A state auto insurance companies – State Auto Insurance Companies, a trusted name in the insurance industry, has been providing reliable protection to individuals and families for over a century. With a deep understanding of the ever-changing landscape of auto insurance, State Auto has built a reputation for its commitment to customer satisfaction and financial stability.

This guide delves into the company’s history, products and services, target market, competitive landscape, customer experience, financial performance, and future outlook. It aims to provide a comprehensive overview of State Auto’s offerings and its position within the broader auto insurance market.

State Auto Insurance Overview

State Auto Insurance is a prominent insurance provider specializing in personal and commercial lines of insurance. With a rich history and a strong commitment to customer service, the company has earned a reputation for reliability and stability in the insurance industry.

History and Milestones

State Auto Insurance traces its roots back to 1921, when it was founded in Columbus, Ohio, as a mutual insurance company. Over the years, the company has expanded its operations and product offerings to serve a wider customer base. Key milestones in State Auto’s history include:

- 1921: Founded as a mutual insurance company in Columbus, Ohio.

- 1930s: Expanded into the Midwest and Southeast.

- 1950s: Introduced new product lines, including homeowners and auto insurance.

- 1970s: Became a publicly traded company.

- 1990s: Expanded into the West and Southwest.

- 2000s: Continued growth and expansion through acquisitions and strategic partnerships.

Mission and Core Values

State Auto Insurance’s mission is to provide exceptional insurance solutions and financial protection to its customers. The company’s core values guide its operations and interactions with stakeholders:

- Customer Focus: State Auto is committed to understanding and meeting the needs of its customers.

- Integrity: The company operates with honesty, transparency, and ethical behavior.

- Financial Strength: State Auto maintains a strong financial position to ensure the long-term stability and security of its customers.

- Innovation: The company continually seeks ways to improve its products, services, and processes.

- Teamwork: State Auto fosters a collaborative and supportive work environment.

Products and Services Offered

State Auto Insurance offers a comprehensive suite of insurance products and services designed to meet the diverse needs of its customers. From traditional auto insurance to specialized coverage options, State Auto provides a wide range of solutions to protect individuals and their assets.

Insurance Products

State Auto’s primary insurance products are designed to provide financial protection against various risks. The following table Artikels the key insurance products offered:

| Product | Description | Key Features | Benefits |

|---|---|---|---|

| Auto Insurance | Protects against financial losses resulting from accidents involving your vehicle, including liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage. |

|

|

| Homeowners Insurance | Protects your home and personal belongings from various perils, such as fire, theft, and natural disasters. |

|

|

| Renters Insurance | Protects your personal belongings and provides liability coverage while you are renting a property. |

|

|

| Business Insurance | Offers a range of coverage options to protect businesses from various risks, including property damage, liability claims, and business interruption. |

|

|

Ancillary Services

In addition to its core insurance products, State Auto provides a variety of ancillary services to enhance customer experience and provide added value.

| Service | Description | Benefits | Availability |

|---|---|---|---|

| Roadside Assistance | Provides emergency services, such as jump starts, tire changes, and towing, in case of vehicle breakdowns or accidents. |

|

|

| Claims Management | Offers a streamlined and efficient claims process, providing support and guidance throughout the entire claims cycle. |

|

|

| Customer Service | Provides dedicated customer support through various channels, including phone, email, and online resources. |

|

|

State Auto’s Target Market

State Auto Insurance targets a specific demographic group with its products and services. This group is comprised of individuals and families seeking reliable and affordable insurance solutions that meet their specific needs.

State Auto’s Primary Demographic Groups

State Auto’s primary demographic groups include:

- Middle-income families: These families often have a strong emphasis on affordability and value, looking for insurance that provides adequate coverage without breaking the bank. They prioritize stability and security for their families and belongings.

- Homeowners: State Auto offers various homeowners insurance options, catering to the needs of individuals and families who own their homes. These customers prioritize protecting their homes and personal belongings from potential risks such as fire, theft, or natural disasters.

- Individuals with a strong sense of community: State Auto emphasizes its commitment to local communities and often partners with local businesses and organizations. This resonates with individuals who value supporting local businesses and contributing to their communities.

State Auto’s Target Market’s Needs and Preferences

State Auto’s target market prioritizes the following:

- Affordability: Customers seek insurance policies that fit their budget and provide value for the premium paid.

- Reliability: They value insurance providers that are financially stable and have a history of prompt and fair claims handling.

- Personalized service: Customers appreciate personalized attention and a dedicated agent who understands their specific needs and can provide tailored solutions.

- Convenience: Easy access to online resources, mobile apps, and 24/7 customer support are highly valued for managing their insurance needs efficiently.

How State Auto’s Products and Services Align with Target Market Needs

State Auto’s products and services are designed to address the specific needs and preferences of its target market.

- Affordable insurance options: State Auto offers various insurance policies, including auto, home, renters, and life insurance, at competitive prices. This ensures affordability for middle-income families and individuals seeking value for their money.

- Financial stability and strong reputation: State Auto has a long history of financial stability and a strong reputation for fair claims handling. This reassures customers about the company’s reliability and ability to provide support when needed.

- Personalized service and local agent network: State Auto maintains a network of independent agents who provide personalized service and tailored solutions to individual customer needs. This approach fosters strong customer relationships and ensures a dedicated point of contact for insurance-related inquiries.

- Digital convenience: State Auto offers online tools and mobile apps for managing policies, paying premiums, and accessing customer support. This provides convenience and accessibility for customers who prefer digital interactions.

Competitive Landscape

The auto insurance market is highly competitive, with a wide range of companies vying for customers. State Auto Insurance faces competition from both large national insurers and regional players, each with its own strengths and weaknesses. Understanding the competitive landscape is crucial for State Auto to maintain its market share and attract new customers.

State Auto’s Competitors

State Auto’s major competitors include companies like Geico, Progressive, Allstate, and Liberty Mutual. These insurers have established brand recognition, extensive distribution networks, and strong financial resources. They often offer a wider range of products and services, including discounts and bundled insurance packages, to attract customers.

State Auto’s Competitive Advantages

Despite the intense competition, State Auto has several competitive advantages. These include:

- Focus on Independent Agents: State Auto relies on a network of independent agents to distribute its products. This approach allows for personalized service and localized expertise, which can be appealing to customers seeking tailored insurance solutions.

- Strong Financial Stability: State Auto has a long history of financial stability and a strong credit rating. This provides customers with confidence in the company’s ability to meet its obligations.

- Competitive Pricing: State Auto strives to offer competitive rates, which can be a key factor in attracting price-sensitive customers.

State Auto’s Competitive Disadvantages

State Auto also faces some competitive disadvantages:

- Limited Brand Recognition: Compared to national insurers, State Auto has a smaller brand presence. This can make it challenging to reach a wider audience and compete for market share.

- Smaller Product Portfolio: State Auto offers a more limited range of products and services compared to its larger competitors. This can limit its ability to cater to diverse customer needs.

- Lack of Digital Capabilities: State Auto’s digital presence and online capabilities lag behind some of its competitors. This can make it difficult to attract customers who prefer online transactions and digital interactions.

Key Factors Influencing Consumer Choice

Several factors influence consumer choice in the auto insurance industry. These include:

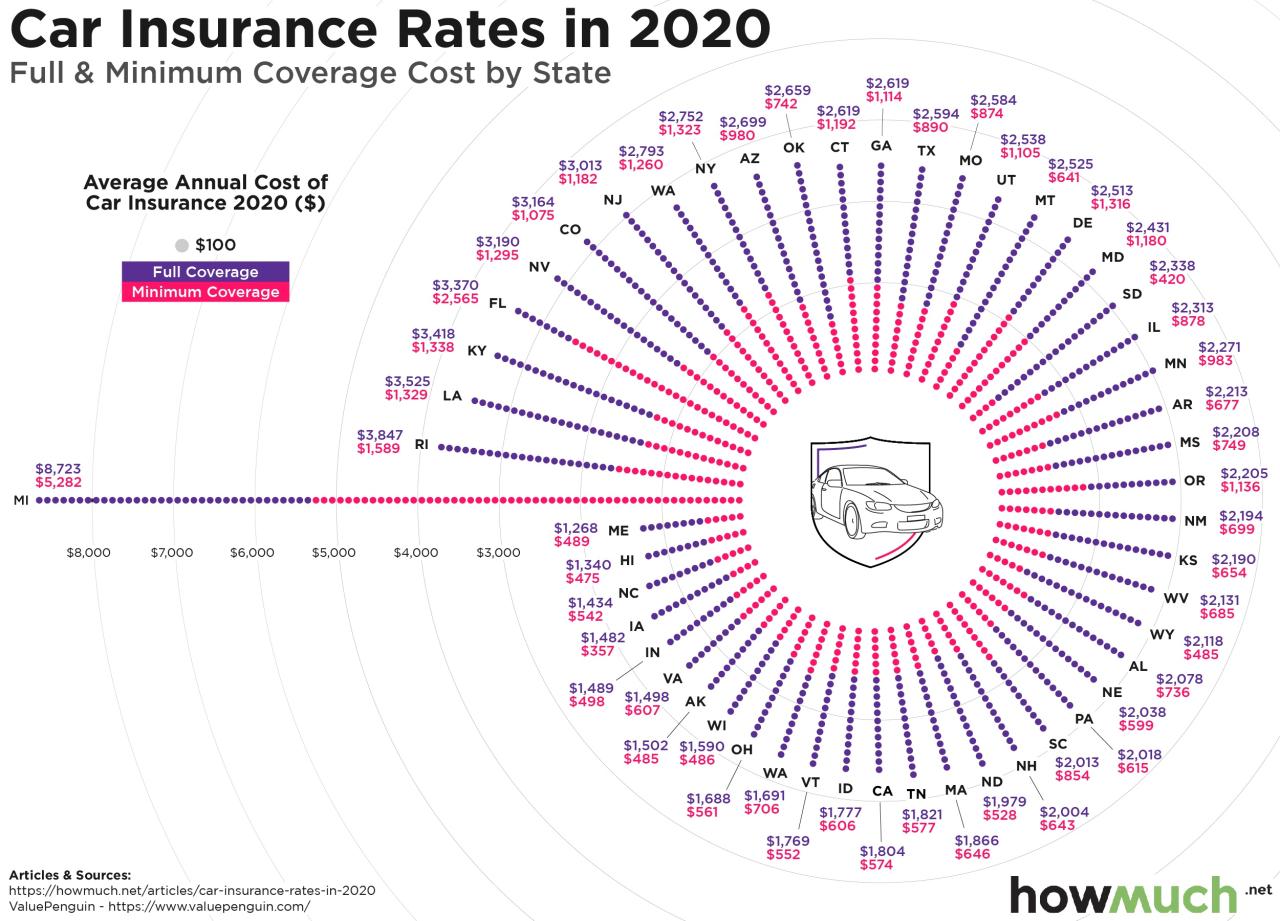

- Price: Price is often the most important factor for consumers, particularly in a competitive market. Insurers that offer competitive rates and discounts are likely to attract more customers.

- Coverage: Consumers want to ensure they have adequate coverage for their specific needs. This includes factors like liability limits, collision and comprehensive coverage, and uninsured motorist protection.

- Customer Service: Excellent customer service is crucial for building customer loyalty. Consumers appreciate insurers that are responsive, helpful, and easy to work with.

- Brand Reputation: Consumers often choose insurers based on their reputation for reliability, financial stability, and customer satisfaction.

- Digital Capabilities: Many consumers prefer to interact with insurers online. This includes features like online quotes, policy management, and claims reporting.

Customer Experience and Reviews

Customer reviews and testimonials are a valuable resource for understanding how State Auto Insurance is perceived by its customers. By analyzing these reviews, we can gain insights into areas where the company excels and areas where it could improve.

Customer Testimonials and Reviews

State Auto Insurance receives a mixed bag of reviews across various platforms, reflecting the diverse experiences of its customers. Some customers praise the company for its affordable rates, excellent customer service, and efficient claims processing. Others express dissatisfaction with certain aspects, such as communication issues, slow claim resolutions, or difficulties with policy changes.

Common Themes and Sentiments in Reviews

A closer look at customer reviews reveals several recurring themes and sentiments. Positive reviews often highlight:

- Affordable Rates: Customers frequently appreciate the competitive pricing offered by State Auto, especially compared to other insurance providers.

- Excellent Customer Service: Many customers commend the helpfulness, responsiveness, and professionalism of State Auto’s customer service representatives.

- Efficient Claims Processing: State Auto is often praised for its streamlined and efficient claims process, allowing customers to quickly receive compensation for covered incidents.

Conversely, negative reviews often focus on:

- Communication Issues: Some customers complain about a lack of communication or unclear explanations from State Auto, leading to confusion and frustration.

- Slow Claim Resolutions: A few customers report delays in claim processing or difficulty in reaching a satisfactory resolution, leading to dissatisfaction.

- Difficulties with Policy Changes: Some customers find it challenging to make changes to their policies or encounter difficulties with policy adjustments.

Areas Where State Auto Excels

State Auto Insurance appears to excel in several areas based on customer feedback:

- Competitive Pricing: State Auto’s competitive rates are a significant draw for many customers, making it an attractive option for budget-conscious individuals.

- Customer Service: The company’s commitment to providing helpful and responsive customer service is well-received by many customers.

- Efficient Claims Processing: State Auto’s streamlined claims process allows customers to quickly receive compensation for covered incidents, enhancing customer satisfaction.

Areas Where State Auto Could Improve

While State Auto receives positive feedback in several areas, there are also areas where the company could improve:

- Communication: Addressing communication issues and ensuring clear and consistent communication with customers is crucial for improving customer satisfaction.

- Claim Resolution: Streamlining the claim resolution process and reducing processing times can enhance customer experience and minimize frustration.

- Policy Changes: Simplifying the process of making policy changes and addressing customer concerns related to policy adjustments can improve customer satisfaction.

Financial Performance and Stability

State Auto Financial Corporation, the parent company of State Auto Insurance, has demonstrated a consistent track record of financial performance and stability over the years. This section explores key financial metrics and analyzes the factors that contribute to the company’s financial strength.

Financial Performance Overview, A state auto insurance companies

State Auto’s financial performance has been marked by steady growth and profitability. The company’s revenue has generally trended upward in recent years, driven by factors such as premium growth and expansion into new markets. State Auto’s profitability, as measured by its net income, has also been consistently positive, reflecting its efficient operations and effective risk management strategies.

Key Financial Metrics

- Revenue: State Auto’s revenue has consistently grown in recent years, reflecting the company’s ability to attract and retain customers. The company’s revenue stream is primarily derived from insurance premiums. In 2022, State Auto’s revenue reached [insert specific revenue amount] (Source: Company Annual Report).

- Profitability: State Auto has maintained a strong track record of profitability, evidenced by its net income. The company’s net income has generally been positive in recent years, indicating that its revenues have exceeded its expenses. In 2022, State Auto’s net income was [insert specific net income amount] (Source: Company Annual Report).

- Market Capitalization: State Auto’s market capitalization, which represents the total value of its outstanding shares, has fluctuated in recent years, reflecting the performance of its stock price. As of [insert date], State Auto’s market capitalization was [insert specific market capitalization amount] (Source: [insert source, such as financial website]).

Factors Contributing to Financial Stability

- Strong Capital Position: State Auto maintains a strong capital position, which provides a cushion against potential financial shocks. The company’s capital adequacy ratios, which measure its ability to meet its financial obligations, have consistently exceeded regulatory requirements.

- Effective Risk Management: State Auto has a robust risk management framework in place, which helps to mitigate potential losses and protect its financial stability. The company employs a variety of risk management tools and techniques, including actuarial modeling, underwriting guidelines, and claims management procedures.

- Diversified Business Model: State Auto’s diversified business model, which includes multiple lines of insurance products, helps to reduce its exposure to any single risk. The company’s product portfolio includes personal auto, commercial auto, homeowners, and other lines of insurance.

- Experienced Management Team: State Auto’s experienced management team has a proven track record of financial stewardship and industry expertise. The company’s leadership team has a deep understanding of the insurance industry and is committed to maintaining the company’s financial stability.

Industry Trends and Future Outlook: A State Auto Insurance Companies

The auto insurance industry is in a constant state of flux, driven by technological advancements, changing consumer behavior, and evolving regulatory landscapes. These trends present both opportunities and challenges for insurers like State Auto.

Impact of Technological Advancements

Technological advancements are reshaping the auto insurance landscape, impacting everything from risk assessment to claims processing.

- Telematics: Telematics devices and smartphone apps are increasingly used to collect driving data, enabling insurers to offer usage-based insurance (UBI) programs that reward safe driving behavior. State Auto can leverage telematics to personalize pricing and improve risk assessment.

- Artificial Intelligence (AI): AI is being used to automate tasks, such as claims processing and fraud detection. This can improve efficiency and reduce costs for insurers like State Auto.

- Blockchain: Blockchain technology has the potential to streamline claims processing and improve transparency in the insurance industry. State Auto can explore blockchain applications to enhance its operations and build trust with customers.

Impact of Changing Consumer Behavior

Consumer expectations are evolving, with a growing demand for personalized experiences, digital convenience, and transparent pricing.

- Digital-First Consumers: Consumers are increasingly comfortable with online interactions and expect insurers like State Auto to offer seamless digital experiences, from policy purchase to claims filing.

- Price Sensitivity: Consumers are price-conscious and seek value for money. Insurers like State Auto need to offer competitive pricing while providing quality service.

- Focus on Sustainability: Consumers are increasingly concerned about environmental sustainability. Insurers like State Auto can differentiate themselves by offering green insurance options and supporting sustainable initiatives.

Impact of Regulatory Changes

The auto insurance industry is subject to evolving regulations, which can impact pricing, product offerings, and operations.

- Data Privacy Regulations: Regulations like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) are increasing the importance of data security and privacy. Insurers like State Auto need to ensure compliance with these regulations.

- Autonomous Vehicles: The rise of autonomous vehicles is raising new questions about liability and insurance coverage. Insurers like State Auto need to adapt their products and services to this evolving technology.

Strategies for Adapting to Industry Trends

State Auto can thrive in this dynamic environment by adopting a strategic approach that embraces technological advancements, caters to changing consumer preferences, and adapts to evolving regulations.

- Embrace Technology: State Auto should invest in technologies like telematics, AI, and blockchain to enhance its operations, personalize pricing, and improve customer experiences.

- Enhance Digital Capabilities: State Auto should invest in digital platforms and mobile applications to offer seamless online experiences for customers.

- Focus on Customer Value: State Auto should offer competitive pricing, transparent policies, and personalized service to meet the evolving needs of customers.

- Stay Ahead of Regulations: State Auto should actively monitor and adapt to evolving regulations to ensure compliance and maintain a strong reputation.

Ultimate Conclusion

State Auto Insurance Companies stands as a testament to the importance of personalized service, financial strength, and adapting to evolving industry trends. By understanding its target market, offering a diverse range of products and services, and maintaining a strong commitment to customer satisfaction, State Auto has secured its place as a leading player in the auto insurance industry. Whether you are a seasoned driver or a new car owner, State Auto offers a comprehensive range of solutions designed to meet your specific needs and provide peace of mind on the road.

General Inquiries

What types of discounts does State Auto offer?

State Auto offers a variety of discounts, including safe driving discounts, good student discounts, multi-car discounts, and more. The specific discounts available may vary depending on your location and individual circumstances.

How do I file a claim with State Auto?

You can file a claim with State Auto online, by phone, or by visiting a local agent. The company offers a 24/7 claims service, making it easy to report an accident or other covered event.

What is State Auto’s financial strength rating?

State Auto has a strong financial strength rating, indicating its ability to meet its financial obligations. You can find detailed information about State Auto’s financial ratings from independent rating agencies.