Gusto Health Insurance states offer a unique approach to employee benefits, providing a streamlined way for businesses to offer affordable and comprehensive health insurance plans. Gusto’s platform simplifies the enrollment process, allowing employers to easily compare plans and choose the best option for their employees. This article will delve into the specifics of Gusto health insurance availability by state, highlighting key features, pricing factors, and enrollment details.

Understanding Gusto’s approach to health insurance is crucial for businesses seeking to offer competitive benefits packages. By analyzing state-specific plans and comparing them to traditional options, employers can make informed decisions that meet the needs of their workforce while staying within budget constraints.

Gusto Health Insurance Overview

Gusto health insurance is a type of health insurance plan offered through Gusto, a popular payroll and HR platform. Gusto acts as a broker, connecting businesses with various health insurance carriers to provide comprehensive health insurance options. These plans are designed to cater to the needs of small and medium-sized businesses (SMBs).

Gusto health insurance plans offer a range of features and benefits that aim to provide affordable and comprehensive coverage for employees. These plans are often more flexible and customizable than traditional health insurance options, allowing businesses to choose the level of coverage that best suits their budget and employee needs.

Key Features and Benefits

Gusto health insurance plans offer a variety of features and benefits, designed to make health insurance more accessible and affordable for businesses and their employees.

- Competitive Pricing: Gusto negotiates with insurance carriers to offer competitive rates, potentially saving businesses money on their health insurance premiums.

- Flexible Plans: Businesses can choose from a variety of plan options, allowing them to tailor coverage to their specific needs and budget. This flexibility can include different levels of coverage, deductibles, and co-pays.

- Simplified Administration: Gusto simplifies the administration of health insurance plans, handling tasks such as enrollment, billing, and claims processing. This allows businesses to focus on other aspects of their operations.

- Online Access: Gusto provides an online platform where employees can access their health insurance information, manage their benefits, and submit claims.

- Dedicated Support: Gusto offers dedicated customer support to assist businesses and employees with any questions or concerns they may have regarding their health insurance plans.

Comparison with Traditional Health Insurance

Gusto health insurance differs from traditional health insurance options in several ways.

- Brokerage Model: Gusto acts as a broker, connecting businesses with various health insurance carriers. Traditional health insurance plans are typically offered directly by insurance companies.

- Focus on SMBs: Gusto health insurance is specifically designed for small and medium-sized businesses. Traditional health insurance plans are often available to a wider range of businesses and individuals.

- Technology Integration: Gusto leverages technology to simplify the administration and management of health insurance plans. Traditional health insurance plans may rely on more traditional, paper-based processes.

Gusto Health Insurance Availability by State

Gusto offers health insurance plans to businesses of all sizes across the United States. However, the specific plan options and features available may vary depending on the state.

Gusto Health Insurance Availability by State

The table below provides an overview of Gusto health insurance availability by state, including plan options and key features.

| State | Plan Availability | Plan Options | Key Features |

|---|---|---|---|

| Alabama | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Alaska | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Arizona | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Arkansas | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| California | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Colorado | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Connecticut | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Delaware | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Florida | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Georgia | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Hawaii | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Idaho | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Illinois | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Indiana | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Iowa | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Kansas | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Kentucky | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Louisiana | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Maine | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Maryland | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Massachusetts | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Michigan | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Minnesota | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Mississippi | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Missouri | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Montana | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Nebraska | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Nevada | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| New Hampshire | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| New Jersey | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| New Mexico | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| New York | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| North Carolina | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| North Dakota | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Ohio | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Oklahoma | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Oregon | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Pennsylvania | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Rhode Island | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| South Carolina | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| South Dakota | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Tennessee | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Texas | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Utah | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Vermont | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Virginia | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Washington | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| West Virginia | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Wisconsin | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

| Wyoming | Yes | Individual and group plans | HSA-compatible plans, dental and vision coverage, telemedicine |

Gusto Health Insurance Pricing and Cost Factors

Gusto health insurance pricing is influenced by various factors, making it crucial to understand these elements to find the most suitable and affordable plan. Several variables play a role in determining the final cost of your health insurance through Gusto.

Pricing Variations

Pricing for Gusto health insurance can vary significantly based on several factors, including the state you reside in, the type of plan you choose, and your individual circumstances.

- State: Health insurance costs differ considerably across states. This variation is primarily due to the cost of healthcare services in different regions and the number of insurance providers operating in the area. For instance, the average monthly premium for a Bronze plan in California could be significantly higher than in Texas.

- Plan Type: Gusto offers various health insurance plans, each with its own coverage levels and associated costs. Bronze plans typically have the lowest monthly premiums but offer limited coverage. Gold plans, on the other hand, have higher premiums but provide more comprehensive coverage.

- Individual Circumstances: Individual factors like age, health status, and tobacco use can also influence health insurance premiums. For example, a younger and healthier individual might qualify for lower premiums compared to someone with pre-existing conditions or a history of smoking.

Estimated Monthly Premiums

To illustrate the range of premiums, here are some estimated monthly costs for different plan options in various states:

| State | Plan Type | Estimated Monthly Premium |

|---|---|---|

| California | Bronze | $300-$450 |

| Texas | Bronze | $200-$300 |

| New York | Gold | $600-$800 |

| Florida | Silver | $400-$600 |

These are just estimates, and actual premiums may vary based on individual circumstances. It is crucial to obtain a personalized quote from Gusto to determine the exact cost of your health insurance.

Gusto Health Insurance Eligibility and Enrollment

Gusto health insurance plans are available to businesses and their employees. To be eligible for Gusto health insurance, you must meet specific requirements. This section will Artikel the eligibility requirements for Gusto health insurance plans and provide a step-by-step guide to the enrollment process, including any deadlines or waiting periods associated with enrollment.

Eligibility Requirements

Gusto health insurance plans are available to businesses and their employees. To be eligible for Gusto health insurance, you must meet specific requirements. These requirements vary depending on the specific plan you are interested in, but generally include:

- Being a legal resident of the United States

- Being employed by a company that offers Gusto health insurance

- Meeting the minimum enrollment requirements for the plan, such as being a full-time employee or working a certain number of hours per week

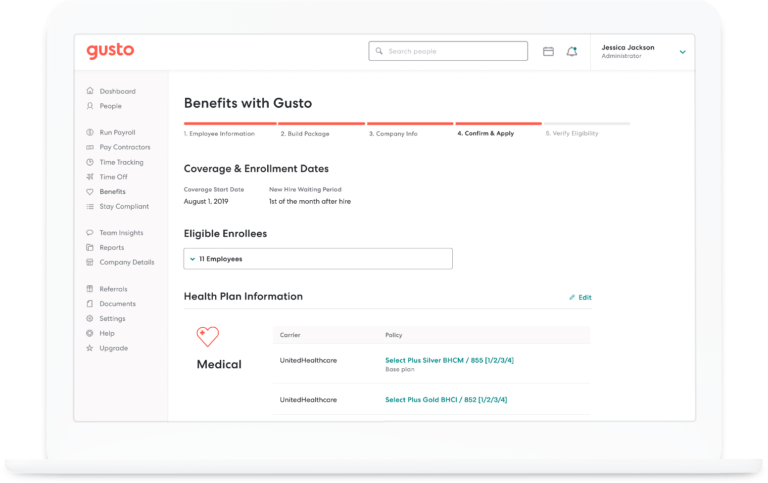

Enrollment Process

The enrollment process for Gusto health insurance is straightforward. Here’s a step-by-step guide:

- Review the available plans: Once your employer has partnered with Gusto for health insurance, you will receive information about the available plans, including details on coverage, premiums, and deductibles. Take time to review each plan and compare them based on your needs and budget.

- Choose a plan: After reviewing the available plans, select the plan that best suits your needs and budget. You can consult with your employer or a Gusto representative for guidance.

- Complete the enrollment form: Once you have chosen a plan, you will need to complete an enrollment form. This form will collect your personal information, including your Social Security number and any dependents you wish to cover.

- Submit your enrollment form: Once you have completed the enrollment form, submit it to Gusto. You may be able to submit it online, by mail, or through your employer.

- Review your coverage: After you have enrolled, review your coverage details to ensure they are accurate and that you understand your benefits. You can contact Gusto if you have any questions or need clarification.

Deadlines and Waiting Periods

There are deadlines and waiting periods associated with enrolling in Gusto health insurance.

- Open Enrollment Period: Most employers have an open enrollment period during which you can enroll in or change your health insurance plan. This period typically occurs once a year and lasts for a few weeks. It is important to note that the open enrollment period may vary depending on your employer’s policies.

- Special Enrollment Period: In some cases, you may be eligible for a special enrollment period outside of the open enrollment period. These periods are typically granted for life events such as marriage, birth of a child, or loss of coverage.

- Waiting Periods: Some health insurance plans have waiting periods before certain benefits can be used. For example, there may be a waiting period before you can use your coverage for preventive care or certain medical treatments. It is important to check the specific waiting periods associated with your plan.

Gusto Health Insurance Customer Support and Resources

Gusto offers comprehensive customer support and resources to ensure a smooth and hassle-free experience for its health insurance policyholders. Whether you have questions about your plan, need help filing a claim, or require assistance with managing your account, Gusto provides various channels and tools to support your needs.

Customer Support Channels

Gusto provides multiple channels for customers to reach out for assistance.

- Phone Support: Customers can call Gusto’s dedicated customer support line during business hours. This option allows for immediate assistance and personalized guidance from a representative.

- Email Support: For non-urgent inquiries or detailed information requests, customers can contact Gusto via email. This provides a convenient option for communication, especially for situations requiring documentation or written responses.

- Live Chat: Gusto offers a live chat feature on its website, allowing customers to connect with a representative in real-time. This option is ideal for quick questions or immediate assistance.

- Online Help Center: Gusto’s website features an extensive help center with comprehensive FAQs, articles, and tutorials. This resource provides a self-service option for customers to find answers to common questions or learn about various aspects of their health insurance plan.

Managing Health Insurance Online

Gusto offers various online tools and mobile applications to facilitate seamless health insurance management.

- Online Account Portal: Gusto’s secure online account portal allows customers to access their policy details, view claims history, update personal information, and manage other aspects of their health insurance.

- Mobile App: Gusto’s mobile app provides convenient access to health insurance information and services on the go. Customers can check their coverage details, submit claims, find in-network providers, and access other features through the app.

Comparing Gusto Health Insurance to Other Options

Choosing the right health insurance plan can be a daunting task, especially with the wide range of options available. Gusto, a popular payroll and HR platform, offers health insurance plans alongside its other services. To help you make an informed decision, this section compares Gusto health insurance plans with other popular providers, highlighting key differences in coverage, pricing, and customer service.

Coverage Comparison

When comparing Gusto health insurance plans to other providers, it’s crucial to consider the specific coverage details. Gusto offers various plan options, including HMO, PPO, and HSA-compatible plans, catering to different needs and budgets. Here’s a breakdown of coverage aspects:

- Network Access: Gusto’s plans offer access to a wide network of healthcare providers, ensuring you have options when seeking medical care. Compare this network with other providers to see if it aligns with your preferred doctors and hospitals.

- Prescription Drug Coverage: The availability and coverage of prescription drugs can vary significantly between providers. Carefully review the formulary, which lists covered medications, and compare it with your current prescriptions and potential future needs.

- Mental Health and Substance Abuse Coverage: Mental health and substance abuse services are increasingly essential. Check the coverage details for these services, including the number of sessions covered and any limitations on specific treatments.

Pricing and Cost Factors

Gusto’s health insurance plans are priced competitively, but the actual cost depends on several factors, including your location, age, and chosen plan. To get a precise estimate, you’ll need to provide specific information about your situation.

- Plan Premiums: Gusto offers various plan options, with premiums varying based on coverage levels and deductibles. Compare these premiums with those offered by other providers to see which option best suits your budget.

- Deductibles and Co-pays: The deductible is the amount you pay out-of-pocket before insurance coverage kicks in. Co-pays are fixed amounts you pay for specific services. Carefully evaluate these factors to understand the overall cost of using the plan.

- Out-of-Pocket Maximum: The out-of-pocket maximum is the highest amount you’ll pay in a year for healthcare expenses. This limit can vary between providers, so compare it to understand the potential financial risk associated with each plan.

Customer Service and Resources

Customer service and resources are essential aspects to consider when choosing a health insurance provider. Gusto provides dedicated customer support channels for its health insurance plans.

- Customer Support: Gusto offers various customer support channels, including phone, email, and online chat. Compare the availability and responsiveness of these channels with other providers to assess their customer service quality.

- Online Resources: Gusto provides online resources, such as FAQs, plan details, and enrollment guides. These resources can be helpful for understanding your plan and managing your coverage. Compare the availability and comprehensiveness of these resources with other providers.

- Claims Processing: The claims processing speed and ease can vary between providers. Research how Gusto handles claims and compare it with other providers to understand the potential waiting times and complexity of the process.

Case Studies and Real-World Examples

Gusto health insurance has been adopted by a diverse range of businesses and individuals, resulting in a wealth of real-world experiences. These case studies offer valuable insights into the impact of Gusto health insurance on organizations and individuals, highlighting both the benefits and challenges encountered.

Examples of Businesses Using Gusto Health Insurance, Gusto health insurance states

These examples demonstrate the diverse applications of Gusto health insurance across various industries and company sizes.

- Small Tech Startup: A small tech startup with 15 employees found that Gusto health insurance offered them a cost-effective solution for providing comprehensive health coverage to their team. The company was able to choose a plan that fit their budget and offered a variety of benefits, including dental and vision coverage. The startup’s employees appreciated the ease of access to healthcare through Gusto’s platform and the ability to manage their benefits online.

- Large Retail Chain: A large retail chain with thousands of employees across the country chose Gusto health insurance to streamline their benefits administration and improve employee satisfaction. The company was able to leverage Gusto’s robust platform to manage enrollment, claims, and other administrative tasks, freeing up their HR team to focus on other priorities. The employees appreciated the wide selection of plans available through Gusto and the ability to access their benefits information online.

- Non-Profit Organization: A non-profit organization with a limited budget found that Gusto health insurance provided them with an affordable and accessible solution for offering health coverage to their employees. The organization was able to choose a plan that met their specific needs and budget constraints, while still providing their employees with quality healthcare coverage. The non-profit’s employees were grateful for the opportunity to have access to affordable health insurance through their employer.

Experiences of Individuals Using Gusto Health Insurance

These examples illustrate the personal experiences of individuals who have utilized Gusto health insurance, highlighting the impact on their health and well-being.

- Young Entrepreneur: A young entrepreneur who started his own business was initially hesitant to offer health insurance to his employees due to the cost. However, after researching Gusto health insurance, he realized that it was a more affordable option than he had anticipated. The entrepreneur was able to choose a plan that fit his budget and provided his employees with comprehensive coverage. He was also impressed by the ease of use of Gusto’s platform, which made managing his employees’ benefits a breeze. The entrepreneur’s employees were happy to have access to quality health insurance through their employer, which gave them peace of mind.

- Freelancer: A freelancer who was previously uninsured found that Gusto health insurance offered him an affordable and flexible option for obtaining health coverage. The freelancer was able to choose a plan that met his individual needs and budget, and he appreciated the ability to manage his benefits online. The freelancer was also impressed by the customer service provided by Gusto, which was responsive and helpful.

- Small Business Owner: A small business owner who was previously struggling to manage her employees’ benefits found that Gusto health insurance made the process much easier. The business owner was able to choose a plan that fit her budget and offered a variety of benefits, including dental and vision coverage. She was also impressed by the ease of use of Gusto’s platform, which made managing her employees’ benefits a breeze. The business owner’s employees were happy to have access to quality health insurance through their employer, which gave them peace of mind.

Challenges Faced by Businesses and Individuals Using Gusto Health Insurance

While Gusto health insurance offers numerous benefits, it’s important to acknowledge the challenges that some businesses and individuals may encounter.

- Limited Network Availability: In some areas, the network of healthcare providers available through Gusto health insurance may be limited, potentially restricting access to preferred providers.

- Plan Options: While Gusto offers a variety of plans, the specific options available may not always align perfectly with the needs of every business or individual.

- Customer Support: While Gusto generally provides responsive customer support, some users have reported experiencing delays or difficulties in resolving specific issues.

Outcomes of Using Gusto Health Insurance

The experiences of businesses and individuals using Gusto health insurance have yielded a range of positive outcomes.

- Improved Employee Satisfaction: Businesses that have adopted Gusto health insurance have often reported an increase in employee satisfaction, as employees appreciate having access to affordable and comprehensive health coverage.

- Reduced Administrative Burden: Gusto’s platform streamlines the process of managing employee benefits, freeing up HR teams to focus on other priorities. This can lead to increased efficiency and productivity within organizations.

- Enhanced Peace of Mind: For individuals, having access to quality health insurance through Gusto provides peace of mind and financial security, knowing that they are protected in case of unexpected health issues.

Ultimate Conclusion

Gusto health insurance offers a compelling alternative to traditional health insurance providers, particularly for businesses seeking a simplified and user-friendly approach. With its state-specific plans, transparent pricing, and dedicated customer support, Gusto empowers employers to provide valuable health benefits to their employees. As the healthcare landscape continues to evolve, Gusto’s innovative approach positions itself as a valuable resource for businesses seeking to navigate the complexities of employee health insurance.

Common Queries: Gusto Health Insurance States

What are the eligibility requirements for Gusto health insurance?

Eligibility requirements for Gusto health insurance plans vary depending on the state and plan type. Generally, businesses must meet certain size and employee criteria to qualify. It’s best to contact Gusto directly for specific eligibility details.

How do I enroll in Gusto health insurance?

The enrollment process for Gusto health insurance is typically handled through their online platform. You’ll need to provide information about your business and employees. Gusto offers step-by-step guidance throughout the enrollment process.

Does Gusto offer any discounts on health insurance plans?

Gusto may offer discounts on health insurance plans based on factors such as business size, industry, and employee demographics. It’s recommended to contact Gusto directly to inquire about available discounts.