A State Auto Insurance stands as a prominent player in the insurance industry, offering a comprehensive range of coverage options and services tailored to meet the diverse needs of its customers. With a rich history and a commitment to customer satisfaction, State Auto Insurance has earned a solid reputation for its financial stability and reliable claims handling processes.

This guide delves into the intricacies of State Auto Insurance, exploring its origins, coverage options, customer experience, financial performance, and competitive landscape. We aim to provide you with a clear understanding of the company’s offerings and its position within the market, empowering you to make informed decisions about your insurance needs.

Understanding State Auto Insurance

State Auto Insurance is a well-established insurance company with a rich history and a strong presence in the insurance market. Founded in 1921, the company has evolved significantly over the years, adapting to changing market conditions and customer needs.

History and Evolution

State Auto Insurance was established in 1921 in Columbus, Ohio. Initially, the company focused on providing automobile insurance to residents of Ohio. Over time, it expanded its geographic reach and product offerings, entering new markets and introducing additional insurance products, such as homeowners, commercial, and life insurance. This expansion was driven by a commitment to meeting the evolving needs of its customers and staying competitive in the insurance industry.

Core Services and Product Offerings

State Auto Insurance offers a comprehensive range of insurance products designed to meet the diverse needs of its customers.

- Auto Insurance: State Auto offers a variety of auto insurance coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. They also provide additional features like roadside assistance and rental car reimbursement.

- Homeowners Insurance: State Auto provides homeowners insurance that protects against damage to the insured’s home and personal property from various perils, such as fire, theft, and natural disasters. They also offer additional coverage options, such as liability coverage and personal property coverage.

- Commercial Insurance: State Auto offers a range of commercial insurance products to protect businesses from various risks. These products include general liability, property, workers’ compensation, and professional liability insurance.

- Life Insurance: State Auto provides life insurance products designed to protect the financial well-being of beneficiaries upon the death of the insured. These products include term life insurance, whole life insurance, and universal life insurance.

Target Audience and Needs, A state auto insurance

State Auto Insurance primarily targets individuals and families seeking affordable and reliable insurance coverage. Their target audience often includes:

- Individuals and families: State Auto offers a range of personal insurance products, including auto, homeowners, and life insurance, catering to the needs of individuals and families seeking comprehensive protection.

- Small businesses: The company provides a range of commercial insurance products specifically designed to meet the unique needs of small businesses, helping them manage risk and protect their assets.

Coverage Options and Policies

State Auto Insurance offers a comprehensive suite of coverage options designed to protect you and your assets. Understanding the various policy types and their associated costs is crucial in choosing the right coverage for your specific needs.

Policy Options and Costs

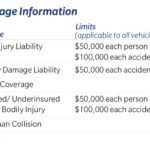

State Auto Insurance offers a range of policy options, each with its own coverage details and pricing factors. Here’s a breakdown of the most common types:

| Policy Type | Coverage Details | Pricing Factors |

|---|---|---|

| Liability Coverage | Protects you financially if you are at fault in an accident, covering damages to other vehicles and injuries to others. | Driving history, age, location, vehicle type, coverage limits. |

| Collision Coverage | Covers damages to your vehicle in an accident, regardless of fault. | Vehicle value, age, driving history, deductible amount. |

| Comprehensive Coverage | Protects your vehicle against damages from non-collision events, such as theft, vandalism, natural disasters, and falling objects. | Vehicle value, age, location, deductible amount. |

| Uninsured/Underinsured Motorist Coverage | Provides financial protection if you are involved in an accident with a driver who is uninsured or underinsured. | State requirements, coverage limits, driving history. |

| Personal Injury Protection (PIP) | Covers medical expenses, lost wages, and other related costs for you and your passengers in the event of an accident, regardless of fault. | State requirements, coverage limits, driving history. |

| Medical Payments Coverage (Med Pay) | Covers medical expenses for you and your passengers in the event of an accident, regardless of fault. | State requirements, coverage limits, driving history. |

| Rental Reimbursement Coverage | Covers the cost of renting a vehicle while yours is being repaired after an accident. | Coverage limits, driving history. |

| Roadside Assistance Coverage | Provides assistance for situations like flat tires, dead batteries, and lockouts. | Coverage limits, driving history. |

Factors Affecting Policy Costs

Several factors influence the cost of your State Auto Insurance policy. These include:

- Driving History: Your driving record, including accidents, tickets, and violations, plays a significant role in determining your premiums. A clean driving record generally translates to lower rates.

- Age and Gender: Younger and inexperienced drivers tend to have higher premiums due to a statistically higher risk of accidents. Gender can also impact rates, although this varies by state.

- Location: The geographic location where you live affects your rates. Areas with higher accident rates or crime rates typically have higher insurance premiums.

- Vehicle Type: The type of vehicle you drive impacts your premiums. High-performance cars or vehicles with a history of theft are often associated with higher risks and therefore higher premiums.

- Coverage Limits: The amount of coverage you choose for each type of insurance affects your premium. Higher coverage limits generally result in higher premiums.

- Deductible Amount: Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lead to lower premiums.

- Credit Score: In some states, insurance companies use credit scores as a factor in determining premiums. A higher credit score generally results in lower rates.

Understanding Policy Details

It is essential to understand the specific details of your policy, including the coverage limits, deductibles, and exclusions. This information helps you make informed decisions about your insurance needs and ensure you have adequate protection.

Customer Experience and Services

State Auto Insurance strives to provide a positive customer experience throughout the policy lifecycle. From initial inquiries to claims resolution, the company aims to deliver efficient and reliable services.

Customer Service Channels and Accessibility

State Auto Insurance offers various customer service channels to cater to diverse customer preferences.

- Phone Support: Customers can reach dedicated customer service representatives via phone, available during standard business hours. This option provides immediate assistance and personalized guidance.

- Online Portal: The company’s online portal provides a convenient platform for managing policies, making payments, and accessing account information. This self-service option allows customers to access information 24/7.

- Email Support: For non-urgent inquiries, customers can utilize email support, providing detailed information and receiving prompt responses within a reasonable timeframe.

- Live Chat: For quick and direct assistance, State Auto Insurance offers a live chat feature on its website, allowing customers to connect with a representative in real-time.

State Auto Insurance ensures accessibility through its diverse communication channels, making it convenient for customers to interact with the company.

Claims Process and Efficiency

State Auto Insurance aims to simplify the claims process and expedite claim settlements.

- Online Claims Filing: Customers can file claims conveniently through the company’s online portal, providing detailed information and uploading supporting documents. This streamlines the process and reduces the need for physical paperwork.

- Dedicated Claims Adjusters: Once a claim is filed, a dedicated claims adjuster is assigned to handle the process, ensuring personalized attention and timely communication.

- 24/7 Claims Reporting: For emergencies, State Auto Insurance provides 24/7 claims reporting through its phone line, ensuring immediate assistance and prompt action.

- Transparent Communication: Throughout the claims process, customers receive regular updates and clear communication from their assigned claims adjuster, keeping them informed about the progress and next steps.

State Auto Insurance prioritizes efficiency and transparency in its claims process, striving to minimize delays and provide a smooth experience for customers.

Unique Customer Benefits and Programs

State Auto Insurance offers a range of unique benefits and programs designed to enhance customer satisfaction.

- Accident Forgiveness: This program allows eligible policyholders to avoid a rate increase after their first at-fault accident, providing peace of mind and financial protection.

- Telematics Programs: State Auto Insurance offers telematics programs that track driving behavior and reward safe driving habits with discounts on premiums. This incentivizes responsible driving and promotes road safety.

- Loyalty Programs: Long-term policyholders may qualify for loyalty programs, offering exclusive benefits and discounts, rewarding customer commitment and building long-lasting relationships.

- Community Involvement: State Auto Insurance actively participates in community initiatives and supports local organizations, demonstrating its commitment to giving back and fostering a positive relationship with its customers.

These programs highlight State Auto Insurance’s commitment to customer satisfaction, offering unique benefits and fostering a sense of community.

Financial Stability and Reputation

State Auto Insurance’s financial performance and reputation are key indicators of its reliability and trustworthiness as an insurer. Understanding the company’s financial stability and its standing within the industry can help potential customers make informed decisions about their insurance needs.

Financial Performance and Stability

State Auto Insurance’s financial performance has been consistently strong over the years. The company has a history of profitability and a solid capital base, which provides a buffer against potential financial shocks.

State Auto Insurance’s financial performance is regularly evaluated by independent rating agencies, such as A.M. Best and Moody’s. These agencies assess the company’s financial strength, operating performance, and overall risk profile. State Auto Insurance has consistently received high ratings from these agencies, indicating its strong financial stability.

For example, A.M. Best has assigned State Auto Insurance a financial strength rating of A+ (Superior), reflecting the company’s strong operating performance, conservative investment strategy, and robust risk management practices.

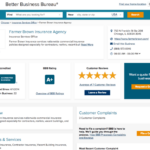

Reputation within the Insurance Industry

State Auto Insurance has a well-established reputation within the insurance industry. The company is known for its commitment to customer service, its focus on innovation, and its strong financial performance. State Auto Insurance has also received numerous awards and recognitions for its excellence in the insurance industry.

Customer Reviews

Customer reviews are a valuable source of information about a company’s reputation. State Auto Insurance generally receives positive customer reviews, with customers praising the company’s friendly and responsive customer service, its competitive pricing, and its efficient claims handling process.

Online review platforms, such as Google Reviews and Yelp, provide a platform for customers to share their experiences with State Auto Insurance. The majority of reviews on these platforms are positive, with customers highlighting the company’s helpful staff, quick response times, and fair claims settlements.

State Auto Insurance in the Market

State Auto Insurance operates in a competitive insurance market, where it faces various rivals offering similar products and services. Understanding how State Auto stacks up against its competitors is crucial for potential customers seeking the best value and coverage.

Comparison with Competitors

To understand State Auto’s position in the market, it’s essential to compare it with its competitors. This comparison considers factors like pricing, coverage options, customer service, and financial stability.

- Pricing: State Auto’s pricing is generally competitive, but it might not be the cheapest option across all categories. Its rates can vary depending on factors like location, vehicle type, and driving history.

- Coverage Options: State Auto offers a standard range of coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. However, it may not offer as many specialized or niche coverage options compared to some of its competitors.

- Customer Service: State Auto’s customer service is generally well-regarded, with positive reviews for its responsiveness and helpfulness. However, customer service experiences can vary depending on individual interactions and location.

- Financial Stability: State Auto is a financially stable company with a strong track record. Its financial strength rating is considered good, indicating its ability to meet its obligations to policyholders.

Key Strengths and Weaknesses

State Auto possesses certain strengths and weaknesses compared to its competitors.

Strengths

- Strong Financial Stability: State Auto’s solid financial foundation instills confidence in customers, as it demonstrates the company’s ability to meet its obligations and provide long-term stability.

- Focus on Customer Service: State Auto prioritizes customer service and aims to provide a positive experience for policyholders. This commitment to customer satisfaction can be a significant advantage in the competitive insurance market.

- Regional Expertise: As a regional insurer, State Auto has deep knowledge of the local markets it serves. This localized expertise allows it to tailor its products and services to meet the specific needs of its customers in different regions.

Weaknesses

- Limited National Presence: State Auto’s regional focus means it has a smaller national presence compared to some of its larger competitors. This limited reach might make it less attractive to customers seeking nationwide coverage.

- Potential for Higher Prices: While State Auto’s pricing is generally competitive, it might not always offer the lowest rates, especially for customers with higher risk profiles or in certain geographic areas.

- Fewer Niche Coverage Options: State Auto’s coverage options are relatively standard, and it may not offer as many specialized or niche coverage options compared to some of its competitors. This could be a drawback for customers with unique insurance needs.

Comparative Table

The following table provides a concise comparison of State Auto Insurance with some of its key competitors across various criteria:

| Criteria | State Auto | Competitor 1 | Competitor 2 | Competitor 3 |

|---|---|---|---|---|

| Pricing | Competitive | Lower | Higher | Competitive |

| Coverage Options | Standard | Wide Range | Limited | Comprehensive |

| Customer Service | Good | Excellent | Average | Below Average |

| Financial Stability | Strong | Excellent | Good | Average |

| National Presence | Regional | National | Regional | National |

Final Wrap-Up

In conclusion, State Auto Insurance presents itself as a viable option for individuals and families seeking reliable and comprehensive insurance coverage. The company’s strong financial standing, customer-centric approach, and competitive offerings make it a compelling choice for those looking for peace of mind and protection. Whether you’re seeking auto insurance, homeowners insurance, or other related services, State Auto Insurance offers a range of solutions to meet your specific needs. By understanding the company’s history, coverage options, customer experience, and financial stability, you can confidently assess whether State Auto Insurance aligns with your insurance goals and priorities.

FAQ Section: A State Auto Insurance

What types of auto insurance policies does State Auto Insurance offer?

State Auto Insurance provides various auto insurance policies, including liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage. They also offer optional coverage options such as rental reimbursement, roadside assistance, and gap insurance.

How can I get a quote for State Auto Insurance?

You can obtain a quote for State Auto Insurance online, over the phone, or through an insurance agent. The quote process typically requires information about your vehicle, driving history, and desired coverage levels.

Does State Auto Insurance offer discounts?

Yes, State Auto Insurance offers various discounts to eligible customers, such as good driver discounts, multi-policy discounts, and safe driver discounts. It’s recommended to inquire about available discounts when requesting a quote.

How do I file a claim with State Auto Insurance?

You can file a claim with State Auto Insurance online, over the phone, or through an insurance agent. The claims process typically involves providing details about the accident, including date, time, location, and involved parties. State Auto Insurance strives to process claims efficiently and fairly.