Get State Farm car insurance and discover a trusted name in the industry, offering comprehensive coverage and personalized solutions to meet your unique needs. With a rich history and a commitment to customer satisfaction, State Farm has become a household name, providing peace of mind to millions of drivers across the nation. This guide explores the key features, benefits, and advantages of choosing State Farm car insurance, empowering you to make informed decisions about your automotive protection.

State Farm stands out for its diverse range of coverage options, competitive pricing, and exceptional customer service. From basic liability coverage to comprehensive and collision protection, State Farm offers a customizable approach to meet individual requirements. Their commitment to driver safety is evident in their various programs and initiatives designed to promote responsible driving habits and reduce accidents.

State Farm Car Insurance Overview

State Farm is a leading provider of car insurance in the United States, known for its comprehensive coverage options, competitive pricing, and exceptional customer service. The company has a rich history, dating back to 1922, and has consistently earned a reputation for reliability and financial stability.

History and Background

State Farm was founded in 1922 by George J. Mecherle in Bloomington, Illinois. Initially focused on providing auto insurance to farmers, the company quickly expanded its offerings and customer base. Today, State Farm is one of the largest insurance providers in the world, serving millions of customers across the United States and Canada.

Core Services and Offerings

State Farm offers a wide range of car insurance products and services to meet the diverse needs of its customers. These include:

- Liability coverage: This protects you financially if you cause an accident that injures another person or damages their property.

- Collision coverage: This covers repairs to your vehicle if you’re involved in an accident, regardless of who is at fault.

- Comprehensive coverage: This protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, or natural disasters.

- Uninsured/underinsured motorist coverage: This protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your losses.

- Personal injury protection (PIP): This covers medical expenses and lost wages if you’re injured in an accident, regardless of who is at fault.

- Roadside assistance: This provides help with services such as flat tire changes, jump starts, and towing.

State Farm also offers a variety of discounts to help customers save money on their premiums. These discounts can be based on factors such as good driving history, multiple policy discounts, and safety features in your vehicle.

Customer Base and Market Reach

State Farm has a vast customer base, with millions of policyholders across the United States. The company has a strong presence in all 50 states, as well as in Canada. State Farm’s commitment to customer satisfaction has helped it earn a loyal following and a reputation for reliability. The company consistently ranks high in customer satisfaction surveys and has a strong financial rating.

Key Features and Benefits

State Farm car insurance offers a wide range of features and benefits designed to provide comprehensive coverage and peace of mind to its policyholders. These features are tailored to meet the diverse needs of drivers and can be customized to suit individual requirements.

Comprehensive Coverage Options

State Farm provides a comprehensive suite of car insurance coverages, including:

- Liability Coverage: This coverage protects you financially if you are at fault in an accident and cause damage to another person’s property or injury to another person. It covers medical expenses, property damage, and legal fees.

- Collision Coverage: This coverage pays for repairs to your vehicle if it is damaged in an accident, regardless of fault. It covers damage caused by collisions with other vehicles, objects, or even hitting a deer.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It covers your medical expenses, lost wages, and property damage.

- Personal Injury Protection (PIP): This coverage covers your medical expenses, lost wages, and other expenses related to injuries you sustain in an accident, regardless of fault.

- Rental Car Coverage: This coverage provides you with a rental car while your vehicle is being repaired after an accident.

Competitive Pricing and Discounts

State Farm is known for its competitive pricing and offers a variety of discounts to help policyholders save money on their premiums. These discounts include:

- Safe Driving Discounts: These discounts are offered to drivers with clean driving records, demonstrating their responsible driving habits.

- Multi-Policy Discounts: State Farm offers discounts to policyholders who bundle their car insurance with other insurance products, such as homeowners or renters insurance.

- Good Student Discounts: These discounts are available to students who maintain good academic standing.

- Anti-theft Device Discounts: Discounts are offered for vehicles equipped with anti-theft devices, as they reduce the risk of theft.

- Defensive Driving Discounts: Drivers who complete defensive driving courses may be eligible for discounts, as they demonstrate their commitment to safe driving practices.

Exceptional Customer Service

State Farm has a reputation for providing exceptional customer service. They offer 24/7 customer support through various channels, including phone, email, and online chat. Their agents are knowledgeable and readily available to assist with any questions or concerns.

Innovative Technology and Digital Tools, Get state farm car insurance

State Farm embraces technology and offers a range of digital tools to make managing insurance easier for its customers. These tools include:

- Mobile App: The State Farm mobile app allows policyholders to access their policy information, file claims, manage payments, and find local agents, all from their smartphones.

- Online Portal: State Farm’s online portal provides a secure platform for policyholders to manage their accounts, view their policy documents, and make changes to their coverage.

- Digital Claim Filing: State Farm simplifies the claims process with digital claim filing options, allowing policyholders to file claims online or through the mobile app.

Unique Features and Competitive Advantages

State Farm differentiates itself from other insurance providers by offering several unique features and competitive advantages, including:

- Drive Safe & Save Program: This program utilizes telematics technology to track driving behavior and reward safe drivers with discounts on their premiums. It uses a device plugged into the vehicle’s diagnostic port to monitor driving habits like speed, braking, and acceleration.

- State Farm Rewards Program: This program allows policyholders to earn points for safe driving, completing online tasks, and engaging with State Farm. These points can be redeemed for rewards like gift cards, discounts, and charitable donations.

- State Farm Bank: State Farm offers banking services through its subsidiary, State Farm Bank, providing policyholders with convenient access to financial products and services.

- Strong Financial Stability: State Farm is a financially stable company with a long history of paying claims and providing reliable insurance coverage.

Pricing and Coverage Options

State Farm offers a range of car insurance coverage options to suit your needs and budget. The cost of your insurance premiums will vary depending on several factors, including your driving history, vehicle type, location, and coverage choices.

Factors Influencing State Farm Car Insurance Premiums

State Farm, like other insurance companies, considers various factors to determine your car insurance premium. Understanding these factors can help you make informed decisions about your coverage and potentially reduce your costs.

- Driving History: Your driving record plays a crucial role in determining your premium. A clean driving history with no accidents or traffic violations generally results in lower premiums. Conversely, a history of accidents or traffic violations can lead to higher premiums.

- Vehicle Type: The type of vehicle you drive significantly impacts your premium. Higher-value vehicles, sports cars, and luxury vehicles often have higher insurance premiums due to their higher repair costs and potential for greater damage.

- Location: Your location can influence your premium due to factors like traffic density, crime rates, and the cost of living. Areas with higher traffic congestion or higher crime rates may have higher premiums due to the increased risk of accidents or theft.

- Coverage Choices: The level of coverage you choose directly impacts your premium. Opting for higher coverage limits or additional coverage options, such as comprehensive or collision coverage, will generally result in higher premiums.

- Credit Score: In some states, State Farm may consider your credit score when determining your premium. A good credit score can indicate financial responsibility, which can lead to lower premiums. However, this practice is subject to state regulations and may not apply in all areas.

- Age and Gender: While State Farm does not discriminate based on age or gender, these factors can indirectly influence premiums. Younger drivers, especially those with less experience, may face higher premiums due to a higher risk of accidents.

State Farm Car Insurance Coverage Options

State Farm provides a comprehensive range of car insurance coverage options, allowing you to tailor your policy to your specific needs and budget. Here’s an overview of some key coverage options:

- Liability Coverage: This coverage protects you financially if you are at fault in an accident that causes injury or damage to others. Liability coverage typically includes bodily injury liability and property damage liability.

- Collision Coverage: This coverage helps pay for repairs to your vehicle if it’s damaged in a collision, regardless of who is at fault.

- Comprehensive Coverage: This coverage protects your vehicle against damage caused by events other than collisions, such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It helps cover your medical expenses and property damage.

- Personal Injury Protection (PIP): This coverage, also known as no-fault coverage, helps pay for your medical expenses and lost wages, regardless of who is at fault in an accident.

- Medical Payments Coverage: This coverage helps pay for your medical expenses, regardless of who is at fault in an accident.

- Rental Car Coverage: This coverage helps pay for a rental car if your vehicle is damaged or stolen and you need transportation while it is being repaired.

- Roadside Assistance: This coverage provides assistance with services like towing, flat tire changes, and jump-starts.

Coverage Levels and Costs

The following table illustrates the different coverage levels and their associated costs, based on an example scenario:

| Coverage Level | Liability Coverage | Collision Coverage | Comprehensive Coverage | Estimated Monthly Premium |

|---|---|---|---|---|

| Minimum Coverage | $25,000/$50,000 | None | None | $50 |

| Standard Coverage | $100,000/$300,000 | $500 Deductible | $500 Deductible | $100 |

| Premium Coverage | $250,000/$500,000 | $250 Deductible | $250 Deductible | $150 |

Note: This table is for illustrative purposes only and actual premiums will vary based on individual factors.

Customer Experience and Service: Get State Farm Car Insurance

State Farm is known for its strong customer service and commitment to providing a positive experience for its policyholders. The company has a reputation for being responsive, reliable, and helpful throughout the insurance journey, from initial quote requests to claims handling.

Customer Service Channels and Accessibility

State Farm offers multiple channels for customers to access support, ensuring convenience and accessibility. These include:

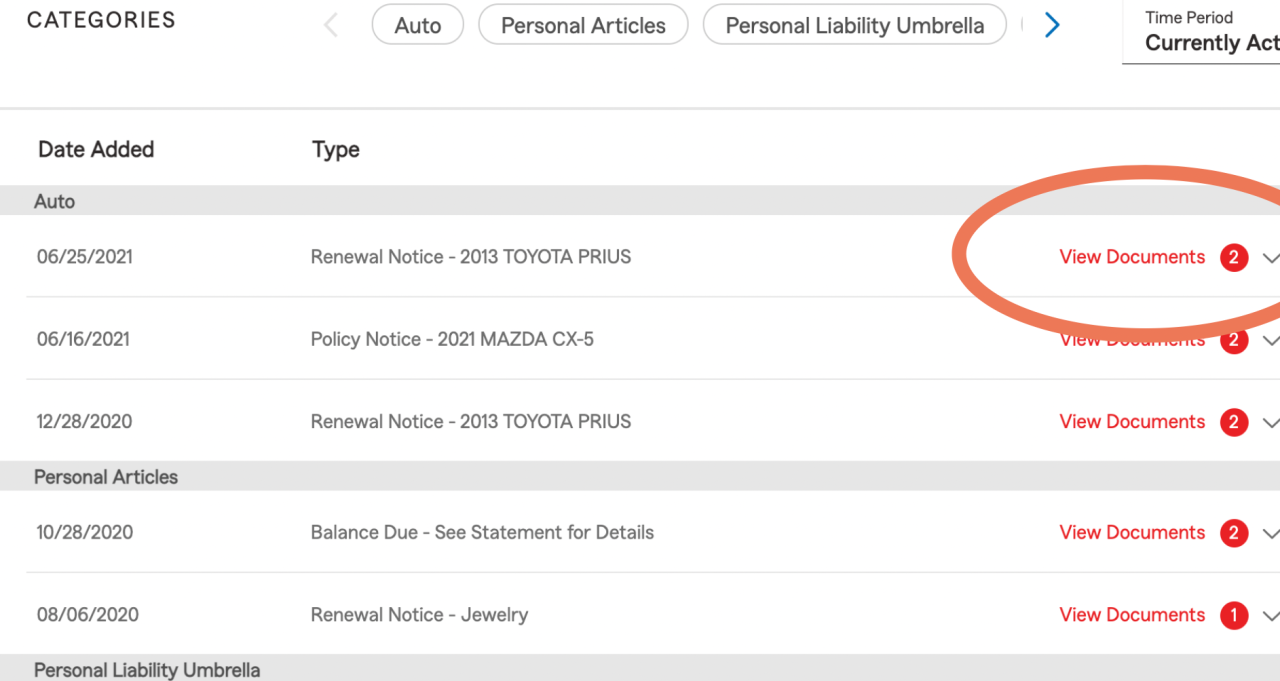

- Online Portal: The State Farm website allows policyholders to manage their accounts, make payments, review policy details, and file claims online. This provides a convenient and 24/7 accessible platform for self-service.

- Mobile App: The State Farm mobile app offers similar features to the website, allowing customers to access their insurance information and manage their policies on the go. This mobile-first approach caters to the increasing preference for digital interactions.

- Phone Support: State Farm maintains a dedicated customer service phone line, offering immediate assistance from trained representatives. This traditional method remains a crucial touchpoint for many customers, particularly those who prefer direct human interaction.

- Local Agents: State Farm has a vast network of local agents across the United States. This provides customers with a physical presence they can visit for personalized support, policy consultations, and claim assistance.

Claims Process and Support

State Farm aims to simplify the claims process, making it as straightforward and efficient as possible for policyholders. The company offers:

- 24/7 Claims Reporting: Customers can report claims online, through the mobile app, or by phone, ensuring immediate action and support regardless of the time of day or day of the week.

- Dedicated Claims Adjusters: Once a claim is reported, a dedicated claims adjuster is assigned to handle the case. This individual works directly with the policyholder, guiding them through the process, investigating the claim, and facilitating the necessary repairs or compensation.

- Direct Repair Network: State Farm maintains a network of preferred repair shops, providing policyholders with access to qualified and experienced technicians for vehicle repairs. This streamlines the repair process, ensuring quality work and timely completion.

- Claims Payment Options: State Farm offers flexible payment options for claims, including direct deposit, checks, and even mobile payments. This allows policyholders to choose the most convenient method for receiving their compensation.

Customer Reviews and Testimonials

State Farm consistently receives positive feedback from customers regarding its service and claims handling. Online reviews and testimonials often highlight the company’s:

- Responsiveness: Customers appreciate the prompt and efficient communication from State Farm, both during the initial quote process and throughout the claims process.

- Professionalism: State Farm’s agents and claims adjusters are generally praised for their professionalism, knowledge, and helpfulness in guiding customers through their insurance needs.

- Fairness: Policyholders often express satisfaction with the fairness of State Farm’s claims settlements, feeling that they received appropriate compensation for their losses.

“I recently had to file a claim after an accident, and I was so impressed with how quickly and efficiently State Farm handled everything. My claims adjuster was very helpful and kept me informed throughout the entire process. I would definitely recommend State Farm to anyone.” – Sarah, a satisfied State Farm customer.

Digital Tools and Resources

State Farm understands the importance of convenience in today’s digital world. They offer a suite of digital tools and resources designed to make managing your car insurance policy and interacting with the company a seamless experience. These tools simplify policy management, provide 24/7 access to information, and enhance the overall customer experience.

Online Account Management

State Farm’s online account management portal allows you to access and manage your policy information from anywhere with an internet connection. You can view your policy details, make payments, update personal information, and even file claims online.

Mobile App

The State Farm mobile app extends the convenience of online account management to your smartphone. The app provides access to all the features of the online portal, including:

- Viewing policy details and payment history

- Making payments

- Reporting claims

- Accessing roadside assistance

- Finding nearby State Farm agents

The app also offers additional features, such as:

- Digital ID cards: Store your insurance card digitally for easy access.

- Driving score tracking: Monitor your driving habits and potentially earn discounts.

- Personalized recommendations: Receive tailored advice on coverage options and discounts.

Customer Service Chatbot

State Farm’s customer service chatbot is available 24/7 to answer your questions and provide assistance. The chatbot can help you with a variety of tasks, including:

- Finding your policy number

- Checking your coverage

- Getting a quote

- Reporting a claim

The chatbot can also connect you with a live agent if needed.

Digital Documents

State Farm offers digital versions of important documents, such as your policy documents, ID cards, and claims information. This eliminates the need for paper copies and makes it easier to access your information whenever you need it.

Online Payment Options

State Farm offers a variety of convenient online payment options, including:

- Credit card

- Debit card

- Electronic check

- Bank account transfer

You can set up automatic payments to ensure that your premiums are paid on time.

Safety and Driving Programs

State Farm is dedicated to promoting safe driving practices and preventing accidents. They believe that a safe driving environment benefits everyone, reducing the risk of injuries and fatalities. State Farm actively participates in initiatives and offers programs that aim to educate drivers and encourage responsible behavior on the road.

Driver Education Programs

State Farm recognizes that proper driver education is crucial for developing safe driving habits. They offer a range of programs designed to enhance driving skills and knowledge, including:

- Defensive Driving Courses: These courses teach drivers how to anticipate potential hazards, improve their reaction time, and make safer decisions on the road. They cover topics such as speed management, lane changes, and avoiding distractions. These courses are often offered online or in person, making them convenient for busy drivers.

- Teen Driver Programs: Recognizing the unique challenges faced by teenage drivers, State Farm offers programs specifically tailored to their needs. These programs provide guidance on topics such as responsible driving habits, the risks associated with driving under the influence, and the importance of seatbelt use. They also emphasize the importance of parental involvement and communication in shaping safe driving behaviors.

Safety Resources and Information

State Farm provides valuable resources and information to help drivers stay informed about safety best practices. These resources include:

- Website and Mobile App: State Farm’s website and mobile app offer a wealth of information on road safety, including articles, videos, and interactive tools. Drivers can access information on topics such as distracted driving, drowsy driving, and winter driving safety. The mobile app also includes features that can help drivers stay focused while on the road, such as a “Drive Safe Mode” that silences notifications and reduces distractions.

- Community Outreach: State Farm actively engages with communities through events and workshops that promote road safety. These events often feature presentations by safety experts, demonstrations of safe driving techniques, and opportunities for drivers to interact with law enforcement officers. They also provide information on traffic laws and regulations, helping drivers stay compliant and make informed decisions on the road.

Community Involvement and Social Responsibility

State Farm is deeply committed to giving back to the communities it serves. The company believes that strong communities are essential for a thriving society, and it actively engages in a variety of initiatives to support local organizations and address important social issues.

Community Partnerships and Grants

State Farm’s community engagement efforts are multifaceted and encompass a wide range of initiatives. The company collaborates with various non-profit organizations and community groups, providing financial support through grants and sponsorships. These partnerships aim to address critical needs within local communities, such as education, public safety, and disaster relief.

- State Farm provides grants to organizations focused on improving educational opportunities for underprivileged children. These grants support programs that promote literacy, STEM education, and college readiness.

- The company also supports organizations working to enhance public safety by funding initiatives that address crime prevention, traffic safety, and fire safety.

- In times of natural disasters, State Farm steps up to provide financial assistance to communities affected by hurricanes, tornadoes, and other calamities. The company also deploys its employees and resources to help with recovery efforts.

Volunteerism and Employee Engagement

State Farm encourages its employees to volunteer their time and skills to make a positive impact in their communities. The company offers paid time off for volunteer work and provides opportunities for employees to participate in various volunteer projects.

- State Farm employees participate in community cleanup events, mentor youth, and assist with disaster relief efforts. These volunteer activities foster a sense of community and contribute to the well-being of local residents.

- The company also supports employee-led initiatives that promote social responsibility and address local needs. These initiatives demonstrate State Farm’s commitment to empowering its employees to make a difference.

Impact on Brand Image and Reputation

State Farm’s commitment to community involvement and social responsibility has a positive impact on its brand image and reputation. Consumers are increasingly drawn to companies that demonstrate a genuine concern for their communities and a commitment to ethical practices.

- State Farm’s community engagement efforts build trust and goodwill among customers and stakeholders. By supporting worthy causes and contributing to the well-being of local communities, State Farm strengthens its brand image as a responsible and caring company.

- The company’s community involvement also enhances its reputation as a good corporate citizen. By aligning itself with organizations and initiatives that address important social issues, State Farm demonstrates its commitment to making a positive difference in the world.

Last Recap

Ultimately, choosing the right car insurance provider is a personal decision that should be based on your individual needs and budget. State Farm offers a compelling package of features, benefits, and customer support that makes them a strong contender for your consideration. By understanding the intricacies of their offerings, you can confidently navigate the world of car insurance and find the optimal solution to protect yourself and your vehicle on the road.

Top FAQs

How do I get a quote for State Farm car insurance?

You can get a quote online, over the phone, or by visiting a local State Farm agent.

What discounts are available for State Farm car insurance?

State Farm offers a variety of discounts, such as good driver discounts, safe driver discounts, and multi-policy discounts.

How do I file a claim with State Farm car insurance?

You can file a claim online, over the phone, or by visiting a local State Farm agent.