Get State Farm insurance online sets the stage for a convenient and efficient way to secure your financial well-being. This comprehensive guide explores the benefits of obtaining State Farm insurance online, delving into the various insurance products available, the online application process, and the tools for managing your policy digitally.

Whether you’re looking for auto, home, renters, or life insurance, State Farm offers a range of online solutions to meet your needs. This digital approach simplifies the process, allowing you to compare quotes, customize coverage, and manage your policy all from the comfort of your own home.

State Farm Insurance Online Services

State Farm offers a comprehensive suite of insurance products and services that can be conveniently accessed online. This digital platform allows you to manage your insurance policies, get quotes, file claims, and access various resources from the comfort of your home.

Benefits of Obtaining State Farm Insurance Online

Getting your State Farm insurance online offers numerous benefits, including:

- Convenience: You can access State Farm’s online services 24/7, allowing you to manage your insurance needs at your convenience. This eliminates the need for in-person visits or phone calls during business hours.

- Speed and Efficiency: Online applications and quotes are processed quickly, allowing you to get the insurance coverage you need without unnecessary delays.

- Transparency: Online platforms provide access to detailed information about insurance policies, including coverage details, premiums, and policy terms. This transparency empowers you to make informed decisions.

- Cost-Effectiveness: Online services often offer competitive rates and discounts, allowing you to save money on your insurance premiums.

Available Insurance Products Online

State Farm offers a wide range of insurance products that can be purchased online, including:

- Auto Insurance: This covers your vehicle against damages caused by accidents, theft, and other incidents. State Farm’s online platform allows you to customize your auto insurance policy based on your specific needs and budget.

- Home Insurance: This protects your home and belongings from various risks, including fire, theft, and natural disasters. State Farm’s online services enable you to obtain quotes and purchase home insurance policies conveniently.

- Renters Insurance: This provides coverage for your personal belongings in case of theft, damage, or other incidents while renting. You can easily get a renters insurance quote and purchase a policy online through State Farm.

- Life Insurance: This provides financial protection for your loved ones in the event of your death. State Farm offers various life insurance options online, allowing you to choose the coverage that best suits your needs.

Comparing Online and Traditional Application Processes

The online application process for State Farm insurance is generally faster and more convenient than traditional methods.

- Online: You can apply for insurance online 24/7, completing the application process at your own pace. You can access and submit all necessary documents electronically, eliminating the need for physical paperwork. State Farm’s online platform guides you through the application process, ensuring you provide all required information.

- Traditional: Traditional methods involve contacting a State Farm agent in person or over the phone. This process may require multiple appointments and phone calls, potentially leading to delays. You will need to physically submit documents and wait for them to be processed, which can take longer than online applications.

Getting a Quote Online

Getting a quote for State Farm insurance online is a straightforward process. You can quickly get an estimate of your insurance costs by providing some basic information about yourself and your vehicle.

Factors Influencing Insurance Premiums, Get state farm insurance online

Several factors influence your insurance premiums. Understanding these factors can help you make informed decisions to potentially lower your costs.

- Age and Driving Experience: Younger drivers with less experience are statistically more likely to be involved in accidents. As you gain experience and age, your premiums generally decrease.

- Driving History: Your driving record, including accidents, traffic violations, and DUI convictions, significantly impacts your insurance rates. A clean driving history usually translates to lower premiums.

- Location: Insurance premiums vary based on your location. Areas with higher accident rates or crime rates tend to have higher insurance premiums.

- Vehicle Type and Value: The type and value of your vehicle also influence your premiums. Luxury cars or high-performance vehicles are typically more expensive to insure due to their higher repair costs and theft risk.

- Coverage Options: The level of coverage you choose, such as comprehensive, collision, and liability limits, impacts your premium. Higher coverage levels generally mean higher premiums.

Tips for Getting the Best Possible Rate

You can take several steps to potentially lower your insurance premiums:

- Shop Around: Compare quotes from multiple insurance companies to find the best rates for your specific needs.

- Maintain a Good Driving Record: Avoid accidents and traffic violations, as they can significantly increase your premiums.

- Consider Bundling Policies: Bundling your auto, home, or renters insurance with the same company can often lead to discounts.

- Ask About Discounts: Many insurance companies offer discounts for things like good student grades, safety features in your vehicle, and membership in certain organizations.

- Increase Your Deductible: A higher deductible means you pay more out of pocket in the event of an accident, but it can also lower your premium.

Managing Your Policy Online

Managing your State Farm insurance policy online offers convenience and efficiency, allowing you to access and manage your policy information anytime, anywhere. With the State Farm online portal, you can easily make payments, update contact information, file claims, and view policy details, all from the comfort of your home or on the go.

Features for Online Policy Management

Online policy management provides a range of features that streamline your insurance experience. Here are some of the key benefits:

- Making Payments: You can easily make payments online through the State Farm portal, ensuring your premiums are paid on time. You can also set up automatic payments to avoid missing deadlines and potential late fees.

- Updating Contact Information: Keeping your contact information up-to-date is crucial for receiving important policy updates and communications. The online portal allows you to update your address, phone number, and email address quickly and easily.

- Filing Claims: If you need to file a claim, you can do so conveniently online. The online portal provides a step-by-step guide, allowing you to submit claim information and upload supporting documents.

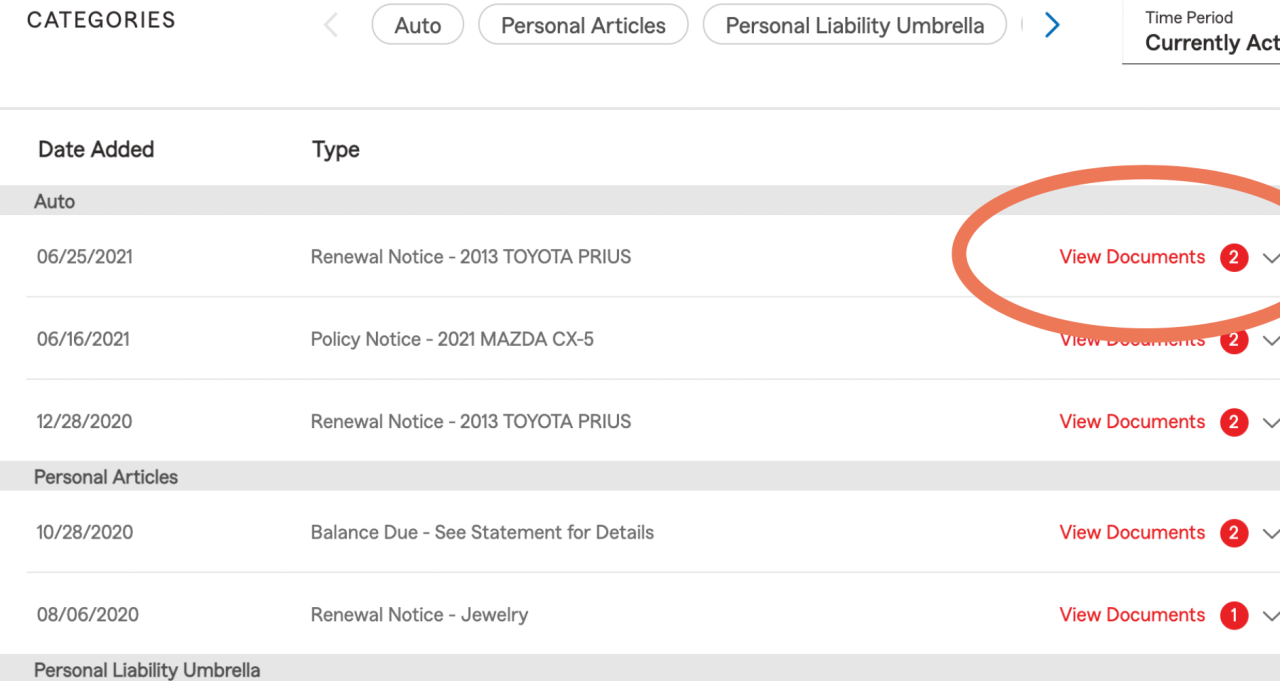

- Viewing Policy Details: Accessing your policy details online provides transparency and control. You can view your coverage, deductibles, and other important information anytime, ensuring you have a clear understanding of your policy.

- Managing Multiple Policies: If you have multiple State Farm policies, you can manage them all from one convenient location. This eliminates the need to navigate multiple websites or accounts.

Benefits of Online Policy Management

Managing your policy online offers several advantages over traditional methods. Here’s a comparison:

| Feature | Online Policy Management | Traditional Methods |

|---|---|---|

| Convenience | Access and manage your policy anytime, anywhere. | Requires visiting a State Farm agent or calling customer service. |

| Speed | Quick and efficient transactions. | Can involve waiting on hold or scheduling appointments. |

| Security | Secure online platform with encryption and authentication measures. | Potential for lost or stolen documents. |

| Transparency | Access to detailed policy information and history. | May require contacting an agent for specific details. |

Customer Support and Resources

State Farm understands that you may have questions or need assistance with your insurance policy. That’s why they offer a comprehensive range of online customer support options and resources to make managing your insurance seamless.

Online Customer Support Options

State Farm provides various online customer support options, including:

- Online Chat: Connect with a State Farm representative directly through their website for immediate assistance with your policy, claims, or general inquiries.

- Email: Reach out to State Farm through their dedicated email address for non-urgent inquiries, policy updates, or general information requests.

- Online Forms: State Farm offers online forms for various purposes, such as requesting a quote, reporting a claim, or making policy changes. This provides a convenient and efficient way to submit your requests.

Available Resources for Policyholders

State Farm provides a wealth of resources to help you understand your policy and navigate your insurance journey. Here’s a table summarizing some key resources:

| Resource | Description |

|---|---|

| FAQs | A comprehensive list of frequently asked questions about various insurance topics, including policy details, claims procedures, and coverage options. |

| Online Tutorials | Step-by-step guides and videos explaining various insurance concepts, policy management tools, and online services offered by State Farm. |

| Contact Information | A directory of contact information for State Farm representatives, customer service lines, and regional offices. |

| Policy Documents | Access to your policy documents, including your policy summary, declarations page, and coverage details, online. |

Navigating the State Farm Website

The State Farm website is designed to be user-friendly and intuitive. To make the most of your online experience, consider the following:

- Use the Search Bar: The website’s search bar is your best friend. Simply type in your query, and the website will direct you to relevant information, articles, or resources.

- Explore the Menu: The website’s menu provides a clear navigation structure. Browse through different sections to find information related to your policy, claims, or general insurance needs.

- Utilize the Help Center: The Help Center section offers detailed information about various topics, including policy features, claim procedures, and online services. You can access it through the website’s menu or search bar.

- Contact Support: If you can’t find the information you need, don’t hesitate to reach out to State Farm’s customer support team through their online chat, email, or phone. They’re available to assist you with any questions or concerns.

Security and Privacy

At State Farm, we understand the importance of protecting your personal information. We are committed to safeguarding your data and ensuring your privacy when you interact with us online. This commitment extends to all aspects of our online services, from getting a quote to managing your policy.

Data Security Measures

State Farm implements robust security measures to protect your online data. These measures include:

- Encryption: All data transmitted between your device and our website is encrypted using industry-standard protocols like Transport Layer Security (TLS) and Secure Sockets Layer (SSL). This ensures that your personal information is unreadable to unauthorized parties during transmission.

- Firewalls: Our network is protected by multiple layers of firewalls, which act as barriers to prevent unauthorized access from outside sources. These firewalls continuously monitor and block suspicious activity, enhancing the security of our systems.

- Regular Security Audits: We conduct regular security audits to identify and address any vulnerabilities in our systems. These audits involve comprehensive assessments of our infrastructure, applications, and security practices to ensure ongoing protection against threats.

- Employee Training: Our employees receive regular training on data security best practices. This training equips them with the knowledge and skills to handle sensitive information responsibly and protect our systems from internal threats.

Importance of Safeguarding Personal Information

Protecting your personal information when purchasing insurance online is crucial for several reasons:

- Identity Theft: Sharing your personal information online can expose you to the risk of identity theft. If your data falls into the wrong hands, criminals can use it to open credit accounts, make unauthorized purchases, or commit other fraudulent activities.

- Financial Loss: Unauthorized access to your financial information can result in significant financial loss. For example, if someone gains access to your credit card details, they could make fraudulent purchases, leading to financial hardship.

- Privacy Violations: Sharing your personal information online exposes you to the risk of privacy violations. Your data could be used for unauthorized marketing, profiling, or other purposes without your consent, infringing on your right to privacy.

Online Security Practices

Here are some recommendations to enhance your online security practices:

- Strong Passwords: Use strong passwords that are at least 12 characters long and include a combination of uppercase and lowercase letters, numbers, and symbols. Avoid using personal information like your name or birthdate in your passwords.

- Two-Factor Authentication (2FA): Enable 2FA whenever possible. This adds an extra layer of security by requiring you to enter a code sent to your phone or email in addition to your password when logging in.

- Be Cautious of Phishing: Be wary of suspicious emails or links that ask for your personal information. Never click on links or open attachments from unknown senders. If you receive an email that appears to be from State Farm, verify its authenticity by contacting us directly.

- Keep Software Updated: Regularly update your operating system, web browser, and security software. Software updates often include security patches that fix vulnerabilities that could be exploited by hackers.

- Use a Secure Wi-Fi Network: Avoid using public Wi-Fi networks for sensitive transactions. If you must use a public Wi-Fi network, use a virtual private network (VPN) to encrypt your internet traffic.

Final Summary

Securing your future with State Farm insurance online empowers you to take control of your financial well-being. With its user-friendly platform, comprehensive coverage options, and robust online tools, State Farm simplifies the insurance process, making it convenient and efficient. From obtaining quotes to managing your policy, you can enjoy the benefits of a digital experience tailored to your individual needs.

Common Queries: Get State Farm Insurance Online

How secure is my personal information when purchasing insurance online?

State Farm employs advanced security measures to protect your personal information. They use encryption technology to safeguard your data during transmission and maintain strict security protocols to prevent unauthorized access.

What if I need help with the online application process?

State Farm offers a dedicated customer support team available online, via phone, or email. You can reach out to them for assistance with any questions or issues you encounter during the application process.

Can I manage multiple policies online?

Yes, you can access and manage all your State Farm insurance policies through their online portal. This allows you to make payments, update contact information, and file claims for all your policies in one convenient location.