Home State Auto Insurance Texas is a leading provider of auto insurance in the state, offering a range of coverage options to meet the diverse needs of Texas drivers. Navigating the complexities of Texas auto insurance can be overwhelming, but with the right information and guidance, you can find the best policy for your individual circumstances. This comprehensive guide explores the intricacies of Texas auto insurance, providing valuable insights to help you make informed decisions and secure the protection you deserve.

Understanding the unique aspects of Texas auto insurance law is crucial for every driver. From the minimum coverage requirements to the role of the Texas Department of Insurance, this guide sheds light on the key regulations that govern the industry. We’ll also delve into the factors that influence auto insurance premiums in Texas, empowering you to understand how your driving history, vehicle type, and other factors impact your costs.

Understanding Texas Auto Insurance

Texas has a unique approach to auto insurance, with laws and regulations that differ from other states. This guide will explore the key aspects of Texas auto insurance, helping you understand your obligations and options.

Texas Auto Insurance Requirements

Texas law mandates specific types of auto insurance coverage to protect drivers and passengers. These requirements are designed to ensure financial responsibility in case of accidents.

- Liability Coverage: This is the most important requirement, covering damages you cause to others in an accident. It includes bodily injury liability and property damage liability.

- Medical Payments Coverage (MPC): This coverage pays for medical expenses for you and your passengers, regardless of who is at fault.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are hit by a driver without insurance or with insufficient insurance to cover your damages.

Texas Auto Insurance Compared to Other States

Texas stands out with its “no-fault” system for personal injury protection (PIP). Unlike many other states, Texas does not require PIP coverage. This means you are responsible for your own medical expenses after an accident, even if you are not at fault.

- No-Fault System: Texas is one of a few states with a no-fault system for PIP, meaning you are responsible for your own medical expenses after an accident.

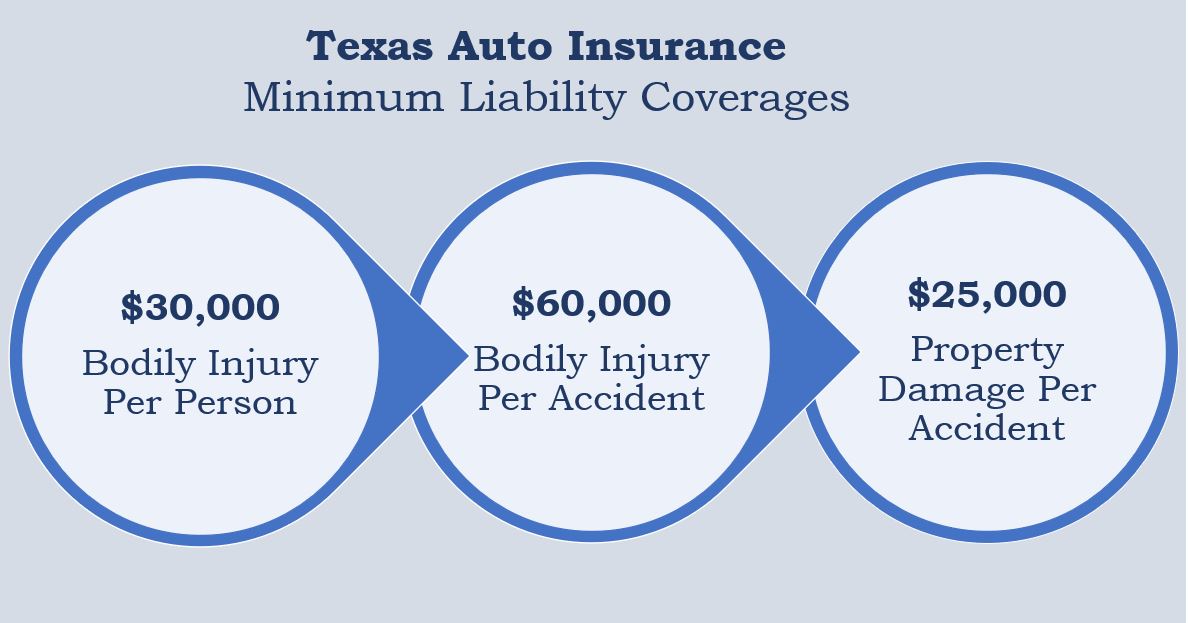

- Lower Minimum Coverage Requirements: Texas has lower minimum liability coverage requirements compared to some other states, which can lead to insufficient coverage in serious accidents.

- Freedom of Choice: Texas allows drivers to choose their own insurance companies and coverage levels, offering more flexibility than some other states.

Role of the Texas Department of Insurance

The Texas Department of Insurance (TDI) plays a crucial role in regulating the auto insurance industry. The TDI ensures that insurance companies operate fairly and responsibly, protecting consumers’ interests.

- Licensing and Oversight: The TDI licenses and oversees insurance companies operating in Texas, ensuring they meet regulatory standards.

- Consumer Protection: The TDI investigates consumer complaints and helps resolve disputes between policyholders and insurance companies.

- Market Regulation: The TDI monitors the insurance market to ensure fair pricing and competition.

Finding the Right Home State Auto Insurance in Texas

Navigating the world of auto insurance in Texas can feel overwhelming, especially with so many providers offering various plans. This guide aims to simplify the process, empowering you to find the right Home State auto insurance policy that fits your needs and budget.

Steps to Finding the Right Auto Insurance in Texas

It’s essential to follow a structured approach when searching for auto insurance. This step-by-step guide will lead you through the process, ensuring you make informed decisions:

- Assess Your Needs: Before you start comparing quotes, understand your specific requirements. Consider factors like the type of vehicle you own, your driving history, and the level of coverage you need. Do you need comprehensive and collision coverage, or are you comfortable with liability-only coverage?

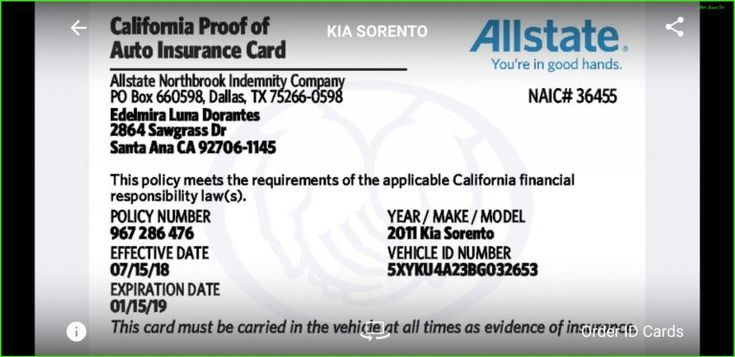

- Gather Information: Collect details about your vehicle, including its make, model, year, and VIN. Also, have your driving history handy, including any accidents or violations.

- Compare Quotes: This is where the real work begins. Utilize online comparison tools, contact insurance agents directly, or work with a broker. Ensure you’re comparing apples to apples by requesting quotes for the same coverage levels and deductibles.

- Review Policy Details: Don’t just focus on the premium. Carefully examine each policy’s terms and conditions, including coverage limits, deductibles, and exclusions. Look for any hidden fees or restrictions.

- Consider Discounts: Many insurance providers offer discounts for good driving records, safety features in your vehicle, or bundling your auto insurance with other policies like homeowners or renters insurance.

- Read Reviews: Check online reviews and ratings of insurance companies to gauge customer satisfaction and identify any potential red flags.

- Contact the Insurance Provider: Once you’ve narrowed down your choices, contact the insurance provider directly to ask any questions you might have. This is a good opportunity to clarify any unclear aspects of the policy.

Comparing Quotes from Different Providers

When comparing quotes, it’s crucial to ensure you’re comparing apples to apples. Here are some key tips to ensure a fair comparison:

- Use the Same Coverage Levels: Request quotes for the same coverage levels across different providers. For example, if you’re comparing quotes for liability-only coverage, make sure all quotes are for the same liability limits.

- Choose the Same Deductibles: Deductibles are the amount you pay out of pocket before your insurance coverage kicks in. Using the same deductible across all quotes allows for a more accurate comparison.

- Include All Relevant Information: Provide all necessary information to each provider, such as your driving history, vehicle details, and desired coverage levels. This ensures that each quote reflects your specific situation.

- Consider Discounts: Ask each provider about any discounts they offer, such as good driver discounts, safety feature discounts, or multi-policy discounts. Factor these discounts into your final comparison.

Individual Driving History and Vehicle Type

Your driving history and the type of vehicle you own play a significant role in determining your auto insurance premiums.

- Driving History: A clean driving record with no accidents or violations will generally result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions can lead to higher premiums.

- Vehicle Type: The make, model, year, and safety features of your vehicle all influence your insurance rates. Luxury cars, high-performance vehicles, and older vehicles with lower safety ratings typically have higher premiums.

Factors Influencing Auto Insurance Premiums in Texas

Several factors contribute to the cost of auto insurance in Texas:

- Location: Insurance premiums can vary significantly depending on your location. Areas with higher accident rates or crime rates tend to have higher premiums.

- Age and Gender: Younger drivers, especially those under 25, often face higher premiums due to their higher risk of accidents. In some cases, gender can also influence premiums.

- Credit Score: Your credit score can surprisingly impact your auto insurance premiums. This is because insurance companies view a good credit score as an indicator of responsible financial behavior.

- Driving History: As mentioned earlier, a clean driving record with no accidents or violations will generally result in lower premiums.

- Vehicle Type: The make, model, year, and safety features of your vehicle all influence your insurance rates. Luxury cars, high-performance vehicles, and older vehicles with lower safety ratings typically have higher premiums.

- Coverage Levels: The level of coverage you choose will significantly impact your premiums. Comprehensive and collision coverage are more expensive than liability-only coverage.

- Deductibles: A higher deductible means you pay more out of pocket in the event of an accident, but you’ll have lower premiums. Conversely, a lower deductible means you pay less out of pocket, but your premiums will be higher.

Types of Auto Insurance Coverage in Texas

Texas law requires all drivers to have liability insurance. However, there are various other coverage options available that can help protect you financially in case of an accident. Understanding the different types of auto insurance coverage in Texas is crucial for making informed decisions about your insurance policy.

Liability Coverage

Liability coverage is the most basic type of auto insurance. It covers the costs of damage or injuries you cause to others in an accident. Liability insurance has two components:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages to individuals injured in an accident caused by you. The coverage limit is typically expressed as a per-person limit and a per-accident limit. For example, a 25/50/25 limit means up to $25,000 per person injured, up to $50,000 per accident, and up to $25,000 for property damage.

- Property Damage Liability: This coverage pays for damages to another person’s vehicle or property caused by you. The coverage limit is typically expressed as a single amount, such as $25,000.

Liability coverage is mandatory in Texas, and the minimum limits are set by the state. However, it is advisable to consider higher coverage limits, especially if you have significant assets or a high net worth.

Collision Coverage

Collision coverage pays for damages to your vehicle in case of an accident, regardless of fault. This coverage is optional, but it is recommended for newer vehicles or vehicles with a high value. If you have a loan on your vehicle, your lender may require you to have collision coverage.

- Benefits: Collision coverage helps you pay for repairs or replacement of your vehicle after an accident, even if you are at fault. It also helps to cover deductibles for other types of coverage, such as comprehensive coverage.

- Limitations: Collision coverage typically has a deductible, which is the amount you pay out-of-pocket before your insurance company covers the remaining costs. You will also need to pay for any repairs or replacement costs that exceed your coverage limit.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damages caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. This coverage is optional, but it is recommended for newer vehicles or vehicles with a high value.

- Benefits: Comprehensive coverage helps you pay for repairs or replacement of your vehicle after a covered event, even if you are not at fault. It also helps to cover deductibles for other types of coverage, such as collision coverage.

- Limitations: Comprehensive coverage typically has a deductible, which is the amount you pay out-of-pocket before your insurance company covers the remaining costs. You will also need to pay for any repairs or replacement costs that exceed your coverage limit.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you in case you are injured in an accident caused by a driver who does not have insurance or has insufficient coverage. This coverage is optional, but it is highly recommended.

- Benefits: UM/UIM coverage pays for your medical expenses, lost wages, and other damages, even if the other driver is at fault and does not have insurance or has insufficient coverage.

- Limitations: UM/UIM coverage typically has a limit, which is the maximum amount your insurance company will pay. It is important to choose a coverage limit that is sufficient to cover your potential losses.

Saving Money on Auto Insurance in Texas

Saving money on your auto insurance in Texas is achievable with a strategic approach. By understanding the factors influencing your premiums and taking proactive steps, you can potentially reduce your costs. This guide provides insights and tips for lowering your insurance premiums.

Improving Driving Habits and Reducing Risk Factors

Safe driving habits are crucial for reducing your risk of accidents and, consequently, your insurance premiums. Here are some tips for improving your driving habits and reducing risk factors:

- Maintain a Clean Driving Record: A clean driving record with no accidents or traffic violations is essential for securing lower insurance rates.

- Avoid Distracted Driving: Distracted driving, such as texting or talking on the phone while driving, increases your risk of accidents. Focus solely on the road while driving.

- Practice Defensive Driving: Defensive driving techniques, such as maintaining a safe distance from other vehicles and being aware of your surroundings, can help you avoid accidents.

- Avoid Speeding: Speeding increases your risk of accidents and can lead to higher insurance premiums. Adhere to posted speed limits.

- Drive Safely in Adverse Weather Conditions: Adjust your driving habits in adverse weather conditions, such as rain, snow, or fog. Reduce your speed and increase your following distance.

Bundling Auto and Home Insurance

Bundling your auto and home insurance policies with the same insurer can often result in significant cost savings. Insurance companies often offer discounts for bundling policies, as it reduces administrative costs and creates a more loyal customer base.

Discounts for Safe Drivers and Good Students

Insurance companies recognize and reward safe driving practices and academic achievement. Here are some potential discounts available for safe drivers and good students:

- Safe Driver Discount: This discount is typically offered to drivers with a clean driving record, demonstrating a lower risk of accidents.

- Good Student Discount: Insurance companies often offer discounts to students who maintain a certain GPA or academic standing. This reflects the positive correlation between academic achievement and responsible driving habits.

- Defensive Driving Course Discount: Completing a defensive driving course can qualify you for a discount, as it demonstrates your commitment to safe driving practices.

Understanding Texas Auto Insurance Claims

In the unfortunate event of an accident, navigating the auto insurance claims process can be overwhelming. Understanding the steps involved, the role of the insurance adjuster, and the importance of accurate documentation will help you file a claim effectively and receive the compensation you deserve.

Filing an Auto Insurance Claim in Texas

The first step in filing a claim is to contact your insurance company as soon as possible after the accident. You can usually do this by calling their 24/7 claims hotline or through their website.

- Report the Accident: Provide the insurance company with all the necessary details of the accident, including the date, time, location, and a description of what happened.

- File a Claim: You will need to provide the insurance company with your policy information and any relevant documentation, such as a police report, photos of the damage, and witness statements.

- Cooperate with the Adjuster: The insurance company will assign an adjuster to your claim, who will investigate the accident and determine the extent of the damage. You will need to cooperate with the adjuster by providing them with any information they request and scheduling a time for them to inspect the damage.

- Receive a Settlement Offer: The adjuster will evaluate your claim and make a settlement offer. You have the right to negotiate this offer, and you can consult with an attorney if you are not satisfied with the offer.

The Role of the Insurance Adjuster, Home state auto insurance texas

The insurance adjuster plays a crucial role in evaluating your claim. Their responsibilities include:

- Investigating the accident to determine the cause and liability.

- Assessing the extent of the damage to your vehicle.

- Reviewing your policy to determine the coverage you have.

- Making a settlement offer based on their findings.

Importance of Accurate Documentation and Communication

Accurate documentation is essential for a smooth claims process. You should keep a detailed record of the accident, including:

- The date, time, and location of the accident.

- A description of what happened.

- The names and contact information of any witnesses.

- Photos of the damage to your vehicle.

- Copies of any police reports.

- Medical bills and other related expenses.

It is also important to communicate effectively with your insurance company and the adjuster. Respond to their requests promptly and provide them with all the information they need.

Tips for Navigating the Claims Process Efficiently

- Keep your policy handy: Review your policy to understand your coverage and limits. This will help you navigate the claims process more effectively.

- Be prepared for the inspection: Make sure your vehicle is accessible to the adjuster and provide them with any necessary information or documentation.

- Keep a detailed record: Keep a log of all communications with your insurance company, including dates, times, and summaries of conversations.

- Don’t be afraid to ask questions: If you are unsure about anything, ask your insurance company or the adjuster for clarification.

- Get everything in writing: Request written confirmation of any agreements or decisions made by the insurance company.

Texas Auto Insurance for Specific Situations

Not all drivers in Texas have the same insurance needs. Certain situations may require specialized coverage or adjustments to your policy. Here are some examples of unique auto insurance needs in Texas.

High-Risk Drivers in Texas

High-risk drivers often face challenges finding affordable auto insurance. These drivers may have a history of accidents, traffic violations, or other factors that make them appear more likely to file claims.

- Factors that may increase your risk:

- Multiple accidents or traffic violations

- Driving record with DUI or DWI convictions

- Young age and lack of driving experience

- Driving a high-performance vehicle

- Strategies for high-risk drivers:

- Compare quotes from multiple insurers: Don’t settle for the first quote you receive. Shop around and see what different companies offer.

- Consider a high-risk insurance program: Some insurers specialize in providing coverage for high-risk drivers.

- Improve your driving record: Take defensive driving courses and avoid traffic violations to lower your risk profile.

- Maintain a good credit score: Insurers often consider your credit history when determining your rates.

Coverage Options for Drivers with Accidents or Violations

Drivers with a history of accidents or violations may find it difficult to obtain affordable coverage. However, there are options available to help you get the insurance you need.

- SR-22 Insurance: This type of insurance is required in Texas for drivers who have been convicted of certain offenses, such as DUI or DWI. SR-22 insurance provides proof of financial responsibility and helps ensure that you can pay for any damages you may cause in an accident.

- High-Risk Insurance Pools: These pools are designed to provide insurance for drivers who have been rejected by traditional insurers. They may offer higher premiums but can be a good option if you have a difficult driving record.

- Consider a non-standard insurance company: Some insurers specialize in providing coverage for drivers with less-than-perfect driving records.

Insuring Classic Cars or Antique Vehicles in Texas

Classic cars and antique vehicles are often cherished possessions and require specialized insurance coverage. Traditional auto insurance policies may not provide adequate protection for these vehicles.

- Factors to consider when insuring a classic car:

- Agreed Value Coverage: This type of coverage sets a predetermined value for your vehicle, which is the amount you’ll receive if it’s totaled.

- Limited Use Coverage: If you only drive your classic car occasionally, you may be able to get a lower premium with limited use coverage.

- Specialized Coverage for Parts and Restoration: Classic cars often require specialized parts and restoration services. Make sure your policy covers these expenses.

- Tips for finding insurance for classic cars:

- Contact specialized insurers: Some insurance companies specialize in insuring classic cars and antique vehicles.

- Join a classic car club: Many clubs offer group insurance plans that can provide discounted rates.

- Provide detailed information about your vehicle: The more information you provide about your classic car, the better the insurer can assess its value and determine the appropriate coverage.

Commercial Vehicle Insurance in Texas

Commercial vehicles, such as trucks, vans, and buses, require specific insurance coverage to protect both the vehicle and the business owner.

- Types of coverage for commercial vehicles:

- Liability Coverage: This coverage protects you from financial losses if you’re involved in an accident that causes injury or property damage to others.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, or natural disasters.

- Cargo Coverage: This coverage protects the goods you’re transporting in your commercial vehicle.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have adequate insurance.

- Factors to consider when insuring a commercial vehicle:

- Type of vehicle: The type of commercial vehicle you operate will affect your insurance premiums.

- Usage: How often and where you use your commercial vehicle will also influence your rates.

- Driving record: Your driving history can impact your premiums, just as it does with personal auto insurance.

- Safety measures: Implementing safety measures, such as driver training and vehicle maintenance, can help reduce your insurance costs.

Closure: Home State Auto Insurance Texas

Securing the right auto insurance in Texas is a critical step in protecting yourself and your finances. By understanding the various coverage options, exploring ways to save money, and navigating the claims process effectively, you can ensure that you have the necessary protection in place. Remember, knowledge is power when it comes to auto insurance. Use this guide as a valuable resource to make informed decisions and drive with confidence.

Q&A

What is the minimum auto insurance coverage required in Texas?

Texas requires drivers to carry liability insurance, which covers damages to others in case of an accident. The minimum requirements are $30,000 for bodily injury per person, $60,000 for bodily injury per accident, and $25,000 for property damage.

How can I get a free auto insurance quote from Home State?

You can obtain a free quote online, by phone, or by visiting a local Home State office. Be prepared to provide information about your driving history, vehicle, and desired coverage levels.

What are some common discounts offered by Home State Auto Insurance?

Home State offers various discounts, including good driver discounts, safe driver discounts, multi-car discounts, and bundling discounts for combining auto and home insurance.

What should I do if I need to file an auto insurance claim with Home State?

Contact Home State immediately after an accident. They will guide you through the claims process, including reporting the accident, gathering necessary documentation, and scheduling an inspection.