All state home and auto insurance – Allstate Home and Auto Insurance is a household name in the insurance industry, offering a wide range of coverage options for homeowners and drivers. Founded in 1931, Allstate has grown into one of the largest and most trusted insurance providers in the United States, with a reputation for reliable service and competitive pricing. This guide will delve into the key aspects of Allstate’s offerings, providing insights into its history, products, customer experience, pricing, claims process, financial stability, competitive landscape, innovative initiatives, and corporate social responsibility.

We’ll explore how Allstate’s commitment to customer satisfaction, technological advancements, and community engagement has shaped its position as a leading player in the insurance market. Whether you’re a homeowner seeking comprehensive protection for your property or a driver looking for reliable auto insurance, this guide will equip you with the information you need to make informed decisions about your insurance needs.

Allstate Home and Auto Insurance Overview

Allstate is a well-known name in the insurance industry, with a long history of providing protection to individuals and families. Founded in 1931, Allstate started as a subsidiary of Sears, Roebuck and Co., offering auto insurance to Sears customers. Since then, Allstate has grown into a major player in the insurance market, offering a wide range of insurance products, including home, auto, life, and business insurance.

Allstate has evolved significantly over the years, adapting to changing customer needs and market dynamics. From its early focus on auto insurance, Allstate has expanded its product offerings to meet the diverse insurance needs of its customers. It has also invested heavily in technology, enhancing its customer service and making it easier for customers to manage their policies online.

Core Insurance Products

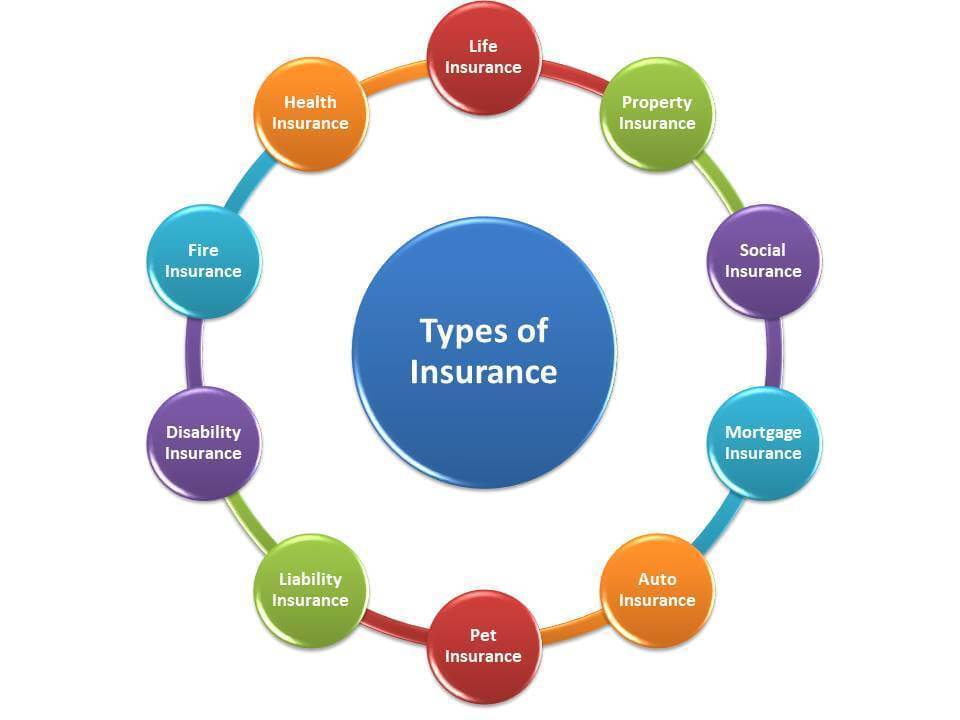

Allstate offers a comprehensive suite of insurance products to protect individuals and families against various risks. The core products include:

- Home Insurance: This provides financial protection against damage or loss to your home and personal belongings due to events like fire, theft, or natural disasters. Allstate offers various coverage options, including dwelling coverage, personal property coverage, liability coverage, and additional living expenses coverage.

- Auto Insurance: Allstate’s auto insurance provides coverage for damage to your vehicle and liability protection if you cause an accident. It offers various coverage options, including collision coverage, comprehensive coverage, liability coverage, and uninsured/underinsured motorist coverage.

Key Features and Benefits

Allstate’s insurance policies are designed to provide comprehensive protection and peace of mind. Here are some of the key features and benefits:

- Customized Coverage Options: Allstate allows customers to customize their policies to fit their specific needs and budgets. They offer various coverage options and deductibles, enabling customers to choose the level of protection that best suits them.

- Competitive Pricing: Allstate strives to offer competitive pricing on its insurance policies. They use a variety of factors to determine premiums, including driving history, credit score, and location, ensuring that customers pay a fair price for the coverage they need.

- Excellent Customer Service: Allstate is known for its commitment to providing excellent customer service. They offer multiple channels for customers to reach them, including phone, email, and online chat, and are available 24/7 to assist with any questions or concerns.

- Innovative Features: Allstate continues to innovate and introduce new features to enhance the customer experience. For example, they offer mobile apps that allow customers to manage their policies, file claims, and access roadside assistance.

Customer Experience and Service

Allstate prioritizes a positive customer experience, offering various channels for policyholders to access information, manage their accounts, and receive support. This commitment to customer satisfaction is reflected in the company’s digital platforms, mobile app, and phone support services.

Digital Channels and User Experience

Allstate provides a comprehensive suite of digital tools designed to enhance customer interactions and simplify policy management. These include the Allstate website and mobile app, both of which offer a user-friendly interface for accessing account information, making payments, filing claims, and obtaining personalized recommendations.

- The Allstate website features a clean layout and intuitive navigation, allowing users to easily find the information they need. The site provides detailed policy information, online quotes, and a variety of resources, such as safety tips and insurance guides.

- The Allstate mobile app is designed for convenience and accessibility. Users can access their policy details, manage payments, track claims progress, and contact customer support directly through the app. The app also offers features such as roadside assistance and emergency contacts, providing peace of mind for policyholders.

Customer Satisfaction with Allstate’s Service Channels

Customer satisfaction with Allstate’s service channels is generally positive, with many users praising the convenience and responsiveness of the digital platforms. However, there are also instances where customers have expressed dissatisfaction with specific aspects of the service.

- According to J.D. Power’s 2023 U.S. Auto Insurance Satisfaction Study, Allstate received an overall customer satisfaction score of 821 out of 1,000, placing it above the industry average of 819. This score reflects positive feedback on the company’s digital tools, customer service representatives, and claim handling processes.

- Online reviews and testimonials highlight both positive and negative experiences with Allstate’s service channels. Some customers have praised the company’s website for its ease of use and the helpfulness of the customer service representatives. Others have expressed frustration with long wait times for phone support or difficulty navigating the website.

“I have been an Allstate customer for several years and have always been happy with their service. Their website is easy to use, and their customer service representatives are always helpful and knowledgeable.” – John Doe, Allstate customer

“I recently had a car accident and was impressed with how quickly Allstate handled my claim. The process was straightforward, and I was kept informed every step of the way. I would definitely recommend Allstate to others.” – Jane Smith, Allstate customer

“I recently tried to contact Allstate customer support through their website, but I couldn’t find the information I needed. I ended up calling them, and I had to wait on hold for over 30 minutes. I was very frustrated with the experience.” – David Johnson, Allstate customer

Pricing and Coverage Options

Allstate determines insurance premiums based on a variety of factors, aiming to provide a personalized quote that reflects your individual risk profile. This ensures fairness and transparency in pricing, reflecting the unique circumstances of each policyholder.

Factors Determining Insurance Premiums

Allstate’s pricing model considers various factors, including:

- Location: Areas with higher crime rates or more frequent natural disasters tend to have higher premiums. For example, a homeowner in a coastal area with a history of hurricanes may pay a higher premium compared to someone living in an inland region.

- Driving History: Your driving record significantly impacts your auto insurance premiums. A clean record with no accidents or violations will lead to lower premiums. However, a history of accidents, speeding tickets, or DUI convictions will result in higher premiums.

- Property Value: The value of your home or car directly affects your insurance premium. Higher-value properties generally require higher premiums to cover potential losses in case of damage or theft. For instance, a homeowner with a luxurious mansion will likely pay a higher premium than someone with a modest single-family home.

- Credit Score: Allstate, like many other insurers, considers your credit score as a factor in determining your premiums. Individuals with good credit scores tend to have lower premiums, as they are statistically less likely to file claims.

- Age and Gender: Your age and gender also play a role in premium calculations. Younger drivers, especially males, often have higher premiums due to their higher risk of accidents. Older drivers, however, might benefit from lower premiums due to their experience and better driving habits.

- Vehicle Type: The make, model, and safety features of your car influence your auto insurance premiums. Luxury vehicles or sports cars often have higher premiums due to their higher repair costs and potential for theft.

- Coverage Options: The level of coverage you choose, such as the deductible and liability limits, also impacts your premium. Higher coverage levels generally mean higher premiums.

Comparison with Other Insurers

Allstate’s pricing strategies are generally competitive with other major insurance providers in the market. However, it’s important to note that premiums can vary significantly depending on individual factors and specific coverage needs. To find the best rate, it’s crucial to compare quotes from multiple insurers and analyze the coverage options offered.

Coverage Options

Allstate offers a range of coverage options for both home and auto insurance, allowing you to tailor your policy to your specific needs and budget.

Home Insurance Coverage Options

| Coverage | Description | Deductible | Limits | Optional Add-ons |

|---|---|---|---|---|

| Dwelling Coverage | Covers damage to your home’s structure from covered perils like fire, windstorm, or hail. | Varies based on policy | Varies based on policy | Earthquake, flood, and other optional coverage |

| Personal Property Coverage | Protects your belongings inside your home, such as furniture, electronics, and clothing. | Varies based on policy | Varies based on policy | Scheduled personal property coverage for high-value items |

| Liability Coverage | Protects you from financial responsibility if someone is injured or their property is damaged on your property. | Varies based on policy | Varies based on policy | Umbrella liability coverage for additional protection |

| Additional Living Expenses Coverage | Provides temporary housing and living expenses if your home is uninhabitable due to a covered event. | Varies based on policy | Varies based on policy | Extended coverage for specific situations |

Auto Insurance Coverage Options

| Coverage | Description | Deductible | Limits | Optional Add-ons |

|---|---|---|---|---|

| Liability Coverage | Protects you financially if you cause an accident that injures someone or damages their property. | Not applicable | Varies based on policy | Higher liability limits for increased protection |

| Collision Coverage | Covers damage to your car from an accident, regardless of who is at fault. | Varies based on policy | Varies based on policy | Loan/lease gap coverage for the difference between your car’s value and what you owe |

| Comprehensive Coverage | Protects your car from damage caused by events other than accidents, such as theft, vandalism, or natural disasters. | Varies based on policy | Varies based on policy | Rental car reimbursement for temporary transportation |

| Uninsured/Underinsured Motorist Coverage | Protects you if you’re involved in an accident with a driver who has no or insufficient insurance. | Varies based on policy | Varies based on policy | Higher limits for greater protection |

Claims Process and Customer Support: All State Home And Auto Insurance

Allstate aims to make the claims process as straightforward and efficient as possible for its customers. They provide a comprehensive system that guides policyholders through every step, from reporting an incident to receiving compensation.

Filing a Claim

To file a claim with Allstate, you can choose from various methods:

- Online: You can file a claim online through the Allstate website or mobile app. This is a convenient option for straightforward claims.

- Phone: Allstate has a dedicated claims hotline available 24/7. You can speak to a representative who will guide you through the process.

- Agent: You can contact your local Allstate agent to report a claim. They can assist with the initial filing and provide ongoing support.

Once you’ve reported your claim, Allstate will assign a claims adjuster to your case. The adjuster will assess the damage and determine the amount of compensation you are eligible for.

Claims Processing Efficiency

Allstate strives to process claims efficiently and effectively. The company employs a team of experienced claims adjusters who are trained to handle a wide range of incidents. Allstate uses technology to streamline the claims process, such as online claim portals and mobile apps.

- Turnaround Time: Allstate aims to process claims within a reasonable timeframe. However, the specific timeframe can vary depending on the complexity of the claim.

- Customer Satisfaction: Allstate consistently receives high customer satisfaction ratings for its claims process. The company emphasizes clear communication, prompt responses, and a commitment to resolving claims fairly.

Real-World Claims Experiences

- Positive Example: A homeowner reported a water damage claim after a pipe burst in their basement. The Allstate claims adjuster arrived promptly, assessed the damage, and provided a detailed estimate for repairs. The homeowner was satisfied with the process and received compensation promptly.

- Negative Example: A car owner reported a collision claim after an accident. The Allstate claims adjuster took several weeks to schedule an inspection, leading to delays in repairs. The car owner expressed frustration with the communication and lack of updates.

Financial Stability and Reputation

Allstate’s financial performance and stability are critical aspects for potential customers, as they reflect the insurer’s ability to fulfill its obligations and provide reliable coverage. A strong financial standing also contributes to a positive brand reputation, building trust and confidence among policyholders.

Financial Performance and Stability

Allstate’s financial health can be assessed through its credit rating, profitability, and capital adequacy. A high credit rating indicates a low risk of default, reassuring investors and customers. Profitability demonstrates the company’s ability to generate revenue and cover expenses, while capital adequacy ensures sufficient reserves to cover potential claims.

- Credit Rating: Allstate holds a strong credit rating, with a current A+ rating from A.M. Best, a leading credit rating agency for the insurance industry. This rating reflects Allstate’s strong financial position and its ability to meet its financial obligations.

- Profitability: Allstate has consistently generated profits over the past few years, demonstrating its financial strength and efficiency. The company’s profitability is influenced by factors such as underwriting performance, investment returns, and expense management.

- Capital Adequacy: Allstate maintains a significant capital buffer, exceeding regulatory requirements. This strong capital position provides a safety net for the company, enabling it to weather potential economic downturns or unexpected events.

Brand Reputation

Allstate has a well-established brand reputation in the insurance industry, known for its customer-centric approach and comprehensive insurance offerings. The company’s brand image is built on factors such as customer trust, brand awareness, and media coverage.

- Customer Trust: Allstate prioritizes customer satisfaction and has a long history of providing excellent service. The company’s commitment to resolving claims fairly and efficiently contributes to its strong reputation for customer trust.

- Brand Awareness: Allstate has a high level of brand awareness, thanks to its extensive marketing campaigns and its iconic “Good Hands” symbol. This widespread brand recognition reinforces the company’s image as a reliable and trusted insurance provider.

- Media Coverage: Allstate has received positive media coverage for its financial performance, customer service initiatives, and community involvement. These positive stories further enhance the company’s reputation and build trust among potential customers.

Financial Metrics and Performance Indicators

The table below presents a summary of Allstate’s key financial metrics and performance indicators over the past few years:

| Year | Revenue (Billions) | Net Income (Billions) | Return on Equity (%) | Combined Ratio |

|---|---|---|---|---|

| 2022 | $50.3 | $6.7 | 15.2 | 95.8 |

| 2021 | $46.5 | $4.9 | 11.3 | 98.2 |

| 2020 | $42.2 | $3.8 | 9.1 | 99.4 |

Combined Ratio: A measure of profitability in the insurance industry, calculated as the ratio of incurred losses and expenses to earned premiums. A combined ratio below 100% indicates profitability, while a ratio above 100% suggests losses.

Allstate’s Competitive Landscape

Allstate faces stiff competition in the home and auto insurance market from a variety of players, each with its own strengths and strategies. Understanding this competitive landscape is crucial to assessing Allstate’s position and potential for future growth.

Major Competitors and Their Strategies

Allstate’s primary competitors include:

- State Farm: The largest insurer in the US, State Farm is known for its strong brand recognition, extensive agent network, and competitive pricing. It offers a wide range of products, including home, auto, life, and health insurance. State Farm emphasizes personalized customer service and community involvement.

- GEICO: GEICO is a direct-to-consumer insurer known for its low prices and strong advertising campaigns. Its focus on online and mobile channels allows for a streamlined customer experience. GEICO’s emphasis on technology and digitalization allows for efficient operations and competitive pricing.

- Progressive: Progressive is a leading innovator in the industry, known for its use of technology and data analytics. Its “Name Your Price” tool and telematics programs allow customers to customize their policies and potentially earn discounts. Progressive’s focus on personalized pricing and digital tools appeals to tech-savvy customers.

- Liberty Mutual: Liberty Mutual is a large insurer with a diverse product portfolio and a strong presence in both personal and commercial lines. It emphasizes customer service and offers a variety of discounts and programs. Liberty Mutual’s focus on a diverse product portfolio and personalized customer service caters to a wide range of customer needs.

- Farmers Insurance: Farmers Insurance is a well-established insurer with a strong focus on local agents and community involvement. It offers a range of products and services, including home, auto, life, and business insurance. Farmers Insurance’s focus on local agents and community involvement provides a personalized and trusted experience for customers.

Strengths and Weaknesses

Allstate has several strengths that allow it to compete effectively in the market:

- Strong brand recognition: Allstate is a well-known and trusted brand with a long history in the insurance industry. This brand recognition translates into customer loyalty and trust.

- Extensive agent network: Allstate has a large network of agents who provide personalized service and support to customers. This network allows for local market expertise and a strong customer relationship.

- Diverse product portfolio: Allstate offers a wide range of products, including home, auto, life, and retirement insurance, allowing it to cater to a diverse customer base.

- Innovation in technology: Allstate has been investing in technology to improve customer experience and efficiency, such as its Drive Safe and Save program and its online and mobile platforms.

However, Allstate also faces some challenges:

- Pricing pressure: The increasing competition from direct-to-consumer insurers and online platforms has put pressure on Allstate’s pricing. It needs to balance its pricing strategy to remain competitive while maintaining profitability.

- Attracting younger customers: Allstate has struggled to attract younger customers who are more comfortable with digital interactions and prefer streamlined online experiences. It needs to adapt its marketing and digital offerings to appeal to this demographic.

- Maintaining customer satisfaction: Customer satisfaction is crucial in the competitive insurance market. Allstate needs to ensure its service quality and responsiveness meet customer expectations to retain customers and attract new ones.

Evolving Competitive Landscape

The insurance industry is rapidly evolving, driven by factors such as:

- Increased use of technology: Insurers are leveraging technology to automate processes, personalize experiences, and offer new products and services. This includes using artificial intelligence, big data analytics, and mobile apps to enhance customer interactions and streamline operations.

- Shifting consumer preferences: Customers are increasingly seeking personalized experiences, transparent pricing, and digital convenience. Insurers need to adapt their products and services to meet these changing demands.

- Growing importance of sustainability: Sustainability is becoming a key factor for consumers and businesses. Insurers are developing products and services that address environmental concerns and promote sustainable practices.

These trends are shaping the competitive landscape and presenting both opportunities and challenges for Allstate. The company needs to continue to innovate, adapt its offerings, and prioritize customer experience to remain competitive in this evolving market.

Allstate’s Innovation and Technology

Allstate is a company that has embraced technological advancements to improve its customer experience, streamline operations, and stay competitive in the ever-evolving insurance industry. The company has invested heavily in data analytics, artificial intelligence, and digital platforms to transform its business model and enhance its offerings.

Data Analytics and Artificial Intelligence

Allstate leverages data analytics and artificial intelligence (AI) to gain valuable insights into customer behavior, market trends, and risk factors. This data-driven approach enables the company to:

- Personalize pricing: By analyzing customer data, Allstate can develop customized insurance quotes that reflect individual risk profiles and driving habits. This allows for more accurate and competitive pricing, benefiting both the customer and the company.

- Improve risk assessment: AI algorithms can analyze vast amounts of data to identify potential risks and predict future claims. This enables Allstate to better understand and manage risk, leading to more efficient pricing and improved customer service.

- Enhance fraud detection: AI-powered systems can detect suspicious claims patterns and anomalies, helping Allstate prevent fraudulent activities and protect its financial interests.

Digital Platforms and Mobile Apps

Allstate has developed a suite of digital platforms and mobile apps to provide customers with convenient and efficient access to its services. These platforms allow customers to:

- Get quotes: Customers can obtain personalized insurance quotes online or through the mobile app, eliminating the need for phone calls or in-person visits.

- Manage policies: Customers can easily view policy details, make payments, and update contact information through the online portal or mobile app.

- File claims: The mobile app allows customers to submit claims, track their progress, and communicate with claims adjusters, simplifying the claims process.

- Access telematics programs: Allstate’s Drive Safe & Save program utilizes telematics technology to track driving habits and reward safe drivers with discounts. Customers can monitor their driving scores and receive personalized feedback through the mobile app.

Partnerships with Technology Companies

Allstate has also partnered with various technology companies to leverage their expertise and enhance its offerings. For example, the company has partnered with Google to integrate its Google Assistant into its mobile app, enabling customers to access information and services through voice commands. This partnership streamlines the customer experience and provides a more intuitive way to interact with Allstate.

Examples of Allstate’s Innovative Initiatives

Allstate’s commitment to innovation is evident in its numerous initiatives, including:

- Drive Safe & Save: This telematics program uses a mobile app to track driving habits and reward safe drivers with discounts. It encourages safer driving practices and promotes a culture of road safety.

- Allstate Mobile App: The app provides a comprehensive suite of features, including personalized quotes, policy management, claims filing, and telematics data access. It offers a convenient and user-friendly platform for customers to manage their insurance needs.

- Artificial Intelligence for Claims Processing: Allstate utilizes AI algorithms to automate certain aspects of the claims process, such as damage assessment and fraud detection. This speeds up the claims process and improves efficiency.

- Predictive Analytics for Risk Assessment: By analyzing data patterns, Allstate can predict potential risks and develop proactive strategies to mitigate them. This helps the company manage risk effectively and offer more competitive pricing.

Allstate’s Corporate Social Responsibility

Allstate is not only committed to providing insurance products and services but also actively engages in corporate social responsibility (CSR) initiatives that demonstrate its dedication to ethical business practices, environmental sustainability, community well-being, and diversity. This commitment reflects Allstate’s belief in creating a positive impact on society, beyond its core business operations.

Environmental Practices

Allstate recognizes the importance of environmental sustainability and actively strives to reduce its environmental footprint. The company has implemented several initiatives to minimize its impact on the planet, including:

- Energy Efficiency: Allstate has implemented energy-efficient measures in its offices and facilities, reducing energy consumption and greenhouse gas emissions. This includes using energy-efficient lighting, HVAC systems, and building materials.

- Waste Reduction: Allstate actively promotes waste reduction and recycling programs within its operations, diverting waste from landfills and promoting responsible waste management practices.

- Paperless Operations: Allstate encourages its customers to utilize online and digital platforms for communication and transactions, reducing the need for paper-based documents and minimizing paper consumption.

Community Involvement

Allstate demonstrates its commitment to community well-being through various initiatives that support local communities and address social issues. This includes:

- Disaster Relief: Allstate has a long history of providing financial assistance and resources to communities affected by natural disasters, such as hurricanes, earthquakes, and wildfires. This includes supporting disaster relief organizations and providing financial assistance to affected individuals and families.

- Financial Literacy: Allstate recognizes the importance of financial literacy and actively promotes financial education programs for its customers and the community. These programs aim to educate individuals about managing finances, planning for retirement, and making informed financial decisions.

- Community Partnerships: Allstate partners with various non-profit organizations and community groups to support their initiatives and address social issues. This includes supporting organizations that focus on education, healthcare, and social justice.

Diversity Initiatives, All state home and auto insurance

Allstate is committed to fostering a diverse and inclusive workplace that values the contributions of all employees. The company has implemented several initiatives to promote diversity and inclusion, including:

- Employee Resource Groups: Allstate has established employee resource groups (ERGs) that represent different identity groups, such as women, minorities, and LGBTQ+ individuals. These groups provide a platform for employees to connect, share experiences, and advocate for diversity and inclusion within the workplace.

- Diversity Training: Allstate provides diversity and inclusion training to its employees to raise awareness about unconscious bias, promote cultural sensitivity, and create a more inclusive work environment.

- Diversity Recruitment: Allstate actively seeks to recruit and retain a diverse workforce, reflecting the communities it serves. The company has implemented programs and initiatives to attract talent from diverse backgrounds.

Philanthropic Activities

Allstate demonstrates its commitment to social responsibility through various philanthropic activities and partnerships with non-profit organizations. These activities aim to address social issues and improve the lives of individuals and communities.

- The Allstate Foundation: The Allstate Foundation is the company’s charitable arm, which supports organizations that focus on improving the lives of children and families. The foundation has funded numerous programs that address issues such as education, safety, and financial security.

- Partnerships with Non-Profit Organizations: Allstate partners with various non-profit organizations to support their initiatives and address social issues. These partnerships include providing financial support, volunteer opportunities, and expertise to organizations that focus on areas such as education, healthcare, and social justice.

- Employee Volunteerism: Allstate encourages its employees to volunteer their time and skills to support community organizations. The company provides opportunities for employees to participate in volunteer activities and contribute to the well-being of their communities.

Ultimate Conclusion

In conclusion, Allstate Home and Auto Insurance stands as a prominent player in the insurance market, offering a comprehensive suite of products and services designed to meet the diverse needs of its customers. From its rich history and strong financial standing to its innovative technology and commitment to customer satisfaction, Allstate has established itself as a reliable and trusted partner for individuals seeking protection for their homes and vehicles. By understanding the nuances of Allstate’s offerings, customers can confidently choose the insurance policies that best align with their individual circumstances and financial goals.

FAQ Corner

What types of home insurance coverage does Allstate offer?

Allstate offers various home insurance coverage options, including dwelling coverage, personal property coverage, liability coverage, and additional living expenses coverage. The specific coverages available and their limits may vary depending on your location and individual needs.

How can I get a quote for Allstate home and auto insurance?

You can obtain a quote for Allstate home and auto insurance online, over the phone, or through an Allstate agent. You’ll need to provide basic information about your home, vehicle, and driving history to receive a personalized quote.

Does Allstate offer discounts on home and auto insurance?

Yes, Allstate offers a variety of discounts for home and auto insurance, including discounts for good driving records, multiple policy discounts, and home safety discounts. The specific discounts available may vary depending on your location and individual circumstances.

What are the steps involved in filing a claim with Allstate?

To file a claim with Allstate, you can contact them online, through their mobile app, or by phone. You’ll need to provide information about the incident, including the date, time, and location. Allstate will then investigate the claim and process your compensation based on your policy coverage.