Get renters insurance state farm – Get Renters Insurance with State Farm and safeguard your belongings against unexpected events. Renters insurance offers vital protection for your personal property, liability, and additional living expenses in case of unforeseen circumstances such as theft, fire, or natural disasters. State Farm provides a range of customizable coverage options to suit your individual needs and budget, ensuring peace of mind in your rental property.

Understanding the benefits of renters insurance is essential for every renter. State Farm’s renters insurance policies offer comprehensive coverage, including personal property protection, liability coverage, and additional living expenses coverage. These components work together to safeguard your financial well-being in the event of an unexpected incident.

Understanding Renters Insurance

Renters insurance is an essential protection for your belongings and financial well-being. It safeguards you against unexpected events that could damage your possessions or cause personal liability.

Types of Coverage Offered by State Farm Renters Insurance

State Farm renters insurance offers a variety of coverage options tailored to your specific needs. These options include:

- Personal Property Coverage: This coverage protects your belongings, such as furniture, electronics, clothing, and other personal items, against loss or damage from covered perils, including fire, theft, and vandalism.

- Liability Coverage: This coverage protects you from financial responsibility if someone is injured on your property or you accidentally damage someone else’s property. For example, if a guest trips and falls in your apartment, liability coverage can help cover their medical expenses.

- Additional Living Expenses Coverage: If your apartment becomes uninhabitable due to a covered event, this coverage can help pay for temporary housing, meals, and other essential expenses while your apartment is being repaired or rebuilt.

Components of a Renters Insurance Policy

Renters insurance policies typically consist of several key components:

- Personal Property Coverage: This coverage is designed to reimburse you for the actual cash value or replacement cost of your belongings, up to your policy limits. The actual cash value considers depreciation, while the replacement cost covers the full cost of replacing damaged or stolen items with new ones.

- Liability Coverage: This coverage provides financial protection against lawsuits or claims arising from bodily injury or property damage caused by you or a member of your household. It typically includes a per-occurrence limit and an aggregate limit for the entire policy period.

- Additional Living Expenses Coverage: This coverage helps cover the extra costs you incur when you’re forced to live elsewhere due to a covered event, such as a fire or flood. It typically provides a daily or monthly limit for a specific period.

State Farm Renters Insurance Features: Get Renters Insurance State Farm

State Farm offers a comprehensive renters insurance policy that provides financial protection against various risks that could affect your belongings and personal liability.

Coverage Options

State Farm provides a variety of coverage options to meet your specific needs and budget. You can choose different deductible levels, which affect the amount you pay out-of-pocket before your insurance kicks in. You can also choose coverage limits, which determine the maximum amount your insurance will pay for a particular claim.

- Personal Property Coverage: This covers your belongings, such as furniture, electronics, clothing, and other personal items, against damage or loss due to covered perils like fire, theft, vandalism, and natural disasters. You can choose to insure your belongings at actual cash value (ACV) or replacement cost value (RCV). ACV pays for the depreciated value of your belongings, while RCV pays for the cost of replacing them with new items.

- Liability Coverage: This protects you from financial losses if someone is injured or their property is damaged on your rental property. It also covers legal expenses if you are sued.

- Additional Living Expenses: This covers the costs of temporary housing, food, and other necessities if you are unable to live in your rental property due to a covered event.

- Personal Injury Coverage: This covers you against claims of libel, slander, false arrest, and other personal injury claims.

Discounts, Get renters insurance state farm

State Farm offers a variety of discounts to help you save money on your renters insurance premium.

- Multi-policy Discount: If you have other insurance policies with State Farm, such as auto or homeowners insurance, you may be eligible for a multi-policy discount.

- Safety and Security Discounts: Installing security systems, smoke detectors, or fire extinguishers can qualify you for discounts.

- Loyalty Discounts: Long-time State Farm customers may receive discounts.

- Bundling Discounts: Bundling your renters insurance with other State Farm policies can save you money.

Claims Process

State Farm makes the claims process as simple as possible.

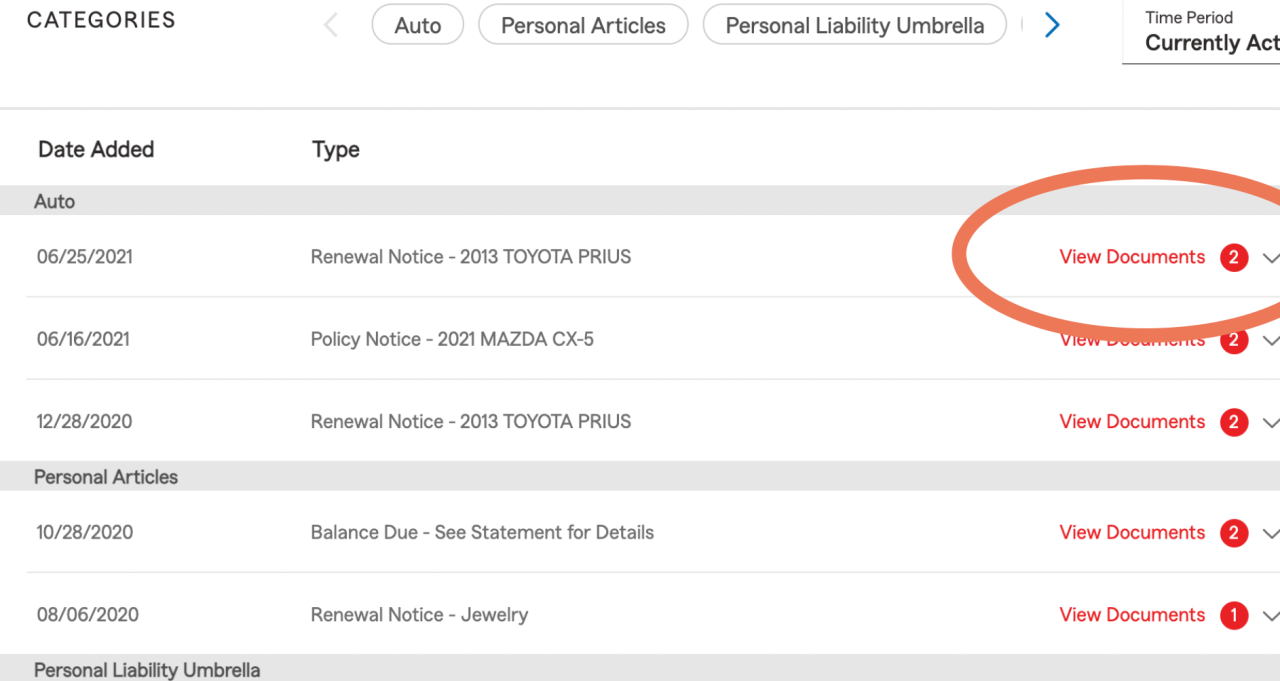

- 24/7 Claims Service: You can report a claim online, by phone, or through the State Farm mobile app.

- Expert Claim Adjusters: State Farm has a team of experienced claim adjusters who will guide you through the process and help you get your claim settled quickly and fairly.

- Direct Payment Options: In some cases, State Farm can pay your repair or replacement costs directly to your landlord or contractor.

Customer Support

State Farm is committed to providing excellent customer support.

- 24/7 Customer Service: You can reach State Farm customer service by phone, email, or online chat.

- Local Agents: State Farm has a network of local agents who can answer your questions and help you with your insurance needs.

- Online Resources: State Farm provides a variety of online resources, including FAQs, policy documents, and claim forms.

Getting a Quote and Purchasing Coverage

Getting a renters insurance quote from State Farm is a straightforward process. You can get a quote online, over the phone, or by visiting a local State Farm agent.

Getting a Quote Online

To get a quote online, you will need to provide some basic information about yourself, your property, and your coverage preferences. You can also use the State Farm website to compare different coverage options and find the best policy for your needs.

Steps to Get a Quote Online:

- Visit the State Farm website and click on the “Get a Quote” button.

- Enter your zip code and select the type of insurance you are looking for (renters insurance).

- Answer a few basic questions about yourself, your property, and your coverage preferences.

- Review your quote and choose the coverage options that best meet your needs.

- If you are satisfied with your quote, you can purchase your policy online.

Essential Information Needed for a Quote

To get an accurate quote, you will need to provide State Farm with some essential information, including:

Personal Details:

- Your name, address, and contact information.

- Your date of birth and Social Security number.

- Your driving history and any previous insurance claims.

Property Information:

- The address of your rental property.

- The type of building (apartment, house, condo, etc.).

- The number of bedrooms and bathrooms in your rental unit.

- The estimated value of your personal belongings.

Coverage Preferences:

- The amount of coverage you want for your personal belongings.

- The amount of liability coverage you want.

- Any additional coverage options you want, such as coverage for personal injury or medical payments.

Payment Options

State Farm offers a variety of payment options to make it easy for you to pay your renters insurance premium. You can choose to pay:

- Online through your State Farm account.

- By phone with a State Farm representative.

- By mail with a check or money order.

- Through automatic payments from your bank account.

Renters Insurance Essentials

Understanding the terms and conditions of your renters insurance policy is crucial to ensure you have the right coverage and protection for your belongings. This section will guide you through essential considerations to make informed decisions when choosing a renters insurance policy.

Coverage Limits

It’s important to understand the limits of your coverage. This refers to the maximum amount your insurance company will pay for covered losses. Consider the value of your belongings and choose coverage limits that adequately protect your assets. For example, if your belongings are worth $50,000, you should consider a coverage limit of at least $50,000 to ensure full protection.

Deductibles

Your deductible is the amount you’ll pay out of pocket before your insurance kicks in. Higher deductibles typically result in lower premiums, while lower deductibles mean higher premiums. It’s essential to find a balance between affordability and the amount you’re willing to pay in case of a loss. For example, if your deductible is $500, you’ll need to pay the first $500 of any covered loss before your insurance starts paying.

Exclusions

Renters insurance policies often exclude certain items or situations. Understanding these exclusions is crucial to ensure you’re not caught off guard in case of a loss. Common exclusions include:

- Earthquakes and floods

- Items of high value, such as jewelry or art

- Losses caused by negligence or intentional acts

Essential Considerations for Renters Insurance

| Factor | Description | Importance |

|---|---|---|

| Coverage Limits | The maximum amount your insurance company will pay for covered losses. | Ensures adequate protection for your belongings. |

| Deductibles | The amount you pay out of pocket before your insurance kicks in. | Impacts the cost of your premiums. |

| Exclusions | Items or situations not covered by your policy. | Helps you understand the limitations of your coverage. |

| Liability Coverage | Protects you from financial liability if someone is injured on your property. | Provides essential protection in case of accidents. |

| Personal Property Coverage | Covers your belongings against theft, fire, and other perils. | Ensures your belongings are protected against unforeseen events. |

| Additional Living Expenses | Covers temporary living expenses if your home becomes uninhabitable due to a covered loss. | Provides financial assistance during a difficult time. |

Real-World Scenarios and Examples

Renters insurance provides valuable protection against unexpected events that could cause significant financial losses. Here are some common scenarios where renters insurance would be crucial:

Imagine coming home to find your apartment door wide open, your belongings scattered, and valuable items missing. Or, picture yourself fleeing your apartment during a sudden fire, leaving behind all your possessions. These situations highlight the importance of having renters insurance, as it can help you recover from these unexpected events and get back on your feet.

Common Perils Covered by Renters Insurance

Renters insurance typically covers losses caused by a wide range of perils, including:

- Theft: Covers losses from theft of your belongings, whether from your apartment or while you’re away.

- Fire: Provides coverage for damage to your belongings caused by fire, including smoke and water damage.

- Natural Disasters: Protects against losses from natural disasters like hurricanes, tornadoes, earthquakes, and floods (if you have flood insurance).

- Vandalism: Covers damage to your belongings caused by vandalism or malicious acts.

- Liability: Provides coverage for injuries or property damage caused to others while on your property.

| Peril | Covered Losses | Potential Exclusions |

|---|---|---|

| Theft | Stolen belongings, including electronics, furniture, clothing, and jewelry. | Cash, valuable jewelry, and certain collectibles may have limits. |

| Fire | Damage to belongings from fire, smoke, and water used to extinguish the fire. | Damage caused by negligence or intentional acts may not be covered. |

| Natural Disasters | Damage to belongings from hurricanes, tornadoes, earthquakes, and floods (if you have flood insurance). | Specific perils may have limitations or exclusions. |

| Vandalism | Damage to belongings from vandalism or malicious acts. | Damage caused by negligence or intentional acts may not be covered. |

| Liability | Medical expenses and property damage caused to others while on your property. | Coverage may be limited for certain activities or situations. |

Concluding Remarks

Choosing the right renters insurance is a crucial step in protecting yourself and your belongings. State Farm offers a user-friendly process for obtaining a quote and purchasing coverage. By understanding the terms and conditions of your policy and selecting the appropriate coverage limits and deductibles, you can ensure adequate protection for your valuable possessions. Remember, renters insurance provides peace of mind, knowing that you have financial support in the event of an unexpected loss.

FAQ Compilation

What is the difference between renters insurance and homeowners insurance?

Renters insurance protects your personal property and liability while living in a rented property, whereas homeowners insurance protects the structure of the home and the owner’s liability.

How much renters insurance do I need?

The amount of renters insurance you need depends on the value of your belongings and your personal risk tolerance. It’s advisable to get a quote from State Farm and discuss your specific needs with an insurance agent.

What are some common exclusions in renters insurance policies?

Common exclusions in renters insurance policies include damage caused by earthquakes, floods, and acts of war. However, these exclusions may vary depending on the insurance provider and policy details.