All state insurance quotes – Allstate insurance quotes offer a potential path to financial security, protecting your assets and loved ones from unforeseen events. Allstate, a leading name in the insurance industry, has a long history of providing comprehensive coverage options, and understanding their quotes is crucial for making informed decisions about your insurance needs.

This guide explores the world of Allstate insurance quotes, delving into the various factors that influence pricing, the different types of coverage available, and tips for getting the best possible rate. Whether you’re a seasoned policyholder or a newcomer to the insurance landscape, this comprehensive overview will equip you with the knowledge to navigate the intricacies of Allstate quotes.

Allstate Insurance Overview

Allstate is a leading insurance company in the United States, known for its comprehensive range of insurance products and services. Founded in 1931, Allstate has a rich history of serving customers and protecting their assets.

Allstate’s History and Role in the Insurance Market

Allstate was initially established as a subsidiary of Sears, Roebuck and Company. The company’s initial focus was on providing auto insurance to Sears customers. Over the years, Allstate expanded its product offerings to include homeowners, renters, life, and other types of insurance. Allstate’s innovative approach to insurance, combined with its strong brand recognition and customer loyalty, has enabled it to become one of the largest and most respected insurance companies in the United States.

Allstate’s Core Insurance Products and Services

Allstate offers a wide range of insurance products and services to meet the diverse needs of its customers. Some of its key products include:

- Auto Insurance: Allstate’s auto insurance policies provide coverage for liability, collision, comprehensive, and other types of auto-related risks.

- Homeowners Insurance: Allstate offers homeowners insurance policies that protect against damage to homes and personal property due to various perils, such as fire, theft, and natural disasters.

- Renters Insurance: Allstate provides renters insurance policies to protect renters’ personal belongings against damage or loss.

- Life Insurance: Allstate offers various life insurance products, including term life, whole life, and universal life insurance, to provide financial protection for loved ones in the event of death.

Allstate’s Reputation and Customer Satisfaction Ratings

Allstate has consistently received high ratings for customer satisfaction and financial strength. For example, J.D. Power has consistently ranked Allstate highly in its annual customer satisfaction surveys for auto insurance.

“Allstate has a strong reputation for providing excellent customer service and financial stability. The company is committed to meeting the needs of its customers and offering innovative insurance solutions.”

Obtaining Allstate Insurance Quotes

Getting a quote from Allstate is a straightforward process, offering you the flexibility to choose the method that best suits your preferences. Whether you prefer the convenience of online tools, the personalized touch of a phone call, or the face-to-face interaction with an agent, Allstate provides options to suit your needs.

Methods for Obtaining Quotes

Allstate offers multiple ways to obtain a personalized insurance quote. You can choose the method that aligns best with your preferences and comfort level.

- Online: Allstate’s website provides a user-friendly platform for obtaining quotes. Simply visit the website, enter your details, and receive an instant quote. This method offers convenience and allows you to compare different coverage options at your own pace.

- Phone: If you prefer a more personal touch, you can contact Allstate’s customer service line. An agent will guide you through the quoting process, answer your questions, and provide personalized recommendations.

- Agent: You can schedule an appointment with a local Allstate agent. This allows for a face-to-face interaction, where you can discuss your insurance needs in detail and receive tailored advice.

Information Required for a Personalized Quote

To generate an accurate and personalized quote, Allstate requires specific information about you and your vehicle. This information helps them assess your risk profile and determine the appropriate premium for your insurance coverage.

- Personal Information: Your name, address, date of birth, and contact information are essential for identifying you and creating your policy.

- Driving History: Your driving record, including any accidents, violations, or driving experience, is crucial for evaluating your risk as a driver.

- Vehicle Information: Details about your vehicle, such as make, model, year, and VIN (Vehicle Identification Number), are necessary to assess its value and determine coverage needs.

- Coverage Preferences: You’ll need to specify the type of coverage you require, such as liability, collision, comprehensive, and uninsured motorist coverage. This helps Allstate understand your insurance needs and tailor the quote accordingly.

Factors Influencing Insurance Quote Pricing

Several factors contribute to the pricing of your Allstate insurance quote. Understanding these factors can help you make informed decisions about your coverage and potentially lower your premium.

- Driving History: As mentioned earlier, your driving record significantly influences your quote. A clean driving history with no accidents or violations generally leads to lower premiums. Conversely, a history of accidents or traffic violations can increase your risk profile and result in higher premiums.

- Age and Gender: Statistics show that younger and male drivers tend to have higher accident rates. Therefore, insurance premiums may be higher for these groups.

- Location: The area where you live plays a role in determining your premium. Factors such as traffic density, crime rates, and weather conditions can influence the risk of accidents and affect insurance costs.

- Vehicle Type: The type of vehicle you drive also influences your premium. Higher-value vehicles, performance cars, and luxury models generally have higher premiums due to their greater repair costs and higher risk of theft.

- Coverage Options: The level of coverage you choose directly affects your premium. Higher coverage limits, such as higher liability limits or comprehensive coverage, typically result in higher premiums.

- Deductibles: Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible usually translates to a lower premium, as you are assuming more financial responsibility in case of an accident.

- Discounts: Allstate offers various discounts that can reduce your premium. These discounts can be based on factors such as safe driving, good student status, multiple policies, and safety features in your vehicle.

Understanding Allstate Insurance Quotes

Allstate insurance quotes provide a detailed breakdown of potential insurance costs, helping you understand the coverage options and pricing structure. This information empowers you to make informed decisions about your insurance needs and budget.

Components of an Allstate Insurance Quote

An Allstate insurance quote typically includes several key components:

- Coverage Options: This section details the types of coverage you’ve selected, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage. It also Artikels the coverage limits for each type, which affect the overall premium.

- Deductibles: Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally lead to lower premiums, while lower deductibles result in higher premiums.

- Vehicle Information: The make, model, year, and value of your vehicle are crucial factors influencing your premium. Higher-value vehicles, newer models, and vehicles with a higher risk of theft or accidents tend to have higher premiums.

- Driver Information: Your driving history, age, and location play a significant role in determining your premium. Drivers with clean driving records, older drivers, and those residing in areas with lower accident rates generally receive lower premiums.

- Discounts: Allstate offers a range of discounts, such as good driver discounts, safe driver discounts, multi-policy discounts, and discounts for safety features, which can significantly reduce your premium.

Comparing Allstate’s Coverage Options

Allstate provides various coverage options to meet different needs and budgets. Understanding the differences between these options is crucial for choosing the right coverage for you:

- Liability Coverage: This coverage protects you financially if you’re responsible for an accident that causes damage to another person’s property or injuries to another person. Higher liability limits provide greater financial protection but also increase your premium.

- Collision Coverage: This coverage helps pay for repairs or replacement of your vehicle if it’s damaged in a collision with another vehicle or object. It’s typically optional, but it’s recommended for newer or more expensive vehicles.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by non-collision events such as theft, vandalism, natural disasters, or animal collisions. It’s also typically optional and can be valuable for newer or more expensive vehicles.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. It can help cover your medical expenses and property damage.

Understanding Potential Discounts and Savings

Allstate offers a variety of discounts that can significantly reduce your premium. Here are some common discounts:

- Good Driver Discount: This discount is awarded to drivers with clean driving records and no accidents or traffic violations. The discount amount can vary based on your driving history.

- Safe Driver Discount: This discount is available to drivers who have completed a defensive driving course or have installed safety features like anti-theft devices or anti-lock brakes.

- Multi-Policy Discount: This discount is offered to customers who bundle multiple insurance policies with Allstate, such as car insurance, home insurance, and life insurance.

- Other Discounts: Allstate also offers discounts for students, seniors, and members of certain organizations or professions. You can inquire about specific discounts during the quote process.

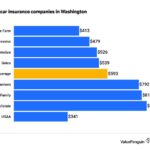

Allstate Insurance Quotes vs. Competitors: All State Insurance Quotes

When comparing Allstate insurance quotes to those of its main competitors, several factors come into play, including coverage options, pricing, and customer experience. While Allstate offers a comprehensive suite of insurance products, its competitors like Geico, Progressive, and State Farm also have their strengths and unique offerings. Understanding these differences can help you make an informed decision that best suits your needs and budget.

Key Differences in Coverage, Pricing, and Customer Experience

Allstate, Geico, Progressive, and State Farm are among the leading insurance providers in the United States. Each company offers a range of insurance products, including auto, home, renters, and life insurance. However, they differ in their coverage options, pricing, and customer service.

Coverage Options

- Allstate: Known for its “Drive Safe & Save” program, which offers discounts based on driving behavior. It also provides optional coverage like accident forgiveness and ride-sharing insurance.

- Geico: Offers a wide range of coverage options, including accident forgiveness, roadside assistance, and rental reimbursement. It also has a strong reputation for its affordable rates.

- Progressive: Provides a variety of coverage options, including comprehensive and collision coverage, as well as optional features like accident forgiveness and rental car reimbursement.

- State Farm: Offers a comprehensive suite of insurance products, including auto, home, renters, and life insurance. It is known for its strong customer service and its “Drive Safe & Save” program.

Pricing

- Allstate: Pricing can vary depending on factors like driving history, vehicle type, and location. Its “Drive Safe & Save” program can help lower premiums for safe drivers.

- Geico: Generally known for its competitive rates, often considered one of the most affordable options. It frequently offers discounts for good driving records, multiple policies, and other factors.

- Progressive: Offers a wide range of discounts, including safe driver, good student, and multi-policy discounts. Its “Name Your Price” tool allows you to set your desired premium and find policies that match.

- State Farm: Pricing is competitive and often comparable to other major insurers. It offers discounts for safe driving, good student, and multi-policy discounts.

Customer Experience

- Allstate: Offers a user-friendly website and mobile app for managing policies and making payments. It also has a network of local agents for in-person assistance.

- Geico: Known for its easy-to-use website and mobile app, which allows customers to manage policies, file claims, and access other services. It also offers 24/7 customer support.

- Progressive: Offers a range of customer service channels, including online, phone, and in-person options. It also has a strong reputation for its quick claim processing.

- State Farm: Known for its excellent customer service, with a network of local agents and a 24/7 customer support line. It also offers a user-friendly website and mobile app.

Comparing Key Features

The following table summarizes key features of Allstate and its competitors:

| Feature | Allstate | Geico | Progressive | State Farm |

|---|---|---|---|---|

| Coverage Options | Comprehensive, including “Drive Safe & Save” program, accident forgiveness, and ride-sharing insurance | Wide range of coverage options, including accident forgiveness, roadside assistance, and rental reimbursement | Variety of coverage options, including comprehensive and collision coverage, accident forgiveness, and rental car reimbursement | Comprehensive suite of insurance products, including auto, home, renters, and life insurance, “Drive Safe & Save” program |

| Pricing | Varies depending on factors like driving history, vehicle type, and location. “Drive Safe & Save” program can lower premiums for safe drivers | Generally known for competitive rates, often considered one of the most affordable options. Discounts for good driving records, multiple policies, and other factors | Offers a wide range of discounts, including safe driver, good student, and multi-policy discounts. “Name Your Price” tool allows you to set your desired premium and find policies that match | Competitive pricing, often comparable to other major insurers. Discounts for safe driving, good student, and multi-policy discounts |

| Customer Experience | User-friendly website and mobile app, network of local agents for in-person assistance | Easy-to-use website and mobile app, 24/7 customer support | Range of customer service channels, including online, phone, and in-person options. Strong reputation for quick claim processing | Excellent customer service, network of local agents, 24/7 customer support, user-friendly website and mobile app |

Tips for Getting the Best Allstate Insurance Quote

Getting the best Allstate insurance quote involves understanding how factors affect your premium and utilizing strategies to optimize your rate. This section will provide insights on how to achieve this.

Factors Influencing Your Allstate Insurance Premium

Several factors influence your Allstate insurance premium, including your driving history, vehicle type, location, and coverage choices.

- Driving History: Your driving record plays a crucial role in determining your premium. A clean record with no accidents or traffic violations generally leads to lower premiums. Conversely, accidents, speeding tickets, and DUI convictions can significantly increase your rates.

- Vehicle Type: The type of vehicle you drive influences your premium. Expensive, high-performance vehicles are generally more expensive to insure due to higher repair costs and potential theft risk. Conversely, older, less expensive vehicles tend to have lower premiums.

- Location: Your location also affects your premium. Areas with higher crime rates or more frequent accidents tend to have higher insurance premiums.

- Coverage Choices: The type and amount of coverage you choose also impact your premium. Higher coverage limits, such as comprehensive and collision coverage, generally result in higher premiums.

- Other Factors: Other factors can influence your premium, including your age, credit score, and even your marital status. For example, younger drivers may have higher premiums due to their higher risk profile.

Negotiating Your Allstate Insurance Rate

Negotiating your Allstate insurance rate can potentially save you money. Here are some effective strategies:

- Bundle Policies: Bundling your auto and home insurance with Allstate can often result in significant discounts.

- Shop Around: Compare quotes from multiple insurance companies to see if you can find a better rate.

- Ask About Discounts: Allstate offers various discounts, such as safe driver discounts, good student discounts, and multi-car discounts. Inquire about these discounts and see if you qualify.

- Consider Increasing Your Deductible: Increasing your deductible can lower your premium. However, ensure you can afford to pay the deductible if you need to file a claim.

- Review Your Coverage: Ensure you have adequate coverage but not excessive coverage. Excess coverage can unnecessarily increase your premium.

- Be Polite and Persistent: Be polite and persistent when negotiating with your Allstate agent. Explain your situation and express your desire to find a more affordable rate.

Allstate Insurance Quote Resources

Obtaining accurate and comprehensive Allstate insurance quotes requires utilizing the right resources. This section will Artikel the various avenues available for understanding and accessing Allstate insurance quotes.

Allstate Website Features

Allstate’s website provides a wealth of information and tools to help you get a quote and understand your insurance options. Here’s a table outlining some of the key features:

| Feature | Description |

|---|---|

| Online Quote Tool | Provides instant quotes for various insurance types, including auto, home, renters, and life. |

| Policy Management | Allows you to manage your existing policies, make payments, and access important documents. |

| Customer Support | Offers online chat, phone support, and email options for assistance with quotes and policies. |

| Resource Center | Provides educational materials, FAQs, and helpful articles about insurance topics. |

Allstate Contact Information

You can reach Allstate through various channels:

| Channel | Contact Information |

|---|---|

| Phone | 1-800-ALLSTATE (1-800-255-7828) |

| customerservice@allstate.com | |

| Social Media | Facebook, Twitter, Instagram |

Navigating Allstate’s Online Platform, All state insurance quotes

Here are some tips for navigating Allstate’s website effectively:

- Start by entering your zip code on the homepage to access personalized quotes.

- Utilize the search bar to find specific information, such as insurance types, policy details, or FAQs.

- Explore the “Resources” or “Help” section for comprehensive information and support.

- Save your quotes and policy information for easy access and comparison.

- Contact customer support if you have any questions or need assistance.

Final Summary

In the end, securing the right Allstate insurance quote is about more than just finding the lowest price. It’s about finding a policy that provides the coverage you need, at a price you can afford, and from a company you can trust. By understanding the nuances of Allstate quotes, you can make confident decisions about your insurance protection, ensuring peace of mind and financial stability for yourself and your loved ones.

FAQ Insights

What types of insurance does Allstate offer?

Allstate offers a wide range of insurance products, including car, home, renters, motorcycle, boat, and life insurance.

How do I get a quote from Allstate?

You can get a quote online, over the phone, or through an Allstate agent.

What factors affect my Allstate insurance quote?

Factors like your driving history, age, location, vehicle type, and coverage options can influence your quote.

Can I bundle my insurance policies with Allstate?

Yes, bundling your car and home insurance with Allstate can often result in significant discounts.