All States Insurance Reviews: A Guide to Finding the Best Coverage – Navigating the world of insurance can be a daunting task, especially when considering the vast differences in coverage and regulations across the United States. This comprehensive guide provides insights into the diverse insurance landscape, helping you make informed decisions about your insurance needs.

From understanding the basics of auto, home, health, and life insurance to navigating the complex world of insurance reviews, this guide equips you with the knowledge to find the best coverage for your unique situation. We’ll explore key factors to consider when reviewing insurance providers, analyze state-specific trends, and offer tips for finding the right provider for your needs.

Understanding the Insurance Landscape

The insurance industry is vast and complex, catering to diverse needs across different states. Understanding the nuances of insurance in each state is crucial for making informed decisions.

Insurance Needs Across States

The insurance needs of individuals and businesses vary significantly across different states due to factors like climate, demographics, and local regulations. For instance, states prone to natural disasters like hurricanes or earthquakes may have higher demand for property insurance, while states with dense urban populations may see a greater need for liability insurance.

Major Insurance Categories

The insurance industry is broadly categorized into several major categories, each addressing specific risks and needs. Here’s a brief overview of some key categories:

- Auto Insurance: This category covers financial losses arising from accidents involving vehicles, including damage to the vehicle, injuries to individuals, and property damage.

- Home Insurance: This category provides coverage for damages to a residential property due to various perils, including fire, theft, and natural disasters.

- Health Insurance: This category covers medical expenses incurred by individuals, including hospitalizations, doctor visits, and prescription drugs.

- Life Insurance: This category provides financial protection to beneficiaries in the event of the insured’s death.

State-Specific Insurance Regulations

Insurance regulations differ significantly across states, influencing factors like coverage options, premium rates, and consumer protection. Each state has its own insurance commissioner or department responsible for overseeing the insurance industry and ensuring fair practices.

Navigating Insurance Reviews

In today’s digital age, insurance reviews are a valuable resource for consumers seeking to make informed decisions about their coverage. These reviews offer insights into the experiences of others, helping you identify reliable and trustworthy insurance providers.

Understanding the Importance of Insurance Reviews

Reading insurance reviews can be a game-changer when it comes to selecting the right insurance plan. These reviews provide valuable insights into the strengths and weaknesses of different insurance companies, helping you avoid potential pitfalls and make informed choices.

Key Factors to Consider in Insurance Reviews

Insurance reviews can be overwhelming, but focusing on key factors can help you decipher the valuable information.

| Factor | Importance | Example | Impact |

|---|---|---|---|

| Customer Service | Ensures prompt and efficient support when you need it. | Reviews mentioning quick response times, helpful agents, and smooth claim processes. | Positive reviews can indicate a company that prioritizes customer satisfaction. |

| Claim Handling | Highlights the company’s efficiency and fairness in handling claims. | Reviews discussing transparent claim processes, timely payments, and minimal hassle. | Negative reviews regarding claim denials, delays, or unfair practices should be a red flag. |

| Pricing and Coverage | Reveals the company’s pricing structure and the comprehensiveness of their policies. | Reviews comparing premiums, deductibles, and coverage options with other providers. | Reviews can help you find a balance between affordability and adequate coverage. |

| Reputation and Financial Stability | Assesses the company’s track record and its ability to fulfill its obligations. | Reviews mentioning awards, industry recognition, and financial ratings from reputable organizations. | A company with a strong reputation and financial stability offers greater peace of mind. |

Platforms for Insurance Reviews

Insurance reviews are readily available on various platforms, offering a diverse range of perspectives.

- Insurance Comparison Websites: These websites often include customer reviews alongside policy comparisons, providing a comprehensive view of different providers.

- Consumer Review Websites: General consumer review platforms like Yelp, Trustpilot, and Google Reviews often feature insurance company ratings and reviews.

- Industry-Specific Forums: Online forums dedicated to insurance topics can offer valuable insights from experienced individuals and industry experts.

- Social Media Platforms: Social media platforms like Facebook, Twitter, and LinkedIn can be used to search for reviews and customer experiences with insurance companies.

Analyzing State-Specific Reviews

Insurance reviews are essential for making informed decisions, but the landscape varies significantly across states. Understanding state-specific reviews helps consumers navigate the nuances of insurance regulations, market trends, and common customer experiences.

State-Specific Insurance Regulations and Challenges

Each state has unique insurance regulations that affect the availability, cost, and coverage of different types of insurance. These regulations impact the experiences of insurance customers and are reflected in reviews.

- Rate Regulation: Some states have stricter rate regulation than others, which can influence the pricing of insurance policies. For example, states with strong rate regulation may see lower average premiums but potentially fewer options from insurers.

- Coverage Requirements: Mandatory coverages, such as minimum liability limits for auto insurance, vary by state. These requirements can impact the cost and coverage options available to consumers.

- Consumer Protection Laws: States have different laws governing insurance practices and consumer protection. For example, some states have stronger laws regarding insurance fraud or unfair claims practices, which can affect customer satisfaction.

Examples of State-Specific Insurance Reviews

Analyzing reviews from different states reveals specific themes and trends related to local insurance markets.

- California: Reviews for California auto insurance often mention high premiums, complex regulations, and the availability of various insurance options. Some reviews may discuss the impact of natural disasters, such as earthquakes, on insurance costs.

- Texas: Texas auto insurance reviews frequently focus on the competitive market, with numerous insurers vying for customers. Reviews may also discuss the prevalence of uninsured drivers and the challenges of finding affordable coverage.

- New York: New York insurance reviews often reflect the state’s strict regulations and consumer protection laws. Reviews may discuss the availability of different types of insurance, including health insurance, and the accessibility of customer service.

Common Themes and Trends in State Insurance Reviews

By analyzing reviews across states, we can identify common themes and trends that provide valuable insights into the insurance industry.

- Price and Value: Consumers consistently prioritize price and value when choosing insurance. Reviews often discuss the affordability of premiums and the perceived value of coverage.

- Customer Service: Customer service is a critical factor in insurance satisfaction. Reviews frequently highlight positive or negative experiences with insurers, including claims processing, communication, and responsiveness.

- Claims Experience: The claims process is a crucial aspect of insurance, and reviews often reflect the ease or difficulty of filing claims, the speed of processing, and the overall fairness of settlements.

Factors Influencing Reviews

Insurance reviews are influenced by a multitude of factors, each playing a crucial role in shaping consumer perceptions and ultimately impacting the overall rating of an insurance company. These factors are not static, and their influence can vary depending on the specific state and the individual needs and priorities of the consumer.

Factors Influencing Insurance Reviews, All states insurance reviews

Understanding the key factors that influence insurance reviews is crucial for both consumers and insurance companies. Consumers can use this knowledge to make informed decisions about their insurance choices, while insurance companies can use this information to identify areas where they can improve their services and attract more customers.

- Price: Price is often the first and foremost consideration for consumers when choosing an insurance policy. Affordable premiums are a major draw for many, especially in states where insurance costs are high.

- Coverage: The extent of coverage offered by an insurance policy is another critical factor. Consumers want to ensure that their policy provides adequate protection against the risks they face, and they are likely to favor companies that offer comprehensive coverage.

- Customer Service: Excellent customer service is essential for building trust and loyalty among insurance customers. Prompt and helpful responses to inquiries, efficient claim processing, and a friendly and professional demeanor are all highly valued by consumers.

- Claims Process: The ease and speed of the claims process is a significant factor in customer satisfaction. Consumers want to ensure that their claims are processed fairly and efficiently, with minimal hassle and delays.

Impact of Factors Across States

The relative importance of these factors can vary considerably across different states. For instance, in states with a high prevalence of natural disasters, coverage and claims processing may be more important than price, while in states with a highly competitive insurance market, price may be the dominant factor.

- Texas: Due to its susceptibility to hurricanes and other natural disasters, coverage and claims processing are paramount in Texas. Consumers are more likely to prioritize companies that offer comprehensive coverage and have a proven track record of handling claims efficiently and fairly.

- California: California’s diverse landscape and high cost of living make insurance pricing a significant concern for many consumers. While coverage is also important, affordability often takes precedence.

- New York: New York’s densely populated urban areas make customer service a critical factor. Consumers value companies that provide prompt and helpful assistance, especially in the event of an emergency.

Top Factors in Each State

To illustrate the relative importance of these factors across states, the following table summarizes the top factors that matter most to consumers in each state.

| State | Top Factors |

|---|---|

| Texas | Coverage, Claims Process, Customer Service |

| California | Price, Coverage, Customer Service |

| New York | Customer Service, Price, Coverage |

Finding the Right Insurance Provider

Insurance reviews can be a valuable tool in your quest to find the right insurance provider. By analyzing these reviews, you can gain insights into the experiences of other policyholders, allowing you to make a more informed decision.

Using Insurance Reviews to Select a Provider

Insurance reviews can help you narrow down your options by providing insights into various aspects of an insurance provider, including customer service, claims processing, and overall satisfaction. Here’s how to use reviews effectively:

- Focus on multiple sources: Don’t rely solely on one review site. Check out various platforms, including those specific to your state, to get a comprehensive picture.

- Look for trends: Pay attention to recurring themes in the reviews. Are there consistent complaints about specific issues? Do many reviewers highlight positive experiences?

- Read both positive and negative reviews: Negative reviews can expose potential problems, while positive reviews can highlight strengths. A balanced perspective is crucial.

- Consider the reviewer’s context: Take into account the reviewer’s specific needs and circumstances. For example, a review from a homeowner with a high-value property may have different priorities than a renter.

Comparing Quotes and Coverage Options

Once you’ve narrowed down your choices, it’s essential to compare quotes and coverage options. This step helps you determine the best value for your specific needs.

- Get multiple quotes: Don’t settle for the first quote you receive. Contact several insurance providers to compare prices and coverage details.

- Compare coverage levels: Ensure that you understand the coverage offered by each provider. Some providers may offer more comprehensive coverage, while others may offer more basic options. Choose the level of coverage that best suits your needs and budget.

- Factor in deductibles and premiums: Consider the trade-off between deductibles and premiums. A higher deductible will usually result in lower premiums, but you’ll pay more out of pocket if you need to file a claim.

- Read the fine print: Pay close attention to the terms and conditions of each policy. This includes exclusions, limitations, and other details that can affect your coverage.

Seeking Advice from Independent Insurance Agents

Independent insurance agents can be invaluable resources in your search for the right insurance provider. They represent multiple insurance companies, allowing them to provide unbiased recommendations.

- Access to a wider range of options: Independent agents can access policies from a variety of insurers, providing you with more choices.

- Personalized guidance: Agents can tailor their recommendations to your specific needs and circumstances, ensuring you get the coverage you need.

- Expert advice: Agents have a deep understanding of the insurance market and can help you navigate complex policy options.

- Ongoing support: Agents can provide ongoing support throughout the policy lifecycle, including renewal, claims filing, and policy adjustments.

Final Thoughts

By understanding the nuances of insurance across different states and leveraging the power of reviews, you can confidently navigate the insurance market and secure the coverage you need. Remember to consider your individual needs, compare quotes, and seek advice from independent insurance agents to ensure you’re making the best decision for your financial well-being.

Question & Answer Hub: All States Insurance Reviews

What are the most important factors to consider when reviewing insurance providers?

Price, coverage, customer service, claims process, and financial stability are key factors to evaluate when reviewing insurance providers.

How can I find insurance reviews for my state?

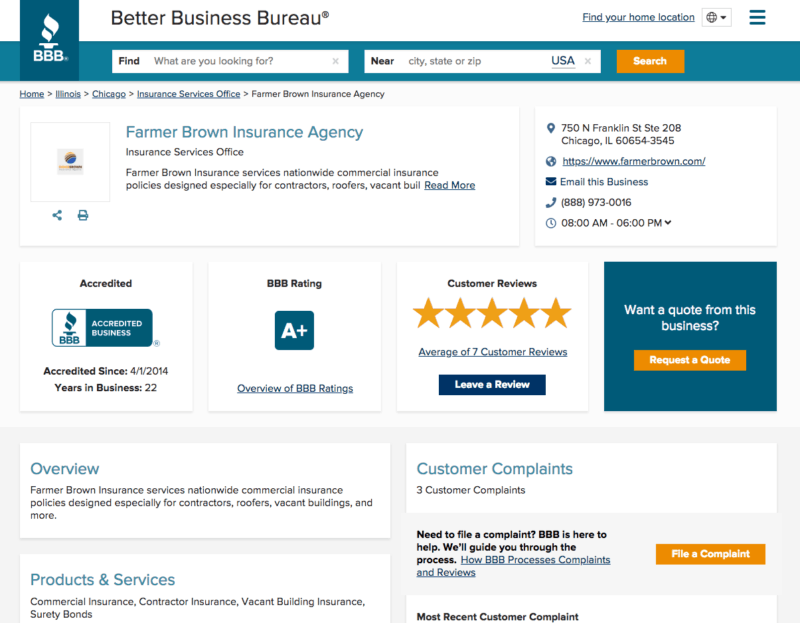

You can find insurance reviews on websites like Consumer Reports, J.D. Power, and the Better Business Bureau. Many insurance companies also have their own review sections on their websites.

Is it worth getting insurance from a provider with good reviews?

While positive reviews are a good indicator, it’s essential to consider multiple factors before making a decision. Compare quotes, coverage options, and customer service experiences to ensure you’re choosing the best provider for your needs.