All state insur – Allstate Insurance sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Allstate, a household name in the insurance industry, boasts a long and storied history, having been founded in 1931. Its journey from a fledgling company to a behemoth in the insurance market is one of innovation, resilience, and a steadfast commitment to customer satisfaction.

This comprehensive overview delves into the intricacies of Allstate’s operations, exploring its diverse product portfolio, its dedication to customer experience, and its financial performance. We’ll examine the company’s strategies for navigating the ever-evolving insurance landscape and assess its competitive position in the market.

Allstate Insurance Overview

Allstate Insurance is a prominent and well-established insurance company in the United States. Founded in 1931, it has become a household name synonymous with reliable and comprehensive insurance solutions. Allstate’s history is marked by innovation, growth, and a commitment to customer satisfaction.

History and Background

Allstate was established in 1931 as a subsidiary of Sears, Roebuck and Co., a retail giant at the time. The company’s initial focus was on offering auto insurance to Sears customers. This strategic partnership provided Allstate with a ready-made customer base and a platform for rapid expansion.

In the early years, Allstate pioneered the concept of direct-to-consumer insurance sales, bypassing traditional insurance agents. This approach proved successful, allowing the company to reach a wider audience and offer competitive rates. Over time, Allstate expanded its product portfolio to include various types of insurance, including homeowners, renters, life, and business insurance.

In 1995, Allstate became an independent company, separating from Sears. This move allowed Allstate to pursue its own growth strategy and further expand its reach in the insurance market.

Key Facts and Figures

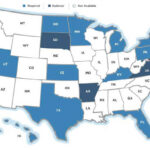

Allstate is a major player in the insurance industry, with a significant presence in the United States. The company has a vast network of agents and offices across the country, serving millions of customers.

* Size: Allstate is one of the largest insurance companies in the United States, with over 16 million customers.

* Market Share: Allstate holds a substantial market share in the auto insurance sector, ranking among the top providers.

* Financial Performance: Allstate has a strong financial track record, consistently generating significant revenue and profits. The company’s financial stability and profitability are crucial factors in its ability to offer competitive insurance products and provide reliable customer service.

Mission, Vision, and Core Values

Allstate’s mission is to protect people and their futures. The company aims to provide comprehensive insurance solutions that meet the diverse needs of its customers. Allstate’s vision is to be the leading provider of insurance products and services, known for its customer-centric approach and commitment to innovation.

Allstate’s core values are:

* Customer Focus: Allstate prioritizes customer satisfaction and strives to provide exceptional service.

* Integrity: The company operates with honesty and transparency, upholding ethical standards in all its dealings.

* Innovation: Allstate is committed to developing innovative products and services that meet the evolving needs of its customers.

* Teamwork: Allstate values collaboration and teamwork, recognizing that success is achieved through collective efforts.

Products and Services

Allstate offers a comprehensive range of insurance products designed to protect individuals and businesses against various risks. These products are tailored to meet the diverse needs of customers, providing financial security and peace of mind.

Auto Insurance

Auto insurance is one of Allstate’s core products, providing financial protection in case of accidents, theft, or damage to your vehicle. Key features include:

- Liability Coverage: Covers damages to other vehicles or property, as well as injuries to others, if you are at fault in an accident.

- Collision Coverage: Covers damages to your vehicle resulting from a collision, regardless of who is at fault.

- Comprehensive Coverage: Protects against damages to your vehicle caused by non-collision events, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Provides financial protection if you are involved in an accident with a driver who is uninsured or underinsured.

- Personal Injury Protection (PIP): Covers medical expenses and lost wages for you and your passengers, regardless of who is at fault.

Allstate also offers a variety of discounts to help customers save on their auto insurance premiums, such as:

- Safe Driving Discounts: Rewarding safe driving habits with lower premiums.

- Good Student Discounts: Recognizing students with good academic performance.

- Multi-Policy Discounts: Bundling multiple insurance policies with Allstate, such as home and auto insurance.

- Anti-theft Device Discounts: Offering discounts for vehicles equipped with anti-theft devices.

Allstate’s auto insurance customers benefit from comprehensive customer support services, including:

- 24/7 Claims Reporting: Allowing customers to report claims online, over the phone, or through the Allstate mobile app.

- Dedicated Claims Representatives: Providing personalized assistance throughout the claims process.

- Rental Car Coverage: Providing temporary transportation while your vehicle is being repaired.

Home Insurance

Allstate’s home insurance policies provide financial protection against various risks that can damage or destroy your home, including:

- Fire and Lightning: Covering damages caused by fire or lightning strikes.

- Windstorm and Hail: Protecting against damages from windstorms, hail, and other severe weather events.

- Theft and Vandalism: Providing coverage for losses due to theft or vandalism.

- Water Damage: Covering damages from flooding, burst pipes, and other water-related events.

- Liability Coverage: Protecting you from legal claims if someone is injured on your property.

Allstate’s home insurance policies offer various customization options, allowing customers to choose the coverage that best suits their needs and budget.

Life Insurance

Allstate offers a range of life insurance products designed to provide financial security for your loved ones in the event of your death. These products include:

- Term Life Insurance: Providing coverage for a specific period, typically 10, 20, or 30 years, at a fixed premium.

- Permanent Life Insurance: Offering lifetime coverage and a savings component that can grow tax-deferred.

- Universal Life Insurance: Providing flexible premiums and death benefits, allowing you to adjust your coverage based on your changing needs.

- Variable Life Insurance: Offering investment options that allow your death benefit to grow based on the performance of the underlying investments.

Allstate’s life insurance products are designed to meet a variety of needs, from providing financial protection for young families to securing a legacy for future generations.

Renters Insurance

Renters insurance provides financial protection for your personal belongings and liability in case of damage or loss to your rental property. Key features include:

- Personal Property Coverage: Protecting your belongings, such as furniture, electronics, and clothing, against theft, fire, or other covered perils.

- Liability Coverage: Providing financial protection if someone is injured on your property or you are held liable for property damage.

- Additional Living Expenses: Covering the cost of temporary housing and other expenses if you are displaced from your rental property due to a covered event.

Renters insurance is essential for anyone who rents a property, as it provides crucial financial protection against unforeseen events.

Business Insurance

Allstate offers a range of business insurance products designed to protect businesses from various risks, including:

- General Liability Insurance: Protecting your business from claims of negligence or property damage caused by your business operations.

- Workers’ Compensation Insurance: Providing coverage for medical expenses and lost wages for employees injured on the job.

- Property Insurance: Protecting your business property, such as buildings, equipment, and inventory, against damage or loss.

- Business Income Insurance: Covering lost income if your business is forced to shut down due to a covered event.

- Professional Liability Insurance: Protecting professionals from claims of negligence or malpractice.

Allstate’s business insurance products are tailored to meet the specific needs of businesses of all sizes, providing comprehensive protection and peace of mind.

Customer Experience

Allstate strives to provide a positive and seamless customer experience across all touchpoints. The company offers a variety of channels for customers to interact with, including its website, mobile app, customer service representatives, and claims process.

Website and Mobile App

Allstate’s website and mobile app provide customers with convenient access to their insurance information, policy management tools, and claims reporting. The website is user-friendly and offers a wealth of information about Allstate’s products and services. The mobile app allows customers to manage their policies, pay their bills, file claims, and access roadside assistance, all from their smartphones.

Customer Service Channels, All state insur

Allstate offers a variety of customer service channels, including phone, email, and live chat. The company’s customer service representatives are available 24/7 to assist customers with their inquiries and concerns.

Claims Process

Allstate’s claims process is designed to be efficient and straightforward. Customers can file claims online, through the mobile app, or by phone. The company provides regular updates on the status of their claims and works to resolve them promptly.

Customer Reviews and Feedback

Customer reviews and feedback provide valuable insights into Allstate’s customer experience. While Allstate generally receives positive reviews, some customers have expressed concerns about long wait times for customer service, difficulty navigating the website, and delays in claim processing.

Areas for Improvement

Based on customer feedback, Allstate could improve its customer experience by:

- Reducing wait times for customer service

- Simplifying the website navigation

- Streamlining the claims process

- Providing more proactive communication about claim updates

Financial Performance

Allstate’s financial performance is a crucial aspect of its overall success. It is important to analyze its revenue, profitability, and debt levels to understand its financial health and its ability to compete in the insurance industry.

Revenue Growth and Trends

Allstate’s revenue has grown steadily in recent years, driven by factors such as increased insurance premiums, expansion into new markets, and acquisitions. The company has also benefited from the strong growth of the U.S. economy, which has led to increased demand for insurance products.

- In 2022, Allstate’s total revenue was $47.8 billion, representing a 7.7% increase from the previous year. This growth was driven by strong performance in both its personal and commercial insurance segments.

- Allstate’s revenue growth has been consistently above the industry average in recent years, indicating its strong market position and ability to attract new customers.

- The company’s revenue is expected to continue growing in the coming years, driven by factors such as increasing insurance penetration, rising insurance premiums, and expansion into new markets.

Profitability and Key Metrics

Allstate’s profitability is a key indicator of its financial health and ability to generate returns for its shareholders. The company’s profitability has been impacted by factors such as increased competition, rising claims costs, and the impact of natural disasters.

- Allstate’s net income in 2022 was $3.2 billion, down from $4.1 billion in 2021. This decline was primarily due to higher catastrophe losses and increased competition in the insurance market.

- Allstate’s operating margin, which measures its profitability from core operations, was 9.8% in 2022, down from 11.5% in 2021. This decline was primarily due to higher claims costs.

- Allstate’s return on equity (ROE), which measures its profitability relative to its shareholders’ equity, was 12.5% in 2022, down from 15.7% in 2021. This decline was also primarily due to higher claims costs.

Debt Levels and Leverage

Allstate’s debt levels are a key factor in its financial health and ability to withstand economic downturns. The company has a relatively low level of debt, which provides it with financial flexibility and reduces its vulnerability to interest rate increases.

- Allstate’s total debt was $12.7 billion at the end of 2022, representing a debt-to-equity ratio of 0.35. This ratio is relatively low compared to its peers, indicating a strong financial position.

- Allstate’s debt levels have remained relatively stable in recent years, reflecting its conservative financial management approach.

- The company’s low debt levels provide it with financial flexibility to invest in growth opportunities, such as acquisitions or new product development.

Comparison to Competitors and Industry Benchmarks

Allstate’s financial performance is generally considered to be strong compared to its competitors and industry benchmarks. The company’s revenue growth, profitability, and debt levels are all in line with or better than its peers.

- Allstate’s revenue growth has been consistently above the industry average in recent years, indicating its strong market position and ability to attract new customers.

- Allstate’s operating margin and ROE are also generally above the industry average, reflecting its efficient operations and strong profitability.

- Allstate’s debt levels are relatively low compared to its peers, providing it with financial flexibility and reducing its vulnerability to interest rate increases.

Factors Influencing Financial Performance

Several factors have influenced Allstate’s financial performance in recent years, including:

- Economic Growth: The strong growth of the U.S. economy has led to increased demand for insurance products, boosting Allstate’s revenue and profitability.

- Competition: Increased competition from other insurance companies has put pressure on Allstate’s pricing and profitability. The company has responded by investing in technology and innovation to improve its customer experience and offer more competitive products.

- Claims Costs: Rising claims costs, driven by factors such as inflation and more frequent severe weather events, have negatively impacted Allstate’s profitability. The company has taken steps to mitigate these costs, such as raising premiums and improving its risk management practices.

- Regulation: Changes in insurance regulations have also impacted Allstate’s financial performance. The company has had to adapt to new regulations and requirements, which can be costly and time-consuming.

- Technology: Allstate has been investing heavily in technology to improve its customer experience and streamline its operations. This investment has helped the company to improve its efficiency and profitability.

Industry Trends

The insurance industry is constantly evolving, driven by technological advancements, regulatory changes, and shifting consumer preferences. These trends are reshaping the way insurers operate and interact with their customers, presenting both opportunities and challenges for companies like Allstate.

Technological Advancements

Technological advancements are transforming the insurance industry, enabling insurers to improve efficiency, personalize customer experiences, and develop innovative products and services.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML are being used to automate tasks, analyze large datasets, and improve risk assessment. For example, Allstate uses AI-powered chatbots to provide 24/7 customer support and to personalize insurance quotes based on individual risk profiles.

- Internet of Things (IoT): The proliferation of connected devices allows insurers to collect real-time data on driving habits, home security, and other risk factors. This data can be used to develop usage-based insurance programs and to provide personalized risk management advice.

- Blockchain Technology: Blockchain technology can streamline insurance processes, improve transparency, and reduce fraud. For example, Allstate is exploring the use of blockchain to manage claims and to track insurance policies.

Regulatory Changes

The insurance industry is subject to a constantly evolving regulatory landscape, which can impact pricing, product development, and distribution.

- Data Privacy Regulations: Regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) are increasing the focus on data privacy and security. Insurers must comply with these regulations to protect customer data and maintain trust.

- Cybersecurity Regulations: The increasing threat of cyberattacks has led to stricter cybersecurity regulations for insurers. Allstate must invest in robust cybersecurity measures to protect its systems and customer data.

- Climate Change Regulations: As climate change intensifies, insurers are facing new challenges related to natural disasters and extreme weather events. Allstate is adapting to these challenges by developing new products and services that address climate-related risks.

Changing Consumer Preferences

Consumer preferences are shifting, with customers increasingly demanding personalized experiences, convenient access to services, and digital-first interactions.

- Digital-First Consumers: Consumers are increasingly comfortable managing their insurance online and through mobile apps. Allstate has invested heavily in digital channels to provide seamless customer experiences, including online quoting, policy management, and claims reporting.

- Transparency and Trust: Consumers are demanding more transparency from insurers, particularly regarding pricing and claims processes. Allstate is addressing these concerns by providing clear and concise information about its products and services, and by streamlining its claims process.

- Personalized Experiences: Consumers expect insurers to provide personalized experiences that meet their individual needs. Allstate is leveraging data analytics and AI to personalize insurance quotes, provide customized risk management advice, and offer tailored products and services.

Competitive Landscape

Allstate operates in a highly competitive insurance market, facing a diverse range of rivals across various segments. These competitors can be categorized based on their size, scope, and target customer base.

Major Competitors

Allstate’s major competitors in the insurance market include:

- Progressive: Known for its direct-to-consumer model and innovative marketing campaigns, Progressive is a strong competitor in the auto insurance market, offering competitive pricing and a wide range of coverage options.

- State Farm: As the largest insurer in the U.S., State Farm is a formidable competitor with a vast distribution network and a strong brand reputation. It offers a comprehensive suite of insurance products, including auto, home, life, and health.

- Geico: Known for its humorous advertising and competitive pricing, Geico is a major player in the auto insurance market, attracting customers with its ease of online purchase and quick claims processing.

- Liberty Mutual: A large, diversified insurer, Liberty Mutual offers a broad range of insurance products and services, including auto, home, commercial, and life insurance.

- Farmers Insurance: With a focus on providing personalized service and a strong agent network, Farmers Insurance offers a variety of insurance products, including auto, home, life, and business insurance.

Product and Service Comparison

Allstate’s competitors offer a range of products and services similar to those provided by Allstate. The key differentiators lie in pricing, coverage options, and customer experience. For instance, Progressive’s “Name Your Price” tool allows customers to set their desired premium and receive tailored coverage options, while Geico emphasizes its ease of online purchase and quick claims processing. State Farm, known for its strong brand reputation and extensive agent network, provides personalized service and a wide range of insurance products.

Strengths and Weaknesses

Allstate’s strengths include its strong brand recognition, diverse product portfolio, and extensive distribution network. However, it faces challenges in areas such as pricing competitiveness and customer service.

- Strengths:

- Strong brand recognition and reputation.

- Diverse product portfolio, including auto, home, life, and business insurance.

- Extensive distribution network with a strong agent force.

- Focus on customer satisfaction and innovation.

- Weaknesses:

- Pricing competitiveness in some segments.

- Customer service challenges in certain areas.

- Limited digital capabilities compared to some competitors.

- Potential for higher claims costs due to its focus on higher-risk customers.

Future Outlook

Allstate, as a leading insurance provider, faces a dynamic landscape with both challenges and opportunities. The company’s future growth and profitability will be influenced by various factors, including technological advancements, evolving customer expectations, and the competitive landscape.

Technological Advancements

Technological advancements are transforming the insurance industry. Allstate needs to adapt to these changes to remain competitive.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML are transforming how insurance companies assess risk, automate processes, and personalize customer experiences. Allstate can leverage these technologies to enhance its underwriting capabilities, improve fraud detection, and offer customized insurance products.

- Internet of Things (IoT): IoT devices are generating vast amounts of data that can be used to understand risk profiles better. Allstate can utilize this data to offer usage-based insurance programs and develop more accurate risk assessments.

- Blockchain: Blockchain technology can streamline insurance claims processing, improve transparency, and enhance security. Allstate can explore blockchain applications to optimize its operations and enhance customer trust.

Evolving Customer Expectations

Customer expectations are evolving rapidly, with customers demanding more personalized, digital, and convenient experiences. Allstate needs to cater to these changing preferences.

- Digital-First Approach: Customers increasingly prefer to interact with insurance companies online. Allstate needs to strengthen its digital capabilities, including its website, mobile apps, and online customer service channels.

- Personalized Experiences: Customers expect insurance companies to understand their individual needs and provide tailored solutions. Allstate can leverage data analytics and AI to offer personalized insurance products and services.

- Seamless Customer Service: Customers expect prompt and efficient service. Allstate can improve its customer service by investing in technology, training, and processes that ensure a seamless experience.

Competitive Landscape

The insurance industry is becoming increasingly competitive, with new entrants and established players vying for market share. Allstate needs to differentiate itself to remain competitive.

- Innovation: Allstate needs to invest in innovation to develop new products and services that meet evolving customer needs.

- Customer Focus: Allstate needs to prioritize customer satisfaction and build strong relationships to retain customers.

- Cost Efficiency: Allstate needs to optimize its operations to reduce costs and improve profitability.

Last Recap

In conclusion, Allstate Insurance stands as a testament to the power of innovation, adaptability, and customer-centricity. With a robust product portfolio, a strong financial foundation, and a commitment to embracing industry trends, Allstate is well-positioned for continued success in the years to come.

FAQ Overview: All State Insur

What are the different types of insurance offered by Allstate?

Allstate offers a wide range of insurance products, including auto, home, life, renters, and business insurance.

How can I contact Allstate customer service?

You can reach Allstate customer service through their website, mobile app, phone, or email.

Does Allstate offer discounts on its insurance policies?

Yes, Allstate offers a variety of discounts, such as safe driver discounts, good student discounts, and multi-policy discounts.

What is the claims process like with Allstate?

Allstate’s claims process is designed to be straightforward and convenient. You can file a claim online, through the mobile app, or by phone.