Green state insurance, a concept gaining traction, offers a unique approach to insurance that prioritizes environmental sustainability. It signifies a shift towards policies that incentivize and reward eco-conscious behavior, fostering a future where insurance becomes a force for positive change.

This emerging field encompasses various types of insurance, ranging from policies that cover renewable energy installations to those that offer discounts for energy-efficient homes. By incorporating environmental considerations into insurance practices, green state insurance aims to promote responsible consumption, reduce carbon emissions, and contribute to a greener future.

What is Green State Insurance?

Green State Insurance is a relatively new concept in the insurance industry that focuses on promoting sustainability and environmental responsibility. It involves integrating environmental considerations into insurance products, services, and operations.

Green State Insurance aims to reduce the environmental impact of the insurance sector and contribute to a more sustainable future. It encompasses various initiatives, including:

History and Evolution of Green State Insurance

The concept of Green State Insurance emerged in response to growing concerns about climate change and its impact on the insurance industry. The insurance sector is heavily impacted by climate-related risks, such as extreme weather events, rising sea levels, and natural disasters.

In recent years, there has been a significant increase in the number of insurance companies and regulators adopting sustainable practices and integrating environmental considerations into their operations.

Examples of Green State Insurance Programs and Initiatives

There are several examples of Green State Insurance programs and initiatives being implemented worldwide. These include:

- Green Building Insurance: This type of insurance provides coverage for buildings designed and constructed using sustainable materials and practices, such as energy-efficient appliances, renewable energy sources, and water-saving fixtures.

- Climate-Smart Agriculture Insurance: This insurance product helps farmers adapt to climate change by providing coverage for losses due to extreme weather events, drought, and other climate-related risks.

- Renewable Energy Insurance: This insurance covers the risks associated with investing in renewable energy projects, such as solar and wind power.

- Carbon Offset Insurance: This insurance allows individuals and businesses to offset their carbon footprint by investing in projects that reduce greenhouse gas emissions.

Green State Insurance is a growing trend in the insurance industry, driven by increasing awareness of environmental sustainability and the need to mitigate climate change risks.

Benefits of Green State Insurance

Green State Insurance offers a range of benefits for both individuals and businesses, encompassing financial, environmental, and social advantages. These benefits are grounded in our commitment to sustainability and responsible practices.

Benefits for Individuals

Green State Insurance offers a variety of benefits for individuals, including:

- Lower premiums: By adopting eco-friendly practices, such as using energy-efficient vehicles and reducing waste, individuals can qualify for lower insurance premiums. Green State Insurance incentivizes sustainable behavior through discounted rates.

- Access to green products and services: Green State Insurance partners with businesses that offer sustainable products and services, giving policyholders access to a wider range of eco-friendly options. This includes discounts on electric vehicles, solar panels, and energy-efficient appliances.

- Peace of mind: Knowing that your insurance provider is committed to sustainability can provide peace of mind. Green State Insurance prioritizes environmental responsibility, ensuring that your insurance is aligned with your values.

Benefits for Businesses

Green State Insurance offers a range of benefits for businesses, including:

- Reduced risk: By adopting sustainable practices, businesses can reduce their risk of environmental liabilities and regulatory penalties. Green State Insurance provides guidance and resources to help businesses mitigate these risks.

- Enhanced reputation: Businesses that demonstrate a commitment to sustainability can enhance their reputation and attract environmentally conscious customers. Green State Insurance helps businesses communicate their sustainability efforts to stakeholders.

- Cost savings: Sustainable practices can lead to cost savings for businesses, such as reduced energy consumption and waste management. Green State Insurance offers incentives and programs to help businesses implement these practices.

Environmental Impact

Green State Insurance’s commitment to sustainability has a positive impact on the environment. By supporting businesses and individuals who adopt eco-friendly practices, we contribute to:

- Reduced carbon emissions: By promoting the use of renewable energy sources and energy-efficient vehicles, Green State Insurance helps reduce greenhouse gas emissions.

- Improved air and water quality: Green State Insurance supports businesses that prioritize environmental protection, leading to cleaner air and water quality.

- Conservation of natural resources: By promoting sustainable practices, Green State Insurance helps conserve natural resources for future generations.

Economic Benefits

Green State Insurance’s commitment to sustainability also has economic benefits. By supporting the development of green industries and technologies, we contribute to:

- Job creation: The growth of the green economy creates new jobs in sectors such as renewable energy, sustainable agriculture, and green building.

- Economic diversification: Green State Insurance supports the development of new industries and technologies, diversifying the economy and reducing dependence on fossil fuels.

- Increased competitiveness: Businesses that adopt sustainable practices are often more competitive, as they are able to reduce costs and attract environmentally conscious customers.

Types of Green State Insurance

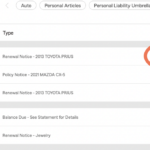

Green State Insurance offers a range of policies designed to meet the diverse needs of its customers. From comprehensive coverage for homes and vehicles to specialized policies for businesses and individuals, Green State provides a comprehensive suite of insurance solutions.

Green State Insurance policies are designed to protect you and your assets from a wide range of risks. These policies are categorized based on the type of coverage they offer, and each category has unique features and benefits.

Types of Green State Insurance Policies

Green State Insurance provides various types of insurance policies, catering to different needs and risk profiles. Here are some of the most common types:

- Home Insurance: This policy protects your home and its contents from various perils, including fire, theft, and natural disasters. Green State offers different coverage options, allowing you to customize your policy based on your specific needs and budget.

- Auto Insurance: Green State’s auto insurance policies provide financial protection in case of an accident, covering damages to your vehicle, medical expenses, and liability claims. They offer various coverage options, including collision, comprehensive, and liability coverage.

- Life Insurance: Green State offers different life insurance policies, including term life, whole life, and universal life insurance. These policies provide financial security to your loved ones in case of your untimely demise, ensuring their financial stability.

- Health Insurance: Green State’s health insurance plans provide coverage for medical expenses, including hospital stays, doctor visits, and prescription drugs. They offer various plans with different coverage levels and deductibles to suit your needs and budget.

- Business Insurance: Green State offers various business insurance policies, including general liability, property insurance, and workers’ compensation. These policies protect your business from financial losses due to lawsuits, property damage, and employee injuries.

Comparing Green State Insurance Providers

Different Green State Insurance providers may offer varying coverage options and premiums. It’s crucial to compare policies from multiple providers to find the best value for your money.

Here’s a table comparing the key features of different Green State Insurance products:

| Feature | Provider A | Provider B | Provider C |

|---|---|---|---|

| Home Insurance Coverage | $100,000 | $150,000 | $200,000 |

| Auto Insurance Deductible | $500 | $1,000 | $1,500 |

| Life Insurance Coverage | $250,000 | $500,000 | $1,000,000 |

| Health Insurance Premium | $200/month | $250/month | $300/month |

Green State Insurance and Sustainability

Green State Insurance recognizes the critical role it plays in promoting sustainability. We are committed to aligning our operations and offerings with environmental responsibility, helping our customers make greener choices, and contributing to a healthier planet.

Supporting Renewable Energy Initiatives

Green State Insurance actively supports renewable energy initiatives by offering competitive insurance rates for homeowners and businesses that install solar panels, wind turbines, or other renewable energy sources. These incentives encourage individuals and businesses to transition to cleaner energy options, reducing their carbon footprint and dependence on fossil fuels.

- For example, Green State Insurance offers a 10% discount on homeowners insurance for those who install solar panels on their property. This incentive makes solar energy more accessible and financially attractive, encouraging homeowners to embrace renewable energy.

- We also provide specialized insurance policies for renewable energy projects, covering potential risks associated with installation, operation, and maintenance. This reduces the financial burden on developers and investors, fostering growth in the renewable energy sector.

Reducing Carbon Emissions

Green State Insurance actively works to reduce its own carbon footprint by implementing sustainable practices in its operations. We strive to minimize energy consumption, reduce waste generation, and promote eco-friendly transportation options for our employees.

- Our offices are designed with energy efficiency in mind, incorporating features like LED lighting, energy-efficient appliances, and smart thermostats. This reduces our overall energy consumption and lowers our carbon emissions.

- We actively promote paperless communication and encourage employees to use public transportation, carpooling, or cycling for commuting. This reduces our dependence on private vehicles and minimizes traffic congestion and air pollution.

Choosing a Green State Insurance Provider

Selecting the right Green State Insurance provider is crucial to ensure you’re getting the best coverage while aligning your values with a company that prioritizes environmental responsibility. This decision involves careful consideration of various factors, including your specific needs, the provider’s commitment to sustainability, and the overall value they offer.

Factors to Consider, Green state insurance

Choosing a Green State Insurance provider involves weighing several factors, including:

- Coverage Options: Evaluate the range of insurance products offered, ensuring they meet your specific needs, such as home, auto, or health insurance. Compare the coverage levels, deductibles, and premiums offered by different providers.

- Sustainability Practices: Investigate the provider’s environmental initiatives. This might involve their use of renewable energy sources, paperless processes, carbon offsetting programs, or support for environmental organizations.

- Financial Stability: Assess the provider’s financial health to ensure they can meet their obligations in the long term. Look for indicators like credit ratings, claims-paying history, and capital adequacy ratios.

- Customer Service: Review customer reviews and ratings to understand the provider’s reputation for customer service and responsiveness. Good communication and prompt assistance are essential when dealing with insurance claims.

- Pricing and Value: Compare premiums and policy terms across providers, considering the coverage offered and the provider’s commitment to sustainability. Look for providers that offer competitive pricing without compromising on quality.

Research and Comparison Tips

To effectively research and compare Green State Insurance providers, consider these tips:

- Start with Online Research: Begin by searching online for “Green State Insurance providers” or “sustainable insurance companies.” Look for websites, articles, and reviews that provide information on various providers and their environmental practices.

- Check for Certifications and Awards: Many organizations, such as B Corp, recognize companies for their commitment to sustainability. Look for providers that have earned such certifications or awards, indicating their dedication to environmental responsibility.

- Contact Providers Directly: Reach out to shortlisted providers to ask specific questions about their sustainability practices and policies. This direct interaction can provide valuable insights into their commitment to green initiatives.

- Read Reviews and Testimonials: Explore customer reviews and testimonials on websites like Trustpilot or Google Reviews to gain insights into the provider’s customer service and overall satisfaction levels.

- Compare Quotes: Request quotes from multiple providers to compare premiums and coverage options. Use this information to make an informed decision based on your needs and budget.

Essential Features in a Green State Insurance Policy

When choosing a Green State Insurance policy, look for these key features:

- Renewable Energy Coverage: Consider policies that offer coverage for renewable energy systems, such as solar panels or wind turbines. This can help protect your investment and promote the adoption of clean energy.

- Eco-Friendly Discounts: Some providers offer discounts for environmentally friendly practices, such as owning a hybrid or electric vehicle or having energy-efficient home improvements. These discounts can incentivize sustainable choices and reduce your insurance premiums.

- Green Claims Processing: Look for providers that offer paperless claims processing and other sustainable practices throughout the claims process. This minimizes environmental impact and improves efficiency.

- Sustainable Investments: Some providers invest a portion of their assets in environmentally responsible companies and projects. This aligns your insurance premiums with your values and supports sustainable development.

- Transparency and Reporting: Choose providers that are transparent about their sustainability practices and provide regular reports on their environmental performance. This allows you to track their progress and hold them accountable for their commitments.

The Future of Green State Insurance

The Green State Insurance market is poised for significant growth and transformation, driven by a confluence of factors including increasing awareness of climate change, evolving regulatory landscapes, and advancements in technology. This section explores the trends shaping the future of Green State Insurance, analyzes the potential impact of emerging technologies, and shares predictions for the growth and development of this market.

Trends Shaping the Future of Green State Insurance

The future of Green State Insurance is being shaped by a number of key trends, including:

- Growing demand for sustainable insurance products: Consumers are increasingly demanding insurance products that align with their values and support environmental sustainability. This is driving insurers to develop and offer a wider range of green insurance products, such as renewable energy insurance, green building insurance, and electric vehicle insurance.

- Increasing regulatory pressure: Governments around the world are introducing regulations to promote sustainability and reduce carbon emissions. This is putting pressure on insurers to adopt more sustainable practices and offer products that support these goals. For example, the European Union’s Sustainable Finance Disclosure Regulation (SFDR) requires insurers to disclose the environmental impact of their investments.

- Rising climate risks: Climate change is leading to more frequent and severe weather events, such as hurricanes, floods, and wildfires. This is increasing the risk of property damage and business interruption, and is driving demand for insurance products that provide coverage for these risks.

Impact of Emerging Technologies on Green State Insurance

Emerging technologies are playing a significant role in shaping the future of Green State Insurance, with the potential to:

- Improve risk assessment and pricing: Technologies like artificial intelligence (AI) and machine learning (ML) can be used to analyze large datasets of climate data and property information to improve risk assessment and pricing of green insurance products. This can help insurers to better understand the risks associated with climate change and develop more accurate and competitive pricing models.

- Enable personalized insurance products: Emerging technologies can be used to develop personalized insurance products that are tailored to the specific needs of individual customers. For example, insurers can use wearable technology to track the energy consumption of customers and offer discounts based on their energy-saving behavior.

- Promote sustainable practices: Insurers can use technologies like blockchain to track the environmental impact of their investments and ensure that their portfolio aligns with their sustainability goals. This can help to promote transparency and accountability in the insurance industry.

Predictions for the Growth and Development of the Green State Insurance Market

The Green State Insurance market is expected to grow significantly in the coming years, driven by factors such as:

- Increased awareness of climate change: As awareness of climate change grows, consumers and businesses are increasingly looking for ways to reduce their environmental impact. This is driving demand for green insurance products that can help them to mitigate their climate risks.

- Government support: Governments around the world are providing incentives and support for the development of green insurance products. This is helping to create a favorable environment for the growth of the Green State Insurance market.

- Technological advancements: Advancements in technology are enabling insurers to develop more innovative and affordable green insurance products. This is further driving the growth of the market.

“The Green State Insurance market is expected to grow at a CAGR of over 15% during the forecast period, driven by the increasing demand for sustainable insurance products and the growing awareness of climate change.” – Source: Research and Markets

Last Point

As we navigate a world increasingly concerned about climate change, green state insurance presents a promising avenue for individuals and businesses to align their financial decisions with their environmental values. By embracing this innovative approach, we can collectively contribute to a more sustainable future, where insurance plays a vital role in protecting both our well-being and the planet.

FAQ: Green State Insurance

What are the potential drawbacks of green state insurance?

While green state insurance offers numerous benefits, potential drawbacks include higher premiums for some policies, limited availability in certain regions, and potential complexities in verifying eligibility for discounts.

How can I find a reputable green state insurance provider?

Researching online reviews, checking for industry certifications like B Corp, and contacting consumer advocacy groups can help identify reputable green state insurance providers.

Does green state insurance cover damages caused by climate change?

While green state insurance may not directly cover damages caused by climate change, it can encourage responsible practices that mitigate the impact of such events. It’s crucial to review policy details and consult with providers to understand specific coverage.