A State Auto Insurance phone number is a vital tool for anyone seeking assistance with their insurance policies or inquiries. Whether you need to report a claim, make a payment, or simply ask a question, having the correct contact information is crucial.

State Auto Insurance provides a comprehensive range of insurance services, including auto, homeowners, renters, and life insurance. They offer various options for reaching their customer service team, including phone, email, online chat, and social media.

Finding the State Auto Insurance Phone Number

Getting in touch with State Auto Insurance is often necessary, whether you need to make a claim, update your policy, or have a general inquiry. Fortunately, finding their phone number is quite straightforward.

Ways to Find the State Auto Insurance Phone Number

Finding the correct State Auto Insurance phone number is essential to ensure you’re contacting the right department and avoid potential scams. Here are some reliable ways to locate their phone number:

- State Auto Insurance Website: The most reliable source for the State Auto Insurance phone number is their official website. Look for a “Contact Us” or “Customer Service” section, where you’ll usually find their main phone number along with other contact details.

- State Auto Insurance Social Media Pages: Check their official Facebook, Twitter, or LinkedIn pages. Many insurance companies list their phone numbers on their social media profiles, making it convenient for quick access.

- Online Directories: Reputable online directories like Yellow Pages or Yelp often list contact information for businesses, including insurance companies. Use their search feature to find State Auto Insurance and access their phone number.

Verifying the Authenticity of the Phone Number

Once you’ve found a phone number, it’s crucial to verify its authenticity to avoid falling victim to scams or fraudulent activities. Here’s how:

- Cross-Reference with Official Sources: Compare the phone number you found with the one listed on State Auto Insurance’s official website or social media pages. If they match, it’s likely legitimate.

- Check for Reviews and Complaints: Online review sites like Trustpilot or Google Reviews can provide insights into the authenticity of a phone number. Look for user feedback and complaints regarding potential scams associated with specific phone numbers.

- Contact State Auto Insurance Directly: If you’re unsure about a phone number, contact State Auto Insurance through their website or social media channels to confirm its authenticity.

Tips for Quickly Locating the Phone Number

Here are some tips to help you find the State Auto Insurance phone number quickly:

- Bookmark the Website: Save the State Auto Insurance website as a bookmark in your browser for easy access to their contact information.

- Use Search Engines: Use a search engine like Google to search for “State Auto Insurance phone number.” This will often lead you to their website or relevant directory listings.

- Check Your Policy Documents: Your State Auto Insurance policy documents may contain their phone number, especially on the first page or in the contact information section.

Understanding State Auto Insurance Services: A State Auto Insurance Phone Number

State Auto Insurance is a reputable provider of various insurance products designed to protect individuals and families from unexpected financial burdens. They offer a comprehensive range of services to cater to different needs and situations.

State Auto Insurance Services Overview

State Auto Insurance offers a diverse range of insurance products, including:

- Auto Insurance: This provides coverage for damages to your vehicle and liabilities arising from accidents involving your car.

- Homeowners Insurance: This protects your home and belongings against risks such as fire, theft, and natural disasters.

- Renters Insurance: This safeguards your personal belongings and provides liability coverage while renting a property.

- Life Insurance: This provides financial protection for your loved ones in the event of your untimely death.

State Auto Insurance Products Comparison

The following table provides a detailed comparison of the different insurance products offered by State Auto:

| Insurance Type | Coverage Details | Benefits | Potential Costs |

|---|---|---|---|

| Auto Insurance | Liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage | Financial protection in case of accidents, peace of mind while driving | Varies based on factors such as driving record, vehicle type, and coverage levels |

| Homeowners Insurance | Dwelling coverage, personal property coverage, liability coverage, additional living expenses coverage | Protection against damage or loss to your home and belongings, financial assistance in case of disasters | Varies based on factors such as home value, location, and coverage levels |

| Renters Insurance | Personal property coverage, liability coverage, additional living expenses coverage | Protection for your belongings while renting, financial assistance in case of theft or damage | Typically more affordable than homeowners insurance, varies based on coverage levels and value of belongings |

| Life Insurance | Term life insurance, whole life insurance, universal life insurance | Financial security for your loved ones in the event of your death, peace of mind knowing your family is protected | Varies based on factors such as age, health, coverage amount, and policy type |

Target Audience for State Auto Insurance Products, A state auto insurance phone number

Each insurance product offered by State Auto caters to a specific target audience with unique needs and expectations:

- Auto Insurance: This is essential for anyone who owns or operates a vehicle, including individuals, families, and businesses.

- Homeowners Insurance: This is crucial for homeowners who want to protect their investment and ensure financial security in case of unforeseen events.

- Renters Insurance: This is ideal for renters who want to safeguard their personal belongings and have liability coverage while living in a rented property.

- Life Insurance: This is suitable for individuals who want to provide financial support for their dependents in the event of their death, such as families, spouses, and children.

Contacting State Auto Insurance Customer Service

Reaching out to State Auto Insurance customer service is straightforward, with various options available to suit your needs and preferences. Whether you prefer a phone call, email, online chat, or social media, State Auto Insurance provides convenient channels to address your inquiries and concerns.

Phone

State Auto Insurance offers a dedicated phone number for customer service, allowing you to speak directly with a representative. This option is particularly useful for urgent matters or complex inquiries requiring immediate attention.

To contact State Auto Insurance by phone, dial the number provided on their website or your insurance policy.

For non-urgent inquiries or detailed information requests, you can reach State Auto Insurance via email. This method allows you to provide comprehensive details about your issue and receive a written response at your convenience.

To send an email to State Auto Insurance, visit their website and locate the “Contact Us” section. You will find a dedicated email address for customer service inquiries.

Online Chat

State Auto Insurance offers a live chat feature on their website, providing an instant communication channel for quick questions or assistance. This option is particularly helpful for simple inquiries or when you require immediate feedback.

To access the live chat feature on the State Auto Insurance website, navigate to the “Contact Us” section and look for the chat icon or button.

Social Media

State Auto Insurance maintains active social media profiles on platforms such as Facebook, Twitter, and LinkedIn. These platforms serve as additional channels for communication and customer service, allowing you to ask questions, share feedback, or report issues.

To connect with State Auto Insurance on social media, search for their official profiles on the respective platforms. You can then send direct messages or post comments on their public pages.

Preparing for a Phone Call

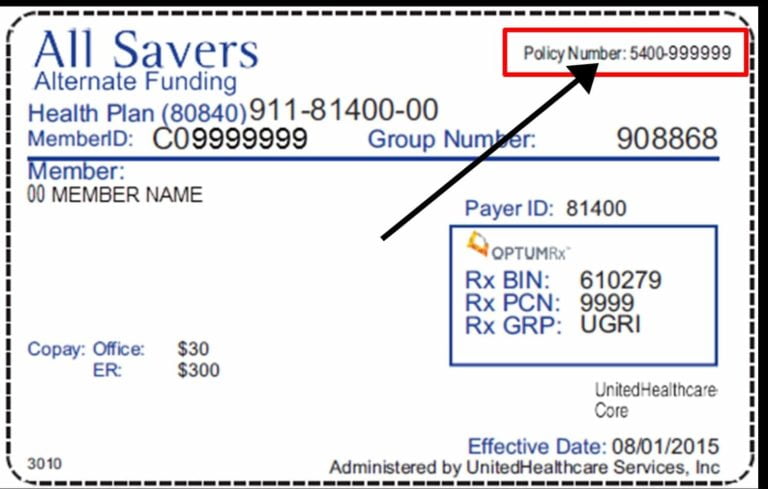

When contacting State Auto Insurance by phone, it is helpful to have your policy information readily available, including your policy number, name, and contact details. This allows the representative to quickly identify your account and address your inquiry efficiently.

State Auto Insurance Phone Number Usage Scenarios

Knowing when and how to use the State Auto Insurance phone number is crucial for policyholders. There are various scenarios where you might need to contact them, each requiring a specific phone number or department. Understanding these scenarios and their corresponding phone numbers ensures you connect with the right team for your needs.

Scenarios for Using State Auto Insurance Phone Numbers

State Auto Insurance offers multiple phone numbers for different purposes. Knowing the right number to call for your specific need can save you time and frustration. Here are some common scenarios where you might need to contact State Auto Insurance:

| Scenario | Phone Number |

|---|---|

| Reporting a Claim | 1-800-334-3333 |

| Making a Payment | 1-800-428-2886 |

| Requesting Policy Information | 1-800-334-3333 |

| Inquiring about Coverage Options | 1-800-334-3333 |

| Changing Your Address | 1-800-334-3333 |

| Canceling Your Policy | 1-800-334-3333 |

Remember that these are just some common scenarios. You may need to contact State Auto Insurance for other reasons. In such cases, it’s best to check their website or contact their customer service for guidance.

State Auto Insurance Customer Experience

State Auto Insurance’s phone service is a critical touchpoint for policyholders seeking information, assistance, or resolving issues. Understanding the customer experience through testimonials, reviews, and analysis can shed light on the strengths, weaknesses, and potential areas for improvement.

Customer Testimonials and Reviews

Customer testimonials and reviews provide valuable insights into the real-world experience with State Auto Insurance’s phone service. Many customers praise the phone representatives for their helpfulness, professionalism, and efficiency in resolving issues. However, some reviews highlight concerns regarding long wait times, difficulties in reaching the right department, and inconsistent service quality.

- Positive Feedback: “I recently called State Auto to make a change to my policy. The representative was very helpful and answered all my questions clearly. I was able to make the change quickly and easily.”

- Negative Feedback: “I waited on hold for over 30 minutes before finally speaking to a representative. The representative was not very helpful and did not seem to understand my issue. I ended up having to call back again the next day.”

Strengths and Weaknesses of State Auto Insurance’s Phone Service

Analyzing customer feedback reveals both strengths and weaknesses in State Auto Insurance’s phone service.

- Strengths:

- Helpful and knowledgeable representatives

- Efficient processing of policy changes and claims

- Availability of 24/7 customer support

- Weaknesses:

- Long wait times

- Difficulties reaching the correct department

- Inconsistent service quality across representatives

Recommendations for Improvement

Based on customer feedback and identified weaknesses, State Auto Insurance can implement several improvements to enhance the phone service experience.

- Reduce Wait Times: Implement strategies to reduce wait times, such as hiring additional representatives, optimizing call routing systems, and offering self-service options for common inquiries.

- Improve Call Routing: Develop a more intuitive call routing system that directs customers to the appropriate department more efficiently, reducing the need for transfers and unnecessary wait times.

- Enhance Training and Consistency: Provide comprehensive training to representatives to ensure consistent service quality and knowledge of policies and procedures.

- Offer Online Resources: Provide comprehensive online resources and FAQs to address common inquiries, reducing the need for phone calls.

- Gather Feedback: Regularly collect customer feedback through surveys and post-call evaluations to identify areas for improvement and track progress over time.

Closing Summary

By understanding the various ways to find the State Auto Insurance phone number and the different scenarios where you might need to use it, you can ensure a smooth and efficient experience when interacting with their customer service team. Remember to verify the phone number’s authenticity to avoid scams or fraudulent activities.

Expert Answers

What if I need to make a claim?

For claims, you can find the appropriate phone number on your policy documents or by visiting the State Auto Insurance website.

Is there a specific number for policy changes?

Yes, State Auto Insurance typically has a dedicated phone number for policy changes. You can find this number on their website or by contacting their general customer service line.

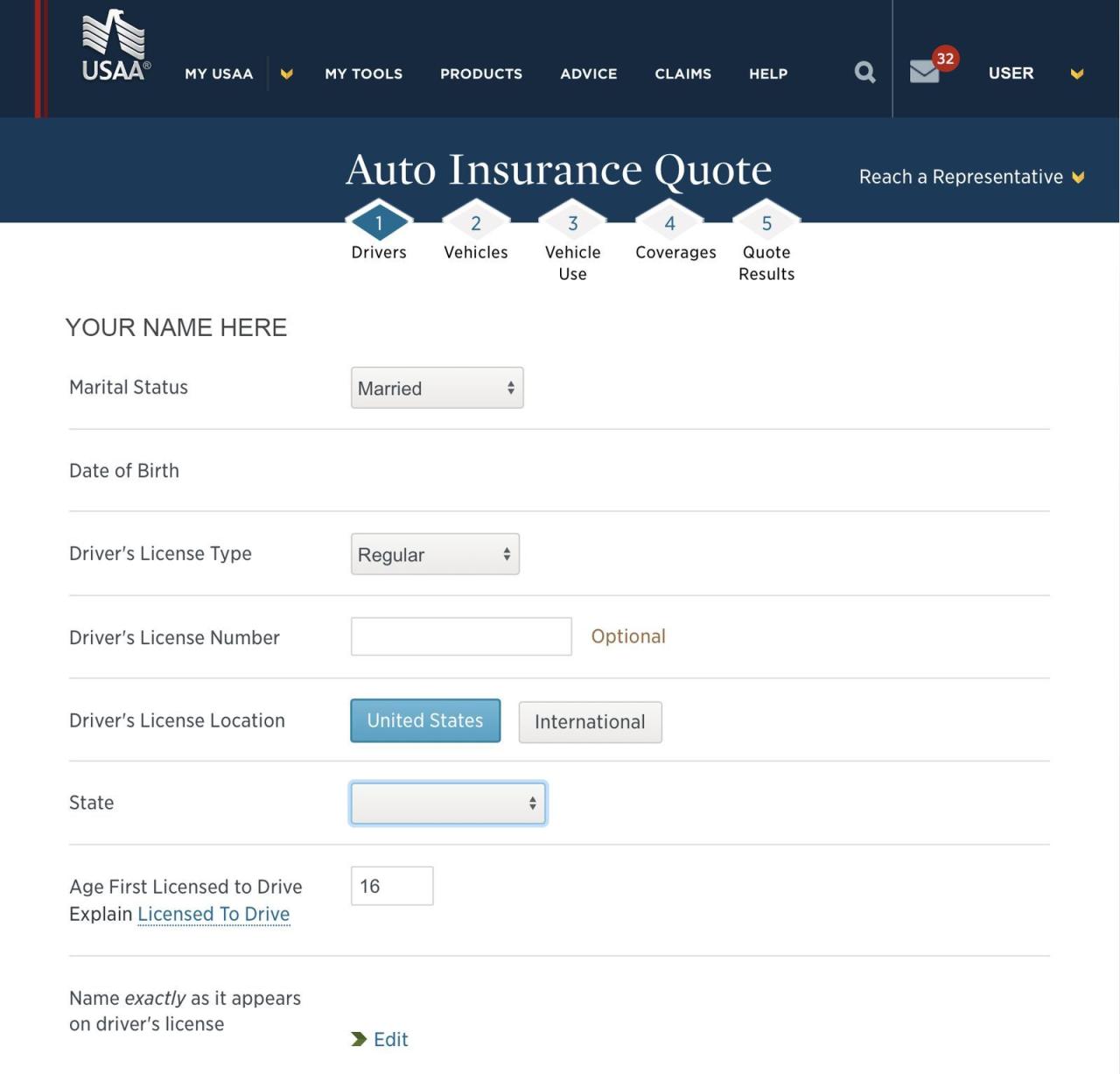

How can I get a quote for insurance?

To obtain a quote, you can visit the State Auto Insurance website or contact their customer service line directly.