All state landlord insurance – Allstate Landlord Insurance is a specialized insurance policy designed to protect landlords from financial losses related to their rental properties. It offers comprehensive coverage for various risks, including property damage, liability claims, and lost rental income, providing peace of mind for property owners.

This type of insurance is essential for landlords who want to safeguard their investment and minimize potential financial setbacks. Allstate Landlord Insurance offers a range of coverage options to suit different needs, ensuring landlords can find the right protection for their unique circumstances.

What is Allstate Landlord Insurance?

Allstate Landlord Insurance is a specialized type of insurance designed to protect landlords from financial losses and liabilities associated with owning and managing rental properties. It provides coverage for various risks, including property damage, liability claims, and lost rental income.

Key Features and Benefits

Allstate Landlord Insurance offers a range of features and benefits tailored to meet the unique needs of landlords. Here are some of the key aspects:

- Property Damage Coverage: This covers damages to the rental property caused by events such as fire, theft, vandalism, and natural disasters. It helps landlords rebuild or repair the property, minimizing financial burdens.

- Liability Coverage: This protects landlords from lawsuits arising from injuries or damages sustained by tenants or visitors on the property. It covers legal fees and settlements, providing financial security in case of liability claims.

- Lost Rental Income: If a covered event renders the rental property uninhabitable, this coverage helps landlords compensate for lost rental income while the property is being repaired or rebuilt.

- Personal Property Coverage: This optional coverage protects landlords’ personal belongings stored in the rental property, such as tools, appliances, or furniture.

- Additional Living Expenses: In case of a covered event that displaces tenants, this coverage helps landlords cover temporary housing costs for tenants while the property is being repaired.

Comparison with Other Landlord Insurance

Allstate Landlord Insurance is comparable to other types of landlord insurance, but it may offer unique features or benefits. Some key differences include:

- Coverage Limits: Allstate may offer different coverage limits compared to other insurers, impacting the amount of protection available.

- Deductibles: Deductibles, the amount landlords pay out of pocket before insurance kicks in, may vary between Allstate and other insurers.

- Exclusions: Allstate may have specific exclusions, such as coverage for certain types of damage or events, which may differ from other insurers.

- Pricing: Allstate’s premiums may vary compared to other insurers, influenced by factors such as property location, size, and risk profile.

Who Needs Allstate Landlord Insurance?

Allstate Landlord Insurance is a valuable tool for landlords of all sizes, but some types of landlords may find it particularly beneficial.

Landlords with Multiple Properties, All state landlord insurance

Landlords with multiple rental properties are at a higher risk of facing financial losses due to property damage, tenant liability, or legal issues. Allstate Landlord Insurance can help protect these landlords by providing coverage for a wide range of potential risks. For example, if a fire damages one of their properties, Allstate Landlord Insurance can help cover the cost of repairs or replacement.

Landlords with High-Value Properties

Landlords with high-value properties, such as luxury apartments or commercial buildings, are also at a higher risk of financial losses. Allstate Landlord Insurance can provide coverage for these properties, including protection against damage from natural disasters, vandalism, and other perils.

Landlords with Challenging Tenants

Landlords with challenging tenants may be more likely to face legal issues, such as eviction or property damage. Allstate Landlord Insurance can provide coverage for these situations, including legal defense costs and liability protection.

Types of Coverage Offered by Allstate Landlord Insurance

Allstate Landlord Insurance provides coverage for a wide range of risks, including:

- Property damage: This coverage helps protect landlords against financial losses due to damage to their rental properties from a variety of perils, including fire, windstorm, hail, vandalism, and theft.

- Liability: This coverage protects landlords against claims of negligence or wrongdoing by tenants or other parties. For example, if a tenant is injured on the property, Allstate Landlord Insurance can help cover the cost of medical expenses and legal defense.

- Loss of rental income: This coverage helps landlords make up for lost rental income if their property is damaged and uninhabitable. This coverage can be crucial for landlords who rely on rental income to pay their bills.

- Legal defense: This coverage helps landlords pay for legal defense costs if they are sued by tenants or other parties. This can be a valuable protection for landlords who face challenging legal situations.

Examples of Situations Where Allstate Landlord Insurance Could Be Crucial

- A tenant starts a fire in the rental property: Allstate Landlord Insurance can help cover the cost of repairs or replacement, as well as lost rental income.

- A tenant is injured on the property and sues the landlord: Allstate Landlord Insurance can provide liability coverage and legal defense costs.

- A landlord is forced to evict a tenant who is damaging the property: Allstate Landlord Insurance can help cover the cost of legal fees and lost rental income.

- A natural disaster, such as a hurricane or tornado, damages the rental property: Allstate Landlord Insurance can help cover the cost of repairs or replacement.

Coverage Options for Allstate Landlord Insurance

Allstate Landlord Insurance offers a variety of coverage options to protect your investment. These options can be customized to meet your specific needs and budget.

Coverage Options

Allstate Landlord Insurance offers a range of coverage options, each designed to address specific risks faced by landlords. These options can be tailored to your individual needs and budget.

Building Coverage

Building coverage protects your property from damage caused by covered perils, such as fire, theft, and vandalism. It also covers the cost of repairs or rebuilding if your property is damaged or destroyed.

- Dwelling Coverage: This coverage protects the physical structure of your rental property, including the walls, roof, plumbing, and electrical systems. It covers the cost of repairs or replacement in case of damage or destruction.

- Other Structures Coverage: This coverage protects detached structures on your property, such as garages, sheds, and fences, from damage caused by covered perils.

Liability Coverage

Liability coverage protects you from lawsuits filed by tenants or others who are injured on your property.

- Personal Liability Coverage: This coverage protects you from lawsuits filed by tenants or others who are injured on your property, even if the injury was not your fault. It also covers legal defense costs and any settlements or judgments awarded against you.

- Medical Payments Coverage: This coverage pays for medical expenses incurred by tenants or others who are injured on your property, regardless of fault. It can help to reduce your liability exposure and avoid costly lawsuits.

Loss of Rent Coverage

Loss of rent coverage helps to protect your income if your tenants are unable to live in their rental unit due to a covered peril.

- Fair Rental Value Coverage: This coverage pays you the rental income you would have received if your property had not been damaged or destroyed. It helps to cover your mortgage payments, property taxes, and other expenses while your property is being repaired or rebuilt.

Additional Coverage Options

Allstate Landlord Insurance also offers several additional coverage options, including:

- Personal Property Coverage: This coverage protects your personal property, such as furniture, appliances, and other belongings, from damage or theft.

- Replacement Cost Coverage: This coverage pays to replace your damaged or destroyed property with new, similar property, regardless of depreciation.

- Liability Coverage for Business Operations: This coverage protects you from lawsuits filed by tenants or others who are injured on your property due to your business operations, such as providing laundry services or renting out storage units.

- Umbrella Liability Coverage: This coverage provides additional liability protection beyond your standard policy limits. It can help to protect your assets in the event of a large lawsuit or judgment.

Factors to Consider When Choosing Coverage Options

When choosing your coverage options, you should consider the following factors:

- The value of your property: The value of your property will determine how much building coverage you need.

- Your risk tolerance: Your risk tolerance will influence your decision on how much liability coverage you need.

- Your budget: You should choose coverage options that fit your budget.

- The specific needs of your rental property: Consider the type of rental property you have and the potential risks it faces.

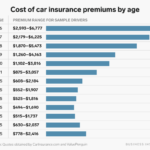

Cost and Factors Affecting Premiums: All State Landlord Insurance

Allstate Landlord Insurance premiums are calculated based on a variety of factors, and understanding these factors can help you determine the cost of your policy and potentially find ways to save money.

Factors Influencing Premiums

The cost of Allstate Landlord Insurance is influenced by several factors, including:

- Property Location: The risk of property damage and liability claims varies depending on the location of your rental property. Properties in high-crime areas or areas prone to natural disasters may have higher premiums. For example, a rental property located in a coastal area with a history of hurricanes would likely have higher premiums than a property in a more inland location.

- Property Type and Value: The type and value of your rental property also play a role in determining premiums. Larger and more expensive properties, such as multi-family homes or commercial buildings, may have higher premiums than smaller, less valuable properties. A single-family home with a market value of $500,000 would likely have higher premiums than a duplex with a market value of $300,000.

- Number of Units: The number of units in your rental property can also affect your premiums. Landlords with multiple units may have higher premiums than those with single-family homes, as they face a higher risk of potential claims from multiple tenants. For instance, a landlord with a four-unit apartment building would likely have higher premiums than a landlord with a single-family home.

- Tenant Screening: Your tenant screening process can impact your premiums. Landlords who have a thorough screening process and rent to responsible tenants may be eligible for lower premiums. Landlords who carefully verify income, employment history, and credit scores of potential tenants may be seen as lower risk by insurance companies.

- Claims History: Your past claims history, including the number and type of claims filed, can significantly influence your premiums. Landlords with a history of frequent or large claims may face higher premiums. If you have a history of filing claims for damage caused by tenants, your premiums may be higher compared to a landlord with a clean claims history.

- Coverage Options: The specific coverage options you choose will also affect your premiums. Choosing higher coverage limits or adding optional coverages, such as liability protection, will generally result in higher premiums. For example, choosing a higher liability limit to cover potential lawsuits from tenants would likely lead to higher premiums compared to a lower limit.

- Deductible: The deductible you choose for your policy will also influence your premiums. A higher deductible will typically result in lower premiums, as you will be responsible for paying more out-of-pocket in the event of a claim. For example, a landlord choosing a $1,000 deductible would likely have lower premiums than a landlord with a $500 deductible.

Filing a Claim with Allstate Landlord Insurance

Filing a claim with Allstate Landlord Insurance is a straightforward process. To ensure a smooth experience, it’s crucial to understand the steps involved, the necessary documentation, and the expected timeline.

Steps Involved in Filing a Claim

This section will Artikel the essential steps to file a claim with Allstate Landlord Insurance.

- Report the Incident: The first step is to contact Allstate as soon as possible after the incident occurs. You can report the claim online, over the phone, or through the Allstate mobile app. Provide detailed information about the incident, including the date, time, and location.

- Gather Necessary Documentation: Once you’ve reported the incident, Allstate will provide you with instructions on the documentation required for your claim. This documentation typically includes:

- Police report: If the incident involved a crime, such as theft or vandalism.

- Proof of loss: This could be receipts, invoices, or other documentation that proves the value of the damaged or lost property.

- Rental agreement: This document will verify the terms of your lease agreement, including your responsibilities as a landlord.

- Photographs or videos: These can help document the damage or loss.

- Submit the Claim: Once you’ve gathered all the necessary documentation, submit your claim to Allstate. This can be done online, by mail, or by fax.

- Claim Investigation: Allstate will investigate your claim to verify the details and determine the extent of the damage or loss. This may involve an inspection of the property by an Allstate representative.

- Claim Resolution: Once the investigation is complete, Allstate will determine the amount of compensation you are eligible to receive. This compensation will be based on the terms of your policy and the extent of the damage or loss.

Documentation Required for a Successful Claim

The documentation you provide plays a crucial role in the success of your claim. Here’s a breakdown of the documentation required for a successful claim:

- Police report: This document is essential if the incident involved a crime, such as theft or vandalism. It provides official documentation of the incident, which strengthens your claim.

- Proof of loss: This documentation helps verify the value of the damaged or lost property. It can include receipts, invoices, appraisals, or other documentation that supports the value of the property.

- Rental agreement: This document is critical to establish the terms of your lease agreement and your responsibilities as a landlord. It helps demonstrate that you have met your obligations under the lease.

- Photographs or videos: These can help document the damage or loss and provide visual evidence to support your claim.

- Other relevant documentation: Depending on the specific circumstances of your claim, you may need to provide other relevant documentation, such as repair estimates or medical records.

Claim Process and Timeframe for Receiving Compensation

The claim process can vary depending on the complexity of your claim. However, here’s a general overview of the process:

- Reporting the incident: This is the first step, and you should contact Allstate as soon as possible.

- Claim investigation: Allstate will conduct an investigation to verify the details of your claim and determine the extent of the damage or loss. This may involve an inspection of the property.

- Claim resolution: Once the investigation is complete, Allstate will determine the amount of compensation you are eligible to receive. This compensation will be based on the terms of your policy and the extent of the damage or loss.

- Payment: Once the claim is approved, Allstate will issue payment for the covered losses. The payment timeframe can vary depending on the complexity of the claim. However, Allstate aims to process claims as quickly as possible.

Alternatives to Allstate Landlord Insurance

While Allstate is a reputable insurance provider, it’s crucial to compare different options to find the best landlord insurance for your needs. Exploring alternatives can lead to better coverage, lower premiums, or more tailored features.

Comparing Allstate Landlord Insurance with Other Providers

Several other insurance companies offer landlord insurance policies, each with its unique features and pricing. When comparing Allstate to other providers, consider factors such as:

- Coverage Options: Compare the types of coverage offered by each provider, including liability, property damage, and loss of rental income. Ensure the policy meets your specific requirements and the risks associated with your rental properties.

- Premiums: Obtain quotes from multiple insurers to compare pricing and identify the most affordable option. Consider factors such as the location, size, and type of your rental property, as well as your risk profile, when comparing premiums.

- Customer Service: Research the reputation of each insurer for customer service, claim handling, and responsiveness. Look for reviews and ratings from other landlords to gauge their experience with the provider.

- Discounts: Inquire about available discounts, such as those for multiple properties, security systems, or safety features. These discounts can significantly reduce your overall premium costs.

Pros and Cons of Choosing an Alternative Insurance Provider

Choosing an alternative insurance provider can offer advantages and disadvantages compared to Allstate.

Pros

- More Competitive Pricing: Other insurers may offer lower premiums than Allstate, especially if you have a specific risk profile or property type.

- Wider Coverage Options: Some providers offer more comprehensive coverage options or specialized features tailored to specific landlord needs, such as coverage for vacant properties or legal liability for tenant disputes.

- Improved Customer Service: You may find better customer service and claim handling experiences with other insurers, depending on their reputation and focus on customer satisfaction.

Cons

- Limited Availability: Some insurers may not offer coverage in all geographic areas or for specific property types.

- Unfamiliar Policies: You may be less familiar with the policies and procedures of an alternative provider, which can lead to confusion or difficulty understanding your coverage.

- Less Established Reputation: Some insurers may have a less established reputation than Allstate, which could raise concerns about their financial stability or claim handling practices.

Finding the Best Landlord Insurance

To find the best landlord insurance for your needs, follow these steps:

- Assess Your Risks: Determine the potential risks associated with your rental properties, including property damage, liability claims, and loss of rental income.

- Research Insurance Providers: Compare coverage options, premiums, customer service, and discounts offered by different insurers.

- Obtain Quotes: Get quotes from multiple providers to compare pricing and coverage options.

- Read Policy Documents: Carefully review the policy documents to understand the coverage details, exclusions, and limitations.

- Seek Professional Advice: Consult with an insurance broker or agent who specializes in landlord insurance to obtain personalized guidance and recommendations.

Tips for Landlords

Being a landlord comes with its share of responsibilities, and understanding how to manage risks and protect your property is crucial. By implementing preventative measures and making informed decisions, you can minimize potential claims and create a safe and secure environment for your tenants. This section provides practical tips for landlords to optimize their insurance coverage and navigate the complexities of property management.

Maintaining a Safe Rental Environment

Maintaining a safe rental environment is paramount for landlords. Not only does it protect tenants, but it also helps prevent accidents and potential claims. Here are some key steps landlords can take:

- Regular Inspections: Conduct regular inspections of the property to identify and address any potential safety hazards, such as faulty wiring, leaking pipes, or structural issues. This proactive approach can prevent accidents and reduce the risk of claims.

- Proper Maintenance: Ensure that all essential systems and appliances are in good working order and properly maintained. This includes regular servicing of heating and cooling systems, plumbing, and electrical wiring.

- Clear Communication: Establish clear communication channels with tenants regarding safety procedures, emergency contacts, and reporting maintenance issues. This fosters a collaborative approach to safety and encourages prompt action when necessary.

- Fire Safety: Install and maintain smoke detectors and fire extinguishers in accordance with local regulations. Regularly test these devices to ensure they are functional and provide tenants with clear instructions on their use.

- Security Measures: Implement appropriate security measures, such as sturdy locks, security cameras, and well-lit exterior areas, to deter crime and protect tenants’ belongings.

Tenant Screening and Selection

Thorough tenant screening is essential for minimizing risks and ensuring responsible renters. Here’s how to improve your tenant selection process:

- Background Checks: Conduct comprehensive background checks on potential tenants, including credit history, criminal records, and rental history. This provides valuable insights into their financial responsibility and past tenancy behavior.

- References: Contact previous landlords to verify rental history, payment patterns, and overall tenant behavior. This can help you assess a potential tenant’s reliability and suitability for your property.

- Income Verification: Verify the tenant’s income to ensure they can afford the rent and associated expenses. This helps prevent financial hardship and potential rent delinquency.

- Lease Agreement: Draft a comprehensive lease agreement that Artikels clear terms and conditions, including rent payment schedule, responsibilities, and termination procedures.

Understanding Your Insurance Coverage

Landlord insurance policies vary, so it’s crucial to understand your coverage and ensure it aligns with your specific needs. Here’s how to optimize your protection:

- Property Coverage: Ensure your policy provides adequate coverage for the replacement value of your property, including the building structure, fixtures, and appliances.

- Liability Coverage: Protect yourself from liability claims arising from tenant injuries or property damage. Consider increasing your liability limits to account for potential high-cost claims.

- Loss of Rent Coverage: This coverage provides financial protection if you’re unable to collect rent due to damage to the property or a covered event.

- Additional Coverages: Explore optional coverages such as flood insurance, earthquake insurance, or personal property coverage for your own belongings stored on the property.

- Regular Review: Review your insurance policy annually to ensure it remains current and meets your changing needs.

Final Summary

Investing in Allstate Landlord Insurance can be a wise decision for landlords seeking comprehensive protection. By understanding the coverage options, costs, and claim process, landlords can make informed choices to secure their investment and manage potential risks effectively. Whether you’re a seasoned landlord or just starting, Allstate Landlord Insurance can provide the necessary financial safety net to navigate the complexities of property ownership.

FAQ Section

How much does Allstate Landlord Insurance cost?

The cost of Allstate Landlord Insurance varies depending on factors such as the property’s location, size, age, and the level of coverage chosen. It’s best to contact Allstate directly for a personalized quote.

What are the common exclusions in Allstate Landlord Insurance?

Allstate Landlord Insurance typically excludes coverage for certain risks, such as intentional damage caused by the landlord or tenant, acts of war, and natural disasters beyond a specific coverage limit. It’s essential to review the policy carefully to understand the specific exclusions.

What are the benefits of choosing Allstate Landlord Insurance?

Allstate Landlord Insurance offers several benefits, including financial protection from unexpected losses, peace of mind, and access to experienced claims adjusters. It can also help landlords maintain good relationships with tenants by providing a safety net in case of unforeseen events.