How much is State Farm car insurance monthly? This is a question many drivers ask, especially those seeking reliable and affordable coverage. State Farm, a leading insurance provider with a rich history, offers a variety of car insurance policies tailored to different needs and budgets. Factors such as your driving history, location, vehicle type, and coverage choices significantly influence your monthly premium.

Understanding how these factors impact your rate is crucial for making informed decisions. This guide will delve into the intricacies of State Farm car insurance pricing, exploring the key factors that determine your monthly premium, and offering tips to potentially save on your costs.

State Farm Car Insurance Overview

State Farm is a leading provider of car insurance in the United States, known for its comprehensive coverage options, competitive rates, and exceptional customer service. With a long history of financial stability and a commitment to its policyholders, State Farm has earned a reputation for reliability and trustworthiness.

Company History, Mission, and Values

Founded in 1922, State Farm has grown from a small insurance agency in Bloomington, Illinois, to one of the largest insurance companies in the world. The company’s mission is to help people manage the risks of everyday life, recover from the unexpected, and realize their dreams. State Farm’s core values are integrity, customer focus, financial strength, and innovation. These values guide the company’s operations and ensure that its customers receive the highest level of service and support.

Key Features and Benefits of State Farm Car Insurance

State Farm offers a wide range of car insurance coverage options to meet the needs of its policyholders. Some of the key features and benefits of State Farm car insurance include:

- Comprehensive Coverage: State Farm provides comprehensive coverage for a wide range of incidents, including accidents, theft, vandalism, and natural disasters. This ensures that policyholders are protected against financial losses from unexpected events.

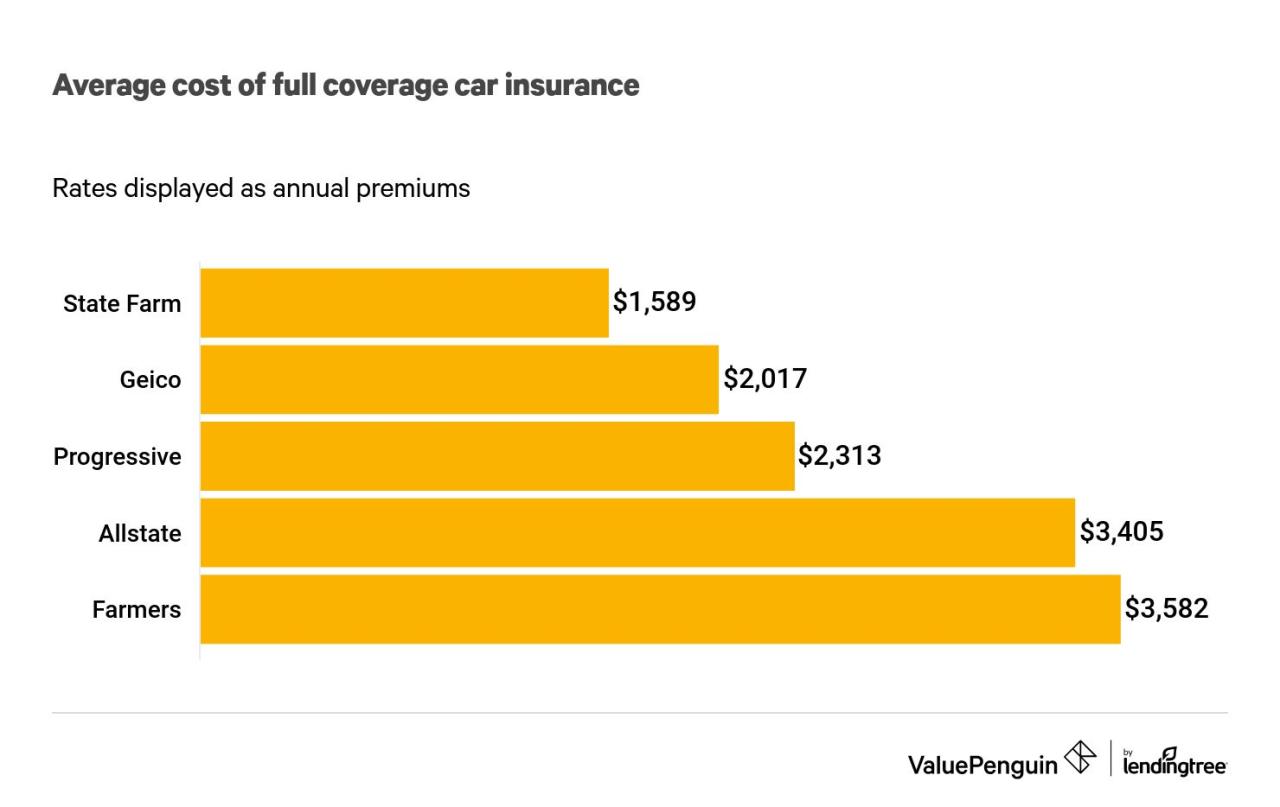

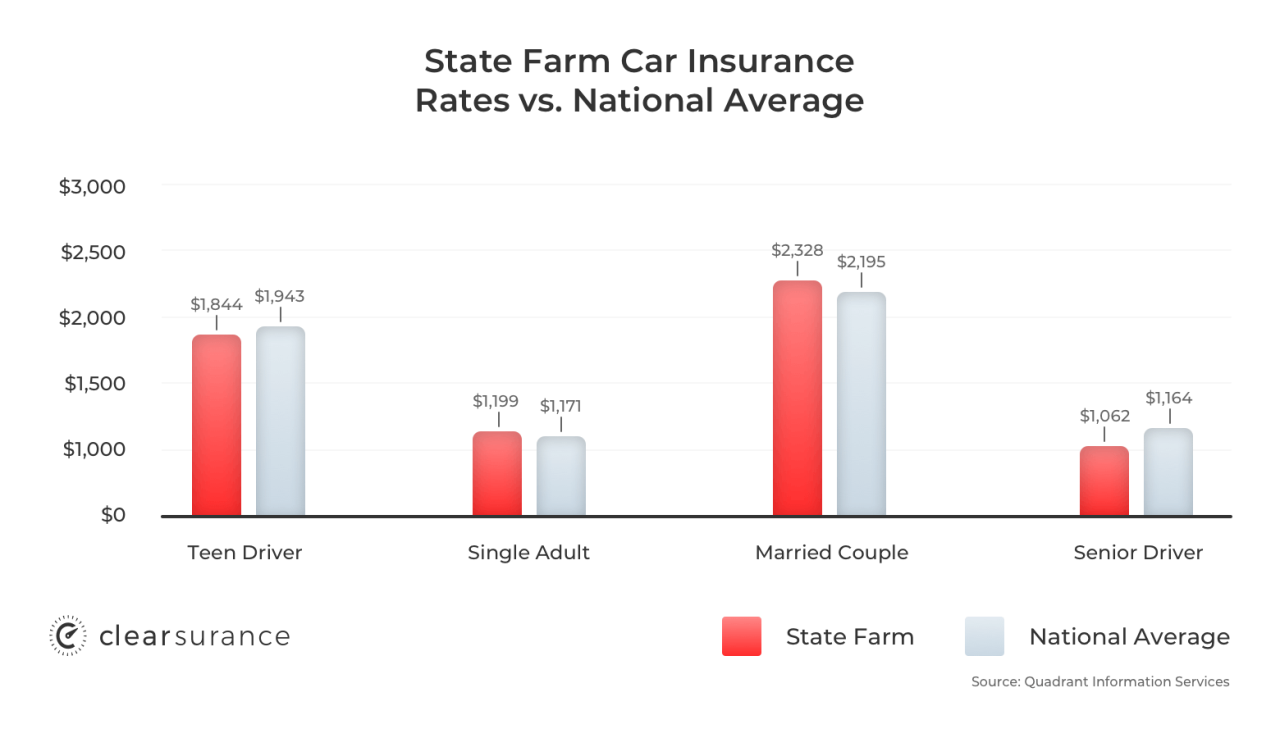

- Competitive Rates: State Farm offers competitive rates for car insurance, making it an attractive option for budget-conscious drivers. The company uses a variety of factors to determine rates, including driving history, vehicle type, and location.

- Excellent Customer Service: State Farm is known for its excellent customer service, with a team of dedicated agents available to answer questions, provide support, and help policyholders file claims. The company also offers a variety of online and mobile tools to make managing insurance policies easier.

- Discounts: State Farm offers a variety of discounts to help policyholders save money on their car insurance premiums. These discounts can be based on factors such as good driving records, safety features, and multiple policy ownership.

Factors Influencing Monthly Premiums

State Farm, like other insurance companies, considers various factors when determining your car insurance rates. These factors help assess your risk and ensure fair pricing for your coverage.

Vehicle Type

The type of vehicle you drive significantly influences your insurance premium. State Farm uses a system to categorize vehicles based on their safety features, repair costs, and theft risk.

- Safety Features: Vehicles with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, are generally considered safer and may result in lower premiums.

- Repair Costs: Vehicles with high repair costs, often luxury or sports cars, tend to have higher insurance premiums due to the expense of replacing or repairing damaged parts.

- Theft Risk: Vehicles with higher theft rates, like certain models of SUVs or trucks, may face higher premiums as insurance companies factor in the risk of having to cover theft losses.

Driving History

Your driving history is a crucial factor in determining your car insurance rates. State Farm reviews your driving record to assess your risk as a driver.

- Accidents: Having a history of accidents, especially those where you were at fault, can significantly increase your premiums. The severity of the accident and the number of claims you’ve filed also play a role.

- Traffic Violations: Receiving traffic violations, such as speeding tickets or reckless driving citations, can lead to higher premiums. These violations indicate a higher risk of future accidents.

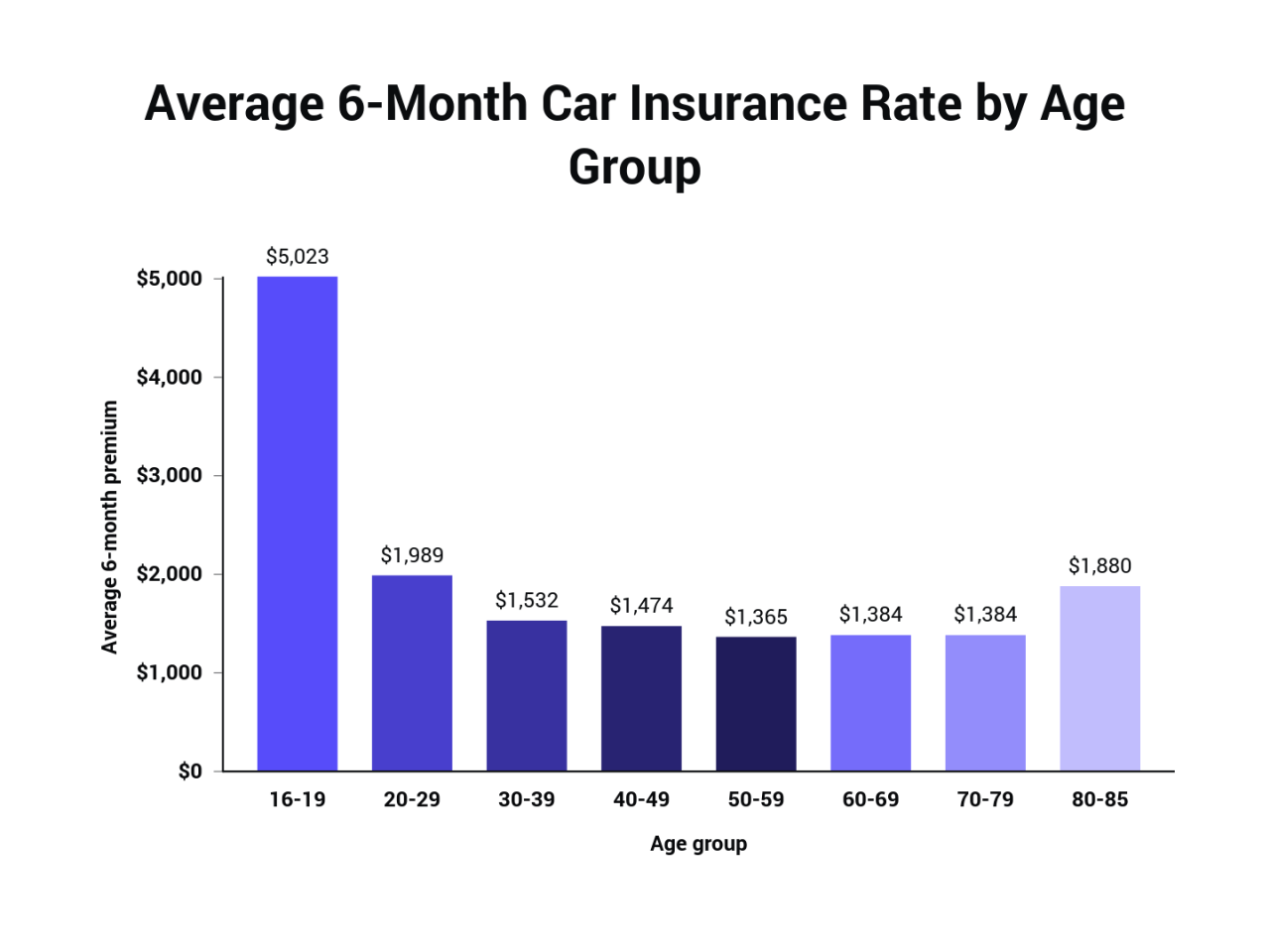

- Driving Experience: Younger drivers with less experience on the road often face higher premiums compared to more experienced drivers. This is due to the higher risk associated with inexperienced drivers.

Location

Your location significantly influences your car insurance rates. State Farm considers factors such as:

- Population Density: Areas with high population density often have more traffic congestion and higher accident rates, leading to potentially higher insurance premiums.

- Crime Rates: Areas with higher crime rates, including theft and vandalism, may face higher insurance premiums due to the increased risk of vehicle damage or theft.

- Weather Conditions: Regions with severe weather conditions, such as hurricanes, tornadoes, or heavy snow, may have higher insurance premiums due to the increased risk of damage to vehicles.

Other Factors

State Farm considers other factors beyond those mentioned above, including:

- Credit Score: Your credit score can be a factor in determining your car insurance rates, although this practice varies by state.

- Coverage Options: The type and amount of coverage you choose, such as comprehensive or collision coverage, will influence your premium.

- Deductible: A higher deductible, the amount you pay out-of-pocket before insurance kicks in, generally leads to lower premiums.

Estimating Monthly Premiums

Getting an accurate estimate of your State Farm car insurance costs is crucial before you commit to a policy. Understanding the factors that influence your premiums allows you to make informed decisions and potentially save money.

Methods for Estimating Premiums

There are several ways to estimate your monthly State Farm car insurance costs:

- Online Quote Tools: Most insurance companies, including State Farm, offer online quote tools. These tools allow you to input your personal information, vehicle details, and coverage preferences to receive a personalized estimate.

- Phone Call: Contacting a State Farm agent directly allows you to discuss your specific needs and receive a personalized quote based on your individual circumstances.

- Insurance Comparison Websites: Websites like Policygenius or Insurance.com allow you to compare quotes from multiple insurance providers, including State Farm, in one place.

Factors Influencing Estimated Premiums

It’s essential to understand the factors that influence your estimated monthly premium. This knowledge empowers you to make informed decisions that can potentially lower your costs.

| Factor | Description | Example | Impact on Premium |

|---|---|---|---|

| Driving History | Your past driving record, including accidents, violations, and driving history. | A clean driving record with no accidents or violations. | Lower premium. |

| Vehicle Type | The make, model, year, and safety features of your vehicle. | A newer, safer car with advanced safety features. | Lower premium. |

| Location | Your address and the overall risk level of your area, such as crime rates and traffic density. | Living in a rural area with low crime rates. | Lower premium. |

| Coverage Options | The level of coverage you choose, such as liability, collision, and comprehensive. | Choosing a higher deductible for collision and comprehensive coverage. | Lower premium. |

For example, a young driver with a clean driving record living in a rural area and driving a newer, safe car might receive a lower premium than an older driver with multiple accidents living in a densely populated urban area and driving an older, less safe vehicle.

Discounts and Savings

State Farm offers a variety of discounts that can significantly reduce your monthly car insurance premiums. These discounts are designed to reward safe driving habits, responsible vehicle ownership, and other positive factors.

Discounts Offered by State Farm

State Farm provides a range of discounts to help you save on your car insurance. These discounts are categorized based on different aspects of your driving habits, vehicle, and personal circumstances.

Driving Experience and Safety

- Safe Driver Discount: This discount is awarded to drivers with a clean driving record, demonstrating responsible driving behavior.

- Defensive Driving Course Discount: Completing an approved defensive driving course can qualify you for a discount, indicating your commitment to safe driving practices.

- Good Student Discount: Students with good grades may qualify for a discount, reflecting their responsible behavior and commitment to education.

Vehicle Features and Safety

- Anti-theft Device Discount: Installing anti-theft devices like alarms or tracking systems on your vehicle can deter theft, making your vehicle less risky to insure.

- New Car Discount: New cars often come equipped with advanced safety features, making them safer to drive and less prone to accidents.

- Airbag Discount: Vehicles equipped with airbags offer additional safety protection, reducing the severity of injuries in accidents.

Policy and Payment Options

- Multiple Policy Discount: Bundling your car insurance with other policies like homeowners or renters insurance can result in a discount, reflecting the loyalty and commitment to State Farm.

- Paperless Billing Discount: Opting for paperless billing can reduce administrative costs for State Farm, which is reflected in a discount for you.

- Automatic Payment Discount: Setting up automatic payments for your premiums can streamline the payment process, leading to a discount for convenience.

Other Factors

- Military Discount: State Farm offers discounts to active military personnel and veterans, recognizing their service and contributions.

- Good Neighbor Discount: Living in a neighborhood with a low crime rate and fewer accidents can result in a discount, reflecting the lower risk associated with your location.

Eligibility Criteria for Discounts, How much is state farm car insurance monthly

Each discount offered by State Farm has specific eligibility criteria that you must meet to qualify. These criteria can vary depending on the type of discount and your individual circumstances.

Reviewing Your Eligibility

To determine your eligibility for specific discounts, you should contact your State Farm agent or visit their website. They can provide detailed information about the requirements and how to apply for each discount.

Estimating Potential Savings

| Discount Type | Description |

|---|---|

| Safe Driver Discount | Up to 20% off your premium |

| Defensive Driving Course Discount | Up to 10% off your premium |

| Good Student Discount | Up to 25% off your premium |

| Anti-theft Device Discount | Up to 15% off your premium |

| New Car Discount | Up to 10% off your premium |

| Airbag Discount | Up to 10% off your premium |

| Multiple Policy Discount | Up to 15% off your premium |

| Paperless Billing Discount | Up to 5% off your premium |

| Automatic Payment Discount | Up to 5% off your premium |

| Military Discount | Up to 10% off your premium |

| Good Neighbor Discount | Up to 10% off your premium |

Note: Discount amounts and eligibility criteria can vary by state and individual circumstances.

Policy Options and Coverage

State Farm offers a variety of car insurance coverage options to meet your individual needs and budget. Understanding these options is crucial to ensure you have the right level of protection.

Coverage Options

State Farm offers various coverage options, each designed to protect you in different scenarios. Here’s a breakdown of the most common types:

| Coverage Type | Description | Benefits |

|---|---|---|

| Liability Coverage | This coverage protects you financially if you cause an accident that injures someone or damages their property. It covers the other driver’s medical expenses, lost wages, and property damage. | It safeguards you from potentially devastating financial losses in case of an accident where you are at fault. |

| Collision Coverage | This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. | It ensures you can get your car fixed or replaced without having to pay out of pocket, even if you are at fault in an accident. |

| Comprehensive Coverage | This coverage pays for repairs or replacement of your vehicle if it’s damaged due to events other than an accident, such as theft, vandalism, or natural disasters. | It protects your vehicle from damage caused by events outside your control, providing peace of mind. |

| Uninsured/Underinsured Motorist Coverage | This coverage protects you if you’re injured in an accident caused by a driver without insurance or with insufficient coverage. | It ensures you have financial protection in case you’re involved in an accident with an uninsured or underinsured driver, covering your medical expenses and lost wages. |

| Personal Injury Protection (PIP) | This coverage pays for your medical expenses, lost wages, and other related expenses, regardless of who is at fault in an accident. | It provides financial protection for your own medical expenses and lost wages, even if you are at fault in an accident. |

| Medical Payments Coverage (Med Pay) | This coverage pays for medical expenses for you and your passengers, regardless of who is at fault in an accident. | It provides immediate financial assistance for medical expenses, regardless of fault, making it a valuable addition to your coverage. |

Optional Coverage

State Farm also offers optional coverage that can provide additional protection:

- Rental Reimbursement: This coverage helps cover the cost of a rental car while your vehicle is being repaired after an accident.

- Roadside Assistance: This coverage provides help with services such as towing, flat tire changes, and jump starts.

- Gap Insurance: This coverage helps pay the difference between the actual cash value of your vehicle and the amount you owe on your loan or lease if your vehicle is totaled.

Customer Experience

State Farm is known for its strong customer service and commitment to providing a positive experience for its policyholders. The company offers a variety of resources and tools to make the insurance process as smooth and efficient as possible.

Customer Service

State Farm’s customer service is available 24/7 through phone, email, and online chat. The company has a reputation for providing friendly and knowledgeable support to its customers. State Farm also offers a variety of self-service options, such as online account management and mobile app access, allowing customers to manage their policies and make payments conveniently.

Claims Process

State Farm’s claims process is designed to be straightforward and efficient. Policyholders can file claims online, through the mobile app, or by phone. The company provides 24/7 claims support and offers a variety of options for handling claims, such as direct repair programs and mobile claims adjusters.

Online Tools

State Farm offers a comprehensive suite of online tools to help customers manage their insurance policies. The company’s website and mobile app provide access to a variety of features, including:

- Policy management: View policy details, make payments, update contact information, and manage coverage.

- Claims reporting: File claims online, track claim status, and communicate with adjusters.

- Digital ID cards: Access digital copies of insurance cards for easy sharing.

- Roadside assistance: Request roadside assistance services, such as towing and jump starts.

- Quote and comparison: Get personalized insurance quotes and compare different coverage options.

Website and Mobile App

State Farm’s website and mobile app are user-friendly and easy to navigate. The website features a clean and intuitive design, with clear menus and easy-to-find information. The mobile app offers a similar experience, providing access to key features and services on the go.

- Website:

- Clean and modern design with a focus on clear navigation and user-friendly interface.

- Intuitive menu structure that allows users to easily find the information they need.

- Comprehensive information on insurance products, services, and resources.

- Secure online account management for policyholders.

- Mobile App:

- User-friendly interface with a focus on mobile accessibility.

- Key features for policy management, claims reporting, and roadside assistance.

- Push notifications for important updates and reminders.

- Geolocation services for finding nearby agents and service providers.

- Good Student Discount: This discount is available to students with high GPAs. It acknowledges the responsibility and good judgment of students with excellent academic performance.

- Safe Driver Discount: This discount is awarded to drivers with a history of safe driving, often measured by years without accidents or violations. It reflects the lower risk associated with drivers with a proven track record of safe driving.

- Multi-Policy Discount: If you bundle your car insurance with other policies like home or renters insurance, you can qualify for a multi-policy discount. This is a common practice among insurance companies to encourage customers to consolidate their insurance needs.

- Anti-theft Device Discount: Installing anti-theft devices like alarms or GPS trackers can make your car less attractive to thieves. This reduces the risk for insurance companies, leading to a potential discount on your premiums.

Comparison with Competitors

Choosing the right car insurance provider can be a complex decision, as many companies offer various coverage options and price points. To help you make an informed choice, this section compares State Farm car insurance rates and coverage options with other major insurance providers.

Comparison of Key Features and Rates

Comparing State Farm’s car insurance offerings with its competitors helps you understand its strengths and weaknesses. The following table highlights key features and comparison points for State Farm and other major insurance providers.

| Provider | Key Features | Comparison Points |

|---|---|---|

| State Farm | Wide coverage options, strong customer service, discounts and savings, mobile app, online services | Generally competitive rates, strong customer satisfaction, known for its strong financial stability |

| Geico | Known for its low rates, online quote process, wide range of coverage options | Often offers the lowest rates, strong online experience, may lack some personalized service |

| Progressive | Offers Name Your Price tool, discounts and savings, customizable coverage options | Competitive rates, innovative features, strong online and mobile experience, may have complex pricing structures |

| Allstate | Strong customer service, various coverage options, mobile app, discounts and savings | Competitive rates, good reputation for claims handling, may have higher rates in some areas |

| USAA | Exclusive to military members and their families, strong financial stability, excellent customer service | Often offers lower rates for eligible members, highly rated for customer satisfaction, limited availability |

Tips for Saving on Car Insurance

Finding ways to save on your car insurance can significantly impact your monthly budget. State Farm offers a range of discounts and programs that can help you reduce your premiums. Here are some tips to explore:

Comparing Quotes

Getting quotes from multiple insurers is crucial for finding the best rates. State Farm makes it easy to get a quote online or by contacting an agent. You can compare quotes based on your specific needs and preferences, ensuring you’re getting the most competitive price.

Maintaining a Good Driving Record

A clean driving record is essential for securing lower insurance premiums. Avoid traffic violations, accidents, and speeding tickets. Maintaining a good driving record demonstrates your responsibility on the road and can lead to significant savings.

Exploring Discounts

State Farm offers a variety of discounts that can help you save on your car insurance. Here are some common discounts:

Last Recap

By understanding the factors that influence State Farm car insurance costs and exploring available discounts, you can gain valuable insights into how to secure the best possible rates for your car insurance needs. Remember to compare quotes, maintain a clean driving record, and leverage available discounts to potentially lower your monthly premium. With careful planning and informed choices, you can find the right coverage at a price that fits your budget.

FAQs: How Much Is State Farm Car Insurance Monthly

What are some common discounts offered by State Farm?

State Farm offers a variety of discounts, including good driver discounts, safe driver discounts, multi-car discounts, and discounts for safety features on your vehicle.

Can I get a quote for State Farm car insurance online?

Yes, you can get a free online quote for State Farm car insurance through their website or mobile app.

How do I file a claim with State Farm?

You can file a claim online, over the phone, or through the State Farm mobile app.

What are the different types of car insurance coverage offered by State Farm?

State Farm offers a range of coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage.