Amer States Insurance, a prominent name in the insurance industry, has a rich history marked by significant milestones and strategic acquisitions. From its humble beginnings, the company has evolved into a multifaceted provider of property and casualty insurance, life insurance, and a range of financial services. With a robust presence across the nation, Amer States Insurance has established itself as a reliable and trusted partner for individuals and businesses seeking comprehensive insurance solutions.

The company’s commitment to customer satisfaction is evident in its comprehensive product portfolio, tailored to meet diverse needs. Whether you require homeowners, renters, auto, life, or health insurance, Amer States Insurance offers a variety of policies designed to provide peace of mind and financial security. Furthermore, the company’s commitment to innovation and technological advancements has enabled it to adapt to the changing landscape of the insurance industry, ensuring a seamless and efficient customer experience.

Amer States Insurance

Amer States Insurance is a leading provider of insurance and financial services in the United States. Founded in 1928, the company has a long history of serving customers and communities across the country. Amer States Insurance has grown significantly over the years, expanding its product offerings and geographic reach through strategic acquisitions and organic growth.

History of Amer States Insurance

Amer States Insurance was founded in 1928 as the American States Life Insurance Company in Indianapolis, Indiana. The company began by offering life insurance products to individuals and families. In the following decades, Amer States expanded its product portfolio to include property and casualty insurance, health insurance, and financial services.

- 1950s: Amer States Insurance began offering property and casualty insurance, expanding its reach beyond life insurance.

- 1960s: The company expanded its geographic reach by acquiring insurance companies in other states.

- 1970s: Amer States Insurance began offering health insurance products, further diversifying its business.

- 1980s: The company continued to grow through acquisitions, expanding its product offerings and market presence.

- 1990s: Amer States Insurance entered the financial services market, offering investment products and retirement planning services.

- 2000s: The company continued to expand its product offerings and geographic reach, becoming a major player in the insurance and financial services industries.

- 2010s: Amer States Insurance continued to focus on its core business areas, while also exploring new opportunities for growth, such as the development of digital insurance products.

Core Business Areas

Amer States Insurance operates in several key business areas, including:

- Property and Casualty Insurance: Amer States Insurance offers a wide range of property and casualty insurance products, including homeowners insurance, auto insurance, renters insurance, and business insurance.

- Life Insurance: Amer States Insurance provides life insurance products, such as term life insurance, whole life insurance, and universal life insurance. These products help individuals and families protect their loved ones financially in the event of death.

- Financial Services: Amer States Insurance offers a variety of financial services, including investment products, retirement planning services, and wealth management services. These services help individuals and families plan for their financial future.

Market Position

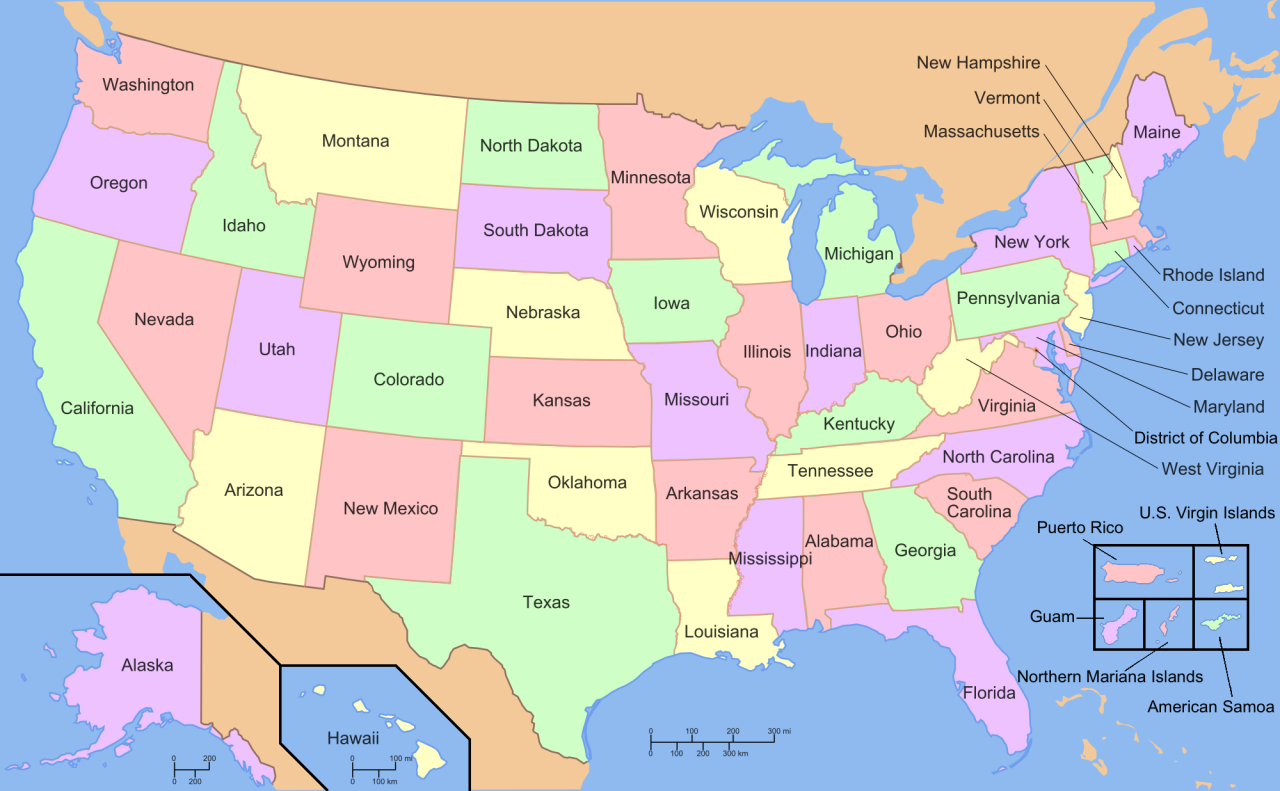

Amer States Insurance is a major player in the insurance and financial services industries. The company has a strong reputation for providing quality products and services to its customers. Amer States Insurance has a significant market share in its core business areas, and its products are available in all 50 states. The company has a strong financial position and a solid track record of profitability.

Amer States Insurance is committed to providing its customers with the products and services they need to protect their assets and plan for their financial future.

Products and Services

Amer States Insurance offers a comprehensive range of insurance products and services designed to meet the diverse needs of individuals and families. The company strives to provide reliable protection and peace of mind, catering to various aspects of life, from personal assets to health and well-being.

Main Products and Services

Amer States Insurance offers a variety of insurance products and services tailored to specific customer needs. Here’s a breakdown of their main offerings:

| Product/Service | Target Audience | Key Features |

|---|---|---|

| Homeowners Insurance | Homeowners | Coverage for dwelling, personal property, liability, and additional living expenses |

| Renters Insurance | Renters | Coverage for personal property, liability, and additional living expenses |

| Auto Insurance | Vehicle owners | Coverage for liability, collision, comprehensive, and uninsured/underinsured motorist |

| Life Insurance | Individuals and families | Financial protection for beneficiaries in the event of death |

| Health Insurance | Individuals and families | Coverage for medical expenses, including hospitalization, surgery, and prescription drugs |

| Business Insurance | Businesses | Coverage for property, liability, workers’ compensation, and other business risks |

| Financial Services | Individuals and families | Financial planning, investment management, and retirement planning |

Insurance Policy Details

Amer States Insurance offers a variety of insurance policies with different coverage types, premiums, and deductibles. The specific details vary based on individual needs and risk factors. Here’s a general overview:

| Policy Type | Coverage Types | Premiums | Deductibles |

|---|---|---|---|

| Homeowners Insurance | Dwelling, personal property, liability, additional living expenses | Varies based on factors like home value, location, and coverage amount | Varies based on policy and coverage level |

| Renters Insurance | Personal property, liability, additional living expenses | Generally more affordable than homeowners insurance | Varies based on policy and coverage level |

| Auto Insurance | Liability, collision, comprehensive, uninsured/underinsured motorist | Varies based on factors like vehicle type, driving history, and location | Varies based on policy and coverage level |

| Life Insurance | Term life, whole life, universal life | Varies based on factors like age, health, and coverage amount | Not applicable |

| Health Insurance | Individual health plans, employer-sponsored plans | Varies based on factors like age, health, and plan type | Varies based on plan type and coverage level |

Benefits of Choosing Amer States Insurance

Amer States Insurance offers a range of benefits for individuals and families seeking reliable insurance protection. Some of the key advantages include:

“Personalized service and expert advice from dedicated insurance professionals.”

“Competitive pricing and flexible policy options to suit individual needs.”

“Strong financial stability and a commitment to customer satisfaction.”

“A wide range of insurance products and services to meet diverse needs.”

“Convenient online and mobile access for policy management and claims reporting.”

Choosing Amer States Insurance provides peace of mind knowing that you have a trusted partner to protect your assets and well-being.

Financial Performance and Key Metrics: Amer States Insurance

Amer States Insurance has a solid track record of financial performance, demonstrating consistent revenue growth, profitability, and return on equity. This performance reflects the company’s strategic focus on core markets, effective risk management practices, and operational efficiency.

Revenue Growth

Amer States Insurance has consistently demonstrated revenue growth in recent years, driven by factors such as expansion into new markets, product diversification, and strong customer retention. The company’s revenue growth has outpaced the industry average, indicating its ability to capture market share and capitalize on industry trends.

Profitability

Amer States Insurance has maintained healthy profitability margins, reflecting its ability to control expenses and generate strong underwriting results. The company’s focus on underwriting discipline and effective risk management practices has contributed to its consistent profitability.

Return on Equity

Amer States Insurance has consistently delivered a high return on equity (ROE), indicating its ability to generate profits from its shareholder investments. The company’s ROE has been above the industry average, reflecting its strong financial performance and efficient capital allocation.

Factors Influencing Financial Performance

Several factors influence Amer States Insurance’s financial performance, including:

- Economic Conditions: The overall economic environment plays a significant role in insurance demand and pricing. During periods of economic growth, insurance demand tends to increase, while during recessions, demand may decline.

- Competition: The insurance industry is highly competitive, with numerous players vying for market share. Amer States Insurance faces competition from both large national carriers and regional insurers.

- Regulatory Changes: Insurance regulations are subject to change, which can impact the industry’s profitability and operating environment. Amer States Insurance must adapt to these changes to remain competitive.

Comparison to Competitors

Amer States Insurance’s financial performance compares favorably to its competitors in the industry. The company’s revenue growth, profitability, and ROE have consistently outpaced the industry average, indicating its strong competitive position. However, it’s important to note that the insurance industry is dynamic, and Amer States Insurance must continue to innovate and adapt to remain competitive.

Customer Experience and Reputation

Amer States Insurance strives to provide a positive customer experience, focusing on key aspects like claims processing, customer service, and policy management. This dedication translates into customer satisfaction, loyalty, and a strong brand reputation.

Customer Experience, Amer states insurance

Amer States Insurance prioritizes a seamless and efficient customer experience, encompassing various aspects of their services.

- Claims Processing: The company aims for a straightforward and timely claims process, with dedicated claims adjusters working to ensure a smooth experience for policyholders.

- Customer Service: Amer States Insurance provides multiple channels for customer interaction, including phone, email, and online chat, ensuring accessibility and responsiveness to inquiries and concerns.

- Policy Management: The company offers user-friendly online platforms and mobile applications, enabling policyholders to manage their policies, make payments, and access important documents conveniently.

Customer Reviews and Testimonials

Customer feedback is crucial for understanding the effectiveness of Amer States Insurance’s offerings.

- Positive Feedback: Many customers praise the company’s responsive customer service, efficient claims processing, and helpful agents who provide personalized guidance.

- Negative Feedback: Some customers have expressed concerns about occasional delays in claims processing or difficulties navigating the online platform.

Brand Reputation

Amer States Insurance has established a solid reputation in the insurance industry.

- Brand Image: The company projects an image of reliability, trustworthiness, and commitment to customer satisfaction.

- Customer Loyalty: Amer States Insurance has cultivated a loyal customer base through its focus on providing exceptional service and fair pricing.

- Social Media Presence: The company actively engages with customers on social media platforms, providing updates, answering questions, and addressing concerns.

Industry Trends and Future Outlook

The insurance industry is undergoing a significant transformation, driven by technological advancements, evolving customer expectations, and a dynamic regulatory landscape. These trends are shaping the competitive landscape and creating both opportunities and challenges for insurers like Amer States Insurance.

Digital Transformation and Insurtech

The rise of digital technologies is fundamentally changing how insurers operate and interact with customers. Insurtech companies, leveraging innovative technologies like artificial intelligence (AI), blockchain, and the Internet of Things (IoT), are disrupting traditional business models.

- Digital Distribution Channels: Insurers are increasingly adopting online platforms and mobile apps to offer insurance products and services, providing greater convenience and accessibility for customers. This shift is driving a move away from traditional agent-based distribution models.

- Personalized Customer Experiences: Data analytics and AI enable insurers to personalize customer experiences by tailoring products and services based on individual needs and preferences. This approach enhances customer satisfaction and loyalty.

- Automation and Efficiency: Insurers are using automation technologies to streamline processes, reduce costs, and improve operational efficiency. AI-powered chatbots and virtual assistants are automating tasks like claims processing and customer support, freeing up human agents for more complex interactions.

Data Analytics and Risk Management

The availability of vast amounts of data and advanced analytics tools are empowering insurers to better understand and manage risk. By leveraging data insights, insurers can:

- Develop More Accurate Pricing Models: Data analytics enables insurers to develop more accurate pricing models by identifying risk factors and segmenting customers based on their individual risk profiles. This leads to more equitable and competitive pricing.

- Improve Claims Management: AI and machine learning algorithms can analyze claims data to identify patterns and potential fraud, enabling faster and more efficient claims processing. This reduces costs and improves customer satisfaction.

- Enhance Risk Mitigation Strategies: By analyzing data from various sources, insurers can identify emerging risks and develop proactive risk mitigation strategies. This helps them stay ahead of potential losses and maintain financial stability.

Changing Customer Expectations

Customers today are increasingly demanding personalized experiences, instant gratification, and seamless digital interactions. They expect insurers to be:

- Responsive and Accessible: Customers expect insurers to be available 24/7 through multiple channels, including online platforms, mobile apps, and social media.

- Transparent and Trustworthy: Customers want clear and concise information about insurance products and services, and they value insurers who demonstrate transparency and ethical practices.

- Data-Driven and Innovative: Customers appreciate insurers who leverage data and technology to offer innovative products and services that meet their evolving needs.

Closing Notes

As the insurance industry continues to evolve, Amer States Insurance remains at the forefront, embracing technological advancements and adapting to the evolving needs of its customers. With a strong foundation built on decades of experience and a commitment to innovation, Amer States Insurance is well-positioned to navigate the future of the industry, providing reliable and comprehensive insurance solutions to its valued customers. Whether you are an individual seeking personal insurance coverage or a business looking for tailored risk management solutions, Amer States Insurance offers a comprehensive range of products and services designed to meet your specific needs.

Question & Answer Hub

What types of insurance does Amer States Insurance offer?

Amer States Insurance offers a wide range of insurance products, including property and casualty insurance, life insurance, and health insurance. They provide coverage for homeowners, renters, auto, and other personal needs.

How can I contact Amer States Insurance for customer support?

You can reach Amer States Insurance customer support by phone, email, or through their website. Contact information is typically available on their website or insurance documents.

What are the benefits of choosing Amer States Insurance?

Amer States Insurance offers a range of benefits, including competitive rates, personalized service, and a comprehensive range of insurance products tailored to meet diverse needs.