance costs. High-performance or luxury vehicles generally attract higher premiums due to their increased repair costs and potential for theft.

- Coverage Needs: Evaluate your individual needs and determine the level of coverage required. For example, if you own a new or high-value vehicle, comprehensive and collision coverage might be essential. However, if you have an older car, liability coverage might suffice.

- Location: Your location plays a role in determining your insurance premiums. Areas with higher rates of accidents or theft generally have higher insurance costs.

- Budget: Consider your budget and affordability when choosing an auto insurance policy. You can adjust your coverage levels and deductibles to find a balance between coverage and cost.

Comparing Insurance Quotes

Comparing quotes from different insurance companies is essential to find the best deal. Online comparison websites and independent insurance brokers can streamline this process.

- Use Online Comparison Websites: Several websites allow you to compare quotes from multiple insurance providers simultaneously. This helps you quickly assess different options and identify the most competitive rates.

- Contact Independent Insurance Brokers: Independent brokers represent multiple insurance companies and can help you compare quotes from different providers. They can also provide personalized advice based on your specific needs and situation.

- Review Policy Details Carefully: When comparing quotes, carefully review the policy details, including coverage levels, deductibles, and exclusions. Ensure you understand the terms and conditions before making a decision.

Discounts and Savings

Several discounts and savings options are available to reduce your auto insurance premiums. These discounts can significantly impact your overall costs.

- Safe Driver Discounts: Many insurance companies offer discounts for drivers with clean driving records and no accidents or violations. These discounts can be substantial and provide significant savings over time.

- Multi-Policy Discounts: Bundling your auto insurance with other insurance policies, such as homeowners or renters insurance, can result in significant discounts.

- Good Student Discounts: Students with good academic performance may be eligible for discounts on their auto insurance premiums.

- Anti-theft Device Discounts: Installing anti-theft devices in your vehicle, such as alarms or tracking systems, can qualify you for discounts.

- Pay-in-Full Discounts: Some insurance companies offer discounts for paying your premiums in full rather than in installments.

Key Questions to Ask

Before choosing an insurance provider, it’s essential to ask specific questions to ensure you understand the policy details and coverage options.

- What coverage options are available?: Clarify the different types of coverage offered and their limitations.

- What are the policy limits and deductibles?: Understand the maximum amount covered by each policy and the amount you’re responsible for paying in case of an accident.

- What discounts are available?: Inquire about any potential discounts you may be eligible for, such as safe driver, multi-policy, or good student discounts.

- What is the claims process like?: Understand the procedures for filing a claim and the expected timeline for processing.

- What are the customer service options?: Ask about the availability of customer support channels, such as phone, email, or online chat.

Filing a Claim with Your Auto Insurance in Washington

Filing a claim with your auto insurance company in Washington is a necessary step if you’ve been involved in an accident or your vehicle has been stolen. The process is designed to be straightforward, but understanding the steps involved and the required documentation can help ensure a smooth and efficient experience.

Reporting an Accident or Theft

It’s essential to report any accident or theft to your insurance company as soon as possible. Most insurance companies have a 24/7 claims hotline that you can call to initiate the reporting process. When reporting an accident, be prepared to provide details such as:

- Date, time, and location of the accident

- Details of the other vehicles involved, including license plate numbers and insurance information

- Description of the accident, including any injuries or damages

- Contact information for any witnesses

If you’ve experienced a vehicle theft, be prepared to provide:

- Date, time, and location of the theft

- Description of the stolen vehicle, including make, model, year, color, and VIN

- Any information about the theft, such as if you witnessed it or if you have any leads

Documentation Required for Filing a Claim, Auto insurance in washington state

To support your claim, you’ll need to gather specific documentation. This includes:

- Police report: In most cases, a police report is required for accidents or thefts. You can obtain a copy of the report from the police department that responded to the incident.

- Photos and videos: Take detailed photos or videos of the damage to your vehicle, the accident scene, and any injuries sustained. This visual documentation can help support your claim.

- Medical records: If you’ve sustained injuries, gather medical records from your doctor or hospital visits.

- Repair estimates: Obtain repair estimates from reputable auto body shops. These estimates will help determine the cost of repairs.

- Vehicle registration and insurance information: Keep your vehicle registration and insurance information readily available. You may need to provide this information to your insurance company.

Tips for Ensuring a Smooth Claim Process

Following these tips can help streamline your claim process:

- Report the incident promptly: Contact your insurance company as soon as possible after an accident or theft. This helps ensure timely processing of your claim.

- Be accurate and truthful: Provide accurate and truthful information to your insurance company. Any discrepancies or inconsistencies can delay the claim process.

- Keep detailed records: Maintain records of all communication with your insurance company, including dates, times, and details of conversations. This documentation can be helpful if any issues arise.

- Follow instructions: Follow the instructions provided by your insurance company regarding claim procedures and deadlines.

- Be patient: The claim process can take time, especially if there are complex circumstances involved. Be patient and communicate regularly with your insurance company.

Resources for Auto Insurance Information in Washington

Navigating the world of auto insurance can be a daunting task, but thankfully, there are numerous resources available in Washington State to guide you through the process. This section will highlight several reputable organizations and websites that can provide valuable information about auto insurance requirements, coverage options, and claim procedures.

Government Agencies

Government agencies play a crucial role in regulating the insurance industry and protecting consumers’ rights. These agencies offer a wealth of information about auto insurance, including state regulations, consumer protection tips, and complaint resolution processes.

- Washington State Office of the Insurance Commissioner (OIC): The OIC is the primary regulatory body for insurance in Washington. It sets insurance rules and regulations, investigates complaints against insurance companies, and provides consumer education materials. You can access their website for information about auto insurance, including brochures, FAQs, and a searchable database of licensed insurance companies.

- Washington State Department of Licensing (DOL): The DOL handles vehicle registration and licensing, which is directly tied to auto insurance requirements. They ensure that all vehicles registered in Washington have the minimum required auto insurance coverage. The DOL website provides information about auto insurance requirements, as well as resources for obtaining and renewing your driver’s license.

Consumer Protection Organizations

Consumer protection organizations are dedicated to advocating for the rights of consumers and providing them with information and resources to make informed decisions. These organizations can be invaluable sources of information about auto insurance, especially when it comes to understanding your rights and resolving disputes with insurance companies.

- Washington State Department of Financial Institutions (DFI): The DFI oversees the financial services industry in Washington, including insurance. They provide consumer protection resources, including information about auto insurance, and offer tools for resolving disputes with insurance companies.

- Consumer Reports: Consumer Reports is a non-profit organization that provides independent reviews and ratings of products and services, including auto insurance. They offer detailed information about different insurance companies, coverage options, and claim handling processes.

Insurance Comparison Websites

Insurance comparison websites are online platforms that allow you to compare quotes from multiple insurance companies simultaneously. These websites can save you time and money by helping you find the most competitive rates for your specific needs.

- Insurify: Insurify is a popular insurance comparison website that aggregates quotes from over 20 insurance companies. You can use their website to compare quotes for auto insurance, as well as other types of insurance, such as homeowners and renters insurance.

- Policygenius: Policygenius is another reputable insurance comparison website that offers personalized recommendations based on your individual needs. They also provide detailed information about different insurance companies and coverage options.

Resources for Auto Insurance Claims and Disputes

Filing a claim with your auto insurance company can be a stressful experience. It’s important to understand your rights and responsibilities, as well as the process for resolving disputes.

- Washington State Office of the Insurance Commissioner (OIC): The OIC offers a range of resources for consumers who are having problems with their auto insurance company. They can provide information about your rights, help you file a complaint, and mediate disputes.

- Washington State Department of Financial Institutions (DFI): The DFI also provides resources for resolving disputes with insurance companies. They offer mediation services and can help you understand your options for pursuing legal action.

Conclusive Thoughts

Navigating the world of auto insurance in Washington can be overwhelming, but with the right knowledge and resources, you can make informed decisions and secure the protection you need. By understanding the state’s requirements, factors affecting premiums, and available coverage options, you can find a policy that meets your specific needs and budget. Remember to compare quotes, explore discounts, and keep your driving record clean to minimize your insurance costs. This guide serves as a valuable starting point for your journey towards confident and responsible driving in Washington state.

Top FAQs

What is the minimum liability coverage required in Washington state?

The minimum liability coverage required in Washington state is $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $10,000 for property damage.

What are some common discounts offered by auto insurance companies in Washington?

Common discounts include good driver discounts, safe driver discounts, multi-car discounts, and discounts for safety features like anti-theft devices and airbags.

What are some resources for resolving auto insurance disputes in Washington?

You can contact the Washington State Office of the Insurance Commissioner or seek assistance from consumer protection organizations like the Washington State Department of Financial Institutions.