General liability insurance Washington state cost is a crucial aspect of running a business in the Evergreen State. It acts as a safety net, protecting your company from financial ruin in the event of lawsuits stemming from accidents, injuries, or property damage. Understanding the factors influencing the cost of this insurance is essential for making informed decisions about your coverage.

This comprehensive guide explores the intricacies of general liability insurance in Washington State, delving into the types of risks covered, the factors determining cost, and the steps involved in obtaining quotes and choosing a policy. We’ll also provide insights on navigating the claims process and ensuring timely resolution.

Understanding General Liability Insurance in Washington State

General liability insurance is a crucial aspect of risk management for businesses in Washington State. It provides financial protection against various liabilities that may arise from business operations, safeguarding your company’s assets and reputation.

Types of Risks Covered, General liability insurance washington state cost

General liability insurance in Washington State covers a wide range of risks, ensuring businesses are protected against potential financial losses. Here are some key areas of coverage:

- Bodily Injury: This coverage protects your business from financial responsibility if someone sustains an injury on your property or due to your business activities. For example, if a customer trips and falls on your store floor, general liability insurance would cover medical expenses, legal fees, and potential settlements.

- Property Damage: General liability insurance covers damages to third-party property caused by your business operations. For instance, if your business’s negligence leads to a fire that damages a neighboring building, the insurance would cover the cost of repairs or replacement.

- Personal Injury: This coverage protects your business against claims of defamation, libel, slander, copyright infringement, and other forms of personal injury that can arise from your business activities. For example, if your company’s marketing materials falsely accuse a competitor of wrongdoing, the insurance would cover legal fees and potential settlements.

Factors Influencing General Liability Insurance Cost in Washington State: General Liability Insurance Washington State Cost

The cost of general liability insurance in Washington State is influenced by various factors that insurers consider to assess the risk associated with your business. Understanding these factors can help you understand why your premiums are what they are and how you can potentially lower them.

Industry

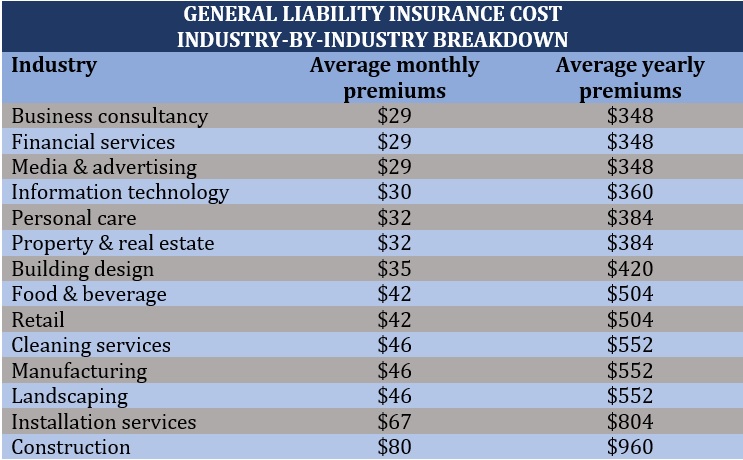

Your industry plays a significant role in determining your general liability insurance cost. High-risk industries, such as construction, manufacturing, and healthcare, often face greater liability risks and therefore higher premiums. For example, a construction company is more likely to be sued for accidents on a job site than a retail store. Insurers use industry data and statistics to assess the average risk associated with specific industries.

Business Size

The size of your business also impacts your premium. Larger businesses typically have more employees and operate in more locations, which can increase the potential for accidents and lawsuits. Larger businesses may also handle more transactions and have a wider customer base, potentially exposing them to a greater number of claims.

Claims History

Your past claims history is a major factor in determining your premium. If you have a history of frequent or high-cost claims, insurers may view you as a higher risk and charge you higher premiums. Conversely, a clean claims history can earn you discounts. Insurers may also consider the severity and frequency of claims filed by your industry as a whole.

Location

Your business location can also influence your premium. Areas with higher crime rates or a greater density of businesses may have higher insurance premiums. For example, a business located in a busy urban area might face a greater risk of property damage or customer injuries than a business in a rural area. Additionally, the cost of living and the availability of legal resources in your location can impact premiums.

Financial Stability

Insurers assess your financial stability to determine your risk. A business with a strong financial history and healthy revenue streams is considered less risky and may receive lower premiums. Conversely, businesses with a history of financial instability or a high debt-to-equity ratio may face higher premiums.

Safety Practices

Implementing strong safety practices can demonstrate to insurers that you are taking proactive steps to mitigate risks. This can include things like regular safety training for employees, implementing safety protocols, and conducting safety inspections. By demonstrating a commitment to safety, you can potentially lower your premiums.

Risk Management Practices

Having a comprehensive risk management plan in place can significantly impact your insurance cost. This plan should include measures to identify, assess, and control potential risks. For example, you might implement policies to minimize the risk of slip and falls, fire hazards, or data breaches. Insurers may offer discounts to businesses with strong risk management practices.

Employee Training

Investing in employee training can also help reduce your risk and potentially lower your premiums. Training employees on safety protocols, customer service, and conflict resolution can help prevent accidents and lawsuits. Well-trained employees are more likely to handle situations safely and professionally, minimizing the risk of claims.

Customer Service

Excellent customer service can help minimize the likelihood of claims. By resolving customer issues promptly and fairly, you can reduce the chance of a customer filing a lawsuit. Insurers may consider your customer service record as a factor in determining your premium.

Insurance Coverage

The amount of insurance coverage you choose can also impact your premium. Higher coverage limits typically come with higher premiums. However, it’s important to choose coverage limits that are appropriate for your business needs. You should work with an insurance broker to determine the appropriate coverage for your business and to explore options for potentially reducing your premium.

Insurance Broker

Working with a reputable insurance broker can help you secure the best possible general liability insurance coverage at a competitive price. An experienced broker can help you understand the various factors that influence your premium, shop around for quotes from multiple insurers, and negotiate the best possible terms.

Common Coverage Options and Exclusions

General liability insurance policies in Washington State provide a range of coverage options, protecting businesses from various risks. These options are designed to cater to the specific needs of different industries and businesses. Understanding these coverage options and their exclusions is crucial for ensuring adequate protection.

Coverage Options

General liability insurance policies in Washington State commonly include the following coverage options:

| Coverage Option | Description | Limits |

|---|---|---|

| Bodily Injury and Property Damage Liability | Covers legal expenses and damages arising from bodily injury or property damage caused by the insured’s negligence. This includes accidents, slips, trips, falls, and other incidents. | Typically ranges from $1 million to $5 million per occurrence, with an aggregate limit of $2 million to $10 million per policy period. |

| Personal and Advertising Injury Liability | Protects against claims of libel, slander, false arrest, invasion of privacy, and other forms of personal injury. It also covers damages resulting from false advertising or copyright infringement. | Similar to bodily injury and property damage liability, with limits ranging from $1 million to $5 million per occurrence and $2 million to $10 million per policy period. |

| Medical Payments Coverage | Provides coverage for medical expenses incurred by third parties due to injuries sustained on the insured’s premises or as a result of the insured’s operations, regardless of fault. | Typically ranges from $1,000 to $10,000 per person, with a total limit of $10,000 to $50,000 per occurrence. |

| Defense Costs | Covers legal expenses incurred in defending against claims, including attorney fees, court costs, and expert witness fees. | Typically unlimited, but subject to the policy’s overall limit. |

Exclusions

General liability insurance policies in Washington State also contain exclusions that limit coverage. These exclusions typically include:

| Exclusion | Description | Examples |

|---|---|---|

| Intentional Acts | Excludes coverage for injuries or damages caused by intentional acts of the insured or their employees. | Assault, battery, fraud, and defamation. |

| Professional Services | Excludes coverage for claims arising from the insured’s professional services, such as medical malpractice, legal negligence, or accounting errors. | A doctor’s negligence during surgery, a lawyer’s breach of fiduciary duty, or an accountant’s failure to file taxes on time. |

| Environmental Contamination | Excludes coverage for claims arising from environmental contamination, such as pollution or hazardous waste disposal. | Leaking underground storage tanks, spills of hazardous materials, and air pollution. |

| Workers’ Compensation | Excludes coverage for injuries sustained by employees while working for the insured. | An employee’s injury during a work-related accident. |

| Auto Liability | Excludes coverage for claims arising from the use of automobiles, which are typically covered by separate auto insurance policies. | An accident involving a company vehicle. |

Obtaining Quotes and Choosing a Policy

Once you understand the basics of general liability insurance and how its cost is determined, the next step is to obtain quotes from different insurance providers in Washington State. This will allow you to compare coverage options, premiums, and policy features to find the best fit for your business needs.

Steps to Obtain Quotes

- Identify your insurance needs: Before contacting insurance providers, it’s crucial to assess your business’s specific risks and determine the level of coverage you require. This includes understanding the potential liabilities your business faces and the types of incidents that could lead to claims.

- Gather relevant information: Insurance providers will ask for specific details about your business, such as its size, industry, revenue, and any past claims history. Having this information readily available will streamline the quote process.

- Contact multiple insurance providers: Obtaining quotes from several insurance providers is essential to ensure you get a competitive price. You can contact providers directly, use online quote comparison tools, or consult with an insurance broker.

- Provide accurate information: It’s important to be truthful and transparent with insurance providers when providing information about your business. Inaccurate information can lead to policy cancellation or denial of claims later.

- Review the quotes carefully: Once you receive quotes, carefully review the policy details, including the coverage limits, deductibles, exclusions, and premiums. Pay attention to the language used in the policy and don’t hesitate to ask for clarification on any terms you don’t understand.

Comparing Quotes and Evaluating Policy Features

Comparing quotes from different insurance providers is essential to ensure you get the best value for your money. Consider the following factors when comparing quotes:

- Premium: This is the cost of the insurance policy, and it’s usually calculated based on your business’s risk profile. Look for a policy with a reasonable premium that provides adequate coverage.

- Coverage limits: This refers to the maximum amount the insurance company will pay for a covered claim. Choose a policy with sufficient coverage limits to protect your business from significant financial losses.

- Deductible: This is the amount you’ll pay out-of-pocket for a covered claim before the insurance company starts paying. A higher deductible generally means a lower premium, but you’ll need to be prepared to pay more upfront in case of a claim.

- Exclusions: These are specific events or circumstances that are not covered by the policy. Make sure you understand the exclusions and that they don’t significantly limit the policy’s coverage.

- Policy features: Some policies offer additional features, such as legal defense coverage, which can be valuable in certain situations. Consider these features when comparing quotes.

- Reputation and financial stability: Choose an insurance provider with a strong reputation and a solid financial standing. This ensures they’ll be able to pay claims when you need them.

Choosing the Right General Liability Insurance Policy

Selecting the right general liability insurance policy for your business in Washington State requires careful consideration. Here’s a checklist of key factors to evaluate:

- Business size and industry: Different businesses have different risk profiles. Choose a policy that’s tailored to your business size and industry.

- Specific risks and liabilities: Identify the potential liabilities your business faces and choose a policy that provides adequate coverage for those risks.

- Coverage limits and deductibles: Determine the appropriate coverage limits and deductibles based on your business’s financial capacity and risk tolerance.

- Policy exclusions: Ensure you understand the policy exclusions and that they don’t significantly limit the coverage you need.

- Customer service and claims handling: Look for an insurance provider with a reputation for good customer service and efficient claims handling.

- Policy cost and value: Consider the overall cost of the policy and the value it provides in terms of coverage and protection.

Filing a Claim and Understanding the Claims Process

In Washington State, the claims process for general liability insurance is designed to be straightforward and efficient. Knowing the steps involved can help businesses navigate the process successfully and receive the necessary support.

Understanding the Claim Filing Process

The process of filing a claim under general liability insurance typically begins with a prompt notification to your insurance company. This notification should be made as soon as you become aware of a potential claim. The insurance company will then guide you through the necessary steps, including gathering information and documentation to support your claim.

Information Required for Filing a Claim

To file a claim, you’ll need to provide your insurance company with specific details. These include:

- Your policy details: This includes your policy number, coverage limits, and effective dates.

- Details of the incident: This includes the date, time, location, and nature of the incident that led to the claim.

- Information about the claimant: This includes the claimant’s name, address, and contact information.

- Evidence of damages: This may include photographs, repair estimates, medical bills, or other documentation that supports the extent of the damages.

- Witnesses: If any witnesses were present during the incident, their names and contact information should be provided.

Navigating the Claims Process

To ensure a smooth claims process, businesses can take the following steps:

- Communicate promptly: Inform your insurance company about the claim as soon as possible after the incident occurs. This helps to preserve evidence and ensures a timely response from your insurer.

- Be thorough in your documentation: Provide all the required information and documentation promptly. This can help speed up the claims process.

- Cooperate with your insurance company: Respond to all requests for information and documentation promptly. This ensures that the claims process moves forward efficiently.

- Keep detailed records: Maintain records of all communication with your insurance company, including dates, times, and the content of conversations. This can be helpful if any disputes arise.

- Seek legal counsel: If you are unsure about the claims process or have concerns about the handling of your claim, it’s advisable to consult with an experienced attorney specializing in insurance law.

Closing Summary

Navigating the complexities of general liability insurance in Washington State can feel daunting, but with the right information and guidance, you can make informed decisions that protect your business. By understanding the factors influencing cost, carefully comparing quotes, and choosing a policy that meets your specific needs, you can secure the necessary coverage to operate with confidence and peace of mind.

Quick FAQs

What are the common exclusions under general liability insurance in Washington State?

Common exclusions include intentional acts, professional negligence, workers’ compensation claims, and environmental damage. It’s crucial to review the policy carefully to understand the specific exclusions.

How can I reduce my general liability insurance premium?

You can lower your premium by implementing safety measures, maintaining a good claims history, and exploring discounts offered by insurers.

What are the typical limits for general liability coverage in Washington State?

Limits vary depending on the insurer and the policy, but common limits include $1 million per occurrence and $2 million aggregate. You can choose higher limits based on your specific risk profile.