All state insurance quote – Allstate insurance quotes offer a glimpse into the world of comprehensive protection, covering everything from your car to your home. But navigating the process of obtaining a quote can be overwhelming, especially with so many factors influencing the final price. This guide will demystify the process, offering a step-by-step approach to getting the best possible rate, understanding the different coverage options, and comparing Allstate’s offerings with those of its competitors.

We’ll delve into the history and values of Allstate, exploring their diverse product offerings and target audience. From understanding the factors that impact your premium to analyzing policy terms and conditions, we’ll equip you with the knowledge you need to make informed decisions about your insurance needs.

Allstate Insurance Overview

Allstate Insurance is a leading provider of insurance products in the United States, known for its commitment to customer service and innovative solutions. Founded in 1931, Allstate has a rich history of serving the needs of individuals and families.

Allstate’s Mission and Values

Allstate’s mission is to protect people and their futures. The company’s values are centered around integrity, customer focus, and innovation. These values guide Allstate’s actions and decision-making processes, ensuring that its products and services meet the evolving needs of its customers.

Allstate’s Product Offerings

Allstate offers a comprehensive range of insurance products to cater to various needs. Here are some of its key offerings:

Car Insurance

Allstate’s car insurance provides coverage for damage to your vehicle and liability for injuries or property damage caused to others. It includes various optional coverages like collision, comprehensive, uninsured/underinsured motorist, and roadside assistance.

Home Insurance

Allstate’s home insurance protects your dwelling and personal belongings against perils such as fire, theft, and natural disasters. It offers different coverage options based on the type of home and your specific needs.

Renters Insurance

Allstate’s renters insurance safeguards your personal belongings in a rented property. It provides coverage against theft, fire, and other covered perils, offering peace of mind for renters.

Life Insurance

Allstate offers various life insurance policies to help protect your loved ones financially in case of your untimely death. It provides financial support to cover expenses like funeral costs, outstanding debts, and income replacement.

Business Insurance

Allstate’s business insurance provides coverage for businesses of all sizes, offering protection against risks such as property damage, liability claims, and business interruption. It includes a range of policies tailored to different industries and business needs.

Allstate’s Target Audience

Allstate’s target audience includes individuals, families, and businesses seeking reliable and comprehensive insurance solutions. The company aims to provide coverage for a wide range of needs, from protecting personal assets to safeguarding business operations.

Obtaining an Allstate Insurance Quote

Getting an Allstate insurance quote is straightforward and can be done in several ways. You can get a quote online, over the phone, or in person at an Allstate agency.

Getting an Allstate Insurance Quote Online

Getting an Allstate insurance quote online is the most convenient and quickest way. You can get a quote in minutes from the comfort of your home.

Here’s a step-by-step guide:

- Visit the Allstate website and click on the “Get a Quote” button.

- Enter your zip code and select the type of insurance you need (auto, home, renters, etc.).

- Provide basic information about yourself and your vehicle(s) or property.

- Review your quote and make any necessary changes.

- If you’re happy with the quote, you can purchase your policy online.

Tips for Getting the Best Possible Rate

There are several things you can do to get the best possible rate on your Allstate insurance.

- Shop around: Compare quotes from multiple insurance companies before making a decision. This will help you find the best rate for your needs.

- Improve your driving record: A clean driving record will help you get a lower rate. If you have any traffic violations, consider taking a defensive driving course to improve your record.

- Bundle your policies: If you have multiple insurance policies with Allstate, you may be eligible for a discount.

- Increase your deductible: A higher deductible will typically result in a lower premium. Consider increasing your deductible if you’re comfortable with the financial risk.

- Ask about discounts: Allstate offers a variety of discounts, such as good student, safe driver, and multi-car discounts. Ask your agent about the discounts you may qualify for.

Factors that Influence Insurance Premiums

Several factors can influence your insurance premiums, including:

- Driving history: Your driving history, including any accidents, tickets, or points, is a major factor in determining your premium.

- Age: Younger drivers are generally considered to be higher risk, so they may pay higher premiums. Older drivers may also pay higher premiums, as they are more likely to have health issues that could affect their driving ability.

- Location: The location where you live can affect your premium. For example, areas with higher rates of car theft or accidents may have higher premiums.

- Vehicle type: The type of vehicle you drive can also affect your premium. For example, sports cars and luxury vehicles are generally considered to be higher risk, so they may have higher premiums.

- Credit score: Your credit score can also be a factor in determining your premium. Insurance companies may use your credit score as a measure of your financial responsibility.

Analyzing Allstate Insurance Quotes

After obtaining an Allstate insurance quote, it’s crucial to analyze it thoroughly and compare it with quotes from other major insurance companies. This process helps you make an informed decision and choose the policy that best suits your needs and budget.

Comparing Allstate Insurance Quotes with Competitors

When comparing Allstate insurance quotes with those from other major insurance companies, consider factors such as coverage options, pricing, discounts, and customer service. Look for quotes from companies like Geico, Progressive, State Farm, and Liberty Mutual. You can use online comparison tools or contact insurance agents directly to obtain quotes.

Key Differences Between Allstate Policies and Competitors

Allstate insurance policies have unique features that distinguish them from competitors. Here are some key differences:

- Drive Safe & Save: Allstate offers a telematics program that tracks your driving habits and rewards you with discounts for safe driving.

- Accident Forgiveness: This program prevents your rates from increasing after your first at-fault accident.

- Claims Satisfaction Guarantee: Allstate guarantees satisfaction with its claims process, promising to resolve issues promptly and fairly.

Benefits and Drawbacks of Choosing Allstate Insurance

Choosing Allstate insurance comes with both benefits and drawbacks. It’s essential to weigh these factors carefully before making a decision.

Benefits of Allstate Insurance

- Comprehensive Coverage Options: Allstate offers a wide range of coverage options to meet various needs, including auto, home, renters, life, and business insurance.

- Competitive Pricing: Allstate’s prices are generally competitive with other major insurance companies, offering discounts for good driving records, safety features, and multiple policy bundles.

- Excellent Customer Service: Allstate has a reputation for providing excellent customer service, with responsive agents and online tools for managing your policies.

Drawbacks of Allstate Insurance

- Limited Availability in Certain Areas: Allstate’s availability may vary depending on your location, with limited coverage in some areas.

- Potential for Higher Rates in Certain Cases: While Allstate offers competitive rates, some customers may find their rates higher than those offered by other companies, particularly if they have a poor driving record or live in high-risk areas.

- Complexity of Policies: Allstate’s policies can be complex, with various options and add-ons that may require careful review and understanding.

Comparing Allstate Coverage Options and Pricing with Competitors

The following table provides a comparison of Allstate’s coverage options and pricing with those of other major insurance companies. Note that prices may vary depending on factors such as location, vehicle type, and individual driving history.

| Insurance Company | Coverage Options | Average Annual Premium |

|---|---|---|

| Allstate | Auto, Home, Renters, Life, Business | $1,200 – $1,500 |

| Geico | Auto, Home, Renters, Motorcycle, Boat | $1,100 – $1,400 |

| Progressive | Auto, Home, Renters, Motorcycle, Boat | $1,000 – $1,300 |

| State Farm | Auto, Home, Renters, Life, Business | $1,150 – $1,450 |

| Liberty Mutual | Auto, Home, Renters, Life, Business | $1,250 – $1,550 |

Understanding Allstate Insurance Policies: All State Insurance Quote

Allstate insurance policies offer a range of coverage options to protect you and your assets in various situations. It’s crucial to understand the different types of coverage available and how they can benefit you. This section will delve into the key components of Allstate insurance policies, providing a clear understanding of their structure and benefits.

Liability Coverage

Liability coverage protects you financially if you are found responsible for an accident that causes damage to another person’s property or injuries. It covers legal costs, medical expenses, and property damage up to the policy limits. Allstate offers different liability coverage limits, allowing you to choose the level of protection that best suits your needs. For example, if you cause an accident that results in $50,000 in property damage and $100,000 in medical expenses, your liability coverage would pay for these costs up to the policy limits.

Collision Coverage

Collision coverage protects you against damage to your vehicle resulting from a collision with another vehicle or object, regardless of fault. It covers repairs or replacement costs, minus your deductible. This coverage is optional, but it is highly recommended, especially if you have a loan or lease on your vehicle. For example, if you hit a parked car, collision coverage would cover the cost of repairs to your vehicle, minus your deductible.

Comprehensive Coverage

Comprehensive coverage protects you against damage to your vehicle caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. This coverage also covers repairs or replacement costs, minus your deductible. Like collision coverage, comprehensive coverage is optional, but it can provide valuable protection against unexpected events. For example, if your car is damaged by a hailstorm, comprehensive coverage would cover the cost of repairs, minus your deductible.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you and your passengers if you are involved in an accident with a driver who has no insurance or insufficient insurance. This coverage pays for medical expenses, lost wages, and property damage up to the policy limits. This coverage is particularly important in states with a high percentage of uninsured drivers. For example, if you are hit by an uninsured driver who causes $20,000 in medical expenses, your uninsured motorist coverage would pay for these expenses up to your policy limits.

Understanding Policy Terms and Conditions

It’s essential to carefully review your Allstate insurance policy and understand the terms and conditions. This includes:

- Deductibles: This is the amount you pay out-of-pocket before your insurance coverage kicks in.

- Coverage limits: This is the maximum amount your insurance company will pay for a covered event.

- Exclusions: These are specific events or situations that are not covered by your policy.

- Premium: This is the amount you pay for your insurance coverage.

Understanding these terms will help you make informed decisions about your coverage and ensure you have adequate protection in case of an accident or other covered event.

Real-World Scenarios

Here are some real-world scenarios where Allstate insurance policies have been used:

- A driver rear-ended another vehicle, causing damage to both vehicles. The driver’s liability coverage paid for the other driver’s medical expenses and property damage.

- A car was stolen from a parking lot. The owner’s comprehensive coverage paid for the replacement cost of the vehicle, minus the deductible.

- A driver was involved in an accident with an uninsured driver. The driver’s uninsured motorist coverage paid for their medical expenses and lost wages.

These examples demonstrate how Allstate insurance policies can provide financial protection in various situations, helping policyholders recover from unexpected events and minimize financial losses.

Customer Experience with Allstate Insurance

Allstate is a well-known insurance provider, and its customer experience is a crucial factor in its success. Understanding how Allstate interacts with its customers, including their satisfaction with the company’s services, can provide valuable insights for potential policyholders.

Customer Service

Allstate’s customer service is a significant aspect of its overall customer experience. The company offers various channels for customers to reach out, including phone, email, and online chat. Allstate has received mixed reviews regarding its customer service. Some customers praise its responsiveness and helpfulness, while others have reported difficulties getting through to agents or receiving satisfactory resolutions to their issues.

Claims Handling Process, All state insurance quote

Allstate’s claims handling process is another crucial aspect of its customer experience. The company aims to provide a smooth and efficient process for customers who need to file a claim. However, like with customer service, customer experiences with Allstate’s claims handling process can vary. Some customers have reported positive experiences, with claims being processed quickly and efficiently. Others have encountered delays or difficulties in getting their claims approved.

Customer Reviews and Testimonials

Customer reviews and testimonials provide valuable insights into the customer experience with Allstate. Many online platforms, such as Trustpilot and Yelp, host reviews from customers who have interacted with Allstate. These reviews offer a diverse range of perspectives, highlighting both positive and negative experiences.

Customer Satisfaction Ratings

Customer satisfaction ratings provide a quantifiable measure of the overall customer experience with Allstate. Allstate’s customer satisfaction ratings have varied over time, with some years showing higher levels of customer satisfaction than others. These ratings can be influenced by factors such as the company’s performance in specific areas, such as claims handling or customer service.

Overall Customer Experience

The overall customer experience with Allstate is a complex and multifaceted issue. Customers have varying experiences with the company, influenced by factors such as their specific needs, the type of insurance policy they hold, and the particular agents or representatives they interact with. While some customers have reported positive experiences, others have encountered challenges and frustrations.

Allstate Insurance in the Digital Age

Allstate, a leading insurance provider, has embraced the digital age, implementing innovative strategies to enhance customer experience and streamline operations. Their online presence, mobile app, and technological advancements demonstrate their commitment to meeting the evolving needs of modern consumers.

Allstate’s Online Presence and Digital Marketing Strategies

Allstate has a strong online presence, leveraging various digital marketing strategies to reach potential customers. Their website offers a comprehensive platform for obtaining quotes, managing policies, and accessing customer support. Allstate also actively engages with customers on social media platforms, providing valuable information and promoting their services. They utilize targeted advertising campaigns across various digital channels to reach specific demographics and cater to their unique needs.

Allstate’s Mobile App and its Features

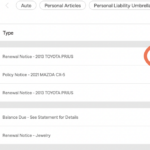

The Allstate mobile app provides customers with convenient access to their insurance policies, claims information, and other essential services. Key features include:

- Policy Management: View policy details, make payments, and update contact information.

- Claims Reporting: Submit claims quickly and easily with photos and detailed descriptions.

- Roadside Assistance: Request roadside assistance, including towing, jump starts, and flat tire changes.

- Digital ID Cards: Access digital copies of insurance cards for convenient presentation.

- Personalized Recommendations: Receive tailored recommendations based on individual needs and driving habits.

Allstate’s mobile app is a testament to their commitment to providing a seamless and user-friendly digital experience for their customers.

Technology Transforming the Insurance Industry and Allstate’s Role

Technology is rapidly transforming the insurance industry, leading to increased efficiency, personalized experiences, and innovative solutions. Allstate is actively embracing these advancements, implementing various technological solutions to improve customer service and operational efficiency.

- Artificial Intelligence (AI): Allstate utilizes AI-powered chatbots and virtual assistants to provide 24/7 customer support and answer common inquiries. This technology streamlines the customer experience, providing instant responses and personalized assistance.

- Data Analytics: Allstate leverages data analytics to understand customer behavior, identify trends, and personalize insurance offerings. This data-driven approach enables them to offer tailored policies and services based on individual needs and preferences.

- Telematics: Allstate offers telematics programs that track driving behavior, providing insights into driving habits and promoting safer driving practices. This data helps them assess risk and offer personalized discounts based on individual driving patterns.

Examples of Innovative Solutions Allstate is Implementing to Enhance the Customer Experience

Allstate continuously seeks to improve the customer experience by implementing innovative solutions. Some examples include:

- Drive Safe & Save: This telematics program rewards safe drivers with discounts based on their driving habits, encouraging responsible driving practices.

- Digital Claims Process: Allstate has streamlined the claims process with a user-friendly digital platform that allows customers to submit claims quickly and easily through their mobile app or website.

- Virtual Reality (VR) Training: Allstate uses VR technology to train its agents and claims adjusters, providing immersive simulations that enhance their skills and knowledge.

Allstate’s commitment to innovation ensures they remain at the forefront of the digital age, providing customers with a seamless and personalized insurance experience.

Ultimate Conclusion

In today’s digital age, Allstate has embraced technology, offering online quotes, mobile apps, and innovative solutions to enhance the customer experience. By understanding the nuances of Allstate insurance quotes, you can confidently navigate the world of insurance and find the coverage that best suits your needs and budget.

User Queries

What is the difference between liability coverage and collision coverage?

Liability coverage protects you financially if you cause an accident that injures someone or damages their property. Collision coverage covers damage to your own vehicle in an accident, regardless of who is at fault.

How often should I review my insurance policy?

It’s a good idea to review your insurance policy at least once a year, or whenever you experience a significant life change, such as getting married, having a child, or buying a new car.

What are some tips for getting the best possible rate on my insurance?

Some tips for getting a good rate include maintaining a good driving record, taking a defensive driving course, bundling multiple policies, and shopping around for quotes from different insurers.