All state insurance rates – Allstate insurance rates are a crucial aspect for anyone considering this major insurance provider. Understanding the factors that influence these rates is essential for making informed decisions about your coverage.

This guide delves into the intricacies of Allstate’s pricing model, exploring the key factors that determine your premiums. We’ll examine how your driving record, location, and vehicle type can impact your rates, providing insights into how Allstate calculates your insurance costs.

Allstate Insurance Overview

Allstate Insurance is a prominent insurance company in the United States, known for its diverse range of insurance products and services. It has a rich history and a strong commitment to providing financial protection and peace of mind to its customers.

History of Allstate Insurance

Allstate was founded in 1931 by Sears, Roebuck and Co. as a subsidiary to offer automobile insurance to its customers. The company’s initial focus was on providing affordable and accessible insurance to the growing middle class in America.

Allstate quickly gained popularity and expanded its offerings to include other types of insurance, such as homeowners, renters, life, and business insurance. In 1995, Allstate became a publicly traded company, separating from Sears.

Allstate’s Business Model and Insurance Offerings

Allstate operates a diversified business model, providing a comprehensive suite of insurance products and services. The company’s core business revolves around:

- Personal Insurance: This segment encompasses auto, homeowners, renters, life, and motorcycle insurance, catering to the needs of individuals and families.

- Commercial Insurance: Allstate offers a range of business insurance solutions, including property, liability, and workers’ compensation insurance, designed to protect businesses of all sizes.

- Financial Services: Allstate provides financial services, such as retirement planning, investment products, and banking services, to complement its insurance offerings.

Allstate’s Mission Statement and Core Values

Allstate’s mission statement is:

“To be the best at protecting people and their futures.”

The company’s core values are:

- Customer Focus: Allstate prioritizes understanding and meeting the needs of its customers.

- Integrity: The company upholds the highest ethical standards in all its business dealings.

- Excellence: Allstate strives for continuous improvement and delivering exceptional service.

- Innovation: The company embraces new technologies and approaches to enhance its products and services.

Factors Influencing Allstate Insurance Rates

Allstate, like other insurance companies, uses a variety of factors to determine your insurance rates. These factors help them assess your risk and determine how much they should charge you for coverage. Understanding these factors can help you understand your insurance premiums and potentially lower your costs.

Factors Affecting Allstate Insurance Rates, All state insurance rates

Several factors influence Allstate insurance rates. These factors are categorized into various groups, each playing a crucial role in determining your final premium.

| Factor | Description | Impact on Rates | Example |

|---|---|---|---|

| Vehicle Type | The make, model, and year of your vehicle influence rates. Newer, safer vehicles tend to have lower rates. | Vehicles with higher safety ratings and lower repair costs generally result in lower premiums. | A newer, safer Honda Civic might have lower rates compared to an older, less safe Ford Mustang. |

| Driving History | Your driving record, including accidents, violations, and DUI convictions, significantly impacts your rates. | A clean driving record with no accidents or violations leads to lower premiums, while a history of accidents or violations results in higher rates. | A driver with a clean driving record for the past five years will likely pay lower premiums compared to someone with a recent DUI conviction. |

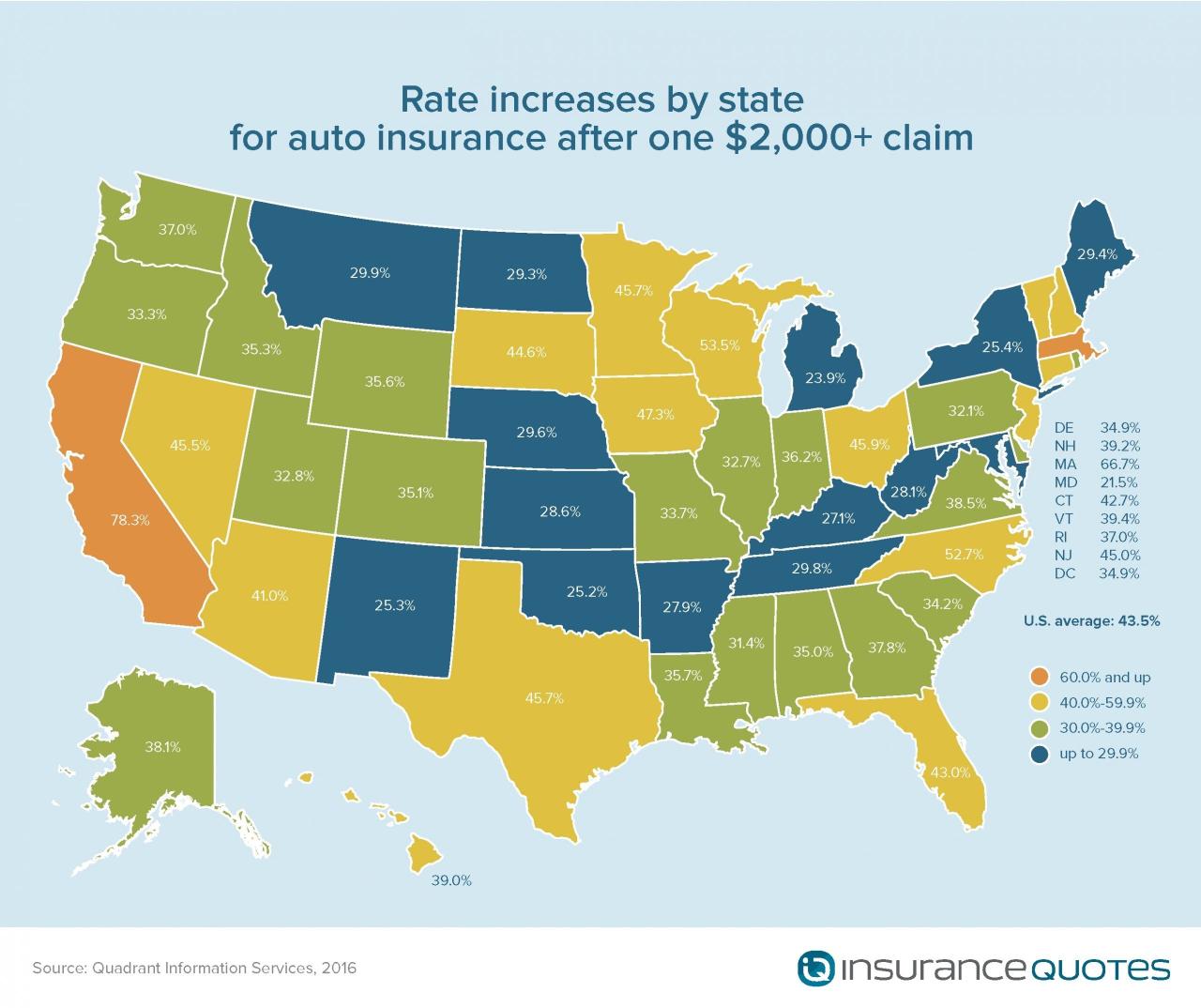

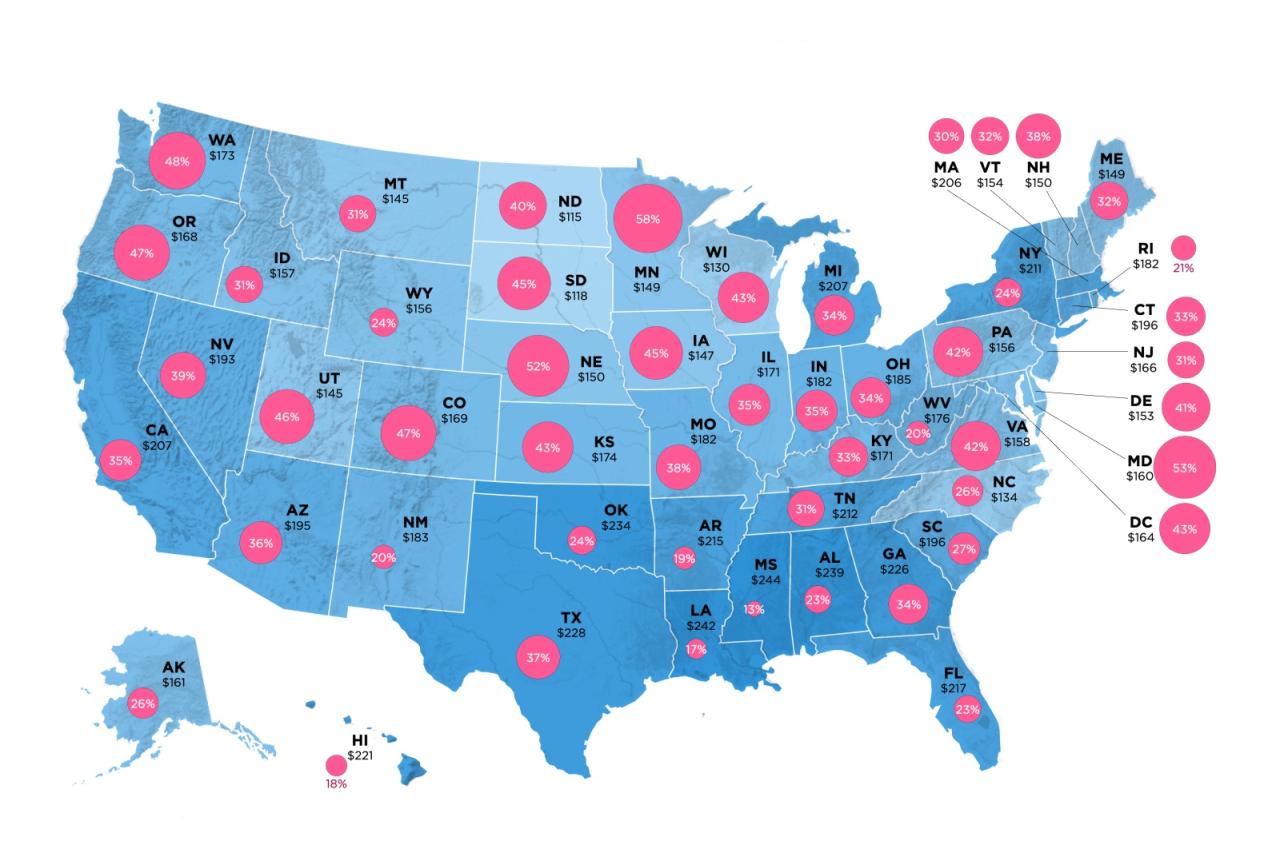

| Location | Your location, including your zip code, can impact your rates due to factors like traffic density, crime rates, and weather conditions. | Areas with high traffic density, higher crime rates, or more frequent natural disasters generally have higher premiums. | A driver living in a densely populated urban area with high crime rates might pay higher premiums compared to someone living in a rural area with low crime rates. |

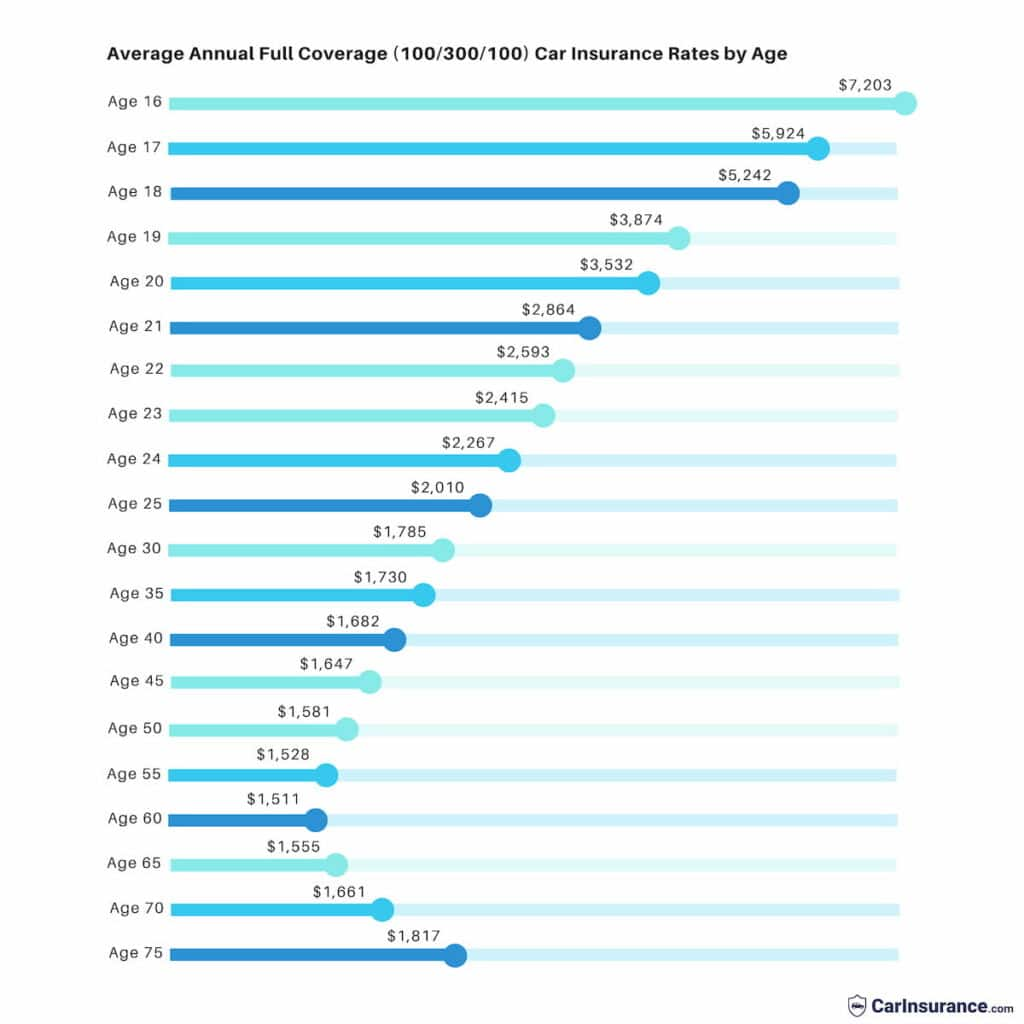

| Age and Gender | Age and gender can influence rates, with younger drivers and males generally paying higher premiums. | Younger drivers have less experience and are statistically more likely to be involved in accidents, leading to higher rates. Males tend to have higher rates due to higher risk profiles. | A young, male driver might pay higher premiums compared to an older, female driver with more driving experience. |

| Credit Score | Your credit score is used by some insurance companies, including Allstate, to assess your risk. | Individuals with good credit scores are generally considered less risky and may qualify for lower premiums. | A driver with a high credit score might receive a discount compared to someone with a lower credit score. |

| Coverage and Deductibles | The type of coverage you choose and the amount of your deductible can significantly impact your rates. | Higher coverage limits and lower deductibles typically result in higher premiums. | A driver with comprehensive and collision coverage with a $500 deductible might pay higher premiums compared to someone with liability coverage only and a $1000 deductible. |

| Discounts | Allstate offers various discounts for safe driving, good student status, multiple policy discounts, and more. | Taking advantage of available discounts can significantly reduce your premiums. | A driver with a good student discount, a safe driving record, and multiple policy discounts might receive a substantial discount on their premiums. |

Comparing Allstate Rates with Competitors: All State Insurance Rates

It’s essential to compare Allstate’s rates with those of its competitors to determine the best value for your insurance needs. This section will compare Allstate’s rates with two major competitors, highlighting the advantages and disadvantages of each insurer’s pricing structure.

Comparison of Average Rates

To understand how Allstate’s rates compare, we’ll look at average rates for auto, home, and renters insurance.

- Auto Insurance: Allstate’s average auto insurance rates are generally competitive, often falling in the middle of the pack compared to major competitors like Geico and Progressive. While Allstate may not always offer the absolute lowest rates, it’s known for its comprehensive coverage options and customer service.

- Home Insurance: For home insurance, Allstate’s rates tend to be slightly higher than those of competitors like State Farm and Liberty Mutual. This can be attributed to factors like Allstate’s focus on providing specialized coverage options, including coverage for valuable personal property and unique risks.

- Renters Insurance: Allstate’s renters insurance rates are generally comparable to those of its competitors, such as Nationwide and Travelers. However, Allstate’s rates can vary depending on the specific coverage options chosen and the location of the rental property.

Advantages and Disadvantages of Allstate’s Pricing

Allstate’s pricing strategy offers both advantages and disadvantages for potential customers.

- Advantages:

- Comprehensive Coverage Options: Allstate offers a wide range of coverage options, which can be beneficial for customers with unique needs or valuable possessions.

- Customer Service Reputation: Allstate is known for its customer service, which can be a significant factor for some individuals.

- Disadvantages:

- Higher Rates for Certain Coverage: As mentioned earlier, Allstate’s rates for certain types of coverage, such as home insurance, can be higher than those of its competitors.

- Limited Discounts: Compared to some competitors, Allstate may offer fewer discounts, potentially impacting the overall cost of insurance.

Allstate’s Rate Calculation Process

Allstate, like other insurance companies, utilizes a complex and multifaceted process to determine insurance premiums. This process involves analyzing a vast amount of data, applying sophisticated algorithms, and considering various factors that contribute to risk assessment.

Factors Considered in Rate Calculation

Allstate considers numerous factors when calculating insurance rates. These factors are grouped into categories that help the company assess the likelihood of an insured event and the potential cost of claims.

- Vehicle Information: This includes the year, make, model, and safety features of the vehicle. Vehicles with higher safety ratings and advanced safety features are generally associated with lower risk and may result in lower premiums.

- Driving History: This includes information about past accidents, traffic violations, and driving experience. Drivers with a clean driving record and significant driving experience are typically considered lower risk.

- Location: The geographic location of the insured vehicle is a significant factor. Areas with higher crime rates, traffic congestion, and adverse weather conditions are often associated with higher insurance rates.

- Coverage Options: The type and amount of coverage selected by the insured individual also influence premiums. Comprehensive and collision coverage typically result in higher premiums compared to liability-only coverage.

- Demographics: Age, gender, marital status, and credit score are some demographic factors that can influence insurance rates. For instance, younger drivers are generally considered higher risk due to less experience, while individuals with good credit history may be rewarded with lower premiums.

Data and Algorithms

Allstate leverages a vast amount of data and sophisticated algorithms to analyze risk and determine premiums. This data includes historical claims data, driving records, vehicle information, and demographic information. Allstate’s algorithms use statistical models and machine learning techniques to identify patterns and predict the likelihood of future claims.

Allstate’s algorithms are continuously refined and updated to incorporate new data and improve accuracy.

Rate Calculation Process

The rate calculation process involves a series of steps:

- Data Collection: Allstate gathers information from various sources, including government agencies, credit bureaus, and its own databases.

- Risk Assessment: This involves analyzing the collected data to assess the likelihood of an insured event and the potential cost of claims.

- Premium Calculation: Using algorithms and statistical models, Allstate calculates a base premium based on the assessed risk level.

- Adjustments: The base premium is adjusted based on factors such as coverage options, discounts, and surcharges.

- Final Premium: The final premium is presented to the insured individual as a quote.

Allstate’s Discount Programs

Allstate offers a variety of discount programs to help policyholders save money on their insurance premiums. These discounts are designed to reward safe driving habits, responsible homeownership, and other positive behaviors. By taking advantage of these programs, you can potentially lower your insurance costs significantly.

Allstate Discount Programs

Allstate offers a wide range of discount programs, each with its own set of eligibility criteria. Here’s a breakdown of some of the most common discounts:

| Discount Name | Description | Eligibility Criteria | Estimated Discount Amount |

|---|---|---|---|

| Good Student Discount | This discount is available to students who maintain a good academic record. | A minimum GPA of 3.0 or higher is typically required. | 5-15% |

| Safe Driver Discount | This discount is awarded to drivers with a clean driving record. | No accidents or traffic violations within a specified period. | 10-25% |

| Multi-Policy Discount | This discount is available to customers who bundle multiple insurance policies with Allstate. | Holding at least two insurance policies with Allstate, such as auto and home insurance. | 10-20% |

| Homeowner Discount | This discount is available to homeowners who have certain safety features installed in their homes. | Features like smoke detectors, burglar alarms, and fire sprinklers can qualify for the discount. | 5-10% |

| Defensive Driving Course Discount | This discount is available to drivers who complete a certified defensive driving course. | Completion of a course approved by Allstate or your state’s Department of Motor Vehicles. | 5-10% |

Allstate’s Customer Service and Claims Process

Allstate prioritizes customer satisfaction and aims to provide a seamless experience for policyholders throughout their insurance journey. The company offers various customer service channels and employs a comprehensive claims handling process designed to expedite resolution and minimize stress for those involved.

Customer Service Policies and Procedures

Allstate offers various avenues for customers to connect with their representatives.

- Customers can contact Allstate through their website, mobile app, or phone.

- The company provides 24/7 customer support, ensuring accessibility at any time.

- Allstate offers a dedicated claims department that can be reached directly for immediate assistance.

- The company utilizes a network of local agents who can provide personalized service and support to policyholders.

Allstate’s customer service policies emphasize prompt responses, personalized attention, and clear communication. The company strives to address customer inquiries and concerns efficiently and effectively.

Claims Handling Process

Allstate’s claims handling process is designed to be straightforward and transparent.

- Upon reporting a claim, customers are guided through a series of steps to gather necessary information and documentation.

- Allstate employs a network of independent adjusters who assess damage and determine the extent of coverage.

- The company strives to process claims within a reasonable timeframe, typically within 24-48 hours for initial assessments.

- Allstate provides regular updates on claim progress and communicates with policyholders throughout the process.

- The company offers a range of payment options, including direct deposit and checks, for claim settlements.

Allstate emphasizes clear communication and transparency during the claims process, keeping customers informed of every step and addressing any questions or concerns promptly.

Customer Satisfaction Ratings and Feedback

Allstate consistently receives positive customer satisfaction ratings.

- According to J.D. Power, Allstate ranks among the top insurance companies for customer satisfaction in various categories.

- The company has received numerous awards and recognitions for its customer service excellence.

- Allstate actively solicits feedback from customers to continuously improve its service offerings and address any areas for improvement.

Allstate’s commitment to customer satisfaction is evident in its high ratings and positive feedback from policyholders. The company strives to provide a positive and hassle-free experience for customers throughout their insurance journey.

Allstate’s Financial Performance and Stability

Allstate Corporation is a major player in the insurance industry, with a strong financial track record and a reputation for stability. Its financial performance and stability are crucial for its ability to meet its obligations to policyholders and investors. This section will explore Allstate’s recent financial performance, analyze its financial stability, and discuss key factors influencing its performance.

Recent Financial Performance

Allstate’s financial performance has been consistent over the past few years, with steady revenue growth and profitability. Here’s a breakdown of its key financial metrics:

- Revenue: Allstate’s revenue has grown steadily in recent years. In 2022, the company reported total revenue of $48.7 billion, up from $44.2 billion in 2021. This growth can be attributed to factors such as increased insurance premiums and expansion into new markets.

- Profitability: Allstate has maintained strong profitability, generating significant net income each year. In 2022, the company reported net income of $4.3 billion, compared to $3.7 billion in 2021. This profitability is driven by factors such as effective underwriting practices, efficient operations, and disciplined investment management.

- Market Capitalization: Allstate’s market capitalization, a measure of its overall value, has also been stable. As of December 2022, the company’s market capitalization was approximately $35 billion. This reflects investor confidence in Allstate’s long-term prospects and its ability to generate value.

Financial Stability

Allstate’s financial stability is crucial for its ability to meet future claims obligations. The company has a strong capital position, with ample reserves to cover potential losses. It also maintains a robust risk management framework, which helps to mitigate potential financial risks.

- Strong Capital Position: Allstate maintains a strong capital position, with significant reserves to cover potential claims. This allows the company to absorb unexpected losses and maintain financial stability even in challenging economic conditions.

- Robust Risk Management: Allstate has a comprehensive risk management framework that helps to mitigate potential financial risks. This framework includes various strategies such as careful underwriting, diversification of its business portfolio, and effective claims management. This framework helps to ensure that the company is well-positioned to manage potential risks and maintain financial stability.

- Favorable Ratings: Allstate has received favorable ratings from major credit rating agencies, such as A.M. Best and Standard & Poor’s. These ratings reflect the company’s strong financial position and its ability to meet its obligations to policyholders.

Industry Trends and Regulatory Changes

Allstate’s financial performance is also influenced by various industry trends and regulatory changes. Some of the key factors include:

- Rising Insurance Costs: The cost of insurance has been rising in recent years due to factors such as inflation, increased severity of claims, and changing weather patterns. This has put pressure on insurance companies to raise premiums and manage their expenses effectively.

- Technological Advancements: Technological advancements are transforming the insurance industry, leading to new products and services, improved customer experiences, and more efficient operations. Allstate is actively investing in technology to enhance its operations and adapt to the evolving industry landscape.

- Regulatory Changes: The insurance industry is subject to various regulations, which can impact companies’ financial performance. Allstate has been actively adapting to regulatory changes and ensuring compliance with all applicable laws and regulations.

Tips for Obtaining Competitive Allstate Rates

Securing the most competitive Allstate insurance rates requires a strategic approach. By understanding Allstate’s rate calculation process and utilizing available discounts, you can significantly reduce your premiums. This section provides practical tips and strategies to help you achieve this.

Maximizing Discounts

Discounts play a crucial role in lowering your Allstate insurance premiums. Allstate offers a wide range of discounts based on various factors, such as your driving history, vehicle safety features, and even your home security system. Here’s how you can maximize your potential discounts:

- Bundle Your Policies: Combining your auto and home insurance policies with Allstate can lead to substantial savings through a bundled discount. This is often one of the most significant discounts available.

- Safe Driving Record: Maintaining a clean driving record with no accidents or traffic violations is essential for securing lower rates. Allstate often offers discounts for drivers with a history of safe driving.

- Vehicle Safety Features: Vehicles equipped with advanced safety features like anti-theft devices, airbags, and anti-lock brakes can qualify for discounts. Allstate recognizes these features as contributing to reduced accident risks.

- Good Student Discount: If you have a student in your household with good grades, you may be eligible for a good student discount. Allstate often rewards students who demonstrate academic excellence.

- Home Security System: Installing a home security system can lower your homeowners insurance premiums. Allstate may offer discounts for homeowners who have taken proactive measures to protect their property.

- Other Discounts: Explore other potential discounts, such as those for multiple cars, paying your premium in full, or being a member of certain organizations. Allstate may have additional discounts tailored to specific circumstances.

Negotiating Rates

Effective communication with Allstate representatives can help you negotiate better rates. Here are some strategies:

- Shop Around: Before contacting Allstate, obtain quotes from other insurers to understand the competitive landscape. This information can be valuable during negotiations.

- Highlight Your Positive Factors: Emphasize your positive factors, such as your clean driving record, safe driving habits, and any relevant discounts you qualify for. This can influence Allstate’s perception of your risk profile.

- Be Prepared to Explain: Be ready to explain any potential concerns or questions Allstate might have regarding your driving history, vehicle usage, or other factors. This demonstrates transparency and can build trust.

- Be Polite and Professional: Maintaining a polite and professional demeanor throughout the negotiation process is essential. This can foster a positive relationship and increase your chances of reaching a mutually beneficial agreement.

End of Discussion

Navigating the world of insurance can be complex, but understanding Allstate’s rate structure empowers you to make informed choices about your coverage. By considering the factors discussed, you can gain a better understanding of how your individual circumstances impact your premiums and potentially find ways to optimize your costs.

Question Bank

How do I get a free quote from Allstate?

You can get a free quote online, over the phone, or by visiting an Allstate agent.

What is Allstate’s customer service like?

Allstate is known for its customer service, which is generally rated highly. However, individual experiences can vary.

Does Allstate offer discounts for good drivers?

Yes, Allstate offers discounts for good drivers, as well as for other factors like safety features, bundling policies, and paying your premium in full.