Arkansas state minimum auto insurance sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. In the state of Arkansas, driving without the proper auto insurance can lead to significant consequences. Understanding the minimum requirements and the potential ramifications of not meeting them is crucial for all drivers. This comprehensive guide explores the intricacies of Arkansas’s auto insurance laws, providing valuable insights for navigating the complex world of car insurance.

The minimum auto insurance requirements in Arkansas are designed to protect drivers and their passengers in the event of an accident. The state mandates specific liability limits for bodily injury, property damage, and uninsured/underinsured motorist coverage, ensuring that victims of accidents have access to compensation for their injuries and losses. This guide delves into the specific requirements for each type of coverage, explaining the importance of meeting these minimum standards.

Arkansas State Minimum Auto Insurance Requirements

Driving a vehicle in Arkansas comes with the responsibility of carrying auto insurance. This ensures financial protection for you and others in case of an accident. The state mandates specific insurance coverages to ensure all drivers meet a minimum level of financial responsibility.

Liability Coverage

Liability insurance covers damages caused to others in an accident. Arkansas law requires all drivers to carry liability coverage. This coverage protects you from financial responsibility if you are at fault in an accident.

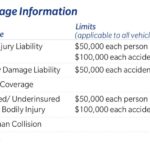

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages to the other driver and passengers involved in an accident caused by you. Arkansas requires a minimum limit of $25,000 per person and $50,000 per accident. This means that the insurance company will pay up to $25,000 for injuries to one person and up to $50,000 for all injuries in a single accident.

- Property Damage Liability: This coverage pays for repairs or replacement of damaged property belonging to the other driver or anyone else involved in an accident caused by you. Arkansas mandates a minimum limit of $25,000 per accident. This means the insurance company will pay up to $25,000 for damages to property in a single accident.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. This coverage helps cover your medical expenses, lost wages, and property damage.

- Uninsured Motorist Coverage: This coverage protects you if you are hit by a driver without insurance. Arkansas requires a minimum limit of $25,000 per person and $50,000 per accident. This means that the insurance company will pay up to $25,000 for your injuries and up to $50,000 for all injuries in a single accident.

- Underinsured Motorist Coverage: This coverage protects you if you are hit by a driver with insurance but their coverage limits are insufficient to cover your damages. Arkansas requires a minimum limit of $25,000 per person and $50,000 per accident. This means that the insurance company will pay up to $25,000 for your injuries and up to $50,000 for all injuries in a single accident.

Personal Injury Protection (PIP) Coverage

PIP coverage, also known as “no-fault” insurance, covers your medical expenses and lost wages after an accident, regardless of who was at fault. While not mandatory in Arkansas, it is highly recommended. PIP coverage is often included as part of a comprehensive auto insurance policy.

- PIP Coverage: Arkansas law allows drivers to choose a PIP coverage limit between $2,500 and $50,000. This means that the insurance company will pay up to the chosen limit for your medical expenses and lost wages after an accident, regardless of who was at fault.

Understanding Arkansas’s Financial Responsibility Law: Arkansas State Minimum Auto Insurance

In Arkansas, the Financial Responsibility Law is a crucial component of road safety, ensuring that drivers are financially accountable for any damage or injuries caused by their vehicles. This law mandates that all drivers carry a minimum amount of auto insurance to cover potential liabilities arising from accidents.

Consequences of Driving Without Minimum Required Auto Insurance

Driving without the minimum required auto insurance in Arkansas carries significant legal and financial consequences. Failure to comply with this law can result in various penalties, including:

- Suspension of Driver’s License: The Arkansas Department of Finance and Administration (DFA) can suspend your driver’s license if you fail to provide proof of insurance.

- Fines: You may face fines for driving without insurance, with penalties varying depending on the specific circumstances.

- Vehicle Impoundment: Your vehicle can be impounded if you are caught driving without insurance, adding to the cost of recovering your vehicle.

- Court Appearance: You may be required to appear in court and face further legal action, potentially leading to additional fines or penalties.

Penalties for Driving with Suspended Registration Due to Lack of Insurance

If your vehicle registration is suspended due to a lack of insurance, you will face additional consequences:

- Inability to Register Your Vehicle: You will be unable to renew your vehicle registration until you provide proof of insurance.

- Fines: You may be subject to fines for driving with a suspended registration, further increasing your financial burden.

- Legal Action: If you are caught driving with a suspended registration, you may face legal action, including potential jail time.

Legal and Financial Repercussions of an Accident Without Adequate Coverage

Being involved in an accident without adequate insurance coverage can have severe legal and financial repercussions.

- Liability for Damages: Even if you are not at fault for the accident, you could be held liable for the damages caused to other vehicles or injuries sustained by others.

- Lawsuits: The other party involved in the accident may sue you for damages, potentially leading to substantial financial losses.

- Financial Ruin: Without adequate insurance coverage, you could face significant financial burdens to cover medical expenses, property repairs, legal fees, and other costs associated with the accident.

- Credit Score Impact: Unpaid judgments from an accident can negatively impact your credit score, making it more difficult to obtain loans or credit in the future.

Exploring Insurance Options Beyond the Minimum

While Arkansas’s minimum auto insurance requirements are designed to protect you from financial ruin in case of an accident, they may not be sufficient to cover all potential expenses. Many drivers choose to purchase additional coverage to ensure comprehensive protection and peace of mind.

Types of Optional Auto Insurance Coverage

Here are some common types of optional auto insurance coverage available in Arkansas:

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who’s at fault. It’s important to consider the value of your vehicle and your financial situation when deciding if collision coverage is right for you. If your car is older or has a lower value, you might choose to forgo collision coverage, as the cost of repairs could exceed the vehicle’s worth.

- Comprehensive Coverage: This coverage protects you against damage to your vehicle caused by events other than accidents, such as theft, vandalism, fire, hail, or natural disasters. If you have a newer or more expensive vehicle, comprehensive coverage is often a good idea.

- Medical Payments Coverage (Med Pay): This coverage helps pay for medical expenses for you and your passengers, regardless of who’s at fault in an accident. Med Pay coverage can supplement your health insurance and cover costs such as ambulance fees, hospital stays, and doctor visits.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. It can help cover your medical expenses, lost wages, and property damage.

- Rental Reimbursement Coverage: This coverage helps pay for a rental car while your vehicle is being repaired after an accident. It can be a lifesaver if you rely on your car for work or daily errands.

- Roadside Assistance Coverage: This coverage provides assistance with things like jump-starts, flat tire changes, and towing in case of a breakdown. It can offer peace of mind knowing you’re not stranded on the side of the road.

Benefits and Drawbacks of Optional Coverage

Each type of optional auto insurance coverage has its own benefits and drawbacks.

- Collision Coverage:

- Benefit: Pays for repairs or replacement of your vehicle in an accident, regardless of fault.

- Drawback: Can be expensive, especially for newer or more expensive vehicles.

- Comprehensive Coverage:

- Benefit: Covers damage to your vehicle caused by events other than accidents.

- Drawback: May not be necessary if you have an older or less valuable vehicle.

- Medical Payments Coverage (Med Pay):

- Benefit: Supplements health insurance and covers medical expenses for you and your passengers.

- Drawback: Can be redundant if you have comprehensive health insurance.

- Uninsured/Underinsured Motorist Coverage (UM/UIM):

- Benefit: Protects you in accidents with uninsured or underinsured drivers.

- Drawback: May not be necessary if you live in an area with a low percentage of uninsured drivers.

- Rental Reimbursement Coverage:

- Benefit: Covers the cost of a rental car while your vehicle is being repaired.

- Drawback: Can be expensive if you rarely need a rental car.

- Roadside Assistance Coverage:

- Benefit: Provides assistance with breakdowns and emergencies.

- Drawback: May be unnecessary if you have a roadside assistance plan through your car manufacturer or credit card company.

Factors Influencing Auto Insurance Costs

Several factors can influence the cost of auto insurance in Arkansas, including:

- Age: Younger drivers typically pay higher premiums due to their higher risk of accidents. As you get older and gain more driving experience, your premiums may decrease.

- Driving History: Your driving record plays a significant role in determining your insurance rates. Accidents, traffic violations, and DUIs can all increase your premiums. Maintaining a clean driving record is essential for keeping your insurance costs low.

- Vehicle Type: The type of vehicle you drive also impacts your insurance rates. Higher-performance vehicles or those with a history of theft or accidents are generally more expensive to insure.

- Location: Your location can affect your insurance premiums. Areas with higher rates of accidents or theft tend to have higher insurance costs.

- Credit Score: In some states, including Arkansas, insurance companies may use your credit score to determine your insurance rates. Drivers with good credit scores often receive lower premiums.

Finding Affordable Auto Insurance in Arkansas

Securing affordable auto insurance in Arkansas is crucial for responsible drivers. Finding the right coverage at a reasonable price requires careful planning and comparison. This section will provide valuable insights and strategies to help you find the best deals on auto insurance.

Reputable Insurance Companies in Arkansas

Choosing a reliable insurance company is the first step towards finding affordable coverage. Many reputable insurance companies operate in Arkansas, each offering unique features and rates.

- State Farm: Known for its wide range of coverage options, competitive rates, and excellent customer service, State Farm is a popular choice for Arkansas drivers.

- GEICO: GEICO is another reputable insurer known for its competitive rates, user-friendly online platform, and 24/7 customer support.

- Progressive: Progressive offers a variety of coverage options, including unique features like Snapshot, a program that rewards safe driving habits with discounts.

- Allstate: Allstate is a well-established insurer with a strong reputation for customer service and a wide range of coverage options.

- Farmers: Farmers Insurance is a trusted insurer known for its personalized service and competitive rates.

Strategies for Obtaining Affordable Quotes

Once you have identified a few reputable insurance companies, it’s time to start comparing quotes. Here are some tips to help you secure the best possible rates:

- Compare Quotes from Multiple Insurers: Obtaining quotes from several insurance companies allows you to compare prices, coverage options, and discounts. Online comparison tools can simplify this process.

- Explore Discounts: Most insurance companies offer discounts for various factors, such as safe driving records, good credit scores, multiple policy bundling, and vehicle safety features. Inquire about available discounts and ensure you qualify for all applicable ones.

- Consider Policy Adjustments: Review your current coverage and consider adjustments that may reduce your premium without compromising essential protection. For instance, increasing your deductible or opting for a higher coverage limit can sometimes lead to lower premiums.

- Shop Around Regularly: Insurance rates can fluctuate, so it’s beneficial to shop around for new quotes every year or two to ensure you’re still getting the best deal.

Understanding Policy Terms and Conditions

Before committing to an insurance policy, it’s crucial to carefully review the terms and conditions. Understanding the details of your coverage is essential for making informed decisions and ensuring you’re adequately protected.

- Coverage Limits: Pay close attention to the coverage limits for each type of insurance, such as liability, collision, and comprehensive. These limits determine the maximum amount the insurer will pay for covered losses.

- Deductibles: The deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible typically results in a lower premium, while a lower deductible means a higher premium.

- Exclusions: Understand the exclusions in your policy, which are specific situations or events not covered by your insurance. For example, some policies may exclude coverage for certain types of damage or specific driving scenarios.

Navigating the Claims Process in Arkansas

Dealing with an auto accident can be stressful, but understanding the claims process in Arkansas can help you navigate the situation effectively. This section will guide you through the steps involved in filing a claim, communicating with your insurer, and understanding your rights and responsibilities.

Reporting the Accident

The first step after an accident is to report it to the authorities. This is crucial for several reasons:

- It establishes a record of the accident.

- It ensures that any injuries are attended to promptly.

- It helps determine fault and liability.

In Arkansas, you are legally required to report any accident involving:

- Injury or death

- Property damage exceeding $1,000

You can report the accident to the local police department or the Arkansas State Police.

Gathering Necessary Documentation

After reporting the accident, gather all the necessary documentation to support your claim. This includes:

- Police report

- Photos and videos of the accident scene and vehicle damage

- Contact information of all parties involved, including witnesses

- Medical records and bills for any injuries sustained

- Repair estimates from a reputable mechanic

Having this documentation readily available will streamline the claims process and help you receive the compensation you deserve.

Contacting the Insurer, Arkansas state minimum auto insurance

Once you have gathered the necessary documentation, contact your insurance company to report the accident and file a claim. Be prepared to provide detailed information about the accident, including:

- Date, time, and location of the accident

- Description of the accident

- Names and contact information of all parties involved

- Details of any injuries sustained

- Information about the other driver’s insurance

Your insurer will assign a claims adjuster to handle your claim. The claims adjuster will investigate the accident, review the documentation you provide, and determine the extent of coverage under your policy.

Communicating Effectively with the Insurance Company

Communication is key to a smooth claims process. Be honest and transparent with your insurer, providing all the information they need to process your claim.

It’s important to keep a detailed record of all communication with your insurer, including dates, times, and summaries of conversations.

If you have any questions or concerns, don’t hesitate to contact your claims adjuster or your insurance agent.

Understanding Your Rights and Responsibilities

As a policyholder, you have certain rights and responsibilities during the claims process. It’s important to understand these rights to ensure you are treated fairly and receive the compensation you deserve.

- You have the right to file a claim for covered losses.

- You have the right to be treated with respect and courtesy by the insurer.

- You have the right to receive a fair and prompt settlement of your claim.

- You have the right to appeal a decision you believe is unfair.

It’s also important to understand your responsibilities as a policyholder:

- You are responsible for reporting the accident promptly and accurately.

- You are responsible for cooperating with the insurer’s investigation.

- You are responsible for providing all necessary documentation.

The Importance of Documentation and Communication

Documentation and communication are crucial to a successful claims process. Keeping a detailed record of all communication with your insurer and gathering all necessary documentation will help ensure you are treated fairly and receive the compensation you deserve.

Final Wrap-Up

Navigating the world of auto insurance in Arkansas can seem daunting, but with the right information and a proactive approach, finding affordable and comprehensive coverage is achievable. By understanding the minimum requirements, exploring available options, and utilizing resources to compare rates and policies, drivers can make informed decisions that protect their financial well-being and ensure they are adequately covered in the event of an accident. This guide provides a comprehensive overview of Arkansas’s auto insurance landscape, empowering drivers to make confident and informed choices.

FAQ Guide

What happens if I get into an accident without the minimum required auto insurance in Arkansas?

You could face serious consequences, including fines, license suspension, and even jail time. You may also be held personally liable for the damages caused to others.

How can I find affordable auto insurance in Arkansas?

Compare quotes from multiple insurance companies, explore discounts, and consider adjusting your policy coverage based on your needs and risk tolerance.

What are some common discounts offered by auto insurance companies in Arkansas?

Some common discounts include good driver discounts, safe driver discounts, multi-car discounts, and discounts for safety features on your vehicle.

What should I do if I need to file an auto insurance claim in Arkansas?

Report the accident to your insurance company as soon as possible, gather necessary documentation, and communicate effectively with the insurer throughout the claims process.