All state insurance rate – Allstate Insurance Rates are a crucial aspect of securing financial protection in the event of unforeseen circumstances. Understanding how these rates are determined, how to obtain a quote, and how they compare to competitors is essential for making informed decisions about your insurance needs. This guide explores the factors that influence Allstate rates, provides insights into obtaining a quote, and compares Allstate to other insurance providers.

From exploring coverage options and available discounts to analyzing customer reviews and understanding the claims process, this comprehensive guide aims to empower you with the knowledge necessary to navigate the world of Allstate insurance.

Understanding Allstate Insurance Rates

Allstate insurance rates are influenced by a variety of factors, ensuring that premiums are tailored to the individual risk profile of each policyholder.

Factors Influencing Allstate Insurance Rates

Allstate considers several factors when determining your insurance rates, including:

- Driving History: Your driving record, including accidents, traffic violations, and DUI convictions, significantly impacts your rates. A clean driving record generally leads to lower premiums, while incidents like accidents or speeding tickets can increase your rates.

- Vehicle Type: The type of vehicle you drive plays a crucial role in determining your insurance rates. Higher-performance vehicles, luxury cars, and newer models tend to have higher insurance costs due to their potential for greater damage and repair expenses.

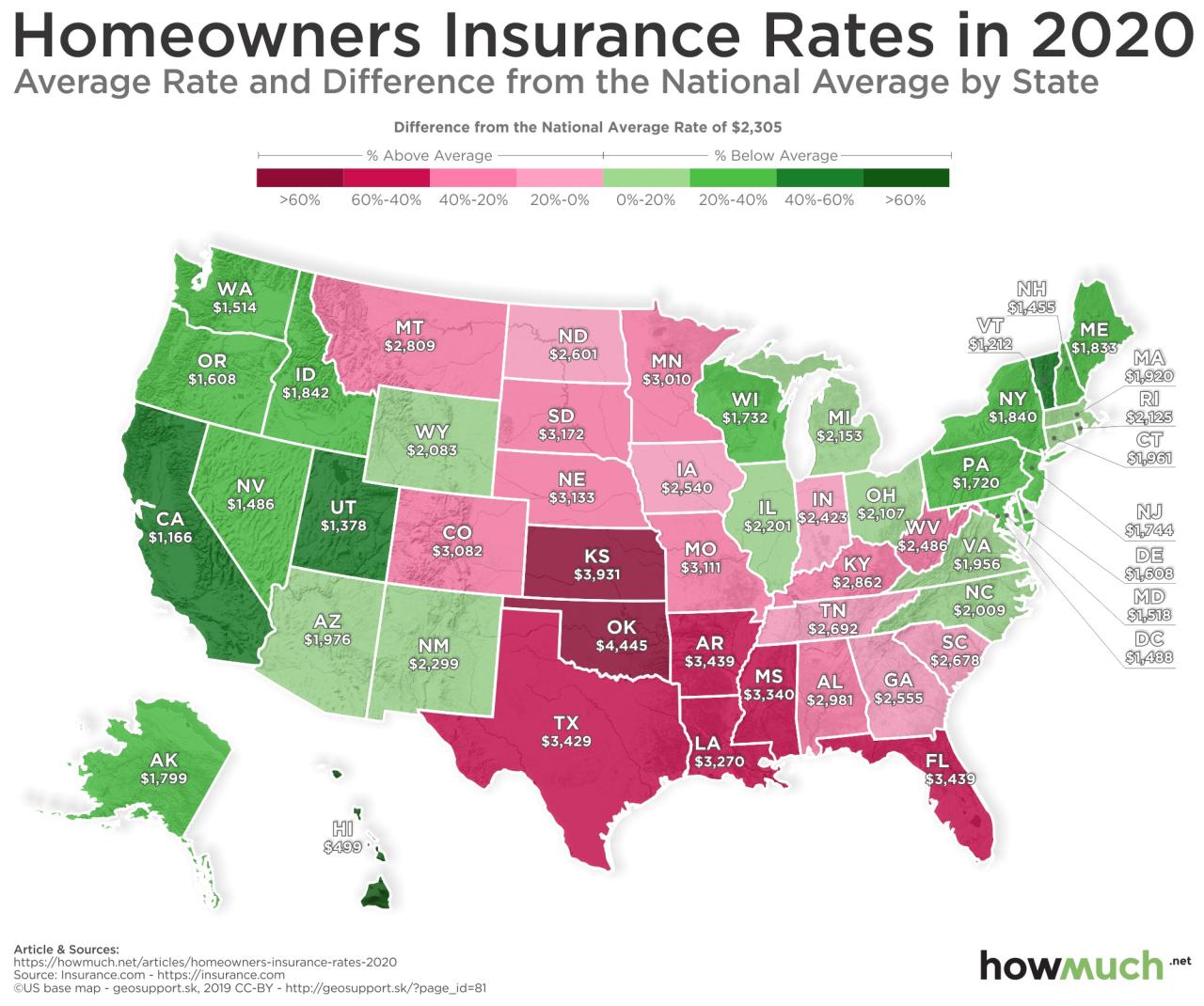

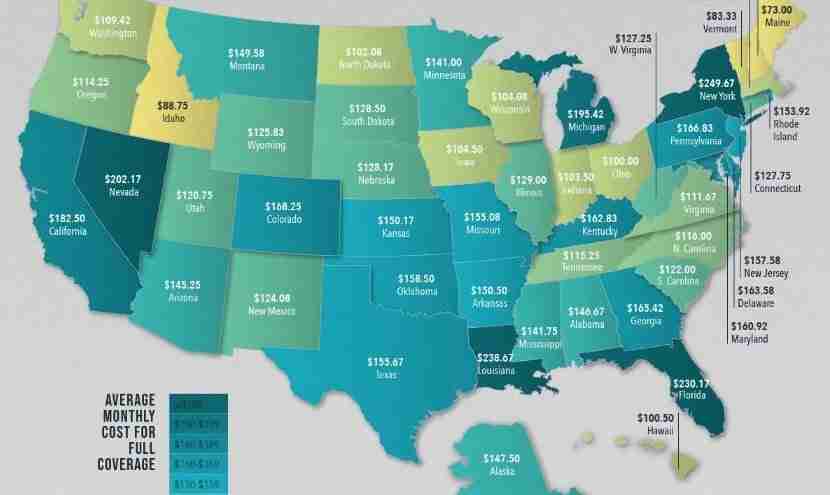

- Location: Your geographic location influences your insurance rates. Areas with higher crime rates, traffic congestion, and a higher frequency of accidents typically have higher insurance premiums.

- Age and Gender: Age and gender are also considered when calculating insurance rates. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents, resulting in higher premiums.

- Credit Score: Your credit score can surprisingly impact your insurance rates. Individuals with good credit scores often receive lower rates as they are considered more financially responsible.

- Coverage Options: The type and amount of coverage you choose also influence your rates. Opting for higher coverage limits, such as comprehensive and collision coverage, will generally result in higher premiums.

- Driving Habits: Your driving habits, such as mileage driven and commuting distance, can affect your insurance rates. Individuals who drive fewer miles or commute shorter distances may receive lower premiums.

- Safety Features: Vehicles equipped with safety features, such as anti-lock brakes, airbags, and stability control, can qualify for discounts, lowering your insurance premiums.

Impact of Driving History on Allstate Rates

Your driving history is a significant factor in determining your Allstate insurance rates. A clean driving record can result in lower premiums, while accidents, traffic violations, and DUI convictions can lead to rate increases.

For example, a driver with a clean driving record for five years may receive a lower rate compared to a driver who has been involved in an accident or received a speeding ticket within the past year.

It’s important to maintain a safe driving record to benefit from lower insurance premiums.

Obtaining a Quote

Getting a quote for Allstate insurance is a straightforward process that can be completed in several ways. The information you provide will determine the accuracy and relevance of the quote you receive.

Methods for Obtaining a Quote

Allstate offers several ways to obtain a quote, each with its benefits and drawbacks. Here are the most common methods:

- Online: The most convenient method, allowing you to get a quote 24/7. You can enter your information, compare coverage options, and receive a quote instantly. However, online quotes may not always be as accurate as quotes obtained through other methods, as they rely on self-reported information.

- Phone: You can call Allstate directly to speak with a representative who can help you obtain a quote. This method allows for personalized guidance and clarification of any questions you may have. However, it can be time-consuming, and you may have to wait on hold.

- In-Person: Visiting an Allstate agent’s office provides the most comprehensive and personalized experience. You can discuss your needs in detail, receive expert advice, and get a quote tailored to your specific situation. However, this method requires scheduling an appointment and may not be as convenient as other options.

Information Required for a Quote

To obtain an accurate and relevant quote, Allstate will need certain information from you. This typically includes:

- Personal Information: Name, address, date of birth, contact information, and driving history.

- Vehicle Information: Year, make, model, VIN, and usage details (e.g., daily commute, pleasure driving).

- Coverage Preferences: Desired coverage levels (e.g., liability, collision, comprehensive), deductibles, and any special requests.

- Driving History: Number of accidents, violations, and driving experience.

Comparison of Quote Methods

Here is a table comparing the benefits and drawbacks of each quote method:

| Method | Benefits | Drawbacks |

|---|---|---|

| Online | Convenient, 24/7 access, instant quotes | May not be as accurate as other methods, limited personalization |

| Phone | Personalized guidance, clarification of questions | Time-consuming, potential wait times |

| In-Person | Most comprehensive and personalized experience, expert advice | Requires scheduling an appointment, may not be as convenient |

Comparing Allstate Rates to Competitors

When deciding on an insurance provider, comparing rates from different companies is crucial to find the best value for your money. Allstate is a well-known insurer, but it’s important to see how its rates stack up against other major providers. This comparison will highlight key differences in coverage and pricing between Allstate and its competitors, allowing you to make an informed decision.

Comparing Allstate Rates to Competitors

To understand how Allstate’s rates compare, it’s helpful to look at rates from other major insurance providers. Here’s a table showing estimated annual premiums for similar coverage from different companies:

| Company | Coverage | Estimated Annual Premium |

|---|---|---|

| Allstate | $50,000 liability, $25,000 collision, $25,000 comprehensive | $1,200 |

| State Farm | $50,000 liability, $25,000 collision, $25,000 comprehensive | $1,150 |

| Geico | $50,000 liability, $25,000 collision, $25,000 comprehensive | $1,050 |

| Progressive | $50,000 liability, $25,000 collision, $25,000 comprehensive | $1,100 |

Please note that these are estimated premiums and actual rates may vary based on factors like your driving record, location, vehicle type, and coverage options.

Key Differences in Coverage and Pricing

While the table above shows similar coverage, there can be significant differences in the details of coverage offered by each company. For example:

- Allstate offers a “Drive Safe & Save” program that can lower premiums for safe drivers.

- State Farm has a “Drive Safe & Save” program as well, and also offers discounts for good students, multiple policies, and safe driving courses.

- Geico is known for its competitive rates, particularly for younger drivers.

- Progressive offers a “Name Your Price” tool that allows you to set your desired premium and then see what coverage options fit within your budget.

It’s essential to compare the specific coverage details and discounts offered by each company before making a decision.

Factors Affecting Insurance Rates

Besides the insurer, several factors influence your insurance rates. These include:

- Your driving record: Accidents and traffic violations will increase your premiums.

- Your age and gender: Younger drivers generally pay higher premiums due to higher risk.

- Your location: Areas with higher accident rates tend to have higher premiums.

- Your vehicle: The make, model, and year of your vehicle can affect your rate.

- Your coverage options: Choosing higher liability limits or adding comprehensive and collision coverage will increase your premiums.

It’s crucial to consider all these factors when comparing insurance rates and making a decision.

Understanding Coverage Options: All State Insurance Rate

Allstate offers a wide range of insurance coverage options to cater to different needs and situations. Understanding these options is crucial to ensure you have the right protection for your assets and liabilities.

Coverage Options

Allstate offers various coverage options to protect you and your assets. These options are typically categorized into two main groups: liability coverage and property coverage.

- Liability Coverage: This type of coverage protects you from financial losses arising from accidents or incidents caused by you or your insured vehicle.

- Property Coverage: This type of coverage protects your assets, such as your car, home, or belongings, from damage or loss due to various events like accidents, theft, or natural disasters.

Liability Coverage Options

Liability coverage protects you from financial responsibility in case you are found at fault in an accident. Here are some common liability coverage options:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages incurred by someone else due to an accident caused by you. It is typically expressed as a per-person limit and a per-accident limit, such as $100,000 per person and $300,000 per accident.

- Property Damage Liability: This coverage pays for repairs or replacement of someone else’s property that is damaged due to an accident caused by you. It is typically expressed as a single limit, such as $50,000 per accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with an uninsured or underinsured driver. It covers your medical expenses, lost wages, and property damage.

Property Coverage Options

Property coverage protects your assets from damage or loss due to various events. Here are some common property coverage options:

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in a collision, regardless of who is at fault.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged due to events other than collisions, such as theft, vandalism, fire, or hail.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses, lost wages, and other expenses, regardless of who is at fault in an accident.

- Medical Payments Coverage (MedPay): This coverage pays for medical expenses for you and your passengers, regardless of who is at fault in an accident.

Cost and Features

The cost of each coverage option varies based on factors like your driving record, vehicle type, location, and coverage limits. Here is a table summarizing some common coverage options, their costs, and key features:

| Coverage Option | Cost | Key Features |

|---|---|---|

| Bodily Injury Liability | Varies based on limits | Covers medical expenses, lost wages, and other damages incurred by someone else due to an accident caused by you. |

| Property Damage Liability | Varies based on limit | Covers repairs or replacement of someone else’s property that is damaged due to an accident caused by you. |

| Uninsured/Underinsured Motorist Coverage | Varies based on limits | Protects you if you are involved in an accident with an uninsured or underinsured driver. |

| Collision Coverage | Varies based on vehicle type and coverage limits | Pays for repairs or replacement of your vehicle if it is damaged in a collision. |

| Comprehensive Coverage | Varies based on vehicle type and coverage limits | Pays for repairs or replacement of your vehicle if it is damaged due to events other than collisions. |

| Personal Injury Protection (PIP) | Varies based on state requirements | Pays for your medical expenses, lost wages, and other expenses, regardless of who is at fault in an accident. |

| Medical Payments Coverage (MedPay) | Varies based on limits | Pays for medical expenses for you and your passengers, regardless of who is at fault in an accident. |

Discounts and Savings

Allstate offers a wide range of discounts to help policyholders save money on their insurance premiums. These discounts can significantly reduce your overall insurance costs, making Allstate a more affordable option for many drivers.

Types of Discounts

Allstate offers a variety of discounts, including:

- Good Student Discount: This discount is available to students who maintain a certain GPA. For example, a student with a GPA of 3.0 or higher may qualify for a 10% discount on their car insurance. This can save you hundreds of dollars per year.

- Safe Driver Discount: This discount is offered to drivers who have a clean driving record, meaning they have not been involved in any accidents or received any traffic violations. This discount can be substantial, as drivers with a history of accidents or violations typically pay higher premiums.

- Multi-Car Discount: If you insure multiple vehicles with Allstate, you may qualify for a multi-car discount. This discount can be significant, especially if you insure several cars with Allstate.

- Multi-Policy Discount: Allstate also offers a discount if you bundle your car insurance with other types of insurance, such as home or renters insurance. Bundling your policies can save you a considerable amount of money on your overall insurance costs.

- Homeowner Discount: If you own your home and insure it with Allstate, you may be eligible for a homeowner discount on your car insurance. This discount is offered to homeowners who have a proven track record of responsible homeownership.

- Defensive Driving Course Discount: If you complete a defensive driving course, you may qualify for a discount on your car insurance. This discount is offered to drivers who have demonstrated a commitment to safe driving practices.

- Anti-theft Device Discount: If your car is equipped with anti-theft devices, such as an alarm system or GPS tracking, you may qualify for a discount on your car insurance. This discount is offered to drivers who have taken steps to reduce the risk of theft.

- Loyalty Discount: Allstate may offer a discount to long-term customers who have been insured with the company for several years. This discount is a way for Allstate to reward its loyal customers.

Qualifying for Discounts

To qualify for Allstate’s discounts, you must meet certain eligibility requirements. For example, to qualify for the good student discount, you must be enrolled in a full-time program and maintain a certain GPA. Similarly, to qualify for the safe driver discount, you must have a clean driving record. You can find out more about the eligibility requirements for each discount by contacting Allstate directly or visiting their website.

Impact of Discounts

Discounts can significantly impact the overall cost of your car insurance. For example, a good student discount can save you hundreds of dollars per year, while a multi-car discount can save you even more. By taking advantage of Allstate’s discounts, you can significantly reduce your insurance costs and make your insurance more affordable.

Customer Reviews and Ratings

Understanding customer reviews and ratings is crucial when choosing an insurance provider. These reviews offer valuable insights into the experiences of real customers, allowing you to assess Allstate’s performance and compare it to other insurance companies.

Customer Satisfaction Scores

Customer satisfaction scores are a good indicator of an insurance company’s overall performance. Allstate consistently receives above-average ratings from various independent organizations. For example, J.D. Power, a renowned market research firm, has consistently ranked Allstate among the top performers in customer satisfaction for auto insurance. In their 2023 U.S. Auto Insurance Satisfaction Study, Allstate ranked third overall, scoring high in areas such as price, policy offerings, and claims experience.

Common Themes and Concerns in Customer Reviews

While Allstate generally receives positive reviews, there are some recurring themes and concerns expressed by customers. These often revolve around specific aspects of the insurance experience, such as:

- Claims Processing: Some customers have reported delays or difficulties in processing claims. This could be due to various factors, including complex claims, internal processes, or communication issues.

- Customer Service: While Allstate generally has a good reputation for customer service, some customers have expressed dissatisfaction with the responsiveness or helpfulness of representatives.

- Pricing: Some customers have found Allstate’s rates to be higher compared to other insurers, especially for certain types of coverage or demographics.

It’s important to note that these are general observations based on customer feedback. Individual experiences may vary, and it’s always advisable to research and compare multiple insurers before making a decision.

Customer Service and Claims Process

Allstate offers a range of customer service channels and resources to assist policyholders. Understanding how to access these services and navigate the claims process is essential for a smooth experience.

Customer Service Channels

Allstate provides multiple avenues for customers to reach out for assistance.

- Phone: Allstate maintains a 24/7 customer service hotline, allowing policyholders to connect with representatives at any time.

- Website: The Allstate website offers a comprehensive online portal where customers can manage their policies, submit claims, access account information, and find answers to frequently asked questions.

- Mobile App: The Allstate mobile app provides convenient access to policy details, claims management, roadside assistance, and other services on the go.

- Social Media: Allstate is active on social media platforms, such as Facebook and Twitter, where customers can engage with the company, ask questions, and share feedback.

Filing a Claim with Allstate

The claims process with Allstate is designed to be straightforward.

- Report the Claim: Policyholders can report a claim through any of the available customer service channels, including phone, website, or mobile app.

- Provide Information: Allstate will request details about the incident, including the date, time, location, and nature of the claim.

- Claim Review: Allstate will review the claim and determine coverage eligibility. This may involve an investigation, including contacting witnesses or reviewing documentation.

- Claim Resolution: If the claim is approved, Allstate will process the payment according to the policy terms. This may involve direct payment to repair shops or medical providers, or reimbursement to the policyholder.

Customer Experiences with Claims and Customer Service, All state insurance rate

Customer experiences with Allstate’s claims process and customer service vary.

Many customers have reported positive experiences with Allstate’s customer service representatives, praising their responsiveness, helpfulness, and professionalism.

However, some customers have reported delays in claim processing or difficulties in obtaining desired outcomes.

It’s essential to note that individual experiences can be influenced by factors such as the complexity of the claim, the specific representative handling the case, and the policy terms.

Last Recap

Ultimately, choosing the right insurance policy comes down to a careful evaluation of your individual needs, budget, and priorities. By understanding the factors that influence Allstate insurance rates, exploring available coverage options, and comparing rates to competitors, you can make a well-informed decision that ensures you have the protection you need at a price you can afford.

FAQ Guide

What is the average Allstate insurance rate?

The average Allstate insurance rate varies significantly depending on factors such as location, driving history, vehicle type, and coverage options. It’s best to obtain a personalized quote to get an accurate estimate.

How often are Allstate insurance rates reviewed?

Allstate typically reviews insurance rates annually, but they may adjust rates more frequently based on changes in your risk profile or market conditions.

Can I bundle my auto and home insurance with Allstate?

Yes, Allstate offers discounts for bundling multiple insurance policies, such as auto and home insurance. This can potentially save you money on your overall premiums.